Académique Documents

Professionnel Documents

Culture Documents

ECO Paper - Tyler

Transféré par

Tyler ToroDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ECO Paper - Tyler

Transféré par

Tyler ToroDroits d'auteur :

Formats disponibles

Tyler Toro May 13, 2011 ECO 389

The Time Value of Money

When thinking of money, does one readily believe and fully understand the triviality of monetary notation? Civilizations through human history have printed colorful pieces of paper and minted small metal coins with the intention of creating a monetary tool for exchange with an exact value. One piece of money equates to a particular good or service. Unfortunately, for better or for worse, the value of money changes over time. A unit of money decades ago could purchase more compared to today. For example, using a calculator from the Bureau of Labor Statistics, $0.25 in 1959 had the same purchasing power as $1.92 in todays terms1. While this is an example of the negative aspects of money over time, a positive example would be saving and investing. Money saved today can become a larger amount in the future. These both cases help explain how time can affect the value of money. When we consider analyzing a particular investment or amount of money throughout time to determine its value, there are two stages to keep in mind; Present Value (PV) and Future Value(FV). As their names apply, present value represents how much value the investment or amount money initially has and future value represents how much value the investment or amount of money will have at a later date. There is a generic formula to determine what the future value of an investment or amount of money is; as long as time, interest rate, and present value are given.

http://www.bls.gov/data/inflation_calculator.htm

FV = PV (1+ interest rate)time

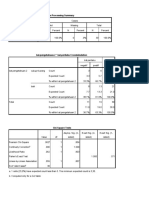

As seen in the equation, the only way for an investment or amount of money to increase in value is if the interest rate is larger the zero. Interest is the reason money grows. In our textbook we are made aware of two types of interest: Simple and Compound. Simple is the case in which an interest payment is derived from only the initial investment. Compound interest is the case where there is an Earning of interest on interest. Two stress the difference between both types of interest; let us look at an example. If there is an initial amount of money of $1000.00 this would give us a Present Value of $1000.00. For argument sake, let the interest rate equal 10%. In the case of simple interest, there is no need to take time into consideration because only the initial amount will earn interest. The interest payment ( PV interest rate) would be (1000.00 0.10) = $100.00 , which would make the FV of the amount of money to $1100.00 With the case of compounding interest, unlike the simple interest, time does affect the Future Value. But is simple interest different from compounded interest for the first year? The answer is no because compounded interest is acquired through the passing of more than one period. To reiterate the point let us mathematically examine case with more than one period. At the start of the saving, the Present Value is still $1000.00; let us represent this Present Value as PV1 . To calculate the FV1 we will use the previous formula: FV = PV (1+r)t . This gives us a Future Value of [1000 (1.10)1 = $1100.00]. Of course this is the same value as calculated with simple interest, but when we calculate with a larger year amount (t) there will b a larger

interest payment. The new Present Value for the second period will be the Future Value of the previous period. This is because the entire cash flow is similar to a timeline, a linear path. To calculate the new Future Value ( FV2) , we use the same formula and increase t from 1 to 2, representing the second period. Future Value FV2 = FV1 (1+r)t or FV2 = 1100.00 (1.10)2 = $1331.00 It is also possible to calculate the time needed to acquire some Future Value amount. Let the interest rate for this example still equal 10% (r=.10), and the Present Value equal $3000.00 (PV = 3000). If we eventually would like to have $4000.00, (FV = 4000), how many years would it take? We can manipulate the formula and isolate the t exponent. FV = PV(1+r)t 4000 = 3000(1 + .10)t 1.33 = 1.1t If t=3 then 1.13 1.33

4000/3000 = (1.10)t If t = 1 then 1.11 = 1.1

If t=2 then 1.12 = 1.21

With these formulas, we can see how time directly affects the value of money. In order for there to be any increase in a savings investment or amount of money there must be some sort of interest accumulated. It is a phenomenon to create money out of thin air, but with interest gained on a saving investment or amount of money, one could increase the value of money over time. Time plays a crucial role because according to Suzan Murphy time allows one the opportunity to postpone consumption and earn interest.

Work cited

United States Department of Labor. CPI Inflation Calculator. , Web. 13 May 2011. <http://www.bls.gov/data/inflation_calculator.htm>.

Brealy, Myers, and Marcus. Fundamentals of Corporate Finance. 6th. New York, NY (USA): McGraw-Hill Irwin , 2009. 112-123. Print.

