Académique Documents

Professionnel Documents

Culture Documents

FSA Project

Transféré par

Mehvish Ghafoor0 évaluation0% ont trouvé ce document utile (0 vote)

76 vues115 pagesMehvish Ghafoor BB07014 BBA 7 th (M) University of the Punjab Gujranwala Campus. Report is made according to your defined instructions and guidance. He has tried to explain every possible aspect of Financial Statement Analysis of Fauji Cement Company Limited.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentMehvish Ghafoor BB07014 BBA 7 th (M) University of the Punjab Gujranwala Campus. Report is made according to your defined instructions and guidance. He has tried to explain every possible aspect of Financial Statement Analysis of Fauji Cement Company Limited.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

76 vues115 pagesFSA Project

Transféré par

Mehvish GhafoorMehvish Ghafoor BB07014 BBA 7 th (M) University of the Punjab Gujranwala Campus. Report is made according to your defined instructions and guidance. He has tried to explain every possible aspect of Financial Statement Analysis of Fauji Cement Company Limited.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 115

1

Flnunclul Stutement Anulysls of Fuu|l

Cement Compuny llmlted

Submltted to: Slr Umur SufdurKlyunl

Submltted by: Mehvlsh Ghufoor

BB07014

BBA 7

th

(M)

University of the Punjab

Gujranwala Campus

2

3

Acknowledgement

We have no words at our command to express our deepest gratitude and

innumerous thanks to The Most Beneficent, The Most Merciful, The Most

Compassionate, The Most Gracious ALMIGHTY ALLAH, Whose Bounteous

Blessing and Exaltation flourished our thoughts and thrive our ambition to have the

cherish fruit of our modest efforts in form of this manuscript from the blooming

spring of blossoming knowledge.

We also offer our humble thanks to HOLY PROPHET MUHAMMAD (PBUH),

who is forever a source of guidance and beacon of knowledge for the mankind.

4

Dedicated to.

Holy prophet Hazrat Muhammad (PBUH)

&

Our loving, parents and teachers,

Whom greatness we just cant describe in

Words, by whom only, we have been able to,

Touch this stage of life

5

Letter of Transmittal

Respected Sir,

Punjab University Gujranwala Campus

Its my honor to present you the report related to the study of Financial Analysis of Fauji Cement

Company Limited of the subject of Financial Statement Analysis. This report is made according

to your defined instructions and guidance. I have tried to explain every possible aspect of

Financial Statement Analysis of Fauji Cement Company Limited.

Formation of this report has helped me a lot in increasing my knowledge and experience. I hope

that findings of this report shall also guide those students who will study this report.

Thank you.

Yours obedient student;

Mehvish Ghafoor BB07014

6

Table of Contents

Serial no. Contents Page No.

1

Overview of report 7

2

Fauji Cement Companys profile 8

3

Pakistans economy overview 14

4

Cement sectors overview 26

5

Vertical Analysis of Balance Sheet 34

6

Horizontal Analysis of Balance Sheet 36

7

Vertical Analysis of Income Statement 40

8

Horizontal Analysis of Income Statement 41

9

Graphs 42

10

Ratio Analysis 43

11

Activity ratios 43

12

Debt ratios 68

13

Profitability ratios 74

14

Market Ratios 92

15

Cash flow ratios 102

16

Ratio analysis as a loan officer 109

17

Ratio analysis as corporate controller 111

18

Ratio analysis as an investor 113

19

Conclusion & recommendations 115

7

Overview of the Report

A longtime leader in the cement manufacturing industry, Fauji Cement Company, headquartered

in Islamabad, operates a cement plant at Jhang Bahtar, Tehsil Fateh Jang, and District Attock in

the province of Punjab. The Company has a strong and longstanding tradition of service,

reliability, and quality that reaches back more than 11 years. Sponsored by Fauji Foundation the

Company was incorporated in Rawalpindi in 1992.

The cement plant operating in the Fauji Cement is one of the most efficient and best maintained

in the Country and has an annual production capacity of 1.165 million tons of cement. The

quality Portland cement produced at this plant is the best in the Country and is preferred in the

construction of highways, bridges, commercial and industrial complexes, residential homes, and

a myriad of other structures needing speedy strengthening bond, fundamental to Pakistan's

economic vitality and quality of life.

In this project analysis of Fauji Cement Company Limited is done in very detail to check out

current position, performance and progress of the company. To measure these activities balance

sheet (trend analysis), balance sheet (vertical analysis), income statement (trend analysis),

income statement (vertical analysis) and ratio analysis are performed that has explored the real

picture. At the end conclusion is made on the basis of these analysis. Then future

recommendations are made to improve company in every aspect.

All the ratios have decreasing trend from 2006 to 2008, because in this time period profitability

of the company is decreasing due to decrease in cement prices and increasing manufacturing

costs. In 2009, almost all profitability ratios are increasing because of increase in cement prices

as well as demand. In 2010, again ratios are decreasing because profitability is decreasing due to

decrease in cement prices.

Company is not giving any dividend to its investors and liabilities of company are also

increasing. All this is because of heavy investment in fixed assets for the purpose of expansion.

Company is growth oriented and expanding its operations, which will increase the profitability of

the company in near future.

8

History of Fauji Cement Company Limited

Fauji Cement Company Limited was sponsored by Fauji Foundation and incorporated as

a public limited company on 23 November 1992. It obtained the Certificate of

Commencement of Business on 22 May 1993. The Company has been setup with primary

objective of producing and selling Ordinary Portland Cement (OPC). For the purpose of

selection of sound process technology, state of the art equipment, civil design and project

monitoring, local and foreign consultants were engaged.

The Company entered into a contract with World renowned cement plant manufacturers

M/s F.L. Smidth to carry out design, engineering, procurement, manufacturing, delivery,

erection, installation, testing and commissioning at site of a new, state of the art, cement

plant including all auxiliary and ancillary equipment, complete in all respects for the

purpose of manufacturing a minimum of 3,000 tpd clinker and corresponding quantity of

Ordinary Portland Cement as per Pakistan/ British Standard Specifications.

The contract came into force on 1 January 1994. Physical work on the project started in

August 1994.

Commissioning activities started in May 1997 generally remained smooth and trouble

free, which enabled first batch of clinker production on 26 September 1997 followed by

cement production in November 1997.

Subsequently in 2005, the Plant capacity was increased to 3,700 tons of clinker per day

i.e. 3,885 tons of cement per day.

In line with the Cement Industry, Fauji Cement has signed a contract with Polysius, a

German cement plant manufacturing firm for installation of state of the art, the largest

single line (7200 tons per day of clinker) ever commissioned in Pakistan. Meaningful

9

expansion will help the Company to expand its market share. The project will be

Inshallah commissioned in the 1st quarter of 2011.

Introduction of Company

A longtime leader in the cement manufacturing industry, Fauji Cement Company, headquartered

in Islamabad, operates a cement plant at Jhang Bahtar, Tehsil Fateh Jang, District Attock in the

province of Punjab. The Company has a strong and longstanding tradition of service, reliability,

and quality that reaches back more than 11 years. Sponsored by Fauji Foundation the Company

was incorporated in Rawalpindi in 1992.

The cement plant operating in the Fauji Cement is one of the most efficient and best maintained

in the Country and has an annual production capacity of 1.165 million tons of cement. The

quality portland cement produced at this plant is the best in the Country and is preferred in the

construction of highways, bridges, commercial and industrial complexes, residential homes, and

a myriad of other structures needing speedy strengthening bond, fundamental to Pakistan's

economic vitality and quality of life.

10

Mission

FCCL while maintaining its leading position in quality of cement and through greater

market outreach will build up and improve its value addition with a view to ensuring

optimum returns to the shareholders.

11

Vision

To transform FCCL into a role model cement manufacturing Company fully aware of

generally accepted principles of corporate social responsibilities engaged in nation

building through most efficient utilization of resources and optimally benefiting all stake

holders while enjoying public respect and goodwill.

12

BUSINESS PATTERN:

The Company has been set up with the primary objective of producing and selling

ordinary Portland cement. The finest quality of cement is available for all types of

customers whether for dams, canals, industrial structures, highways, commercial or

residential needs using latest state of the art dry process cement manufacturing process.

