Académique Documents

Professionnel Documents

Culture Documents

Market Outlook: India Research Dealer's Diary

Transféré par

Angel BrokingDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Market Outlook: India Research Dealer's Diary

Transféré par

Angel BrokingDroits d'auteur :

Formats disponibles

Market Outlook

India Research

September 21, 2011

Dealers Diary

The key benchmark indices nudged higher in opening trade as most Asian stocks reversed initial losses and soon extended initial gains. The market further extended gains to hit a fresh intraday high in morning trade and moved in a narrow range in mid-morning trade. The market remained firm in early afternoon trade and hit fresh intraday highs in afternoon trade as European stocks bounced back soon after a weak opening. The market extended gains to hit a fresh intraday high in mid-afternoon trade and spurted to a 1.5-week high in late trade as European stocks rose and as US index futures jumped, buoyed by expectations that Greece will receive the next aid tranche from international creditors as well as hopes that the Federal Reserve may announce fresh measures to stimulate the economy. The Sensex and Nifty ended with gains of 2.1% and 2.2%, respectively. The mid-cap and small-cap indices closed up by 0.9% and 1.2%, respectively. Among the front runners, Hindalco Industries, TCS, SBI, RIL and DLF gained 3-4%, while ONGC and BHEL lost 0-3%. Among mid caps, Rajesh Exports, Shree Global Trading, Religare Enterprises, Deccan Chronicle and Sunteck Realty gained 6-13%, while Nava Bharat Ventures, Alfa Level, Bajaj Hindustan, Godrej Properties and NCC lost 3-5%.

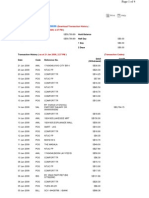

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%) 2.1 2.2 0.9 1.2 1.1 0.5 2.3 1.3 2.0 1.9 3.2 Chg (%) 0.1 (0.9) 2.0 (1.6) 0.5 0.9 0.4

(Pts) 108.3 57.6 88.6 65.4 39.9 118.0 168.2 163.4 (Pts) (22.6) 104.2 (142.9) 23.6 10.0

(Close) 5,140 6,429 7,300 5,995 7,721 8,981 8,844 5,216 (Close) 2,590 5,364 8,721 2,781 2,448

353.9 17,099

254.5 11,252 238.2 12,350

7.7 11,409

Markets Today

The trend deciding level for the day is 16,998/5,108 levels. If Nifty trades above this level during the first half-an-hour of trade then we may witness a further rally up to 17,23717,375/5,1825,223 levels. However, if Nifty trades below 16,998/5,108 levels for the first half-an-hour of trade then it may correct up to 16,86016,621/5,0674,994 levels.

Indices SENSEX NIFTY S2 16,621 4,994 S1 16,860 5,067 R1 17,237 5,182 R2 17,375 5,223

96.9 19,015

Indian ADRs Infosys Wipro ICICI Bank HDFC Bank Advances / Declines Advances Declines Unchanged Volumes (` cr) BSE

Chg (%) 1.0 (0.1) 1.9 1.0

(Pts) 0.5 (0.0) 0.7 0.3 BSE 1,849 937 130

(Close) $50.0 $9.7 $36.9 $31.3 NSE 989 441 64

News Analysis

Coal Indias August-September production hit due to heavy rains HCL Tech to set up software delivery centre in Dublin

Refer detailed news analysis on the following page

Net Inflows (September 19, 2011) ` cr Purch Sales FII MFs 1,560 560 1,564 410

Net (4) 150

MTD 1,543 (801)

YTD 735 5,473

FII Derivatives (September 20, 2011) ` cr Index Futures Stock Futures Gainers / Losers Gainers Company Cairn India Reliance Power Reliance Cap Educomp Sol Adani Enter Price (`) 305 84 419 243 605 chg (%) 5.0 4.9 4.8 4.8 4.6 NCC IVRCL Ltd ONGC Ashok Leyland Company United Spirits Losers Price (`) 792 69 40 262 26 chg (%) (3.5) (3.2) (3.1) (2.9) (1.9) Purch 2,711 2,165 Sales 2,611 2,486 Net 100 (321) Open Interest 16,302 30,393

2,541 10,298

NSE

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

Coal Indias August-September production hit due to heavy rains

As per NC Jha, Chairman, Coal India, the companys August and September production was lower than its target on account of heavy rains. The production was lower in its fully owned subsidiaries, Eastern Coalfields and Bharat Coking Coal. Nevertheless, the company maintained its production target at 452mn tonnes for FY2012. We maintain our production volumes estimate at 455mn tonnes and sales volumes estimate at 458mn tonnes for FY2012. We continue to maintain our Neutral rating on the stock.

