Académique Documents

Professionnel Documents

Culture Documents

EMELINO T MAESTRO BIR Ask For Receipt

Transféré par

juliet_emelinotmaestroDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

EMELINO T MAESTRO BIR Ask For Receipt

Transféré par

juliet_emelinotmaestroDroits d'auteur :

Formats disponibles

30 plaridel, qc and 6 v.

luciano, qc

Emelino T Maestros Way of Thanking You!

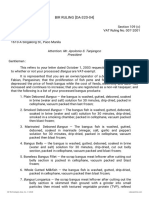

It is a calling-card size BIR

Ask for Receipt and it can be

yours if you just ask for number

of copies.

How shall it be used?

Whenever ETM is with the

company of clients having

dinner or lunch in a regular

restaurant and hotel, he

observed that his clients

always ask for a receipt or

invoice under the name of their

respective companies. By

doing so, the attending hotel/

restaurant personnel would ask

back his clients as to whom the

official receipt or sales invoice

shall be placed.

And, when the said receipt

or invoice was handed over to

particular ETM client, ETM

noticed that the information

contained therein is

incomplete. Thus, such receipt

or invoice cannot be used to be

an evidence for claiming

creditable input tax.

To resolve this shortcoming

not only on the part of ETM

client and attending sellers of

services or goods, ETM, once

again, innovate and improve

the way the BIR ask for receipt

shall be used and utilized.

Now, taxpayers employees

or suppliers who shall

reimburse the expenses

incurred in the furtherance of

the taxpayers business shall

only place the name, address

and TIN of the said taxpayer

on the space provided in the

BIR Ask for Receipt (or Card)

and whenever an invoice or

official receipt shall be asked

for, the said employees or

suppliers shall only present the

said Card to the attending

selling so that the latter may

not commit mistake or error in

placing the correct and

complete info in his invoice or

official receipt.

The other side of the Card

having the identical statement

of the original BIR Ask for

Receipt shall be a reminder to

all attending sellers their

obligations to issue an invoice

or official receipts and less

important, a deterrent factor to

avoid acts that are contrary to

the laws of the State.

How can you help? ETM

prepare a plan to give each

and every taxpayers

employees and suppliers

and assist incoming

taxpayers such as college,

high-school and elementary-

school students the purpose

and benefits of asking for an

invoice or official receipt.

This task is an opportunity

for you to embark to a

selfless endeavor that will

help and sustain the needs

of the State.

You can donate if you

want to or the least, you can

forward this message to all

your contacts and help ETM

make a dent against BIR

graft and corruption.

Please call 02-439 3918 or

text 0922 862 0922.

Visit

emelinotmaestro.com now to

be empowered and remove

yourself from corruption.

BIRASKFORRECEIPT

O

c

t

o

b

e

r

7

,

2

0

1

1

$6.)25

5(&(,37 %,5

This will ensure that the

taxes on your purchases

will be remitted to the

government. t will be

used for the development

of the Philippines.

2 TO 4 YEARS MPRSONMENT

FOR NON-SSUANCE OF RECEPT

BR CONTACT CENTER (02)981-8888

commissioner@bir.gov.ph

ANY BR OFFCE

www.emelinotmaestro.com

TAX-PROBLEM SOLVER

REPORT VOLATORS TO ANY OF THE FOLLOWNG:

This NOTCE nust be posted within this establishment in an area conspicious

to the public view (RR 7-200514-11-05)

Vous aimerez peut-être aussi

- Quiz EmbryologyDocument41 pagesQuiz EmbryologyMedShare90% (67)

- TAX BRIEFING-NEW RegistrantsDocument57 pagesTAX BRIEFING-NEW RegistrantsPcl Nueva Vizcaya100% (3)

- RR 2-98 Section 2.57 (B) - CWTDocument3 pagesRR 2-98 Section 2.57 (B) - CWTZenaida LatorrePas encore d'évaluation

