Académique Documents

Professionnel Documents

Culture Documents

Santa Clara County Market Update - September 2011

Transféré par

Gwen WangCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Santa Clara County Market Update - September 2011

Transféré par

Gwen WangDroits d'auteur :

Formats disponibles

SEPTEMBER/OCTOBER 2011

Inside This Issue

Gwen Wang

Keller Williams Realty 505 Hamilton Ave., Ste. 100 Palo Alto, CA 94301 (650) 454-8568 (415) 225-4936 Gwen.Wang@kw.com http://homes-for-sale-PaloAlto-today.com

http://www.MenloRealEstate.com

DRE #01393647

> LOCAL MARKET TRENDS ..................... 1 > MORTGAGE RATE OUTLOOK ............... 2 > HOME STATISTICS .............................. 2 > FORECLOSURE STATS ........................ 3 > CONDO STATISTICS ............................ 3 > ANNUAL TABLES ................................. 4

The Real Estate Report local market trends

SANTA CLARA COUNTY

Where are All the Foreclosures?

With all the pundits talking about phantom For a more complete report on Santa Clara County inventory and the huge surplus of foreclosures, one foreclosures, see the page three article. would expect a massive number of bank-owned MARKET STATISTICS properties to be on the market. Home sales were quite strong in August. The sale They are not. Enquiring minds want to know why of single-family, re-sale homes rose 22.6% from not. July and were up 14.3% year-over-year. Year-todate, home sales are up 0.3%. First, lets look at some numbers. According to http://foreclosureradar.com, the number of bankCondo sales were also strong in August, up 17.6% owned properties, called REOs, in Santa Clara from July and up 17.3% year-over-year. Year-toCounty have averaged about 2,200 for the past date, condo sales are up 11.2%. There have been thirteen months. more condos sold this year than any year since 2007. Yet, in the MLS, only about 220 properties are listed as REO. Now, remember, banks are not in Prices, on the other hand, dipped last month. the real estate business so they wont be selling The median price for homes was down 5.3% yearthese properties themselves. They will be listing over-year. This is the tenth month in a row the them with real estate brokers. median price for homes has been lower than the Which begs the question, why arent the rest of the year before. REOs on the market? The median price for condos was off 13.7% Well, its pretty simple. The banks dont like to lose compared to last August. Thats twelve months in a money. If they put all these properties on the row the median price has been lower than the year market at once, prices would plummet. before. The banks are being very judicious about selling Inventory of both homes and condos continues to their REO property. be weak. Home inventory was down 23.4%

Santa Clara County Homes: Sales Momentum

60.0% 40.0% 20.0%

Trends at a Glance

(Single-family Homes) Aug 11 Jul 11 Aug 10 Median Price: $ 600,000 $ 615,000 $ 633,250 Av erage Price: $ 766,252 $ 793,801 $ 800,957 Home Sales: 992 809 868 Pending Sales: 1,934 2,065 2,027 Inv entory : 2,222 2,405 2,900 Sale/List Price Ratio: 99.3% 99.2% 99.6% Day s on Market: 51 48 42

compared to last August: 2,222 homes actively listed. Please note, only active listings are included in this figure. Numbers from the local associations include properties that are also in a pending status, meaning they have an accepted offer, but havent been taken off the market. Condo inventory was down 34% year-over-year. Please remember, while statistics are nice, they will not determine the price you pay or get for a property. That will come down to you and the buyer or seller.

0 FMAMJ JASOND0 FMAMJ JASOND0 FMAMJ JA SOND0 FMAMJ JA SOND1 FMAMJ JA SOND1 FMAMJ JA 7 8 9 0 1 -20.0% 6 -40.0% -60.0% Sales Pendings Median 2011 rereport.com

0.0%

Gwen Wang | Gwen.Wang@kw.com | (650) 454-8568

The Real Estate Report

Mortgage Rate Outlook

30-Year Fixed Mortgage Rates

07-11 04-11 01-11 10-10 07-10 04-10 01-10 10-09 07-09 04-09 01-09 10-08 07-08 04-08 01-08 10-07 07-07 04-07 01-07 10-06 07-06 04-06 01-06 10-05 07-05 04-05 01-05 3.0%

