Académique Documents

Professionnel Documents

Culture Documents

0912C

Transféré par

Gillian GraceDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

0912C

Transféré par

Gillian GraceDroits d'auteur :

Formats disponibles

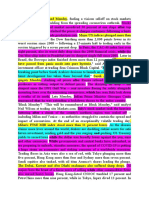

NA0912C001X (R/O) 9/11/01 20:09

Rogers Wireless holders kill bid to go private. Page C6

FINANCIAL POST

C1

W E D N E S DAY, S E P T E M B E R 1 2 , 2 0 0 1

TERROR TAKES ITS TOLL

OIL

GOLD

U.S. DOLLAR

300

31

+ US $1.61

CLOSE: US$29.06

290

+ US$ 14.50

-0.02 Euros

CLOSE: US$286.25

CLOSE: 1.093 Euros

1.110

TSE 300

7350

1.115

FTSE 100

5150

-295.90

CLOSE: 7048.80

7300

30

7250

5000

285

1.105

TRADING

HALTED

29

TRADING

HALTED

280

28

7200

275

-287.70

7150

1.100

TRADING

HALTED

1.095

4850

TRADING

HALTED

7100

CLOSE:

4746.00

7050

Brent crude oil per barrel

27

9 a.m.

11 a.m.

1 p.m.

Spot price per ounce

270

9 a.m.

3 p.m.

11 a.m.

1 p.m.

U.S. dollar in euros

1.090

3 p.m.

9 a.m.

11 a.m.

1 p.m.

3 p.m.

7000

10 a.m.

12 p.m.

2 p.m.

Close

4700

3 a.m. E T

6 a.m.

8 a.m.

12 p.m.

SOURCE: BLOOMBERG NEWS

TSE plunges

295 points

before it

shuts down

Panic selling

is expected

in U.S.stocks

MAY REOPEN TODAY

B Y S I N C L A I R S T E WA R T

The Toronto Stock Exchange

plunged nearly 300 basis points

before shutting down yesterday

morning, as a wave of terrorist attacks on the United States incited

a massive sell-off by panicked investors.

The TSE 300 Composite Index

tumbled 295.90 to 7048.80,

roughly 4%, in just 70 minutes of

frenzied trading, and industry

watchers are predicting it could

drop an additional 10% or more

when it reopens.

Robert Pattillo, vice-president

of public and corporate affairs for

the TSE, said staff would convene

early this morning to decide on a

resumption of trading, adding

that the closure of the U.S. markets today would factor into the

TSEs decision-making.

Neither the New York Stock Exchange nor the Nasdaq Stock

Market opened yesterday, and

many investors are predicting

they will stay shuttered for the

rest of the week.

If there are people on the buy

side who are anxious to participate in the market and require an

orderly market to do that, we

probably will reopen to facilitate

that activity, said Mr. Pattillo.

The real issue is can we conduct

an orderly market?

Insurers and travel-related

companies were hit particularly

hard on a day in which nervous

investors ed to the traditional

safe havens of gold and oil. In all,

229 of the benchmark indexs

300 member companies were

down, including 25 of 28 nancial rms and six of its seven

transportation stocks.

See TSE on Page C10

Market Eye, Page C3

INDEX

CURRENCY

COMMODITIES

HANLEY

INT. STOCKS

C17

C17

C3

C17

MUTUALS

C18

STOCK LISTS

C21

STOCK MKTS.

C2

WORLD

C11-14

It will probably be

the ... opportunity

of the decade

BY SANDRA RUBIN

RALPH ORLOWSKI / REUTERS

A trader at the Frankfurt, Germany, stock exchange reacts after the

attack on the World Trade Centre in New York yesterday.

BayStreet empties out

as tragic news spreads

SECURITY PRECAUTION

B Y D E R E K D E C L O E T,

PETER BRIEGER

AND BARBARA SHECTER

Brad Crompton, president of

Morgan Stanley Dean Witter &

Co.s Canadian division, sent employees home yesterday morning

after terrorists struck the World

Trade Center, said one of the

rms analysts.

Morgan Stanley had about 3,500

employees in the twin towers that

were destroyed yesterday. The centre was the headquarters of Morgans retail operations, and the brokerage rm was its largest tenant.

On Bay Street, activity ground

to a standstill as bank and brokerage employees absorbed the

news of the attack, which destroyed two of the most important buildings in the worlds most

important nancial district.

Most staff in Torontos bank towers were given the option of leaving as fears circulated that they,

too, could be terrorist targets.

Canadian Imperial Bank of

Commerce suspended operations

at its headquarters. Toronto-Dominion Bank evacuated its headquarters and moved key operations into an emergency centre in

downtown Toronto.

We were told that for security

reasons, given what happened in

New York, that we should all leave

the ofce, said Csaba Puskas, a

program analyst at the bank. I

think everyone was just stunned.

See STREET on Page C10

Shocked investors, fearful the attack on the World Trade Center

signals a sustained campaign of

terror against the United States

that could trigger a recession, are

expected to engage in broad panic

selling when U.S. markets nally

reopen, experts said yesterday.

There is apprehension that

benchmark U.S. market indexes

could instantly lose in excess of

5%, wiping out billions of dollars

in shareholder value.

I expect some panic I expect

capitulation, said Irwin Michael, a

portfolio manager at ABC Funds

in Toronto. There will be margin

calls. There will be people feeling

very uncomfortable and they want

out of everything. I wouldnt be

surprised to see major capitulation

and, ultimately, a classic bottom.

It will probably be the buying

opportunity of the decade, added

Mr. Michael, a value investor.

The New York Stock Exchange,

the American Stock Exchange

and Nasdaq all said they will remain closed, but they expect to

determine today when they will

reopen. The last time the NYSE

was closed for two consecutive

days was in 1933 during the

Great Depression.

The new trading oor at the

NYSE was being used yesterday

to treat some of the thousands injured when terrorists rammed

both towers of the nearby World

Trade Center with hijacked U.S.

passenger jets.

Harvey Pitt, chairman of the

U.S. Securities and Exchange

Commission, said in a statement

that trading will resume as soon

as it is practicable to do so.

However, it appeared likely to

be several days before markets

reopen as Wall Street grapples

with the fallout of the destruction

of the twin 110-storey towers,

which housed some of the most

important names in global nance from Morgan Stanley

Dean Witter & Co., which occupied 50 oors, to the Credit Suisse Group, Bank of America

Corp. and Deutsche Bank AG.

Oil surges on Middle East worries

INDEX UP 182 POINTS

BY CAROL HOWES

Crude oil surged

yesterday after hijacked airliners crashed into the World

Trade Center in New York and

the Pentagon in Washington,

over concerns supply may be affected by military retaliation

from the United States and an

escalation in Middle East tensions.

CAL GARY

Crude oil in London rose to an

eight-month high, while rattled

investors scrambled into the safe

haven of energy stocks, sending

the Canadian oil and gas index up

more than 182 points in about 70

minutes of trading before the

Toronto Stock Exchange was shut

down.

The whole environment going

forward depends more on the

U.S. reaction than the actual

events, said Stephen Calderwood, a Calgary analyst with Salomon Partners.

See OIL on Page C10

See MARKETS on Page C10

W H A T S

O P E N

All U.S. stock exchanges will

be closed today. Toronto

Stock Exchange officials said

they would decide this

morning whether to open.

The CDNX, bond markets

and the Montreal Exchange

are expected to follow the

TSEs lead. Commodities

and futures trading in New

York and Chicago has also

been cancelled. Full trading

is scheduled at all major

exchanges in Europe and

Asia. Prices from yesterdays

abbreviated trading sessions

appear on Pages 18 - 23.

The holy

war on

economic

freedom

TERENCE CORCORAN

hatever illusions we have

had that religious terrorism, especially Islamic terrorism,

is strictly a religious crusade with

narrow geographic limits were

shattered yesterday as the greatest symbol of world capitalism

and economic freedom the

twin towers of the World Trade

Center collapsed in the wake of

a terrorist attack.

