Académique Documents

Professionnel Documents

Culture Documents

Rural Banking in India

Transféré par

Amit SinhaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Rural Banking in India

Transféré par

Amit SinhaDroits d'auteur :

Formats disponibles

Rural Banking in India:Realizing the Potential through Technology

Catalyzed by the growth of the domestic economy, the banking sector in India has truly come of age. But with the current slowdown and fears of a global recession, the Indian economy and the banking sector have been looking for new avenues of growth. In the face of these circumstances, it is ironic that rural banking which has hitherto been a slow growth sector could prove the next development engine for Indian banks. With affordable and relevant technology driving penetration as well as providing an improved service experience, rural banking could bring in financial inclusion and help banks grow their business radically. Indian banks have awakened to the vast potential of the rural sector. Specialized and innovative schemes to improve rural penetration have become the popular mantra. No-frills credit cards, franchisee networks, supply chain financing for agriculture, investments in rural infrastructure and crossselling of products are only some of the programs directed at the rural sector. Needless to say, at the core of these initiatives lies sophisticated yet reasonably priced technology - playing a significant role both in effective operations and delivery.

The First Steps The Challenges Technology can Transform Its the Way the World Works

The First Steps

India lives in its villages, and the founding fathers deemed it imperative to enable financial inclusion for the rural population. The Regional Rural Bank (RRB) emerged from Indias early aspirations for a stronger institutional arrangement to develop a savings culture in the rural eco-system, provide rural credit and agriculture finance, while enabling poverty elevation. The formation of the Narasimham Committee in 1975, and eventually the passing of the RRB Act in 1976 were key milestones in this journey. Legislation mandated joint ownership of RRBs by the Central Government, State Government and a sponsor commercial bank, in the ratio of 50%: 35%: 15%, respectively. From a modest beginning of just 6 RRBs with 17 branches covering 12 districts in 1975, the numbers grew to 196 RRBs with 14,446 branches working in 518 districts across the country, in 2004. However, given the multiagency shareholding and entailed restrictions, several RRBs failed to sustain viable operations and others merged vertically or horizontally, resulting in the total number of RRBs stabilizing at 91, in 2007, with over 14,000 branches, spread across 585 of the 622 identified districts. Thus, history has clearly established that the original mandate of promoting profitable banking with a rural focus will be an enduring phenomenon, only when the RRB is able to deliver customer-relevant products with optimal operational efficiency and ensure the functioning of a sustainable and viable business. With 80% of RRBs in rural India, it serves the larger cause of financial inclusion as well.

The First Steps The Challenges Technology can Transform Its the Way the World Works

The Challenges

This, however, is easier said than done. RRBs today continue to traverse an increasingly rocky path, facing significant economic, infrastructural and business hurdles that heighten in complexity with every passing year. Lack of a Robust Governance Structure While other rural financial services providers like Scheduled Commercial Banks and private banking entrants have robust processes for functions ranging from HR to product development, RRBs are largely insulated in operation and lag behind their commercial counterparts in efficiency and rationalization of process as well as governance mandates. Manual Operations While automation of operations at RRBs is the vision of The Reserve Bank of India (RBI), even mechanization remains a challenge for several of these banks. Basic automation, like the Advanced Ledger Posting Machine (ALPM), for end-of-day (EOD) reporting, is yet to reach a significant number of RRBs. Lack of automation also hampers reporting and MIS, which in turn results in poor visibility into business and operational parameters, critical for management-driven business decisions. Inadequate Infrastructure Lack of sufficient infrastructure and consequently the inability of most RRBs to retain qualified managers affect the growth and the discharge of their operations. Inadequate infrastructure support also translates into high project preparation costs, and risk aversion amongst sponsor entities. Dynamic Market Conditions Few RRBs are up to the rigours of channel expansion and customer segmentation mandated to conduct business in todays fast changing times. Even the otherwise ubiquitous ATM, is ever so often a channel not supported by RRBs. Most RRBs also lack a robust product innovation agenda to deliver relevant offerings, factoring in the need for customer convenience and flexibility increasingly critical in todays highly competitive and dynamic rural marketplace. Undefined Roadmap The RRBs share of woes also includes budgetary constraints, mounting over-dues, lack of adequate infrastructure facilities, and limited channels of investment. Owing to these problems, some RRBs are not able to achieve financial viability. In addition, they have little visibility into operational and business imperatives. Working for growth in very challenging conditions, sustenance is possible only when RRBs have a clear roadmap for:

Abiding relationships with customers through customer data analysis Operations with clear cost-efficiency and productivity Unified 360-degree view of the business Relevant and timely product innovation

Technology can Transform

The RBIs diktat is for RRBs to achieve automation before the dawn of 2011. In fact, for RRBs established after September 2009, automation will be a clear mandate right from day one of inception. Rightly so - since, a robust technology solution can enable RRBs to confront several current market and business challenges. As an ideal solution, it can help RRBs break through the insular mould, share information, reuse data and business logic, deliver one view of the customer, and sustain fruitful relationships in the long term. Knowledge Repository RRBs can leverage technology to build a knowledge repository by consolidating knowledge about products, customers, systems, processes, revenue and practices. This provides them with an integrated, 360-degree view of the entity. Such consolidated knowledge is intellectual capital which can be realized by proactively sharing it with all stakeholders both within and outside the bank. Employees will thus be empowered with the knowledge necessary to sustain and grow business. They will also have the wide-ranging information to match customers with products and enable mapping of process to the business challenge. Customer-centricity RRBs can no longer adopt the one-size-fits-all approach restricting their offerings to a skeletal spread of microfinance for Self Help Groups (SHG), and small loans and deposits. They must cater to the markets need for a comprehensive range of banking and insurance products arising from diverse customer segments ranging from the agri-based sector, the cottage and small scale industry and artisans. A primary route through which an RRB can address all these requirements is by having an integrated back office environment. It provides them with a holistic and actionable view of customers, their interactions, accounts, transactions, and products, from a single integrated hub. This can enable the RRB to mine customer data and leverage the information to offer customers tailored financial services that fulfill their needs. Capitalizing on already existing data will help the RRB save money and seize cross-sell opportunities. Process-centricity RRBs must migrate to an IT environment that comprises an integrated suite of core functionenabling systems that make it easy for the RRB to standardize processes for all services. Such an environment introduces much needed intelligence into the RRB organization and empowers it to chart a successful and sustainable future road-map, which in turn can strengthen profitability. Regulation Compliance Like every strong player in the banking domain, mitigating compliance risk would be a clear mandate for RRBs as well. To play a meaningful role in the financial eco-system of the country, it will be imperative that RRBs comply with regulations like AML and KYC. To enable regulatory compliance, RRBs can leverage technology for effective data mining techniques to improve systems that detect violations or outlying risk factors, consolidate processing for data-intensive jobs and factor in compliance requirements at the product development level too. Above all, the technology platform can enable complete visibility into customer transactions. It can also form the basis of information sharing between RRBs for mutual risk-mitigation from poor credit and eventual gains.

Its the Way the World Works

Worldwide, the mandate for social and development banks like credit unions, cooperative societies and micro-finance institutions, has been to extend financial inclusion. This includes services to under-banked rural areas, credit for agriculture and small scale-industry related businesses, as opposed to the traditional approach to business from a pure-profit perspective. The most successful among these institutions have been the ones that have adopted appropriate technology platforms to achieve customer-centricity, break down silos, reuse data and business logic, while accessing an enterprisewide view of operations. They have driven their service agenda successfully, while also creating enough profits to ensure sustenance and viability in the long term.

