Académique Documents

Professionnel Documents

Culture Documents

CH 2

Transféré par

Daniiar KamalovDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CH 2

Transféré par

Daniiar KamalovDroits d'auteur :

Formats disponibles

Solutions, Chapter 2/HL

ANSWERS TO CHAPTER 2

The Simple Regression Model

Econometrics

Economics of Innovation and Growth

A = Problems

B = Examples (from chapter 2)

C = Cumputer Exercises

Solutions, Chapter 2/HL

A: Problems

2.1

Let kids denote the number of children born to a woman, and let educ denote years of

education for the woman. A simple model relating fertility to years of education is

kids = 0 + 1educ + u

where u is the unobserved error.

(i)

(ii)

What kind of factors are contained in u? Are these likely to be correlated with

level of education?

Will a simple regression analysis uncover ceteris paribus effects of education on

fertility? Explain.

(i) Income, age, and family background (such as number of siblings) are just a few

possibilities. It seems that each of these could be correlated with years of education. (Income

and education are probably positively correlated; age and education may be negatively

correlated because women in more recent cohorts have, on average, more education; and

number of siblings and education are probably negatively correlated.)

(ii) Not if the factors we listed in part (i) are correlated with educ. Because we would like to

hold these factors fixed, they are part of the error term. But if u is correlated with educ then

E(u|educ) 0, and so SLR.3 fails.

--------------------------------------------------------------------------------------------------------------2.2

In the simple linear regression model y=0+1x + u, suppose that E(u) 0. Letting

0=e(u), show that the model can always be rewritten with the same slope, but new

intercept and error, where the new error has a zero expected value.

Answers

In the equation y = 0 + 1x + u, add and subtract 0 from the right hand side to get y = (0 +

0) + 1x + (u 0). Call the new error e = u 0, so that E(e) = 0. The new intercept is 0 +

0, but the slope is still 1.

Solutions, Chapter 2/HL

2.3

The following table contains the ATC scores and the GPA (grade point average) for 8

college students. Grade point average is based on a four-point scale and has been rounded

to the one digit after the decimal.

Student

1

2

3

4

5

6

7

8

GPA

2.8

3.4

3.0

3.5

3.6

3.0

2.7

3.7

ACT

21

24

26

27

39

25

25

30

(i) Estimate the relationship between GPA and ACT using ols; that is, obtain the

intercept and slope in the equation

GP A = 0 + 1 ACT

Comment on the direction of the relationship. Does the intercept have a useful

interpretation here? Explain. How much higher is GPA predicted to be if the ACT

score is increased by 5 points?

(ii) Compute the fitted valued and the residuals for each observation, and verify that

the residuals (approximately) sum to zero.

(iii) What is the predicted value of GPA when ACT =20?

(iv) How much of the variation in GPA for the 8 students is explained by ACT.

Explain.

2.3 (i) Let yi = GPAi, xi = ACTi, and n = 8. Then x = 25.875, y = 3.2125, (xi x )(yi

i=1

n

y ) = 5.8125, and (xi x )2 = 56.875. From equation (2.9), we obtain the slope as 1 =

i=1

5.8125/56.875 .1022, rounded to four places after the decimal. From (2.17), 0 = y

x 3.2125 (.1022)25.875 .5681. So we can write

1

GPA

= .5681 + .1022 ACT

n = 8.

The intercept does not have a useful interpretation because ACT is not close to zero for the

increases by .1022(5) = .511.

population of interest. If ACT is 5 points higher, GPA

Solutions, Chapter 2/HL

(ii) The fitted values and residuals rounded to four decimal places are given along

with the observation number i and GPA in the following table:

GPA

i GPA

1 2.8

2.7143 .0857

2 3.4

3.0209 .3791

3 3.0

3.2253 .2253

4 3.5

3.3275 .1725

5 3.6

3.5319 .0681

6 3.0

3.1231 .1231

7 2.7

3.1231 .4231

8 3.7

3.6341 .0659

You can verify that the residuals, as reported in the table, sum to .0002, which is pretty close

to zero given the inherent rounding error.

= .5681 + .1022(20) 2.61.

(iii) When ACT = 20, GPA

n

(iv) The sum of squared residuals,

u

i =1

and the total sum of squares,

(yi

2

i

, is about .4347 (rounded to four decimal places),

y )2, is about 1.0288. So the R-squared from the

i=1

regression is

R2 = 1 SSR/SST 1 (.4347/1.0288) .577.

Therefore, about 57.7% of the variation in GPA is explained by ACT in this small sample of

students.

--------------------------------------------------------------------------------------------------------------2.4

The data set BWGHT.DTA contains data on births to women in the United States. Two

variables of interest are the dependent variable infant birth weight on ounces (bwght), and an

explanatory variable, average number of cigarettes the mother smoked per day during

pregnancy (cigs). The following simple regression was estimated using data on n=1,388 births

bwght = 119.77 0.514cigs

(i) What is the predicted birth weight when cig s= 0? What about when cigs = 20?

Comment on the difference.

(ii) Does the simple regression necessarily capture a causal relationship between the

chids birth weight and the mothers smoking habits? Explain.

Solutions, Chapter 2/HL

(iii) The predict a birth weight of 125 ounces, what would cigs have to be? Comment.

(iv) What fraction of the women in the sample do not smoke while pregnant? Does this

help reconcile your finding from part (iii)?

�

= 109.49.

(i) When cigs = 0, predicted birth weight is 119.77 ounces. When cigs = 20, bwght

This is about an 8.6% drop.

(ii) Not necessarily. There are many other factors that can affect birth weight, particularly

overall health of the mother and quality of prenatal care. These could be correlated with

cigarette smoking during birth. Also, something such as caffeine consumption can affect birth

weight, and might also be correlated with cigarette smoking.

