Académique Documents

Professionnel Documents

Culture Documents

Rogue Trader

Transféré par

Nehal VoraDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Rogue Trader

Transféré par

Nehal VoraDroits d'auteur :

Formats disponibles

CASE STUDY BARINGS BANK AND ITS ROGUE TRADER Barings Bank background: Barings Bank plc was

a British bank and previously as a merchant banker it was known as Baring Brothers & Co. It was one of the oldest merchant banks in Britain having been founded in the year 1762. As a bank, it was much respected in the United Kingdom and had a long history of successful merchant banking operations. The bank in fact, maintained close business relationship with British monarchy till its failure in February 1995. It started Barings Securities Ltd. (BSL) in 1984 by acquiring a small stock broking firm Henderson Crosthwaite, with a staff of 15 based in London, Hong Kong and Tokyo. The idea was to take advantage of the stock market boom in 1980. BSL was separately and liberally managed company and proved to be very successful by trading in Japanese equity warrants kind of bonds sold with warrants, which were exercisable into shares. Encouraged by the success in Asian market, it decided to diversify into the field of derivatives. They considered that making profits through arbitrage was a good opportunity in Asian markets. They therefore established Barings Futures (Singapore) Pte Ltd. (abbreviated as BFS) as a subsidiary of Barings Bank. The subsidiary was set up to trade in derivative products on Singapore International Monetary Exchange (SIMEX) in 1986. The subsidiary started its operations in SIMEX from July 1992. The Exchange was trading in futures and options in currencies, equities & commodities. Mr Nicholas (Nick) Leeson, who had earlier been successful in making profits for BSL on currency and stock derivatives mainly through arbitrage, was promoted and posted in Singapore as the trader in charge of BFS operations on SIMEX. The bank aspired to become one of the first banks to trade on derivatives in this region and the Board gave Nick Leeson considerable freedom for his activity though the terms given to him was to make money through arbitrage which was considered to be risk less profit. In 1993, Nick was appointed General Manager of BFS and was authorized to trade proprietary as also Clients accounts on far east exchanges and on behalf of many Baring Group companies. Nick Leeson dealt with mainly six futures and some options on them: 1. Nikkei 225 contract traded on SIMEX; 2. Nikkei 225 contract traded on OSE (Osaka Stock Exchange) Japan; 3. 10-year JGB (Japanese Government Bonds) contract traded on SIMEX; 4. 10-year JGB contract traded on TSE (Tokyo Stock Exchange) Japan; 5. 3-month euroyen contract traded on SIMEX and

6. Three-month euroyen contract traded on TIFFE (Tokyo Financial Futures Exchange), Japan. [Please note that the euroyen refers to yen currency traded in the global market outside Japan. It has nothing to do with the currency Euro, which came into existence much later.] Arbitrage business made significant contribution to the profitable business of BFS. Initially, it was in the form of cash / futures arbitrage in Tokyo. However, soon Nick Leeson started studying and exploiting the arbitrage between SIMEX and OSE on Nikkei 225 futures contracts. He would buy and sell these futures contracts simultaneously on SIMEX and OSE platforms taking advantage of the small difference between identical contracts. He would buy at a lower price and sell at a slightly higher price. This made tremendous business sense since SIMEX and OSE had different market conditions. While OSE had business from mainly local participants, SIMEX dealt mainly with international clients or off-shore business. Even the speeds of operations were different on these exchanges. OSE operations were slower vis--vis those of SIMEX. As a result of these circumstances, there were plenty of opportunities for making gains through trading on arbitrage. Similarly, market for JGB also offered opportunities since it witnessed considerable volatility. Leeson would make profits by trading on JGB futures contracts simultaneously on SIMEX and TSE platforms. He also encashed on arbitrage opportunities on euroyen futures contracts traded on SIMEX and TIFFE platforms to make profit. Arbitrage is strictly risk less profit and hence, everything was going in positive direction for Leeson and BFS as long as Leeson matched (squared off) positions. However, Leeson started keeping unmatched positions (whenever they went wrong i.e. whenever they could have incurred a loss) open for a long time. He was also able to conceal such unauthorized open positions for over a year. This was possible because he was allowed to manage both, the front office and back office functions of the trading activities of BFS carried through the Simex. Also the senior managers at Barings could not find out about the correct position of BFS on these futures since they came mostly with a merchant banking background and knew very little about trading. Even when Leeson showed huge profits through arbitrage, the management did not become alert or think that substantial risks were taken. Large profits, which are usually not possible in arbitrage, failed to alert the senior management about the accumulated open positions on futures contracts. On the contrary, they believed that Nick Leeson was making low risk profit and held only matched positions on the SIMEX and the OSE and hence was making a lowrisk profit.

