Académique Documents

Professionnel Documents

Culture Documents

Maryam Intern Report

Transféré par

qadirjan32Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Maryam Intern Report

Transféré par

qadirjan32Droits d'auteur :

Formats disponibles

Meezan Bank Limited

WHAT IS ISLAMIC BANKING?

Islamic banking has been defined as banking in consonance with the culture and value system of Islam and governed, in addition to the conventional good governance and risk management rules, by the principles laid down by Islamic Shariah. Interest free banking, the more general term is expected not only to avoid interest-based transactions, prohibited in the Islamic Shariah, but also to avoid unethical practices and participate actively in achieving the goals and objectives of an Islamic economy. The prohibition of a risk free return and permission of trading, as enshrined in the Verse 2:275 of the Holy Quran, makes the financial activities in an Islamic set-up real asset-backed with ability to cause value addition.

BRIEF HISTORY OF ISLAMIC BANKING

1947 The inception of Pakistan as the first Islamic Republic created in the name of Islam. 1980 CII presents report on the elimination of Interest genuinely considered to be the first major comprehensive work in the world undertaken on Islamic banking and finance. 1985 Commercial banks transformed their nomenclature stating all Rupee Saving Accounts as interest-free. However, foreign currency deposits in Pakistan and foreign loans continued as before. 1991 Procedure adopted by banks in 1985 was declared un-Islamic by the Federal Shariat Court (FSC). The Government and some banks/DFIs made appeals to the Shariat Appellate Bench (SAB) of the Supreme Court of Pakistan. 1997 Al-Meezan Investment Bank is established with a mandate to pursue Islamic Banking. Mr. Irfan Siddiqui appointed as first and founding Chief Executive Officer. 1999 The Shariat Appellate Bench of the Supreme Court of Pakistan rejects the appeals and directs all laws on interest banking to cease. The government sets up a high level

Meezan Bank Limited commission, task forces and committees to institute and promote Islamic banking on parallel basis with conventional system. 2001 The Shariah Supervisory Board is established at Al-Meezan Investment Bank which is led by Justice (Retd.)Muhammad Taqi Usmani, as chairman. State Bank of Pakistan sets criteria for establishment of Islamic commercial banks in private sector and subsidiaries and stand-alone branches by existing commercial banks to conduct Islamic banking in the country. 2002 Meezan Bank acquires the Pakistan operations of Societe Generale and concurrently Al Meezan Investment Bank converts itself into a full fledged Islamic commercial bank. The first Islamic banking license is issued to the Bank and it is renamed Meezan Bank. President General Pervaiz Musharraf inaugurates the new Islamic Commercial Bank at a formal ceremony in Karachi. 2003 Meezan Bank establishes itself as the pioneer of Islamic Banking in Pakistan and quickly establishes branches in all major cities of the country. A wide range of products are developed and launched consolidating the Banks position as the premier Islamic Bank of the country Al Meezan Investment Management Limited (AMIM), the asset management arm of Meezan Bank, introduces Meezan Islamic Fund (MIF), the countrys first open-end Islamic Mutual Fund. 2004 The State Bank establishes a dedicated Islamic Banking Department (IBD) by merging the Islamic Economics Division of the Research Department with the Islamic Banking Division of the Banking Policy Department. A Shariah Board has been appointed to regulate and approve guidelines for the emerging Islamic Banking industry. The Government of Pakistan awards the mandate for debut of international Sukuk (Bond) offering for USD 500 million. The offering is a success and establishes a benchmark for Pakistan. Meezan Bank acts as the Shariah Structuring Advisor for this historic transaction. 2005 Meezan Bank becomes the first customer of Islamic Insurance (Takaful) by signing the first

Meezan Bank Limited Memorandum of Understanding MoU with Pak-Kuwait Takaful Company Limited (PKTCL). The signing of this MoU has ushered Pakistan into a new era of Islamic Insurance (Takaful). 2006 A numbers of new dedicated Islamic Banks, namely Bank Islami and Dubai Islamic Bank, commence operations in Pakistan. Meezan continues its leadership position in the industry by more than doubling it branch network to a total of 62 branches in 21 cities, clearly establishing itself as the largest Islamic Bank of the country. Meezan Bank becomes the first Islamic bank to introduce 8 am to 8 pm banking at selected branches in Karachi. 2007 Meezan Bank opens up its 100th branch. Two new dedicated Islamic Banks start operations in Pakistan, namely Emirates Global Islamic Bank and Dawood Islamic Bank. 2008 With 166 Branches (including 35 sub-branches) in 40 cities across Pakistan, Meezan Bank is clearly positioned as the leading Islamic Bank in the country. Work starts on the construction of Meezan Banks new Head Office building. The financing and investment portfolio of local Islamic banks reached Rs. 185 billion in December 2008 compared to Rs. 137.6 billion in December 2007. Market share in the overall banking increased to five per cent at end December 2008 compared with four per cent at end December 2007. Total assets of Islamic banking reached Rs. 271.1 billion in December 2008 compared to Rs. 205.2 billion in December 2007.

Meezan Bank Limited

HISTORY OF MEEZAN BANK LIMITED

Meezan Bank Limited, a publicly listed company, was incorporated on January 27, 1997 and started operations as an investment bank in August that year. In January, 2002 in an historic initiative, Meezan Bank was granted the nations first full-fledged commercial banking license as a dedicated Islamic Bank, by the State Bank of Pakistan. Meezan Bank has clearly established itself as the largest Islamic Bank in Pakistan with the largest branch network in all major cities of the country. The banking sector is showing a significant paradigm shift away from traditional means of business, and is catering to an increasingly astute and demanding financial consumer who is also becoming keenly aware of Islamic Banking. During the seven years of its operation as an Islamic commercial bank (from 2002 to 2009), offering universal banking services to customers, Meezan Bank has been one of the fastest growing banks in the history of the banking sector. Average growth in deposits has been 55% per annum during this period while the branch network grew from 4 to 166.

SHAREHOLDING STRUCTURE

The Banks main shareholders are leading financial institutions of the Region namely, Noor Financial Investment Company, Kuwait, a leading investment company based in Kuwait; Pak-Kuwait Investment Company, a AAA rated financial entity in the country and the Islamic Development Bank of Jeddah. The established position, reputation, strength and stability, of these institutions add significant value to the Bank through Board representation and applied synergies.