In selecting as their target the

worlds most powerful economic

emblem, in the heart of New York

City a few minutes from Wall

Street, the terrorists have sent a

message that will change the

world. They have declared war on

freedom and democracy, on

growth and prosperity, on free

markets and on the United States

as the dominant international

symbol of Western economic

achievement.

All signs point to Islamic extremists. One Hamas terrorist

leader once spelled out the economic core of his crusade.

Hamas, he said, represents the

conict between Islamic thought

and Western thought and a

conict of existence and destiny

between the Jewish capitalist alliance and the Muslim people in

Palestine. Palestine, however, is

really just an afterthought in the

grand anti-Western, anti-freedom and anti-markets crusade

that has global ambitions.

The question now is: To what

extent will the World Trade Center attack give the terrorists an

economic victory? Over the short

term, the impact could be severe.

Trade will be disrupted for days,

if not weeks.

See CORCORAN on Page C4

Choices are nice. Too many choices can be confusing. Thats why self-directed investors like Rene Russo value Analysts Choice Funds research,**

access to our FundSmart Specialists and now Morningstar research. Choice, research, support without fees or commissions.* Click on, call in,

or drop by any TD Waterhouse, or TD Canada Trust branch to find out why over 1 million Canadian investors choose TD Waterhouse.

Also available at branches of

www.tdcanadatrust.com

Call today for your free copy of the latest edition of our FundSmart Quarterly.

w w w. t d w a t e r h o u s e . c a

1.800.363.8009

TD Waterhouse Investor Services (Canada) Inc. (TD Waterhouse) is a subsidiary of TD Waterhouse Group, Inc., a subsidiary of TD Bank. TD WaterhouseMember CIPF. Trade-mark of TD Bank. TD Waterhouse is a licensed user. Based on studies published in Canadian Business Magazine, September 24, 1999 and October 16, 2000. * Early redemption fees

may apply, fees may also apply for some research. ** Analysts Choice Funds research is offered by TD Asset Management Inc., a wholly-owned subsidiary of TD Bank. Commissions, trailing commissions,management fees and expenses all may be associated with mutual fund investments. PLEASE READ the funds simplified prospectus carefully before

investing. There is no guarantee that the full amount of your investment in the fund will be returned to you, as the value of the funds units changes frequently and past performance may not repeat. Mutual fund investments are not insured by the Canada Deposit Insurance Corporation or the Rgie de lassurance-dpt du Qubec and are not guaranteed by

TD Bank. Morningstar and Fund Quicktakes are registered trademarks of Morningstar Research, Inc.

NA0912C001X (R/O)

NA0912C002X 9/11/01 19:13

C2

FINANCIAL POST, WEDNESDAY, SEPTEMBER 12, 2001

THE FALLOUT

MONEY MARKETS AWAIT U.S. MOVE

CURRENCIES

LATIN AMERICA

Investors rush to

dump U.S. dollar

BRAZIL FEARS

ITWILL SUFFER

FROM ECONOMIC

SHOCK WAVES

BY KATHRYN LEGER

The immediate outlook for the U.S.

dollar and other world currencies

will depend as much on political

posturing as on investor perception

about where is the safest place to

park money, analysts said yesterday.

A lot depends on what the U.S.

ofcial reaction will be and what

the U.S. Federal Reserve will do,

said Max Tessier, assistant vicepresident, currency, for TAL International in Montreal.

It is also not unreasonable to

think that ofcials from the (U.S.)

Fed and the Federal Bank of Japan

and the European Central Bank

will be having a phone call to make

sure we dont see big swings in currency markets in the next few days

as their contribution to creating a

sense of calm, said Mr. Tessier.

Before yesterdays terrorist attacks, many currency analysts considered the greenback to be overvalued as international investors

sought a safe haven because of jitters about a slowdown in the world

economy.

Yesterday, investors piled both in

and out of the currency as uncertainty and panic selling ripped

through world markets before they

either ground to a virtual halt or

were closed.

On the one hand, there was a

generalized rush to sell the U.S.

dollar. The dollar fell 2% against

the euro, 1.8% against the yen, and

hit seven-month lows against the

pound and the Swiss franc as investors shunned U.S. assets and

opted for the traditional safe

havens of Europe. Elsewhere, investors dumped local currencies in

favour of the greenback, which has

increased steadily in value over the

past ve years.

While many analysts were waiting

for the dust to settle before making

projections, some said they expect

the U.S. dollar will remain steady

and perhaps increase in value.

The knee-jerk reaction to the

blasts has been to sell the dollar,

said Ian Stannard at BNP Paribas

in London. I would expect further

gains in the near term. Key to how

much the dollar suffers is whether

this will affect foreign investor condence in U.S. assets. Said Doug

Davis, president of David-Rea Investment Counsel Ltd. in Toronto:

The U.S. currency is still the

strongest in the world.

I guess I can see why they [investors] might not like to hold it

right now, added Mr. Davis. But

when things get back under control it will still be seen as the

strongest currency.

William McDonough, president

of the Federal Reserve Bank of

New York, which oversees U.S.

monetary policy and plays a key

role in ensuring stability in global

nancial markets, said the U.S.

central bank was standing by to

provide liquidity if there is a surge

in demand.

No one knew yesterday where

things will head today. We have no

way of knowing where markets

stand, said TALs Mr. Tessier. After 11 a.m., liquidity dried up.

This is something thats never

happened, and nobody knows

whats going to come next, said

Cristian Engels, a currency trader

at BanEdwards Corredores de Bolsa SA in Santiago.

Financial Post

kleger@nationalpost.com

BY CLAUDIA PIRES

AXEL SEIDEMANN / THE ASSOCIATED PRESS

Lufthansa aircraft are parked at the Frankfurt international airport. The carrier turned back its U.S.-bound planes yesterday.

World Bank, Airlines, insurers lead plunge

IMF meetings as global markets in free fall

FTSE 100 posts

in jeopardy biggest

one-day fall

BY ANNA WILLARD

WA S H I N G T O N After terrorist

attacks it remained unclear

whether the World Bank and International Monetary Fund

would postpone or cancel their

annual meetings due to take

place here at the end of this

month.

Today, we are only thinking

about the tragedy and what we

can do to help, Caroline Anstey,

head of media relations at the

World Bank, said yesterday.

But in a day or two we will

have to turn our attention to

what can be done about the annual meetings and what the implications are.

The annual meetings bring together top nance ministers and

central bank governors from

around the world to discuss the

global economic situation.

The meetings, scheduled for

Sept. 29-30, had already been

shortened to two days because

of the threat of violent protests.

Washington police expect as

many as 100,000 demonstrators.

We havent had the ability to

talk about it yet, said Adam Eidinger of the Mobilization for

Global Justice, a coalition of

groups that is organizing massive demonstrations during the

meetings. People should take

some time to mourn and the decision will be made after careful

consideration.

Reuters

since 1987 crash

B Y DAV I D S T E I N H A RT

World stock markets plunged

yesterday after the attacks on

the U.S. nancial and political

capitals of New York and Washington, with airlines and insurance companies leading the free

fall.

Most European exchanges said

they planned to open for business today.

The London Stock Exchange

Europes biggest evacuated its

tower headquarters as a precautionary measure but continued

to run trading until the close of

business. It said it would open

for trading as normal today. The

FTSE 100 index closed down

287.7 points in its biggest oneday fall since the crash of October, 1987, wiping US$98-billion

off the value of shares.

As well, the London Metal Exchange three-month base metals ended sharply higher, as

dealers rushed to cover huge

short positions in reaction to attacks on the World Trade Center

and Pentagon.

The Paris bourse said the

benchmark CAC-40 index ended down 7.39% or 433.2 points

at 4059.75 points.