Vous aimerez peut-être aussi

- The First StepsDocument8 pagesThe First Stepssnehalkadam2712Pas encore d'évaluation

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)D'EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Pas encore d'évaluation

- Approach Paper: It-Enabled Financial InclusionDocument28 pagesApproach Paper: It-Enabled Financial InclusionAbdoul FerozePas encore d'évaluation

- Impact of Globalization On Indian Banking Sector: AbhinavDocument8 pagesImpact of Globalization On Indian Banking Sector: AbhinavDivyesh GandhiPas encore d'évaluation

- Atif Bajwa InterviewDocument4 pagesAtif Bajwa Interviewtrillion5Pas encore d'évaluation

- 2015iciee - India3 Challenges PDFDocument7 pages2015iciee - India3 Challenges PDFVishakha RathodPas encore d'évaluation

- Title: Measuring Effectiveness of Retail Banking in Public Sector and Private Sector BankDocument5 pagesTitle: Measuring Effectiveness of Retail Banking in Public Sector and Private Sector BankMonisha KalaPas encore d'évaluation

- 3 Paper Agent BankDocument9 pages3 Paper Agent BankDr. Hemendra ShahPas encore d'évaluation

- Case Study Solution IBS HyderabadDocument5 pagesCase Study Solution IBS HyderabadDeepak BhatiaPas encore d'évaluation

- SME Financing: Issues and Strategies: Ishrat HusainDocument9 pagesSME Financing: Issues and Strategies: Ishrat HusainKhurram Ali SyedPas encore d'évaluation

- Executive - AnswersDocument53 pagesExecutive - AnswersRakesh KushwahaPas encore d'évaluation

- Chapter-4 Customer Relationship Management in Indian BanksDocument46 pagesChapter-4 Customer Relationship Management in Indian BanksAryan SharmaPas encore d'évaluation

- KPMG CII Indian BankingDocument32 pagesKPMG CII Indian BankingMukesh Pareek100% (1)

- Project On Standard Charted BankDocument82 pagesProject On Standard Charted BankViPul82% (11)

- MA0044Document11 pagesMA0044Mrinal KalitaPas encore d'évaluation

- Banks in Microfinance-GuidelinesDocument7 pagesBanks in Microfinance-GuidelinesAvijit MajumdarPas encore d'évaluation

- South Indian Bank: Corporate Books To Retail BookDocument14 pagesSouth Indian Bank: Corporate Books To Retail BookAshish BnPas encore d'évaluation

- University of Gondar College of Business and Economics Department of Marketing ManagementDocument14 pagesUniversity of Gondar College of Business and Economics Department of Marketing ManagementMartha GetanehPas encore d'évaluation

- Strategic Management of Summit Bank PDFDocument28 pagesStrategic Management of Summit Bank PDFRabia VirkPas encore d'évaluation

- Fi Case Study 2 NewDocument9 pagesFi Case Study 2 NewKrutik ShahPas encore d'évaluation

- Q - 5 Changing Role of Bank in IndiaDocument3 pagesQ - 5 Changing Role of Bank in IndiaMAHENDRA SHIVAJI DHENAKPas encore d'évaluation

- Retail BankingDocument15 pagesRetail BankingjazzrulzPas encore d'évaluation

- Core Bank in Axis BankDocument24 pagesCore Bank in Axis BankNatasha MistryPas encore d'évaluation

- Challenges: Need One Bank Licensing Policy, But Several Bank LicensingpoliciesDocument8 pagesChallenges: Need One Bank Licensing Policy, But Several Bank LicensingpoliciesAbhinav WaliaPas encore d'évaluation

- Being Five Star in ProductivityDocument48 pagesBeing Five Star in ProductivityfaemozPas encore d'évaluation

- RB Chapter 1 - Introduction To Retail BankingDocument7 pagesRB Chapter 1 - Introduction To Retail BankingHarish YadavPas encore d'évaluation

- GP CoreDocument133 pagesGP CoreDivya GanesanPas encore d'évaluation

- Service Quality of Public Sector Banks To SME Customers: An Empirical Study in The Indian ContextDocument24 pagesService Quality of Public Sector Banks To SME Customers: An Empirical Study in The Indian Contextvikas_chourasiaPas encore d'évaluation