Murphy, Suzan. 2000. The Time Value of Money. University if Tennessee Department of Finance. itc.utk.edu/spotlight/archive/murphy/MBA_Prep_Summer_Tech.ppt

Vous aimerez peut-être aussi

- Engineering Economy Problem SetDocument38 pagesEngineering Economy Problem SetJaysonJavier80% (5)

- Time Value of MoneyDocument5 pagesTime Value of MoneydeepeshmahajanPas encore d'évaluation

- Finance for Non-Financiers 1: Basic FinancesD'EverandFinance for Non-Financiers 1: Basic FinancesPas encore d'évaluation

- Review of Basic Bond ValuationDocument6 pagesReview of Basic Bond ValuationLawrence Geoffrey AbrahamPas encore d'évaluation

- Time Value of MoneyDocument16 pagesTime Value of Moneyমেহেদী হাসান100% (2)

- Form RitaseDocument6 pagesForm Ritaseshanti RafikPas encore d'évaluation

- Lecture 3 - Time Value of MoneyDocument22 pagesLecture 3 - Time Value of MoneyJason LuximonPas encore d'évaluation

- Chapter 5 Time Value of Money ReadingDocument30 pagesChapter 5 Time Value of Money ReadingRose Peres100% (1)

- Evaluating Capital Projects PDFDocument254 pagesEvaluating Capital Projects PDFnochua5864Pas encore d'évaluation

- Land Assignment in Kerala - Full Procedures From REALUTIONZ - The Best Land Problem Solvers in Kerala 9447464502Document89 pagesLand Assignment in Kerala - Full Procedures From REALUTIONZ - The Best Land Problem Solvers in Kerala 9447464502James Adhikaram100% (1)

- Time Value of MoneyDocument18 pagesTime Value of MoneyJunaid SubhaniPas encore d'évaluation

- High-Q Financial Basics. Skills & Knowlwdge for Today's manD'EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manPas encore d'évaluation

- Hussen Field ReportDocument17 pagesHussen Field ReportHussein Makame100% (1)

- Kunci JWB Soal B 2015 PDFDocument29 pagesKunci JWB Soal B 2015 PDFAnisaa Okta100% (5)

- Compound Interest Formula DerivationsDocument13 pagesCompound Interest Formula DerivationsDanishkoolPas encore d'évaluation

- What Is Time Value of MoneyDocument14 pagesWhat Is Time Value of MoneyJohn Michael EubraPas encore d'évaluation

- An Overview of Financial Mathematics: William Benedict Mccartney July 2012Document13 pagesAn Overview of Financial Mathematics: William Benedict Mccartney July 2012OwenPas encore d'évaluation

- Learning Packet 5 Time Value of MoneyDocument10 pagesLearning Packet 5 Time Value of MoneyPrincess Marie BaldoPas encore d'évaluation

- Time Value of Money ConceptsDocument9 pagesTime Value of Money ConceptskishorerocxPas encore d'évaluation

- 8482041Document23 pages8482041Minh Tú HoàngPas encore d'évaluation

- Nilai Waktu Uang Bhs InggrisDocument7 pagesNilai Waktu Uang Bhs InggrisALBERT KURNIAWANPas encore d'évaluation

- Time Value of MoneyDocument4 pagesTime Value of Moneyshiva ranjaniPas encore d'évaluation

- FM Chapter 5Document65 pagesFM Chapter 5Nagiib Haibe Ibrahim Awale 6107Pas encore d'évaluation

- The Time Value of MoneyDocument39 pagesThe Time Value of MoneyAbhinav JainPas encore d'évaluation

- Time Value of MoneyDocument7 pagesTime Value of MoneyMarvin AlmariaPas encore d'évaluation

- Basic Practical Examples: Simple Interest Compound Interest. PrincipalDocument10 pagesBasic Practical Examples: Simple Interest Compound Interest. PrincipalArvie Angeles AlferezPas encore d'évaluation

- ManagmentDocument91 pagesManagmentHaile GetachewPas encore d'évaluation

- The Time Value of MoneyDocument24 pagesThe Time Value of Moneysaliljain2001Pas encore d'évaluation

- The Time Value of MoneyDocument18 pagesThe Time Value of MoneyRaxelle MalubagPas encore d'évaluation

- Planning and Evaluationl English 3Document24 pagesPlanning and Evaluationl English 3Absa TraderPas encore d'évaluation