German bourses sank to levels

not seen for almost three years.

The DAX was down 396.6

points or 8.49%, with insurer

Munich Re leading the tumble.

Germanys benchmark index

touched levels not seen since

October 1998.

In Milan, the Mib 30 index

closed down 7.79% at 29,106

points. The Swiss SMI index

shed 7.07% at 5695.1 points.

The Madrid Ibex-35 index was

down by 7.42%. However, Spanish nancial markets said they

would open for trading today as

normal.

The Dow Jones Industrial and

the Nasdaq didnt opened yesterday, while the Toronto Stock

Exchange was open for a little

over an hour.

German airline Lufthansa,

which said it had turned back its

U.S.-bound planes on news of

the attack, plunged 22%, while

tourism group Preussag, fell

14% as investors mulled the impact on the tourism industry.

THE MARKET IS

REACTING WITHOUT

A DOUBT TO THE

AIRPLANES CRASH

British Airways slumped 21% to

close at its weakest level in 10

years at 208 pence, hurt by the

prospect of higher oil prices and

worries about international security. Singapore Airlines Ltd.

and Cathay Pacic Airways Ltd.,

Asias third- and sixth-biggest

carriers by sales, diverted or

cancelled all U.S.-bound services. On the Hang Seng, Cathay

Pacic was down 0.20 at 8.35.

Air France also traded 16.2%

lower.

Gold soars as worried investors head for a haven

RISES 5.7% IN LONDON

BY DREW HASSELBACK

Panic from the attacks on the United States sent gold prices soaring

on a day that was otherwise expected to be spent in quiet anticipation

of todays scheduled gold sale at the

Bank of England.

The gold x in London rose 5.7%

or US$15.60 an ounce after the afternoon benchmark price was nally set at US$287. The price for

immediate delivery rose 5.4% to

US$286.25 in London the

biggest one day gain since Sept. 28,

1999.

Gold stocks, meanwhile, rose in

early trading on the Toronto Stock

Exchange.

The Toronto Stock Exchanges

gold and precious metal prices index was up 343.31 points or 7% to

5250.72, before the market was

closed in response the tragedy in

New York. The close was the highest since May 22.

Martin Potts, an analyst with

Williams de Broe in London, said

the market instinctively turns to

gold in times of terrible news. The

feeling is that this could get nastier.

Gold was not expected to be on

too many radar screens yesterday.

The Bank of England is today

scheduled to sell off 20 tonnes of

gold, and most traders would have

been content to let the market absorb the new supply before trying

to play the price.

But the destruction of the two

World Trade Center towers and the

resulting evacuation of Manhatten

rekindled interest in gold, which

has historically been a safe place to

park funds during international

emergencies.

In a time of crisis, in a time of potential war, in a time of uncertainty,

gold has been a safe haven and a

commodity to have, said John Ing,

president of Maison Placements

Canada. For example, families

from Thailand and Indonesia were

able to preserve their fortunes by

converting their holdings to gold

and gold stocks prior to the collapse of their local currencies during the Asian meltdown of 1997.

But generally speaking, it has

been some time since gold played

its traditional role as a hedge

against ination and panic. Gold

prices, which peaked at about

US$850 in the early 1980s, have

been in decline for 20 years.

The seemingly endless bull market of the 1990s, combined with

the evaporation of ination, left investors from Europe and North

America ignoring gold for other investments. The U.S. dollar, for example, seemed to be just as invincible as gold ever was. As a result,

some of the recent geopolitical crisises, such as the 1991 Gulf War, resulted in a blip in prices.

Yesterdays brief urry of trading

led to one of the biggest jumps in

months on the TSE gold and precious minerals index.

NA0912C002X

Latin American stock exchanges suspended trading and

currencies tumbled after the

tragedies. Stock exchanges in

Brazil, Mexico, Argentina,

Venezuela and Chile suspended

trading as shares plummeted

following the attacks. The

Brazilian real fell to a record

low, weakening as much as

2.9% against the U.S. dollar.

The Chilean, Mexican and

Colombian pesos also slid.

The market is reacting without a doubt to the airplanes

crash, said Sergio Machado, director of xed-income trading at

Banco Fator SA in Sao Paulo.

Brazils benchmark Bovespa

index fell as much as 9.2% before the suspension of trading

after 75 minutes. Argentinas

Buenos Aires Stock Exchange

suspended trading, after the

benchmark index fell 5.2%.

The Chilean stock exchange

suspended trading after the

benchmark index fell 5.2%,

while Venezuelas Caracas

Stock Exchange suspended

trading after its index fell 2%.

Insurers were some of the

biggest casualties on the German markets, with re-insurer

Munich Re tumbling 14% and

Allianz falling 9.6%, as investors mulled the prospect

that the disaster would result in

claims worth billions of dollars.

Insurer Swiss Re, the worlds

second-largest reinsurer, said

its exposure was impossible to

quantify. Swiss Re shares were

down 17.3%. Swiss insurer

Baloise was down 8.8%.

Financial Post, with les from

Reuters and Bloomberg News

dsteinhart@nationalpost.com

Barrick Gold Corp. of Toronto,

for instance, the worlds largest

gold company in terms of market

value, rose 9.9% to end trading at

$27.70. Placer Dome Inc. of Vancouver was up 7.1% to end trading

at $18.60.

Golds safe haven status remains,

said Greg Barns, chief executive of

the Australian Gold Council, a producer-sponsored group. Obviously thats not something the market

would gloat about, given the

tragedy thats occurring. But golds

safe haven role is what were seeing

at the moment.

Gold has been valued from time

immemorial. Portable, liquid and

instrinsically valuable, it was seen

as the perfect way to maintain

wealth.

Gold prices were stable throughout the rst half the nineteenth

century. They took their rst spike

during the U.S. Civil War of the

early 1860s as investors sought to

B R A S I L I A , B R A Z I L Brazilian

President Fernando Henrique

Cardoso warned there could be

economic difculties for Latin

Americas largest country after

yesterays series of aerial attacks

on the United States.

It is probable that considering the

virulent nature of these acts there

will be consequences in the whole

world, mainly economic, Cardoso,

president of the worlds fth most

populous country, said.

And Brazil which is part of the

world economy could be directly or

indirectly affected by this turbulence and by the difculties that

could occur in the economic area,

he added.

Brazil is among the worlds top 15

economies and its economic performance has already deteriorated

sharply this year due to worries over

debt-ridden neighboring Argentina,

an acute energy shortage at home

and a plunging currency value.

In the worst terror attack on the

U.S. mainland in modern history,

two hijacked planes slammed into

the twin towers of the World Trade

Center in New York where about

40,000 people work and a third

plane hit the Pentagon, across the

Potomac river from Washington.

The death toll, initially difcult to

calculate, was expected to be in the

thousands.

Shocked by the attacks, Brazilian

investors sold stocks, plunging

their value 9.2 percent Tuesday before the Sao Paulo stock exchange

suspended trading for the day. The

real currency plummeted to record

low levels against the dollar, bringing its declines in the year to 27

percent.

But Cardoso added, For now

there is no reason for great worry.

Stock exchanges in the worlds nancial center were shut down and

would remain so Wednesday after

the attacks, while markets the world

over plunged on concern that the

fallout from attacks could further

slow global economic output.

Amid the uncertainty for the economy, assets traditionally considered

safe haven investments like oil and

gold soared on the news. But in

Brazil, economists worried investors would become wary of holding assets in emerging markets in

Latin American nations, which generally have a volatile history.

Cardoso was speaking shortly before a meeting of the National Defense Council, Brazils highest defense authority.

Cardoso, who earlier sent a statement to President Bush condemning the attacks, said: I want to reiterate our expression of horror and

condemnation by the government

and (Brazils) people.

The councils members include

Cardoso, the defense, justice and

foreign ministers, and the top chief

in Congress.