However, the reality was altogether different. Though Leeson started with arbitrage profits, he had started keeping his loss making positions open for a long time. Not only this, he started trading derivatives contracts on the two exchanges that were of different types or in mismatched amounts. For example, he resorted to a trading strategy known as a "straddle," with the objective of making a profit by selling put and call options on the same underlying financial instrument i.e. Nikkei 225 Index. A Straddle involves selling call and put options simultaneously on the same underlying asset practically at the same strike price. Selling options ensures that you are earning premium on them, though it also means that you are taking unlimited risks (while selling call options) and almost unlimited risks while selling put options.

While selling a straddle can make money for the investor when the markets are stable, the strategy is almost suicidal when the markets become volatile!! As shown in the diagram above a short straddle will generally produce positive earnings when markets are stable i.e. when the markets move within a very small / narrow range of price for the underlying. In other words, when the markets are not volatile and remain more or less close to strike price, the speculator stands to gain. However, the strategy could result in to huge losses if markets become volatile and the price of the underlying goes on either side. As the General Manager of the subsidiary, Nick Leeson was running the banks trading activities on Simex. Unfortunately, Leeson kept his unmatched positions

and concealed them for over a year since he was managing both the trading and back office operations himself without any supervision or auditing by his seniors. Trading and Back office functions: While the front office actually puts through all the trading transactions, like buy / sell orders, the back office keeps track of settlement process and accounting records of all transactions. Mr Nick Leeson, thus, had responsibilities both for trading and the accounting and settlement activities. As a matter of fact, the prudent business policy dictates that the functions of front office (trading) and back office are to be segregated and different persons were put in charge of the two sections to avoid any fraudulent activity. This had not been done in the case of Singapore subsidiary of Barings. It was an error of judgment on the part of the banks management to entrust both types of activities to Mr Leeson, who later brought down the bank through unauthorized deals and became known as the rogue trader Account No. 88888: Mr Leeson, as a trader in July 1992 itself (remember that he became the general manager of the BFS in 1993) had opened an account titled 88888 in the Exchange. On the BFS system, this account was described as an Error account. It is a common practice for a trader to maintain similar accounts with exchanges for the purpose of netting minor trading differences. As a routine practice, banks and other institutions sometimes maintain suspense account to temporarily put through transactions which could not be reconciled immediately. However many times the suspense account itself would be the beginning for bigger fraud. No body imagined that the so called error account 88888 would seal the very existence of the bank itself in a matter of few years. Leesons intentions: Leesons intention to open account 88888 seems to be with different idea. In the first month of its opening itself, a large number of transactions were booked through the account. Normally, error account should have fewer entries and should be used only for reconciling small value differences. Further, the error account should be closed on daily basis and net difference positive (gain) or negative (losses) should be recorded as profit or loss. However, account number 88888 was used to put through a large number of transactions on daily basis from the beginning itself. In other words, the account did not seem to be intended to serve as an error account. The error account itself was operated as a regular trading account.