(iii) If we want a predicted bwght of 125, then cigs = (125 119.77)/( .524) 10.18, or

about 10 cigarettes! This is nonsense, of course, and it shows what happens when we are

trying to predict something as complicated as birth weight with only a single explanatory

variable. The largest predicted birth weight is necessarily 119.77. Yet almost 700 of the

births in the sample had a birth weight higher than 119.77.

(iii) 1,176 out of 1,388 women did not smoke while pregnant, or about 84.7%.

--------------------------------------------------------------------------------------------------------------2.5

In the linear consumption function

cons = 0 + 1inc

the (estimated) marginal propensity to consume (MPC) out of the income is simply the slope

1 , while the average propensity to consume (APC) is cons / inc = 0 / inc + 1

Using observations for 100 families, the annual income and consumption (both measured in

dollars), the following equation is obtained:

Cons(est)=-124.84 + 0.853 inc

N = 100, R2=0.692

(i) Interpret the intercept in this equation, and comment onb its sign and magnitude.

(ii) What is the predicted consumption when family income is $30,000?

(iii) Whit inc on the x-axis, draw the graph of the estimated MPC and APC

(i) The intercept implies that when inc = 0, cons is predicted to be negative $124.84. This, of

course, cannot be true, and reflects that fact that this consumption function might be a poor

predictor of consumption at very low-income levels. On the other hand, on an annual basis,

$124.84 is not so far from zero.

� = 124.84 + .853(30,000) = 25,465.16 dollars.

(ii) Just plug 30,000 into the equation: cons

Solutions, Chapter 2/HL

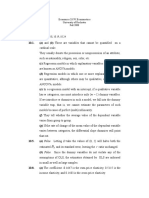

(iii) The MPC and the APC are shown in the following graph. Even though the intercept is

negative, the smallest APC in the sample is positive. The graph starts at an annual income

level of $1,000 (in 1970 dollars).

MPC

APC

.9

MPC

.853

APC

.728

.7

1000

20000

10000

30000

inc

--------------------------------------------------------------------------------------------------------------2.6

Using data from 1988 for houses sold in Andover, Massachusetts, from Kiel and McClain

(1995), the following equation relates housing price (price) to the distance from the recently

built garbage incinerator (dist):

Log (price) = 0.9.40 + 0.213 log(dist)

N = 135, R2=0.162

(i) Interpret the coefficient on log (dist). Is the sign of this estimate what you expected it

to be?

(ii) Do you think simple regression provides an unbiased estimator of the ceteris paribus

elasticity of price with respect to dist? (Think about the citys decision on where to put

the incinerator.)

Solutions, Chapter 2/HL

(iii) What other factors about a house affect its price? Might these be correlated with

distance from the incinerator?

(i) Yes. If living closer to an incinerator depresses housing prices, then being farther away

increases housing prices.

(ii) If the city chose to locate the incinerator in an area away from more expensive

neighborhoods, then log(dist) is positively correlated with housing quality. This would

violate SLR.3, and OLS estimation is biased.

(iii) Size of the house, number of bathrooms, size of the lot, age of the home, and quality of

the neighborhood (including school quality), are just a handful of factors. As mentioned in

part (ii), these could certainly be correlated with dist [and log(dist)].

Solutions, Chapter 2/HL

B: Examples

Example 2.3: CEO Salary and Return on Equity

Data: CEOSAL1

sum salary roe

Variable |

Obs

Mean

Std. Dev.

Min

Max

---------+----------------------------------------------------salary |

209

1281.12

1372.345

223

14822

roe |

209

17.18421

8.518509

.5

56.3

reg salary roe

Source |

SS

df

MS

---------+-----------------------------Model | 5166419.04

1 5166419.04

Residual |

386566563

207 1867471.32

---------+-----------------------------Total |

391732982

208 1883331.64

Number of obs

F( 1,

207)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

209

2.77

0.0978

0.0132

0.0084

1366.6

-----------------------------------------------------------------------------salary |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------roe |

18.50119

11.12325

1.663

0.098

-3.428195

40.43057

_cons |

963.1913

213.2403

4.517

0.000

542.7902

1383.592

-----------------------------------------------------------------------------Salary for ROE = 0

display _b[roe]*0+_b[_cons]

963.19134

Salary for ROE = 30

display _b[roe]*30+_b[_cons]

1518.2269

Example 2.4: Wage and Education

Data WAGE1

summ wage

Variable |

Obs

Mean

Std. Dev.

Min

Max

---------+----------------------------------------------------wage |

526

5.896103

3.693086

.53

24.98

reg wage educ

Source |

SS

df

MS

Number of obs =

526

---------+-----------------------------F( 1,

524) = 103.36

Model | 1179.73204

1 1179.73204

Prob > F

= 0.0000

Residual | 5980.68225

524 11.4135158

R-squared

= 0.1648

---------+-----------------------------Adj R-squared = 0.1632

Total | 7160.41429

525 13.6388844

Root MSE

= 3.3784

-----------------------------------------------------------------------------wage |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------educ |

.5413593

.053248

10.167

0.000

.4367534

.6459651

_cons | -.9048516

.6849678

-1.321

0.187

-2.250472

.4407687

-----------------------------------------------------------------------------Wage for educ = 0

display _b[educ]*0+_b[_cons]

-.90485161

Wage for educ = 8

display _b[educ]*8+_b[_cons]

3.4260224

Return to 4 years education

display _b[educ]*4

2.165437

Solutions, Chapter 2/HL

Example 2.5: Voting Outcomes and Campaign Expenditures

Data

VOTE1

reg voteA shareA

Source |

SS

df

MS

---------+-----------------------------Model | 41486.4749

1 41486.4749

Residual | 6970.77363

171 40.7647581

---------+-----------------------------Total | 48457.2486

172 281.728189

Number of obs

F( 1,

171)

Prob > F

R-squared

Adj R-squared

Root MSE

=

173

= 1017.70

= 0.0000

= 0.8561

= 0.8553

= 6.3847

-----------------------------------------------------------------------------voteA |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------shareA |

.4638239

.0145393

31.901

0.000

.4351243

.4925234

_cons |

26.81254

.8871887

30.222

0.000

25.06129

28.56379

------------------------------------------------------------------------------

Example 2.6: CEO Salary and Return on Equity

Data: CEOSAL1

summ salary roe

Variable |

Obs

Mean

Std. Dev.