10

Meezan Bank Limited

SHARIAH SUPERVISORY BOARD

The embers of the Shariah Board of Meezan Bank are internationally renowned scholars serving on the Boards of many Islamic banks operating in different countries. The members of the Shariah Board are: 1. Justice (Retd.) Muhammad Taqi Usmani (Chairman) 2. Dr. Abdul Sattar Abu Ghuddah 3. Sheikh Essam M. Ishaq 4. Dr. Muhammad Imran Usmani Justice (Retd.) Muhammad Taqi Usmani is a renowned figure in the field of Shariah, particularly Islamic Finance. He holds the position of Deputy Chairman at the Islamic Fiqh Academy, Jeddah and Chairman of the Accounting and Auditing Organization for Islamic Financial Institutions. He is the Deputy President of Jamia Darul-Uloom, Karachi. He is also a member of Shariah advisory boards of a number of financial institutions practicing Islamic Banking and Finance including Abu Dhabi Islamic Bank, Dubai Bank, European Islamic Investment Bank and Dow Jones Islamic Index. He has been teaching various subjects on Islam for 39 years. He also served as a Judge in the Shariat Appellate Bench, Supreme Court of Pakistan. Justice (Retd.) Muhammad Taqi Usmani holds an LLB from Karachi University. He completed his M.A. in Islamic Studies from Punjab University in 1970. Prior to that, he completed Alimiyyah & Takhassus course i.e. the specialization course of Islamic Fiqh and Fatwa (Islamic Jurisprudence) from Jamia Darul-Uloom, Karachi. He is also editor-inchief of monthly Al-Balagh magazine and the author of more than 100 books in different subjects of Islam, particularly on Tafseer, Hadith, Fiqh and Islamic Finance. Dr. Abdul Sattar Abu Ghuddah holds positions of Shariah Advisor and Director, Department of Financial Instruments at Al-Baraka Investment Co. of Saudi Arabia. He holds a Ph. D in Islamic Law from Al Azhar University Cairo, Egypt. He is an active member of Islamic Financial Institutions. Dr. Abdul Sattar teaches Fiqh, Islamic Studies and Arabic in Riyadh and has done a valuable task of researching and compiling information for the Fiqh Encyclopedia in the Ministry of Awqaf and Islamic Affairs in Kuwait. He was member of the Fatwa Board in the Ministry from 1982 to 1990.

11

Meezan Bank Limited Sheikh Essam M. Ishaq graduated in Political Science from McGill University, Montreal, Canada. Currently he is teaching Fiqh and Aqeeda courses in UAE and Bahrain at Umm Al-DarDa Islamic Centre. He holds the position of Shariah Advisor at Discover Islam, Bahrain. He also serves as an advisor/ member of Shariah Boards in a number of Islamic banks and Islamic financial institutions. Muhammad Imran Usmani, son of Justice (Retd.) Muhammad Taqi Usmani is a LLB, M. Phil, and Ph. D. in Islamic Finance and graduated as a scholar in Alimiyyah & Takhassus specialization courses in Islamic Fiqh and Fatwa from Jamia Darul-Uloom, Karachi. From the inception of Meezan Bank he is the in-house Shariah Advisor and Head of Product Development and Shariah Compliance department of the Bank, where he supervises training for different courses, Audit & Compliance; R&D Advisory Services for Shariah based banking. Dr. Usmani has been serving as lecturer/teacher of different subjects of Shariah and is administrator of several divisions of Jamia Darul-Uloom, Karachi since 1990. He has also been leading Friday Khudhbah and prayer in the Jamia Mosque for 18 years. Dr. Usmani serves also as an advisor/ member of Shariah Boards of the State Bank of Pakistan, HSBC Amanah Finance, Guidance Financial Group USA, Lloyds TSB Bank UK, Japan Bank for International Cooperation (JABIC), Credit Suisse Switzerland, ABN Amro Global, Future Growth AlBarakah Equity Fund South Africa, Capitas Group USA, Bank of London and Middle East Kuwait, DCD group Dubai and other Mutual & Property Funds and international Sukuk. He is also an advisor of International Islamic Financial Markets (IIFM) Bahrain and International Center of Islamic Economics and Finance (INCIEF) Malaysia. Dr. Usmani is the author of many books related with Islamic Finance and other subject of Shariah. He has been presenting papers in many national and international seminars and has delivered lectures in various academic institutions such as Harvard, LSE, IBA, LUMS and others.

12

Meezan Bank Limited

MANAGEMENT TEAM

Irfan Siddiqui Ariful Islam Najmul Hassan Muhammad Shoaib Qureshi Shabbir Hamza Khandwala Dr. Muhammad Imran Usmani Abdul Ghaffar Memon Rizwan Ata Saleem Khan Arshad Majeed Mohammad Haris Mohammad Sohail Khan Ms. Mehnaz Ikram Faiz-ur-Rehman Munawar Rizvi Zafar Ali Khan Muhammad Abdullah Ahmed President & Chief Executive Officer Chief Operating Officer General Manager Corporate & Business Development General Manager Commercial Banking Chief Financial Officer & Company Secretary Shariah Advisor Regional Manager - South Regional Manager - Central Regional Manager - North Head of Operations Head of Corporate & Structured Finance Head of Human Resources and Administration Head of Legal Affairs Head of Information Technology Head of Branch Expansion & Business Promotion Head of Consumer Assets and Marketing Head of Treasury & Financial Institutions

13

Meezan Bank Limited Saleem Wafai Zia ul Hasan Muhammad Raza Head of Compliance Head of Internal Audit Head of Liability Products & Service Quality

Ahmed Ali Siddiqui Azeem Iqbal Pirani

Manager Product Development & Shariah Compliance Manager Alternate Distribution

MEEZAN'S BRANCH NETWORK

Meezan Bank has established 204 branches in 40 cities across Pakistan. This is a milestone that is not only the success story of Meezan Bank but also the continuing success story of Islamic Banking in Pakistan. With this extensive network, all existing and potential customers are now closer than ever in attaining Islamic Banking at their doorstep. All branches provide real time online banking facilities to customers. One of the key objectives of the Bank is to have its footprint strategically placed throughout the country enabling the public to avail the benefits of Shariah Compliant Banking in their neighborhood. The Bank is currently segmented into three Regions of Pakistan. The cities in which the Bank presently operates are as follows:

Southern Region Hub (Lasbela) Hyderabad Karachi Nawabshah Quetta Sakrand Sukkur

Central Region Bahawalpur Daska Dera Ghazi Khan Faisalabad Gojra Gujranwala Jhang

Northern Region Abbottabad Dera Ismail Khan Gujar Khan Haripur Islamabad Kohat Mansehra

14

Meezan Bank Limited

Tando Adam Tando-Allah-Yar Kasur Lahore Mandi Bahauddin Mian Channu Multan Okara Rahim Yar Khan Sadiqabad Sahiwal Sargodha Sheikhupura Sialkot Mardan Muzaffarabad Peshawar Rawalpindi Swat

DIFFERENCE BETWEEN ISLAMIC AND CONVENTIONAL BANKING

Sr. No. 1.

CONVENTIONAL BANKING Money is a commodity besides medium of exchange and store of value. Therefore, it can be sold at a price higher than its face value and it can also be rented out. Time value is the basis for charging interest on capital. Interest is charged even in case the organization suffers losses by using banks funds. Therefore, it is not based on profit and loss sharing. While disbursing cash finance, running finance or working capital finance, no agreement for exchange of goods & services is made. Conventional banks use money as a commodity which leads to inflation.

ISLAMIC BANKING Money is not a commodity though it is used as a medium of exchange and store of value. Therefore, it cannot be sold at a price higher than its face value or rented out. Profit on trade of goods or charging on providing service is the basis for earning profit. Islamic bank operates on the basis of profit and loss sharing. In case, the business man has suffered losses, the bank will share these losses based on the mode of finance used either Mudarabah or Musharakah. The execution of agreements for the exchange of goods & services is a must, while disbursing under Murabaha, & Istisna contracts. Islamic banking tends to create link with real sectors of the economic system by using trade related activities. Since, the money is linked with the real assets 15

2. 3.

4.

5.

Meezan Bank Limited therefore; it contributes directly in the economic development.

WHAT I LEARNT AND DID?

During my internship in Meezan Bank Limited I worked in the following 2 departments, for 3weeks in each department. > Trade Finance Department > Corporate Department As this is an Islamic bank therefore my focus was to study the comparison between a conventional and Islamic bank in each of the department.

1. TRADE FINANCE DEPARTMENT:

This department deals with foreign trade i.e. import and export by way of letter of credit. There are two main transactions: 1) import 2) Export Import: Letter of credit Contract Advance payment Export: Export negotiation Collection Advance payment I worked in both sections. My basic learning in this is as following:

IMPORT:

This department provides the facility to their customers to import machinery or products from other countries, or within the same country. It is necessary for the importers to have the licenses, which is issued by the chief controller of imports and exports. Before obtaining an import license the license must be registered with the chief controller of import and export. For having the license, an individual or firm submits the application through

16

Meezan Bank Limited his bank. For imports the bank is required to have a contract with the customer and than to open the Letter of Credit.

Documents Required:

1. 2.

CNIC (Computerized National Identity Card) NTN (National Tax Number)

3. Sales Tax Registration 4. Registration with Lahore Chamber of Commerce and Industry 5. Limit for credit has to be assigned by the corporate department 6. In case of firm or company, the Memorandum and the Article of Association

Contract:

In this the bank has no liability. Its purpose is that the beneficiary (seller) will get the payment through his bank. The bank doesnt take the responsibility of the goods.

Letter of Credit (LC):

It is a written undertaking by a bank (issuing bank) given to the seller (beneficiary) at the request and on the instructions of the buyer (applicant) to pay at sight or at a determinable future date, up to a stated sum of money.

Parties Involved In a Letter of Credit:

There are four parties involved in a letter of credit: Importer Issuing party or Importers Bank Exporter Paying or negotiating bank

Account party or Importer: The buyer or the importer on whose account and request the letter of credit is opened is known as account party. Issuing party: The bank, which issues or opens a letter of credit at the request of importer, it is called the issuing bank.

17

Meezan Bank Limited Exporter: The seller or the party in whose favour the letter of credit is draw is the third party and it is also known as the beneficiary. Paying or negotiating bank: The paying bank in the exporters country on which the draft is drawn is called the paying bank. It is also known as the advising bank.

How a Letter of Credit is issued:The process of issuing a letter of credit is briefly explained below:

>

The buyer and the seller conclude a sales contract providing for payment by letter of credit.

> The buyer instructs his bank the issuing bank to issue credit in favour of the seller (beneficiary). > The advising or confirming bank informs the seller that the credit has been issued. > The issuing bank asks another bank, usually in the country of the seller to advise or confirm the credit.

Reasons for Letter of Credit:

1) The exporters are uncertain of the importer capacity to pay. 2) The importers are unwilling to pay the amount unless the goods are actually shipped and the documents received by the bank. 3) In case of non-payment the seller should be assured to legal rights in foreign country. 4) There should be an agency, which should meet the sellers need of finance when the goods are shipped. 5) The importers can undertake the obligation to pay to the exporter for the purchase made by the importer and this is usually done through a letter of credit.

Documentation in Letter of Credit:Documents are the most important part of international trade. Without them trade cannot be completed. Documents are of five types:-

18

Meezan Bank Limited Commercial Documents: Commercial documents consist of following forms: Invoice form following forms: Airway bill Bill of lading Rail consignment note Roadway bill Certificate of origin Weight note Packing list Quality or insurance certificate Documents of title Transport Documents:

These documents are related with transfer of goods. These documents consist of

2. Insurance Documents: These documents consists of the following forms: Letter of insurance Insurance policy

3. Financial Documents:

Bill of exchange Cheque Delivery against acceptance Delivery against payment Promissory note

Types of Letter of Credit:The type of letter of credit are explained below:-

1. Merchandise, Commercial and Trade: The majority of LCs

made against documents for goods shipped.

issued

are

in

payment for goods in shipment or current services performed. Payment is normally

19

Meezan Bank Limited

2. Standby: This type of LC functions like a guarantee. This type of credit can only be

drawn against a credit agreement. It is a definite undertaking of the issuing bank.

