Académique Documents

Professionnel Documents

Culture Documents

Incredible Story of Transaction Cost Measurement

Transféré par

Wayne H WagnerCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Incredible Story of Transaction Cost Measurement

Transféré par

Wayne H WagnerDroits d'auteur :

Formats disponibles

The Incredible Story of

Transaction Cost Management:

A Personal Recollection

ly

WAYNE H. WAGNER

On

ew

I

WAYNE H. WAGNER t’s 1984. The summer Olympics are in We are building a 2,300-stock portfolio

is a founder of Plexus Los Angeles, the winter Olympics in including a very large number of industry

vi

Group, Inc., in Venice,

Sarajevo. Wayne Gretzky Is in his prime representatives to create a well tracking port-

CA.

waynewagner@stanfordalumni.org as the Oilers win the Stanley Cup; the folio without holding all 5,000-plus securities

Re

Celtics and the Lakers stand out in the NBA

finals. Roger Clemens is a rookie. The best

in the index. I’m sitting on the trading desk,

phoning the brokers with lists of company

news from 1984 is what didn’t happen: 1984 names which we’re trading. (Remember, it’s

doesn’t look anywhere near as grim George 1984; the FAX machine is high-tech.)

or

Orwell’s apocalyptic vision. I come across a company, quite famous

Personally, I am very busy this day, at the time, even to me, named Green Tree

April 24, in 1984.1 Wilshire Asset Man- Acceptance. The company financed manu-

F

agement is putting into place a $1.3 billion factured housing, later called mobile homes,

Wilshire 5000 Index Fund for the Min- but then known as “trailers.” Clearly, who-

ft

nesota State Board of Investment. We had ever was in charge of assigning industry codes

convinced the SBI that indexing could com- didn’t know that, for he had classified Green

a

pete with active management performance, Tree as a Forestry company. (Green Tree =

Dr

that indexing technology had progressed to Forestry; makes sense, right?)

the point where it was feasible to mirror the I am dumbstruck. Not by the fact that

Wilshire 5000 Index in a real portfolio, and Green Tree was misclassified, but by the fact

that Wilshire could do it best due to exten- that it didn’t matter that I knew nothing—

or

sive work in indexing. We had tutored 40 absolutely nothing—about the thousands of

organizations in running index funds with companies I was buying. Not only that, I was

th

our software, but we had never actually run buying on the basis of erroneous information!

any portfolio ourselves. How can it be that demonstrable dummies,

We were anxious to demonstrate our such as me, can sell index funds on the basis

Au

proficiency to the SBI. One of our best cards of highly competitive performance?

is to show innovative trading savvy to keep I knew from previous measurement

trading costs low. We devise several trading at Wells Fargo and Wilshire that almost all

techniques to disguise our footprints and analyses of quantitative selection models or

reduce impact, but those techniques are not financial analysts’ picks showed value in the

the subject here. This narrative is about how decisions, usually in the range of 50bp. Okay,

the hidden costs of trading were discovered. so analysts’ models add 50bp, but performance

records show portfolio managers underperform

SUMMER 2008 THE JOURNAL OF T RADING 1

IIJ-JOT-WAGNER.indd 1 5/20/08 5:22:30 PM

by something like 50bp before fees. Could the leakage transaction costs associated with brokers protecting

be transaction costs? Not by the then-current estimates themselves against knowledgeable traders. (Which, as

of impact plus commission costs, which were in the demonstrated above, we clearly weren’t.) In a world

range of 25bp. If the value added by investment selection of fixed commissions and only active managers, how

is 50bp and implementation costs take away 25bp, the could we get around the problem of incurring active

net value-added should be positive, right? But it wasn’t. trading costs in a heretofore inconceivable non-active

(And still isn’t!) Where did the value go? portfolio?

ly

Well, that wasn’t my biggest problem at the time, We devised some passive trading techniques that

so I set it aside for many years. Although I thought about we called teddy-bear trading to turn our indifference to

On

it occasionally, it wasn’t until the late 1980s that I got individual stocks selections into an advantage. We wrote

serious about this conundrum. this up in 1975 for the Financial Analysts Journal, which I

believe was the second article on transaction costs pub-

THE INCREDIBLE DISAPPEARING lished.3 We went on to other things, while progress was

ew

ACT OF HAROLD DEMSETZ made elsewhere.

In the late 1980s, commercial transaction cost

Before going forward, let’s trace back a little bit measurement services were offered by Gil Beebower at

further. How many readers are familiar with the name A.G. Becker and Abel Noser. I knew them as friends,

vi

Harold Demsetz? When I asked that question to my but to me the services seemed to be missing something.

Montréal audience, I wasn’t surprised to receive blank The objective seemed to be to cast a suspicious eye on

looks. (Harold wouldn’t be surprised either!)