The terrorist acts that hit the

United States demonstrate that the

threats to the free world are very real

and that the biggest ones are those

of suicide terrorist attacks, Defense

Minister Geraldo Quintao said.

Reuters

protect their holdings.

Prices stablized by the close of the

century and remained relatively

stable until the Great Depression

of the 1930s and World War Two

from 1939-1945.

It was always used by a great

many families not only as a means

of liquifying and maintaining the

wealth, but it was also a way to get

across borders, Mr. Ing said.

In recent times, gold shot upwards with oil crisis imposed by

the Organization of Petroleum Exporting Countries in the early

1970s and the runaway ination at

the end of that decade. Yet gold

prices have been trending downward since ination seemed to

have been brought under control

in the 1990s. Its a knee-jerk reaction, said Tony Warwick-Ching, a

consultant with CRU International

in London.

Financial Post with wires

dhasselback@nationalpost.com

NA0912C003X 9/11/01 19:09

C3

FINANCIAL POST, WEDNESDAY, SEPTEMBER 12, 2001

AFTERMATH

BUSINESS STANDSTILL

After 70 minutes

TSE shifts course

Shock

waves hits

Canada

hard

Decision to trade

not terrible

just ill-advised

BIGGEST TRADING PARTNER

WILLIAM HANLEY

Market Eye

B Y PA U L B R E N T

Global business ground to a halt

yesterday, as the effects of the

attack on the World Trade Center reverberated beyond lower

Manhattan.

As Americas largest trading partner, Canadians were most affected

as ofce towers were evacuated in

Toronto, air travel was halted and

businesses closed early.

Peter Godsoe, chairman and chief

executive of Bank of Nova Scotia,

left the podium in the midst of a

speech to business leaders in

Toronto to receive reports on the

banks 300 Manhattan employees.

Our ofces in New York are just a

stones throw away from the World

Trade Center, which no longer exists, he told members of the banks

investment forum. Im sure I will

have lost some friends as maybe all

of us in the room will be touched,

because its going to be bad.

Companies with ties to American

corporations or to U.S. head ofces

expect it will be at least a week before business returns to normal.

Its hit the heart and centre of the

(U.S) economy, said Cynthia Keeshan, director of public relations at

Toronto high-tech incubator

Brightspark. Her company has

been notied of the cancellation of

scheduled conferences and calls

over this week. One colleague attending a conference on a ship in

New York is now in international

waters to make room for the U.S.

Navy while another at a nancial

conference in San Francisco that

has been cancelled due to a widespread security clampdown.

Cascades Inc. chief executive

Laurent Lemaire was in New York

to close a previously announced

deal to buy two U.S. mills, and the

company was to hold a telephone

brieng about the deal tomorrow.

Company spokeswoman Francine

Benoit-Plamondon said the agreement wasnt signed because a

meeting was scheduled to take

CHRISTINNE MUSCHI/ THE NATIONAL POST

Peter Godsoe of ScotiaBank left in the middle of a speech yesterday to receive reports from New York.

place a few blocks from the World

Trade Centre.

Ford Motor Company closed all

of its plants in the United States

and Canada starting with the

second shift, primarily out of

concern for employees peace of

mind and material shortages,

and closed its headquarters in

Dearborn, Mich., and regional

ofces in New York City and

Washington as a precautionary

measure following the apparent

terrorist attacks.

Ford expects nearly all of its facilities in the United States and

Canada will be open today, except New York and Washington.

DaimlerChrysler AG, the thirdlargest automaker, closed its U.S.

facilities, sending more than

12,000 employees home but anticipates reopening this morning.

As a German-American enterprise, we are in complete solidarity with the American people during this dark hour, DaimlerChrysler chief executive Juergen

Schrempp said in a statement.

General Motors Corp. closed

three assembly plants in Linden,

N.J., Baltimore, and Wilmington,

Del,. because of their proximity

to New York and Washington,

D.C., said Toni Simonetti, a

spokeswoman for the largest automaker. Most employees at

GMs headquarters in Detroit

and its ofces in New York were

sent home.

Canadas largest electronics retailer, Future Shop Ltd. of Vancouver, conducting what is most

likely its last annual meeting after its acquisition by an American rival, held a sombre annual

meeting devoid of the usual congratulatory executive speeches.

This is a terrible morning, said

Hassan Khosrowshahi, founder

and chairman of the 88-store

chain. We have some business

to do and we will try to put it out

of the way as quickly as possible.

Gerry Noble, chief executive of

the Global Television Network,

narrowly missed getting caught up

in the crisis. He ew to New York

on Monday evening for a dinner

meeting and boarded a plane ying back to Toronto just an hour

before the rst plane crashed into

the World Trade Center. The CBC,

CanWest Global and CTV Inc.

television networks suspended

regular television programming

last night to cover the crisis.

Coca-Cola Co. sent the 4,000

employees at its Atlanta headquarters home yesterday as

dozens of businesses and government agencies around the city

shut down following terrorist attacks in New York and Washington. Atlantas Hartseld International Airport, one of the nations

busiest, was shut as the countrys

air network was grounded,

stranding about 30,000 people.

Even Hollywood was not immune. The U.S. entertainment

capital shut down yesterday as

two key awards shows and a

Madonna concert were cancelled

and most of Hollywoods big studios closed their doors and instructed staff to go home.

Sundays 53rd annual Primetime Emmy Awards were postponed indenitely because of

the attacks and organizers cancelled the second annual Latin

Grammy Awards show, a US$4million music industry event

which had been moved to Los

Angeles from Miami for security

reasons last month.

Who wants to be in a public

place with thousands of people

under these circumstances?

said one Latin music executive.

Financial Post

pbrent@nationalpost.com

with les from Sean Silcoff, Barbara Shecter and wire services

t is the way of the markets

and the people who trade in

them, that there is nothing

nothing that is not a commercial opportunity. So, yesterday,

the price of oil, gold and base

metals rose as the World Trade

Center towers fell, providing

nimble traders with an opportunity to make some quick prots

even before the enormity of the

catastrophe was known.

And then theres the Toronto

Stock Exchange, which along

with the Canadian Venture Exchange and the Montreal Exchange decided to open for business at 9:30 Eastern time, even

though the New York Stock Exchange, the Nasdaq Stock Market and the American Stock Exchange had said they would at

least delay their openings in

light of the events unfolding in

New York and elsewhere.

So, the TSE, which at times

has been unable to open trading

due to technical difculties, decided it must be open for trading on perhaps the one day it

should have at least stayed

closed until such time as its major U.S. counterparts could

open. In the event, the TSE did

suspend trading at 10:40 a.m.,

saying: In response to the

events today in the United

States, the Toronto Stock Exchange has closed. TSE ofcials

will be monitoring the situation

and will issue a news release

when a decision is made to resume trading. A while later, ofcials decided it wouldnt open

again yesterday.

A spokeswoman for the Canadian Venture Exchange said the

CDNX collaborated with the

TSE and the ME in making its

decision. We made our best decision that it should be business

as usual, she said, adding that

the CDNX isnt tied to the NYSE

or Nasdaq through interlisted

stocks, as is the TSE.

Our goal is to protect the integrity of the market and the decision was based on the best interests of investors.

When the NYSE has halted

trading in response to plunges

in the Dow Jones industrial average, the TSE has also stopped

trading, its ofcials realizing

that the connections between

the Canadian and U.S. market

indeed, between all markets

make a co-ordinated approach

necessary for a properly functioning market that is fair to all

participants.

Indeed, one Toronto money

manager told us yesterday: An

open functioning market is a

cornerstone of democracy.

Its not a forum for sympathy,

for expressing sympathy for

those who got killed, he said.

Its not a secular temple. Its a

place for allocating capital.

That said, to function properly,

a market needs good information and access to it, and active

involvement by all the players in

the market.