3. Revocable: A revocable letter of credit may be amended or cancelled by the issuing

bank at any moment and without prior notice to the beneficiary.

4. Unconfirmed: Bears only the guarantee of the issuing bank. The beneficiary should

look to the credit worthiness of only the issuing bank, and not to any intermediary.

5. Confirmed: Is a credit in which a second guarantee is added to the letter of credit

by another bank.

6. Sight: Payment is at sight, which means that the drafts and documents are honored,

if in order, by making payment without delay.

7. Time, Usuance: The draft honored by accepting it for payment at a future date.

Payment is delayed at a future date. Payment is delayed until the maturity of the draft.

8. Revolving Credit: One where the amount is renewed or reinstated without specific

amendment to the credit being needed. It can revolve in relation to time or value.

9. Red Clause Credit: Authorizes the advising or confirming bank to make advances

to the beneficiary before presentation of the documents.

10. Transferable Credit: Can be transferred by the original beneficiary to one or

more other parties. It is normally used when the first beneficiary does not supply the merchandise himself, but is a middleman and wants to transfer all or part of his rights to the actual supplier.

11. Back-to-Back Credit: The seller as beneficiary of the first credit offers it as

security to the advising bank for issuance of a second credit.

Islamic Way of Opening Letter of Credit:

Musharakah can be used for Import Financing as well. There are two types of bank charges on the letter of credit provided to the importer: 1. Service charges for opening an LC. 2. Interest charged on LC, which are not opened on full margin. Collecting service charges for this purpose is allowed, but as interest cannot be charged in any case, experts have proposed two methods for financing LC: 20

Meezan Bank Limited 1. 2. Based on Musharakah / Mudarabah Based on Murabahah Musharakah / Mudarabah: This is the best substitute for opening the LC. The bank and the importer can make an agreement of Mudarabah or Musharakah before opening the LC. If the LC is being opened at zero margin then an agreement of Mudarabah can be made, in which the bank will become Rab-ul-Maal and the importer Mudarib. The bank will own the goods that are being imported and the profit will be distributed according to the agreement. If the LC is being opened with a margin then a Musharakah agreement can be made. The bank will pay the remaining amount and the goods that are being imported will be owned by both of them according to their share of investment. The bank and the importer, with their mutual consent can also include a condition in the agreement, whereby; Musharakah or Mudarabah will end after a certain time period even if the goods are not sold. In such a case, the importer will purchase the bank's share at the market price. Murabahah: At present Islamic banks are using Murabahah, to finance LC. This product is also being used in Meezan bank. The banks themselves import the required goods and then sell these goods to the importer on Murabahah agreement. Murabahah financing requires the bank and the importer to sign at least two agreements separately; one for the purchase of the goods, and the other for appointing the importer as the agent of the bank (agency agreement). Once these two agreements are signed, the importer can negotiate and finalize all terms and conditions with the exporter on behalf of the bank.

EXPORT:

Usually the exporter does not rely on the credit of a banker in the country of importer, and insist on a confirmation from a banker carrying on business in his own country. Thus this department of a bank helps the exporters to settle down their financial affairs. For exporting it is necessary for exporter to get export license from the chief controller of import and export after registration.

21

Meezan Bank Limited Documents are required for the registration such as N. I. C. Card, income tax certificate, registration with Lahore Chamber of Commerce and Industry, and bank certificate which shows that the exporter is his account holder and have a good dealing with them. In response to the letter of credit exporter submit the following documents to the negotiating bank. Bill of exchange Invoice Bill of lading or Airway bill Insurance documents Packing list Any other documents, if so required.

The negotiating bank will send the same documents to the issuing bank. In accordance with the terms and condition laid down in letter of credit. A bank plays two very important roles in Exports. It acts as a negotiating bank and charges a fee for this purpose, which is allowed in Shariah. Secondly it provides exportfinancing facility to the exporters and charge interest on this service. These services are of two types: 1. Pre shipment financing 2. Post shipment financing Interest cannot be charged in any case. Pre Shipment Financing: Pre shipment financing needs can be fulfilled by two methods. 1. Musharakah / Mudarabah 2. Murabahah Musharakah / Mudarabah: The most appropriate method for financing exports is Musharakah or Mudarabah. Bank and exporter can make an agreement of Mudarabah provided that the exporter is not investing; other wise Musharakah agreement can be made. Agreement in such case will be easy, as cost and expected profit is known.

22

Meezan Bank Limited The exporter will manufacture or purchase goods and the profit obtained by exporting it will be distributed between them according to the predefined ratio. A problem that can be encountered by the bank is that if the exporter is not able to deliver the goods according to the terms and conditions of the importer, then the importer can refuse to accept the goods, and in this case exporter's bank will ultimately suffer. This problem can be rectified by including a condition in Mudarabah or Musharakah agreement that, if exporter violates the terms and conditions of import agreement then the Bank will not be responsible for any loss which arises due to this negligence. This condition is allowed in Shariah as the Rab-ul-mal is not responsible for any loss that arises due to the negligence of Mudarib. Post Shipment Financing: Post shipment finance is similar to the discounting of the bill of exchange. Its alternate Shariah compliant procedure is discussed below: The exporter with the bill of exchange can appoint the bank as his agent to collect receivable on his behalf. The bank can charge a fee for this service and can provide interest free loan to the exporter, which is equal to the amount of the bill, and the exporter will give his consent to the bank that it can keep the amount received from the bill as a payment of the loan. Here two processes are separated, and thus two agreements will be made:1. One will authorize the bank to collect the loan on his behalf as an agent, for which he will charge a particular fee. 2. The second agreement will provide interest free loan to the exporter, and authorize the bank for keeping the amount received through bill as a payment for loan. These agreements are correct and allowed according to Shariah because collecting fee for service and giving interest free loan is permissible.

