Académique Documents

Professionnel Documents

Culture Documents

State Pension Funding: Prepared by PSERS & SERS For The Senate Finance Committee - September 28, 2011

Transféré par

PAindyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

State Pension Funding: Prepared by PSERS & SERS For The Senate Finance Committee - September 28, 2011

Transféré par

PAindyDroits d'auteur :

Formats disponibles

State Pension Funding

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

Jeffrey Clay

David Durbin

PSERS Executive Director

SERS Office of Member Services Director

State Pension Funding

Table of Contents

Snapshot of the Systems Funding Streams Cost of Benefits Reduced in 2010 Remaining Budgetary Challenge -- The Debt PSERS Graph SERS Graph Debt Built Over Decades PSERS History of Employer Contributions Graph SERS History of Employer Contributions Graph Case Law on Contract Impairment Popular Legislative Options Cost of Closing Plans A Combination of Solutions The Good News The Bad News PSERS Investment Return Stress Test Data SERS Investment Return Stress Test Data Cash Infusion Projections Other Issues to Consider 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 15 16 17 18

Prepared by PSERS & SERS for the Senate Finance Committee - September 26, 2011

State Pension Funding

Snapshot

Public School Employees Retirement System

(as of 6/30/10)

State Employees Retirement System

(as of 12/31/10)

579,000 members 282,000 active 185,000 retirees/beneficiaries 112,000 vested inactive 749 employers $51.4 billion in assets (as of 6/30/11) 75.1% funded (actuarial value) 57.8% funded (market value) $19.7 billion unfunded liability

227,000 members 109,000 active 112,000 retirees/beneficiaries 6,000 vested inactive 106 employers $26.0 billion in assets 75.2% funded (actuarial value) 66.1% funded (market value) $9.7 billion unfunded liability

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

Pension systems are designed to remain solvent by receiving three regular funding streamsemployee contributions, employer contributions, and investment earnings.

PSERS Funding

(10-Year History)

SERS Funding

(10-Year History)

Investment Income 69%

Investment Income 73%

Employer Contributions Member 12% Contributions 19%

Member Contributions 18%

Employer Contributions 9%

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

Pennsylvania public pensions were reformed in 2010, reducing the cost of benefits for new employees hired after Jan. 1, 2011 to just 3% (PSERS) and 4% (SERS) of payroll.

Reduced benefit accrual for new employees by 20% -- from 2.5% to 2% of salary for each year of service Retained employee contributions at pre-reform levels Created shared risk to allow increased employee contributions in certain circumstances Increased normal retirement age Eliminated lump sum withdrawal of contributions and interest at retirement Rolled back the vesting period to ten years Required that members purchase prior nonstate service at full actuarial cost Reamortized existing liabilities through an actuarial fresh start Capped growth of employer contributions: - 3% in FY 11/12 - 3.5% in FY 12/13 - 4.5% thereafter until no longer needed

The Employee Benefit Research Institute found that retirement funding for private employers amounts to about 3.5% of employee compensation. In May 2010, the Wisconsin Legislative Council found that major public employee retirement systems provided employer contributions ranging from 1.95% (MA) to 17.01% (ME), with a median in the 8% range. Some recent legislative proposals in Pennsylvania attempt to achieve savings by closing the existing defined benefit plans and replacing them with 401(k)-style defined contribution plans, including a 6% employer match.

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

Despite the $2.9 billion in savings achieved by pension reforms, a significant budgetary challenge remains.

$29.4 billion debt has already been incurred.

$19.7 PSERS $9.7 SERS

A debt of the Commonwealth, backed by the full faith and credit of the Commonwealth Statutory interest charges payable, the maintenance of reserves in the fund, and the payment of all annuities and other benefits granted by the board under the provisions of this part are hereby made obligations of the Commonwealth. All income, interest, and dividends derived from deposits and investments authorized by this part shall be used for the payment of the said obligations of the Commonwealth.