Shuting out account 88888 from the system: In fact, Leeson gave specific instructions to his staff, right in the beginning of the opening of error account, to modify the office software to exclude transactions in account 88888 from the system and from all market activity reports. Thus he wanted to shut out all transactions in the account from the eyes of his bosses. The information in the account was only used for the limited purpose of estimation of margin requirements at the Exchange. Barings Securities Ltd.: It should be mentioned here that Barings Securities Ltd. (BSL) is a subsidiary of original Barings Brothers & Co. Barings Securities Ltd. was functioning as a broker dealer in securities market in various regions like Japan, Latin America, London, New York etc. This security company had another subsidiary in Japan known as Barings Securities Japan (BSJ) Ltd. for trading in Japanese securities market. Profitable operations of BFS and BSJ: In 1993, Leeson was able to generate profits for BFS, Singapore as well as for Barings Securities Japan Ltd. from rightful trading activities carried on in Barings own account. The trading carried both on clients account as well as on proprietary basis was successful and making good amount of profits. As you know, proprietary trading relates to trading on companys own account, while clientstrading refers to trading on account of clients. Arbitrage Operations: You are aware that when a particular commodity or product having similar or same properties, is traded in two different markets at different prices, it offers an opportunity for making profit by buying the product at the market where the price is lower and selling the product at the market where the price is higher. Of course, such operations are limited to factors like transaction cost, time element etc. This type of opportunity is referred to as arbitrage facility. During 1992-93, there were certain arbitrage facilities available in the price differentials between Simex contracts and the equivalent contracts of similar products on Japanese markets. The contracts were mainly in equity derivatives particularly in futures contracts. Leeson was able to exploit such low risk arbitrage advantage to the benefit of his company. His profitable trading and arbitrage money gained him a reputation as a star trader on Simex and made him popular in the trading ring.

Unauthorized deals: While he was carrying on normal ordinary trading activities on behalf of BFS, simultaneously he was also carrying on unauthorized speculative trading which were put through the error account 88888. Here, he was taking much riskier positions by buying and selling different amounts of the contracts on the two exchanges and buying and selling contracts of different types. The unauthorized speculative position taken by him and routed through the error account, too became profitable in the early stages of operation i.e upto October 1993. In fact, it was revealed later that Leeson had no authority to maintain open positions overnight. Open position refers to maintaining long or short position without squaring up of positions. Every open position is an un-hedged position. Open position overnight refers to maintaining un-hedged position as at the close of business on any day. However, his trading in the subsequent period did not turn out to be lucky for him and his operations started running into losses. Euroyen futures: To try his luck elsewhere, he moved from equity market to currency market. During the last quarter of 1993, he started trading in euroyen futures through the error account. He was not successful in the euroyen futures. He suffered only a modest 3 million pound sterling from his euroyen position. You must note that euroyen has nothing to do with the Euro currency. In fact Euro currency came into being only from January 1999. The euroyen refers to yen currency traded in the global market outside Japan. Unhedged positions: Interestingly most transactions booked in account 88888 were initially booked in the accounts of BSJ and BSL. The positions taken on account of Barings Securities Japan and Barings Securities Ltd. were kept open and the positions were not hedged. These positions were also not reported correctly by Leeson to these offices. The reason for non reporting could be that he had exceeded the prescribed risk limits and the positions were unhedged.. Manipulation of unhedged positions & Excess risk taking:

It is mentioned in the preceding paragraph that positions created in the name of BSL and BSJ were kept open and accordingly such positions were at risk due to price fluctuations. To avoid disclosure of unhedged positions in the reports sent to these two organizations, Leeson used a method, called transfer trades. In a second step, the manipulation was carried on by recording fictitious trades between the accounts of BSL & BSJ on one side and account 88888 on the other side. Let us now understand in details the method of transfer trades and fictitious trades arranged by Leeson. Transfer trades: Under transfer trades, Leeson was actually transferring trades originally taken on account of BSJ and BSL (remember many of the trades were in excess of his powers and the positions were also kept open and not hedged ) to account 88888 at the eleventh hour of close of trade. This he had done by executing offsetting trades about 30 seconds before market close to place transactions from BSL or BSJ accounts into account 88888. Thus, the outstanding position in the accounts of both the securities firms were transferred to account 88888 and the former account showed nil balance at the end of the day. However transfer involves pricing also since transfer means a sale or purchase transaction. Here, the transfers were sale for BSJ and BSL. The prices of these transfer trades were later adjusted in favour of BSJ and BSL at the expense of account 88888. This, of course, requires complicated alterations between different sets of records. The master fraud Mr Leeson was able to do this job also in a complicated manner for some time. Fictitious trades: A second way to manipulate the records was to record fictitious trades between the accounts of BSL & BSJ and account 88888 in the daily report of trades at BFS sent to the Securities firms. Hence in the daily reports, transactions which were not actually carried out, were shown as trading transactions. At the same time, since he was also in charge of the back office functions, he instructed his settlement staff to record fictitious trades in the accounting system. The staff duly obliged him since he was their boss. Reversal of fictitious transactions: However if these fictitious trades happen to remain in the accounting system, it would pose the danger of being noticed. Hence the staff was instructed to reverse such entries at the opening of market on the following day. This type of accounting entries helped him to avoid reporting unauthorized and unhedged

positions as also enabled him to reduce end-day open positions in the Japanese stock and bond futures. The accounting jugglery also helped him to avoid being caught for additional margin money and effectively reduced margin calls from Simex. This practice helped him only partially and not to the extent of his additional margin money requirements. Thus fresh funds needed for Simexs margin calls steadily started increasing. Margin calls: You are by now familiar with risk surveillance mechanism of exchanges in the form of Mark to Market norms. Futures trading involves daily cash flow. In case you make profit in futures contract, you are permitted to withdraw the gain on daily basis subject to maintenance of minimum margin requirements. Similarly, losses suffered due to adverse price movements, have to be recouped on daily basis to the margin account. This was exactly the problem of Mr Leeson then. His futures losses from unauthorized trading needed variation margin money to the exchanges. He overcame the problem of additional margin money by manipulating the trading and accounting records in BFS. Modus Operandi for margin money: In the beginning of 1994, he started writing (selling) call and put options on the Nikkei 225 equity index. (Nikkei 225 equity index is the Japanese stock index similar to our BSE 30 stock SENSEX). The selling of options on stock earned him premiums and these premiums were credited to account 88888. Simultaneously he was using a number of devious methods to convince BSL management to transfer large sums of money to Singapore. He explained that large scale arbitrage operations would lead to higher profits as against small value arbitrage trading. Further margins were required to be posted in both the exchanges viz. at Simex and Japanese exchange. He further stated that Simex rules require posting of advance margin calls in view of high volatility in the market. He was also able to convince the BSL management of the need for more money saying that it was difficult for him to obtain same day payment from the ultimate client due to differences in time zones. He got what he wanted. Large sums of money were transferred from Barings bank, London to Singapore. In addition, he earned premiums by writing options on the Nikkei index through account 88888. These operations helped him to post margin money. The Loss Curve:

The fact that some one is receiving margin calls from the exchanges indicated that he was losing in futures trading. Leesons unauthorized trade was no exception to this rule. By the end of 1993, the cumulative losses in account 88888 were to the order of US $ 35.8 million. The losses increased to 208 million pound sterling (around US $ 340 million ) by end-December 1994. As the losses mounted, Leeson increased his bets as any greedy person does. The bets were mostly in equity derivatives in Japan. Leeson was buying low priced equity futures and index futures in Japan in the hope of equity price to rebound in Japan. Bolt from the Blue: The largest part of his losses came from a massive long position maintained in the Nikkei 225 index futures. As we know, a trader goes into a long position in the hope of the underlying reaching a higher level. In this case, Leeson went long on the Nikkei index futures hoping that the index would rise still higher. Unfortunately, the Nikkei 225 index fell by a massive 1000 points in January 1995 after an earth quake hit the industrial town Kobe in Japan. This incident reversed his profit making positions in Nikkei into a loss of US $ 108 million in February 1995. Demise of Barings bank: The total losses of the Singapore subsidiary went through the roof in February 1995 when it amounted to 830 million pound sterling or around US $ 1.3 billion. On over all position, the Barings bank, as the promoter of its Singapore subsidiary, took a loss of over US $ 1 billion in its book wiping out its entire capital fund of 900 million US dollar. At the time of Barings bank went to receivership for the action of Leeson, it had outstanding notional futures position on Japanese equities viz. Nikkei 225 index to the tune of US $ 7 billion and additionally on interest rate futures on Japanese government bonds (JGB ) & on euroyen contracts together to the extent of US $ 20 billion. Although the nominal value of these positions was very high, the actual loss from the position was less for the reason, as you are aware, that any futures position can be closed out in the exchange at the ruling rate. Thereby reversal of position will offset the payables and receivables leading to the difference to be received or paid depending upon your position being closed out at a profit or loss. In the case of Leeson, the net situation was a loss making position. In July August 1994, an internal auditor was sent to BFS to investigate the unusually large profits reported in 1992 & 1993. The auditor actually identified the weakness of internal control measures at BFS and recommended segregation of operational charge between trading and accounting. Consequently, a financial

manager in their Hong Kong office was entrusted with the part-time responsibility for watching the back office functions of BFS. It was, however, not enough At the same time in August 1994, the bank had set up an integrated group treasury and risk function management division and an Asset Liability Committee ( ALCO ) and asked the former to report all treasury related operations to the newly set up ALCO. However this happened to be a last minute effort of no consequence as we know that the bank had already gone deep in red. ING Bank acquires Barings bank: The Bank of England, the central bank of England, permitted the ING Bank of Netherlands to take over Barings bank for a nominal sum of one pound sterling. Yes, it was for 1 pound sterling. The take over, of course includes all assets and liabilities of Barings bank. Post-mortem sermons: The Chairman of Barings bank, Mr Peter Baring, described the failure of controls with regard to BFS as absolute. He said that lack of effective controls provided opportunities for Leeson to undertake his unauthorized trading activities. This apart he claimed that inadequate communication between departments and between individuals responsible for trading and monitoring helped Leeson to perpetrate his crime. REVIEW QUESTIONS FOR THE CASE STUDY: 1. What went wrong with Barings Futures Singapore? 2. Did Barings bank do something to check / detect fraud at BFS? 3. What lessons can we learn from Barings bank failure? 4. Should a bank like Barings Bank have a separate Risk Management cell? 5. Suggest measures that could have been initiated by Barings Bank senior Management well in advance to prevent the failure of a bank that was once known for its integrity. Suggest an appropriate structure and reporting system and relevant reporting procedures for treasury department of a bank like Barings Bank.

Vous aimerez peut-être aussi

- Barings Case StudyDocument3 pagesBarings Case StudySHANKY MEHTAPas encore d'évaluation

- Early Life: Employee Employer TradersDocument3 pagesEarly Life: Employee Employer TradersRavi WadherPas encore d'évaluation

- Baring Not Just One ManDocument6 pagesBaring Not Just One Man大大Pas encore d'évaluation

- Sectors and Styles: A New Approach to Outperforming the MarketD'EverandSectors and Styles: A New Approach to Outperforming the MarketÉvaluation : 1 sur 5 étoiles1/5 (1)

- Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming CompaniesD'EverandSmall Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming CompaniesPas encore d'évaluation

- Tutorial 02 AnsDocument3 pagesTutorial 02 Anscharlie simoPas encore d'évaluation

- FM CH 07 PDFDocument72 pagesFM CH 07 PDFLayatmika SahooPas encore d'évaluation

- Business Ethics - Barings Bank CaseDocument4 pagesBusiness Ethics - Barings Bank Caseazmatali80Pas encore d'évaluation

- HedgingDocument7 pagesHedgingSachIn JainPas encore d'évaluation

- Returns To Buying Winners and Selling Lose RS: Implications For Stock Market EfficiencyDocument48 pagesReturns To Buying Winners and Selling Lose RS: Implications For Stock Market Efficiencymuath alzahraniPas encore d'évaluation