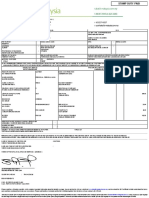

PRACTICAL WORK:During my internship in trade finance department I was given the following tasks to do: Export and Import Forms: In export section I was given the task of making E-forms, that is export forms. These forms are issued by the head office of the respective bank and it is than issued to the

23

Meezan Bank Limited exporter by the bank. The customer fills it according to his requirements. An e-form contains 4 copies, the original copy is kept with the custom office, duplicate copy is kept with the bank and is filed in the LC, triplicate copy is submitted to the State Bank of Pakistan and the forth copy is kept with the customer. I n the imports section the task of preparing I-forms i.e. import form, was given to me. These forms are used to report the detail information about the total amount of export and import taking place in the respective branch of the bank. These are submitted to the SBP for keeping all the records. These forms play an important role in helping SBP to make the balance of payment sheet of Pakistan. Lodgment in FDBC / LBDC: In this all the documents provided by the exporter are verified according to the E-form. These documents are than lodged in the foreign documentary bill of collection (FBDC) and in the Local documentary bill of collection (LBDC). This lodgment is done with the current date. Cover Letter:I learnt how to make a cover letter in the Letter of Credit in the export section. After the lodgment in FDBC/ LBDC the bank makes the covering letter and attaches it with the LC. It is a small description of all documents attached with the LC. Posting on ITRS: It is software known as International Transactions and Recording System issued by the SBP. It is used to report the foreign exchange returns to the SBP at the end of the FY. All the entries of total export taken place through the bank are made at the end of each month. After posting on ITRC I filled form-M for each currency. The form-M is used to report all foreign transactions total amount at the end of the month. The posting on ITRS is based on the SBP Return Manual given below. Study of SBP Return Manual:

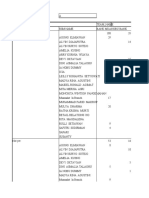

SCHEDULE

S-1: A1/O1

REPORTING

Form E reporting when full payment realized

24

Meezan Bank Limited Advanced payment reporting / partial payment of E-form. NIL Form I reporting Withdrawal from foreign current account (FCA) Form-M (foreign account currency FAC) Other than export remittance received Cash received from authorized data Withdrawal from FCA (cash) Cash send to authorized dealer Deposit in FCA NIL NIL

A2/02 A3/03 E2/P2 E3/P3 E4/P4 J-O-3 S-6: Schedule C E3/P3 Schedule G J-O-3 Schedule W A2/02 Form EE-1:

I also added data in the particulars of export receipts in respect of eligible commodities under part II of the Export finance Scheme for the monitoring period from 1sty July, 2008 to 30th June 2009. This information is reported to the SBP at the end of the FY. The main entries of this form are: Export form number, Name of consignee, Commodity, Contract L/C under which shipment is made, Shipment date, Amount in foreign exchange, Amount in PKR, Date of realization, Item no., Schedule and Reporting month.

2. CORPORATE DEPARTMENT:After completing 3 weeks in trade finance department I was moved to corporate department for the next 3 weeks. In this the main function is to provide facility to the people who need advance money to meet their requirements, give them short term and long term loans and create profit for the bank. It also creates limits for opening letter of credit. Corporate department deals with the grant of loan to the customers. Credit department, car ijara and house financing are included in this department. To work in this department the person must be very intelligent and careful to judge the right man to be sanctioned a right amount of loan. Credit further deals with 3 different categories: 1. SME: (1 to 75 million limit) 2. Consumer: (75 to 150 million limit) 3. Corporate: (above 150 million limit)

25

Meezan Bank Limited I studied and learnt about SME and corporate functioning. Detail of what I studied and understood during my internship is given as under.

Small and Medium Enterprises:

SME is an entity which does not employ more than 250 persons (if it is manufacturing/service concern) and 50 persons (if it is trading concern). The growth in the SME sector in Pakistan in recent years has been a major contributor to the growth in the national economy. Meezan Bank is committed towards developing tailored financial solutions and expanding its footprint in the SME sector. SME has to fulfill the following criteria of either a & c or b & c:a) A trading/service concern with total assets at cost excluding land and building up o Rs. 50million. b) A manufacturing concern with total assets at cost excluding land and building up o Rs.100 million c) Any concern (trading, service or manufacturing) with net sales not exceeding Rs. 300 million as per latest financial statements. An individual if he/she meets the above criteria can also be categorized as an SME. SME for all the financial institutions make up the limit up to 100 million excluding leased assets and 150 million including leased assets. This branch of Meezan bank had a wide range of customers that lie in SME sector of financing; a few of them are given below: > Master Book Center > Millennium & Pioneer Chemicals > Master Book Depot > Karachi Chemicals > Java Chemical > Waqar Plastic > & others. Prudential Regulations for SME Financing:-

1. Medium and Long Term Facilities: it means the facilities with maturities of more

than 1 year.

2. Sort Term Facilities: the facilities with maturities up to 1 year.

26

Meezan Bank Limited

3. Liquid Assets: are the assets which are readily convertible into cash without

recourse to a court of law.

Corporate:A customer is considered as a member of corporate if any his annual sales turnover is of Rs. 800 million or more, funded and non funded lines of over Rs. 150 million and he has a successful business trade record for a minimum period of 3 years, backed by audited financials. At present, Corporate Banking has a large number of multinational and local clients representing various sectors of the economy. Client relationships are handled by dedicated Relationship Managers and fully supported by the Branch staff to provide high quality service at competitive and market driven pricing. This branch of Meezan bank had a wide range of customers who lie in the corporate sector, a few of them are: > Javed International > Malik Enterprise > Fawad Textiles > Qazi & Company > US Denim Mills > US Apparel & Textiles > Stylers International > & others.