State Employees Retirement Code, Title 71, Pa.C.S. 5951 Public School Employees Retirement Code, Title 24, Pa.C.S. 8531

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

PA Public School Employees' Retirement System Components of Projected Total Employer Contribution Rate - Act 120 Based on June 30, 2010 Actuarial Valuation - Assumes 8% Rate of Return

30%

Total Employer Cost as Percentage of Payroll

25%

20%

Unfunded Liability Rate

15%

10%

5%

Employer Normal Cost

0% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2043 2044

Rate Collars in effect FY 2012 to FY 2015

Fiscal Year Health Care Employer Normal Cost Unfunded Liability

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

SERS Employer Contribution Projections Presuming Plan is Closed to New Members

($ millions)

$2,000 $1,800 $1,600 $1,400

Contribution

$1,200 $1,000 $800 $600 $400 $200

Unfunded Liability Contribution Dollars

Normal Cost Contribution Dollars

$0 2013

2015

2017

2019

2021

2023

2025

2027

2029

2031

2033

2035

2037

2039

2041

2043

Fiscal Year Ended June 30

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

Factors influencing the $29.4 billion debt have been building over decades.

The $29.4 billion debt is largely the result of: employer contributions below normal costs losses that neutralized the past investment gains used to justify low employer contributions benefit increases without increased funding streams funding changes to extend time to pay down liabilities cummulative negative impact of the above on investment returns

Despite 2008s unprecedented investment losses, PSERS and SERS long-term investment performance has exceeded actuarial return objectives. PSERS Current Actuarial Return Objective One-Year Return

(ending June 30, 2011)

SERS 8.0% 18.8% 9.0%

7.5% 20.4% 8.8%

25-Year Rate of Return

(annualized, net of fees)

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

History of PSERS' Contribution Rates as a Percent of Payroll

Average Member Rate 21 18 15 12 9 6 3 0 1982 Employer Contribution Rate Employer Normal Cost Rate

Percent

1987

1992

1997

2002

2007

2011

Year

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

32.00%

History of SERS' Employer Contribution Rates as a Percent of Payroll

28.00% Employer Contribution Rates Employer Normal Cost Rates

24.00%

20.00%

18.1% 16.0%

16.00%

13.1%

12.00%

9.9% 10.3%

8.7% 8.3% 8.4% 8.21% 9.5%

11.5%

8.00%

5.0%

8.0% 5.0% 4.08%*

15-Year Total $3.6 Billion

4.0% 3.0%

4.00%

3.6%

1.4%

0.0% 1981

SERS 03-08-11

1984

1988

1992

1996

2000

2004

2008

2012

Projected Rates

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

State Pension Funding

Case law has held that contract clauses prohibit benefit changes for existing employees.

A significant body of case law establishes that the contract clauses of the United States and Pennsylvania constitutions protect public retirement benefits from being retroactively changed in any way that may be interpreted as a net detriment to employees. This prohibits not only reductions in already earned benefits but also reductions in the rate of future benefit accrual. A net detriment has been found in both reductions in benefits agreed-to at the time of hire and in increases in employee contributions in order to maintain the same level of agreed-to benefits. Although the General Assembly can change the employment contract of new employees to allow future reductionsas occurred with recent reformseven a constitutional amendment is unlikely to allow the reduction of already earned benefits and may not allow the reduction of future accruals for existing employees.

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

10

State Pension Funding

Many seemingly sensible attempts to further reduce costs do not actually cost less and may well exacerbate the debt issue to potentially insurmountable proportions.

Some of the more popular legislative options seem to be: creating a cash balance tier to the current defined benefit plan developing a hybrid plan that includes both defined benefit and defined contribution components closing the defined benefit plan in favor of a 401(k)-style defined contribution plan

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

11

State Pension Funding

Any proposal that includes closing the current defined benefit plans would exacerbate the debt issue to potentially insurmountable proportions.

The commonwealth would have to pay off the existing debt while also paying for whatever new retirement benefit is put in its place. Pension plans must be fully funded as of the date the last member is eligible to retire. Thus because there would be no new members joining the plan the clock would start ticking and the $29.4 billion debt would be due within about 35 years. As the plans wind down fewer people would be paying in, the employer share would be spread over fewer employees, and there would less time to make up for market fluctuations. The commonwealths share of the existing debt would become intolerably volatile.

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

12

State Pension Funding

The most likely way to deal with a debt of this size is including substantial funding infusions and consistently higher levels of employer funding over time.

a combination of solutions

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

13

State Pension Funding

The Good News

Pension reform benefit reductions have helped create proportionately higher levels of funding. Higher levels of funding may possibly be achieved by reallocating dedicated funding streams.

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

14

State Pension Funding

The Bad News

The funds cannot earn their way out of this debt through existing investments.