Sep. 09, 2011 -- Labor Day came and went this week,

and the administration has turned an eye toward one of the two most intractable problems facing the economy: joblessness. The other problem is the poor state of the housing market, and there are some rumors that a new plan may be afoot, either from the administration or perhaps in conjunction with other agencies, to promote a refinance plan for potentially millions of borrowers. The Federal Reserve is thought to be pondering a plan to foster economic growth. Meanwhile, the European debt crisis pressed interest rates down to record lows. HSH.com's broad-market mortgage tracker -- our weekly Fixed-Rate Mortgage Indicator (FRMI) -found that the overall average rate for 30-year fixedrate mortgages decreased by seven basis points (0.07%) from last week, moving to a new record-low average of 4.42%. FHA-backed 30-year fixed-rate mortgages, especially important to first-time homebuyers and low-equity refinancers, have shed a full tenth percentage point. closing the week at just 4.06% Hybrid 5/1 ARMs might interest a few borrowers, with five-year fixed-rate periods slipping by another four basis points this week to average an ultralow 3.13%.

It goes without saying that conforming 30-year FRMs are sporting a new record low, too. The eight basis point decline this week puts the average at 4.23%. There are few signs that the economy is building the kind of momentum needed to significantly lower unemployment, and time is running short on hopes of seeing aggregate GDP growth near 3% for the year. The third quarter comes to a close in just a few weeks' time, and there has been little strength to talk about, but only perhaps less-bad-than-feared figures as growth stumbles along. Anyone looking for a quick fix for the economic woes will need to keep looking. We are years into this mess at this point, and by some reckonings are in much better shape now, relative to both the depths of the mess and many other countries. That said, we are or have been in a near stasis for the recovery for 6-8 months, and the risk of faltering back into recession is a real one at this moment. Low interest rates - whether at new record lows or only near them -- are likely to be with us for a long while yet as these difficult troubles slowly sort themselves out or otherwise come to resolution. Expect more of the same again next week.

4.0%

5.0%

6.0%

7.0%

8.0%

$1,100 $900 $700 $500 $300 $100 0FM AMJJAS OND0FM AMJJAS OND0FM AMJJAS OND0FM AMJJAS OND1FM AMJJAS OND1FM AMJJA 6 7 8 9 0 1

1,100 900 700 500 300 100

Santa Clara County - August 2011

Single-Family Homes

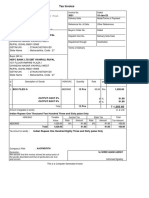

Cities County Campbell Cupertino Gilroy Los Altos Los Altos Hills Los Gatos Milpitas Monte Sereno Morgan Hill Mountain View Palo Alto San Jose Santa Clara Saratoga Sunny v ale Prices Median Average Sales Pend Inven $ 600,000 $ 766,252 992 1,934 2,222 $ 670,000 $ 683,075 22 39 63 $ 1,208,000 $ 1,293,780 23 27 79 $ 405,323 $ 446,273 46 144 132 $ 1,650,000 $ 1,726,670 27 27 47 $ 2,450,000 $ 2,631,520 11 5 40 $ 1,395,000 $ 1,519,890 32 43 114 $ 550,000 $ 571,753 33 57 59 $ 1,660,740 $ 1,660,740 1 4 12 $ 525,000 $ 608,940 51 100 133 $ 996,500 $ 1,038,300 22 29 26 $ 1,380,000 $ 1,546,630 45 33 46 $ 500,000 $ 558,830 540 1,205 1,099 $ 580,000 $ 616,503 50 99 88 $ 1,618,000 $ 1,652,400 29 27 123 $ 783,250 $ 788,701 48 73 86 DOI 67 86 103 86 52 109 107 54 360 78 35 31 61 53 127 54