Harold might not be renowned as the father of Best

Re broker behavior. To me, there seemed to be much more

to understand: What role did the trader himself play in

Execution as a discipline rather than a legal concept, but the process? How about the portfolio manager?

he was first to measure it. The quiet birth of what we now Around 1990, Plexus Group was in need of new

or

know as Transaction Cost Measurement started in 1968 product, and our attention turned again to the still lightly

with an article by Harold Demsetz.2 Considering the plowed fields of transaction cost measurement. It seemed

paucity of available data and the general lack of interest that there was more that could be done to help invest-

F

in the topic, Harold’s work was very illuminating. ment managers reduce transaction costs. In all truth, this

I have a personal story concerning Harold. My was an uphill fight, as suggested by the Demsetz quote.

ft

wife and I were attending a cocktail party in the early Portfolio mangers, chief investment officers, and head

1990s at the home of a UCLA professor. I walked up traders all echoed the thought best expressed to me by a

a

and introduced myself to a stranger—and it’s Harold Canadian investment manager: “I pick stocks. The rest

Dr

Demsetz! I enthused about this seminal work which is just plumbing.”

had so strongly inf luenced my career. With a wry look Later, I would add: “leaky plumbing.” For a while

on his face, he said, “As far as I know, you’re the only I was infatuated about quotes on plumbing. Here is the

person who ever read it.” best, from the eminently quotable John Gardner:

or

SOME MORE ANCIENT HISTORY We must learn to honor excellence in every

th

socially accepted human activity, however humble

Let’s move on to 1972, to the fabled Management the activity, and to scorn shoddiness, however

Sciences Department of Wells Fargo Bank. An investor exalted the activity. An excellent plumber is

Au

with a background from The University of Chicago, infinitely more admirable than an incompetent

the hotbed of early quantitative work in finance, was philosopher. The society that scorns excellence in

searching for someone who could create a real-world plumbing because plumbing is a humble activity

application of the then newly minted Sharpe model. Of and tolerates shoddiness in philosophy because

course, we now know this as an index fund, although it is an exalted activity will have neither good

the term wasn’t invented until later. This first attempt plumbing nor good philosophy. Neither its pipes

was crude and largely off-base, but workable, except nor its theories will hold water.

for one thing: We couldn’t afford to pay the normal

2 THE INCREDIBLE STORY OF T RANSACTION COST M ANAGEMENT: A P ERSONAL R ECOLLECTION SUMMER 2008

IIJ-JOT-WAGNER.indd 2 5/20/08 5:22:30 PM

Now we’ve come full circle to the basic conun- walk” theory of price movements didn’t apply when

drum: can costs explain the difference between port- there was latent, unfilled demand (or supply). Until

folio managers’ positive potential value and the negative that committed but uncompleted trading interest

realization? Three events added momentum to our new was filled, there would be constant one-sided pres-

pursuit: sure on the stock price. The result: delay hurt much

more often than it helped.

• A new model: In 1988, Andre Perold defined imple- • This effect can be measured by simple arithmetic,

ly

mentation shortfall as the true all-in cost of trans- when you know the manager’s intentions. Many

acting, calling on Treynor’s thoughts of 20 years terms have been applied to this cost, but we called

On

before. it “delay” cost or “opportunity” cost. It is almost

• A new data source: Seth Merrin’s first functional, and koan-like: the cost of not trading.

soon to be indispensable, Order Management System. • By measurement then, and even now, these egre-

For the first time, data was available to trace the gious costs comprise 60-75% of the total costs. Yet

ew

fundamental questions: who did what, when, why, nobody, myself included, even suspected them,

and how? although it seems so obvious now.

• An urgent motivation: Plexus Group’s relationship

with Instinet’s Crossing Network had come to Secondl, broker misbehavior might have been a

vi

a close. We needed a new product to generate problem, but it wasn’t the problem. The problem was

revenue! one of institutional trading size compared with trader

Fortunately we had good friends in the industry

Re

motivation, combined with a whole lot of temporizing,

hedging, and second guessing of the trading decisions.

who showed interest in anything that would help The traders’ self-standard of excellence—minimizing

them improve performance. I am forever indebted to impact—was disconnected from the primary motive:

or

Ted Aronson of (then) Aronson and Fogler, and Mark the maximization of investor wealth.

Edwards, who was running active quantitative portfolios It turned out the traders were right when they

for Minnesota SBI and ultimately became an inspiring complained that the trade cost analyses of the day were

F

partner at Plexus. Importantly, no one had ever looked at simplistic and naïve. The data showed many levels of

this level of transaction data: the order from the portfolio complexity, the “complex tapestry” of skills, handoffs,

ft

manager, and the process by which it transformed into and tradeoffs as described in the CFA-Institute’s Best

changes in portfolio holdings. Execution Taskforce Report:

a

We had the total cost from Perold’s insight. We

Dr

could isolate the commissions and impact, and they • Managers would slowly feed orders to the desk,

were in line with expectations. But there was something imposing ever-shifting price limits and quantities;

more, a missing piece: the Perold cost was three times • The size of the institutional orders often exceeded

as large as commissions plus impact. It didn’t take much the practical limits of available liquidity;

or

searching of the data to discover where the hidden costs • There was little attempt to prioritize orders, so

were, and to identify two sources of the problem. traders could not tell which orders were the most

th

First, traders were focused on monitoring their sensitive;

potentially disloyal friends, the brokers, and on min- • Traders would attempt to time the market, usually

imizing the impact of their trading on the market. unsuccessfully, holding back when they didn’t like

Au

Meanwhile, in front of their noses—but completely the tenor of the market.

invisible—were other, insidious, egregious, hidden costs

of trading: All these factors contributed to the invisible costs,

which were two to three times the explicit costs. Invis-

• The traders focused on minimizing impact, but ible, yes, but also egregious: if the price eroded in a stock

that was only part of the story. to be sold because of manager hesitancy, trader reluc-

• If you fail to trade while the stock is trending, you tance, or market conditions, real losses were incurred by

will ultimately trade at worse prices. The “random the investor, both on sales and purchases.