- Fin Man Unit 5Document5 pagesFin Man Unit 5Jenelle Lee ColePas encore d'évaluation

- FM I CH IiiDocument8 pagesFM I CH IiiDùķe HPPas encore d'évaluation

- Corporate Finance 3Document3 pagesCorporate Finance 3Mujtaba AhmadPas encore d'évaluation

- CH 3Document13 pagesCH 3tamirat tadesePas encore d'évaluation

- FM Unit 4 Lecture Notes - Time Value of MoneyDocument4 pagesFM Unit 4 Lecture Notes - Time Value of MoneyDebbie DebzPas encore d'évaluation

- Present Value The Current Worth of A Future Sum of Money or Stream of Cash FlowsDocument10 pagesPresent Value The Current Worth of A Future Sum of Money or Stream of Cash FlowsPhamela Mae RicoPas encore d'évaluation

- Time Value of MoneyDocument3 pagesTime Value of MoneyMcQueen 18Pas encore d'évaluation

- Concept of Time Value of Money and Other Relevant ValuesDocument16 pagesConcept of Time Value of Money and Other Relevant ValuesTesfaeyesus BirliePas encore d'évaluation

- Financial Management Time Value of Money Lecture 2 3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2 3 and 4Kratika Pandey SharmaPas encore d'évaluation

- Section 13.4, Applications of Definite Integrals in Business and EconomicsDocument1 pageSection 13.4, Applications of Definite Integrals in Business and EconomicsAshley BaronPas encore d'évaluation

- Module 1 Time Value of MoneyDocument4 pagesModule 1 Time Value of MoneyChristianPas encore d'évaluation

- Time Value MoneyDocument19 pagesTime Value Moneyjunaid11saeedPas encore d'évaluation

- The Importance of The Time Value of MoneyDocument2 pagesThe Importance of The Time Value of MoneyC h r i s t i n 3Pas encore d'évaluation

- Time Value of Money Notes Loan ArmotisationDocument12 pagesTime Value of Money Notes Loan ArmotisationVimbai ChituraPas encore d'évaluation

- Financial Management Time Value of Money Lecture 2,3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2,3 and 4Rameez Ramzan Ali67% (3)

- Options, Futures and Other Derivatives (John Hull)Document24 pagesOptions, Futures and Other Derivatives (John Hull)sidPas encore d'évaluation

- Chapter 03 - The Meaning of Interest Rates - p117-138Document22 pagesChapter 03 - The Meaning of Interest Rates - p117-138Dương Thị Kim HiềnPas encore d'évaluation

- Chap 3 Time Value of MoneyDocument19 pagesChap 3 Time Value of MoneyClaudine DuhapaPas encore d'évaluation

- Chapter 3Document22 pagesChapter 3My TraPas encore d'évaluation

- Present Value 1Document7 pagesPresent Value 1shotejPas encore d'évaluation

- Examples: Simple and Compound InterestDocument3 pagesExamples: Simple and Compound InterestnonononowayPas encore d'évaluation

- 304A Financial Management and Decision MakingDocument67 pages304A Financial Management and Decision MakingSam SamPas encore d'évaluation

- Engineering Economy - Time Value of MoneyDocument95 pagesEngineering Economy - Time Value of MoneygedamPas encore d'évaluation

- Engineering Economy Chapter Ii - 1Document33 pagesEngineering Economy Chapter Ii - 1Jom Ancheta BautistaPas encore d'évaluation

- Time Value of Money PDFDocument4 pagesTime Value of Money PDFCalvin SandiPas encore d'évaluation

- Two Dollars Earned: Using Timelines To Visualize Cash FlowsDocument23 pagesTwo Dollars Earned: Using Timelines To Visualize Cash FlowsBella Jean ObaobPas encore d'évaluation

- Compound Interest: You May Wish To Read FirstDocument11 pagesCompound Interest: You May Wish To Read FirstZyhre AustriaPas encore d'évaluation

- Chapter 3 Time Value of MoneyDocument80 pagesChapter 3 Time Value of MoneyMary Nica BarceloPas encore d'évaluation

- Case 3-Case Developing Financial InsightsDocument12 pagesCase 3-Case Developing Financial InsightsfullataniaPas encore d'évaluation

- Time Value of MoneyDocument24 pagesTime Value of MoneyShoaib Ahmed (Lecturer-EE)Pas encore d'évaluation

- What Is The Time Value of MoneyDocument2 pagesWhat Is The Time Value of MoneyFaisal Raheem ParachaPas encore d'évaluation