% Change from Year Before

Prices SP/LP Med Ave Sales Pend2 Inven 99.3% -5.3% -4.3% 14.3% -4.6% -23.4% 98.8% 1.1% -3.7% 22.2% 25.8% -7.4% 100.6% 15.0% 27.9% -23.3% -41.3% -8.1% 99.6% -4.1% 0.7% 21.1% 16.1% 1.5% 98.7% -5.4% -6.1% -3.6% 0.0% -13.0% 96.7% 6.1% -3.6% 22.2% -54.5% -38.5% 97.5% 7.7% 8.0% 23.1% -25.9% -23.5% 99.1% 11.1% 5.5% 26.9% -1.7% -23.4% 97.7% -28.7% -28.7% -50.0% -20.0% -55.6% 98.4% -9.9% -4.7% 50.0% 6.4% -16.4% 100.6% 6.0% 6.0% -18.5% -19.4% -51.9% 107.2% 8.2% 7.9% 28.6% 0.0% -48.9% 98.9% -9.1% -7.6% 13.2% -4.2% -25.7% 99.7% -5.8% 1.2% 56.3% 7.6% -22.1% 98.9% 7.6% -11.4% 0.0% -22.9% -3.9% 99.7% -6.8% 3.1% 4.3% -11.0% -31.7%

Page 2

Single-family Hom e Sales

Median & Average Prices

The chart above shows the National monthly average for 30-year fixed rate mortgages as compiled by HSH.com. The average includes mortgages of all sizes, including conforming, "expanded conforming," and jumbo.

Santa Clara County Homes - Prices & Sales

(3-month moving averageprices in $000's) $1,300 1,300

Santa Clara County Homes: Year-Over-Year Median Price Change

40.0% 30.0% 20.0% 10.0% 0.0% -10.0% -20.0% -30.0% -40.0% -50.0% 0 FMAMJ JASOND0 FMAMJ JASOND0 FMAMJ JASOND0 FMAMJ JA SOND1 FMAMJ JA SOND1 FMAMJ JA 6 7 8 9 0 1

FORECLOSURE STATISTICS

All-in-all, the foreclosure statistics for July, the last month available, are trending in a positive direction. Notices of default, the first step in the foreclosure process, in Santa Clara County dropped 19.7% in July from last July. Notices of sale, which set the date and time of an auction, and serve as the homeowner's final notice before sale, were down 22.4% year-over-year. After the filing of a Notice of Trustee Sale, there are only three possible outcomes. First, the sale can be cancelled for reasons that include a successful loan modification or short sale, a filing error, or a legal requirement to re-file the notice after extended postponements. Alternatively, if the property is taken to sale, the bank will place the opening bid. If a third party, typically an investor, bids more than the bank's opening bid, the

(3-month moving averageprices in $000's) $600 $550 $500 $450 $400 $350 $300 $250 $200 $150 $100 550 500 450 400 350 300 250 200 150 100

Median & Average Prices

property will be sold to the third party; if not, it will go back to the bank and become part of that bank's REO inventory. In June, cancellations were down 32.5% year-overyear, but up 3.8% from June. Properties going back to the bank declined in July by 10.5% compared to last July. They were up 26.7% from June, not a good sign. The total number of homes that have had a notice of default filed declined by 5.8% in July compared to July 2010. The total number of homes scheduled for sale declined by 19.7% year-over-year. The total number of homes owned by the bank was down 3.3% year-over-year.

Santa Clara County Condos- Prices & Sales

Condo Sales

Table Definitions _______________ Median Price

The price at which 50% of prices were higher and 50%were lower.

Average Price

Add all prices and divide by the number of sales.