SUMMER 2008 THE JOURNAL OF T RADING 3

IIJ-JOT-WAGNER.indd 3 5/20/08 5:22:30 PM

What a thrill! We were standing on the edge of not an outcome. As trade directives move down

knowledge, observing from a completely new perspective, the chain of knowledge, valuable feedback infor-

seeing what no one had seen. Clearly, there was a busi- mation now moves in the opposite direction and

ness proposition here—an opportunity to enhance returns alters future behavior.

by tightening up the plumbing. All Plexus needed were 3. We have learned the importance of data. Long

customers. ago, Pythagoras said: “Without proof there is

No matter how striking our findings were to me, it only the poverty of arguable opinion.” Similarly,

ly

often failed to evoke a similar response in the plumbing- without data—accurate, timely, and highly speci-

haters we hoped would become customers. Not only fied data—all we can practice is conjecture and

On

did we need to convince them that we had found a self-justification. Yet the data we capture today is

better way, we had to persuade them that their previous increasingly inadequate to the vastly more com-

knowledge—and by a quick mental deduction, their plicated task of evaluating complex, conditional,

skills—were incomplete and obsolete. and rapidly changing algorithmic trading and dark

ew

I have a Dilbert cartoon in my scrapbook where pool searches.

Dogbert describes himself in the first frame as “the quan- 4. Structural impediments to buyer meeting seller

tifier of unquantifiable things.” In the second frame, he with multiple middlemen inf lated costs by at least

says, “I declare you to be worth $85.” In the third frame a factor of two. Many of those middlemen could

vi

you see Dogbert walking out of the office followed by be found on the f loor of the exchanges, where

a scream of epithets. Dogbert shrugs: “No one likes to we could see the energy of financial markets per-

be quantified.” That is a fairly accurate description of

our early commercial encounters. Still, eventually the

Re sonified. Nostalgic, picturesque—and expensive.

Very expensive as it turns out, and in ways no one

value proposition prevailed. suspected. This is one occasion where regulation

clearly worked to the benefit of investors: the SEC

or

TODAY: WHERE ARE WE NOW? and other regulatory bodies were right to force

down the commission and the spread. Squeezing

I’d like to share with you my observations from out the middlemen’s “vigorish” sparked the move

F

40-plus, on-and-off years of observing markets, trans- to electronic trading venues, which can do the job

acting, and transaction cost management (TCM). a million times faster, with lower error rates and

ft

TCM today has deep penetration into the practice much less information leakage.

of investment management and trading. In fact, we’re at

a

a level of understanding and applicability inconceivable At the height of the internet/biotech frenzy in

Dr

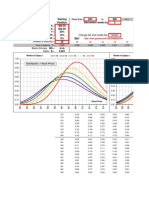

just a few years ago. 2001, Plexus Group recorded one-way costs at 142bp

for USD large capitalization stocks. By 2005, these costs

1. The hidden costs are the major costs, totaling dropped a remarkable 64%, to 51 basis points. They have

two-thirds to three-quarters of the total cost of stayed in that neighborhood ever since.

or

implementing institutional investment decisions.

The source of hidden cost is the inability to create 5. Lower transaction costs empower lower threshold

th

liquidity upon command, i.e., when it is needed strategies. Many good ideas that would not be

the most. The iceberg is the key insight to the pro- profitable in a high-cost environment can now be

cess. Trading cost, we now know, is certainly not executed. Many a worthless old slag heap can now

Au

the commission and not just impact. It is the slip- be re-mined for gold worth $1,000 an ounce.

page between the costless value of the investment 6. There are three big cost factors that determine

idea and the performance realization. Perold’s idea what a trade is going to cost: the size of the trade

reigns supreme. relative to the trading volume; the small capitaliza-

2. TCM is most effective as a feedback and self- tion or thin trading supply of the company; and

evaluation process. It is an exercise in effective price momentum due to a conf luence of trading

business management under conditions of uncer- interest on one side.

tainty. The key insight is that it is a process, and

4 THE INCREDIBLE STORY OF T RANSACTION COST M ANAGEMENT: A P ERSONAL R ECOLLECTION SUMMER 2008

IIJ-JOT-WAGNER.indd 4 5/20/08 5:22:30 PM

7. How do we think about the determinants of performance potential is beneficial. 3) Consider Jack

transaction costs? Here’s my take on the market Bogle’s suggestion that the easiest way to be in the first

dynamics that determine the outer bounds of quartile of performance is to be in the fourth quartile of

transaction costs: costs. 4) Look for the low-hanging fruit to reduce the

drag of transaction costs.

a. The minimum cost is the structural cost of pro-

Am I suggesting that fiduciaries should become TCA

ducing the trading service. In a minimal cost

experts? Empathetically, no. But the people to whom you

ly

market, the lowest cost producer becomes the

delegate your fiduciary responsibility should be.

dominant player.

