Académique Documents

Professionnel Documents

Culture Documents

MBA 502 Financial Accounting Assignment

Transféré par

Nil AkashDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MBA 502 Financial Accounting Assignment

Transféré par

Nil AkashDroits d'auteur :

Formats disponibles

Financial Reporting and Analysis

Name: Mesbah Uddin Ahmed

Id: 0510151

6/26/2011

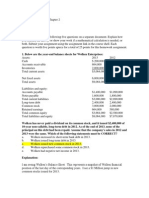

Financial Reporting Problem BY4-1. (a) What were PepsiCos total Current as at December 31, 2005 and December 25, 2004? The list of PepsiCo total current asset at December 31, 2005 and December 25, 2004 were shown in following table: (in millions per share amounts) 2005 2004 Current Asset Cash and cash equivalents $1,716 1,280 Short- term investment 3166 2165 Account and note receivable, net 3,261 2,999 Inventories 1,693 1541 Prepaid expense and other current assets 618 654 Total Current Assets 10,454 8,639 (b) Are assets PepsiCo included under the current assets listed in proper order? Explain. Yes assets PepsiCo included under the current assets listed in proper order. Here we can see that that PepsiCo has list current asset accounts in the order they expect to convert them into cash. (c) How are PepsiCos assets classified? PepsiCo has classified the assets in four sections Current Assets Long term Investment Property, plant, and equipment Intangible Assets

(d) What are cash equivalents? Investment securities that are short-term have high credit quality and are highly liquid. (e) What were PepsiCos total current liabilities at December 31 2005 and December 25, 2004? The list of PepsiCo total current liabilities at December 31, 2005 and December 25, shown in following table: Current Liabilities 2005 Short-term obligations $ 2,889 Account payable and other current liabilities 5,971 Income taxes payable 546 9,406 Total Current liabilities 2004 were 2004 $ 1,054 5,599 99 6,752

Comparative Analysis Problem PepsiCo, Inc. vs. The Coca- Cola Company BYP4-2 (a) Based on the information in these financial statements, determine each of the following for PepsiCo at December 31, 2005, and Coca- Cola at December 31, 2005? (1) Total current assets PepsiCo, Inc. has higher Total Current asset as compare to Coca- Cola Company. However, PepsiCo, Inc. has cash or cash equivalent $ 4,701, where Coca- Cola Company has only $1716, here PepsiCo, Inc. better in current asset than Coca-Cola. (2) Net amount of property, plant and equipment (land, building and equipment ) PepsiCo, Inc. has net amount of property, plant and equipment $8,681 and has Coca-Cola Company $ 5, 786. PepsiCo has more Fixed asset as compare to Coca-Cola Company. (3) Total current liabilities. Coco-Cola Company has more total current liabilities than PepsiCo, Inc. it mean that Coca-Cola Company has more creditor than Pepsi. Coca-Cola is liable pay money to other businesses like its suppliers. (4) Total Stockholders (shareholders) equity. PepsiCo, Inc. Total shareholders Equity in 2005 has $ 16, 355 and Coco-Cola $14, 320. Here we can see that Coca-Cola Pay more money to its shareholders as most companies capital has its shareholder

(b) What conclusion concerning the companies respective financial positions can be drawn? PepsiCo, Inc. Companys financial position is better as compare to Coca-Cola Company. Above Comparison we show that. More appropriate result can be done through Ratio analysis.

Exploring the Web BYP-3 (a) What type of information is aviable? Captn Eli Root Beer Company and Kodak both company Homepage provide that information about their product. In Captn Eli Root Beer Company home page provided the information about different flavor soda they are producing right now and list distributor name list and their contracts. Its home page also includes a brief history about the formation the company. On the other hand in Kodak home page provide information different products that are available in the market and other promotional activities that company is providing now to it customer. (b) Is any accounting related information presented? None of the companies has presented any accounting related information in their home page. (c) Would you describe the home page as informative, promotional or both? Why? Yes both the companies homepages are as informative and promotional. The reason that, here both companies provided enough information about their product and its specification. Both companies also continue updating different promotional activity for its potential clients.