- Micro FinanceDocument36 pagesMicro Financeकुसुम तरुण शाक्यPas encore d'évaluation

- Financial Inclusion For Sustainable Development: Role of IT and IntermediariesDocument7 pagesFinancial Inclusion For Sustainable Development: Role of IT and IntermediariesBasavaraj MtPas encore d'évaluation

- Technology Enabled Transformation in Banking 2011Document28 pagesTechnology Enabled Transformation in Banking 2011Gunay88Pas encore d'évaluation

- Digital Imperative in BankingDocument16 pagesDigital Imperative in BankingMatthew IrwinPas encore d'évaluation

- Dhanlaxmi BankDocument95 pagesDhanlaxmi Bankansariumera233Pas encore d'évaluation

- CRM and Stakeholder ManagementDocument21 pagesCRM and Stakeholder ManagementRamakrishnanPas encore d'évaluation

- Chapter - 1Document8 pagesChapter - 1rajkumariPas encore d'évaluation

- Indian Financial SystemDocument3 pagesIndian Financial Systemgiridhar_rvPas encore d'évaluation

- Technology Driven Indian Banking: Institute For Development and Research in Banking TechnologyDocument6 pagesTechnology Driven Indian Banking: Institute For Development and Research in Banking Technologyshashiiii_4uPas encore d'évaluation

- Dhanlaxmi BankDocument95 pagesDhanlaxmi BankNidhi Mehta0% (2)

- TCS BaNCS Research Journal Issue 3 0713 1Document52 pagesTCS BaNCS Research Journal Issue 3 0713 1Poovana Kokkalera PPas encore d'évaluation

- Future of Banking in IndiaDocument2 pagesFuture of Banking in IndiaKaran BherwaniPas encore d'évaluation

- Project On Credit Appraisal For Sme SectorDocument33 pagesProject On Credit Appraisal For Sme Sectoranish_10677953Pas encore d'évaluation

- Future Indian Banking - Internet BankingDocument98 pagesFuture Indian Banking - Internet BankingRahul R RohitPas encore d'évaluation

- VPBank AR 2018 ENGDocument69 pagesVPBank AR 2018 ENGNguyễn Gia Phương AnhPas encore d'évaluation

- Group 5 - Strategies For HDFC Bank - 16052022Document24 pagesGroup 5 - Strategies For HDFC Bank - 16052022Arpita GuptaPas encore d'évaluation

- Research Paper On Indian Banking SectorDocument7 pagesResearch Paper On Indian Banking Sectoriimytdcnd100% (1)

- Banking: Industries in IndiaDocument41 pagesBanking: Industries in IndiaManavPas encore d'évaluation

- Success in SME FinancingDocument33 pagesSuccess in SME FinancingSachin GuptaPas encore d'évaluation

- Organization Value System and Structure of HDFC BankDocument15 pagesOrganization Value System and Structure of HDFC BankRitwik GantayatPas encore d'évaluation

- Lecture 1.5 Recent Development in BankingDocument6 pagesLecture 1.5 Recent Development in BankingCharu Saxena16Pas encore d'évaluation

- Marketing Approach For Rural AreasDocument2 pagesMarketing Approach For Rural AreasBhuvanvignesh VengurlekarPas encore d'évaluation

- Introduction To The IndustryDocument18 pagesIntroduction To The Industrynikunjsih sodhaPas encore d'évaluation

- The Evolution of Neobanks in India - 1Document34 pagesThe Evolution of Neobanks in India - 1Ravi BabuPas encore d'évaluation

- Porter: Five Forces - Buyer Power (Low)Document7 pagesPorter: Five Forces - Buyer Power (Low)Aniruddha PatilPas encore d'évaluation

- Final Project On Financial InclusionDocument33 pagesFinal Project On Financial InclusionPriyanshu ChoudharyPas encore d'évaluation