On

b. The maximum cost is expectational, and lies in

the realm of the portfolio manager, who views WHAT WE STILL DON’T KNOW

the trade in terms of what can be gained for

TCA has come a long way, but some important oppor-

his portfolio: how much am I willing to pay to

tunities remain. I can think of several key issues that will

capture the potential of this investment idea?

ew

confront transaction cost researchers in the future.

c. Liquidity failure occurs when the other side of

the market disappears, often in a f lash. Once

1. Most of the costs occur according to a sort of 80:20

frightened, liquidity can stay away for a long

rule: 20% of the trades create 80% of the costs. It

vi

time; consider the sub-prime meltdown or the

seems to me, however, that it is probably not pos-

Russian bond crisis for LTCM. Keynes said this

sible to avoid the runaway trading situations and to

best: “The market can stay irrational longer than

you can stay solvent.” Re fill our trades before the price shoots up (or down).

Here are my thoughts on the matter: Except for

f low trading, the reason a manager decides to trade

HOW DOES THIS AFFECT INVESTORS is because something has changed—i.e., a signal

or

AND FIDUCIARIES? that calls out a response. It could be news, earnings

surprise. relative change in value, changing of a

If we add together the components of cost for an rating, data errors in a quantitative database, etc.,

F

average U.S. mutual fund, we typically come up with etc. But if nothing changes, the portfolio manager

numbers like this: sees no motivation to trade.

ft

OK, but our heroic portfolio manager isn’t the only

Management fee 75bp signal reader in the market; others will react as

a

Administration expenses 20bp well, and the result is a herd effect. Thus the price

12(b)–1 fees 50bp

Dr

shoots up because we, the collective, the herd, “we”

Total fees and expenses 145bp are suddenly anxious to trade.

At the height of the Internet frenzy, we measured As long as there are surprises in the market, there

will be runaway trading cost situations. The silly

or

transaction costs peaking at 142bp each way for buying

and selling. Coupled with a 100% turnover rate, trans- solution to this problem would be to trade when

action costs could be twice the total fees and expenses there’s no immediate reason to trade, but would

th

shown above. Even in today’s more efficiently operated you invest with a portfolio manager who trades for

markets, transaction costs can still be the largest draw- no reason?

down of investable funds. So, as a fiduciary, charged 2. The same problem comes up when it’s time to focus

Au

with acting in the best interests of the fund holders, our attention on the TCA reports. Our attention

where would place your emphasis? is naturally drawn to the blowups, but the trade

I suggest that the interests of the beneficial owners desk alone cannot contain the damage. True cost

are best served by following the following logic: 1) Effec- containment comes from dealing with the run-of-

tive oversight means knowing what to look for; which the-mill trading situations, not the conf lagrations.

questions to ask. 2) All costs are negative performance, As with fighting brush fires, containment comes

therefore anything that reduces costs without harming in fighting the many sparks before they blow up.

Once the fire is out of control, the damage cannot

SUMMER 2008 THE JOURNAL OF T RADING 5

IIJ-JOT-WAGNER.indd 5 5/20/08 5:22:30 PM

be contained. As we experience in California, all here: I cannot document that gains in trading efficiency

wildfires extinguish when they reach the ocean. result in thrillingly better portfolio returns.

So it is with trading situations; thus the disasters du We have two data sources we can look at: the Stan-

jour will probably always be there. The trade desk dard & Poor’s SPIVA (S&P50 Index vs. Active) data, and

can make heroic efforts to mitigate the damages, the ITG/Plexus Group client database.

but the winds blow too strong. The SPIVA data shows no trend: I divided the eight

I can see two possibilities for mitigating the damage, years of available data in half. In the first four years, from

ly

one before the fact and one after. Both rest in the 2000 to 2003, the S&P500 index outperformed 54% of

domain of the portfolio manager, not the trade large-cap mutual funds. For the 2004-2007 period, the

On

desk. Before the fact, the solution is to consider the index outperformed 63% of the managers. Certainly no

risk. As we’ve recently found out, quantitative tech- indication of improvement there.

niques such as VAR (value at risk) all too often dras- The Plexus data is more encouraging. In 2002

tically understate the risk. Gaussian statistics don’t the average costs were 140bp, the costless returns were

ew

work during a regime change: they can’t predict 10 110bp, and the net value added was a negative 30 basis

sigma changes. Perhaps the best solution is to induce points. By 2007, average costs were down to 40bp,

terrible nightmares for the portfolio manager and which matched the costless return of 40bp, with a net

motivate him or her to clear-cut the potential fuel value added of zero.

vi

that could lead to a wildfire disaster. Zero value added? Isn’t that wonderful? I would

The after-the-fact solution is to refuse to join the describe myself as unenthralled, but unappalled.

herd: wait six weeks and then decide if you still

want to own the stock. This tactic doesn’t avoid the

Re The cheeriest conclusion I can reach is that this

indicates market efficiency, in the “no free lunch” sense.

loss, it absorbs the blow, then looks to a new day Perhaps the best that can be expected in a hotly com-

when the value of the company can be reassessed petitive market for investment ideas is that the search

or

in a more balanced frame of mind. costs will be covered on average. This conclusion would

3. Another problem is our obsession foreseeing the fit nicely into a robust definition of market efficiency,

future through transaction cost predictors. Over incorporating the wedge costs of search and transaction

F

any time frame greater than a few seconds, this costs.

may be the impossible dream. Predicting all-in Some darker possibilities include:

ft

costs is the same as predicting future prices. If there

is such a person who can do that, he has a great • Could it be a curse of optimism, that managers

a

career ahead of him in a hedge fund. Or a religious will adjust their idea production to the hurdle

Dr

movement. rate and will always overstate their information

advantage?