Min

Max

---------+----------------------------------------------------salary |

209

1281.12

1372.345

223

14822

roe |

209

17.18421

8.518509

.5

56.3

reg salary roe

Source |

SS

df

MS

---------+-----------------------------Model | 5166419.04

1 5166419.04

Residual |

386566563

207 1867471.32

---------+-----------------------------Total |

391732982

208 1883331.64

Number of obs

F( 1,

207)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

209

2.77

0.0978

0.0132

0.0084

1366.6

-----------------------------------------------------------------------------salary |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------roe |

18.50119

11.12325

1.663

0.098

-3.428195

40.43057

_cons |

963.1913

213.2403

4.517

0.000

542.7902

1383.592

-----------------------------------------------------------------------------Fitted Values and Residuals for the First 15 CEOs

predict salhat, xb

gen uhat=salary-salhat

list roe salary salhat uhat in 1/15

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

roe

14.1

10.9

23.5

5.9

13.8

20

16.4

16.3

10.5

26.3

25.9

26.8

14.8

22.3

56.3

salary

1095

1001

1122

578

1368

1145

1078

1094

1237

833

567

933

1339

937

2011

salhat

1224.058

1164.854

1397.969

1072.348

1218.508

1333.215

1266.611

1264.761

1157.454

1449.773

1442.372

1459.023

1237.009

1375.768

2004.808

uhat

-129.0581

-163.8542

-275.9692

-494.3484

149.4923

-188.2151

-188.6108

-170.7606

79.54626

-616.7726

-875.3721

-526.0231

101.9911

-438.7678

6.191895

Solutions, Chapter 2/HL

Example 2.7: Wage and Education

Data: WAGE1

summ wage educ

Variable |

Obs

Mean

Std. Dev.

Min

Max

---------+----------------------------------------------------wage |

526

5.896103

3.693086

.53

24.98

educ |

526

12.56274

2.769022

0

18

reg wage educ

Source |

SS

df

MS

Number of obs =

526

---------+-----------------------------F( 1,

524) = 103.36

Model | 1179.73204

1 1179.73204

Prob > F

= 0.0000

Residual | 5980.68225

524 11.4135158

R-squared

= 0.1648

---------+-----------------------------Adj R-squared = 0.1632

Total | 7160.41429

525 13.6388844

Root MSE

= 3.3784

-----------------------------------------------------------------------------wage |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------educ |

.5413593

.053248

10.167

0.000

.4367534

.6459651

_cons | -.9048516

.6849678

-1.321

0.187

-2.250472

.4407687

-----------------------------------------------------------------------------Wage for educ = 12.56

display _b[educ]*12.56+_b[_cons]

5.8824

Example 2.8: CEO Salary and Return on Equity

Data: CEOSAL1

reg salary roe

Source |

SS

df

MS

---------+-----------------------------Model | 5166419.04

1 5166419.04

Residual |

386566563

207 1867471.32

---------+-----------------------------Total |

391732982

208 1883331.64

Number of obs

F( 1,

207)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

209

2.77

0.0978

0.0132

0.0084

1366.6

-----------------------------------------------------------------------------salary |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------roe |

18.50119

11.12325

1.663

0.098

-3.428195

40.43057

_cons |

963.1913

213.2403

4.517

0.000

542.7902

1383.592

------------------------------------------------------------------------------

Example 2.9: Voting Outcomes and Campaign Expenditures

Data: VOTE1

reg voteA shareA

Source |

SS

df

MS

---------+-----------------------------Model | 41486.4749

1 41486.4749

Residual | 6970.77363

171 40.7647581

---------+-----------------------------Total | 48457.2486

172 281.728189

Number of obs

F( 1,

171)

Prob > F

R-squared

Adj R-squared

Root MSE

=

173

= 1017.70

= 0.0000

= 0.8561

= 0.8553

= 6.3847

-----------------------------------------------------------------------------voteA |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------shareA |

.4638239

.0145393

31.901

0.000

.4351243

.4925234

_cons |

26.81254

.8871887

30.222

0.000

25.06129

28.56379

------------------------------------------------------------------------------

10

Solutions, Chapter 2/HL

Example 2.10: A Log Wage Equation

Data:WAGE1

reg lwage educ

Source |

SS

df

MS

---------+-----------------------------Model | 27.5606296

1 27.5606296

Residual | 120.769132

524 .230475443

---------+-----------------------------Total | 148.329762

525

.28253288

Number of obs

F( 1,

524)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

526

119.58

0.0000

0.1858

0.1843

.48008

-----------------------------------------------------------------------------lwage |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------educ |

.0827444

.0075667

10.935

0.000

.0678796

.0976092

_cons |

.5837726

.0973358

5.998

0.000

.3925562

.774989

------------------------------------------------------------------------------

Example 2.11: CEO Salary and Firm Sales

Data CEOSAL1

reg lsalary lsales

Source |

SS

df

MS

---------+-----------------------------Model | 14.0661711

1 14.0661711

Residual | 52.6559988

207 .254376806

---------+-----------------------------Total | 66.7221699

208 .320779663

Number of obs

F( 1,

207)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

209

55.30

0.0000

0.2108

0.2070

.50436

-----------------------------------------------------------------------------lsalary |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------lsales |