PSERS Stress Test Summary

Early Decade Recession Stress 1 FY 2001 - 2003 returns for FY 2012 - 2014 -7.40% -5.26% 2.74% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% Last Decade Stress 2 FY 2002 - 2011 returns for FY 2012 -2021 -5.26% 2.74% 19.67% 12.87% 15.26% 22.93% -2.82% -26.54% 14.59% 20.37% 7.50% Great Recession Stress 3 FY 2008 - 2009 returns for FY 2012 - 2013 -2.82% -26.54% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 4 Great Years Stress 4 FY 2004 - 2007 returns for FY 2012 - 2015 19.67% 12.87% 15.26% 22.93% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50%

Baseline Projected Return by Fiscal Year (FY) Ending June 30th 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 and there after Current w/Act 2010-120 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50% 7.50%

Results

Max Employer Contribution Rate* Dollars at Max Rate, in millions** Max Rate Fiscal Year 27.72% 4,930.2 FY 2020 34.93% 8,244.1 FY 2028 30.70% 7,778.1 FY 2030 38.10% 9,652.9 FY 2030 23.98% 3,755.8 FY 2016

* - Include Healthcare Premium Assist. ** - Includes Commonwealth and School Share

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

15

State Pension Funding

The Bad News

The funds cannot earn their way out of this debt through existing investments.

SERS Stress Test Summary

Early Decade Recession Stress 1 2000 - 2002 returns for 2011 - 2013 2.20% -7.90% -10.90% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% Last Decade Stress 2 2001 - 2010 returns for 2011 -2020 -7.90% -10.90% 24.30% 15.10% 14.50% 16.40% 17.20% -28.70% 9.10% 11.90% 8.00% Great Recession Stress 3 2008 returns for 2011 -28.70% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 3 Great Years Stress 4 2004 - 2006 returns for 2011 - 2013 15.10% 14.50% 16.40% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00%

Baseline Current w/Act 2010-120 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00%

Projected Return by Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 and there after

Results

Max Employer Contribution Rate Dollars at Max Rate, in millions Max Rate Fiscal Year 25.9% 1,757.9 2016/2017 38.9% 2,894.3 2019/2020 33.4% 2,804.4 2023/2024 41.2% 3,065.7 2019/2020 20.8% 1,370.3 2015/2016

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

16

State Pension Funding

More Bad News

Funding infusions have to be massive to move the needle. They are important as part of the combination of solutions necessary to deal with the debt but they are not likely a viable solution on their own.

Cash Infusion Projections

Additional Infusion Required as of July 1, 2011 to Reduce PSERS Contributions Below Target ($ In billions)

Amount Needed (30 yr Amortization) Target Percent of Payroll To Keep all Future Contribution Rates Below Target Amount Needed (10 yr Amortization) To Keep all Future Contribution Rates Below Target

Cash Infusion Projections

Additional Infusion Required In 2011 To Reduce SERS Contributions Below Target ($ in billions)

Amount Needed (30-Yr Amortization) Target Percent of Payroll To Keep All Future Contribution Rates Below Target Amount Needed (10-Yr Amortization) To Keep All Future Contribution Rates Below Target

< 20% < 15% < 10%

$15.23 $26.71 $37.39

$27.29 $34.17 $41.04

<20% <15% <10%

$3.8 $7.4 $10.9

$9.4 $11.7 $14.1

Rates assume a 1% collar on FY 11, 3% on FY 12, 3.5% on FY 13, and 4.5% on FY 14 and above until collars are no longer needed. (Act 120 collars) Rates projected based upon PSERS June 30, 2010 actuarial valuation.

NOTE: Per current law, rates assume collars of 1% in FY11, 3% in FY 12, 3.5% in FY13 and 4.5% in FY14+ until no longer needed. SERS 09-12-11

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

17

State Pension Funding

Aside from the budgetary concerns, there are some other issues to consider:

Bond ratings GASB exposure draft Employee recruitment and retention Benefit adequacy

Prepared by PSERS & SERS for the Senate Finance Committee - September 28, 2011

18

State Pension Funding

Were in this together. As your partners and technical experts, we are ready to do whatever it takes to help.