COMPANYS STRATEGIES:

We shall achieve our vision by maintaining high quality product, relentless pursuit of

customer satisfaction, empowering FCCL employees to lead cement industry and

achieve manufacturing excellence, producing superior returns to our shareholders.

Companys Values:

CUSTOMERS

We listen to our customers and improve our product to

Meet their present and future needs.

PEOPLE

Our success depends upon high performing people working together in a safe

and healthy work place where diversity, development and team work are

valued and recognized.

ACCOUNTABILITY

We expect superior performance and results. Our leaders set clear goals and

expectations, are supportive and provide and seek frequent feed back.

SOCIAL

RESPONSIBILITY

We support the communities where we do business, hold ourselves to the

highest standards of ethical conduct and environment responsibility, and

communicate openly with public and FCCL employees.

13

Corporate Structure

14

Pakistans Economy

Pakistan was established in 1947 with per capita income of 100$ and had a population of just

30 million people. By that time there was no industrial production because all industries were

located in India and the country had to rely totally on agriculture to feed its population.

After that economic growth gradually started in Pakistan and now its economy is the 27th

largest economy in the world, its population is increased to 170 million people and the per capita

income is also increased to 1000$. It is the third largest exporter of rice, the third largest milk

producer and Pakistan is also among the five major textile producing countries on the world.

Political and other instabilities:

Despite these factors Pakistan is still a developing country. Its economical conditions keeps on

fluctuating due to internal crisis like political disturbance, terrorism, energy crisis, low foreign

investments and sometimes due to national calamities. The recent flood that hits Pakistan had

caused a huge damage to its agriculture sector which has a major contribution to both national

income and GDP.

The main hindrance to the smooth economic growth is the political violence which is

significant in the past few years. Although in between 2004-07 development in different

industries and services took place which raises the GDP from 5% to 8%. In 2009 the industrial

growth rate was -3.6%.But again in 2007 great political instability took place as a result of

lawlessness in the tribal areas and assassination of former Prime Minister Benazir Bhutto. This

leads to high violence in Karachi which is one of the largest cities of Pakistan due to its ports

from where 80% of the countrys exports took place.

All these issues pose a great threat to Pakistans economy and cost the government in billions of

rupees because the industrial and commercial sector was fully damaged in Karachi. Pakistani

currency was also depreciated in this period due to the political and economical instabilities.

The global economic recession of 2008 also causes a great set back to the economic growth of

Pakistan. So all these instabilities shows a major influence on various economic indicators which

15

keeps on fluctuating from time to time. A brief overview of some economic indicators for the

last five years (2006-2010) is given below:

Pakistan GDP Growth Rate:

Gross domestic product means the market value of all goods and services produced in a country

The yearly GDP growth rate describes all the economic activities in a year and according to this

the economy of Pakistan had expanded 2% in previous year and according to the measures taken

by the world bank the GDP of Pakistan is worth 167 billion which constitutes 0.27% of the

worlds economy.

According to the above chart in last five years the average GDP growth is 5.54% , reaching a

maximum historical height of 9% in December 2005 which was due to industrial growth and

now the GDP has decreased to a record minimum level of 2% in 2010.

GDP - composition by sector:

Agriculture: 20.8%

Industry: 24.3%

Services: 54.9% (2009 est.)

16

Inflation Rate in Pakistan:

Inflation rate refers to a general rise in prices measured against a standard level of purchasing

power.

Among different factors which contribute to uneven economic growth, the leading factor is

inflation which stands to be a major problem ever. Two important measures of inflation are

consumer price index and GDP deflator.

It is evident from the above graph that inflation jumped from 7.7% in 2007 to 20.8% in 2008,

this was the result of increase in the prices of oil and other commodities across the world.

Recent rate of inflation in Pakistan is 12.69% as reported on June 2010.

From 2006 to 2010 the average rate is 11.86%. The highest inflation was recorded in august

2008 which were 25.33%. And the least rate of inflation was 1.14% in July 2003.

17

Balance of Trade:

As reported in July 2010 Pakistan is suffering from trade deficit equivalent to 1450.9 Million

USD. Pakistan trade with different countries its main partners are: European Union, China,

United Arab Emirates, United States and Afghanistan.

Following chart shows the trend in the balance of trade for the last 5 years:

Exports of Pakistan:

Pakistan exports rice, furniture, cotton fiber, cement, tiles, marble, textiles, clothing, leather

goods, sports goods, surgical instruments, electrical appliances, software, carpets and rugs and

food products. Apart from these goods Pakistan is also a renowned exporter of cement to Asia

and Middle East and third biggest exporter of rise in world.

18

According to the statistics provided in July 2010 Pakistan exports were of worth 1787.9 Million

USD. Maximum exports of worth 2053.6 million USD were recorded in the mid of 2008.

Imports:

Pakistan imports mainly petroleum, petroleum products, machinery, plastics, transportation

equipment, edible oils, paper and paperboard, iron and steel and tea its major import partners are:

European Union, China, Saudi Arabia, United Arab Emirates and United States.

19

Imports in Pakistan as recorded in July 2010, were of worth 3238.8 million USD and maximum

imports were of 4100 million USD recorded in 2008.

During last five years the average imports worth 2877.04 million USD.

Balance of payments:

Pakistan reported a current account deficit equivalent to 1548.0 Million USD in September of

2010 the BOP trend in the last 5 years is shown in the following graph:

Exchange Rate:

Exchange rate means how much one currency, the USD, is currently worth in terms of the

other, the PKR.

The exchange rate is influenced by different factors e.g. the value of Pakistani currency has

depreciated in previous years due to political instability in the country.

20

During last 12 months Pakistan rupee exchange rate has appreciated by 3.77% and in last 5 years

the average USDPKR is 70.87 reaching a historical height of 86.2 in September 2010.

The least exchange rate was 18.60 recorded in December of 1988.

Unemployment rate:

Unemployment refers to the share of the labor force that is without work but available for and

seeking employment

The labor force is defined as the number of people employed plus the number unemployed but

seeking work.

The non labor force includes those who are not looking for work, those who are

institutionalized and those serving in the military.

According to unemployment rate Pakistan is ranked on 33

rd

numbers in the world. However now

the government is making polices to overcome the problem of unemployment in the country.

21

The unemployment rate in Pakistan has a decreasing trend since last few years.

In December 2009 the unemployment rate was reported to be 5.50%.

During past few years the average unemployment rate was 5.57%.

The maximum rate is recorded to be 8.27% in December 2002 and minimum rate was 2.6% in

1990.

Population of Pakistan:

The last reported population growth was 2.14% in 2008.this figure was given by the World

Bank.

22

Although the rate of population growth has decreased in past few years especially after 2006 but

still the total population in the country has increased at an alarming rate after 2005. Currently the

population is of 170 million people. This is giving rise to high unemployment, more illiteracy

rate more corruption and crime and it is influencing the economic growth. To overcome the

problem of ever increasing population the government has taken many steps in the previous

years.

Literacy rate:

Adult literacy rate is the percentage of people ages 15 and above who can, with understanding,

read and write a short, simple statement on their everyday life. Pakistan's economy has suffered

a lot in past due to high illiteracy rate. Soon after 2000 the literacy rate gradually begins to

increase due to the setting up of many schools and universities by government.

23

The above chart shows the literacy rate of adult population of ages 15 and above in Pakistan. The

last reported literacy rate was 53.70 in 2009.

Foreign direct investment:

Foreign direct investment is net inflows of investment to acquire a lasting management interest

(10 percent or more of voting stock) in an enterprise operating in an economy other than that of

the investor.

24

The above table shows the trends in foreign direct investment in last few years according to the

World Banks report FDI was 5389000000.00 in 2008 and the least was 1062000000 US dollars

in 2005.

25

Conclusion and Recommendations

It is concluded from the above data that Pakistan has gone through a noteworthy economic

growth in past few years. This economic growth has also resulted in increased level of income

which has triggered the domestic demand.

