Académique Documents

Professionnel Documents

Culture Documents

Air India

Transféré par

Vinita SalianDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Air India

Transféré par

Vinita SalianDroits d'auteur :

Formats disponibles

Air india

In 2000, Air India introduced services to Shanghai and to its third US gateway at Newark Liberty International Airport in Newark.In May 2004, Air India launched a wholly owned low cost airline called Air-India Express. Air India Express connecting cities in India with the Middle East, Southeast Asia and the Subcontinent. In 2004 Air India launched flights to its fourth US gateway at Los Angeles International Airport in Los Angeles (which has since been terminated) and expanded its international routes to include flights from Ahmedabad, Amritsar, Bangalore and Hyderabad. On 1 December 2009, Air India introduced services to its fifth US gateway at Washington Dulles International Airport in Washington, D.C., accessed via a stopover at JFK Airport in New York City. This service has been terminated. Re-privatisation plans In 2001, Air India was put up for sale by the then NDA government.[10] One of the bids was by a consortium of Tata Group-Singapore Airlines. However the re-privatisation plans were shelved after Singapore Airlines pulled out and the global economy slumped.[11] Merger with Indian Airlines In 2007, the Government of India announced that Air India would be merged with Indian Airlines. As part of the merger process, a new company called the National Aviation Company of India Limited (NACIL) was established, into which both Air India (along with Air India Express) and Indian Airlines (along with Alliance Air) will be merged. On 27 February 2011, Air India and Indian Airlines merged along with their subsidiaries to form Air India Limited. Financial crisis Around 20062007, the airlines began showing signs of financial distress. The combined losses for Air India and Indian in 2006-07 were Indian Rupee symbol.svg 770 crores (Indian Rupee symbol.svg 7.7 billion). After the merger of the airlines, this went up to Indian Rupee symbol.svg 7,200 crores (Indian Rupee symbol.svg 72 billion) by March 2009.[12] This was followed by restructuring plans which are still in progress.[13] In July 2009, SBI Capital Markets Ltd was appointed to prepare a road map for the recovery of the airline.[14] The carrier sold three Airbus A300 and one Boeing 747-300M in March 2009 for $18.75 million to survive the financial crunch. [15] As of March 2011, Air India has accumulated a debt of Rs. 42,570 crore (approximately $10 billion) and an operating loss of Rs. 22,000 crore, and is seeking Rs. 42,920 crore from the government [16]. For the past three months (June, July, August, 2011), the carrier has been missing salary payments and interest payments and Moodys Investor Service has warned that missing payments by Air India to creditors, such as the State Bank of India, will negatively affect the credit ratings of those banks [16] [17]. A report by the Comptroller and Auditor General (CAG) blamed the decision to buy 111 new planes as one of the major causes of the debt troubles in Air India; in addition it blamed on the ill timed merger with Indian Airlines as well [18], [19]. Air India's corporate headquarters is located at the Air India Building at Nariman Point in South Mumbai. The airline moved there in 1970. The Air India Building also serves as a regional office for Indian. Delhi Hub

On 1 March 2009, Air India had made Frankfurt Airport at Frankfurt am Main as its international hub for onward connections to United States from India; however, the airline shut down the Frankfurt hub on 30 October 2010. However on July 14, 2010 Air India chief, Arvind Jadhav announced their intention to make the new terminal 3 at Delhi's Indira Gandhi International Airport the hub for international and domestic operations with the plans of starting new direct flights to Chicago and Toronto and also taking almost all international long haul flights away from its former Primary hub at Mumbai's Chhatrapati Shivaji International Airport due to lack of space.[20] This would also provide greater convenience for transit passengers who before had to transfer between the international and domestic terminals which were located on completely different sides of the airport. They will now be able to catch their connecting flights within the same terminal. Return to profitability plans The new Chairman and Managing director wants to change the order of some of the 111 planes ordered in 2006 to get narrow-body aircraft instead of the wide-body aircraft.[21]