The truth is that the explanatory power of a pre- • Perhaps we suffer recently from a lack of oppor-

dictor over the full execution of an institutional order tunity—i.e., fewer stocks with skyrocketing pros-

or

is very, very low. The same equations that can explain pects in recent years.

costs after-the-fact lose over 90% of their power when • Is someone else, such as the hedge funds, capturing

th

applied to predictions. It is impossible to forecast inde- the advantage?

pendently occurring demand and supply in an unstable • Or perhaps there’s just too much noise in perfor-

situation. Excessive reliance on predictions is like betting mance data and too loose a connection to transac-

Au

on a coin f lip. tion costs to notice the effect.

THE BOTTOM LINE Nonetheless, we have made great progress, and it

is worthwhile to conclude with a brief list of some of

Finally, the most important point: How have the major accomplishments.

reductions in transaction costs affected bottom-line

investment performance? I have some perplexing news

6 THE INCREDIBLE STORY OF T RANSACTION COST M ANAGEMENT: A P ERSONAL R ECOLLECTION SUMMER 2008

IIJ-JOT-WAGNER.indd 6 5/20/08 5:22:30 PM

1. We have made great progress in understanding ENDNOTES

market microstructure, and how this affects the

cost of trading. This lightly overblown title comes from the kindly and

fertile imagination of my friend, Robert Pouliot of RCP

2. The science of trade cost measurement has become

Partners, S.A, who invited me to give a keynote speech to

widely accepted, and has led to significant enhance- the Centre for Fiduciary Excellence in Montreal, Quebec on

ments to the way we trade securities. March 12, 2008.

3. These new trading methods represent a challenge

ly

1

I ask your forbearance for all the vertical pronouns in

to the TCM process. How do we gather the data this exposition. The first-person voice communicates as more

to make intelligible choices among algorithms and evenly balanced in a speech than it does in writing.

On

the operative settings that govern them? 2

Demsetz, Harold, “The Cost of Transaction,” Quar-

4. The TCM revolution has won major victories, but terly Journal of Economics [February, 1968].

3

is still being fought daily. Continuing evolution Cuneo, Lawrence, and Wayne H. Wagner, “The Costs

will call forth new insights and new challenges. of Transacting.” Financial Analysts Journal [November/December

ew

5. Fiduciaries are well served by the attention they 1975].

pay to these costs, not only for gains in efficiency,

but also for the deeper understanding of the invest-

ment process it provides. To order reprints of this article, please contact Dewey Palmieri

vi

at dpalmieri@ iijournals.com or 212-224-3675

6. Despite whatever successes we’ve had in the past,

best execution is particularly important now, when

the patterns and practices are undergoing con-

tinuing rapid evolution.

Re

Yes, there’s much to be done, and yet we’ve come

or

a long way and that is cause to celebrate. We have saved

billions of dollars for investors, and I am grateful to have

an opportunity to make my own contribution to this

F

noble cause.

a ft

Dr

or

th

Au

SUMMER 2008 THE JOURNAL OF T RADING 7

IIJ-JOT-WAGNER.indd 7 5/20/08 5:22:30 PM

Vous aimerez peut-être aussi

- Spelling Power Workbook PDFDocument98 pagesSpelling Power Workbook PDFTinajazz100% (1)

- Which Shorts Are Informed?Document48 pagesWhich Shorts Are Informed?greg100% (1)

- Reversals in Minds and MarketsDocument4 pagesReversals in Minds and MarketsLUCKYPas encore d'évaluation

- The Markets Ways To TradeDocument8 pagesThe Markets Ways To TradeNassim Alami Messaoudi100% (1)

- Abonacci Trading: Credit: Bobi Abonacci ContactDocument4 pagesAbonacci Trading: Credit: Bobi Abonacci ContactUjangPas encore d'évaluation

- Equity - Strategy - Outlook - August 2009Document7 pagesEquity - Strategy - Outlook - August 2009Trading Floor100% (2)

- Injection Pump Test SpecificationsDocument3 pagesInjection Pump Test Specificationsadmin tigasaudaraPas encore d'évaluation

- Hedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersDocument184 pagesHedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersHedge Clippers100% (2)

- When Do Stop-Loss Rules Stop LossesDocument42 pagesWhen Do Stop-Loss Rules Stop LossesPieroPas encore d'évaluation

- Delta and GammaDocument69 pagesDelta and GammaHarleen KaurPas encore d'évaluation

- Athletic KnitDocument31 pagesAthletic KnitNish A0% (1)

- Defensive Portfolio Construction Based On Extreme VaR SCHIMIELEWSKI and STOYANOVDocument9 pagesDefensive Portfolio Construction Based On Extreme VaR SCHIMIELEWSKI and STOYANOVRuTz92Pas encore d'évaluation

- Forex5 INDICATOR AlligatorDocument11 pagesForex5 INDICATOR AlligatorKamoheloPas encore d'évaluation