But still there are some core problems like political instability, less foreign investment, lack of

controls, terrorism, inflation, illiteracy and many other which are needed to be solved at national

level.

The last five years were highly inflationary. The reason was increase in the prices of oil all over

the world which further causes the transportation charges to increase and in overall it increases

the factors of production and the producers passes the high costs to the consumers. In this way

the imports became expensive and overall inflation was increased.

In such a way one uncontrolled factor influences many other factors of the economy. So the

government should take sufficient actions to bring all uncontrolled factors in controlled

condition.

Instead of importing commodities government should encourage domestic production because

Pakistan is already facing budget deficit from past many years.

Government should also make investment in fruitful projects and spend on the infrastructure of

the country. According to the figures of 2009 the govt. revenue was $23.21 billion whereas the

expenditures stood $30.05 billion. Special attention should be given to the agriculture sector

especially after the current disaster.

Government should make arrangements to attract foreign investment and also request the

developed countries to provide financial and, managerial assistance.

At last it is strongly recommended that there should be a strong monitoring and governing

system. This system should be established in the country at different levels to ensure the smooth

running of the economy.

26

History & Introduction of Cement Industry

Growth of cement industry is rightly considered a barometer for economic activity. The

history of cement industry dates back to 1921when the first plant was established at Wah. In

1947, Pakistan had four inherited cement plants with a total capacity of 0.5 million tons. These

plants were located at Karachi, Rohri, Dandot and Wah. Some expansions took place in 1956-66

but could not keep pace with the economic development and country had to resort to imports of

cement in 1976-77 and continued to do so till 1994-95. The industry was privatized in

1990which led to setting up of new plants.

The industry comprises of 29 firms (19 units in the north and 10 units in the south), with the

installed production capacity of 44.09 million tons. The north with installed production capacity

of 35.18 million tons (80 percent) whiles the south with installed production capacity of 8.89

million tons (20 percent); compete for the domestic market of over 19 million tons. There are

four foreign companies, three armed forces companies and 16 private companies listed in the

stock exchanges. The industry is divided into two broad regions, the northern region and the

southern region. The northern region has around 80 percent share in total cement dispatches

while the units based in the southern region contributes 20 percent to the annual cement sales.

Overview of Cement sector:

Cement is one of major industries of Pakistan. Pakistan is rich in cement raw materials.

Currently many cement plants are operating in private sector. The cement industry has huge

potential for export to neighboring countries like India, Afghanistan & African countries.

Exports of cement industry:

Pakistan cement factories continue to make significant progress in cement exports. Now Pakistan

is ranked 5th in the worlds cement exports after a huge increase of 47 percent in exports during

last fiscal year. According to the Global cement report, China maintained first position with 26

million tones in exports, while Japan got second position by exporting 12.6 million tones of

27

cement. Third largest cement exporter in world is Thailand with around 12 million tones,

followed by Turkey which exported 11.6 million tones of cement. Pakistan now at 5th position

has left Germany behind by exporting 11 million tones of cement during last fiscal year.

Germany now stands at 6th position with 9 million tones exports.

The cement industry of Pakistan entered the export markets a few years back, and has established

its reputation as a good quality product. The latest information is that India will import more

cement from Pakistan. So far 130,000 tones cement has been exported to the neighboring

country.

In 2007, 130,000 tons cement was exported to India.

In 2007, the exports to Afghanistan, UAE and Iraq touched 2.13 million tons.

Pakistans cement exports

Year Exports

(Million Tones)

Value

US$

2006-07 3.2 185 million

2007-08 7.7 450 million

2008-09 8.9 534 million

2009-10(Jul-Mar) 6.7 356 million

New avenues for export of cement are opening up for the indigenous industry as Sri Lanka has

recently shown interest to import 30,000 tons cement from Pakistan every month. If the industry

is able to avail the opportunity offered, it may secure a significant share of Sri Lankan market by

supplying 360,000 tons of cement annually.

28

A reason of increase in exports is that, depreciation of rupee has rendered Pakistani cement as a

highly attractive option.

Sales of cement industry:

Million Tones 9MFY08 9MFY07 % change

Local Sales 16,610,096 15,380,297 8.0

Export Sales 6,819,964 2,145,951 217.8

Total Sales 23,430,060 17,526,248 33.7

During the financial year-07, cement sales registered a growth of 31 percent to 17.53 million

tones as against 13.5 million tones sold last year. The cement sales during July-February-08

showed an increase, both in domestic and regional markets to 18.17 million tones. The domestic

sales registered an increase of 7.2 percent to 14.4 million tones in the current period as compared

to 13.5 million tones last year whereas exports stood at 3.7 million tones as against 1.8 million

tones in the corresponding period last year, showing an increase of 110 percent.

Contribution of cement sector towards country:

The cement sector is contributing above Rs 30 billion to the national exchequer in the form of

taxes.

Cement industry is also serving the nation by providing job opportunities and presently more

than 150,000 persons are employed directly or indirectly by the industry.

Profitability of cement sector:

Cumulative profitability of companies in FY09 stood at Rs 6.2 billion or $78.2 million as

compared to Rs 386 million or $6.2 million depicting a massive growth of 1,492 percent.

Companies with profits in both the years posted 109 percent earnings improvement.

29

Production capacity:

In Pakistan, there are 29 cement manufacturers that are playing a vital role in the building up the

countrys economy and contribution towards growth and prosperity. After 2002-3, most of the

cement manufacturers expanded their operations, and increased production. This sector has

invested about $1.5 billion in capacity expansion over the last six years.

The operating capacity of cement in 1991 was 7 million tons, which increased to become 18

million tons by 2005-06 and by end of 2007 rose to above 37 million tones, and currently the

production capacity is 44.07 million tones. Cement production capacity in the north is 35.18

million tons (80 percent) while in the south it is only 8.89 million tons (20 percent).

The cement manufacturers in 2007-08 added above eight million tons to the capacity and the

total production was expected to exceed 45 million tons by the end of 2010. It may result in a

supply glut of seven million tons in 2009 and 2010.

Despite an excess supply of 11 million tones in 2008, it is estimated that the price would increase

in domestic as well in regional markets that may surely boost the profitability and give relief to

the industry on its new investment.

Demand & Production of Cement (Million Tones)

Installed Capacity 39

No. of units 29

Local Demand(2007-08) 22.6

Production(2008-09) 19.2

Projected Capacity(2010-11) 48

30

According to Government Board of Investment

Actual Cement Production (in million tones)

2001-02 9.83

2002-03 10.85

2003-04 12.86

2004-05 16.09

2005-06 18.48

2006-07 22.73

2007-08 26.75

2008-09 20.28

Pricing:

Another problem faced earlier by the Industry was the high taxation. The general sales tax (GST)

was 186% higher than India. The impact of this tax and duty structure resulted in almost 40%

increase in the cost of a cement bag (50 Kg). A bag in India earlier cost Rs. 160 as compared to

Rs. 220 in Pakistan. In the budget of 2003-04, a duty cut of 25% was permitted to the cement

sector with assurance from the cartel to pass on this benefit to the consumers. In 2006, the price

of a bag went up to Rs. 430 however in 2007 it has stabilized at Rs. 315 per bag. In mid 2008,

cement prices stabilized further at Rs. 220 per bag.

Average industry cost of cement bag/50Kg = Rs.193

Average industry price of cement bag/50Kg = Rs.235

Demand:

The cement demand grew 19 percent and 13 percent during FY05 and FY06 respectively. During

the first nine months of FY07-08, production increased by 30 percent as compared to last year.

The demand for cement was forecasted to grow by 26 percent during FY07 and 17 percent in

FY08. The per capita consumption of cement has risen from 117 kg in FY06 to 131 kg in FY07.

31

The main factors behind increase in demand of cement were: 60 percent higher Public Sector

Development Projects (PSDP) allocation, seven percent GDP growth, increasing number of real

estate development projects for commercial and residential use, developing export market and

expected construction of mega dams.

The cement demand would increase in future due to government policies as the Pakistan

Peoples Partys (PPPs) slogan has always been roti, kapra aur makan (bread, clothing and

housing). In this regard a statement of the new government confirmed that it would encourage

industries and construct small dams.