- The Study of The Japanese Economy: Macroeconomics For Business ExecutivesDocument14 pagesThe Study of The Japanese Economy: Macroeconomics For Business ExecutivesUtkarsh JainPas encore d'évaluation

- Hedging - Series 3 - National Commodities Futures - InvestopediaDocument2 pagesHedging - Series 3 - National Commodities Futures - Investopediasam001040Pas encore d'évaluation

- Equity Tips and Market Analysis For 16 JulyDocument7 pagesEquity Tips and Market Analysis For 16 JulySurbhi JoshiPas encore d'évaluation

- Hedge Funds ShowDocument33 pagesHedge Funds ShowmkpatidarPas encore d'évaluation

- Jean Marie Part 2 - The InterviewsDocument5 pagesJean Marie Part 2 - The Interviewsekramcal100% (1)

- Tutorial 06 AnsDocument3 pagesTutorial 06 Anscharlie simo100% (2)

- A Quantitative Analysis of Managed Futures Strategies: Lintner RevisitedDocument40 pagesA Quantitative Analysis of Managed Futures Strategies: Lintner RevisitedIshan SanePas encore d'évaluation

- Study Schedule For June-2012 ExamDocument3 pagesStudy Schedule For June-2012 ExamḾỠḧṦịṊ ḨḀṝṌṓṈPas encore d'évaluation

- Mike 16Document8 pagesMike 16addinfoPas encore d'évaluation

- CH 5Document4 pagesCH 5Deepak JainPas encore d'évaluation

- Tutorial 07 AnsDocument3 pagesTutorial 07 Anscharlie simoPas encore d'évaluation

- Private Equity in The 2000sDocument4 pagesPrivate Equity in The 2000sfunmastiPas encore d'évaluation

- Calendar Effects in The Philippine Stock Market - JITBMDocument17 pagesCalendar Effects in The Philippine Stock Market - JITBMRENJiiiPas encore d'évaluation

- A Practical Guide To Swing Trading Author Larry SwingDocument74 pagesA Practical Guide To Swing Trading Author Larry SwingDevendra SinghPas encore d'évaluation

- Financial Instruments Risk Disclosure Report Volume 1Document65 pagesFinancial Instruments Risk Disclosure Report Volume 1Araah CabusiPas encore d'évaluation

- Trading Hedging With OptionsDocument57 pagesTrading Hedging With OptionsShweta PinglePas encore d'évaluation

- The Statistics of Statistical Arbitrage' in Stock MarketsDocument10 pagesThe Statistics of Statistical Arbitrage' in Stock MarketskillemansPas encore d'évaluation

- Fundamental AnalysisDocument2 pagesFundamental AnalysisKirtan Balkrishna RautPas encore d'évaluation

- High-Frequency Trading, Order Types, and The Evolution of The Securities Market StructureDocument31 pagesHigh-Frequency Trading, Order Types, and The Evolution of The Securities Market StructuretabbforumPas encore d'évaluation

- 4 - Understanding, Monitoring, and Utilizing ETF'sDocument13 pages4 - Understanding, Monitoring, and Utilizing ETF'scollegetradingexchangePas encore d'évaluation

- The Efficient MarkeDocument50 pagesThe Efficient Markeliferocks232Pas encore d'évaluation

- 07a Hedge Funds and Performance EvaluationDocument66 pages07a Hedge Funds and Performance EvaluationdesbiauxPas encore d'évaluation

- Net Net USDocument70 pagesNet Net USFloris OliemansPas encore d'évaluation

- Dollar Cost AveragingDocument2 pagesDollar Cost AveragingLawrence LanePas encore d'évaluation

- High Probability Chart Reading John Murphy PDFDocument4 pagesHigh Probability Chart Reading John Murphy PDFomarPas encore d'évaluation

