Académique Documents

Professionnel Documents

Culture Documents

Law Case Study Latest

Transféré par

Nadiah AzizDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Law Case Study Latest

Transféré par

Nadiah AzizDroits d'auteur :

Formats disponibles

LAW CASE STUDY Case Profile: Land Acquisition for the purpose of :Flyover Construction Project of KESAS Highway

within the Kota Kemuning Park and Bukit Rimau Park Location :- Section 35 Shah Alam Lot :- Lot 133 (New Lot 72111 & 72112), Klang Mukim, Klang District, Selangor. Case Held at :- Shah Alam High Court. Declaration :Selangor State Declaration No 1465, date 14th August 2003. Purposes of Valuation & Land Acquired Matters arisen: This case was bring into the High Court Shah Alam when there is huge different between the valuation of private valuer and government valuer. Government valuer has come out with the conclusive evidence that show the comparable properties that been taken by the private valuers is irrelevant and cant not be used as comparable properties for Lot 133. No Lot Land Area 10.1045 hectare Acquired Land 4.09 hectare

Lot 133 (New Lot 72111 & 72112)

The land area that been stated above is the land area that been mentioned in Gazette. However based on the previous land acquisition that involve the Construction of KESAS Highway, the land area is based on the latest land title which is :-

Bil i) ii)

Lot No Lot 72111 Lot 72112

Land Area 1.567 hectare 4.397 hectare

Acquired Land 1.168 hectare 2.922 hectare

GOVERNMENT VALUATION Lot 72111 Acquired Land 1.168 hectare Price per hectare Total of Compensation RM700,000.00 (RM RM 817,600.00 6.50 psf) RM138,040.00

iii) iv)

Land Injurious Affection remaining land.

Lot 72112 Acquired Land 2.922 hectare Price per hectare Total of Compensation RM700,000.00 (RM RM2,045,400.00 6.50 psf) RM 3,001,040.00

i)

Land

Total Overall Compensation :

Land Owner Rectify Value (psf) RM 25.00 Say RM 3,142,854.00 Total RM 3,142,854.00

i)

ii)

Land 2.886 acre 125,714.16 psf Remaining RM 17.50 Land 70 % from MV 0.986 acre 42.950.16 psf 3,990.17 psf

RM751,627.80

RM751,627.00

iii) Valuers Fee Total Analysis for Private Valuer Valuations

RM 10,088.00 RM 3,904,569.00

1. Based on all the data of comparable properties that private valuer used, all the comparable are not suitable in order to determine the value of schedule land because the characteristic is totally different. Applicants Valuer disobeyed the Principles relating to determination of compensation as mentioned in First Scheduled, Land Acquisition Act 1960 (Act 486) According to Paragraph 1A, In assessing the market value of any scheduled land, the valuer may use any suitable method of valuation to arrive at the market value provided that

regard may be had to the prices paid for the recent sales of lands with similar characteristics as the scheduled land which are situated within the vicinity of the scheduled land and with particular consideration being given to the last transaction on the scheduled within two years from the date with reference to which the scheduled land is to be assessed.

2. The scheduled land is agriculture land, and based on the normal principle in valuation field the comparable properties that can be used is similar with the subject property (scheduled land). Therefore, is the scheduled land is agriculture, we only consider comparable of agriculture land. 3. The applicant valuers has used a different category of land use as comparable which is industry and commercial while the subject lot is agriculture land. Both of categories of land use are far better compared to the schedule land. The comparable properties only can be use of there is no other comparable properties that similar with the scheduled land within the same locality. But based the reference that been made, there are a lots of comparable property that have same characteristic with the scheduled land. 4. Therefore, the comparable properties that being used by the private valuer is not suitable and cannot accepted as similar property. Plus, the value that been proposed for schedule land is far more high compared to the adequate comparable value that should be used. The value of land for industrial and commercial is away better compared to agriculture land. The value that been imposed towards the scheduled land is not reasonable and doesnt show the real market value. According to the Ng Tiou Hong vs Collector Of Land Revenue Gombak Case Yang Arif Hakim Syed Agil Barakbah stated that the market prices can be measured by consideration of prices of sales of similar land in the neighbourhood or locality and of similar quality and positions.

