Académique Documents

Professionnel Documents

Culture Documents

The Insurance Regulatory and Development Authority

Transféré par

Kaushik DharDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Insurance Regulatory and Development Authority

Transféré par

Kaushik DharDroits d'auteur :

Formats disponibles

The Insurance Regulatory and Development Authority (IRDA) Reforms were initiated with the passage of Insurance Regulatory

and Development Authority (IRDA) Bill in 1999. IRDA was set up as an independent regulatory authority, which has put in place regulations in line with global norms. IRDA has been framing regulations and registering the private sector insurance companies. It launched of the IRDA online service for issue and renewal of licenses to agents. So far, there are 13 life insurance companies and 14 general insurance companies. Premium rates of most general insurance policies come under the purview of the government appointed Tariff Advisory Committee. Powers, Duties & Functions of IRDA The IRDA Act, 1999 lays down the duties, powers and functions of IRDA. The Authority shall have the duty to regulate, promote and ensure orderly growth of the insurance business and re-insurance business. The powers and functions of the Authority shall include, (a) issue to the applicant a certificate of registration, renew, modify, withdraw, suspend or cancel such registration; (b) protection of the interests of the policy holders in matters concerning assigning of policy, nomination by policy holders, insurable interest, settlement of insurance claim, surrender value of policy and other terms and conditions of contracts of insurance; (c) specifying requisite qualifications, code of conduct and practical training for intermediary or insurance intermediaries and agents; (d) specifying the code of conduct for surveyors and loss assessors; (e) promoting efficiency in the conduct of insurance business; (f) promoting and regulating professional organisations connected with the insurance and re-insurance business; (g) levying fees and other charges ; (h) calling for information from, undertaking inspection of, conducting enquiries and investigations including audit of the insurers, intermediaries, insurance intermediaries and other organisations connected with the insurance business; (i) control and regulation of the rates, advantages, terms and conditions that may be offered by insurers in respect of general insurance business not so controlled and regulated by the Tariff Advisory Committee (j) specifying the form and manner in which books of account shall be maintained and statement of accounts shall be rendered by insurers and other insurance intermediaries; (k) regulating investment of funds by insurance companies; (l) regulating maintenance of margin of solvency; (m) adjudication of disputes between insurers and intermediaries or insurance intermediaries; (n) supervising the functioning of the Tariff Advisory Committee; (o) specifying the percentage of premium income of the insurer to finance schemes for promoting and regulating professional organisations engaged in insurance and reinsurance business; (p) specifying the percentage of life insurance business and general insurance business to be undertaken by the insurer in the rural or social sector; and (q) exercising such other powers as may be prescribe.

Vous aimerez peut-être aussi

- Duties of IrdaDocument2 pagesDuties of IrdaShanky Dhamija100% (1)

- DutiesDocument1 pageDutiessumit_pPas encore d'évaluation

- Role & Function of IRDADocument2 pagesRole & Function of IRDAadityavik67% (6)

- Development Authority Act, 1999 and Duly Passed by The Government of IndiaDocument2 pagesDevelopment Authority Act, 1999 and Duly Passed by The Government of IndiaNancygirdherPas encore d'évaluation

- Insurance Regulatory and Development AuthorityDocument3 pagesInsurance Regulatory and Development AuthorityDeepak SharmaPas encore d'évaluation

- Role and Functions of IRDADocument2 pagesRole and Functions of IRDAEknath BirariPas encore d'évaluation

- Development Authority (IRDA) Is A National Agency of The: Government of India HyderabadDocument5 pagesDevelopment Authority (IRDA) Is A National Agency of The: Government of India HyderabadSwarna RajpootPas encore d'évaluation

- Duties and Power of IRDAIDocument6 pagesDuties and Power of IRDAISaurabh ChaudhariPas encore d'évaluation

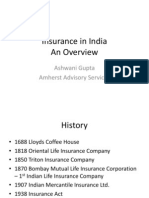

- Insurance in India An Overview: Ashwani Gupta Amherst Advisory ServicesDocument10 pagesInsurance in India An Overview: Ashwani Gupta Amherst Advisory ServicesRupam PatelPas encore d'évaluation