0FM AMJJASOND0FM AMJJAS OND0FM AMJJAS OND0FM AMJJAS OND1FM AMJJAS OND1FM AMJJA 6 7 8 9 0 1

SP/LP

Santa Clara County - August 2011

Condos/Townhomes

Cities County Campbell Cupertino Gilroy Los Altos Los Gatos Milpitas Morgan Hill Mountain View Palo Alto San Jose Santa Clara Saratoga Sunny v ale $ $ $ $ $ $ $ $ $ $ $ $ $ $ Prices Median Average Sales Pend Inven 300,000 $ 364,470 387 878 734 310,000 $ 354,091 11 23 37 585,000 $ 685,643 7 10 19 160,000 $ 164,000 4 9 1 894,500 $ 928,217 6 1 11 657,000 $ 550,984 7 20 41 225,000 $ 266,742 25 31 19 223,000 $ 230,197 10 17 16 580,000 $ 523,626 31 49 45 687,500 $ 684,692 18 13 19 255,000 $ 295,770 206 578 442 295,000 $ 312,431 37 64 37 930,000 $ 930,000 2 2 8 490,000 $ 452,066 23 61 39 DOI 57 101 81 8 55 176 23 48 44 32 64 30 120 51 SP/LP 98.9% 98.1% 100.7% 100.7% 98.2% 96.9% 99.9% 98.1% 98.9% 100.4% 99.0% 98.1% 96.9% 97.7%

% Change from Year Before

Prices Med Ave -13.7% -2.8% -17.3% -1.5% -12.7% 3.8% -11.3% 4.6% 75.4% 82.0% 11.5% 2.6% -11.8% -5.5% -28.8% -20.9% 14.1% -4.6% -5.2% -8.9% -15.0% -8.7% -10.1% -18.7% 24.0% 30.9% 6.4% -1.5% Sales 17.3% 10.0% -36.4% 33.3% 200.0% 16.7% 108.3% 25.0% 29.2% 350.0% 1.0% 60.9% -33.3% 15.0% Pend2 10.4% -11.5% -37.5% 0.0% -80.0% 42.9% -20.5% -43.3% 6.5% -18.8% 12.0% 42.2% -75.0% 144.0% Inven -34.0% -9.8% -29.6% 0.0% -21.4% -14.6% -59.6% 45.5% -50.5% -50.0% -27.9% -43.1% -57.9% -59.8%

Sales price to list price ratio or the price paid for the property divided by the asking price.

DOI

Days of Inventory, or how many days it would take to sell all the property for sale at the current rate of sales.

Pend

Property under contract to sell that hasnt closed escrow.

Inven

Number of properties actively for sale as of the last day of the month.

Page 3

THE REAL ESTATE REPORT

Santa Clara County Gwen Wang

Keller Williams Realty 505 Hamilton Ave., Ste. 100 Palo Alto, CA 94301 (650) 454-8568 (415) 225-4936 Gwen.Wang@kw.com http://homes-for-sale-PaloAlto-today.com http://www.MenloRealEstate.com

Santa Clara County

Sales Year-to-Date

18,000 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0

2003 2004 2005 2006 Condos 3,546 4,732 4,510 3,563 Homes 8,815 11,427 10,667 8,201

2007 2,967 6,959

2008 1,897 5,875

2009 2,246 7,252

2010 2,446 7,073

2011 2,720 7,097

The Real Estate Market Trends Report is published and copyrighted by http://rereport.com.

Vous aimerez peut-être aussi

- Santa Clara County Market Update - November 2011Document4 pagesSanta Clara County Market Update - November 2011Gwen WangPas encore d'évaluation

- San Mateo County Market Update - November 2011Document4 pagesSan Mateo County Market Update - November 2011Gwen WangPas encore d'évaluation

- Santa Clara County Market Update - October 2011Document4 pagesSanta Clara County Market Update - October 2011Gwen WangPas encore d'évaluation

- San Mateo County Market Update - Septemebr 2011Document4 pagesSan Mateo County Market Update - Septemebr 2011Gwen WangPas encore d'évaluation

- San Mateo County Real Esetate Market Update - Feburary 2011Document4 pagesSan Mateo County Real Esetate Market Update - Feburary 2011Gwen WangPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Pain Handout PDFDocument7 pagesPain Handout PDFPatrick Snell100% (2)

- Ate Mapa PrintDocument10 pagesAte Mapa PrintchosPas encore d'évaluation

- 2015 Saln Form Calvert Miguel - NewDocument2 pages2015 Saln Form Calvert Miguel - NewGina Portuguese GawonPas encore d'évaluation