Vous aimerez peut-être aussi

- Business Development Strategy for the Upstream Oil and Gas IndustryD'EverandBusiness Development Strategy for the Upstream Oil and Gas IndustryÉvaluation : 5 sur 5 étoiles5/5 (1)

- Financial Accounting BYP4-1 and BYP4-2Document3 pagesFinancial Accounting BYP4-1 and BYP4-2Imran AhmedPas encore d'évaluation

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsD'EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsPas encore d'évaluation

- Acc-280 Week 2 - Team - Executive SummaryDocument6 pagesAcc-280 Week 2 - Team - Executive SummarybillyleblancPas encore d'évaluation

- Accounting Textbook Solutions - 42Document18 pagesAccounting Textbook Solutions - 42acc-expertPas encore d'évaluation

- Group 5 ELIGIO, Khyle Ferrile A. LOPEZ, Hazel Andrea G. NAVARRO, Jessa Gladys V. ORTEZA, Emmafelle S. TORRICER, Criselda GDocument6 pagesGroup 5 ELIGIO, Khyle Ferrile A. LOPEZ, Hazel Andrea G. NAVARRO, Jessa Gladys V. ORTEZA, Emmafelle S. TORRICER, Criselda GHazel Andrea Garduque LopezPas encore d'évaluation

- AnmoljamwalDocument44 pagesAnmoljamwalAnmol JamwalPas encore d'évaluation

- Guide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?D'EverandGuide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?Pas encore d'évaluation

- Coca-Cola Bottler COKE Overvalued on Governance, Growth ConcernsDocument10 pagesCoca-Cola Bottler COKE Overvalued on Governance, Growth ConcernskennyPas encore d'évaluation

- Multiple Choices and Exercises - AccountingDocument33 pagesMultiple Choices and Exercises - Accountinghuong phạmPas encore d'évaluation

- Chapter 1 ExerciseDocument11 pagesChapter 1 ExerciseUsama MukhtarPas encore d'évaluation

- Pepsi-Co Ethics and Compliance PaperDocument7 pagesPepsi-Co Ethics and Compliance PaperAlvis OBanion Jr.Pas encore d'évaluation

- Elliott Homework Week1Document8 pagesElliott Homework Week1Juli ElliottPas encore d'évaluation

- Coca Cola - Portfolio ProjectDocument15 pagesCoca Cola - Portfolio Projectapi-249694223Pas encore d'évaluation

- Financial Statement Analysis of Coca Cola and PepsiCoDocument17 pagesFinancial Statement Analysis of Coca Cola and PepsiCoShloak AgrawalPas encore d'évaluation

- Class Activity 1Document3 pagesClass Activity 1YASH BHANSALIPas encore d'évaluation

- Financial Statements Practice ProblemsDocument5 pagesFinancial Statements Practice ProblemsnajascjPas encore d'évaluation

- Concepts Rev Iew and Critical Thinking QuestionsDocument8 pagesConcepts Rev Iew and Critical Thinking Questionsdt0035620Pas encore d'évaluation

- Trade Me analysis reveals stock valuationDocument20 pagesTrade Me analysis reveals stock valuationCindy YinPas encore d'évaluation

- Chapter 2 Financial Statement, Taxes - Cash Flow - Student VersionDocument4 pagesChapter 2 Financial Statement, Taxes - Cash Flow - Student VersionNga PhamPas encore d'évaluation

- Review The Annual Reports For PepsiCoDocument2 pagesReview The Annual Reports For PepsiCoalli4896416Pas encore d'évaluation

- Case Study CiscoDocument7 pagesCase Study Ciscoapi-241493839Pas encore d'évaluation

- Coca Cola FSDocument3 pagesCoca Cola FSManan MunshiPas encore d'évaluation

- Working Capital Management: A Comparative Study of The Coca-Cola Company and PepsicoDocument22 pagesWorking Capital Management: A Comparative Study of The Coca-Cola Company and PepsicoIshu SinhaPas encore d'évaluation

- Mcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Document14 pagesMcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Vonna TerriblePas encore d'évaluation

- (Finance and Financial Management Collection) McGowan, Carl-Corporate Valuation Using The Free Cash Flow Method Applied To Coca-Cola-Business Expert Press (2015) - 1Document66 pages(Finance and Financial Management Collection) McGowan, Carl-Corporate Valuation Using The Free Cash Flow Method Applied To Coca-Cola-Business Expert Press (2015) - 1auliawrPas encore d'évaluation

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Document38 pagesSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683verawarnerq5cl100% (13)

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Document38 pagesSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683auntyprosperim1ru100% (15)

- Name SectionDocument9 pagesName SectionbenuocdayPas encore d'évaluation

- Ratio Analysis Practice QuestionsDocument4 pagesRatio Analysis Practice Questionswahab_pakistan100% (1)

- Independent Auditor'S Report Abc CompanyDocument4 pagesIndependent Auditor'S Report Abc CompanyLorena TudorascuPas encore d'évaluation

- Acccob2 Reflection #2Document8 pagesAcccob2 Reflection #2asiacrisostomoPas encore d'évaluation