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- A Practical Guide To Insurance Broker Compensation and Potential Conflicts PDFDocument7 pagesA Practical Guide To Insurance Broker Compensation and Potential Conflicts PDFNooni Rinyaphat100% (1)

- Wiley Chapter 11 Depreciation Impairments and DepletionDocument43 pagesWiley Chapter 11 Depreciation Impairments and Depletion靳雪娇Pas encore d'évaluation

- GST Assignments For B.com 6TH Sem PDFDocument4 pagesGST Assignments For B.com 6TH Sem PDFAnujyadav Monuyadav100% (1)

- Invoice 14469407283Document1 pageInvoice 14469407283Shagun PathaniaPas encore d'évaluation

- Fixed Asset QuestionnaireDocument37 pagesFixed Asset QuestionnaireJannpreet KaurPas encore d'évaluation

- Midterm Review - Key ConceptsDocument10 pagesMidterm Review - Key ConceptsGurpreetPas encore d'évaluation

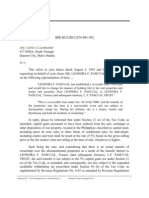

- Name: Kimberly Anne P. Caballes Year and CourseDocument12 pagesName: Kimberly Anne P. Caballes Year and CourseKimberly Anne CaballesPas encore d'évaluation

- PT Kalbe Farma TBK.: Summary of Financial StatementDocument2 pagesPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuPas encore d'évaluation

- Study on Fintech and Digital Banking in IndiaDocument41 pagesStudy on Fintech and Digital Banking in IndiaGayatri Rane100% (4)

- Pag IbigDocument2 pagesPag IbigJenne LeePas encore d'évaluation

- Saddam STPRDocument94 pagesSaddam STPRSumit GuptaPas encore d'évaluation

- Bank StatementDocument8 pagesBank StatementMy Comparison Rwanda TvPas encore d'évaluation

- Behavioral Finance MistakesDocument8 pagesBehavioral Finance MistakesblakePas encore d'évaluation

- DT Notes (Part I) For May & Nov 23Document246 pagesDT Notes (Part I) For May & Nov 23Tushar MalhotraPas encore d'évaluation

- Ac 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesDocument53 pagesAc 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesHarley Gumapon100% (1)

- Bir Ruling Un 041 95Document2 pagesBir Ruling Un 041 95mikmgonzalesPas encore d'évaluation

- Vocabulary Power Through Shakespeare: David PopkinDocument19 pagesVocabulary Power Through Shakespeare: David PopkinimamjabarPas encore d'évaluation

- M & A SetiausahaDocument10 pagesM & A SetiausahamayudiPas encore d'évaluation

- Bank of America NT & SA vs. CA, GR No. 105395, December 10, 1993Document2 pagesBank of America NT & SA vs. CA, GR No. 105395, December 10, 1993Rom100% (1)

- Yes Bank 2004-05Document133 pagesYes Bank 2004-05Sagar ShawPas encore d'évaluation

- Chapter 17 & Chapter 18 (1) NewDocument66 pagesChapter 17 & Chapter 18 (1) NewAlief AmbyaPas encore d'évaluation

- Purchases & PayablesDocument12 pagesPurchases & Payablesrsn_surya100% (2)

- Preparing Financial StatementsDocument6 pagesPreparing Financial StatementsAUDITOR97Pas encore d'évaluation

- Saura vs. DBP ruling on perfected contractDocument1 pageSaura vs. DBP ruling on perfected contractDarlyn BangsoyPas encore d'évaluation

- Roy vs. HerbosaDocument28 pagesRoy vs. HerbosaIsabel GuartePas encore d'évaluation

- Lone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Document142 pagesLone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Texas WatchdogPas encore d'évaluation

- Consent loan rate changeDocument1 pageConsent loan rate changePiyush SilawatPas encore d'évaluation

- Playing To Win: in The Business of SportsDocument8 pagesPlaying To Win: in The Business of SportsAshutosh JainPas encore d'évaluation

- f9 02 The Financial Management EnvironmentDocument27 pagesf9 02 The Financial Management EnvironmentGAURAVPas encore d'évaluation