- Corporate Finance Lecture 5Document29 pagesCorporate Finance Lecture 5Emmanuel Maluke LetetePas encore d'évaluation

- Haugen 1996Document39 pagesHaugen 1996Roland Adi NugrahaPas encore d'évaluation

- Efficient MarketDocument10 pagesEfficient MarketShafiq KhanPas encore d'évaluation

- Liquidity As An Investment StyleDocument30 pagesLiquidity As An Investment StyleBurhan SjahPas encore d'évaluation

- Scott Locklin - A Bestiary of Algorithmic Trading Strategies Locklin On ScienceDocument13 pagesScott Locklin - A Bestiary of Algorithmic Trading Strategies Locklin On Sciencetedcruz4presidentPas encore d'évaluation

- tmp4BCD TMPDocument260 pagestmp4BCD TMPFrontiersPas encore d'évaluation

- Tutorial 12Document3 pagesTutorial 12charlie simo100% (1)

- SPGM SystemDocument17 pagesSPGM SystemSetiawan LionhearthPas encore d'évaluation

- Stock Repair StrategyDocument6 pagesStock Repair Strategyquality99Pas encore d'évaluation

- 12 - Breakout and Range PlaysDocument12 pages12 - Breakout and Range PlayscollegetradingexchangePas encore d'évaluation

- Stock Index Futures GuideDocument13 pagesStock Index Futures GuideEric MarlowPas encore d'évaluation

- 3.slides - July 22, 2019 Wyckoff Workshop 3Document51 pages3.slides - July 22, 2019 Wyckoff Workshop 3chauchauPas encore d'évaluation

- Investment Banking Institute Brochure - 1Document9 pagesInvestment Banking Institute Brochure - 1MEGPas encore d'évaluation

- Market For Currency FuturesDocument35 pagesMarket For Currency Futuresvidhya priyaPas encore d'évaluation

- Corporate Financing Decisions and Efficient Capital Markets: Mcgraw-Hill/IrwinDocument36 pagesCorporate Financing Decisions and Efficient Capital Markets: Mcgraw-Hill/IrwinILHAM BOCIL100% (1)

- Incredible Story of Transaction Cost MeasurementDocument7 pagesIncredible Story of Transaction Cost MeasurementWayne H WagnerPas encore d'évaluation

- Tut Topic 1 QADocument3 pagesTut Topic 1 QASiow Wei100% (1)

- The IBS Effect Mean Reversion in Equity ETFsDocument31 pagesThe IBS Effect Mean Reversion in Equity ETFstylerduPas encore d'évaluation

- Introduction To Economic Fluctuations: Chapter 10 of Edition, by N. Gregory MankiwDocument27 pagesIntroduction To Economic Fluctuations: Chapter 10 of Edition, by N. Gregory MankiwUsman FaruquePas encore d'évaluation

- E-R Diagram of Library Management SystemDocument21 pagesE-R Diagram of Library Management Systemavinash-kumar-9935Pas encore d'évaluation

- Efficient Markets: A Testable Hypothesis To Answer The Question: How Are Securities Market Prices Determined?Document26 pagesEfficient Markets: A Testable Hypothesis To Answer The Question: How Are Securities Market Prices Determined?james4819Pas encore d'évaluation

- Earnings Theory PaperDocument64 pagesEarnings Theory PaperPrateek SabharwalPas encore d'évaluation

- FM Ch. 19Document17 pagesFM Ch. 19Bangkit ZuasPas encore d'évaluation

- Site Accountant Store Keeper Updated On 30-11-06Document15 pagesSite Accountant Store Keeper Updated On 30-11-06farrukhsharifzadaPas encore d'évaluation

- Marketing Planning Notes 1.0Document28 pagesMarketing Planning Notes 1.0Dr Amit Rangnekar100% (6)

- Monetary PolicyDocument8 pagesMonetary PolicyLyubov KushnirPas encore d'évaluation

- Mcrae, Mark - Sure-Fire Forex TradingDocument113 pagesMcrae, Mark - Sure-Fire Forex TradingJovica Damnjanovic100% (2)