- Questions For EquityDocument11 pagesQuestions For EquityRãViï DrAxlerPas encore d'évaluation

- Take Home, S2016 SolutionsDocument14 pagesTake Home, S2016 SolutionsAkshatPas encore d'évaluation

- ACCT 504 Final Exam AnswersDocument5 pagesACCT 504 Final Exam Answerssusanperry50% (2)

- ACC 497 GENIUS Possible Is EverythingDocument36 pagesACC 497 GENIUS Possible Is Everythingalbert0124Pas encore d'évaluation

- ACC 497 GENIUS Empowering and InspiringDocument34 pagesACC 497 GENIUS Empowering and Inspiringalbert0123Pas encore d'évaluation

- Market Analysis of Coca Cola New ProductDocument101 pagesMarket Analysis of Coca Cola New ProducttechcaresystemPas encore d'évaluation

- Quiz 2Document54 pagesQuiz 2Karthik Vee33% (3)

- Assignment 9-Shawanna LumseyDocument14 pagesAssignment 9-Shawanna LumseyShawanna ButlerPas encore d'évaluation

- Ch.2 Accounting For Business CombinationsDocument3 pagesCh.2 Accounting For Business Combinationsyousef100% (1)

- Coca-Cola 2008 Financial AnalysisDocument15 pagesCoca-Cola 2008 Financial AnalysisnintuctgPas encore d'évaluation

- CH 4Document20 pagesCH 4Waheed Zafar100% (1)

- QTTCDocument21 pagesQTTCHuong LanPas encore d'évaluation

- Coca Cola ConsolidationDocument10 pagesCoca Cola ConsolidationLarisa Gruescu - DumoiPas encore d'évaluation

- Review Problems 1rDocument8 pagesReview Problems 1rYousefPas encore d'évaluation

- FIN 534 Homework Chap.2Document3 pagesFIN 534 Homework Chap.2Jenna KiragisPas encore d'évaluation

- Accounting in Organization and SocietyDocument13 pagesAccounting in Organization and SocietyHải BìnhPas encore d'évaluation

- Dwnload Full Corporate Finance The Core 4th Edition Berk Solutions Manual PDFDocument36 pagesDwnload Full Corporate Finance The Core 4th Edition Berk Solutions Manual PDFdesidapawangl100% (16)

- The Following Is A List of Accounts For Speedy DeliveryDocument1 pageThe Following Is A List of Accounts For Speedy DeliveryMiroslav GegoskiPas encore d'évaluation

- CH 1 Consolidation (SOFP)Document25 pagesCH 1 Consolidation (SOFP)ranashafaataliPas encore d'évaluation

- Answer Mini CaseDocument11 pagesAnswer Mini CaseJohan Yaacob100% (3)

- Order 2609108.editedDocument14 pagesOrder 2609108.editedanh hoàngPas encore d'évaluation

- Dick's Sporting GoodsDocument7 pagesDick's Sporting GoodsKeena JonesPas encore d'évaluation

- Financial Accounting (FI015) Group Assignment 1Document11 pagesFinancial Accounting (FI015) Group Assignment 1Johanes Ronaldy PollaPas encore d'évaluation

- PA 581 Quiz Week 3 KellerDocument11 pagesPA 581 Quiz Week 3 Kellerlynnturner123Pas encore d'évaluation

- Barbados Sugarcane Executive SummaryDocument8 pagesBarbados Sugarcane Executive SummarysarkariaPas encore d'évaluation

- Class-9 WTODocument67 pagesClass-9 WTONil AkashPas encore d'évaluation

- Final Banglalink ReportDocument20 pagesFinal Banglalink ReportNil AkashPas encore d'évaluation

- Pack 1 - Welcome To The School Enterprise Challenge!Document20 pagesPack 1 - Welcome To The School Enterprise Challenge!Nil AkashPas encore d'évaluation

- Problem DescriptionDocument2 pagesProblem DescriptionNil AkashPas encore d'évaluation

- Personal PCDocument1 pagePersonal PCNil AkashPas encore d'évaluation

- Accountancy exam questionsDocument32 pagesAccountancy exam questionsVidhiPas encore d'évaluation

- Zillow Group Q3'21 Shareholder LetterDocument20 pagesZillow Group Q3'21 Shareholder LetterGeekWirePas encore d'évaluation

- Sme Discussion TemplateDocument5 pagesSme Discussion TemplateLeahmae OlimbaPas encore d'évaluation

- Cash Management at MarutiDocument68 pagesCash Management at MarutiEshaPas encore d'évaluation

