Académique Documents

Professionnel Documents

Culture Documents

September 2011 Forest & Trees Report

Transféré par

Henry BeckerCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

September 2011 Forest & Trees Report

Transféré par

Henry BeckerDroits d'auteur :

Formats disponibles

Becker Advisory Services

Issue 4

Forest & Trees

report September, 2011 In this issue:

FOREST What is it? Liar or stupid Charting the Forest TREES Cartel Fire insurance Charting the Trees DISCLAIMER What is it? Making a molehill out of a mountain - me

If you read the papers or watch the talking heads on business news stations one would think that things are not so bad. Let me start by saying, by nature, I am not a doom and gloom person. But, the current environment leaves me with no other emotion other than concern. Keep in mind my concerns cross many levels. My rst level of concern is for my kids futures, followed by my clients, myself and all Americans. Here is a list of paraphrased headlines in the last few weeks: Food stamp use in US reaches record high of 43 million people (14% of population) Greece on the verge of actual default Euro zone being torn apart at the seems Big banks paying record bonuses Unemployment still stubbornly at 9.1% Interest rates to remain low until 2013 China (rest of emerging world) ghting price ination Switzerland pegs their currency to Euro Economy growing at anemic levels Money supply has exploded 300% in three years External US debt is larger than any other country that has defaulted US Congress at loggerheads over budget decit US consumer condence at lows Housing still a disaster Corporate leverage is at pre-Lehman Brothers collapse highs So, when I read an article or hear a talking head shining the light on a day or multi-day move in stocks I cannot help but think about a molehill is being made out of a mountain of bad news. In my mind it is of absolute importance to not forget that the US economy and the European economy is in worse shape than it was in 2008. All the while western governments are loading more debt on top of bad debt in the midst of growing moral hazards. Lets call a mountain a mountain. Lets call a bust country a bust country. And, for Petes sake lets bury the dead banks they are just stinking up the joint now.

To subscribe to this report:

Click here to sign up

In addition to this report you will also receive Becker Advisory Services Weekly Market Commentary.

We will not spam your inbox.

Click here for our privacy policy

BeckerAdvisory.com

Becker Advisory Services

Issue 4

LIAR OR STUPID

As I watched the republican debate recently I was struck by the exceedingly uninformed comments by Mitt Romney and Herman Cain about the Federal Reserve. ...We recognize that we need to have a Fed. Why do I say that? Because if we dont have a Fed whos gonna run the currency? Congress, I am not in favor of that. - Mitt Romney For many, many decades the Fed did its job when it was singularly focused on sound money. -Herman Cain I contend that both are either liars or to stupid to know the truth. The sad reality is most politicians agree with Romney and Cain. They must try to understand that the Fed is the problem; they create ination and we (Americans) ask them to x the very problems they create. Below I will outline why we do not need a Fed. Here is Fed Chairman Bernankes answer to the question of whether the Feds policies have reduced Americans standard of living? First, I should start by saying that the Secretary of the Treasury, of course, is the spokesperson for U.S. policy on the dollar and Secretary Geithner had some words yesterday. Let me just add to what he said, rst, by saying that the Federal Reserve believes that a strong and stable dollar is both in American interest and in the interest of the global economy. There are many factors that cause the dollar to move up and down over short periods of time. But over the medium term, where our policy is aimed, were doing two things. First, we are trying to maintain low and stable ination by our denition of price stability by maintaining the purchasing value of the dollar, keeping ination low. Have a peek at the charts on the following page and tell me if you think Dr. Bernanke is lying or too stupid to know what is happening. I do not think Dr. Bernanke is stupid. It is quite clear from the charts below that the Fed is not providing for a strong dollar, low ination or price stability. Below is a quote from Murray Rothbards brilliant book The Case Against the Fed. The Fed and the banks are not part of the solution to ination; they are instead part of the problem. In fact, they are the problem. The American economy has suffered from chronic ination, and from destructive booms and busts, because that ination has been invariably generated by the Fed itself. That role, in fact, is the very purpose of its existence: to cartelize the private commercial banks, and to help them inate money and credit together, pumping in reserves to the banks, and bailing them out if they get into trouble. When the Fed was imposed upon the public by the cartel of big banks and their hired economists, they told us that the Fed was needed to provide needed stability to the economic system. After the Fed was founded, during the 1920s, the Establishment economists and bankers proclaimed that the American economy was now in a marvelous New Era, an era in which the Fed, employing its modern scientic tools, would stabilize the monetary system and eliminate any future business cycles. The result: it is undeniable that, ever since the Fed was visited upon us in 1914, our inations have been more intense, and our depressions far deeper, than ever before. Not much more I can add beyond Mr. Rothbards comments. Well, I can add the charts below that prove the Fed has neither controlled ination, rather created it and has not maintained the dollars value.