- Materials For How To Handle BIR Audit Common Issues - 2021 Sept 21Document71 pagesMaterials For How To Handle BIR Audit Common Issues - 2021 Sept 21cool_peach100% (1)

- Letter Response - Request For ELOA Revalidation V2Document2 pagesLetter Response - Request For ELOA Revalidation V2Jazz TraceyPas encore d'évaluation

- Requirements To Be Accredited As Tax AgentDocument3 pagesRequirements To Be Accredited As Tax AgentAvril Reina0% (1)

- SEC Requirements For Accreditation of CPAs in Public PracticeDocument2 pagesSEC Requirements For Accreditation of CPAs in Public PracticemelissaPas encore d'évaluation

- Directors CertificateDocument2 pagesDirectors CertificateCesar DionidoPas encore d'évaluation

- ROHQ ClosureDocument1 pageROHQ ClosureVeron AGPas encore d'évaluation

- Cyp Accounting, Taxation, Management and Audit ServicesDocument1 pageCyp Accounting, Taxation, Management and Audit ServicesCarol Ledesma Yap-PelaezPas encore d'évaluation

- Tax Update RR 18-2012Document32 pagesTax Update RR 18-2012johamarz6245Pas encore d'évaluation

- Case Studies On Industrial Accidents - 2Document84 pagesCase Studies On Industrial Accidents - 2Parth N Bhatt100% (2)

- Affidavit of Consent For Shared Parental AuthorityDocument2 pagesAffidavit of Consent For Shared Parental AuthorityTet LegaspiPas encore d'évaluation

- Ignition System Spark Test DiagnosisDocument24 pagesIgnition System Spark Test DiagnosisMohamed l'Amine75% (4)

- Matching Cost Against RevenueDocument1 pageMatching Cost Against Revenuejuliet_emelinotmaestroPas encore d'évaluation

- Pagong BagalDocument1 pagePagong Bagaljuliet_emelinotmaestroPas encore d'évaluation

- Expanded Withholding Taxes On Government Income PaymentsDocument172 pagesExpanded Withholding Taxes On Government Income PaymentsBien Bowie A. CortezPas encore d'évaluation

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDocument4 pagesBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiPas encore d'évaluation

- Process For Application To Use LooseleafDocument1 pageProcess For Application To Use LooseleafFrancis MartinPas encore d'évaluation

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniPas encore d'évaluation

- Pinag-Iinitan Ka Ba NG BirDocument1 pagePinag-Iinitan Ka Ba NG Birjuliet_emelinotmaestroPas encore d'évaluation

- Philippines Province Leyte Health Office submits BIR Form 2305 for employeesDocument1 pagePhilippines Province Leyte Health Office submits BIR Form 2305 for employeesSylvia EnovisoPas encore d'évaluation

- Buy AppointmentDocument1 pageBuy Appointmentjuliet_emelinotmaestroPas encore d'évaluation

- 141.protesting BIR Assessments - dds.04.29.2010Document2 pages141.protesting BIR Assessments - dds.04.29.2010Arnold ApduaPas encore d'évaluation

- Revenue Regulations on Minimum Corporate Income TaxDocument5 pagesRevenue Regulations on Minimum Corporate Income TaxKayzer SabaPas encore d'évaluation

- Mandatory Disclosure Form (MDF)Document2 pagesMandatory Disclosure Form (MDF)jonilyn florentino100% (1)

- TRAIN Law - Diaz Murillo Dalupan and CompanyDocument215 pagesTRAIN Law - Diaz Murillo Dalupan and CompanyBien Bowie A. Cortez100% (1)

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezPas encore d'évaluation

- TaxDocument6 pagesTaxChristian GonzalesPas encore d'évaluation

- Additonal Disclosure RR 15 2010Document5 pagesAdditonal Disclosure RR 15 2010Emil A. MolinaPas encore d'évaluation

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- PFF053 MembersContributionRemittanceForm V02-FillableDocument2 pagesPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielPas encore d'évaluation

- Penalties - Expired AtpDocument1 pagePenalties - Expired AtpCherry ChaoPas encore d'évaluation