- 1863 - Duties, Powers and Functions of IRDADocument2 pages1863 - Duties, Powers and Functions of IRDARakshaPas encore d'évaluation

- Institute of Management Studies Davv Indore Mba (Financial Administration) Ii ND Semester - Fa 303C Insurance and Bank ManagementDocument2 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Ii ND Semester - Fa 303C Insurance and Bank ManagementjaiPas encore d'évaluation

- Expectations: Duties, Powers and Functions of IRDADocument3 pagesExpectations: Duties, Powers and Functions of IRDAAlnoor PujaniPas encore d'évaluation

- Insurance Regulatory and Development Authority (Irda) : A Law of Insurance Project OnDocument5 pagesInsurance Regulatory and Development Authority (Irda) : A Law of Insurance Project OnAnju PanickerPas encore d'évaluation

- Role of IrdaDocument6 pagesRole of IrdaSanjiv DhirPas encore d'évaluation

- IRDA Regulation Relating To General InsuranceDocument14 pagesIRDA Regulation Relating To General InsurancerahulhaldankarPas encore d'évaluation

- IrdaDocument15 pagesIrdaNitesh SudanPas encore d'évaluation

- Q. 15 Insurance Regulatory and Development AuthorityDocument2 pagesQ. 15 Insurance Regulatory and Development AuthorityMAHENDRA SHIVAJI DHENAKPas encore d'évaluation

- The Irda ActDocument3 pagesThe Irda ActAdeel RahmanPas encore d'évaluation

- Mulund College of CommerceDocument11 pagesMulund College of CommerceashwitaPas encore d'évaluation

- IRDADocument21 pagesIRDAJyoti SukhijaPas encore d'évaluation

- Section 14 of IRDA Act, 1999 Lays Down The Duties, Powers and Functions of IRDA.Document2 pagesSection 14 of IRDA Act, 1999 Lays Down The Duties, Powers and Functions of IRDA.Mohan RaviPas encore d'évaluation

- 6 IRDADocument23 pages6 IRDASudha AgarwalPas encore d'évaluation

- IRDADocument17 pagesIRDAHemant DeshmukhPas encore d'évaluation

- Irda (Insurance Regulatory & Development Authority)Document20 pagesIrda (Insurance Regulatory & Development Authority)harishkoppalPas encore d'évaluation

- Insurance Regulatory Authority Act ExplainedDocument6 pagesInsurance Regulatory Authority Act ExplainedTitus ClementPas encore d'évaluation

- IRDADocument2 pagesIRDAJIYA DOSHIPas encore d'évaluation

- PIB - IRDA and Its RoleDocument11 pagesPIB - IRDA and Its Roleamittaneja28Pas encore d'évaluation

- IRDADocument45 pagesIRDAGeetika Srivastava100% (2)

- Unit - V Banking and Insurance Law Study NotesDocument4 pagesUnit - V Banking and Insurance Law Study NotesSekar M KPRCAS-CommercePas encore d'évaluation

- Calss PresentationDocument6 pagesCalss PresentationKasiPas encore d'évaluation

- Insurance Law Notes RnDocument84 pagesInsurance Law Notes RnRudraksh NagarPas encore d'évaluation

- Review of Literature on ING Vysya Life Insurance Unit Linked PlansDocument63 pagesReview of Literature on ING Vysya Life Insurance Unit Linked PlansAnkit JainPas encore d'évaluation

- Duties and ObligationsDocument4 pagesDuties and ObligationsSaurabh AgrawalPas encore d'évaluation

- The Insurance Act 1938Document26 pagesThe Insurance Act 1938Rahul Kumar80% (5)

- Topic 8 Legal IssuesDocument106 pagesTopic 8 Legal IssuesM S A B D A L L A H ?Pas encore d'évaluation

- IrdaDocument18 pagesIrdaPankajPas encore d'évaluation

- IRDA Act 1999 regulates Indian insuranceDocument19 pagesIRDA Act 1999 regulates Indian insuranceVinayak BhardwajPas encore d'évaluation

