Académique Documents

Professionnel Documents

Culture Documents

Investment Analysis and Portfolio Management

Transféré par

mohsinraza402Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Investment Analysis and Portfolio Management

Transféré par

mohsinraza402Droits d'auteur :

Formats disponibles

Investment Analysis and Portfolio Management Introduction Investment is the sacrifice of current liquidity or current rupees or current dollars

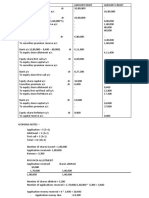

for future liquidity, future rupees or future dollars. There are different concepts and types of investment. In detail, these concepts and types of investment are dealt in this lesson. Concepts of investment There are two concepts of investment, viz, the economic concept and the financial concept. The economic concept of investment refers to investment as expenditures on new plants, machinery, capital equipment and so forth, with the hope of making added wealth. To make added wealth, the rate of return on the investment must be more than the real cost of capital. Suppose, one estimated that his investment in the above referred to assets is giving him a real of return of 15.5% p.a. and his nominal cost of capital is 20% inflation being 10%. The real cost of capital is given by nominal cost inflation rate = 20% - 10% = 10%. Then, the investor makes a net wealth addition to the extent of 1(1 + r) / (1 + K*) I, where I = original investment, r = real rate of return and K* = real cost of capital. If we assume an I = Rs. 100 mn, then Wealth addition = Rs. 100 mn (1 + 15.5%) / (1+10%) Rs. 100 mn = Rs. 100 mn (1.155) / (1.1) Rs. 100 mn = Rs. 105 mn-Rs. 100 mn = Rs. 5 mn The economic concept of investment is wealth creating oriented and that depends on Return on investment (r) and real cost of capital (K *). Only if r > K * wealth addition result. If r = K *, neither wealth addition nor wealth depletion results. If r < K *, wealth depletion takes places. The financial concept of investment refers to investment as, commitment of funds in financial assets with the hope of getting current income in the form of dividend or interest and / or capital gain:. It is nothing but sacrificing certain present consumption for a hoped for enhanced future consumption. Put otherwise, investment is postponement of consumption. That is savings are considered as investment. Savings can be in any form. A farmer produces 100 bags of paddy, but consumes only 40 bags of paddy and difference is his savings and hence his investment. A salaried employee earning Rs. 2 lakh p.a. and his consumption expenditure is Rs. 1.5 lakhs and hence his savings Rs. 50,000 amount to investment which may be in the form of undrawn bank balance, shares, debentures, gold, National Savings Certificates Etc. Goals of Investment Whatever may be the nature of investment, whether it is economic or financial, it has lot of motives. They are as follows: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Get decent current income Obtain reasonable capital gain Benefit from tax-off Right to participate in growth Reduce risk, given overall return Maximize return, given risk Ensure safety of investment Provide for liquidity of investment Easy transferability Preference of pledgeability Protection for future Beat the inflation Sense of participation in national economic development Fulfillment of security, social and esteem needs Economic power

Let us explain each of these goals to an extent.