Jeffrey Clay PSERS Executive Director jclay@pa.gov 717-720-4734

David Durbin

SERS Office of Member Services Director

Prepared by PSERS & SERS for the Senate Finance Committee - September 26, 2011

Vous aimerez peut-être aussi

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018D'EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Pas encore d'évaluation

- Hidden Spending: The Politics of Federal Credit ProgramsD'EverandHidden Spending: The Politics of Federal Credit ProgramsPas encore d'évaluation

- SB 12-119: PERA Fiscal SustainabilityDocument2 pagesSB 12-119: PERA Fiscal SustainabilitySenator Mike JohnstonPas encore d'évaluation

- Proposed Statement of The Governmental Accounting Standards Board: Plain-Language SupplementDocument20 pagesProposed Statement of The Governmental Accounting Standards Board: Plain-Language SupplementGerrie SchipskePas encore d'évaluation

- Sample Policy MemosDocument21 pagesSample Policy MemosIoannis Kanlis100% (1)

- Department of Labor: Since 2001, The AdministrationDocument5 pagesDepartment of Labor: Since 2001, The AdministrationlosangelesPas encore d'évaluation

- Connecticut 2014.01.09 Opm Debt Reduction ReportDocument17 pagesConnecticut 2014.01.09 Opm Debt Reduction ReportHelen BennettPas encore d'évaluation

- The Future of Public PensionsDocument39 pagesThe Future of Public PensionsNational Press FoundationPas encore d'évaluation

- 10 7 Baucus LetterDocument27 pages10 7 Baucus LetterBrian AhierPas encore d'évaluation

- Impact of Unemployment Compensation Fund InsolvencyDocument11 pagesImpact of Unemployment Compensation Fund InsolvencyAndy ChowPas encore d'évaluation

- 0910 BudgetDocument346 pages0910 BudgetValerie F. LeonardPas encore d'évaluation

- Summers 12-15-08 MemoDocument57 pagesSummers 12-15-08 MemochenjiayuhPas encore d'évaluation

- Averting A Fiscal Crisis 0 0 0Document23 pagesAverting A Fiscal Crisis 0 0 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Chapter 14Document23 pagesChapter 14YolandaPas encore d'évaluation

- Final Report - New Jersey Pension and Health Benefit Study Commission - Dec. 6, 2017Document10 pagesFinal Report - New Jersey Pension and Health Benefit Study Commission - Dec. 6, 2017The (Bergen) RecordPas encore d'évaluation

- WA Senate Proposed Operating BudgetDocument34 pagesWA Senate Proposed Operating BudgetKING 5 NewsPas encore d'évaluation

- DOCUMENT: Gov. Dannel P. Malloy Connecticut Budget Fact Sheet (2/3/16)Document6 pagesDOCUMENT: Gov. Dannel P. Malloy Connecticut Budget Fact Sheet (2/3/16)NorwichBulletin.comPas encore d'évaluation

- AlamedaCourtyReportonPensions February 2010Document5 pagesAlamedaCourtyReportonPensions February 2010btmurrellPas encore d'évaluation

- 2017 Session Highlights UpdateDocument90 pages2017 Session Highlights UpdateNew York Senate100% (1)

- Budget Update July 142006Document7 pagesBudget Update July 142006Committee For a Responsible Federal BudgetPas encore d'évaluation

- BENTE RCSD Budget Analysis FinalDocument5 pagesBENTE RCSD Budget Analysis FinalmarybadamsPas encore d'évaluation

- CSCP Final Report Vols1-2Document141 pagesCSCP Final Report Vols1-2Valerie F. LeonardPas encore d'évaluation

- Highlights of The Governors Budget ProposalDocument44 pagesHighlights of The Governors Budget ProposalRichard Costigan IIIPas encore d'évaluation

- Spending Cap: ($10.4 B) ($4.3 B) ($2.6 B) ($7.1 B) ($5.1 B) ($1.9 B)Document6 pagesSpending Cap: ($10.4 B) ($4.3 B) ($2.6 B) ($7.1 B) ($5.1 B) ($1.9 B)tvanootPas encore d'évaluation

- State Budget SummaryDocument6 pagesState Budget SummarymelissacorkerPas encore d'évaluation

- Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515Document50 pagesDouglas W. Elmendorf, Director U.S. Congress Washington, DC 20515josephragoPas encore d'évaluation

- Fiscal 2012 Budget Overview Department of LaborDocument6 pagesFiscal 2012 Budget Overview Department of LaborRob PortPas encore d'évaluation

- The Future of Public PensionDocument23 pagesThe Future of Public PensionNational Press FoundationPas encore d'évaluation

- Senator Murray Budget Memo 1-24Document12 pagesSenator Murray Budget Memo 1-24Ezra Klein100% (1)

- Pension Costs: September 14, 2011 House Finance Committee Senate Finance CommitteeDocument62 pagesPension Costs: September 14, 2011 House Finance Committee Senate Finance Committeepcapineri8399Pas encore d'évaluation