- Important Role of IRDA in The Insurance Sector in IndiaDocument2 pagesImportant Role of IRDA in The Insurance Sector in Indiashaheera banuPas encore d'évaluation

- Guidelines For The Regulation of Insurance Brokers in Nigeria ZERO DRAFT 27.06.2018Document90 pagesGuidelines For The Regulation of Insurance Brokers in Nigeria ZERO DRAFT 27.06.2018Gabriel EtimPas encore d'évaluation

- Role of IRDA in Life Insurance SectorDocument1 pageRole of IRDA in Life Insurance SectorKeerthana MadhavanPas encore d'évaluation

- IRDA Act, 1999: Presentation OnDocument58 pagesIRDA Act, 1999: Presentation Ondeepakarora201188Pas encore d'évaluation

- IrdaDocument10 pagesIrdafundoo16Pas encore d'évaluation

- IRDADocument11 pagesIRDAkhrn_himanshuPas encore d'évaluation

- Regulatory authorities deal with market failureDocument4 pagesRegulatory authorities deal with market failurekeytwokuuPas encore d'évaluation

- Insurance Basics & Banking ReformsDocument44 pagesInsurance Basics & Banking ReformsnamanPas encore d'évaluation

- Chapter 4: Regulation of Insurance Industry in UgandaDocument15 pagesChapter 4: Regulation of Insurance Industry in UgandaHarris YIGPas encore d'évaluation

- Insurance Authority in Abu Dhabi, UAEDocument68 pagesInsurance Authority in Abu Dhabi, UAEahmadbilalPas encore d'évaluation

- IRDA - Role, Objectives and Functions of Insurance RegulatorDocument6 pagesIRDA - Role, Objectives and Functions of Insurance RegulatorRohitPas encore d'évaluation

- IRDA Act ExplainedDocument5 pagesIRDA Act ExplainedSuraj ChandraPas encore d'évaluation

- The Relevance of Insurance Regulatory Authority of India in The Indian Insurance Sector IDocument12 pagesThe Relevance of Insurance Regulatory Authority of India in The Indian Insurance Sector IVaijayanti SharmaPas encore d'évaluation

- Insurance Regulatory and Development Authority (IRDA)Document4 pagesInsurance Regulatory and Development Authority (IRDA)Chandini KambapuPas encore d'évaluation

- IRDA Act SummaryDocument67 pagesIRDA Act SummaryVirendra JhaPas encore d'évaluation

- Insurance Regulatory and Development AuthorityDocument12 pagesInsurance Regulatory and Development AuthorityVipin JacobPas encore d'évaluation

- Optimizing Sales and Distribution of MilkDocument70 pagesOptimizing Sales and Distribution of MilkRavi Shankar SharmaPas encore d'évaluation

- Insurance Management AssignmentDocument9 pagesInsurance Management AssignmentRavindra SharmaPas encore d'évaluation

- IRDAI's Role and FunctionsDocument5 pagesIRDAI's Role and FunctionsKirti ChotwaniPas encore d'évaluation

- Irda Act 1999Document7 pagesIrda Act 1999Bhawana SharmaPas encore d'évaluation

- Principles of Insurance Law with Case StudiesD'EverandPrinciples of Insurance Law with Case StudiesÉvaluation : 5 sur 5 étoiles5/5 (1)

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5D'EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Pas encore d'évaluation

- Limba Engleză - Exercise+2Document4 pagesLimba Engleză - Exercise+2Andreea ElenaPas encore d'évaluation

- Maritime Montering PDFDocument52 pagesMaritime Montering PDFSilvia GeorgianaPas encore d'évaluation

- Administrative Discretion and Judicial Review: Project OnDocument14 pagesAdministrative Discretion and Judicial Review: Project OnIzaan RizviPas encore d'évaluation

- Bago City College: Rafael Salas Drive, Brgy Balingasag, Bago City, Negros Occidental 6101Document6 pagesBago City College: Rafael Salas Drive, Brgy Balingasag, Bago City, Negros Occidental 6101marvsPas encore d'évaluation