- Risk Management Through Forex Derivatives: Presented ByDocument31 pagesRisk Management Through Forex Derivatives: Presented ByRoma ManwaniPas encore d'évaluation

- A Practical Guide To Swing Trading Author Larry SwingDocument74 pagesA Practical Guide To Swing Trading Author Larry SwingDevendra SinghPas encore d'évaluation

- Intra-Day Momentum: Imperial College LondonDocument53 pagesIntra-Day Momentum: Imperial College LondonNikhil AroraPas encore d'évaluation

- Ttmygh 3.18Document37 pagesTtmygh 3.18ZerohedgePas encore d'évaluation

- PDF Created With Pdffactory Trial VersionDocument8 pagesPDF Created With Pdffactory Trial Versionlaozi222Pas encore d'évaluation

- Session 13-WTC PPT (Apr 01, 2019)Document30 pagesSession 13-WTC PPT (Apr 01, 2019)abimalainPas encore d'évaluation

- Orderflow AbstractDocument2 pagesOrderflow AbstractpostscriptPas encore d'évaluation

- Has The Carry Trade Worked in World Bond MarketsDocument10 pagesHas The Carry Trade Worked in World Bond MarketsIbn Faqir Al ComillaPas encore d'évaluation

- JPM Global Data Watch Se 2012-09-21 946463Document88 pagesJPM Global Data Watch Se 2012-09-21 946463Siddhartha SinghPas encore d'évaluation

- Institutional Order Flow and The Hurdles To Superior PerformanceDocument9 pagesInstitutional Order Flow and The Hurdles To Superior PerformanceWayne H WagnerPas encore d'évaluation

- Grade 11 Stem Group 2 Practical Research 1Document19 pagesGrade 11 Stem Group 2 Practical Research 1Roi Vincent Cuaresma BlasPas encore d'évaluation

- The Carry Trade and FundamentalsDocument36 pagesThe Carry Trade and FundamentalsJean-Jacques RousseauPas encore d'évaluation

- Shaping School Culture Case StudyDocument7 pagesShaping School Culture Case Studyapi-524477308Pas encore d'évaluation

- Risk On Risk Off 1Document16 pagesRisk On Risk Off 1ggersztePas encore d'évaluation

- A Look at What Constitutes Unfair Practice and How You Can Ensure You Always Play Fair in The Eyes of The LawDocument1 pageA Look at What Constitutes Unfair Practice and How You Can Ensure You Always Play Fair in The Eyes of The LawguptevaibhavPas encore d'évaluation

- Defender of Catholic FaithDocument47 pagesDefender of Catholic FaithJimmy GutierrezPas encore d'évaluation

- Introduction To Macroeconomics: Notes and Summary of ReadingsDocument27 pagesIntroduction To Macroeconomics: Notes and Summary of ReadingsShibani Shankar RayPas encore d'évaluation

- Lecture 4 - Consumer ResearchDocument43 pagesLecture 4 - Consumer Researchnvjkcvnx100% (1)

- IOF - Standard DevDocument15 pagesIOF - Standard DevOtsile Charisma Otsile SaqPas encore d'évaluation

- Holistic Centre: Case Study 1 - Osho International Meditation Centre, Pune, IndiaDocument4 pagesHolistic Centre: Case Study 1 - Osho International Meditation Centre, Pune, IndiaPriyesh Dubey100% (2)

- Creating A Heirarchy of Trading DecisionsDocument6 pagesCreating A Heirarchy of Trading DecisionsWayne H WagnerPas encore d'évaluation

- Content: The Economics of Money, Banking, and Financial Markets Money, Banking, and Financial MarketsDocument12 pagesContent: The Economics of Money, Banking, and Financial Markets Money, Banking, and Financial MarketsQuang NguyenPas encore d'évaluation

- Tutorial 02 AnsDocument3 pagesTutorial 02 Anscharlie simoPas encore d'évaluation

- Metallgesellschaft AG: A Case StudyDocument24 pagesMetallgesellschaft AG: A Case StudyTariq KhanPas encore d'évaluation

- Tutorial 07 AnsDocument3 pagesTutorial 07 Anscharlie simoPas encore d'évaluation

- 1 Liquidity RiskDocument8 pages1 Liquidity RiskShreyanko GhosalPas encore d'évaluation

- Tutorial 06 AnsDocument3 pagesTutorial 06 Anscharlie simo100% (2)

- Liquidity As An Investment StyleDocument30 pagesLiquidity As An Investment StyleBurhan SjahPas encore d'évaluation

- Fin Model Class13 Option Greek DeltaDocument7 pagesFin Model Class13 Option Greek DeltaGel viraPas encore d'évaluation

- Delta HedgingDocument3 pagesDelta HedgingGallo SolarisPas encore d'évaluation

- Game Plan: Scenario 1 - Highs Made First Price Breaks Yesterday's Highs Unable To SustainDocument4 pagesGame Plan: Scenario 1 - Highs Made First Price Breaks Yesterday's Highs Unable To SustainRICARDO100% (1)

- Tut Topic 1 QADocument3 pagesTut Topic 1 QASiow Wei100% (1)

- Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell JobmanDocument5 pagesIndicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell JobmanLuisa HynesPas encore d'évaluation