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeD'EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangePas encore d'évaluation

- Toward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyD'EverandToward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyPas encore d'évaluation

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesD'EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesPas encore d'évaluation

- Banking 2020: Transform yourself in the new era of financial servicesD'EverandBanking 2020: Transform yourself in the new era of financial servicesPas encore d'évaluation

- The Digital Banking Revolution: How financial technology companies are rapidly transforming the traditional retail banking industry through disruptive innovation.D'EverandThe Digital Banking Revolution: How financial technology companies are rapidly transforming the traditional retail banking industry through disruptive innovation.Pas encore d'évaluation

- Marketing Campaign For Mattress NewDocument22 pagesMarketing Campaign For Mattress NewAmit SinhaPas encore d'évaluation

- FLTDocument4 pagesFLTAmit SinhaPas encore d'évaluation

- FLTDocument4 pagesFLTAmit SinhaPas encore d'évaluation

- FLTDocument4 pagesFLTAmit SinhaPas encore d'évaluation

- FLTDocument4 pagesFLTAmit SinhaPas encore d'évaluation

- Future of Luxury Brands in IndiaDocument76 pagesFuture of Luxury Brands in IndiaHemanshu Pandita100% (1)

- Marketing Plan: Your NameDocument17 pagesMarketing Plan: Your NameFabiola SalinasPas encore d'évaluation

- NITIEDocument13 pagesNITIEAmit SinhaPas encore d'évaluation

- A Proposal For: By. Amit SinhaDocument4 pagesA Proposal For: By. Amit SinhaAmit SinhaPas encore d'évaluation

- IBS HyderabadDocument18 pagesIBS HyderabadAmit SinhaPas encore d'évaluation

- Marketing ProposalDocument3 pagesMarketing ProposalAmit SinhaPas encore d'évaluation

- Brain & VisionDocument16 pagesBrain & VisionAmit Sinha100% (1)

- Marketing Research IsDocument3 pagesMarketing Research IsAmit SinhaPas encore d'évaluation

- HDFC LoansDocument17 pagesHDFC LoansAmit SinhaPas encore d'évaluation

- Retail BankingDocument23 pagesRetail BankingAmit SinhaPas encore d'évaluation

- Transaction Processing SystemsDocument3 pagesTransaction Processing SystemsAmit SinhaPas encore d'évaluation

- Market Analysis Questionnaire On Performance of A Product in The MarketDocument2 pagesMarket Analysis Questionnaire On Performance of A Product in The MarketAmit SinhaPas encore d'évaluation

- Why Language Matters On Global WebsitesDocument30 pagesWhy Language Matters On Global WebsitesLionbridgePas encore d'évaluation

- Human Resource Development and Employee Performance The Role of Individual Absorptive CapacityDocument15 pagesHuman Resource Development and Employee Performance The Role of Individual Absorptive CapacityDamaro ArubayiPas encore d'évaluation

- Liftopia - Leveraging Dynamic Pricing To Optimize Advance PurchaseDocument4 pagesLiftopia - Leveraging Dynamic Pricing To Optimize Advance PurchaseLiftopia, Inc.Pas encore d'évaluation

- Indian Oil 17Document2 pagesIndian Oil 17Ramesh AnkithaPas encore d'évaluation

- Merger and Acquisition ResumeDocument7 pagesMerger and Acquisition Resumeafiwhhioa100% (2)

- Caso Universal Ad AgencyDocument10 pagesCaso Universal Ad AgencyIsabella VinelliPas encore d'évaluation

- Tender Document - 0812dam PDFDocument58 pagesTender Document - 0812dam PDFbansalhimanshu07Pas encore d'évaluation

- Dead Companies Walking - Scott Fearon - Review and Summary - ValueVirtuoso ... Contrarian Value InvestingDocument9 pagesDead Companies Walking - Scott Fearon - Review and Summary - ValueVirtuoso ... Contrarian Value InvestingBanderlei SilvaPas encore d'évaluation