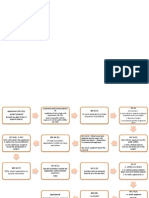

Below is the comparable properties used by PRIVATE VALUER :-

-at another document (landscape) rina pls delete this after u read it

As been stated in the Land Acquisition Act 1960, under First Scheduled (1A) :a. All comparable taken should have the similar characteristic with the scheduled land. b. The huge different of characteristic of land between the comparable and scheduled land with directly affect the valuation and the value of scheduled land. c. Big mistake if someone took a totally different category of land with the scheduled land, because in this case the scheduled land is a agricultural land. Contradict with the comparable property which is industrial & commercial land. d. For item (d) we can Only take the different category of land if there is no other land in the same locality that have the same characteristic with the scheduled land. According to Section 2 of Land Acquisition Act 1960 stated that :a. In order to determining the amount of compensation to awarded we need to consider about : Section 2 (a) Market value as determined in First Scheduled. b. Therefore in this case the valuer has disobeyed the instruction of the act by choosing the wrong comparable properties. Even though the value taken in comparable properties is market value, but we cannot use it. c. At first the principles of choosing the comparable properties have been neglect by the valuer. d. The Section 1 and Section 2 in the First Scheduled is strongly related. If you neglect the Section 1 in this act, you automatically cannot proceed to the Section 2. e. In this case there is injurious affection incurred in the scheduled land. The total land acquired has been stated in the previous table.

The problems arise in this case when the registered proprietor claim amount of compensation that are unreasonable and the government find out some issues regarding the determining the value of compensation. Due to the different prices between the agricultural (scheduled land) and industrial, commercial (comparable properties) the amount of compensation is not a genuine value. As mentioned earlier, value agricultural is much more lower compared to other category of land use.

ALL FACTS ABOVE IS FROM THE GOVERNMENTS VALUER PERSPECTIVE. THE REGISTERED PROPRIETOR SEND AN OBJECTION ABOUT THE AMOUNT OF AWARD.

By sending the objection letter thru Borang N , the owner of the scheduled land Tan Siew Lai stated a few reasons to strengthen the objection which is :a) The valuation made by Kumpulan Jurunilai Sdn Bhd is RM25.00 per sqm for Lot 72111 and RM 39.50 psf for Lot 72112. b) The land is a potential land (Mix Development) c) The surrounding area has been developed for residential and industrial area which is Kota Kemuning, Bukit Rimau and Kemunting Utama. d) The land located at strategic place : entrance of Shah Alam. e) MBSA has putted the signboard before the GAZETTE. We can consider this as trespass. f) Lot 72111 is zoning for residential by MBSA since 2000. g) Lot 72112 is zoning for commercial area since 2000 by MBSA. h) Even thou the Gazette on August 2003, but the land already took , encroachment and all the works has started since 2002. i) One joint venture between the land owner and third party has been canceled due to the acquisition and the land owner has incurred the lost. j) According to The Star on the 08.09.2000, the local authority already authorized the interchange project in land since 1994. k) And etc.

The owner claimed that the award given is minimum and can be classified as vicious, injustice, and unreasonable. The award is too low and failed to fulfill the court proceeding and law accordingly.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Proton's Marketing Strategies and Policies for InternationalizationDocument3 pagesProton's Marketing Strategies and Policies for InternationalizationNadiah AzizPas encore d'évaluation

- Proton Group StructureDocument1 pageProton Group StructureNadiah AzizPas encore d'évaluation

- Procedure of Land AcquisitionDocument3 pagesProcedure of Land AcquisitionNadiah AzizPas encore d'évaluation

- Land ProcurementDocument4 pagesLand ProcurementNadiah AzizPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- ExpressionismDocument16 pagesExpressionismRubab ChaudharyPas encore d'évaluation

- Concepts of Cavity Prep PDFDocument92 pagesConcepts of Cavity Prep PDFChaithra Shree0% (1)

- Minotaur Transformation by LionWarrior (Script)Document7 pagesMinotaur Transformation by LionWarrior (Script)Arnt van HeldenPas encore d'évaluation

- Apola Ose-Otura (Popoola PDFDocument2 pagesApola Ose-Otura (Popoola PDFHowe JosephPas encore d'évaluation