Growth:

The cement sector posted a growth rate of 4.71 percent during July-March 2008-09. Pakistan is

not only meeting its domestic needs but also exporting the surplus. The cement sector is

contributing Rs 30 billion to the national exchequer in the form of taxes. This sector has invested

about Rs 100 billion in capacity expansion over the last four years.

Per capita Cement consumption:

Pakistan currently has a per capita consumption of 131kg of cement, which is comparable to that

for India at 135kg per capita but substantially below the World Average 270kg and the regional

average of over 400kg for peers in Asia and over 600kg in the Middle East.

Cement demand remained stagnated during 90s owing to lack of development activities. In

1997, per capita consumption was 73 kg in both Pakistan and India. By 2005-06, consumption in

India rose to become 115 kg/capita whereas ours rose to 117 kg/capita.

32

A comparison of few countries in 2005:

Bangladesh 50 kg/capita

Pakistan 117 kg/capita

India 115 kg/capita

USA 375 kg/capita

Iran 470 kg/capita

Malaysia 530 kg/capita

EU 560 kg/capita

China 625 kg/capita

UAE 1095 kg/capita

33

Recommendations & Conclusion

The above data shows the continuous growth of cement sector. The main factor of the growth is

accelerating exports of cement. Pakistan is ranked 5

th

largest cement exporter.

Demand for cement has been increasing at domestic level as well as international level. When

demand will increase, the production will also increase. At the same time to meet the demand,

people are being hired and unemployment will decrease. Presently Cement sector employs

150,000 people directly or indirectly. Accelerating exports will also lead to increase n forex

reserves.

The last five years were highly inflationary. The reason was increase in the prices of oil all over

the world which further leads to increase in transportation charges. And overall it increases the

costs of factors of production and ultimately increases in the prices of final product.

In Pakistan electricity charges, tax charges and interest charges etc are very high which leads to

increase in prices. In Pakistan, all taxes come to around Rs 96 per bag which is the highest in the

world. Our govt should give some compensation to industries so that our country can go towards

development.

Investors also reluctant to invest due to high inflation. Because at this time, the whole world is

facing recession. If investors would not invest then companies will effect. Because one

uncontrolled factor influences the many other factors of the economy.

In Pakistan, almost all the operating plants are based on furnace oil and use coal. In the market

oil and coal prices are increasing sharply which is troublesome for industries.

The major problems are political instability and terror attacks due to which investors hesitate to

invest. Currently Pakistan is facing the tragedy of flood due to which it loses a lot.