.2566717

.0345167

7.436

0.000

.1886225

.324721

_cons |

4.821996

.2883397

16.723

0.000

4.253537

5.390455

------------------------------------------------------------------------------

Example 2.12: Student Math Performance and the School Lunch Program

Data: MEAP93

reg math10 lnchprg

Source |

SS

df

MS

---------+-----------------------------Model | 7665.26597

1 7665.26597

Residual | 37151.9145

406 91.5071786

---------+-----------------------------Total | 44817.1805

407 110.115923

Number of obs

F( 1,

406)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

408

83.77

0.0000

0.1710

0.1690

9.5659

-----------------------------------------------------------------------------math10 |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

---------+-------------------------------------------------------------------lnchprg | -.3188643

.0348393

-9.152

0.000

-.3873523

-.2503763

_cons |

32.14271

.9975824

32.221

0.000

30.18164

34.10378

------------------------------------------------------------------------------

11

Solutions, Chapter 2/HL

C: Computer exercises

Question 2.10*

Data: 401K.DTA

The data in 401K.DTA are a subset of data analysed by Papke (1995) to study the relationship

between participation in a 401and the generosity of the plan. The variable prate is the

percentage of eligible workers with an active account: This is the variable we would like to

explain. The measure of generosity is the plan match rate, mrate. This variable gives the

average amount the firm contributes to each workers plan for each $1 dollar contribution by

thw workers. For example, if mrate=0.50, then $1 contribution by the worker is matched by a

50 cents contribution by the firm

(i) Find the average participation rate and the average match rate in the sample of plan.

Answer

*i

sum prate mrate

Variable |

Obs

Mean

Std. Dev.

Min

Max

-------------+-------------------------------------------------------prate |

1534

87.36291

16.71654

3

100

mrate |

1534

.7315124

.7795393

.01

4.91

The average prate is about 87.36 and the average mrate is about .732.

(ii) Estimate the simple regression equation prate = 0 + 1mrate and report the results

along the sample size and R-squared.

*ii

reg prate mrate

Source |

SS

df

MS

-------------+-----------------------------Model | 32001.7271

1 32001.7271

Residual | 396383.812 1532

258.73617

-------------+-----------------------------Total | 428385.539 1533 279.442622

Number of obs

F( 1, 1532)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

1534

123.68

0.0000

0.0747

0.0741

16.085

-----------------------------------------------------------------------------prate |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------mrate |

5.861079

.5270107

11.12

0.000

4.82734

6.894818

_cons |

83.07546

.5632844

147.48

0.000

81.97057

84.18035

------------------------------------------------------------------------------

The estimated equation is

prate = 83.05 + 5.86 mrate

n = 1,534, R2 = .075

(iii) Interpret the intercept in your equation. Interpret the coefficient on mrate.

The intercept implies that, even if mrate = 0, the predicted participation rate is 83.05 percent.

The coefficient on mrate implies that a one-dollar increase in the match rate a fairly large

increase is estimated to increase prate by 5.86 percentage points. This assumes, of course,

that this change prate is possible (if, say, prate is already at 98, this interpretation makes no

sense).

12

Solutions, Chapter 2/HL

(iv) Find the predicted prate when mrate =3.5. Is this a reasonable prediction? Explain

what is happening here.

= 83.05 + 5.86(3.5) = 103.59. This is

If we plug mrate = 3.5 into the equation we get prate

impossible, as we can have at most a 100 percent participation rate. This illustrates that,

especially when dependent variables are bounded, a simple regression model can give strange

predictions for extreme values of the independent variable. (In the sample of 1,534 firms,

only 34 have mrate 3.5.)

(v) How much of the variation in prate is explained by mrate. Is this a lot in your

opinion?

(v) mrate explains about 7.5% of the variation in prate. This is not much, and suggests that

many other factors influence 401(k) plan participation rates.

Question 2.11

The data set in CEOSAL2.DTA contains information of chief executive officers for U.S

corporations. The variable salary is annual compensation, in thousand of dollars, and

ceoten is prior number of years as company CEO.

(i) Find the average salary and the average tenure in the sample

sum salary ceoten

Variable |

Obs

Mean

Std. Dev.

Min

Max

-------------+-------------------------------------------------------salary |

177

865.8644

587.5893

100

5299

ceoten |

177

7.954802

7.150826

0

37

Average salary is about 865.864, which means $865,864 because salary is in thousands of

dollars. Average ceoten is about 7.95.

(ii) How many CEOs are in their first year as CEO (that is, ceoten=0)?, what is the

longest tenure as CEO

There are five CEOs with ceoten = 0. The longest tenure is 37 years.

*ii

tab ceoten

years as |

ceo with |

company |

Freq.

Percent

Cum.

------------+----------------------------------0 |

5

2.82

2.82

1 |

19

10.73

13.56

2 |

10

5.65

19.21

3 |

21

11.86

31.07

4 |

21

11.86

42.94

5 |

10

5.65

48.59

6 |

11

6.21

54.80

7 |

6

3.39

58.19

8 |

11

6.21

64.41

9 |

8

4.52

68.93

10 |

8

4.52

73.45

11 |

4

2.26

75.71

13

Solutions, Chapter 2/HL

12 |

7

3.95

79.66

13 |

7

3.95

83.62

14 |

5

2.82

86.44

15 |

2

1.13

87.57

16 |

2

1.13

88.70

17 |

2

1.13

89.83

18 |

1

0.56

90.40

19 |

2

1.13

91.53

20 |

4

2.26

93.79

21 |

1

0.56

94.35

22 |

1

0.56

94.92

24 |

3

1.69

96.61

26 |

2

1.13

97.74

28 |

1

0.56

98.31

34 |

1

0.56

98.87

37 |

2

1.13

100.00

------------+----------------------------------Total |

177

100.00

(iii) Estimate the simple regression model log(salary ) = 0 + 1ceoten + u and report

your results in the usual form. What is the (approcimate) predicted percentage

increase in salary given one more year as CEO

*iii

reg lsalary ceoten

Source |

SS

df

MS

-------------+-----------------------------Model | .850907024

1 .850907024

Residual |

63.795306

175 .364544606

-------------+-----------------------------Total | 64.6462131

176 .367308029

Number of obs

F( 1,

175)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

177

2.33

0.1284

0.0132

0.0075

.60378

-----------------------------------------------------------------------------lsalary |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------ceoten |