- Pioneers of Financial Economics:: Contributions Prior To Irving FisherDocument2 pagesPioneers of Financial Economics:: Contributions Prior To Irving Fishersolid9283Pas encore d'évaluation

- Quomundo LTD - Brochure-RevDocument14 pagesQuomundo LTD - Brochure-RevHeryanto GeoPas encore d'évaluation

- Mueller, Socialism and Capitalism in The Work of Max WeberDocument22 pagesMueller, Socialism and Capitalism in The Work of Max Webersima_sociology100% (1)

- 1Document2 pages1Ana AnaPas encore d'évaluation

- CIMB-i - CMP-Murabahah Facility-Agreement - FixedVariable-or-Variable - Eng PDFDocument65 pagesCIMB-i - CMP-Murabahah Facility-Agreement - FixedVariable-or-Variable - Eng PDFBannupriya VeleysamyPas encore d'évaluation

- Writing Business Proposals, Business Plan and Case ReportsDocument47 pagesWriting Business Proposals, Business Plan and Case ReportsAbhishek Agarwal100% (2)

- Macro Economics NotesDocument6 pagesMacro Economics NotesPrastuti SachanPas encore d'évaluation

- Shoaib Akhtar Assignment-1 Marketting Research On Mochari Shoes BrandDocument5 pagesShoaib Akhtar Assignment-1 Marketting Research On Mochari Shoes BrandSHOAIB AKHTARPas encore d'évaluation

- Company First Name Last Name Job TitleDocument35 pagesCompany First Name Last Name Job Titleethanhunt3747Pas encore d'évaluation

- Pouring Concrete 1floorDocument2 pagesPouring Concrete 1floorNimas AfinaPas encore d'évaluation

- Tubo FSDocument7 pagesTubo FSdemonjoePas encore d'évaluation

- 2022 KOICA SP Fellows GuidebookDocument34 pages2022 KOICA SP Fellows Guidebookhamzah0303Pas encore d'évaluation

- Marketing Research 1Document7 pagesMarketing Research 1Arpita MehtaPas encore d'évaluation

- 3051 Revised DateDocument1 page3051 Revised DateElla and MiraPas encore d'évaluation

- Nestle SAdfdfdfDocument15 pagesNestle SAdfdfdfJan Uriel DavidPas encore d'évaluation

- Mayank CV Square YardDocument3 pagesMayank CV Square YardNeelesh PandeyPas encore d'évaluation

- Daftar PustakaDocument14 pagesDaftar Pustakadudul12Pas encore d'évaluation

- Rural Development SyllabusDocument2 pagesRural Development Syllabustrustme77Pas encore d'évaluation

- Asta Chemical Company ProfileDocument9 pagesAsta Chemical Company ProfileNura Alam SiddiquePas encore d'évaluation

- Rural Marketing FMCG Product Hindustan Unilever Limited: Master of Business Administration (MBA) Session 2019-20Document6 pagesRural Marketing FMCG Product Hindustan Unilever Limited: Master of Business Administration (MBA) Session 2019-20Amit SinghPas encore d'évaluation

- Accountancy Question BankDocument146 pagesAccountancy Question BankSiddhi Jain100% (1)

- Bid Doc For Petrol PumpDocument5 pagesBid Doc For Petrol PumpMianZubairPas encore d'évaluation

- Advertising ReviewerDocument4 pagesAdvertising Reviewerbench karl bautistaPas encore d'évaluation

- HP Planning PDFDocument20 pagesHP Planning PDFMD. Asiqur RahmanPas encore d'évaluation

- Financial DerivativesDocument2 pagesFinancial Derivativesviveksharma51Pas encore d'évaluation

- Homework P4 4ADocument8 pagesHomework P4 4AFrizky Triputra CahyahanaPas encore d'évaluation

- LEAN Production or Lean Manufacturing or Toyota Production System (TPS) - Doing More With Less (Free Business E-Coach)Document4 pagesLEAN Production or Lean Manufacturing or Toyota Production System (TPS) - Doing More With Less (Free Business E-Coach)Amanpreet Singh AroraPas encore d'évaluation