Académique Documents

Professionnel Documents

Culture Documents

Assets

Transféré par

naeemjafri_110Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assets

Transféré par

naeemjafri_110Droits d'auteur :

Formats disponibles

ASSETS An asset is anything of value that your company owns including cash.

. Assets get recorded on the balance sheet in terms of their dollar/Rupee values. Even if you use credit to purchase an asset, you still own it. CURRENT ASSETS assets with dollar amounts that continually change For example: cash inventory

accounts receivable Or raw materials your company uses to make a product

In accounting, a current asset is an asset on the balance sheet which can either be converted to cash or used to pay current liabilities within 12 months. Typical current assets include cash, cash equivalents, short-term investments, accounts receivable, inventory and the portion of prepaid liabilities which will be paid within a year. On a balance sheet, assets will typically be classified into current assets and long-term assets. The current ratio is calculated by dividing total current assets by total current liabilities. It is frequently used as an indicator of a company's liquidity, its ability to meet short-term obligations.

Current assets are those assets that are expected to be used (sold or consumed) within a year, unlike fixed assets. Current assets are shown on the balance sheet, and are listed in order of increasing liquidity (i.e. how easy they are to convert to cash). Usually stocks will be listed first, followed by debtors, with cash last. The current asset position of a company is important, both for assessing its financial strength financial position (see current assets ratio) and for gauging its operational efficiency.

Current assets are cash and other assets expected to be converted to cash, sold, or consumed either in a year or in the operating cycle (whichever is shorter), without disturbing the normal operations of a business. These assets are continually turned over in the course of a business during normal business activity. There are 5 major items included into current assets:

1.

Cash and cash equivalents it is the most liquid asset, which

includes currency, deposit accounts, and negotiable instruments (e.g., money orders, cheque, bank drafts).

2. 3. 4.

Short-term investments include securities bought and held for sale in the

near future to generate income on short-term price differences (trading securities). Receivables usually reported as net of allowance for uncollectable accounts. Inventory trading these assets is a normal business of a company. The

inventory value reported on the balance sheet is usually the historical cost or fair market value, whichever is lower. This is known as the "lower of cost or market" rule.

5.

entries.

Prepaid expenses these are expenses paid in cash and recorded as assets

before they are used or consumed (a common example is insurance). See also adjusting

The phrase net current assets (also called working capital) is often used and refers to the total of current assets less the total of current liabilities.

CURRENT LIABILITY

if a liability must be paid within a year, it is considered current. This includes: Bills money you owe to your vendors and suppliers employee payroll & short-term loans

In accounting, current liabilities are often understood as all liabilities of the business that are to be settled in cash within the fiscal year or the operating cycle of a given firm, whichever period is longer. A more complete definition is that current liabilities are obligations that will be settled by current assets or by the creation of new current liabilities. An operating cycle for a firm is the average time that is required to go from cash to cash in producing revenues.[citation needed] For example, accounts payable for goods, services or supplies that were purchased for use in the operation of the business and payable within a normal period of time would be current liabilities.

Common Liability Accounts:

Current Liabilities: Notes Payable - Promissory notes to creditors. Accounts Payable - What you owe others on account. Unearned Revenue - You've been paid, but haven't delivered. Salaries Payable - Salaries you owe employees. Interest Payable - Interest you owe. Taxes Payable - Taxes you owe.

Examples of Current Assets: Cash Normally, cash is considered a current asset because it can be used within one

year after the balance sheet date. However, in certain situations, cash may be classified as a non-current asset. For example, if a company has restricted cash in a bank account (i.e. cash that can't be used), and restriction is for more than one year after the balance sheet date, then, this cash is considered non-current. Accounts Receivable Prepaid Expenses Accounts receivable are amounts expected to be collected from customers. Usually, collection is within one year, and thus, accounts receivable are considered a current asset. Prepaid expenses (e.g. prepaid insurance premiums) are usually used within a year after the balance sheet date and thus, are considered a current asset. However, if a company paid a premium for two years as of the balance sheet date, then, one half (one year) of the prepaid expenses balance will be current and the other half (another year) will be non-current.

Examples of Current Liabilities: Accounts Payable Accrued Expenses Accounts payables are obligations of a company to vendors, suppliers, etc. Such obligations are normally settled with current assets (e.g. cash), and thus, they are considered current liabilities. Accrued expenses may include accrued (i.e. incurred but not paid) utility charges, insurance payments, and others. Such accrued expenses are usually paid within a year after the balance sheet date, and therefore, they are considered current liabilities.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- ASSIGNMENTDocument7 pagesASSIGNMENTnaeemjafri_110Pas encore d'évaluation

- FOP and WOPDocument1 pageFOP and WOPnaeemjafri_110Pas encore d'évaluation

- Development of The Human Capital in The Emerging Markets: Submitted ToDocument3 pagesDevelopment of The Human Capital in The Emerging Markets: Submitted Tonaeemjafri_110Pas encore d'évaluation

- Updated ScheduleDocument2 pagesUpdated Schedulenaeemjafri_110Pas encore d'évaluation

- Nae emDocument2 pagesNae emNaeem JafriPas encore d'évaluation

- In The Name of Allah The Most Mercifull and The Most BenificientDocument23 pagesIn The Name of Allah The Most Mercifull and The Most BenificientNaeem JafriPas encore d'évaluation