- PT Jayatama Trial Balance ReportDocument56 pagesPT Jayatama Trial Balance ReportNur AinuPas encore d'évaluation

- Intangible AssetsDocument26 pagesIntangible Assetslee jong suk100% (1)

- MBA 560 Accounting Managerial NotesDocument18 pagesMBA 560 Accounting Managerial NotesDesi MarianPas encore d'évaluation

- Beta Watches Completed The Following Selected Transactions During 2016 andDocument1 pageBeta Watches Completed The Following Selected Transactions During 2016 andhassan taimourPas encore d'évaluation

- FABM 2 Guide Mid Term ALL LearnersDocument8 pagesFABM 2 Guide Mid Term ALL LearnersYnahPas encore d'évaluation

- Adjusting Entries for Financial StatementsDocument90 pagesAdjusting Entries for Financial StatementsBadal singh ThakurPas encore d'évaluation

- 4356062Document5 pages4356062mohitgaba19Pas encore d'évaluation

- NGO Audited Documents Balance Sheet and Profit and Loss A CDocument27 pagesNGO Audited Documents Balance Sheet and Profit and Loss A Cvikash1905Pas encore d'évaluation

- AIDTauditDocument74 pagesAIDTauditCaleb TaylorPas encore d'évaluation

- Unit - III Lesson 7 Holding Companies - IDocument51 pagesUnit - III Lesson 7 Holding Companies - IVandana SharmaPas encore d'évaluation

- Service Business Accounting CycleDocument6 pagesService Business Accounting CycleMarie Kairish Damag Vivar100% (1)

- DAMASO, JONNETTE E. - Lucky Charm Mini MartDocument7 pagesDAMASO, JONNETTE E. - Lucky Charm Mini MartHeide PalmaPas encore d'évaluation

- Afar 2019Document9 pagesAfar 2019TakuriPas encore d'évaluation

- Webcom Investor Presentation Highlights Recurring Revenue GrowthDocument29 pagesWebcom Investor Presentation Highlights Recurring Revenue Growthsl7789Pas encore d'évaluation

- CORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSDocument5 pagesCORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSjjjjjjjjjjjjjjjPas encore d'évaluation

- HANIEVON MERCHANDISING CASE PROBLEMDocument20 pagesHANIEVON MERCHANDISING CASE PROBLEMPrincessjane Largo100% (1)

- Cash Management: By: Judy Ann G. Silva, MBADocument17 pagesCash Management: By: Judy Ann G. Silva, MBAAnastasha GreyPas encore d'évaluation

- Midterm F13 Partial Final f13 For Posting Fall 14 7Document13 pagesMidterm F13 Partial Final f13 For Posting Fall 14 7Miruna CiteaPas encore d'évaluation

- FADocument46 pagesFANishant JainPas encore d'évaluation

- PQ2Document2 pagesPQ2alelliePas encore d'évaluation

- This Study Resource WasDocument4 pagesThis Study Resource WasTegar NurfitriantoPas encore d'évaluation

- Financial Accounting Notes: Accounting Definition, Objectives and RoleDocument20 pagesFinancial Accounting Notes: Accounting Definition, Objectives and RolePrakash MJSPas encore d'évaluation

- Home OfficeHome Office Quizzer by RomelDocument20 pagesHome OfficeHome Office Quizzer by RomelMichaela QuimsonPas encore d'évaluation

- NotesDocument2 pagesNotesNoella Marie BaronPas encore d'évaluation

- ABM-FABM2 12 - Q1 - W2 - Mod2Document16 pagesABM-FABM2 12 - Q1 - W2 - Mod2Jose John Vocal83% (18)

- Cpar - P2 09.15.13Document22 pagesCpar - P2 09.15.13Leo Mark Ramos100% (1)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerD'EverandJoy of Agility: How to Solve Problems and Succeed SoonerÉvaluation : 4 sur 5 étoiles4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsD'EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsPas encore d'évaluation

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityD'EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000D'EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Évaluation : 4.5 sur 5 étoiles4.5/5 (86)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)D'EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Évaluation : 4.5 sur 5 étoiles4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- Financial Risk Management: A Simple IntroductionD'EverandFinancial Risk Management: A Simple IntroductionÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (34)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthD'EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthPas encore d'évaluation

- Note Brokering for Profit: Your Complete Work At Home Success ManualD'EverandNote Brokering for Profit: Your Complete Work At Home Success ManualPas encore d'évaluation

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorD'EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorPas encore d'évaluation

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 5 sur 5 étoiles5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionD'EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionÉvaluation : 5 sur 5 étoiles5/5 (1)