- Negotiations Techniques AssignmentDocument21 pagesNegotiations Techniques AssignmentHaroon Khan100% (1)

- Diversification StrategiesDocument9 pagesDiversification StrategiesJebin JamesPas encore d'évaluation

- Cost Accounting: By: Dr. Aakanksha SinghalDocument19 pagesCost Accounting: By: Dr. Aakanksha SinghalPriyanshu singhPas encore d'évaluation

- Indian Rayon 2009-10Document54 pagesIndian Rayon 2009-10Vimal100% (2)

- LSJ Exceeding Sat 041219 ApprovedDocument5 pagesLSJ Exceeding Sat 041219 ApprovedJustin RohrlichPas encore d'évaluation

- 649749Document43 pages649749Júnia MarúsiaPas encore d'évaluation

- Managerial Economics PPT at Mba 2009Document31 pagesManagerial Economics PPT at Mba 2009Babasab Patil (Karrisatte)Pas encore d'évaluation

- Marketing - Module 7 The Marketing Mix - PRICEDocument12 pagesMarketing - Module 7 The Marketing Mix - PRICEKJ JonesPas encore d'évaluation

- 1999 Taxation Law Bar QDocument8 pages1999 Taxation Law Bar QkdescallarPas encore d'évaluation

- Week05 PPT 2022 Before ClassDocument98 pagesWeek05 PPT 2022 Before Class罗上宗Pas encore d'évaluation

- Bollore Logistics CanadaDocument17 pagesBollore Logistics Canadadeepakshi0% (1)

- Ezz Steel: The Way Is Currently PavedDocument14 pagesEzz Steel: The Way Is Currently PavedAhmed Ali HefnawyPas encore d'évaluation

- ECON3Document20 pagesECON3Christelle De Los CientosPas encore d'évaluation

- Buying and Selling Securities Buying and Selling Securities: Fundamentals InvestmentsDocument39 pagesBuying and Selling Securities Buying and Selling Securities: Fundamentals InvestmentsadillawaPas encore d'évaluation

- Landscape With Invisible Hand by M.T. Anderson Chapter SamplerDocument26 pagesLandscape With Invisible Hand by M.T. Anderson Chapter SamplerCandlewick PressPas encore d'évaluation

- MG 6863 Engg. Economics Unit V DepreciationDocument35 pagesMG 6863 Engg. Economics Unit V Depreciationanantharaman ashaPas encore d'évaluation

- 0304 - Ec 1Document30 pages0304 - Ec 1haryhunter100% (3)

- 2nd Examination For DistributionDocument8 pages2nd Examination For DistributionShibaInu DogePas encore d'évaluation

- Tea at PeninsulaDocument4 pagesTea at PeninsulaBilly GambalanPas encore d'évaluation

- ROI (Return On Investment) Formula On Fashion ShowDocument4 pagesROI (Return On Investment) Formula On Fashion Showsaravana maniPas encore d'évaluation

- Gap Analysis of Services Provided by Real Estate Agents and Customer ExpectationDocument66 pagesGap Analysis of Services Provided by Real Estate Agents and Customer ExpectationJanardhan ThokchomPas encore d'évaluation

- Portfolio Revision PDFDocument15 pagesPortfolio Revision PDFMr. Shopper NepalPas encore d'évaluation

- SM Q and AnsDocument2 pagesSM Q and AnsikramPas encore d'évaluation

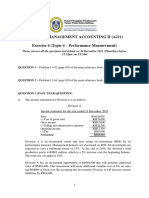

- A211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Document3 pagesA211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Amirul Hakim Nor AzmanPas encore d'évaluation

- Sách Economy TOEIC 4 - Phần Đọc PDFDocument278 pagesSách Economy TOEIC 4 - Phần Đọc PDFCẩm ThạchPas encore d'évaluation

- Varun Beverages IPODocument3 pagesVarun Beverages IPODynamic LevelsPas encore d'évaluation