34

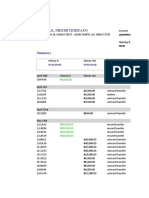

Fauji Cement Company Limited

Vertical Analysis of Balance Sheet

For the Year ended 30 June, 2006 to 2010

Items

Vertical Analysis

Vert 10 Vert 09 Vert 08 Vert 07 Vert 06

Share Capital & Reserves

Share capital

27.71% 34.60% 59.58% 65.53% 67.67%

Reserves

8.18% 10.59% 14.97% -7.17% -14.71%

Total Equity

35.89% 45.19% 74.54% 58.36% 52.96%

Subordinated loan - unsecured

1.49% 0.00% 0.00% 0.00% 0.00%

Non-Current Liabilities

0.00% 0.00% 0.00% 0.00% 0.00%

Long term financing-secured

44.47% 29.02% 2.61% 13.67% 22.99%

Fair value of deprivative

0.27% 0.00% 0.00% 0.00% 0.00%

Deferred liability

0.05% 0.05% 0.08% 0.13% 0.13%

Deferred tax liability-net

2.94% 3.40% 2.92% 5.31% 3.47%

Retention money payable

0.00% 0.67% 0.15% 0.00% 0.00%

Liability against shipment in transit

0.00% 9.42% 0.00% 0.00% 0.00%

Total Non-Current Liabilities

47.74% 42.56% 5.75% 19.11% 26.59%

Current Liabilities

0.00% 0.00% 0.00% 0.00% 0.00%

Trade and other payables

6.34% 6.72% 3.96% 7.32% 6.79%

Markup accrued

1.30% 0.44% 0.27% 0.76% 0.96%

Short term borrowings-secured

3.23% 3.57% 11.07% 5.87% 3.81%

Current portion of long term financing

4.00% 1.52% 4.42% 8.59% 8.87%

Total Current Liabilities

14.88% 12.25% 19.71% 22.53% 20.44%

35

Total Equity & Liabilities

100.00% 100.00% 100.00% 100.00% 100.00%

Non-Current Assets

0.00% 0.00% 0.00% 0.00% 0.00%

Property, plant & equipment

88.94% 87.55% 57.06% 68.62% 73.62%

Long term advance

0.02% 0.03% 0.06% 0.13% 0.15%

Long term deposits & prepayments

3.30% 4.70% 0.37% 0.73% 0.75%

Deferred tax asset-net

0.00% 0.00% 0.00% 0.00% 0.00%

Total Non-Current Assets

92.27% 92.29% 57.49% 69.48% 74.52%

Current Assets

0.00% 0.00% 0.00% 0.00% 0.00%

Stores, spares & loose tools

3.96% 4.84% 7.29% 7.32% 7.92%

Stock in trade

0.36% 0.64% 1.85% 2.86% 2.34%

Trade debts

0.09% 0.25% 0.22% 0.31% 0.41%

Advances, deposits, prepayments, other

receivables

2.60% 1.15% 2.66% 13.34% 1.05%

Interest accrued

0.00% 0.00% 0.12% 0.08% 0.09%

Cash & bank balances

0.72% 0.82% 30.38% 6.61% 13.67%

Total Current Assets

7.73% 7.71% 42.51% 30.52% 25.48%

Total Assets

100.00% 100.00% 100.00% 100.00% 100.00%

36

Fauji Cement Company Limited

Horizontal Analysis of Balance Sheet

For the Year ended 30 June, 2006 to 2010

Items

Horizontal Analysis

H 10-09 H 09- 08 H 08-07 H 07-06 H 06-05

Share Capital & Reserves

- - - - -

Share capital

0.00% 0.00% 76.90% 0.00% 0.00%

Reserves

-3.52% 21.82%

-

505.93% -49.64% -47.74%

Total Equity

-0.83% 4.38% 148.55% 13.79% 34.00%

Subordinated loan - unsecured

- - - - -

Non-Current Liabilities

- - - - -

Long term financing-secured

91.33% 1815.15% -62.86% -38.60% -43.50%

Fair value of deprivative

- - - - -

Deferred liability

36.61% 13.71% 14.39% 4.61% -82.50%

Deferred tax liability-net

8.31% 100.51% 6.84% 57.82% -

Retention money payable

-

100.00% 692.87% - - -

Liability against shipment in transit

-

100.00% - - - -

Total Non-Current Liabilities

40.06% 1175.28% -41.49% -25.79% -35.79%

Current Liabilities

- - - - -

Trade and other payables

17.81% 192.33% 5.29% 11.25% 52.72%

Markup accrued

265.94% 187.49% -31.33% -19.14% -13.82%

37

Short term borrowings-secured

13.05% -44.44% 267.06% 58.88% -23.48%

Current portion of long term financing

229.66% -40.91% 0.00% 0.00% -0.54%

Total Current Liabilities

51.63% 7.06% 70.20% 13.82% 4.99%

Total Equity & Liabilities

24.87% 72.20% 94.58% 3.27% -0.41%

Non-Current Assets

- - - - -

Property, plant & equipment

26.85% 164.22% 61.79% -3.74% -2.04%

Long term advance

-14.29% -12.50% -11.11% -10.00% 0.00%

Long term deposits & prepayments

-12.30% 2064.69% 0.00% 0.00% 0.00%

Deferred tax asset-net

- - - -

-

100.00%

Total Non-Current Assets

24.84% 176.42% 61.01% -3.71% -8.56%

Current Assets

- - - - -

Stores, spares & loose tools

2.16% 14.38% 93.61% -4.51% 36.19%

Stock in trade

-29.66% -40.26% 25.52% 26.34% 159.41%

Trade debts

-55.14% 102.92% 37.68% -23.23% -76.24%

Advances, deposits, prepayments, other

receivables

181.66% -25.26% -61.26% 1216.11% 44.02%

Interest accrued

-20.92% -95.16% 192.06% -7.27% 446.41%

Cash & bank balances

9.25% -95.35% 794.26% -50.08% 40.54%

Total Current Assets

25.19% -68.76% 171.00% 23.69% 34.67%

Total Assets

24.87% 72.20% 94.58% 3.27% -0.41%

38

Fauji Cement Company Limited

Averages of Balance Sheet

For the Year ended 30 June, 2006 to 2010

Items

Averages

2010-2009 2009-2008

2008-

2007

2007-

2006

2006-

2005

Share Capital & Reserves

Share capital

7419887 7419887 5807154.5 4194422 4194422

Reserves

2230800 2067448 702439 -685511 -1328302

Total Equity

9650687 9487335 6509593.5 3508911 2866120

Subordinated loan - unsecured

200000 0 0 0 0

Non-Current Liabilities

0 0 0 0 0

Long term financing-secured

9066628.5 3274613.5 600000 1150000 1973502.5

Fair value of deprivative

36013 0 0 0 0

Deferred liability

12736.5 10117 8872.5 8094.5 26562.5

Deferred tax liability-net

758395 545654 351536 277649.5 107690.5

Retention money payable

71869.5 80934 9064.5 0 0

Liability against shipment in transit

1010458 1010458 0 0 0

Total Non-Current Liabilities

10956100.5 4921776.5 969473 1435744 2107755.5

Current Liabilities

0 0 0 0 0

Trade and other payables

1570249.5 967517.5 480828.5 444760.5 348396

Markup accrued

222268.5 64296.5 40758 54050.5 64564

Short term borrowings-secured

815752.5 1072071.5 876937.5 305931.5 272614.5

Current portion of long term financing

698192 437500 550000 550000 551497.5

39

Total Current Liabilities

3306462.5 2541385.5 1948524 1354742.5 1237072

Total Equity & Liabilities

24113250 16950497 9427590.5 6299397.5 6210947.5

Non-Current Assets

0 0 0 0 0

Property, plant & equipment

21298122 12941901.5 5749524.5 4477782.5 4610693

Long term advance

5850 6750 7650 8550 9000

Long term deposits & prepayments

946912 527797 46611 46611 46611

Deferred tax asset-net

0 0 0 0 168570

Total Non-Current Assets

22250884 13476448.5 5803785.5 4532943.5 4834874

Current Assets

0 0 0 0 0

Stores, spares & loose tools

1049305.5 972834.5 688180 479828 425670

Stock in trade

117067.5 183770 206699 164199.5 100510.5

Trade debts

39577.5 40784 23242.5 22516.5 66353

Advances, deposits, prepayments, other

receivables

471691.5 288959.5 592210 459272.5 54951.5

Interest accrued

642 7772.5 9952.5 5276 3238.5

Cash & bank balances

184082 1979928 2103521 635361.5 725350

Total Current Assets

1862366 3474048.5 3623805 1766454 1376073.5

Total Assets

24113250 16950497 9427590.5 6299397.5 6210947.5

40

Fauji cement Company Limited

Vertical Analysis of Income Statement

For the Year ended 30 June, 2006 to 2010

Items

Vertical Analysis

Vert10 Vert09 Vert08 Vert07 Vert06

Sales

128.72% 130.84% 133.94% 138.02% 132.60%

Less: Government levies

28.72% 30.84% 33.94% 38.02% 32.60%

Net Sales

100.00% 100.00% 100.00% 100.00% 100.00%

Less: Cost of sales

86.46% 68.25% 81.44% 68.48% 48.88%

Gross Profit

13.54% 31.75% 18.56% 31.52% 51.12%

Other income

0.71% 3.58% 3.03% 2.13% 1.01%

Distribution cost

1.25% 0.95% 1.51% 1.17% 0.74%

Administrative expenses

2.72% 1.94% 2.16% 2.06% 1.55%

Other operating expenses

0.67% 1.47% 0.97% 1.68% 2.20%

Net Profit Before Interest & Tax

Taxation

9.61% 30.98% 16.96% 28.74% 47.64%

Finance cost

1.08% 4.23% 4.14% 5.98% 6.17%

Net Profit Before Taxation

8.53% 26.75% 12.82% 22.76% 41.48%

Taxation

1.96% 7.79% 1.16% 4.10% 13.39%

Net Profit After Taxation

6.57% 18.96% 11.66% 18.66% 28.08%

Earning per share-basic

0.00% 0.00% 0.00% 0.00% 0.00%

Earning per share-diluted

0.00% 0.00% 0.00% 0.00% 0.00%

41

Fauji Cement Company Limited

Horizontal Analysis of Income Statement

For the Year ended 30 June, 2006 to 2010

Items

Horizontal Analysis

H 10-09 H 09-08 H 08-07 H 07-06 H 06-05

Sales

-29.50% 46.41% -0.64% -15.90% 44.94%

Less: Government levies

-33.25% 36.19% -8.61% -5.77% 29.84%

Net Sales

-28.34% 49.88% 2.39% -19.20% 50.65%

Less: Cost of sales

-9.22% 25.60% 21.76% 13.21% 18.79%

Gross Profit

-69.45% 156.40% -39.71% -50.19% 102.59%

Other income

-85.71% 77.02% 45.70% 70.43% 286.27%

Distribution cost

-5.02% -5.85% 31.34% 28.24% 48.57%

Administrative expenses

0.29% 34.89% 7.28% 7.01% 57.54%

Other operating expenses

-67.43% 127.98% -40.98% -38.28% 132.45%

Net Profit Before Interest & Tax

Taxation

-77.76% 173.68% -39.56% -51.26% 106.54%

Finance cost

-81.66% 52.92% -29.04% -21.64% 15.09%

Net Profit Before Taxation

-77.14% 212.72% -42.33% -55.66% 134.20%

Taxation

-81.94% 910.34% -71.12% -75.28% 130.92%

Net Profit After Taxation

-75.17% 143.62% -36.01% -46.31% 135.80%

Earning per share-basic

-78.32% 68.24% -50.87% -46.77% 135.51%

Earning per share-diluted

-77.94% 76.62% -49.67% -46.69% 135.25%

42

Graphs of Balance Sheet and Income Statement

-100.00%

-50.00%

0.00%

50.00%

100.00%

150.00%

200.00%

2005-2006 2006-2007 2007-2008 2008-2009 2009-2010

Balance Sheet

Total Assets Current Assets Current Liabilities Owner's Equity

-100.00%

-50.00%

0.00%

50.00%

100.00%

150.00%

200.00%

250.00%

2005-2006 2006-2007 2007-2008 2008-2009 2009-2010

Income Statement

Sales Gross profit Earning before tax Net income

43

Ratio Analysis:

Activity Ratios:

This ratio measures the efficiency with which various accounts are converted into sales or cash.

This ratio shows the efficiency with which assets are being utilized by the firm.

1. Accounts Receivable Turnover:

This ratio measures the liquidity of the firms receivables. It means how many times accounts

receivables have been generated from the sales. The higher turnover is considered as favorable.

Accounts Receivable Turnover =

Net Sales

Average Gross Receivables

Year 2006 2007 2008 2009 2010

Ratios

(Times per year)

63.11 126.06 118.83 116.47 87.27

Time-series Analysis 2006 to 2010:

2006:

FCCLs accounts receivable turnover for 2006 is 63.11 times per year. It means that FCCL is

generating its accounts receivables 63 times in 2006 from its sales. In 2006, total sales are 133%

A tool used by individuals to conduct a quantitative analysis of information in a company's

financial statements. Ratios are calculated from current year numbers and are then compared to

previous years, other companies, the industry, or even the economy to judge the performance of

the company.

44

of the net sales. FCCLs sales are increasing in 2006 as compare to 2005. This increase in sales is

due to increase in local demand, and increase in local demand is due to increase in construction

activities in the country and Governments focus towards infrastructure development. Company

meets the demand because performance of the Plant remained highly satisfactory with overall

efficiency exceeding 91.5%.