- How To Delta HedgeDocument11 pagesHow To Delta Hedgemusadhiq_yavarPas encore d'évaluation

- The Money Supply and Inflation PPT at Bec DomsDocument49 pagesThe Money Supply and Inflation PPT at Bec DomsBabasab Patil (Karrisatte)Pas encore d'évaluation

- Option Delta With Skew AdjustmentDocument33 pagesOption Delta With Skew AdjustmentTze Shao100% (1)

- Information Theory and Market BehaviorDocument25 pagesInformation Theory and Market BehaviorAbhinavJainPas encore d'évaluation

- Potential TradeDocument2 pagesPotential TradeMohd. Rashdan100% (1)

- Liquidity Management Through Sukuk Report 2016Document24 pagesLiquidity Management Through Sukuk Report 2016Miaser El MagnoonPas encore d'évaluation

- Liquidity and Market EfficiencyDocument20 pagesLiquidity and Market EfficiencyAmir HayatPas encore d'évaluation

- Marshall Nickles - Presidential Elections and Stock Market CyclesDocument8 pagesMarshall Nickles - Presidential Elections and Stock Market CyclesJohn SmithPas encore d'évaluation

- OrderFlow Charts and Notes 12th Oct 17 - VtrenderDocument4 pagesOrderFlow Charts and Notes 12th Oct 17 - VtrenderSinghRaviPas encore d'évaluation

- Dow TheoryDocument17 pagesDow TheoryrahmathahajabaPas encore d'évaluation

- The Cboe Skew Index - SkewDocument20 pagesThe Cboe Skew Index - SkewChristopher HoPas encore d'évaluation

- HedgingDocument7 pagesHedgingSachIn JainPas encore d'évaluation

- Project Report, Satpal Singh, B-26, 10906078Document11 pagesProject Report, Satpal Singh, B-26, 10906078satpalsinghsasan1989Pas encore d'évaluation

- Optimal Hedging Using CointegrationDocument23 pagesOptimal Hedging Using CointegrationRICARDOPas encore d'évaluation

- FX Advantages S&C February 2019Document11 pagesFX Advantages S&C February 2019Peter FrankPas encore d'évaluation

- Short Note VP AtolityDocument12 pagesShort Note VP AtolityceikitPas encore d'évaluation

- Stock Gap Research Paper Dow AwardDocument21 pagesStock Gap Research Paper Dow AwardContra_hourPas encore d'évaluation

- Delta Surface Methodology - Implied Volatility Surface by DeltaDocument9 pagesDelta Surface Methodology - Implied Volatility Surface by DeltaShirley XinPas encore d'évaluation

- Hedge Funds ShowDocument33 pagesHedge Funds ShowmkpatidarPas encore d'évaluation

- High-Frequency Trading - Reaching The LimitsDocument5 pagesHigh-Frequency Trading - Reaching The LimitsBartoszSowulPas encore d'évaluation

- Mrunal (Aptitude) Concepts of Marked Price and Successive Discounts (Profit-Loss) Without (Stupid) FormulasDocument9 pagesMrunal (Aptitude) Concepts of Marked Price and Successive Discounts (Profit-Loss) Without (Stupid) FormulasayslaksPas encore d'évaluation

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeD'EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifePas encore d'évaluation

- Decision Timliness and DurationDocument4 pagesDecision Timliness and DurationWayne H WagnerPas encore d'évaluation

- The Moped LawDocument2 pagesThe Moped LawWayne H WagnerPas encore d'évaluation

- The Pension Promise and The Shadow AssetDocument3 pagesThe Pension Promise and The Shadow AssetWayne H WagnerPas encore d'évaluation

- Should I Fire My Trader or Pay Him A MillionDocument6 pagesShould I Fire My Trader or Pay Him A MillionWayne H WagnerPas encore d'évaluation

- Immediacy Cost-Opportunity CostDocument3 pagesImmediacy Cost-Opportunity CostWayne H WagnerPas encore d'évaluation

- The Blindmen and The ElephantDocument3 pagesThe Blindmen and The ElephantWayne H WagnerPas encore d'évaluation

- Noble Challenges FlyerDocument1 pageNoble Challenges FlyerWayne H WagnerPas encore d'évaluation

- What We Learned On Our Way To Our PublisherDocument2 pagesWhat We Learned On Our Way To Our PublisherWayne H WagnerPas encore d'évaluation

- Investment Management Cover and PrefaceDocument5 pagesInvestment Management Cover and PrefaceWayne H Wagner100% (1)

- Measuring Trade DifficultyDocument2 pagesMeasuring Trade DifficultyWayne H WagnerPas encore d'évaluation

- Payment Oriented BrokerageDocument2 pagesPayment Oriented BrokerageWayne H WagnerPas encore d'évaluation

- The Maps Are Being RedrawnDocument3 pagesThe Maps Are Being RedrawnWayne H WagnerPas encore d'évaluation

- If Best Execution Is A Process, What Does The Process Look Like?Document5 pagesIf Best Execution Is A Process, What Does The Process Look Like?Wayne H WagnerPas encore d'évaluation

- Research: How Are PAEG/Ls FormedDocument4 pagesResearch: How Are PAEG/Ls FormedWayne H WagnerPas encore d'évaluation