How to Advance Loan or Provide Facility:This can be explained by dividing the whole procedure into 3 steps: 1) Information required by the bank 2) Preparation of credit proposals 3) Sanction advice These are explained below:-

Information Required by the Bank:

27

Meezan Bank Limited Following information is required from the customer: Nature & structure of borrower business. Names of proprietors, partners or directors. Detail of all firms or companies associated with borrower. Financial condition of borrower business. An assessment of his business abilities. Accurate and up to date financial statements of last two years for comparison purposes. A report from credit standing bureau of State Bank of Pakistan. Documents Required for Financing: The necessary documentation needed by the bank to be filed in the bank record for financing any customer is as following: Request Letter: It is a request for facility by the customer. The amount of fund needed is given on the request letter. Balance sheet and Projected balance sheet: This is the financial report about the customers business in full detail. The cash flow statement, profit and loss account and schedule of fixed assets sheet is also attached with it. List of buyers and sellers: This includes a list of all the intimate buyers and sellers of the customer, so that to know about his business circle. D & B Report: This is required only for the new customers in order to get detail information about their business especially their income level. Special companies are registered to make these reports. Borrowers Basic Fact Sheet (BBFS): It is a form made on the prescribed format of SBP. The bank issues this form to the customer, which is to be filled by him. It contains all the information about his business and partners.

28

Meezan Bank Limited CIB Report (credit information bureau): It tells all the details about the customers history in credit and his performance with other banks, or if he has any outstanding amount with other banks and how much loan has been taken from other banks. Credit Risk Rating Sheet: It tells about all the risks lying in the business. It is prepared by the bank. In this sheet the customers will be rated on the basis of their risk profile against different parameters by using a score card that will reflect the risk grade of the customer. Risk rating of a customer is always reviewed whenever new information is received. Customer Visit Report: This is a very important document in financing. It is prepared by the bank employee. He personally visits customers company and checks all the details. Branch Evaluation Report of Property: This is to verify the property of the customer by some authentic source. Many organizations are working for this purpose, the bank ask any of these to work on its behalf. Facility Advising Letter: After the approval of the proposal of facility raised by the customer from the head office of Meezan bank, now the bank will send a facility advising letter to the customer to inform him.

Preparation of Credit Proposal:

At first a formal application for credit approval is obtained from the party along with complete group position. The partys credibility report is obtained from the bank with which the bank is doing its business. For obtaining credit, party has to submit the last two years Balance Sheet and Profit & Loss statement duly attested by authorized auditors. If the party is also involved in export or import business then the bank also considers the data of three years about import & export. 29

Meezan Bank Limited Current debt and equity ratio is also calculated by the bank. The type of data required to prepare the credit proposal is to be gathered from the different departments. Some data is obtained from the foreign Exchange department. Some data is available in Advance Department. The purpose of obtaining Credit should be explained clearly. The securities offered by the party to the bank are also evaluated. In case of pledging of property in shape of land or building the complete evaluation of the property should also be attached. After all the necessary documents for applying for advance is fulfilled by the party then the case is sent to Manager for approval. If the credit limit is in his range then he can decide over it otherwise the case is forwarded to seniors. If there is any discrepancy then the party is informed of it.

Sanction Advice:

When the documents required are complete and there is no ambiguity then the party is advised that their credit or loan is approved and will be available to you soon. There is a separate form for every annual approval or in case of a new facility. The form contains following information: Nature and amount of limit Purpose Security/ Collateral Margin Validity Bank charges Other terms and conditions:1. The facilities granted are subject to SBPs prudential regulations. 2. The bank would undertake the inspection of stocks from time to time and in any case at least once in the calendar year. 3. The bank shall have full authority to cancel the facilities allowed without assigning any reason and to call for adjustment of the liabilities within the period decided by the bank 4. Audited accounts should be submitted to the bank within six months of date from the date of your financial year end.

30

Meezan Bank Limited

Study of Prudential Regulations:

State Bank of Pakistan has imposed prudential regulations on all the banks. These facilities are being offered with the understanding that your companys financial condition will comply with these regulations. During my internship in this department I was given the task of studying some important prudential regulation related to my task. These are given below:> According to the prudential regulation the bank can only accept the proposal of a company up to 10times of its total equity value, not more than this. Out of which 4 times is the funded and 6times is the non-funded limit. > After 3 calendar years the valuation of the property must be obtained. > The audited balance sheet is necessary if the limit is till 10 million, but below 10 million an audited balance sheet can also be used.

Types of Security:There are following types of securities that are being used by Meezan bank. Loan can be given against any one or more of them:-

1. Hypothecation over Stock: in this the bank has the charge over stock but the

physical possession and owner is the customer. But incase of late payment or any other discrepancy the bank can take the charge anytime. This is enforceable by the law.

2. Pledge: in this the physical possession of the stock is with the bank. The customer

can get it on payment when needed.

3. Equitable Mortgage: in this the memorandum of deposit of the title deed is

deposited to the bank, which shows that the bank has the ownership of the property.

4. Token Registered Mortgage: in this the mortgage deed is registered with the

relevant record i.e. either with Fard (patwaari) or PT-1 or mutation (transfer of property from 1 person to another).

5. Personal Guarantee: it is as per prudential regulation. This is essential for every

customer to give his personal guarantee.

31

Meezan Bank Limited

6. Lien over Import Documents: in case of opening letter of credit the documents

will lie under the banks custody and will be given to the customer at the time of payment.

Products of Islamic Financing in Meezan Bank:A few of them are discussed below: MUHRABA: A short term facility in PKR only for purchasing raw materials and assets by bank and its onward sale to the customer on cost plus profit basis, usually with deferred payment. This facility also covers Muhraba for imported goods (for LC opened under MMFA). MUHRABA SPOT: A Muhraba facility in PKR in which the subject matter is purchased and held by the bank and is reflected in the inventory of the bank. The subject matter is than sold by the bank to the customer against spot payment, as and when required by the customer. MUHRABA PLEDGE: A Muhraba facility in PKR in which the subject matter is sold to the customer and than after delivery the same goods are kept under a pledge arrangement as a security. MUHRABA (FIM) SPOT: This is Muhraba financing of imported merchandise (FIM). It is a Muhraba facility in PKR in which the subject matter, which is an imported good is kept under a pledge arrangement before selling to the customer and the goods are reflected in the inventory of the bank. The subject matter is than sold to the customer against spot payment, as and when required by the customer.