HCL Tech to set up software delivery centre in Dublin

HCL Tech will be establishing a software delivery centre in Dublin, Ireland, which will employee 80 graduates over three years. With this centre, HCL Tech will service a growing number of HCL Tech clients and prospects in the financial services, insurance and healthcare/pharmaceutical industries. Plans for the development centre were provoked by a forecast for rapidly increasing demand for IT services in this region. HCL Tech has global delivery centres in the UK, Poland, Finland, US, Brazil, China, India, Malaysia and Northern Ireland and employs 4,500 people across Europe. We maintain our Buy rating on the stock with a target price of `578.

Economic and Political News

Coal output down 2.5% at 192mn tonnes in April-August HRD Ministry for outlay of `2.3 lakh cr for basic education Japanese government keeps economic view but flags overseas risks

Corporate News

BHEL aims 20,000MW capacity by FY2012 Lupin announces USFDA approval of its first oral contraceptive NTPC targets 1.3 lakh MW project by 2032 Subex to sell its activation biz to NetCracker

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

September 21, 2011

Market Outlook | India Research

Research Team Tel: 022-3935 7800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

Address: 6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3935 7800

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

September 21, 2011

Vous aimerez peut-être aussi

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingPas encore d'évaluation

- Market Outlook 30th September 2011Document3 pagesMarket Outlook 30th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 6th September 2011Document4 pagesMarket Outlook 6th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 23rd August 2011Document3 pagesMarket Outlook 23rd August 2011angelbrokingPas encore d'évaluation

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingPas encore d'évaluation

- Market Outlook: India Research Dealer's DiaryDocument4 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 5th September 2011Document4 pagesMarket Outlook 5th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingPas encore d'évaluation

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 20th September 2011Document4 pagesMarket Outlook 20th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingPas encore d'évaluation

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 5th August 2011Document4 pagesMarket Outlook 5th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingPas encore d'évaluation

- Market Outlook 23rd February 2012Document4 pagesMarket Outlook 23rd February 2012Angel BrokingPas encore d'évaluation

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingPas encore d'évaluation

- Market Outlook 19th August 2011Document3 pagesMarket Outlook 19th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 23rd September 2011Document4 pagesMarket Outlook 23rd September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 26th August 2011Document3 pagesMarket Outlook 26th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 16th February 2012Document4 pagesMarket Outlook 16th February 2012Angel BrokingPas encore d'évaluation

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 4th October 2011Document3 pagesMarket Outlook 4th October 2011Angel BrokingPas encore d'évaluation

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 6th March 2012Document3 pagesMarket Outlook 6th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 21st February 2012Document4 pagesMarket Outlook 21st February 2012Angel BrokingPas encore d'évaluation

- Market Outlook 4th August 2011Document4 pagesMarket Outlook 4th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 22nd November 2011Document4 pagesMarket Outlook 22nd November 2011Angel BrokingPas encore d'évaluation

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 24th February 2012Document4 pagesMarket Outlook 24th February 2012Angel BrokingPas encore d'évaluation

- Market Outlook 11th January 2012Document4 pagesMarket Outlook 11th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 26th March 2012Document4 pagesMarket Outlook 26th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 13th September 2011Document4 pagesMarket Outlook 13th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument5 pagesMarket Outlook: Dealer's DiaryVaibhav BhadangePas encore d'évaluation

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingPas encore d'évaluation

- Market Outlook 07.07Document3 pagesMarket Outlook 07.07Nikhil SatamPas encore d'évaluation

- Market Outlook 29th December 2011Document3 pagesMarket Outlook 29th December 2011Angel BrokingPas encore d'évaluation

- Market Outlook 30th March 2012Document3 pagesMarket Outlook 30th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingPas encore d'évaluation

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 18th August 2011Document3 pagesMarket Outlook 18th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 2nd September 2011Document4 pagesMarket Outlook 2nd September 2011anon_8523690Pas encore d'évaluation

- Daily Technical Report: Sensex (16649) / NIFTY (5050)Document4 pagesDaily Technical Report: Sensex (16649) / NIFTY (5050)Angel BrokingPas encore d'évaluation

- Market Outlook 27th December 2011Document3 pagesMarket Outlook 27th December 2011Angel BrokingPas encore d'évaluation

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingD'EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingPas encore d'évaluation

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingPas encore d'évaluation

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingPas encore d'évaluation

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingPas encore d'évaluation

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingPas encore d'évaluation

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingPas encore d'évaluation

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingPas encore d'évaluation

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingPas encore d'évaluation

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingPas encore d'évaluation

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingPas encore d'évaluation

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingPas encore d'évaluation

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingPas encore d'évaluation

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingPas encore d'évaluation

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingPas encore d'évaluation

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingPas encore d'évaluation

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingPas encore d'évaluation

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingPas encore d'évaluation

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingPas encore d'évaluation

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingPas encore d'évaluation

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingPas encore d'évaluation

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingPas encore d'évaluation

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingPas encore d'évaluation

- Radio & TV slogansDocument6 pagesRadio & TV slogansJames Selibio100% (1)