- Investigatory Project in EnglishDocument13 pagesInvestigatory Project in EnglishLawl R100% (1)

- Non Congnizable Report Punch PrabhakarDocument3 pagesNon Congnizable Report Punch PrabhakarVenkat VelagapudiPas encore d'évaluation

- Supreme Student Governemnt Election Guidelines For S.Y. 2021 2022-2-1 1 REVISEDDocument18 pagesSupreme Student Governemnt Election Guidelines For S.Y. 2021 2022-2-1 1 REVISEDTesda SfistPas encore d'évaluation

- Hand Book HR PDFDocument332 pagesHand Book HR PDFedrialdePas encore d'évaluation

- Documents Requisition Form Blank FINALDocument1 pageDocuments Requisition Form Blank FINALdidid2Pas encore d'évaluation

- 2022 Blue Notes Labor LawDocument229 pages2022 Blue Notes Labor LawGrace Ann Tamboon100% (1)

- Pacquiao Owns Land With Fake Titles in SaranganiDocument1 pagePacquiao Owns Land With Fake Titles in SaranganiJorel Andrew FlautaPas encore d'évaluation

- CONWORLD - Global City, Demography, MigrationDocument7 pagesCONWORLD - Global City, Demography, Migrationbea mariePas encore d'évaluation

- Office of The Punong Barangay: Republic of The Philippines Province of Ilocos Norte City of BatacDocument3 pagesOffice of The Punong Barangay: Republic of The Philippines Province of Ilocos Norte City of BatacLiza de los SantosPas encore d'évaluation

- The Constitution and by Laws of CJSC SNMCDocument8 pagesThe Constitution and by Laws of CJSC SNMCJheann lojaPas encore d'évaluation

- WK 3 PPT Statement of Advice Development UpdatedDocument39 pagesWK 3 PPT Statement of Advice Development UpdatedLore DragonPas encore d'évaluation

- Accident waiver and release formDocument1 pageAccident waiver and release formMike Franks100% (3)

- Clinical Legal Education: Bridging the Gap Between Theory and PracticeDocument10 pagesClinical Legal Education: Bridging the Gap Between Theory and PracticeNaman KhannaPas encore d'évaluation

- Lups-Montelibano Vs Bacolod Murcia MillingDocument2 pagesLups-Montelibano Vs Bacolod Murcia MillingAllenPas encore d'évaluation

- Reproductive Health LawsDocument31 pagesReproductive Health LawsMaurice OlivaresPas encore d'évaluation

- Zero Build Cups - Chapter 4 Season 1 Official RulesDocument16 pagesZero Build Cups - Chapter 4 Season 1 Official Rulescosmin moraruPas encore d'évaluation

- University of Sierra Leone: (Fourah Bay College)Document10 pagesUniversity of Sierra Leone: (Fourah Bay College)David Sahr KamandaPas encore d'évaluation

- OracleDocument54 pagesOracleChakravarthiVedaPas encore d'évaluation

- Engleza Fisa RezolvataDocument4 pagesEngleza Fisa RezolvataOana Maria BasPas encore d'évaluation

- Agreement For BGVB Mortgage LoanDocument6 pagesAgreement For BGVB Mortgage LoanBiswajit DasPas encore d'évaluation

- Civil Rights Complaint Against Prison OfficialsDocument11 pagesCivil Rights Complaint Against Prison OfficialsD100% (1)

- Central Bank of IndiaDocument58 pagesCentral Bank of IndiaAkash PawaskarPas encore d'évaluation

- English 12 Unit 1 - 5Document26 pagesEnglish 12 Unit 1 - 5L. HanaPas encore d'évaluation

- 20 Castillo vs. Republic, GR. No. 214064, Feb. 6, 2017Document2 pages20 Castillo vs. Republic, GR. No. 214064, Feb. 6, 2017Gloria, Melica Ina V.Pas encore d'évaluation

- RPH Taxation ReportDocument38 pagesRPH Taxation ReportLois SabadoPas encore d'évaluation

- PPSD 1693837801Document7 pagesPPSD 1693837801Tanu RathiPas encore d'évaluation