Get decent current income Current income is the periodic (monthly, quarterly, semi-annual or annual) return in the form of interest or dividend or party-pay back. Usually debt investments or some mutual funds or some life policies give/guarantee periodic income. Shares of companies with unbroken dividend income. Current income is surer than future income, as it is analogous to a bird in hand, as against two in the bush. Current income is desired by risk-averters, small investors, income mutual funds and such featured investors. Tax benefit u/s 80L is available for current income. Obtain reasonable capital gain Capital appreciation is net value addition. If it is available in addition to current income, it is double welcome for investors. Tax benefit u/s (48(2) is available for capital gain, after indexation for inflation. Capital gain is bit riskier as it involves a peep into the future which is beset with uncertainty and risk. Shares in growth companies, good turnaround shares, shares in leveraged buy-outs, shares in successful venture schemes, convertible debentures in blue-chips, global depository and American Depository receipts of growth concerns, zero coupon bonds, deep discount bonds, growth mutual funds, etc promise capital gain. Big investors and risk-seeking investors, prefer capital gain to current income. Benefit through tax-off Investors prefer tax-benefit coated investments. Income Tax Act Provisions 80L and 48(2) give tax concessions for current and capital incomes respectively. Besides, tax benefit on investment committed is also available. U/s 88 of the IT Act, investments in NSC, NSS, 10/15 years P.O. savings schemes, LIC policies, Mediclaim policies, PF, PPF, SPF, GIS, equity-committed mutual funds schemes, investment in self-occupied house property to the extent principle repaid, limited to Rs. 10,000 at the maximum out of income, on loans taken for house construction, etc. qualify for tax rebate. Salaried employees in India find this tax-benefit really alluring. The one exception is equity related mutual fund schemes which have not gone fads. There are no investors, and hence no floaters, of late. Pre-emptive right to participate in growth firms If a blue-chip company goes to expand, the additional fresh equity capital required to fund expansion is first sought from existing shareholders, giving them a chance to participate in the companys growth. The shares are issued at discount to market price and that for existing shareholders such right offers, are real bonanza. One has to be at least a moderate sized investor, if not big, to benefit from right offers. Of course, rights can be sold in full or part and that all shareholders can benefit. To right holders capital gain results, as well as current income, as their shareholding base is a bit increased. Reduce risk, given return The dominant goal of investors is to optimize return and risk. Return is the sum total of all benefit expressed annualized % figures. Risk is the std-deviation. i.e., fluctuation, of the returns. As investments are made in plural number of securities, it is possible to reduce risk, without a fall in the overall return. That is what investors aspire for. Increase return, given risk A corollary of the previous goal is, maximize return, keeping risk a constant level. Like the previous one, this goal is possible when one goes for a portfolio of investment. Ensure safety of investment Safety of principal is very important. Return of capital invested in fact, at least must be granted. Return of capital is more important than return on capital. Many a stocks are quoting below par, not at all quoted and hence not saleable or quote at below issue price. In these cases, where is safety of capital? Even if principal is in tact, inflation reduces the real value of principal sum. Govt. securities (also called as gifts), bank deposits, blue-chip bonds/shares, etc ensure safety of investment. The

fly-by-night finance companies are black-sheep who cheat gullible investors. All investors need safety of principal. If that is not ensured, the whole of capital market system shall go out-of-gear and rubbish.

Provide for liquidity Investment is postponement of consumption. It is not permanent postponement. So, when needed the investment must be realizable in cash without loss of time and value. Bank deposits generally have liquidity. Gilts have liquidity, Bluechip shares have liquidity. Gold has liquidity. All the rest have limited or no liquidity. Unquoted shares, delisted shares etc virtually have no liquidity. All investors need liquidity of their investments. Easy transferability Easy transferability refers to minimum procedures, less paper work, no stamp duty, no-recourse, etc. Perhaps bearer bonds are easiest to transfer. For listed scrips the procedure laid out for share/bond transfer is to be followed. Delay must be avoided. Preference for pledgeability Pledgeability refers to ability to raise fund on the collateral of the investment held. Most investments have this. But volatile shocks have less Pledgeability. Protection for future Investment is to facilitate and provide for future consumption of the investor and / or his kith and kin. So, one of the investment objectives is to provide for the futures. Bet the inflation As inflation is inevitable, to suffer not value decrease cash holdings, bank balances, etc be reduces and investment in value-adding investment alternatives is required. Even bonds may not help beating inflation, only growth shares like the MNC scrips, like the sun-rise industries scrips, performing growth mutual funds and convertible scrips can beat inflation. Sense of nation building Investments determine economic growth. Higher Investment lead to higher economic growth leading to more employment, more income, more savings and more investment. This is a virtuous cycle. So, investors have the feeling and rightfully a that, of participation in the economic building of the nation. Fulfilment of social, esteem needs Through investment, the investor concerned ensures his and his familys security, which leads to greater social liking against family and other members and this in turn leads to fulfilment of the esteem needs. True big investor feel esteemed about themselves. They are respected. They weiled social power. Economic power Finally, investment goal is to gain the economic power. Spread your investments. Spread your economic power. Foreign institutional investors have gained great economic power in our country and our bourses dance to their tunes. Similarly, foreign direct investment, NRI investment, etc given them the economic power What is true for institutions, is true for individuals also. Through investments, through interlocking investments, one can command economic power at will. Goal multiplicity and conflicts Investment goals are multiple. This multiplicity eventually lead to conflict among goals. If you want current income capital gain is not be expected much and vice versa. Tax benefit coated investments moderate other benefits. Not that companies price rights issues close to market price which is somewhat rigged just prior to and until the currency of offer period, the benefits of rights issues are bookish rather than a practicable. The monetary policy of the Central Bank is influenced by the powers that be, which cause variations in returns. And this happens at least twice (normally) in a year