BeckerAdvisory.com

Becker Advisory Services

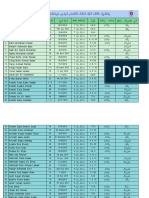

CHARTING THE FOREST

Issue 4

BeckerAdvisory.com

Becker Advisory Services

Issue 4

CARTEL Cartel - a combination of independent commercial enterprises designed to limit competition or x prices

More and more it is hard for me to not think that we no longer live in a democracy but perhaps in a Cartocracy which is my made up word for (Cartel - Democracy). I will give you a glaring example of a massive cartel that operates in the United States - The Fed. To understand the Feds cartel nature we have to visit history. The Federal Reserve Act of December 23, 1913, was part and parcel of the wave of Progressive legislation, on local, state, and federal levels of government, that began about 1900. Progressivism was a bipartisan movement which, in the course of the rst two decades of the twentieth century, transformed the American economy and society from one of roughly laissez-faire to one of centralized statism. - Murray Rothbard - The Origins of the Federal Reserve Until the 1960s most people believed that Progressivism (what ushered in many government agencies in the early 1900s) was rooted in an uprising of workers who were led by seless leaders with the goal of toppling the ever expanding monopolistic big businesses. Wrong! In fact, that is how it was sold but in reality it did just the opposite of the sales pitch. What really happened was big businesses were growing weary of failed attempts to create cartels. The failures were due to competition from below. The rst run at cartels was in the railroads then again in big industry. Big businesses quickly gured out they needed some help in establishing a cartel economy in order to retain dominance and high prots. That help would come from the powers of government. But, how could businesses get the laissez-faire centered American public to go along? Simple, regulatory commissions were lobbied for and staffed by bigbusiness men from the regulated industries in the name of controlling the big business monopolies. The banking system of the United States after 1865 was between free and central banking. Banking was supported and controlled by a handful of large Wall Street banks. There was no governmental, central bank to act as the lender of last resort. The banks could inate the money supply, but when they got into trouble the booms turned into recessions. The banks were forced to contract the money supply or deate to save themselves. Lets turn our attention to the world of money in the early 20th century. The early 20th century political economy was driven by the JP Morgan group and the Rockefellers. Although the Morgans and Rockefellers were on different sides of the political isle they agreed that they both wanted monetary reform in particular a central bank. Both claimed to want to be able to increase the elasticity of money meaning expanding money and credit especially during recessions. The call for reform got louder after the Financial Panic of 1907. The question was how to get the public on board with the idea of a central bank. In the following years the country was groomed with speeches and articles about the need for a central bank. On September 22, 1909 the Wall Street Journal ran a 14 part series called a Central Bank of Issue. Only problem with the articles was that they were penned by Charles A. Conant a leading government propagandist with the National Monetary Commission (NMC). The speeches and writing continued and the propaganda heated up to be complete with polls being presented by Paul M. Warburg (a partner at the then powerful New York Banking house of Kuhn, Loeb & Co.) that showed ...60% of the nations bankers favored a central bank provided it was not controlled by Wall Street or any other monopolistic interest. BeckerAdvisory.com 4