.0097236

.0063645

1.53

0.128

-.0028374

.0222846

_cons |

6.505498

.0679911

95.68

0.000

6.37131

6.639686

------------------------------------------------------------------------------

(iii) The estimated equation is

log (�salary ) = 6.51 + .0097 ceoten

n = 177, R2 = .013.

We obtain the approximate percentage change in salary given ceoten = 1 by multiplying the

coefficient on ceoten by 100, 100(.0097) = 0.97%. Therefore, one more year as CEO is

predicted to increase salary by almost 1%.

2.12

USE the data SLEEP 75.DTA to study whether there is a trade off between time spent

sleeping per week and the time spent in paid work. We could use either variable is the

dependent variable. For concreteness, estimate the model: sleep = 0 + 1totwrk + u where

sleep is minutes sleeping per week and totwrk is total minutes working during the week.

(i) Report your results in equation form along with the number of observations and R2.

What does the intercept in this equation mean?

14

Solutions, Chapter 2/HL

*i

reg sleep totwrk

Source |

SS

df

MS

-------------+-----------------------------Model | 14381717.2

1 14381717.2

Residual |

124858119

704 177355.282

-------------+-----------------------------Total |

139239836

705 197503.313

Number of obs

F( 1,

704)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

706

81.09

0.0000

0.1033

0.1020

421.14

-----------------------------------------------------------------------------sleep |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------totwrk | -.1507458

.0167403

-9.00

0.000

-.1836126

-.117879

_cons |

3586.377

38.91243

92.17

0.000

3509.979

3662.775

------------------------------------------------------------------------------

The estimated equation is

Sleep = 3,586.4 .151 totwrk

n = 706, R2 = .103.

The intercept implies that the estimated amount of sleep per week for someone who does not

work is 3,586.4 minutes, or about 59.77 hours. This comes to about 8.5 hours per night.

(ii) If totwrk increases by 2 hours, by how much is sleep estimated to fall? Do you find

this to be a large effect?

If someone works two more hours per week then totwrk = 120 (because totwrk is measured

� = .151(120) = 18.12 minutes. This is only a few minutes a

in minutes), and so sleep

� =

night. If someone were to work one more hour on each of five working days, sleep

.151(300) = 45.3 minutes, or about five minutes a night.

2.13

Use the data in WAGE.DTA to estimate a simple regression explaining monthly salary

(wage) in terms of IQ score (IQ)

(i) Find the average salary and average IQ in the sample. What is the standard deviation

of IQ? (IQ scores are standardized so that the average in the population is 100 with the

standard deviation equal to 15.)

sum wage IQ

Variable |

Obs

Mean

Std. Dev.

Min

Max

-------------+-------------------------------------------------------wage |

935

957.9455

404.3608

115

3078

IQ |

935

101.2824

15.05264

50

145

Average salary is about $957.95 and average IQ is about 101.28. The sample standard

deviation of IQ is about 15.05, which is pretty close to the population value of 15.

15

Solutions, Chapter 2/HL

(ii)

Estimate the simple regression model where a one-point increase in IQ change wage by a

constant dollar amount. Use this model to find the predicted increase in wage for an

increase in IQ of 15 points. Does IQ explain most of the variation in wage?

*ii

reg wage IQ

Source |

SS

df

MS

-------------+-----------------------------Model | 14589782.6

1 14589782.6

Residual |

138126386

933 148045.429

-------------+-----------------------------Total |

152716168

934 163507.675

Number of obs

F( 1,

933)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

935

98.55

0.0000

0.0955

0.0946

384.77

-----------------------------------------------------------------------------wage |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------IQ |

8.303064

.8363951

9.93

0.000

6.661631

9.944498

_cons |

116.9916

85.64153

1.37

0.172

-51.08078

285.0639

------------------------------------------------------------------------------

This calls for a level-level model:

� = 116.99 + 8.30 IQ

wage

n = 935, R2 = .096.

An increase in IQ of 15 increases predicted monthly salary by 8.30(15) = $124.50 (in 1980

dollars). IQ score does not even explain 10% of the variation in wage.

(iii)

Now, estimate a model where each one-point increase in IQ has the same percentage

effect on wage. If IQ increases by 15 points, what is the approximate percentage increase

in the predicted wage?

reg lwage IQ

Source |

SS

df

MS

-------------+-----------------------------Model | 16.4150939

1 16.4150939

Residual | 149.241189

933 .159958402

-------------+-----------------------------Total | 165.656283

934 .177362188

Number of obs

F( 1,

933)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

935

102.62

0.0000

0.0991

0.0981

.39995

-----------------------------------------------------------------------------lwage |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------IQ |

.0088072

.0008694

10.13

0.000

.007101

.0105134

_cons |

5.886994

.0890206

66.13

0.000

5.712291

6.061698

------------------------------------------------------------------------------

This calls for a log-level model:

log (�wage) = 5.89 + .0088 IQ

n = 935, R2 = .099.

16

Solutions, Chapter 2/HL

If IQ = 15 then log (�wage) = .0088(15) = .132, which is the (approximate) proportionate

change in predicted wage. The percentage increase is therefore approximately 13.2.

2.14

For the population of firm in the chemical industry, let rd denote annual expenditures on

research and development, and let sales denote annual sales (both are in million of dollars).