when credit policy for lean and busy seasons are announced. So, risk-return optimization is hindered, officially speaking, but yet in a nothing official style. The liquidity of investments has become a topic limited to some 500 scrips only, which 100 times more this number of scrips are in place. And liquidity comes against safety of capital. But, goal congruity does exist. Ultimately return maximization and risk minimization and the professed goals. Types of Investment Investment types are infinity. We can put then in five major types, viz, financial, real, business, personal and institutional. These are dealt below. Financial investments Financial investments as were already presented involve commitment of funds in financial and monetary assets. Several financial investments instruments are available. Financial and business investment in broad classification of investment alternatives. The former is security oriented, while the latter is entrepreneurial. We are concerned with financial investments which involve investment in financial assets like bank deposit, bond of government life insurance policy, provident fund contribution mutual fund, chit fund, Contriution, shares, debentures, etc. From the point of view of institutions with which we commit funds, risk involved in investments and on other bases we can classify investment alternatives. From the point of view of institutions with which we commit funds investments may be classified as investment in public sector institution maybe of risk and risk tree type. Investment in public sector banks deposits, in governments bonds, in public provident fund, life insurance policy, public sector bonds, etc are risk free, whereas investments in shares of public sector units and units of mutual funds are risky. Investments in private sector institutions include investment in shares, debentures, mutual funds, etc. All these are risky type. Risk and risk free investments Risky investments generally give high fluctuating return, both current return in the form of interest and dividend and capital appreciation. Risk free investment give less but stable return. Risk averse people prefer risk-free investments such as government bonds, NSC, bank deposits, high rated (AAA2AA+) bonds. Units with safety net, life policies. GPF, PPG, KVP, IVP, etc. Risk seeking investors go for shares, convertible bonds, warrants, open end mutual funds etc. Tax benefit and non-non benefit investments Certain investments give tax benefits. Investment in PPF, GPF, LIC policies mediclaim policies, NSC, units linked insurance scheme. NSS, deposits in 10 year and 154 year P.O. Savings bank (cumulative time deposits) etc upto Rs. 50000 p.a. (Rs. 60000 in the case of artists, professionals etc.) quality for a tax rebate of 20% similarly subscription upto Rs. 10000 in any tax rebate of 20% on sum so invested. Other investments do not provide this sort of tax benefit. Interest Income get section 80L benefit. While dividend is tax-free. Security and non security investment Security investments refer to commitment of funds in equity shares, preference shares, convertible and non-convertible debentures, warrants, traded mutual fund units, etc. The title to the investments are tradeable in stock market. Non-security investments are investments in life policies, bank deposits, public deposits, NSC, NSS, KVP, IVP, non tradeable mutual fund units, post office time deposits, GPF, PPF, etc. These are not traded in stock exchanged. That is, there in no secondary market. However, the interest in these investments can be assigned. Repayment takes place normally at maturity. Investment alternatives in the primary & secondary security markets

Primary market investment alternatives include fresh issue shares, debentures, bonds, units etc. here institutions concerned raise capital by floating these instruments afresh. To the extent of money mobilished capitalisation takes place. Once these securities are listed with stock exchanges, purchases and sales among investors constitute the secondary market. The demand and supply in both the primary and secondary security markets affect each other. Investment in shares, bonds, etc. is known as primary investments Options and futures are known as derivative instruments. Here right to by /sel shares/ bonds is traded and not the share/bonds. Value or right depends on value of the shares/bonds. Hence the name derivative instruments