Indeed, a TSE spokesman said

yesterday that the main question TSE managers will want to

assess this morning before they

make their decision on reopening is whether there can be a fair

market. Even if they believe

GOAL IS TO PROTECT

THE INTEGRITY OF

THE MARKET

they can open a fair market

which seems questionable to us

perhaps they should follow

the lead of the NYSE and Nasdaq, which will be closed again

today.

That would make the most

sense, given the extraordinary

circumstances. Yes, Canada is a

sovereign country, but this is

one case where that doesnt

make a bit of difference to the

interests of those involved.

Common sense is in order

here. TSE ofcials used theirs

when they halted trading at

10:40 after failing to employ it

earlier.

A senior brokerage ofcial said

the decision to open trading was

not terrible under the circumstance. True enough. What happened in New York and elsewhere was terrible.

Financial Post

whanley@nationalpost.com

2.5 kids meet 3.2 litres. The new C320 Sport Wagon.

C320 SPORT WAGON. At a

that aggressive pounce tell you that this

inside story is all leather, laurel wood,

stylish, obsessively safe, and terrifically

on our website, www.mercedes-benz.ca.

time when the stuff-to-kid ratio has never

fibre-optic 7-speaker audio and room.

entertaining car to haul it all in. The

VALUE PRICED STARTING AT $52,850*

been higher, we present the driving

is a true Mercedes-Benz sport vehicle. Its

muscular yet economical V- 6 engine gets

Up to 1,800 litres, or five times the cargo

new and completely uncompromising

enthusiasts alternative to coping with

you to 100 km/h in just 7.2 seconds. Its

capacity of our sedan.

Mercedes-Benz C320 Sport Wagon.

it all: our brand new C320 Sport Wagon.

Touch Shift transmission lets you control

So go ahead, have as big a life as you

Instantly, those sculpted eyes and

the shifts in blissful sport style. And the

want. Because now, theres a superbly

You can find the Mercedes-Benz

dealer nearest you at 1- 800 - 387- 0100, or

E x p e r i e n c e M e r c e d e s - B e n z t h r o u g h T h e C o l l e c t i o n , a c a t a l o g u e o f s i g n a t u r e m e r c h a n d i s e av a i l a b l e a t w w w. m e r c e d e s - b e n z . c a .

2001 Mercedes-Benz Canada Inc., Toronto, Ontario. A DaimlerChrysler Company. *MSRP for 2002 C320 Sport Wagon (optional sport package shown). Dealer may sell for less.

NA0912C003X

The Future of the Automobile

NA0912C004X 9/11/01 19:02

C4

FINANCIAL POST, WEDNESDAY, SEPTEMBER 12, 2001

GRIP OF FEAR

DEFENCE SECTOR

INSURANCE

Property, liabilityclaims

expected to be in billions

Crisis expected

to launch

defense stocks

INSURERS HIT WORLDWIDE

Lloyds of London,

Munich Re likely

to see large losses

Y O R K The damage

caused by the attack on the New

Yorks World Trade Center will

cost insurers worldwide billions

of dollars, in what is the most expensive man-made insured

event in history.

It is safe to assume claims will

be in the billions, said Robert

Hartwig, chief economist for the

Insurance Information Institute

in New York, who witnessed the

airline crashes.

Shares of European insurers

plummeted as it became clear

they could face massive claims

from the terrorist attacks.

Claims will cover many areas,

chiey losses for property damage, aviation, business interruption, personal injury and loss of

life. The total bill could take

years to establish.

To date, the biggest payout was

the US$3-billion for the Piper

Alpha oil platform explosion off

the coast of Britain in 1988.

Insurers face claims for the

complete destruction of the two

World Trade Center towers and

damage to surrounding buildings, plus the costs of relocating

businesses.

The airlines that owned the

planes may also le liability

claims against insurers.

The property losses are likely to

be covered under U.S. insurance

policies, which do not generally

mention coverage for terrorist

acts explicitly.

Unless insurers have explicit

exclusions for terrorist acts, the

losses will hit many rms worldwide. Large property and liability coverages are usually spread

out among insurers and reinsurers to avoid overwhelming

claims on any one insurer.

That means losses are likely to

be shared by U.S. insurers and

big-ticket property and liability

insurers and reinsurers, which

NEW

Bush had already

signalled support

for sector

B Y PA U L H A A VA R D S R U D

Although investors are calling for

most sectors to trade lower after

yesterdays World Trade Center

disaster, defence companies are

among the few stocks expected to

see strength when markets nally

reopen. Shock events like these

do send markets into turmoil. I

expect oil stocks and defence

stocks to soar over this, says Martin Brooker, a strategist with

Credit Lyonnais.

Historically, investors have

poured money into defence stocks

during times of military unrest, a

trend that held to form in Europe

yesterday as big European defence contractor BAE Systems

PLC rose 4.6% to 325 pence

($7.50).

U.S. defence stocks can expect a

similar response when trading reconvenes, according to Roger

Kubarych, chief U.S. economist

for HVP Group in New York, noting the defence industry is where

we are going to see the most impact.

Brookfield N.Y.

buildings miss

worst of blast

NO STRUCTURAL DAMAGE

Toronto property

manager had bid for

World Trade Centre

BY STEVE MAICH

Brookeld Properties Corp.,

an unsuccessful bidder for the

ill-fated World Trade Center,

said none of its New York buildings sustained structural damage when terrorists crashed two

Financial Post, with les

from news services

phaavardsrud@nationalpost.com

airliners into the famous twin

ofce towers yesterday.

In April, the Toronto-based

property manager lost a bid to

buy the World Trade Center for

about US$3.1-billion. Brookeld was outbid by a group led

by Larry Silverstein and Westeld America Inc.

Brookeld generates about

55% of its annual cash ow

from the 11 million square feet

of ofce space it leases in New

York.

Its properties in the city include One Liberty Plaza, and a

large part of the World Financial Center, which is directly adjacent to the site of the World

Trade Center.

The World Financial Center

suffered only broken windows

as the result of the blast. The

company said glass replacement

and cleanup of the area would

begin as soon as possible.

Financial Post

smaich@nationalpost.com

Diamond

Store Online

www.DIACAN.COM

TAKE

TAKE LIFE

ONE PORTERHOUSE

PORTERHOUSE

AT

AT A TIME.

THE STEAKHOUSE

CAREERS

MILITARY SPENDING

Wall Street has been calling for

good things for the defence sector,

since the White House landed in

Republican hands last year. Within the rst few days of taking ofce in January, George W. Bush,

the U.S. President, made it clear

he planned to support the defence

industry by increasing spending

and initiating new projects. Investors have also been betting that

the Bush administration will look

favourably on the sectors recent

move to consolidate.

Although the Standard & Poors

SuperCap Aerospace/Defence index is down 18.2% this year, about

the same as the broader S&P 500

index, that is more a function of

the big players diversication into aerospace and other businesses

than the outlook for defence

spending.

Boeing Co., the worlds largest

aerospace and defence company,

derives about 20% of its revenue

from defence, compared to 60%

from the aerospace side.

Other big defence companies,

such as Lockheed Martin Co.,

Raytheon Co., and General Dynamics Corp., are similarly diversied, but investors expect these

and other stocks to benet as military spending increases in response to yesterdays terrorist attacks.

MONDAY,

WEDNESDAY

& SATURDAY

THE REWARD.

Vancouver 750 West Cordova Street 604.915.5105

1.866.588.7678

www.nationalpost.com

THE NEW YORK TIMES

Lockheed Martin has played a role in weapons systems used on the

U.S. Navys Aegis destroyers such as the USS Arleigh Burke, above.

INVESTOR PSYCHOLOGY

Final nail in the

bull market cofn

Pessimism, even

panic, seen among

fund managers

JONATHAN CHEVREAU

The world became a scarier place

[yesterday]. And the equity markets dont like scary places.

Terry Greene, nancial advisor

he above quote best sums up

what investors will face

when the stock markets reopen

in a few days.