(i) Write down a model (not an estimated equation) that implies a constant elasticity

between rd and sales. Which parameter is the elasticity?

The constant elasticity model is a log-log model:

log(rd) = 0 + 1 log(sales) + u,

where 1 is the elasticity of rd with respect to sales.

(ii) Now, estimate the model using RDCHEM.DTA. Write out the the estimated equation

in the usual form. What is the elasticity of rd with respect to sales? Explain what this

elasticity means.

i

reg lrd lsales

*ii

reg lrd lsales

Source |

SS

df

MS

-------------+-----------------------------Model | 84.8395785

1 84.8395785

Residual | 8.40768588

30 .280256196

-------------+-----------------------------Total | 93.2472644

31 3.00797627

Number of obs

F( 1,

30)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

32

302.72

0.0000

0.9098

0.9068

.52939

-----------------------------------------------------------------------------lrd |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------lsales |

1.075731

.0618275

17.40

0.000

.9494619

1.201999

_cons | -4.104722

.4527678

-9.07

0.000

-5.029398

-3.180047

------------------------------------------------------------------------------

The estimated elasticity of rd with respect to sales is 1.076, which is just above one. A one

percent increase in sales is estimated to increase rd by about 1.08

17

Vous aimerez peut-être aussi

- Veganissimo A To Z ExcerptDocument25 pagesVeganissimo A To Z ExcerptThe Experiment100% (1)

- Introductory Econometrics A Modern ApproDocument202 pagesIntroductory Econometrics A Modern ApproMinnie JungPas encore d'évaluation

- Solutions to problems in regression analysisDocument3 pagesSolutions to problems in regression analysisRifaldi Raja AlamsyahPas encore d'évaluation

- Solution Manual For Introductory Econometrics A Modern Approach 5th Edition Wooldridge 1111531048 9781111531041Document36 pagesSolution Manual For Introductory Econometrics A Modern Approach 5th Edition Wooldridge 1111531048 9781111531041sherrihernandezorpqxcnbwe95% (21)

- Introductory Econometrics A Modern Approach 4th Edition Wooldridge Solutions ManualDocument35 pagesIntroductory Econometrics A Modern Approach 4th Edition Wooldridge Solutions Manualdanagarzad90y100% (19)

- Homework 02 AnswersDocument12 pagesHomework 02 Answersornelaabegaj_83152390% (1)

- Introductory Econometrics A Modern Approach 4th Edition Wooldridge Solutions ManualDocument25 pagesIntroductory Econometrics A Modern Approach 4th Edition Wooldridge Solutions ManualAmyCooperDVMxitbw100% (53)

- Problem Sets (Days 1-6)Document18 pagesProblem Sets (Days 1-6)Harry KwongPas encore d'évaluation

- Problem CH 3Document3 pagesProblem CH 3upb553118Pas encore d'évaluation

- Dwnload Full Introductory Econometrics A Modern Approach 4th Edition Wooldridge Solutions Manual PDFDocument35 pagesDwnload Full Introductory Econometrics A Modern Approach 4th Edition Wooldridge Solutions Manual PDFschmitzerallanafx100% (10)

- Solution Manual For Introductory Econometrics A Modern Approach 6Th Edition Wooldridge 130527010X 9781305270107 Full Chapter PDFDocument29 pagesSolution Manual For Introductory Econometrics A Modern Approach 6Th Edition Wooldridge 130527010X 9781305270107 Full Chapter PDFlois.payne328100% (16)

- Homework Session 2b (Ch2)Document3 pagesHomework Session 2b (Ch2)Anh Thai Thi ChauPas encore d'évaluation

- Problem Set 1Document2 pagesProblem Set 1avinashk1Pas encore d'évaluation

- Homework 03 Answers PDFDocument12 pagesHomework 03 Answers PDFNoahIssaPas encore d'évaluation

- Dummy Variable Regression Models 9.1:, Gujarati and PorterDocument18 pagesDummy Variable Regression Models 9.1:, Gujarati and PorterTân DươngPas encore d'évaluation

- Simple Linear RegressionDocument31 pagesSimple Linear RegressionturnernpPas encore d'évaluation

- Children's math achievement linked to age, family income, parenting practicesDocument24 pagesChildren's math achievement linked to age, family income, parenting practicesDan LuPas encore d'évaluation

- Econ 466 Fall 2010 Homework 5 Answer Key: β / (2 - ˆ β -), or .0003/ (.000000014) ≈ 21, 428.57; reDocument4 pagesEcon 466 Fall 2010 Homework 5 Answer Key: β / (2 - ˆ β -), or .0003/ (.000000014) ≈ 21, 428.57; reJaime Andres Chica PPas encore d'évaluation

- Basic Econometrics 5Th Edition Gujarati Solutions Manual Full Chapter PDFDocument40 pagesBasic Econometrics 5Th Edition Gujarati Solutions Manual Full Chapter PDFJoshuaJohnsonwxog100% (10)

- hw2 Spring2023 Econ3005 SolutionDocument10 pageshw2 Spring2023 Econ3005 SolutionSwae LeePas encore d'évaluation

- Problem Set 6 Answers Provides Insights into Law School Salaries, Stock Returns, and Effects of SmokingDocument15 pagesProblem Set 6 Answers Provides Insights into Law School Salaries, Stock Returns, and Effects of Smokingchan chadoPas encore d'évaluation

- Solutions To Problem Set 1Document6 pagesSolutions To Problem Set 1Harry KwongPas encore d'évaluation

- Full Download Solution Manual For Introductory Econometrics A Modern Approach 6th Edition PDF Full ChapterDocument23 pagesFull Download Solution Manual For Introductory Econometrics A Modern Approach 6th Edition PDF Full Chapterdonshipdiscreetyrwc100% (15)