2007:

FCCLs account receivable turnover for 2007 is 126.06 times per year. It means company is

generating its receivables 126 times in 2007 from its sales. It is better than 2006s ratio. Capacity

utilization of FCCL stood at 98.00 %, which was higher by 6.6% over last year. Capacity of

utilization is increasing but sales are not increasing relatively.

Sales are increasing in 2006 as compare to 2007 but accounts receivable turnover ratio in 2007is

better than 2006. The reason of fewer ratios is, we are using average gross receivables as

denominator. In 2005 value of receivables is high as compare to 2006 which affect the ratio. In

2007 this ratio is increasing but sales are not increasing because most of our production is in

godown as inventory. Decrease in sales in 2007 can also be due to strict credit policy of

company.

2008:

FCCLs accounts receivable turnover for 2008 is 118.83 times per year. This ratio is slightly

decreasing as compare to last year. In 2008, performance of the plant remained above

satisfactory level with an overall production level exceeding 100.83%, which is the highest ever

achieved in the history of Fauji Cement. Due to increase in production level, inventory and sales

are also increasing as compare to last year. Cash and accounts receivables, both are increasing. It

means some sales are on cash basis and some are on credit basis. As demand of cement is

increasing day by day so sales are also increasing and company is trying to meet the demand.

45

2009:

FCCLs accounts receivable turnover for 2009 is 116.47 times per year. There is slightly

decreasing trend in as compare to last year. But the difference is not material. As demand of

cement is increasing day by day not only at national level but also at international level, so sales

are also increasing. Sales are increasing in 2009 as compare to last years because performance of

the plant remained above satisfactory level with 100% capacity utilization. In 2009, with the

increase of sales accounts receivables are also increasing but cash is decreasing. It means that in

2009, most of the sales are on credit basis rather than cash basis.

2010:

FCCLs accounts receivable turnover for 2010 is 87.27 times per year, which means company is

generating its receivables 87 times per year from sales. There is decreasing trend in this ratio

from 2008 to 2010. In 2010, sales of company are decreasing and accounts receivables are also

decreasing. Decrease in sales can be due to decrease in capacity utilization of plant. Capacity

utilization of FCCL in FY2008-09 was 100.09% and in FY2009-10 has been 96.06%.

Company domestic sale is decreasing while exports are increasing as compare to last year.

Increase in exports is favorable because in this way companys forex reserves will increase.

Overall, Company's performance is good from 2006 to onward. It means that companys

management is running the company in an efficient way and it builds its good repute in the mind

of its customers.

2. Days Sales in Receivables:

This ratio determines the time in days, the receivables are outstanding. It indicates how

efficiently the firm manages its receivables. Lesser answer will reduce the chances of bad debts.

Days Sales in Receivables =

Gross Receivables

Net Sales / 365

46

Year 2006 2007 2008 2009 2010

Ratios (Days) 2.27 2.90 3.23 4.03 2.63

Time-series analysis 2006 to 2010:

2006:

FCCLs days sales in inventory for 2006 is 2.3 days and it is quiet favorable for company.

Companys sales are increasing in 2006 as compare to 2005 but its accounts receivables are

decreasing and cash is increasing in 2006 as compare to 2005. It means that company strict its

credit policy, Means Company is reviewing its credit policy and efficiently managing its cash

and receivables. Efficient cash and credit management means fewer chances of bad debts.

2007:

FCCLs days sales in inventory for 2007 are 2.9 days which is close to previous year's ratio. In

2007, companys sales are decreasing. Decrease in sales can be due to strict credit policy of

company. It means that company is strictly following its credit policy. Net receivables are

decreasing but gross receivables are increasing as compare to last year. Decrease in net

receivables in 2007 can be due to more provision for bad debts made by the company. May be

company has more chances of bad debts, thats why it made more provision as compare to last

year.

2008:

FCCLs days sales in inventory for 2008 are 3.2 days, which is slightly greater than the previous

year. Sales of company are increasing and gross receivables are also increasing. The reason in

accounts receivables is that company is selling its product on credit basis. It means that company

loose its credit policy up to some extent to increase its sales volume.

47

2009:

FCCLs days sales in receivables for 2009 are 4.0 days. There is an increasing trend in this ratio

from 2006 to 2009 because accounts receivables are continuously increasing from 2006 to 2009.

In 2009, with the increase of sales accounts receivables are also increasing but cash is

decreasing. It means that in 2009, most of the sales are on credit basis rather than cash basis. It

can be due to leniency in credit policy by the company or it can be due to increase in sales.

2010:

FCCLs days sales in receivables for 2010 are 2.6 days. There is decreasing trend which is

favorable for company. In 2010, company sales are decreasing as well as accounts receivables

are also decreasing but cash is increasing. It means that some sales are on cash basis and some on

cash basis. It reflects strict credit policy and credit terms.

Overall, company is managing its receivables efficiently. Company has strict credit policy and

credit terms. Company is consistently and strictly following its rules and regulations.

3. Accounts Receivable Turnover in Days:

This ratio indicates the amount of time needed to collect accounts receivables. Lesser answer

shows companys efficient management of receivables.

Accounts Receivable Turnover in Days =

Average Gross Receivables

Net Sales / 365

Year 2006 2007 2008 2009 2010

Ratios (Days) 5.70 2.86 3.03 3.09 4.13

48

Time-series Analysis 2006 to 2010:

2006:

FCCLs accounts receivables turnover in days in 2006 is 5.7 days, it means that company is

collecting its receivables in 6 days. Companys sales are increasing in 2006 as compare to 2005.

In 2006, FCCLs accounts receivables are decreasing and cash is increasing as compare to 2005.

It means that company strict its credit policy, Means Company is reviewing its credit policy and

efficiently managing its cash and receivables.

2007:

FCCLs accounts receivable turnover in days for 2007 is 2.9 days, means company is collecting

its receivables in approximately 3 days which is better than last year. Companys average gross

receivables are decreasing as compare to last year. Decrease in receivables mean companys

management is very efficient. Company stricts its credit policy more than previous year and

applying its credit policy consistently. Demand for cement is increasing at national level as well

as international level, so company tightened its policy.

2008:

FCCLs accounts receivable turnover in days for 2008 is 3.0 days. It means company is

collecting its receivables in 3 days, which is almost equal to the last year. As this ratio is

increasing from year to year so we can say that company is loosing its credit policy to increase

its sales volume. As demand of cement is increasing day by day at national level and

international level. So, company is providing leniency to its customers.

2009:

49

FCCLs accounts receivable turnover in days for 2009 is 3.1 days. It means that company is

collecting its receivables in 3 days. There is slightly increasing trend in this ratio from 2006 to

2009 but difference is not material. Increase in ratio does not mean that company is loosing its

credit policy. Ratio is increasing because sales are increasing. It means that company is

consistently and strictly following its credit policy.

2010:

FCCLs accounts receivable turnover in days for 2010 is 4.1 days. Company's ales are

decreasing but receivables are not decreasing with the same ratio. It means that companys sales

are on credit basis as well as cash basis because cash is also increasing.

Overall, somewhere ratio is increasing and somewhere decreasing but the difference is not

material. It means that company has efficient credit policy and following its policy. Company is

conscious about its bad debts. Company is managing its receivables very well.

4. Days Sales in Inventory:

This ratio shows the ending inventory is equivalent to how many days. It means the estimated

number of days that it will take to sell the current inventory. This ratio measures the length of

time it takes to acquire, sell and replace the inventory.

Days Sales in Inventory =

Ending Inventory

Cost of Goods sold / 365

Year 2006 2007 2008 2009 2010

Ratios (Days) 25 28 29 14 11

Time-series Analysis 2006 to 2010:

2006:

50

FCCLs days a sale in inventory for 2006 is 25 days. It means that ending inventory is selling in

25 days. In 2006, inventory is increasing as well as sales are increasing as compare to last year.