They may have to wait until next

week to nd out the exact damage

that will be meted out to their

portfolios. Its expected markets

could be closed for the rest of the

week in the United States and possibly in Canada, too.

Given the magnitude of the terrorism attacks in New York and

Washington, its just as well markets have closed. Instead of panic

selling of stocks and equity mutual funds, investors have time to

talk to their nancial advisors and

act rationally.

At best, markets that were already jittery before the attacks

could plummet several hundred

points and provide the muchsought-after bottom that would

signal a buying opportunity. Thats

the view of Patrick McKeough,

publisher of Toronto-based

newsletter The Successful Investor.

When markets open, there will be

a lot of pent-up selling and weeks

of volatile activity, Mr. McKeough

concedes. But he adds: This could

be a bottom-making incident by

the time November rolls around.

At worst, this nal nail in the bull

markets cofn could spark a mutual fund redemption crisis and

scare a previously fearless

younger generation out of investing in stocks for a long, long time.

Fund analyst Duff Young says

even professional fund managers

are shaken and in some cases panicking, but its not clear whether

retail mutual fund investors will

react more or less rationally than

the pros. In the meantime, cashheavy portfolios are positioned

best. Normally, youd think the

blue chips would do best. But Im

not sure thats a fair assumption.

Toronto-based fund commentator Dan Richards says investors

dont have to worry about getting

their money out of funds if they

need to. The technology is there to

do it instantly, once markets reopen. However, You may not be

able to sell at a price you like. It

makes no sense to act rashly

work with your advisor.

One such advisor is Terry Greene,

quoted above, who is with Vancouver-based MSC Financial Services

Ltd. Mr. Greene is, however, not

optimistic. He believes the terrorism attacks will have a long-term

negative impact on the markets.

Investors fortunate to be already in

cash and sitting on the sidelines

will be even more reluctant to return to the market, he says.

Meanwhile, those exposed to the

stock market could panic and suffer real losses when the markets

do reopen, he says. Some will be

nancially devastated, others will

simply see their retirement savings signicantly lowered.

James Mason, investment and

retirement planner with Royal

Bank of Canada in St. Johns,

Nd., is similarly pessimistic:

With the downtrend in the U.S.

economy and the weakness of the

Dow Jones and S&P 500 this

disaster will have a devastating

impact on these indexes. And, of

course, our own markets will be

hit substantially.

But other nancial planners are

more positive: Sit tight! advises

Warren Baldwin, regional vicepresident of T. E. Financial Consultants Ltd. in Toronto. A proper

asset mix should be comfortable

for the client, no matter what the

markets do. Selling at the deepest part of the panic is a sure way

to lock in serious losses and not

participate in any bounce-back.

Stephen Lowrie, an investment

advisor with Waterloo, Ont.-based

Canaccord Capital Inc. says its

dangerous to make decisions

based on emotional reactions to a

one-time event.

He cites other momentous nancial events in the past 30

years, such as stock market

crashes in 1973-74 and 1987, the

Gulf War, and the bombing of the

World Trade Center in 1993.

Emotion took over the nancial

markets in the short run only to

recover to new highs over a

longer period of time.

While the broad stock indexes

will likely sag, its also clear certain

sectors will hold up better than

others. Gold, oil and other commodities were moving up yesterday, but advisors expect airline

stocks, insurance companies and

possibly other nancial services

stocks to be hammered.

To hold gold now is even less of

a gamble from one perspective

political instability and war, says

Stephen Gadsden, a nancial

planner in Aurora, Ont., But do

not go overboard North America is heading into a sustained period of deep deation, where xed

income securities will likely be

your best bet.

Financial Post

jchevreau@nationalpost.com

NA0912C004X

are concentrated in London, continental Europe and Bermuda.

Reinsurance companies

which often cover losses over an

agreed amount to protect an insurer from a single massive

claim are especially likely to

be hit with losses.

Munich Re, the worlds largest

reinsurer, said claims could be

considerable but would not

threaten its nancial stability.

Swiss Re, the worlds No. 2 reinsurer, said its exposure was

completely inestimable.

In Britain, Lloyds of London

insurance market, whose member syndicates handle many U.S.

and aviation insurance policies,

is also likely to see large losses.

Terrorist acts are not covered

under British insurance polices,

but that does not affect the

terms of insurance policies covering the United States.

The destruction of the World

Trade Center spells nancial disaster for a variety of U.S. public

companies, including many in

the insurance industry and the

rms involved in a private lease

deal for the two towers.

The American Insurance Association said it could not identify

which of its members will be

NO ONE INSURER

COULD OR WOULD

FACE ALL THAT

EXPOSURE

most affected, but said it was

certain the risk is spread across

many companies.

The coverage on those properties is multi-layered. No one insurer could or would face all that

exposure, said Sean McManamy, director of public affairs for the AIA.

Besides insurance on the building, each tenant within would

hold business interruption coverage, spreading the risk load

further into the industry, Mr.

McManamy said.

Reuters, with les

from Dow Jones

ANALYSIS

Terrorists are out to

overthrow capitalism

C O RC O RA N

Continued from Page C1

Monetary policy will be

knocked off kilter as the U.S.

Federal Reserve scrambles to

keep the nancial system ush

with cash. The economic disruption will lower growth and probably precipitate a recession if one

was not already in the cards.

Stock market prices will fall. The

losses in Manhattan alone could

exceed a couple of percentage

points of Canadian GDP.

The shutting of the CanadaU.S.-Mexico borders, while temporary, will have obvious impacts

on economic activity over the

short term. Over the longer term,

the border closures look more

troubling. One of the hallmark

products of international economic freedom is immigration,

and the shutting of borders to

keep out enemies and prevent

them from leaving conveys an

anti-immigration message that

could take years to overcome.

The democratic and economic

freedoms that are taken for

granted in North America are

the safe harbours of criminals

and terrorists. All too often, responding to terrorist and other

threats, governments nd it necessary to undermine those freedoms as part of a strategy to prevent terror. Thus we have governments imposing elaborate

and futile money laundering

regimes that oppress the people

at home while leaving the terrorists core untouched. The horror

at the World Trade Center is ample proof that elaborate international schemes against immigration, money laundering and other alleged sources of terrorist activity are futile. The people who

hijacked the airlines that destroyed the World Trade Center

made it through all the limp protective apparatus that make up

the Wests past policies of appeasement.

The real long-term economic

impact of the World Trade Center attack would be a change in

the Wests attitude to terrorism.

For years, the terrorist threat has

been treated as the work of fringe

religious extremists or, at worst,

relatively minor political and

military irritants. Now the world

knows that the core objectives of

the terrorist movement goes well

beyond securing a homeland or

ghting a local economy. They

are out to destroy the Western

values and economic achieve-

THE REAL IMPACT OF

THE ATTACK WOULD

BE A CHANGE IN THE

WESTS ATTITUDE

TO TERRORISM

ment that those values have created. They are out to overthrow

capitalism.

This is now the work for soldiers and military strategists and

political leaders. Maybe now,

though, now that thousands of

lives of innocent people the ofce staff, bankers, money

movers, construction workers,

bond salesmen, investment advisors, clerks, real estate dealers

who work at the heart of the free

market economic system have

been lost, maybe now the politicians will take the steps necessary to protect that system.

The U.S. and world economy

will recover from this setback,

but the price paid will have been

steep and every step must be taken to make sure it never has to be

paid again.

Financial Post

tcorcoran@nationalpost.com

NA0912C005X 9/11/01 17:31

The new Lexus IS 300 SportCross

is here.

(With everything you want in

a sport sedan. And then some.)