- Introductory Econometrics A Modern Approach 6th Edition Wooldridge Solutions ManualDocument8 pagesIntroductory Econometrics A Modern Approach 6th Edition Wooldridge Solutions ManualJohnWhitextnzm100% (19)

- Applied Econometrics Problem Set 3Document4 pagesApplied Econometrics Problem Set 3pablomxrtinPas encore d'évaluation

- Econometrics Problem Set 1Document4 pagesEconometrics Problem Set 1wazaawazaaPas encore d'évaluation

- Econ 113 Problem Set Solutions: Regression ModelsDocument8 pagesEcon 113 Problem Set Solutions: Regression ModelsnataliasbuenoPas encore d'évaluation

- Solution Manual For Introductory Econometrics A Modern Approach 6th EditionDocument21 pagesSolution Manual For Introductory Econometrics A Modern Approach 6th Editioncarter.tweese.8gud100% (40)

- Full Download Introductory Econometrics A Modern Approach 6th Edition Wooldridge Solutions ManualDocument36 pagesFull Download Introductory Econometrics A Modern Approach 6th Edition Wooldridge Solutions Manualhaineytattiis100% (38)

- Solutions For Chapter 8Document23 pagesSolutions For Chapter 8reloadedmemoryPas encore d'évaluation

- EY D EY D Ey D Ey D Ey y D Ey D Ey D: Solution I Lecture 2 Exercise 2Document6 pagesEY D EY D Ey D Ey D Ey y D Ey D Ey D: Solution I Lecture 2 Exercise 2amrendra kumarPas encore d'évaluation

- Solution Manual For Introductory Econometrics A Modern Approach 6th EditionDocument8 pagesSolution Manual For Introductory Econometrics A Modern Approach 6th Editionburholibanumt4ahh9Pas encore d'évaluation

- ECON209 F2023 - Practice Questions - Midterm 1Document7 pagesECON209 F2023 - Practice Questions - Midterm 1lethihonghahbPas encore d'évaluation

- Exercise 1 (Week 37)Document4 pagesExercise 1 (Week 37)Mathias PlovstPas encore d'évaluation

- Final - Econ3005 - 2022spring - Combined 2Document11 pagesFinal - Econ3005 - 2022spring - Combined 2Swae LeePas encore d'évaluation

- Name: . ID No: .. BITS-Pilani Dubai Campus Econ F241 Econometric Methods Semester I, 2018test-1 (Closed Book)Document6 pagesName: . ID No: .. BITS-Pilani Dubai Campus Econ F241 Econometric Methods Semester I, 2018test-1 (Closed Book)Giri PrasadPas encore d'évaluation

- Lahore School Econometrics Problem Set 1 (LS ECO 204Document2 pagesLahore School Econometrics Problem Set 1 (LS ECO 204Umair ShahzadPas encore d'évaluation

- Stat A02Document6 pagesStat A02Sunny LePas encore d'évaluation

- Chapter 13 Homework Answer: 13.2 The First Equation Omits The 1981 Year Dummy Variable, Y81, and So Does Not AllowDocument4 pagesChapter 13 Homework Answer: 13.2 The First Equation Omits The 1981 Year Dummy Variable, Y81, and So Does Not AllowkPas encore d'évaluation

- Exercise 1Document5 pagesExercise 1Lemi Taye0% (1)

- Homework 3Document10 pagesHomework 3canqarazadeanarPas encore d'évaluation

- Exercise 1:: Chapter 3: Describing Data: Numerical MeasuresDocument11 pagesExercise 1:: Chapter 3: Describing Data: Numerical MeasuresPW Nicholas100% (1)

- Final2017 Solution PDFDocument14 pagesFinal2017 Solution PDFVikram SharmaPas encore d'évaluation

- Number of Children Over 5 Number of Households Relative Frequency 0 1 2 3 4Document19 pagesNumber of Children Over 5 Number of Households Relative Frequency 0 1 2 3 4hello helloPas encore d'évaluation

- Econ5025 Practice ProblemsDocument33 pagesEcon5025 Practice ProblemsTrang Nguyen43% (7)

- Ekonometrika Modellərinin TəhliliDocument16 pagesEkonometrika Modellərinin TəhliliPaul Davis0% (1)

- Lecture 8+9 Multicollinearity and Heteroskedasticity Exercise 10.2Document3 pagesLecture 8+9 Multicollinearity and Heteroskedasticity Exercise 10.2Amelia TranPas encore d'évaluation

- Econometrics Assignment on Linear Regression ModelsDocument3 pagesEconometrics Assignment on Linear Regression Modelsridhi0412Pas encore d'évaluation

- Econ 231 Chapter 10 HW SolutionsDocument8 pagesEcon 231 Chapter 10 HW SolutionsAdnan ShoaibPas encore d'évaluation

- TextbookQuestionsChap 2Document7 pagesTextbookQuestionsChap 2Eddy CheungPas encore d'évaluation

- Solutions To The Exercises: SolutionDocument105 pagesSolutions To The Exercises: Solutionrizwan ghafoorPas encore d'évaluation

- Solutions To The Exercises: SolutionDocument105 pagesSolutions To The Exercises: Solutionaanchal singhPas encore d'évaluation

- Solutions For Chapter 7Document36 pagesSolutions For Chapter 7reloadedmemoryPas encore d'évaluation

- Econometrics Problem Set 2 (Docx) Course SidekickDocument15 pagesEconometrics Problem Set 2 (Docx) Course Sidekickavani.goenkaug25Pas encore d'évaluation

- Dwnload Full Introductory Econometrics A Modern Approach 5th Edition Wooldridge Solutions Manual PDFDocument36 pagesDwnload Full Introductory Econometrics A Modern Approach 5th Edition Wooldridge Solutions Manual PDFdheybarlowm100% (14)