- Time Value of MoneyDocument3 pagesTime Value of MoneyKajal ChaudharyPas encore d'évaluation

- Valuation Concepts: Time Value of Money: Lesson ObjectivesDocument47 pagesValuation Concepts: Time Value of Money: Lesson ObjectivesTAZWARUL ISLAMPas encore d'évaluation

- Chapter 2 Money Time Relationships and Equivalence 2Document21 pagesChapter 2 Money Time Relationships and Equivalence 2Coreen ElizaldePas encore d'évaluation

- Money, Baking and Financial MarketsDocument14 pagesMoney, Baking and Financial MarketsVladimir BulutPas encore d'évaluation

- Customer Request Form (Front)Document2 pagesCustomer Request Form (Front)noel bandaPas encore d'évaluation

- Module 4 - DepreciationDocument70 pagesModule 4 - DepreciationGaurav ShekharPas encore d'évaluation

- BUS 5110-Project 2 (FINISHED)Document6 pagesBUS 5110-Project 2 (FINISHED)florence shoniwa0% (1)

- NG ModulesDocument19 pagesNG ModuleskevintanyjPas encore d'évaluation

- Worksheet 5-PopulationDocument6 pagesWorksheet 5-PopulationrizPas encore d'évaluation

- Marxist Thought On Imperialism Survey and Critique by Charles A. BaroneDocument238 pagesMarxist Thought On Imperialism Survey and Critique by Charles A. BaroneFernandaPas encore d'évaluation

- Quiz2 3Document5 pagesQuiz2 3Kervin Rey JacksonPas encore d'évaluation

- Practice Problems Econ 101eDocument4 pagesPractice Problems Econ 101eVince Ginno DaywanPas encore d'évaluation

- HW 2.10 - CollocationsDocument4 pagesHW 2.10 - Collocationslongcnttvn1404Pas encore d'évaluation

- Course I - Section I - DR - Kanyarat NimtrakoolDocument58 pagesCourse I - Section I - DR - Kanyarat NimtrakoolJO JENG CHINPas encore d'évaluation

- HRDocument2 pagesHRkiranaPas encore d'évaluation

- Barro 2000 - Inequality and Growth in A Panel of CountriesDocument28 pagesBarro 2000 - Inequality and Growth in A Panel of Countriesbb_tt_AAPas encore d'évaluation

- Transport For London: MR Abdihakim Yusuf Flat 14 Mar House, Springfield Grove London Se7 7Tj United KingdomDocument2 pagesTransport For London: MR Abdihakim Yusuf Flat 14 Mar House, Springfield Grove London Se7 7Tj United Kingdomyabdihakim75Pas encore d'évaluation

- CVC GuidelinesDocument23 pagesCVC Guidelinespritish mandalPas encore d'évaluation

- Peningkatan Kapasitas Pemerintahan Daerah Dalam Proses Masyarakat Ekonomi AseanDocument8 pagesPeningkatan Kapasitas Pemerintahan Daerah Dalam Proses Masyarakat Ekonomi AseanZex CeedPas encore d'évaluation

- Adobe Scan 02-Jul-2022Document4 pagesAdobe Scan 02-Jul-2022Akshita SethiPas encore d'évaluation

- Macroeconomics 9Th Edition Abel Solutions Manual Full Chapter PDFDocument36 pagesMacroeconomics 9Th Edition Abel Solutions Manual Full Chapter PDFjames.coop639100% (12)

- Katalog MetalindoDocument20 pagesKatalog MetalindoGusti EgorPas encore d'évaluation

- Cost AccountingDocument7 pagesCost AccountingShubhamPas encore d'évaluation

- Ehc eDocument2 pagesEhc eAnnonimus 1945Pas encore d'évaluation

- Foreign Exchange Rates (FOREX)Document2 pagesForeign Exchange Rates (FOREX)LSTPas encore d'évaluation

- Autocorrelation-Applied TestsDocument16 pagesAutocorrelation-Applied TestsAnsigar ChuwaPas encore d'évaluation

- HTM 220 Assignment #4Document2 pagesHTM 220 Assignment #4Annie ChoiPas encore d'évaluation

- A Simple Approximation of Tobin's QDocument6 pagesA Simple Approximation of Tobin's Qwxmnxfm57wPas encore d'évaluation

- Case Processing SummaryDocument2 pagesCase Processing SummaryEka MuallimahPas encore d'évaluation