- 4 - Rizal Provincial Government v. BIRDocument17 pages4 - Rizal Provincial Government v. BIRCarlota VillaromanPas encore d'évaluation

- Accounting ManualDocument2 pagesAccounting ManualAshok Raaj100% (1)

- Compilation of Relevant Court of Tax AppDocument30 pagesCompilation of Relevant Court of Tax Appcy legaspiPas encore d'évaluation

- Letter For LOADocument1 pageLetter For LOAmaePas encore d'évaluation

- Guidelines Streamline Tax Treaty ReliefDocument18 pagesGuidelines Streamline Tax Treaty ReliefEmil A. MolinaPas encore d'évaluation

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaPas encore d'évaluation

- 2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Document2 pages2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Yya Ladignon100% (2)

- BIR Accreditation For CPAsDocument1 pageBIR Accreditation For CPAsECMH ACCOUNTING AND CONSULTANCY SERVICESPas encore d'évaluation

- Checklist PcabDocument5 pagesChecklist PcabLyka Amascual ClaridadPas encore d'évaluation

- Final Decision On Disputed AssessmentDocument17 pagesFinal Decision On Disputed AssessmentJasper AlonPas encore d'évaluation

- PROPOSED NOTES ON TAXESDocument9 pagesPROPOSED NOTES ON TAXESMary Grace Caguioa AgasPas encore d'évaluation

- Ra 9337Document23 pagesRa 9337cheska_abigail950Pas encore d'évaluation

- 1601EDocument7 pages1601EEnrique Membrere SupsupPas encore d'évaluation

- ITAD BIR Ruling No. 311-14Document9 pagesITAD BIR Ruling No. 311-14cool_peachPas encore d'évaluation

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- Overview of Handling BIR Tax Audit in The PhilippinesDocument3 pagesOverview of Handling BIR Tax Audit in The PhilippinesMarietta Fragata Ramiterre100% (2)

- 1999 BIR RulingsDocument74 pages1999 BIR Rulingschris cardinoPas encore d'évaluation

- List of Assets (RMO 26-2010)Document6 pagesList of Assets (RMO 26-2010)d-fbuser-49417072Pas encore d'évaluation

- 1 - Western Mindanao Power Corporation v. CIRDocument17 pages1 - Western Mindanao Power Corporation v. CIRCarlota VillaromanPas encore d'évaluation

- BIR's Tax Ruling Process ExplainedDocument3 pagesBIR's Tax Ruling Process ExplainedConnieAllanaMacapagaoPas encore d'évaluation

- BIR Ruling on Informer's RewardDocument4 pagesBIR Ruling on Informer's RewardAnonymous fnlSh4KHIgPas encore d'évaluation

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanPas encore d'évaluation

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasPas encore d'évaluation

- Engagement Letter Business Clients NEW PDFDocument9 pagesEngagement Letter Business Clients NEW PDFMark TorresPas encore d'évaluation

- ActDocument2 pagesActJeffrey Garcia IlaganPas encore d'évaluation

- Local Business TaxDocument2 pagesLocal Business TaxvenickeePas encore d'évaluation

- BIR Ruling No. 242-18 (Gift Certs.)Document7 pagesBIR Ruling No. 242-18 (Gift Certs.)LizPas encore d'évaluation

- Year-End Tax Requirements and ProceduresDocument164 pagesYear-End Tax Requirements and ProceduresDarioPas encore d'évaluation

- Notes To Financial StatementsDocument9 pagesNotes To Financial StatementsCheryl FuentesPas encore d'évaluation

- Bank TellerDocument3 pagesBank TellerelocindierPas encore d'évaluation

- Pa #3 PRNNDocument11 pagesPa #3 PRNNJOSUE GILMER ORE CALDERONPas encore d'évaluation

- Get That Bir MobileDocument1 pageGet That Bir Mobilejuliet_emelinotmaestroPas encore d'évaluation