Dont be fooled by the five doors and the

spacious interior. The new SportCross

is a no-nonsense sports machine with

an exuberant 3.0 litre, 215 hp in-line

six, that will take you from 0-60 mph in

7.4 seconds. Its true that theres room

for four adult-sized adults, and yes, you

can fit a very healthy 21.9 cubic feet of

whatever you like in the back. But sit

in that sports seat, put your foot down

on that drilled aluminium pedal and

flick through the wheel-mounted

"E-shift" gear selectors on a half decent

stretch of asphalt. And we think youll

agree that despite all its functional

attributes, the SportCross is first and

foremost a Lexus IS 300.

For Lexus Dealers or more information,

1-800-26-LEXUS www.lexus.ca

Introducing THE NEW LEXUS IS 300 SportCross

T h e R e l e n t l e s s P u r s u i t O f Pe r f e c t i o n .

Introducing THE NEW LEXUS IS 300 SportCross

NA0912C005X

NX0912C006X 9/11/01 18:59

C6

FINANCIAL POST, WEDNESDAY, SEPTEMBER 12, 2001

CANADA

ROGERS LOSES

BID TO TAKE

UNIT PRIVATE

SHAREHOLDERS SAY NO

BY BARBARA SHECTER

Public shareholders of Rogers

Wireless Communications Inc.

have rejected Ted Rogers bid to

take the company private.

Rogers Wireless minority

shareholders, who own about

16% of the companys class B restricted-voting shares, voted

against a proposal that would

have given them 1.1 shares of

Rogers Communications Inc. in

exchange for every wireless share

they own. Only 21% of class B

Rogers Wireless shares were

used to vote in favour of the proposal.

Mr. Rogers, chief executive of

Rogers Communications, said in

a statement yesterday that

Rogers Wireless will go forward

as a public company.

The votes outcome was not entirely surprising for company

watchers. A valuation commissioned by an independent committee of the Rogers Wireless

board in July said the shares were

worth several dollars more than

the offer.

The bid, made in June, valued

the shares of Rogers Wireless at

about $27, a 24% premium to the

ve-day average trading price. But

the fairness opinion from RBC

Dominion Securities pegged their

value at between $31 and $36.

Rogers Wireless minority public shareholders also voted down

a proposal to waive a minority

protection agreement.

A vote in favour of the waiver

would have allowed the public

Mosaid cuts

44 employees

B Y J I L L VA R D Y

O T TAWA Mosaid Technologies

Inc. said yesterday it has cut 44 staff

after negotiations for new business

broke down and the company was

hit by poor market conditions in the

semiconductor industry.

Up until two weeks ago, we believed that a major new patent licensing agreement would be

signed in our second quarter,

said George Cwynar, Mosaids

chief executive. In the absence of

this agreement, we can no longer

sustain the same level of product

and market development activities and must take measures to

lower our cost base. This has resulted in the difcult but necessary decision to reduce our workforce by 17%. Mosaid employed

258 at the end of July.

shareholders to accept an offer

lower than the independent valuation. It would also have allowed

the transaction to be concluded

without a formal valuation of the

Rogers Communications shares

they would be receiving.

Mr. Rogers could still come back

with a sweetened offer for the

Wireless minority shareholders,

but there was no indication of any

such plan yesterday.

[Mr. Rogers] said before we

werent interested in raising the

price it was a premium, said

Jan Innes, the companys spokeswoman.

Large institutional shareholders

and hedge funds voted down the

transaction in hopes of a higher

bid, analysts said. Since one was

not forthcoming, they added,

Rogers Wireless stock is bound to

sink when the market reopen.

Mr. Rogers is said to have wanted to privatize Rogers Wireless

for several reasons, many of

which revolve around the sagging

public values ascribed to wireless

companies.

If foreign ownership restrictions are relaxed, and Mr. Rogers

wants to sell his wireless division,

it would command a higher price

if it did not have an existing value

on public markets, analyst say.

Mr. Rogers is also said to be

frustrated because the small public oat at Rogers Wireless tends

to result in investors trading

through the company that controls it: Rogers Communications.

When Wireless results arent appreciated by investors, it is

Rogers Communications stock

that takes the hit.

Financial Post

bshecter@nationalpost.com

Mosaid designs networking and

computer memory chips. It licenses some designs to others for

manufacture and contracts out

the manufacture of its own networking chips. It also builds testing equipment that chip manufacturers use in their plants.

Mr. Cwynar said the restructuring was forced by the recent

breakdown in patent licensing negotiations with a major unnamed

memory manufacturer and were

compounded by the current dismal semiconductor market. Most

of the layoffs occurred in the

semiconductor division.

Cuts were also made as a result of

the decision by Mosaid customer

Chrysalis-ITS to close its semiconductor division in August. Mosaid

will stop development on an encryption chip designed specically

for Chrysalis-ITS.

The continued downturn in

worldwide memory markets has

meant memory chip memory manufacturers have cut capital spending on automatic test equipment.

Financial Post

jvardy@nationalpost.com

KEVIN VAN PAASSEN / NATIONAL POST

Ed Kilroy, chief executive of IBM Canada, at the opening of the firms Software Solutions Laboratory yesterday near Toronto.

Housing starts jump healthy 12%

Low vacancy

in Ontario

the main driver

BY GARRY MARR

Defying general economic conditions, housing starts took off last

month, erasing some concerns the

sector might nally be slowing

down.

Canada Mortgage and Housing

Corp. said housing starts on an

annualized seasonally adjusted

basis rose 11.6% to 169,200 in August from 151,600 a month earlier.

Ontario has been the main contributor for this month's solid performance. In fact, the annual rate

of total starts was up 37.% in Ontario with singles up 20.2% and

multiples 58.5%, said Philippe Le

Goff, a senior economist with

CMHC.

Ontario had the largest number

of actual starts in August at

7,434, up from 5,153 a month

earlier.

Across the country, CMHC said

there were 15,611 actual starts,

compared with 14,355 a month

earlier.

Although urban multiples,

which includes condos, were up

19.4% from a month earlier, the

number of urban single starts

showed renewed strength. Urban

single starts rose 9.2% to an annualized rate of 79,600 from July.

Across Canada, many urban

centres are currently affected by a

low inventory of unoccupied houses and a low vacancy rate in the

rental market. This partly explains

MANY URBAN

CENTRES ARE

AFFECTED BY

A LOW INVENTORY

why the housing market is still in

good shape, even though the economy has slowed, said Mr. Le Goff.

At this pace, housing starts

might outpace last years number. During the rst eight

months of the year, the actual

number of housing starts was

92,035 units, up 9% from 84,650

CIBCs Mike Pedersen resigns

as retail banking vice-president

Replaced by

investment banker

Jill Denhan

BY THERESA TEDESCO

Mike Pedersen has resigned as

senior executive vice-president

of retail and small banking at

the Canadian Imperial Bank of

Commerce and has been replaced by Jill Denhan, a longtime investment banking executive with a reputation within the

bank as a trouble shooter.

Robert McLeod, a CIBC

spokesman, conrmed Mr. Pedersen left Canadas third-largest

bank late last week to pursue

other interests. However, Mr.

McLeod would not elaborate

and Mr. Pedersen was not available for comment.

Sources say the departure of

Mr. Pedersen was a mutual decision between the 41-year-old

executive, who began his career

as a labour negotiator in the

food industry, and John

Hunkin, CIBCs chairman and

chief executive.

Mr. Pedersen, who is said to

have supported Holger Kluges

failed campaign to succeed former CEO Al Flood in 1999, was

out of step with Mr. Hunkin because the chief executive became impatient with the slow

pace of growth in the banks

massive retail banking operations. Mr. Pedersen, who

presided over 13,143 employees,

had been spearheading the

strategy to transform CIBCs

1,150 retail branches into fullservice nancial outlets.

Hunkin has high expectations

of the retail bank and he

promised better returns to

shareholders on the strength of

that, said a source who asked

not to be named. It wasnt an

angry departure, he just wasnt

moving fast enough.

According to sources, Mr.

Hunkin did not offer Mr. Pedersen another position at the

bank.