Becker Advisory Services

Issue 4

Warburg was a tireless cheerleader for a Central Reserve Bank like the one in Germany at the time. The key for Warburg was that the reserve bank should have a monopoly on all note issues (dollars). To obtain the notes (dollars) the banks would have to keep their reserves at the Central Reserve Bank. The Fed is coming Rhode Island Senator Nelson Aldrich was father-in-law of John D. Rockefeller. Aldrich was Rockefellers man in the senate and was the man in government that made the nal and successful push for a central bank. Nelson surrounded himself with the whos who of nance of the day from both the Rockefeller camp and Morgan camp. Back to Rothbards The Origin of the Federal Reserve: On November 22, 1910, Senator Aldrich, with a handful of companions, set forth in a privately chartered railroad car from Hoboken, New Jersey to the coast of Georgia, where they sailed to an exclusive retreat, the Jekyll Island Club. Facilities for their meeting were arranged by club member and co-owner J. P. Morgan. The cover story released to the press was that this was a simple duck-hunting expedition, and the conferees took elaborate precautions on the trips there and back to preserve their secrecy. Thus, the attendees addressed each other only by rst name, and the railroad car was kept dark and closed off from reporters or other travelers on the train. One reporter apparently caught on to the purpose of the meeting, but was in some way persuaded by Henry P. Davison to maintain silence. The conferees worked for a solid week at Jekyll Island to hammer out the draft of the Federal Reserve bill. In addition to Aldrich, the conferees included Henry P. Davison, Morgan partner; Paul Warburg; Frank A. Vanderlip, vice president of the National City Bank of New York; and nally, A. Piatt Andrew, head of the NMC staff, who had recently been made assistant secretary of the treasury by President Taft. In the end the nancial elites of the day were successful in driving through the Federal Reserve System to establish a cartel that would allow the national banks to inate the money supply in a coordinated fashion. Also, it protected banks from depositors demanding cash when the money supply was expanded too far (read as bank runs). The side affects were also the control the money supply, minimize competition from state banks and to ultimately bring the state banks under control. Take away Seems to me that by denition the Fed is a banking cartel as they control the money supply for a group of independent commercial enterprises. As for elasticity of the money supply we have not seen that. The only thing the Fed knows how to do is inate the money supply. Bernanke himself has taken the country to the steps of hell to avoid deating the money supply. Finally, the Fed was supposed to usher in stability of the money supply and limit the expansion of the money supply by member banks. Instead what we have realized is the Fed creates ination and has wrecked the currency. The lesson I take away from this small exercise in governmental entities is that they are all set to serve a purpose other than society or the greater good. In fact, they are set up to maintain cartels for big business.

BeckerAdvisory.com

Becker Advisory Services

Issue 4

FIRE INSURANCE

Moral hazard is still running wild all around us. One of the worst of those hazards come in the form of credit default swaps (CDS). A CDS is moral hazard at its nest. These highly destructive instruments were conceived of and developed by none other than JP Morgan Co. in the 1990s. Worse yet they were conceived of and developed by a woman named Blythe Masters who just so happens to be the head of Global Commodities for JP Morgan. Recall that JP Morgan is the single largest entity manipulating the metals market. Any one seeing a pattern of evil spewing from JP Morgan? CDS dened A credit default swap is similar to a typical insurance policy in that it obliges the seller to pay the buyer in the event of a loan default. The only signicant difference between a CDS and a typical insurance policy is that the buyer does not have to have an insurable interest in the loan. This difference is where CDS can and are exploited. CDS in the real world Lets say the ctitious Greedman Bank (GB) is our example. Greece comes looking for a loan from GB. GB goes over the books and notes that the country is swimming in debt and is not really credit worthy. So, instead of turning them away GB creates some clever ways to hide the debt which makes Greece appear to be credit worthy. GB then offers up some credit to Greece. Other lenders are no dummies they know that Greece is less than credit worthy so they buy CDSs to make some money in the event of a Greek default. Worse than that GB buys CDSs to insure their loan. From this we can see that GB has an insurable interest since they made the loan but all the other banks have no interest in the transaction other than prot. The really egregious act comes from GB who knew that Greece was a bad risk and the likelihood of default was high and the likelihood got even higher the more credit they extended to Greece. This is like blowing up a balloon; the more air you put in the closer to an explosion. To add insult to injury GB insures two times the amount lent. So, GB would prot from Greeces failure. Remember anyone can buy a CDS against Greece. If you buy a CDS against Greeces default you are hoping for the default. So, as you can see these unregulated, shadowed investment products create a moral hazard the likes of which the world does not need. One expert in the area has been quoted as saying a CDSs are like buying re insurance on your neighbors house. Why It is a certainty that if you control a countrys debt and or money you control the country. When you are owed money you are in control of the debtors nances up to the amount they owe you. So, if you lend to someone up to the level of their assets then you can control their assets or take their assets. Is it any surprise that Greece is being asked to sell national assets to settle up their debts? Also, do you think the creditors did not have this in mind when they loaned a bankrupt country more money?

BeckerAdvisory.com

Becker Advisory Services

Issue 4

CHARTING THE TREES - A little humor this time around. At this point we need it.