- Suggested Solutions: Problem Set 5: β = (X X) X YDocument7 pagesSuggested Solutions: Problem Set 5: β = (X X) X YqiucumberPas encore d'évaluation

- Review Final ExDocument20 pagesReview Final ExNguyet Tran Thi Thu100% (1)

- Solutions and Exercises for Chapter 13Document7 pagesSolutions and Exercises for Chapter 13Sema GençPas encore d'évaluation

- Solutions Manual to accompany Introduction to Linear Regression AnalysisD'EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisÉvaluation : 1 sur 5 étoiles1/5 (1)

- Case 2-22Document2 pagesCase 2-22Daniiar KamalovPas encore d'évaluation

- Reflection Paper OnDocument3 pagesReflection Paper OnDaniiar KamalovPas encore d'évaluation

- Marketing Plan WheatDocument1 pageMarketing Plan WheatDaniiar KamalovPas encore d'évaluation

- Solutions Manual Chapter 10 Economics of Innovation and GrowthDocument22 pagesSolutions Manual Chapter 10 Economics of Innovation and GrowthDaniiar KamalovPas encore d'évaluation

- CH 2Document17 pagesCH 2Daniiar KamalovPas encore d'évaluation

- Philippines Country PulseDocument64 pagesPhilippines Country Pulseellochoco100% (1)

- Narrative 1Document26 pagesNarrative 1Melinda L KPas encore d'évaluation

- September 13Document23 pagesSeptember 13The OntarionPas encore d'évaluation

- MOG-HSEQ-PO-010 Rev A4 - Corporate Smoking Policy EnglishDocument1 pageMOG-HSEQ-PO-010 Rev A4 - Corporate Smoking Policy EnglishSamerPas encore d'évaluation

- Chandler, Alfred 1981 “The United States: Seedbed of Managerial M4 Capitalism” in eds. Alfred Chandler and Herman Daems Managerial Hierarchies: Comparative Perspectives on the Rise of the Modern Industrial Enterprise Cambridge, Massachusetts: Harvard University PressDocument12 pagesChandler, Alfred 1981 “The United States: Seedbed of Managerial M4 Capitalism” in eds. Alfred Chandler and Herman Daems Managerial Hierarchies: Comparative Perspectives on the Rise of the Modern Industrial Enterprise Cambridge, Massachusetts: Harvard University PressCarmela Ledesma100% (1)

- 1 Introduction To StatisticsDocument13 pages1 Introduction To StatisticsRyan AcostaPas encore d'évaluation

- PM's diversification through food industry acquisitionsDocument6 pagesPM's diversification through food industry acquisitionsVinit BardePas encore d'évaluation

- Choosing A Marketing PlanDocument4 pagesChoosing A Marketing Planapi-358995037Pas encore d'évaluation

- Cebu City bans tobacco ads, smoking in publicDocument12 pagesCebu City bans tobacco ads, smoking in publicXyrus BucaoPas encore d'évaluation

- ITC DiversificationDocument2 pagesITC DiversificationTwinkle RoyPas encore d'évaluation

- Perusahaan lq45Document7 pagesPerusahaan lq45Putri ainun jariaPas encore d'évaluation

- ItcDocument13 pagesItcRavi TejaPas encore d'évaluation

- December 12, 2014Document20 pagesDecember 12, 2014Anonymous KMKk9Msn5Pas encore d'évaluation

- Recognizing Statistical SlipDocument12 pagesRecognizing Statistical SlipParlin PardedePas encore d'évaluation

- Buy Pax Era Pods For Sale Online: Best PricingDocument3 pagesBuy Pax Era Pods For Sale Online: Best PricingCruise JobsPas encore d'évaluation

- 852XDocument4 pages852XAlp PalaPas encore d'évaluation

- PPT On ITCDocument23 pagesPPT On ITCMukut Zubaer Khandker100% (1)

- GATS India 2009-10 PDFDocument330 pagesGATS India 2009-10 PDFSachin ParabPas encore d'évaluation

- Good Person of SzechuanDocument77 pagesGood Person of SzechuantweedledoubledeePas encore d'évaluation

- Hand Media v. J.M. Smucker's - UNCRUSTABLE Trademark Complaint PDFDocument10 pagesHand Media v. J.M. Smucker's - UNCRUSTABLE Trademark Complaint PDFMark JaffePas encore d'évaluation

- Cable Television Network Rules 2 Amendment 2006Document1 pageCable Television Network Rules 2 Amendment 2006narsingrao6Pas encore d'évaluation

- Sachit Liquid Glucose Bsi FinalDocument50 pagesSachit Liquid Glucose Bsi FinalSachit GambhirPas encore d'évaluation

- Ra 7171Document3 pagesRa 7171John Paul GarciaPas encore d'évaluation

- Thank You for Smoking script highlights debate on tobacco industryDocument4 pagesThank You for Smoking script highlights debate on tobacco industryvogacianoPas encore d'évaluation

- Joe Girard's 13 Rules To Success!Document2 pagesJoe Girard's 13 Rules To Success!MeGo WiLSoN100% (1)

- Import SampleDocument15 pagesImport SampleZED AAR LOGISTICSPas encore d'évaluation

- Presentation On FMCG Sector in IndiaDocument13 pagesPresentation On FMCG Sector in IndiaAmitPas encore d'évaluation

- "Thank You For Smoking" AnalysisDocument4 pages"Thank You For Smoking" AnalysisHayley CobbPas encore d'évaluation

- Marketing Strategy: Case Study - Dalmia Consumer CareDocument10 pagesMarketing Strategy: Case Study - Dalmia Consumer CareMd TareqPas encore d'évaluation

- Philippine Entrepreneurs' Success StoriesDocument5 pagesPhilippine Entrepreneurs' Success StoriesJobena Rose SerdenaPas encore d'évaluation