ISTISNA-EXPORT:

A short term facility extended to exporters in which the bank orders the exporters to manufacture goods and makes payment for manufacturing the goods as per the specification of export order. The goods are delivered to the bank. After taking the

32

Meezan Bank Limited delivery these goods are exported to the foreign buyer by exporter acting as banks agent. ISTISNA-LOCAL: A short term facility extended to local manufacturer in which the bank orders the exporters to manufacture goods and makes payment for manufacturing the goods as per the specification of local order. The goods are delivered to the bank. After taking the delivery these goods are sold to the local buyer by exporter acting as banks agent.

MEEZAN TIJARAH-EXPORT: A short term financing facility for meeting financing requirements of exporters in which the bank purchases the finished/manufactured goods of the customer. The goods are delivered to the bank. After taking the delivery these goods are than sold and exported to the foreign buyer by exporter acting as banks agent. MEEZAN TIJARAH-LOCAL: A short term financing facility for meeting liquidity requirement of the customer in which the bank purchases the finished/manufactured goods of the customer. The goods are delivered to the bank. After taking the delivery these goods are than sold and exported to the local buyer by exporter acting as banks agent. MUHARABA-USD/FE-25, EXPORT & IMPORT: A short term facility in USD only for purchasing raw materials and assets by bank on advance/cash/credit/import basis and its onward sale to the customer on cost plus profit basis usually with deferred payment. This facility is extended to importer and exporter only, to facilitate trade business. IJARAH-PLANT AND MACHINERY: A medium to long term Islamic leasing facility for plant and machinery. The subject matter of Ijarah may be purchased locally or imported by the customer as an agent of the bank.

33

Meezan Bank Limited

PRACTICAL WORK:In the corporate department I got an opportunity to learn and do very productive work as explained above in detail. A short summary of what I did on my own is mentioned below: I learnt how to make limit for financing any SME company. I made proposal for the renewal of the limit (on work excel). I made the projected balanced and actual balance sheet of a SME company. I worked on the profit & loss account for the year ended on June 30, 2009 of a SME company. I also made the cash flow statement of a SME company.

I studied the detailed cases of 20 SME companies and 10 corporate companies, with

complete documents. I prepared the risk rating sheet for 3 SME companies.

I was given an assignment to write 150 words on a question i.e. What points will you

consider while financing any SME customer?

34

Meezan Bank Limited

FINANCIAL ANALYSIS FOR YEAR 2009

BALANCE SHEET:-

35

Meezan Bank Limited

STATEMENT OF CHANGES IN EQUITY:-

36

Meezan Bank Limited

PROFIT AND LOSS STATEMENT:-

37

Meezan Bank Limited

CASH FLOW STATEMENT:-

38

Meezan Bank Limited

SWOT ANALYSIS:

39

Meezan Bank Limited Meezan Bank Limited is one of the fastest growing banks; its business is growing at a good rate. In the light of situation we can make analysis by using following factors: Strengths Weakness Opportunities Threats

STRENGTHS:

1) Premier in Islamic banking. 2) Fastest growing rate. 3) MBL has strong financial position, as its owners are always willing to inject more equity in it. 4) Bank has successfully launch new product with the passage of time. 5) Increasing number of branches in different areas due to its strong financial position is also major strength. 6) Attractive & fully maintained branches. 7) Use of modern technology gives more efficient results. 8) Provide facilities to all types of customers like individuals, firms, companies, associations etc. 9) Strong relationships with foreign business organization & financial institution.

WEAKNESSES:

Although MBL is a growing bank, yet it has some weaknesses like: 1) Lack of modern advertisement techniques. 2) Give its employees fewer benefits. It results in less efficient team of workers. 3) Give no job satisfaction so, many employees resigned. 4) Negative influence of management regarding favoritism. 5) Hiring of less talented employees & only on reference basis. 6) Burden or load of work on customer relationship department due to which they are not mentally satisfied with job.

40

Meezan Bank Limited

STRESS & STRAINS:

No work can be carried out with, mild level of stress, therefore it is sometime more helpful to create some stressful situation for getting more productivity on making people more stress. As far as MBL is concerned there are few situations present at MBL, which are as follow: Excessive load of work. Late sitting. Time constraints & responsibilities.

OPPORTUNITIES:

1) MBL can introduce new products to satisfy their new customers. 2) With approval of SBP, now more branches will be opened in every city of Pakistan to provide riba free banking services to people.

THREATS:

1) More banks open their Islamic Branches in the country so great competition is there for Meezan Bank Limited. 2) There is less growth for Meezan Bank at international level because of Muslim image in the world. 3) Some employees are not satisfied with MBL policies, so more resignations are there, which is a threat for MBL to some extent.

PROBLEMS FACED BY MEEZAN BANK

41

Meezan Bank Limited There are three major problems, which are being faced by Meezan bank Limited. These include 1) The extensive competition, which is building up in the market. More are more banks are jumping into Islamic Banking. 2) Another problem which is being faced by Meezan Bank is that it is going to expand its branches extensively throughout Pakistan within these two years and for this reason they need a competent staff and there is a lack in human resource which is good in Islamic banking. 3) The third major problem which is faced by the employees of Meezan Bank is to convince the people about the pure Islamic banking as people are not in a position of accepting an Islamic bank and they are of the view that it the same as conventional bank. 4) Time problem is very common for MBL employees. There is late sitting in the branch. The employees are not happy for late sitting.

CONCLUSION

42

Meezan Bank Limited This internship program gave the internee an exposure of the real banking environment and its interaction with commercial sector. The valuable learning experience shows all internal and external of not only about the role of banking but also almost all other sectors of business or private enterprises. According to the findings it is concluded the people of Meezan bank limited are using Customer Service and Automation as their marking weapon in order to attract the customer. Therefore when you are providing service to your customer, honor and attraction plays an important role. As far as the question of Human Resource is concerned the MBLs environment is based on democratic culture. This environment plays an important role to enhance the productivity, capability and performance of the employees and creates an efficient, effective and friendly environment of working. In study of comparison between the Islamic banking of Meezan bank with other conventional banks, it was found that though there is a sound difference between both, but still some more steps are needed to make it completely pure and different from the conventional banking. Another important point that is to be noted that MBL is using limited selectivity instead of coverage in case of promotional activities. They try to send their message within the limits of the cities where they have there own branches.