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Bonos Que Se Pueden NegociarDocument4 pagesBonos Que Se Pueden NegociarCrónica UnoPas encore d'évaluation

- Wagner's Angels: Case StudyDocument8 pagesWagner's Angels: Case StudyCamillaGeorgeonPas encore d'évaluation

- 08-24-09 Delta One Handbook PDFDocument18 pages08-24-09 Delta One Handbook PDFnordinguePas encore d'évaluation

- IF Ppt-28069Document7 pagesIF Ppt-28069Rishibha SinglaPas encore d'évaluation

- Capital Market: Final ModuleDocument16 pagesCapital Market: Final ModuleEduardo VerdilloPas encore d'évaluation

- Options Trading IQDocument12 pagesOptions Trading IQnarendra bhole100% (2)

- Market Internals AnalysisDocument63 pagesMarket Internals AnalysisJMBcrap88% (16)

- Ethics in FinanceDocument11 pagesEthics in FinanceAarushi Barowalia JainPas encore d'évaluation

- Nism NCFM Exam ListDocument3 pagesNism NCFM Exam Listabhishek jainPas encore d'évaluation

- Corporation Multiple ChoiceDocument18 pagesCorporation Multiple ChoiceDexell Mar MotasPas encore d'évaluation

- Financial Accounting and Reporting Ii Final Quiz 2/3Document7 pagesFinancial Accounting and Reporting Ii Final Quiz 2/3jemsPas encore d'évaluation

- CMS Swaps HaganDocument7 pagesCMS Swaps HagandjfwalkerPas encore d'évaluation

- Equity Derivatives NCFM Ver 1.5Document148 pagesEquity Derivatives NCFM Ver 1.5sanky23Pas encore d'évaluation

- Week 12 Investment Management: Options ContractsDocument47 pagesWeek 12 Investment Management: Options ContractsAarti J. KaushalPas encore d'évaluation

- Mutual Funds in NepalDocument13 pagesMutual Funds in NepalRupesh NyaupanePas encore d'évaluation

- Foreign CurrencyDocument7 pagesForeign CurrencyLoraine Garcia GacuanPas encore d'évaluation

- Mergers and Acquisition PDFDocument82 pagesMergers and Acquisition PDFSayantanKandarPas encore d'évaluation

- Synopsis On Financial DerivativesDocument13 pagesSynopsis On Financial Derivativesgursharan4march67% (3)

- Swing Trading Simplified Larry D Spears PDFDocument115 pagesSwing Trading Simplified Larry D Spears PDFAmine Elghazi100% (4)

- Issue of Share CapitalDocument2 pagesIssue of Share CapitalNainika ReddyPas encore d'évaluation

- KSE Karachi Stock Exchange - FAQDocument85 pagesKSE Karachi Stock Exchange - FAQAliPas encore d'évaluation

- Buying Option Strategy (BOS)Document45 pagesBuying Option Strategy (BOS)subodhPas encore d'évaluation

- UntitledDocument2 pagesUntitledUmi AnggraeniPas encore d'évaluation

- AAES-Risk Management.05Document7 pagesAAES-Risk Management.05Vermont Perez100% (1)

- Bearish Shooting Star PDFDocument3 pagesBearish Shooting Star PDFSyam Sundar ReddyPas encore d'évaluation

- Day Trading With Stochastics: by John F. KepkaDocument4 pagesDay Trading With Stochastics: by John F. KepkaVahidPas encore d'évaluation

- Putnam Absolute Return Funds BrochureDocument5 pagesPutnam Absolute Return Funds BrochurePutnam InvestmentsPas encore d'évaluation

- Prelim Exam Aud AnswersDocument5 pagesPrelim Exam Aud Answerslois martinPas encore d'évaluation

- Regulatory Framework of Derivatives in IndiaDocument2 pagesRegulatory Framework of Derivatives in Indiasvtasha0% (1)

- Answer Unit 6 Written AssignmentDocument2 pagesAnswer Unit 6 Written AssignmentbuihuonguyenPas encore d'évaluation