- Social Media A Critical Introduction (Christian Fuchs) (Z-Lib - Org) - 134-160Document27 pagesSocial Media A Critical Introduction (Christian Fuchs) (Z-Lib - Org) - 134-160Ebit Eko BachtiarPas encore d'évaluation

- Principles of Supply Chain MAnagementDocument10 pagesPrinciples of Supply Chain MAnagementGeline Suzane Combalicer TobiasPas encore d'évaluation

- Leave Summary-VapDocument1 pageLeave Summary-VapSuresh MeenaPas encore d'évaluation

- Investor Day Presentation 2015 PDFDocument152 pagesInvestor Day Presentation 2015 PDFexpairtisePas encore d'évaluation

- Magic Floor Produces and Sells A Complete Line of FloorDocument2 pagesMagic Floor Produces and Sells A Complete Line of Floortrilocksp SinghPas encore d'évaluation

- Johannes Sianturi: Personal DetailsDocument3 pagesJohannes Sianturi: Personal DetailsGreen Sustain EnergyPas encore d'évaluation

- REVISED PenCo. Business PlanDocument49 pagesREVISED PenCo. Business PlanHendrieck GarcePas encore d'évaluation

- New - Delhi SouvenirDocument52 pagesNew - Delhi SouvenirDavid ThomasPas encore d'évaluation

- UFred MBA Full BrochureDocument49 pagesUFred MBA Full BrochureHortanPas encore d'évaluation

- C1 - Indirect TaxationDocument36 pagesC1 - Indirect Taxationnabilah natashaPas encore d'évaluation

- Auxiliar de Repaso: Pregunta 1Document7 pagesAuxiliar de Repaso: Pregunta 1hectorfa1Pas encore d'évaluation

- BSP Circular 808 PDFDocument89 pagesBSP Circular 808 PDFKCGPas encore d'évaluation

- Human-Rights-Policy - DR Reddy'sDocument2 pagesHuman-Rights-Policy - DR Reddy'sEsha ChaudharyPas encore d'évaluation

- Dwnload Full Strategic Human Resource Management Canadian 2nd Edition Noe Solutions Manual PDFDocument35 pagesDwnload Full Strategic Human Resource Management Canadian 2nd Edition Noe Solutions Manual PDFnoahgrantz23b100% (12)

- Chapter 10 Types and Forms of Organizational ChangeDocument22 pagesChapter 10 Types and Forms of Organizational ChangeTurki Jarallah75% (4)

- Methods of Producing Water For InjectionDocument10 pagesMethods of Producing Water For InjectionShamsiPas encore d'évaluation

- ESG Conundrum PDFDocument30 pagesESG Conundrum PDFVijay Kumar SwamiPas encore d'évaluation

- Cost Concepts and ClassificationsDocument3 pagesCost Concepts and ClassificationsCONCORDIA RAFAEL IVANPas encore d'évaluation

- Pemodelan Peningkatan Kehandalan: Dengan Metode Root Cause Analysis Dan Fmea Pada Perusahaan Pembangkit ListrikDocument13 pagesPemodelan Peningkatan Kehandalan: Dengan Metode Root Cause Analysis Dan Fmea Pada Perusahaan Pembangkit ListrikiqbalsetionugrohoPas encore d'évaluation

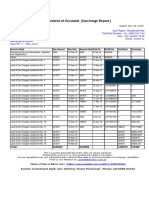

- Surcharge Report BTKSC-P05164Document1 pageSurcharge Report BTKSC-P05164Nasir Badshah AfridiPas encore d'évaluation

- ML Case Solution - (Individual) PGXPM VI (Term III) N.v.deepakDocument4 pagesML Case Solution - (Individual) PGXPM VI (Term III) N.v.deepakDeepak Rnv86% (7)

- Case Study: After Studying This Chapter, You Will Be Able ToDocument87 pagesCase Study: After Studying This Chapter, You Will Be Able ToYASH PATILPas encore d'évaluation