- SKILLS TRANSFER PLAN FOR MAINTENANCE OF NAVAL EQUIPMENTDocument2 pagesSKILLS TRANSFER PLAN FOR MAINTENANCE OF NAVAL EQUIPMENTZaid NordienPas encore d'évaluation

- StructDocument2 pagesStructandriessebastianPas encore d'évaluation

- Self Respect MovementDocument2 pagesSelf Respect MovementJananee RajagopalanPas encore d'évaluation

- A Game of Thrones: George RR MartinDocument6 pagesA Game of Thrones: George RR MartinRavi ShankarPas encore d'évaluation

- Data Report Northside19Document3 pagesData Report Northside19api-456796301Pas encore d'évaluation

- Course Title: Cost Accounting Course Code:441 BBA Program Lecture-3Document20 pagesCourse Title: Cost Accounting Course Code:441 BBA Program Lecture-3Tanvir Ahmed ChowdhuryPas encore d'évaluation

- Metatron AustraliaDocument11 pagesMetatron AustraliaMetatron AustraliaPas encore d'évaluation

- MASM Tutorial PDFDocument10 pagesMASM Tutorial PDFShashankDwivediPas encore d'évaluation

- A Story Behind..: Dimas Budi Satria Wibisana Mario Alexander Industrial Engineering 5Document24 pagesA Story Behind..: Dimas Budi Satria Wibisana Mario Alexander Industrial Engineering 5Owais AwanPas encore d'évaluation

- Topic 8 - Managing Early Growth of The New VentureDocument11 pagesTopic 8 - Managing Early Growth of The New VentureMohamad Amirul Azry Chow100% (3)

- Theory of Karma ExplainedDocument42 pagesTheory of Karma ExplainedAKASH100% (1)

- Cub Cadet 1650 PDFDocument46 pagesCub Cadet 1650 PDFkbrckac33% (3)

- Ds B2B Data Trans 7027Document4 pagesDs B2B Data Trans 7027Shipra SriPas encore d'évaluation

- BLUEBOOK CITATION GUIDEDocument12 pagesBLUEBOOK CITATION GUIDEMichaela PortarcosPas encore d'évaluation

- 02-Procedures & DocumentationDocument29 pages02-Procedures & DocumentationIYAMUREMYE EMMANUELPas encore d'évaluation

- Kasapreko PLC Prospectus November 2023Document189 pagesKasapreko PLC Prospectus November 2023kofiatisu0000Pas encore d'évaluation

- Revised Answer Keys for Scientist/Engineer Recruitment ExamDocument5 pagesRevised Answer Keys for Scientist/Engineer Recruitment ExamDigantPas encore d'évaluation

- Orbit BioscientificDocument2 pagesOrbit BioscientificSales Nandi PrintsPas encore d'évaluation

- FeistGorman - 1998-Psychology of Science-Integration of A Nascent Discipline - 2Document45 pagesFeistGorman - 1998-Psychology of Science-Integration of A Nascent Discipline - 2Josué SalvadorPas encore d'évaluation

- The Beatles - Allan Kozinn Cap 8Document24 pagesThe Beatles - Allan Kozinn Cap 8Keka LopesPas encore d'évaluation

- 15-8377 - 3521 Calandria Communications L. Rivera PDFDocument20 pages15-8377 - 3521 Calandria Communications L. Rivera PDFRecordTrac - City of OaklandPas encore d'évaluation

- Earth & Life Science Q1 Module 2 - DESIREE VICTORINODocument22 pagesEarth & Life Science Q1 Module 2 - DESIREE VICTORINOJoshua A. Arabejo50% (4)

- 1 PPT - Pavement of Bricks and TilesDocument11 pages1 PPT - Pavement of Bricks and TilesBHANUSAIJAYASRIPas encore d'évaluation

- Court Rules on Debt Collection Case and Abuse of Rights ClaimDocument3 pagesCourt Rules on Debt Collection Case and Abuse of Rights ClaimCesar CoPas encore d'évaluation

- Clique Pen's Marketing StrategyDocument10 pagesClique Pen's Marketing StrategySAMBIT HALDER PGP 2018-20 BatchPas encore d'évaluation

- ControllingDocument8 pagesControllingAnjo Pasiolco Canicosa100% (2)