- Bir, Bribes, Bluffs, BulliesDocument1 pageBir, Bribes, Bluffs, Bulliesjuliet_emelinotmaestroPas encore d'évaluation

- Payroll OutlineDocument1 pagePayroll Outlinejuliet_emelinotmaestroPas encore d'évaluation

- Marketing Contract W/ 15% CommissionDocument1 pageMarketing Contract W/ 15% Commissionjuliet_emelinotmaestroPas encore d'évaluation

- Buy AppointmentDocument1 pageBuy Appointmentjuliet_emelinotmaestroPas encore d'évaluation

- Directors Pinahamak TaxpayersDocument1 pageDirectors Pinahamak Taxpayersjuliet_emelinotmaestroPas encore d'évaluation

- Confession of Revenue District OfficerDocument1 pageConfession of Revenue District Officerjuliet_emelinotmaestroPas encore d'évaluation

- Attendee ContractDocument1 pageAttendee Contractjuliet_emelinotmaestroPas encore d'évaluation

- Directors Pinahamak TaxpayersDocument1 pageDirectors Pinahamak Taxpayersjuliet_emelinotmaestroPas encore d'évaluation

- Copy-Circulated: OmbudsmanDocument1 pageCopy-Circulated: Ombudsmanjuliet_emelinotmaestroPas encore d'évaluation

- Attendee ContractDocument1 pageAttendee Contractjuliet_emelinotmaestroPas encore d'évaluation

- When Should The Personal and Additional Exemptions Be ClaimedDocument1 pageWhen Should The Personal and Additional Exemptions Be Claimedjuliet_emelinotmaestroPas encore d'évaluation

- Bir Fools DayDocument1 pageBir Fools Dayjuliet_emelinotmaestroPas encore d'évaluation

- 4 ScenesDocument4 pages4 Scenesjuliet_emelinotmaestroPas encore d'évaluation

- SCH TA CommitmentDocument1 pageSCH TA Commitmentjuliet_emelinotmaestroPas encore d'évaluation

- Why Bir Is Too Slow To Delivery Basic ServicesDocument1 pageWhy Bir Is Too Slow To Delivery Basic Servicesjuliet_emelinotmaestroPas encore d'évaluation

- Pinag-Iinitan Ka Ba NG BirDocument1 pagePinag-Iinitan Ka Ba NG Birjuliet_emelinotmaestroPas encore d'évaluation

- Trabaho Mo, Ipasa MoDocument1 pageTrabaho Mo, Ipasa Mojuliet_emelinotmaestroPas encore d'évaluation

- BIRmagicalspacenorentDocument1 pageBIRmagicalspacenorentjuliet_emelinotmaestroPas encore d'évaluation

- Bir Refused To Receive My LetterDocument1 pageBir Refused To Receive My Letterjuliet_emelinotmaestroPas encore d'évaluation

- About EtmDocument2 pagesAbout Etmjuliet_emelinotmaestroPas encore d'évaluation

- Economic SaboteurDocument1 pageEconomic Saboteurjuliet_emelinotmaestroPas encore d'évaluation

- Bir Secret Plan For ImportersDocument1 pageBir Secret Plan For Importersjuliet_emelinotmaestroPas encore d'évaluation

- Red TVDocument1 pageRed TVjuliet_emelinotmaestroPas encore d'évaluation

- No Id No EntryDocument1 pageNo Id No Entryjuliet_emelinotmaestroPas encore d'évaluation

- LOA PleaseDocument1 pageLOA Pleasejuliet_emelinotmaestroPas encore d'évaluation

- Why Bir Asks For Credit TermDocument1 pageWhy Bir Asks For Credit Termjuliet_emelinotmaestroPas encore d'évaluation

- EEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanDocument3 pagesEEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanBELJUNE MARK GALANANPas encore d'évaluation

- Life Overseas 7 ThesisDocument20 pagesLife Overseas 7 ThesisRene Jr MalangPas encore d'évaluation

- C. Drug Action 1Document28 pagesC. Drug Action 1Jay Eamon Reyes MendrosPas encore d'évaluation