- New Microsoft Office Word DocumentDocument4 pagesNew Microsoft Office Word Documentnaeemjafri_110Pas encore d'évaluation

- 2Document42 pages2naeemjafri_110Pas encore d'évaluation

- CH# 5 Kotler Marketing ManagementDocument20 pagesCH# 5 Kotler Marketing Managementnaeemjafri_110Pas encore d'évaluation

- IssbDocument15 pagesIssbnaeemjafri_110Pas encore d'évaluation

- The Use of In: ComparisonsDocument7 pagesThe Use of In: ComparisonszhareenmPas encore d'évaluation

- Audit and AssuranceDocument4 pagesAudit and Assurancenaeemjafri_110100% (1)

- Small 8Document13 pagesSmall 8naeemjafri_110Pas encore d'évaluation

- IssbDocument18 pagesIssbnaeemjafri_110Pas encore d'évaluation

- Tire SafetyDocument22 pagesTire SafetyDemo CracyPas encore d'évaluation

- Economic System in IslamDocument47 pagesEconomic System in Islamawaiting100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Reporting on Compliance with IFRSDocument10 pagesReporting on Compliance with IFRSnikPas encore d'évaluation

- Financial Accounting ReportingMulti-Lingual GlossaryDocument54 pagesFinancial Accounting ReportingMulti-Lingual GlossaryMeadsiePas encore d'évaluation

- CaseDocument11 pagesCasengogiahuy12082002Pas encore d'évaluation

- Estados Financieros ComcastDocument90 pagesEstados Financieros ComcastGustavo Florez100% (1)

- Accounting Terms for CDC Financial StatementsDocument3 pagesAccounting Terms for CDC Financial StatementsKostasPas encore d'évaluation

- Financial Accounting: Weygandt KimmelDocument82 pagesFinancial Accounting: Weygandt Kimmelclarysage13100% (1)

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalPas encore d'évaluation

- 20x0 20x1 Assets: Amerbran Company Balance Sheet As of December 31, 20x1 and 20x0Document6 pages20x0 20x1 Assets: Amerbran Company Balance Sheet As of December 31, 20x1 and 20x0NITYA NAYARPas encore d'évaluation

- 6 AdvacDocument4 pages6 AdvacKryzzel Anne JonPas encore d'évaluation

- Accounting for Loans and ReceivablesDocument15 pagesAccounting for Loans and ReceivablesJehPoyPas encore d'évaluation

- PS2 - Financial Analysis (Answers) VfinalDocument41 pagesPS2 - Financial Analysis (Answers) VfinalAdrian MontoyaPas encore d'évaluation

- Ch3 Part 2 SolutionsDocument11 pagesCh3 Part 2 SolutionsCharmaine Bernados BrucalPas encore d'évaluation

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocument190 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFdareal laguardiaPas encore d'évaluation

- Module #6Document20 pagesModule #6Joy RadaPas encore d'évaluation

- Practical Accounting IiDocument18 pagesPractical Accounting IiFerb CruzadaPas encore d'évaluation

- Statement of Financial Position With Supporting NotesDocument4 pagesStatement of Financial Position With Supporting NotesKennethEdizaPas encore d'évaluation

- Total PHP 2,208,000 PHP 2,208,000Document4 pagesTotal PHP 2,208,000 PHP 2,208,000Marian Abellanosa MendezPas encore d'évaluation

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoPas encore d'évaluation

- Ias 1 Presentation of Financial StatementsDocument42 pagesIas 1 Presentation of Financial StatementsEjaj-Ur-RahamanPas encore d'évaluation

- Eskimo Limited financial statements and notes summaryDocument6 pagesEskimo Limited financial statements and notes summaryMuhammad ArmaghanPas encore d'évaluation

- Ey Ifrs Update 31 March 2023 v2Document22 pagesEy Ifrs Update 31 March 2023 v2Yehor KonievPas encore d'évaluation

- Accrualschap 10Document33 pagesAccrualschap 10Munyaradzi Onismas ChinyukwiPas encore d'évaluation

- MTN FinancialsDocument200 pagesMTN FinancialsIshaan SharmaPas encore d'évaluation

- Chapter 3 Answers To QuestionsDocument34 pagesChapter 3 Answers To QuestionsjheyfteePas encore d'évaluation

- Home Work One - MBADocument2 pagesHome Work One - MBAIslam SamirPas encore d'évaluation

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Document27 pagesPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaPas encore d'évaluation

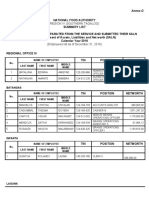

- Annex GDocument3 pagesAnnex GREGIONAL DIRECTOR SOUTHERN TAGALOGPas encore d'évaluation

- Financial Statement Analysis at Lanco InfratechDocument78 pagesFinancial Statement Analysis at Lanco Infratechnaveen100% (1)

- DONE BA 118.3 Module 2 Quiz 1answer KeyDocument8 pagesDONE BA 118.3 Module 2 Quiz 1answer KeyRed Ashley De LeonPas encore d'évaluation

- PT PP (Persero) Tbk 2022 Financial ReportDocument220 pagesPT PP (Persero) Tbk 2022 Financial ReportLuthfia ZulfaPas encore d'évaluation