- VP Professional Services in Dallas TX Resume Frederick GattelaroDocument2 pagesVP Professional Services in Dallas TX Resume Frederick GattelaroFrederickGattelaroPas encore d'évaluation

- United States Bankruptcy Court District of NevadaDocument19 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsPas encore d'évaluation

- Article 1767-1768Document13 pagesArticle 1767-1768janePas encore d'évaluation

- Receivership Specialists Case Appointments - Kevin Singer ReceiverDocument24 pagesReceivership Specialists Case Appointments - Kevin Singer ReceiverCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasPas encore d'évaluation

- DBSDocument4 pagesDBSSilvia DewiyantiPas encore d'évaluation

- Aoun Naqi, Jyoti Srivastava, Vishal Bajaj, Manish Rai: Made byDocument20 pagesAoun Naqi, Jyoti Srivastava, Vishal Bajaj, Manish Rai: Made byChinmay SrivastavaPas encore d'évaluation

- Portfolio Sam DrissiDocument49 pagesPortfolio Sam Drissi451411Pas encore d'évaluation

- Debeers Diamond IndustryDocument16 pagesDebeers Diamond IndustryPRIYA KUMARIPas encore d'évaluation

- Company Analysis - Overview: Bouygues SADocument8 pagesCompany Analysis - Overview: Bouygues SAQ.M.S Advisors LLCPas encore d'évaluation

- Contacts Iphone $sDocument37 pagesContacts Iphone $sDouglas RubioPas encore d'évaluation

- Summer Internship Project Report On Analysis of Credit Appraisal at Bank of IndiaDocument142 pagesSummer Internship Project Report On Analysis of Credit Appraisal at Bank of IndiaSamuel Mckenzie100% (10)

- EEMA Membership List 7Document8 pagesEEMA Membership List 7Manishh Venkateshwara RaoPas encore d'évaluation

- BPODocument10 pagesBPOAzel UyPas encore d'évaluation

- Masdoor 2011 Ethical Theories of Corporate Governance. International Journal of Governance, 1 (2) : 484-492Document9 pagesMasdoor 2011 Ethical Theories of Corporate Governance. International Journal of Governance, 1 (2) : 484-492Dinar Ratih TanjungsariPas encore d'évaluation

- Search: Chanrobles On-Line Bar ReviewDocument13 pagesSearch: Chanrobles On-Line Bar ReviewMiguel Joshua Gange AguirrePas encore d'évaluation

- Articles of AssociationDocument8 pagesArticles of AssociationMurtaza A ZaveriPas encore d'évaluation

- The Strategic Position of AirAsia X CanDocument10 pagesThe Strategic Position of AirAsia X CanNur Aini RachmawatiPas encore d'évaluation

- Maria Socorro CancioDocument1 pageMaria Socorro CancioJulius SorianoPas encore d'évaluation

- Business ManDocument3 pagesBusiness ManSriram RajasekaranPas encore d'évaluation

- Chapter 1 - Introduction To Managerial AccountingDocument18 pagesChapter 1 - Introduction To Managerial AccountingEnrique Miguel Gonzalez Collado75% (4)

- Back/Carry Over Exam Results for Accounting and Law SubjectsDocument6 pagesBack/Carry Over Exam Results for Accounting and Law SubjectsAvYlashKumbharPas encore d'évaluation

- Generate Strategies for Imerex Plaza Hotel Using TOWS MatrixDocument3 pagesGenerate Strategies for Imerex Plaza Hotel Using TOWS MatrixPaolo100% (1)

- CSR of OngcDocument12 pagesCSR of OngcNitika KatariaPas encore d'évaluation

- Q2 FAR0 - 1st Sem 2019 20Document2 pagesQ2 FAR0 - 1st Sem 2019 20Ceejay Cruz TusiPas encore d'évaluation

- Assignment No. 1: ReconstructionDocument5 pagesAssignment No. 1: ReconstructionhelperforeuPas encore d'évaluation

- PDIC and BSP not liable for unpaid cashier's checksDocument2 pagesPDIC and BSP not liable for unpaid cashier's checksSean GalvezPas encore d'évaluation

- Chapter 07 AnsDocument5 pagesChapter 07 AnsDave Manalo100% (1)

- Partnership Accounting Multiple ChoiceDocument3 pagesPartnership Accounting Multiple ChoiceFreann Sharisse AustriaPas encore d'évaluation