- Book 1Document94 pagesBook 1JOHNPas encore d'évaluation

- Farid Jafarov ENG Project FinanceDocument27 pagesFarid Jafarov ENG Project FinanceSky walkingPas encore d'évaluation

- Sub Erna RekhaDocument2 pagesSub Erna Rekhasurabhi mandalPas encore d'évaluation

- Lesson Plan 7 Tabata TrainingDocument4 pagesLesson Plan 7 Tabata Trainingapi-392909015100% (1)

- Aplikasi Berbagai Jenis Media Dan ZPT Terhadap Aklimatisasi Anggrek VandaDocument15 pagesAplikasi Berbagai Jenis Media Dan ZPT Terhadap Aklimatisasi Anggrek VandaSihonoPas encore d'évaluation

- PHAR342 Answer Key 5Document4 pagesPHAR342 Answer Key 5hanif pangestuPas encore d'évaluation

- Nitric OxideDocument20 pagesNitric OxideGanesh V GaonkarPas encore d'évaluation

- Chapter 4Document26 pagesChapter 4Lana AlakhrasPas encore d'évaluation

- HTM 2025 2 (New) Ventilation in HospitalsDocument123 pagesHTM 2025 2 (New) Ventilation in HospitalsArvish RamseebaluckPas encore d'évaluation

- AYUSHMAN BHARAT Operationalizing Health and Wellness CentresDocument34 pagesAYUSHMAN BHARAT Operationalizing Health and Wellness CentresDr. Sachendra Raj100% (1)

- Canada's Health Care SystemDocument11 pagesCanada's Health Care SystemHuffy27100% (2)

- Reach Out and Read Georgia Selected For AJC Peachtree Road Race Charity Partner ProgramDocument2 pagesReach Out and Read Georgia Selected For AJC Peachtree Road Race Charity Partner ProgramPR.comPas encore d'évaluation

- Executive Order 000Document2 pagesExecutive Order 000Randell ManjarresPas encore d'évaluation

- Synthesis, Experimental and Theoretical Characterizations of A NewDocument7 pagesSynthesis, Experimental and Theoretical Characterizations of A NewWail MadridPas encore d'évaluation

- Analysis of Heavy Metals Concentration in Landfill Soil IJERTV8IS120019Document2 pagesAnalysis of Heavy Metals Concentration in Landfill Soil IJERTV8IS120019Eustache NIJEJEPas encore d'évaluation

- Frank Wood S Business Accounting 1Document13 pagesFrank Wood S Business Accounting 1Kofi AsaasePas encore d'évaluation

- WSO 2022 IB Working Conditions SurveyDocument42 pagesWSO 2022 IB Working Conditions SurveyPhạm Hồng HuếPas encore d'évaluation

- Ic Audio Mantao TEA2261Document34 pagesIc Audio Mantao TEA2261EarnestPas encore d'évaluation

- IMCI Chart 2014 EditionDocument80 pagesIMCI Chart 2014 EditionHarold DiasanaPas encore d'évaluation

- VIDEO 2 - Thì hiện tại tiếp diễn và hiện tại hoàn thànhDocument3 pagesVIDEO 2 - Thì hiện tại tiếp diễn và hiện tại hoàn thànhÝ Nguyễn NhưPas encore d'évaluation

- The Impact of StressDocument3 pagesThe Impact of StressACabalIronedKryptonPas encore d'évaluation

- Đề Thi Thử THPT 2021 - Tiếng Anh - GV Vũ Thị Mai Phương - Đề 13 - Có Lời GiảiDocument17 pagesĐề Thi Thử THPT 2021 - Tiếng Anh - GV Vũ Thị Mai Phương - Đề 13 - Có Lời GiảiHanh YenPas encore d'évaluation

- Chemical and Physical Properties of Refined Petroleum ProductsDocument36 pagesChemical and Physical Properties of Refined Petroleum Productskanakarao1Pas encore d'évaluation