Increase in inventory is not favorable because company has to pay its holding cast and some

other charges. Here inventory is increasing, it means poor inventory control. Increase in

inventory is favorable too on the other hand, because it is beneficial to hold inventory in case of

inflation and high demand. You can easily meet with demand of people.

2007:

FCCLs days a sale in inventory for 2007 is 28 days, which is greater than last year and it is

unfavorable. The ratio is increasing in 2007, because the inventory is increasing as compare to

last year. Increase in inventory means increase in cost, because company has to pay its holding

cost and quality also effect in case of long inventory holding. In this way cost of goods sold will

also increase. Increase of ratio reflects poor inventory control management of the company.

2008:

FCCLs days sales in inventory for 2008 is 29 days, which is also greater than last year but not

material. It means that companys inventory is equivalent to 29 days almost one month and it is

not favorable for company. In 2008, inventory has been increased by 26%. When inventory will

increase replacement cost will increase, hence cost of goods sold will increase. It will affect the

sales and ultimately will affect the profitability of the company. It reflects companys poor

management.

2009:

FCCLs days sales in inventory for 2009 are 14 days, which is less than last three years. It is

favorable for company. Decrease in ratio is due to decrease in inventory by 40%. Decrease in

inventory is due to increase in sales by 50%. Decrease in inventory leads to decrease in

inventorys holding cost and increase in profitability of the company. It means that company is

efficiently controlling its inventory.

51

2010:

FCCLs days sales in inventory for 2010 are 11 days. The ratio is less than last four years. In

2010, inventory has been decreased by 30%. Decrease in inventory reduces holding cost of

inventory which ultimately increases the profitability of the company. It means that company is

reviewing its inventory on regular basis and controlling it efficiently.

5. Inventory Turnover:

This ratio indicates the liquidity of the inventory. It determines, how many times inventory is

converting into CGS. The higher the answer, the efficient inventory control. The ratio also

measures the relationship between volume of goods sold and amount of inventory carried during

the year.

Inventory Turnover =

Cost of goods Sold

Average Inventory

Year 2006 2007 2008 2009 2010

Ratios

(Times per year)

20.84 14.44 13.97 19.74 28.13

Time-series analysis 2006 to 2010:

2006:

FCCLs inventory turnover for 2006 is 21 times per year. It means that company is selling its

inventory 21 times per year. In 2006, companys sales are more than last year. As much as

inventory turnover will increase profitability of company will increase. As many time as

inventory will being converted into cash, either company receive cash or generate its account

receivable.

52

2007:

FCCLs inventory turnover for 2007 is 14 times per year, which is less than last year. It means

that companys inventory control management is not efficient. Ratio is decreasing because

inventory is increasing and due to increase in inventory sales are decreasing and cost of goods

sold is increasing. It ultimately will affect the profitability of the company.

2008:

FCCLs inventory turnover for 2008 is 13.97 times per year. The ratio is further decreasing but

not material. Ratio is decreasing because inventory is increasing on continuous basis. On

inventory company has to bear holding cost and some other costs. In this way cost of inventory

will increase and cost of goods sold will increase. And ultimately profitability of company will

effect.

2009:

FCCLs inventory turnover for 2009 is 18 times per year, which is greater than last two years. It

means that companys inventory control management has become conscious. Ratio is increasing

as compare to last two years which is favorable for company. In this year, sales are increasing

due to which inventory is decreasing. Last year inventory was high so cost of goods sold is

increasing. Decrease in inventory means companys management is taking steps to control its

inventory.

2010:

FCCLs inventory turnover for 2010 is 28 times per year, which is greater than last four years.

Ratio is decreasing because inventory is decreasing; it means that companys management is

efficiently controlling its inventory.

Overall, reason for increase in cost of goods sold is that electricity charges and fuel charges are

increasing day by day. Due to high inflation, prices of all goods are increasing which results in

increase in cost of goods sold.

6. Inventory turnover in Days:

53

This ratio indicates, time required from purchase to sale. This ratio shows in how many days

companys stock has been sold. Fewer days means that less time for inventory to turn into sales.

Inventory Turnover in Days =

Average Inventory

Cost of Goods Sold / 365

Year 2006 2007 2008 2009 2010

Ratios (Days) 17.27 24.92 25.77 18.24 12.80

Time-series Analysis 2006 to 2010:

2006:

FCCLs inventory turnover in days for 2006 is 17 days. As demand of cement is increasing day

by day. So inventory is converting into sales in 17 days, which is favorable for company. It

means that companys inventory control management is efficient. More days means more

holding cost.

2007:

FCCLs inventory turnover in days for 2007 is 25 days. Ratio is increasing as compare to last

year and material. Ratio is increasing because inventory is increasing. Company has to pay

inventorys holding cost, repair and maintenance charges and due to increase of these charges

cost of goods sold will also increase. It ultimately will affect the profits of the company.

2008:

FCCLs inventory turnover in days for 2008 is 26 days. Ratio is increasing as compare to last

year because inventory is increasing as compare to 2006 and 2007. Company has to pay

inventorys holding cost and other charges and due to increase of these charges cost of goods

54

sold will also increase. It ultimately will affect the profits of the company. It reflects poor

inventory control management.

2009:

FCCLs inventory turnover in days for 2009 is 18 days. Ratio is decreasing as compare to last

two years. Ratio is decreasing because inventory is decreasing and inventory is converting into

sales. It means inventorys holding cost and other charges are decreasing. It means that

companys management is taking steps to control its inventory.

2010:

FCCLs inventory turnover in days for 2010 is 13 days. Ratio is decreasing as compare to last

four years. Ratio is decreasing because inventory is decreasing and inventory is converting into

sales. It means inventorys holding cost and other charges are decreasing. It means that inventory

control management is efficiently managing its inventory.

Over all, inventory is decreasing. It means that companys management is conscious about its

financial position and efficiently managing its inventory. Company is reviewing its policies on

regular basis.

7. Operating Cycle:

It means the period of time elapsing between the acquisition of goods and the final cash

realization from sales and subsequent collections. The lesser the answer, the more efficient the

company. This ratio indicates how long it will take to realize cash from the ending inventory.

Operating Cycle =

Accounts Receivable Turnover in Days + Inventory Turnover in Days

Year 2006 2007 2008 2009 2010

55

Ratios (Days) 22.98 27.78 28.80 21.33 16.92

Time-series Analysis 2006 to 2010:

2006:

In 2006 FCCLs operating cycle completes in 23 days. It means that in 23 days company

realizes its cash from ending inventory. In 2006, company collects its receivables in 6 days and

turns its inventory into sales in 17 days. It means that companys cash management and

inventory management is efficient and efficiently performing its functions.

2007:

In 2007, FCCL completes its operating cycle in 28 days. ratio is increasing which is unfavorable

for company. In 2007, company is collecting its receivables in 3 days and converting its

receivables into sales in 25 days. It means that cash management is efficiently managing its

receivables and reducing chances of bad debts through strict credit policy. While inventory

control management is not efficiently managing the companys inventory.

2008:

In 2008, FCCL is completing its operating cycle in 29 days. Ratio is increasing as compare to

last two tears. In 2008, company is collecting its receivables in 3 days and converting its

inventory into sales in 26 days. It means that cash management is efficiently managing its

receivables and reducing chances of bad debts through strict credit policy. While inventory

control management is not efficiently managing the companys inventory. As in 2008, inventory

is very high and more inventories mean more holding cost and less profit.

2009:

In 2009, FCCL completes its operating cycle in 21 days. Ratio is decreasing as compare to last

year. In 2009, company is collecting its receivables in 3 days and converting its inventory into

56

sales in 18 days. It means that cash management is efficiently managing its receivables and

reducing chances of bad debts through strict credit policy. While inventory control management

is improving its performance as inventory is decreasing as compare to last three years.

2010:

In 2010, FCCL completes its operating cycle in 17 days, which is less than last four years and it

is favorable for company. Company is collecting its receivables in 4 days and converting its

inventory into sales in 13 days. It means that cash management is efficiently managing its

receivables and reducing chances of bad debts through strict credit policy. Inventory control

management is also efficiently managing the inventory.