Last month, CIBC reported

that prot dropped 23% to

$460-million ($1.12 a share)

for the same period a year earlier.

The August numbers were particularly encouraging, given that

housing starts had fallen 13.4%

from June to July, on a seasonally

adjusted annualized basis. The

July decline was mostly felt in

Ontario, so there has been a

quick turnaround.

However, last months number

still show a slowdown from June,

when there were 175,300 starts

on a seasonally adjusted annualized basis.

Lee Marsden, a senior research

analyst with Clayton Research

Associates, said the volatility in

the housing sector is a key factor

in the swings from month to

month, but he said the gures do

show the real estate sector is not

about to collapse.

Last year we had exponential

growth. Weve always said that

cannot be replicated, said Mr.

Marsden. The main issue is was

the economy slipping into recession.

He added consumer condence

has been lifted by lower interest

rates, which should keep the

housing sector strong.

Financial Post

gmarr@nationalpost.com

during the scal third quarter

ended July 31, down from $601million ($1.43) during the same

three-month period in 2000.

CIBC World Markets, the investment banking operations,

produced 50% of the banks

overall net income in the third

quarter.

In an attempt to accelerate the

banks retail strategy, Mr.

Hunkin turned to Ms. Denhan,

an 18-year veteran of the bank,

who in the words of one colleague gets the job done.

Ms. Denhan, who is in her early 40s, rose through the executive ranks of Wood Gundy and

was recently executive vicepresident and managing director of CIBC.com.

She joined Wood Gundy in

1983 as a vice-president in corporate nance and by 1992 had

been promoted on several occasions to become president of

CIBC Wood Gundy Capital.

Three years later, in 1995, Ms.

Denhan was dispatched to London to become managing director of CIBC Wood Gundys operations in Europe. She returned to Canada in 1999 and

assumed responsibility for

commercial banking and the

banks e-commerce operations

in 2000.

Financial Post

ttedesco@nationalpost.com

IBM Canada

opens

$125M lab

BY KIM HANSON

IBM Canada Ltd. opened a

$125-million software development facility yesterday just outside Toronto, the result of a twoyear effort by its global parent to

move its biggest research activities to Canada.

The IBM Software Solutions

Laboratory, home to 2,500 software developers, is the thirdlargest research lab in Canada

and will act as the computer giants central facility for the advancement of new technologies.

Situated near the companys national headquarters in Markham,

Ont., the lab will create software

and other database-management

systems for more than 300,000

customers. Another 40,000 hightech workers and researchers

from around the world employed by Big Blue or its customers will have access to the

facility, which spreads over 35

hectares of land and will feature

cafs, games rooms, a tness centre and a childrens nursery.

The 600,000-square-foot lab

was expected to house 2,000 employees, but that number has

grown by 500, as the lab is expected to produce more than a

third of the companys worldwide

software sales, which total

US$12.6-billion.

Ed Kilroy, IBM Canadas chief

executive, said the rm had considered building the facility in Ireland and elsewhere before deciding to keep it in Canada, where

the rm had been operating a

smaller lab for 34 years. But we

found this site not only had the incentives to relocate, but also the

ability to expand, Mr. Kilroy said.

Plans to build the facility were

announced in 1999, after IBM

bought the site from Ontario Realty Corp., an arm of the Ontario government. At the time, the company

said it had not received any nancial incentives to stay in the

province. But yesterday, the computer giant said it was granted

$33-million in federal loans, under

the Technology Partnerships Canada program, to be paid by 2008.

It was a program that we took

advantage of, Hershel Harris, director of the lab, said. [Head ofce] wanted to know the government of Canada was supportive

of IBMs investment in Ontario.

Financial Post

khanson@nationalpost.com

WHO'S ON WILLIAM HANLEY'S

LUNCH MENU THIS SATURDAY?

FP Money's William Hanley lunches with colourful personalities from the world

of high finance and gets them to share their money tips.

LUNCH MONEY, EVERY SATURDAY

IN NATIONAL POST

NX0912C006X

NA0912C007X 9/11/01 17:33

C7

FINANCIAL POST, WEDNESDAY, SEPTEMBER 12, 2001

POST Professionals

To advertise call: 1-866-588-7678 or (416) 386-2662 British Columbia, Alberta & Saskatchewan: 1-888-786-6111 Quebec & Atlantic Provinces: (514) 285-8811

See Financial Post every Monday, Wednesday and Saturday for professional and executive positions in Post Professionals.

Careers

Coast to Coast

For these and more opportunities see

www.careerclick.com/execsearch

Nova Scotia

Halifax: Director, Health Services

Career Match Code: 2890431

Halifax: Executive Director,

Nova Scotia Teachers Union

Career Match Code: 2904877

Halifax: Director of Marketing,

Centennial Hotels Limited,

Career Match Code: 2412312

New Brunswick

Moncton: Unit President,

Career Match Code: 2894025

Newfoundland

St. John's: Executive Director,

Newfoundland Association for

Community

Career Match Code: 3010791,

Quebec

Montreal: Technical Director/Power,

Qualit

Career Match Code: 2023725

Association of Canadian Academic Health

Care Organizations

Montreal: Director of Finance, Objexis

Career Match Code: 3006781

Chief Executive Officer

Chisasibi: Director of Professional

Services-Nursing, Cree Board of Health

Career Match Code: 3014125

Ontario

Ottawa: Director/Manager, HW Product

Development

Career Match Code: 2675550

Ottawa: Vice President Strategic

Initiatives

Career Match Code: 2827037

Kingston: Director of Pharmacy

Career Match Code: 2647232

Toronto: Director EBusiness

Career Match Code: 2833407

Manitoba

Winnipeg: Sr. Designer/Developer

Career Match Code: 2951007

Alberta

Calgary: Director of Care, Unit Manager

The Beverly Centre

Career Match Code: 3016283

Calgary: Director of Sales and

Marketing,

Career Match Code: 2543766

British Columbia

Kelowna: Executive Director,

Career Match Code: 3014902

The Association of Canadian

Academic

Health

Care

Organizations represents the

interests of the approximately 40

teaching hospitals and regional

health authorities affiliated with

Canadas 16 health science

universities. Founded over fifty

years ago as the Association of

Canadian Teaching Hospitals,

ACAHO is establishing permanent

offices in Ottawa under the

direction of its first full time CEO.

Together

with

Faculties

of

Medicine and Health Sciences,

ACAHO members are responsible

for the bulk of Canadas health

science research, education of

health professionals and scientists,

and the delivery of advanced

health care services to their

communities. Although health

services are primarily a matter of

provincial jurisdiction, academic

The new CEO, working under the

direction of a small Board

composed of Canadian health

care leaders, will be responsible

for establishing a national profile

for

ACAHO;

build

solid

relationships with other academic

health science organizations like

the Association of Canadian

Medical Colleges; and promote

ACAHOs policies to key decisionmakers like Health Canada and

the Canadian Institutes for Health

Research.

The successful candidate will have

senior level experience with an

academic

health

care

organization or government;

possess a passion for health and

life

sciences

research

and

education; capable of building

bridges to government and other

associations; is bilingual and an

outstanding communicator; and

has administrative, lobbying, and

policy analysis skills. The nature

of this position demands a

self-starter comfortable working in

a volatile environment and with a

volunteer Board.

The Search Committee will begin

reviewing

applications

on

October 1 2001. If you are up to

this exciting challenge, respond in

complete confidence with a

covering letter outlining why you

are interested in and qualified for

this position, together with a

curriculum vitae and the names

and telephone numbers of five

references

to:

Landmark

Consulting Group Inc., 25 Main

Street West, Suite 2225, Hamilton

ON, L8P 1H1, or email to

resumes@landmarkconsulting.org.

LANDMARK CONSULTING GROUP INC.

Executive Search Consultants

09.12

Leaders in

executive search

for the technology

industry.

Our client is a leading North American provider of IT