- Handicaps and HandcuffsDocument4 pagesHandicaps and HandcuffsWayne H WagnerPas encore d'évaluation

- Trading TruthsDocument3 pagesTrading TruthsWayne H WagnerPas encore d'évaluation

- Melting IcebergsDocument4 pagesMelting IcebergsWayne H WagnerPas encore d'évaluation

- The Changing Role of The Buyside TraderDocument4 pagesThe Changing Role of The Buyside TraderWayne H WagnerPas encore d'évaluation

- The Search EngineDocument4 pagesThe Search EngineWayne H WagnerPas encore d'évaluation

- Sneaking An Elephant Across A Putting Green: A Transition Case StudyDocument2 pagesSneaking An Elephant Across A Putting Green: A Transition Case StudyWayne H WagnerPas encore d'évaluation

- Can Systems Make A Good TraderDocument4 pagesCan Systems Make A Good TraderWayne H WagnerPas encore d'évaluation

- How Big Is The Strike Zone?Document2 pagesHow Big Is The Strike Zone?Wayne H WagnerPas encore d'évaluation

- Time of Day Effects On Trading CostsDocument2 pagesTime of Day Effects On Trading CostsWayne H WagnerPas encore d'évaluation

- Persistence of Price MovementDocument2 pagesPersistence of Price MovementWayne H WagnerPas encore d'évaluation

- What Do The Good Desks Do?Document4 pagesWhat Do The Good Desks Do?Wayne H WagnerPas encore d'évaluation

- Revisiting Directed Brokerage: Still No Free LunchDocument2 pagesRevisiting Directed Brokerage: Still No Free LunchWayne H WagnerPas encore d'évaluation

- Drifting Icebergs: Perceptions and Reality in Trading CostsDocument2 pagesDrifting Icebergs: Perceptions and Reality in Trading CostsWayne H WagnerPas encore d'évaluation

- How Big Is Too BigDocument4 pagesHow Big Is Too BigWayne H WagnerPas encore d'évaluation

- Is Eliminating Tracking Error Hazardous To Your Wealth?Document3 pagesIs Eliminating Tracking Error Hazardous To Your Wealth?Wayne H WagnerPas encore d'évaluation

- 4 Thematic AnalysisDocument32 pages4 Thematic Analysisapi-591181595Pas encore d'évaluation

- SMA Releases Online Version of Sunny Design For PV System ConfigurationDocument3 pagesSMA Releases Online Version of Sunny Design For PV System ConfigurationlakliraPas encore d'évaluation

- Clasificacion SpicerDocument2 pagesClasificacion SpicerJoseCorreaPas encore d'évaluation

- NetEco Commissioning Guide (V200R003C01 - 01) (PDF) - enDocument116 pagesNetEco Commissioning Guide (V200R003C01 - 01) (PDF) - enabdo elmozogyPas encore d'évaluation

- Chapter 1Document4 pagesChapter 1Steffany RoquePas encore d'évaluation

- Physics Tadka InstituteDocument15 pagesPhysics Tadka InstituteTathagata BhattacharjyaPas encore d'évaluation

- Laser For Cataract SurgeryDocument2 pagesLaser For Cataract SurgeryAnisah Maryam DianahPas encore d'évaluation

- COPARDocument21 pagesCOPARLloyd Rafael EstabilloPas encore d'évaluation

- Chapter 11 Towards Partition Add Pakistan 1940-47Document5 pagesChapter 11 Towards Partition Add Pakistan 1940-47LEGEND REHMAN OPPas encore d'évaluation

- Affin Bank V Zulkifli - 2006Document15 pagesAffin Bank V Zulkifli - 2006sheika_11Pas encore d'évaluation

- Banking - BPI V Sps Yu 2010Document8 pagesBanking - BPI V Sps Yu 2010roy dPas encore d'évaluation

- Factoring Problems-SolutionsDocument11 pagesFactoring Problems-SolutionsChinmayee ChoudhuryPas encore d'évaluation

- Douglas Boyz Release Bridging The Gap Via Extraordinary Collective Music GroupDocument2 pagesDouglas Boyz Release Bridging The Gap Via Extraordinary Collective Music GroupPR.comPas encore d'évaluation

- Monologues For Danimations - Adam SorrellDocument2 pagesMonologues For Danimations - Adam SorrellCharlie Smith-McMahonPas encore d'évaluation

- Reinforcing Steel and AccessoriesDocument4 pagesReinforcing Steel and AccessoriesTheodore TheodoropoulosPas encore d'évaluation

- Part - 1 LAW - 27088005 PDFDocument3 pagesPart - 1 LAW - 27088005 PDFMaharajan GomuPas encore d'évaluation

- Group Work, Vitruvius TriadDocument14 pagesGroup Work, Vitruvius TriadManil ShresthaPas encore d'évaluation

- 9 Electrical Jack HammerDocument3 pages9 Electrical Jack HammersizwePas encore d'évaluation

- The Best John Green QuotesDocument10 pagesThe Best John Green Quotesapi-586467925Pas encore d'évaluation

- 00000000Document4 pages00000000GagoPas encore d'évaluation

- DockerDocument35 pagesDocker2018pgicsankush10Pas encore d'évaluation

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariPas encore d'évaluation