BeckerAdvisory.com

Becker Advisory Services

Issue 4

DISCLAIMERS

Investing involves substantial risk. Becker Advisory Services (BAS) makes no guarantee or other promise as to any results that may be obtained from their views. No reader should make any investment decision without rst consulting his or her own personal nancial advisor and conducting his or her own research and due diligence, including carefully reviewing the prospectus and other public lings of the issuer. To the maximum extent permitted by law, BAS disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations in the update prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. The information provided in the report is obtained from sources which BAS believes to be reliable. However, BAS has not independently veried or otherwise investigated all such information. BAS does not guarantees the accuracy or completeness of any such information. The commentary, analysis, opinions, advice and recommendations represent the personal and subjective views of the BAS, and are subject to change at any time without notice. The report is not a solicitation or offer to buy or sell any securities.

BeckerAdvisory.com

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- 7wonders ZeusDocument18 pages7wonders ZeusIliana ParraPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Biology 31a2011 (Female)Document6 pagesBiology 31a2011 (Female)Hira SikanderPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Final Seniority List of HM (High), I.s., 2013Document18 pagesFinal Seniority List of HM (High), I.s., 2013aproditiPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Design of Swimming Pool PDFDocument21 pagesDesign of Swimming Pool PDFjanithbogahawatta67% (3)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Eicher HR PoliciesDocument23 pagesEicher HR PoliciesNakul100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Consolidated Terminals Inc V Artex G R No L 25748 PDFDocument1 pageConsolidated Terminals Inc V Artex G R No L 25748 PDFCandelaria QuezonPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- SheenaDocument5 pagesSheenamahamed hassan kuusoowPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Ifm 8 & 9Document2 pagesIfm 8 & 9Ranan AlaghaPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Chapter 11: Re-Situating ConstructionismDocument2 pagesChapter 11: Re-Situating ConstructionismEmilio GuerreroPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Depreciated Replacement CostDocument7 pagesDepreciated Replacement CostOdetteDormanPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Integrative Assessment OutputDocument2 pagesIntegrative Assessment OutputRonnie TambalPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Open Quruan 2023 ListDocument6 pagesOpen Quruan 2023 ListMohamed LaamirPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Political Conditions in ArabiaDocument11 pagesPolitical Conditions in ArabiaAsad Malik100% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Budo Hard Style WushuDocument29 pagesBudo Hard Style Wushusabaraceifador0% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Developing A Business Plan For Your Vet PracticeDocument7 pagesDeveloping A Business Plan For Your Vet PracticeMujtaba AusafPas encore d'évaluation

- Rakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)Document2 pagesRakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)HRD CORP CONSULTANCYPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- UAS English For Acc - Ira MisrawatiDocument3 pagesUAS English For Acc - Ira MisrawatiIra MisraPas encore d'évaluation

- Republic Act No. 9775 (#1)Document6 pagesRepublic Act No. 9775 (#1)Marc Jalen ReladorPas encore d'évaluation

- Before The Judge - Roger EDocument26 pagesBefore The Judge - Roger ELexLuther1776100% (4)

- Travisa India ETA v5Document4 pagesTravisa India ETA v5Chamith KarunadharaPas encore d'évaluation

- Albanian DialectsDocument5 pagesAlbanian DialectsMetaleiroPas encore d'évaluation

- CDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)Document2 pagesCDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)NASEER AHMAD100% (1)

- CHAPTER 1 - 3 Q Flashcards - QuizletDocument17 pagesCHAPTER 1 - 3 Q Flashcards - Quizletrochacold100% (1)

- CT 1 - QP - Icse - X - GSTDocument2 pagesCT 1 - QP - Icse - X - GSTAnanya IyerPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Philippine Literature During Spanish ColonizationDocument4 pagesPhilippine Literature During Spanish ColonizationCharisel Jeanne CasalaPas encore d'évaluation

- A Brief Ion of OrrisaDocument27 pagesA Brief Ion of Orrisanitin685Pas encore d'évaluation

- Final WorksheetDocument13 pagesFinal WorksheetAgung Prasetyo WibowoPas encore d'évaluation

- History and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFDocument1 124 pagesHistory and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFOmkar sinhaPas encore d'évaluation

- Unit Test 11 PDFDocument1 pageUnit Test 11 PDFYOPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Power of Attorney UpdatedDocument1 pagePower of Attorney UpdatedHitalo MariottoPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)