8. Net Working Capital:

This ratio is an indication of the short-term solvency of the business. The higher the answer, the

more the firms ability to fulfill its financial obligations.

Net Working Capital =

Current Assets Current Liabilities

Year 2006 2007 2008 2009 2010

Ratios

(Rs. 000)

312,183

511,240

2,839,322

-973,996

-973,996

Time-series Analysis 2006 to 2010:

2006:

In 2006, FCCLs net working capital is 312,183 thousand rupees. It means that company has

enough working capital to fulfill its current obligations. In 2006, current assets are 25.48% of

57

total assets while current liabilities are 20.44% of total assets. It means that company has enough

current assets to fulfill its current liabilities.

In 2006, inventory is increasing as compare to last year. This is unfavorable for company

because company has to bear some cost on holding of inventory. Quality of cement is being

affected by long holding of inventory. But it is beneficial to hold inventory in case of inflation.

In 2006, trade debts are decreasing as compare to last year which is favorable for company.

Reducing trade debts mean reducing chances of bad debts. In 2006, other current assets are also

increasing as compare to last year. Companys cash and bank balance is also increasing as

compare to last year. Increase in cash is due to increase in companys other income and

receivables. In current liabilities, markup accrued is decreasing, which means company is paying

its interest liability from its cash. Remaining all liabilities are decreasing except trade and other

payables.

2007:

In 2007, FCCLs net working capital is 511,240 thousand rupees. Company is in a position to

fulfill its short-term obligations. In 2007, current assets are 30.52% of total assets and current

liabilities are 22.53% of total assets.

In 2007, inventory is increasing as compare to last year. This is unfavorable for company

because company has to bear some cost on holding of inventory. Quality of cement is being

affected by long holding of inventory. But it is beneficial to hold inventory in case of inflation.

In 2007, trade debts are decreasing as compare to last year which is favorable for company.

Reducing trade debts mean reducing chances of bad debts. Trade debts are also decreasing due to

decrease in sales. In 2007, companys cash and bank balance is decreasing as compare to last

year. Liability of markup accrued is decreasing; it means that company is paying its markup

accrued with cash. Other current liabilities are increasing. But current assets are more than

current liabilities

2008:

58

In 2008, FCCLs net working capital is 2,839,322 thousand rupees. Company has enough

working capital to fulfill its short-term liabilities. In 2008, current assets are 42.51% of total

assets and current liabilities are 19.71% of total assets. It means that in 2008, company

performed very well.

In 2008, inventory is increasing as compare to last year. It is unfavorable for company because

company has to pay its holding cost. Sales can also effect due to large inventory because quality

of product can be affected. In 2008, trade debts are also increasing as compare to last year. It

can be due to increase in sales or lenient credit policy. In 2008, there is an immense increase in

cash and bank balance. As it is 30.38% of total assets. Increase in cash is due to increase in

interest income and other income. It means company is recovering its previous receivables in

2008 due to which cash is increasing. In current liabilities, all liabilities are increasing except

markup accrued. As in 2008, company is recovering its receivables so it is paying its interest

liability from cash.

2009:

In 2009, FCCLs net working capital is -973,996 thousand rupees. Companys current liabilities

are greater than current assets. In 2009, current assets are 7.71% of total assets and current

liabilities are 12.25% of total assets. It is an alarming situation for company.

In 2009, inventory is decreasing as compare to last year. Which means inventory is turning into

sales. In 2009, trade debts are increasing as compare to last three years. Trade debts are

increasing because sales are increasing and most of the sales are on credit basis, which reflects

lenient credit policy. In 2009, cash and bank balance is decreasing because other income is also

decreasing. Another reason of decrease in cash is that company is paying its liability with cash.

In 2009, current liabilities are increasing because markup accrued and payables are increasing.

2010:

In 2010, FCCLs net working capital is -1,914,197 thousand rupees. It means that companys

current liabilities are increasing as compare to current assets. In 2010, current assets are 7.73% of

59

total assets and current liabilities are 14.88% of total assets. Current liabilities are double of

current assets.

In 2010, inventory is decreasing as compare to last year. It means that inventory is converting

into sale but sales are less than previous year. In 2010, trade debts are also decreasing because

most of the sales are on cash basis. It means that company strict its credit policy. In 2010, cash

and bank balance is increasing as compare to last year because prepayments are increasing and

most of the sales are on cash basis. All the current liabilities are increasing in this year as

compare to last four years.

Liquidity Ratios:

This ratio measures the firms ability to pay its short- term obligations as they come due.

Liquidity refers to the solvency of the firms overall financial position-the case with which it can

pay its bills or dues.

1. Current Ratio:

This ratio determines the short-term debt paying ability of the firm. The current ratio is

considered to be more indicative of the short-term debt paying ability of a firm than working

capital. A general standard for the current ratio is 2 to 1 (or 2:1 or 2/1)

Current Ratio =

Current Assets

Current Liabilities

Year 2006 2007 2008 2009 2010

Ratios 1.25 1.35 2.16 0.63 0.52

Tim-series Analysis 2006 to 2010:

60

2006:

FCCLs current ratio for 2006 is 1.25. In 2006, companys current assets are more than current

liabilities which is favorable for company. In 2006, current assets are 25.48% of total assets

while current liabilities are 20.44% of total assets. It means that company has enough current

assets to fulfill its current liabilities.

In 2006, inventory is increasing as compare to last year. This is unfavorable for company

because company has to bear some cost on holding of inventory. Quality of cement is being

affected by long holding of inventory. But it is beneficial to hold inventory in case of inflation.

In 2006, trade debts are decreasing as compare to last year which is favorable for company.

Reducing trade debts mean reducing chances of bad debts. In 2006, other current assets are also

increasing as compare to last year. Companys cash and bank balance is also increasing as

compare to last year. Increase in cash is due to increase in companys other income and

receivables. In current liabilities, markup accrued is decreasing, which means company is paying

its interest liability from its cash. Remaining all liabilities are decreasing except trade and other

payables.

2007:

FCCLs current ratio for 2007 is 1.35, which means current assets are more than current

liabilities and company is in a position to fulfill its short-term obligations with its current assets.

In 2007, current assets are 30.52% of total assets and current liabilities are 22.53% of total assets.

In 2007, inventory is increasing as compare to last year. This is unfavorable for company

because company has to bear some cost on holding of inventory. Quality of cement is being

affected by long holding of inventory. But it is beneficial to hold inventory in case of inflation.

In 2007, trade debts are decreasing as compare to last year which is favorable for company.

Reducing trade debts mean reducing chances of bad debts. Trade debts are also decreasing due to

decrease in sales. In 2007, companys cash and bank balance is decreasing as compare to last

61

year. Liability of markup accrued is decreasing; it means that company is paying its markup

accrued with cash. Other current liabilities are increasing. But current assets are more than

current liabilities.

2008:

FCCLs current ratio for 2008 is 2.16, which is greater than last two years. It means that

company has enough current assets to fulfill its current liabilities. In 2008, current assets are

42.51% of total assets and current liabilities are 19.71% of total assets. It means that in 2008,

company performed very well.

In 2008, inventory is increasing as compare to last year. It is unfavorable for company because

company has to pay its holding cost. Sales can also effect due to large inventory because quality

of product can be affected. In 2008, trade debts are also increasing as compare to last year. It

can be due to increase in sales or lenient credit policy. In 2008, there is an immense increase in

cash and bank balance. As it is 30.38% of total assets. Increase in cash is due to increase in

interest income and other income. It means company is recovering its previous receivables in

2008 due to which cash is increasing. In current liabilities, all liabilities are increasing except

markup accrued. As in 2008, company is recovering its receivables so it is paying its interest

liability from cash.

2009:

FCCLs current ratio for 2009 is 0.63, which is less than last three years. Companys current

liabilities are increasing as compare to current assets. In 2009, current assets are 7.71% of total

assets and current liabilities are 12.25% of total assets. It is an alarming situation for company.

In 2009, inventory is decreasing as compare to last year. Which means inventory is turning into

sales. In 2009, trade debts are increasing as compare to last three years. Trade debts are

increasing because sales are increasing and most of the sales are on credit basis, which reflects