RECOMMENDATIONS

43

Meezan Bank Limited During my internship period with MBL I have learned a lot about banking system, observed deeply the functioning of the branch. In the light of these observances, I have following suggestions for the MBL. These recommendations base on many observations: RIBA FREE COMMERCIAL BANKING to be set up in all countries of the world, Muslims and non-Muslims. This will greatly facilitate international export import trade without the fear of being involved in any Riba dealing. The bank should do proper and effective advertisement, and enhance its public image, goodwill and attract more customers towards Islamic banking by doing efficient advertisement. Increase consumer banking and offer more and more products in it. Develop the healthy and sound competition between employees and bosses. Meezan bank does not provide jobs security to the employees. Most are hired on contractual bases on the start. More people must be employed on permanent bases, providing job security and satisfaction. There is no separate department for the training of new employees. There should be establishment of a separate department for training of new employees and competent teaching staffs should be hired for the training. Meezan Bank Limited should become much specified about its competitors, so that it can understand which of its competitor is in the first degree and who is in the second degree. Then the first-degree competitors should be chased closely. A research cell should continuously try to gather information about the present action of its competitors and their expected future actions. So in this way more effective strategies can be formulated. The performance reward linkages should be made strong as it said, A happy employee deliver more than he receive from organization. The MBL should also try to make its employees happier.

44

Meezan Bank Limited

45

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Syncretism JJDocument6 pagesSyncretism JJShubham KumarPas encore d'évaluation

- Luke Yarbrough - Friends of The Emir - Non-Muslim State Officials in Premodern Islamic Thought-Cambridge University Press (2019)Document380 pagesLuke Yarbrough - Friends of The Emir - Non-Muslim State Officials in Premodern Islamic Thought-Cambridge University Press (2019)Selim Reza100% (1)

- WesternisasiDocument15 pagesWesternisasieuisPas encore d'évaluation

- 10-04-14 EditionDocument32 pages10-04-14 EditionSan Mateo Daily JournalPas encore d'évaluation

- Biography of Hazrat Syed Rahmatulla Quaderi RahmatabadDocument259 pagesBiography of Hazrat Syed Rahmatulla Quaderi RahmatabadMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaPas encore d'évaluation

- Qirad Meaning 'Surrender' Is Used To Refer To The Surrender of Capital, Hence TheDocument2 pagesQirad Meaning 'Surrender' Is Used To Refer To The Surrender of Capital, Hence TheSK LashariPas encore d'évaluation

- 7 Letters For Bingo (CSW12 Only) For Scrabble PlayersDocument38 pages7 Letters For Bingo (CSW12 Only) For Scrabble PlayersfatensiaPas encore d'évaluation

- MSP Report - Forced Marriages and Conversions of Christian Women in PakistanDocument36 pagesMSP Report - Forced Marriages and Conversions of Christian Women in PakistanZeeshan HaiderPas encore d'évaluation

- Condemnation On Abu HanifaDocument12 pagesCondemnation On Abu HanifaUmer Farooque AligarhianPas encore d'évaluation

- Syllabus: Cambridge Igcse Religious StudiesDocument17 pagesSyllabus: Cambridge Igcse Religious StudiesAnesu MutyeberePas encore d'évaluation

- Constitutional Law: An Overview of The Islamic Approach and Its Contemporary RelevanceDocument9 pagesConstitutional Law: An Overview of The Islamic Approach and Its Contemporary RelevanceMuhd ZainabPas encore d'évaluation

- Cambridge O Level Pakistan Studies Syllabus Code 2059 For ExaminationDocument40 pagesCambridge O Level Pakistan Studies Syllabus Code 2059 For Examinationsheryjanobacha57% (14)

- Chand BibiDocument5 pagesChand BibiMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaPas encore d'évaluation

- Data Santri Yang Tidak Hadir Absen Wajib KedatanganDocument3 pagesData Santri Yang Tidak Hadir Absen Wajib KedatanganPORSEKA 46Pas encore d'évaluation

- No Nama Santri Tempat Lahir Tanggal LahirDocument8 pagesNo Nama Santri Tempat Lahir Tanggal LahirAhmad RobiethPas encore d'évaluation

- M PreselectionDocument11 pagesM Preselectionhassane zinePas encore d'évaluation

- Shariah CommitteeDocument2 pagesShariah CommitteeCikgu AbdullahPas encore d'évaluation

- Students - List, Class - IVDocument12 pagesStudents - List, Class - IVShamsul IslamPas encore d'évaluation

- Surah Al MulkDocument11 pagesSurah Al MulkAbdul RosyidPas encore d'évaluation

- The State and The Stray Dogs in Late Ottoman EmpireDocument4 pagesThe State and The Stray Dogs in Late Ottoman EmpireVictor ChiticPas encore d'évaluation

- 880-Article Text-2608-1-10-20211005Document14 pages880-Article Text-2608-1-10-20211005Adrika AiniPas encore d'évaluation

- Hira Azhar Khan Islamic StudiesDocument14 pagesHira Azhar Khan Islamic StudiesHira RazaPas encore d'évaluation

- What Is Innovation (Bidah)Document4 pagesWhat Is Innovation (Bidah)khubaibattaPas encore d'évaluation

- Proxy Wars - Role of External ElementsDocument3 pagesProxy Wars - Role of External ElementsSohaib KhanPas encore d'évaluation

- Muhammad Ali Dinakhel CVDocument6 pagesMuhammad Ali Dinakhel CVMuhammad Ali DinakhelPas encore d'évaluation

- Data Kontrak Dan Surat Perjanjian Perangkat As of 25 Feb 2021Document44 pagesData Kontrak Dan Surat Perjanjian Perangkat As of 25 Feb 2021Lia Fadilah220% (1)

- Risala of Ibn FadlanDocument36 pagesRisala of Ibn FadlanThorvald Gudmundsson100% (1)

- Options No 49. - Women and ReligionDocument47 pagesOptions No 49. - Women and Religionwmcsrilanka100% (2)

- Cover Note 55c1c87Document2 pagesCover Note 55c1c87Relly AtongPas encore d'évaluation

- Do Muslims Celebrate HalloweenDocument3 pagesDo Muslims Celebrate Halloweenmrcyber0% (1)