- Deficit Committee PaperDocument5 pagesDeficit Committee PaperRyan DeCaroPas encore d'évaluation

- Update 2 28 01Document9 pagesUpdate 2 28 01Committee For a Responsible Federal BudgetPas encore d'évaluation

- 2013 CB Sfaff OverviewDocument79 pages2013 CB Sfaff OverviewChris Capper LiebenthalPas encore d'évaluation

- Strengthening Retirement SavingsDocument18 pagesStrengthening Retirement Savingsmatty_yomoPas encore d'évaluation

- Kitsap Budget MemoDocument18 pagesKitsap Budget MemopaulbalcerakPas encore d'évaluation

- State of The State 2010Document43 pagesState of The State 2010CapitolConfidentialPas encore d'évaluation

- Lakeport City Council - Final BudgetDocument119 pagesLakeport City Council - Final BudgetLakeCoNewsPas encore d'évaluation

- The Truth About The Pennsylvania State Employees' Retirement SystemDocument6 pagesThe Truth About The Pennsylvania State Employees' Retirement SystemJeremyPas encore d'évaluation

- Presidents Budget FY05Document9 pagesPresidents Budget FY05Committee For a Responsible Federal BudgetPas encore d'évaluation

- 2021 Riverside County Pension Advisory Review Committee ReportDocument16 pages2021 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comPas encore d'évaluation

- Burgum BudgetDocument3 pagesBurgum BudgetRob PortPas encore d'évaluation

- Release 2011-07-27 2012 Budget and Capital ProgramDocument3 pagesRelease 2011-07-27 2012 Budget and Capital ProgramElizabeth BenjaminPas encore d'évaluation

- Pension Plans ExplainedDocument21 pagesPension Plans ExplainedMichael NguyenPas encore d'évaluation

- 2011 Budget ReformsDocument8 pages2011 Budget ReformsSenatorNienowPas encore d'évaluation

- 2020 Riverside County Pension Review Advisory Committee ReportDocument17 pages2020 Riverside County Pension Review Advisory Committee ReportThe Press-Enterprise / pressenterprise.comPas encore d'évaluation

- IDC Historic Rehabilitation Tax Credit Report - March 16, 2011Document16 pagesIDC Historic Rehabilitation Tax Credit Report - March 16, 2011robertharding22Pas encore d'évaluation

- New York State Dedicated Highway and Bridge Trust Fund CrossroadsDocument18 pagesNew York State Dedicated Highway and Bridge Trust Fund CrossroadsNews10NBCPas encore d'évaluation

- CS TK Tai AnhDocument36 pagesCS TK Tai AnhDuy Duong DangPas encore d'évaluation

- NHRS' Day of ReckoningDocument3 pagesNHRS' Day of ReckoningNHGOPSenatePas encore d'évaluation

- The Australians Mid-Term Expenditure Framework (MTEF) - Its Features and Its Underlying Supporting Institutions/SystemsDocument23 pagesThe Australians Mid-Term Expenditure Framework (MTEF) - Its Features and Its Underlying Supporting Institutions/SystemsOswar MungkasaPas encore d'évaluation

- Averting A Fiscal Crisis 0Document23 pagesAverting A Fiscal Crisis 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Livingston County Adopted Budget (2023)Document401 pagesLivingston County Adopted Budget (2023)Watertown Daily TimesPas encore d'évaluation

- Petri Fall 2010 NewsletterDocument4 pagesPetri Fall 2010 NewsletterPAHouseGOPPas encore d'évaluation

- Kitchener 2013 Budget Preview Nov 5 2012Document52 pagesKitchener 2013 Budget Preview Nov 5 2012WR_RecordPas encore d'évaluation

- BVCSD Statler Report Final BVCSD Five Year Fiscal Forecast 2-11-13-1Document31 pagesBVCSD Statler Report Final BVCSD Five Year Fiscal Forecast 2-11-13-1Faith GreenPas encore d'évaluation

- Social Security and Medicare Trustees ReportDocument28 pagesSocial Security and Medicare Trustees ReportAustin DeneanPas encore d'évaluation

- Massachusetts Capital Budget Prioritizes InfrastructureDocument15 pagesMassachusetts Capital Budget Prioritizes Infrastructuresamuel kebedePas encore d'évaluation

- A Message To The PublicDocument24 pagesA Message To The Publicthe kingfishPas encore d'évaluation

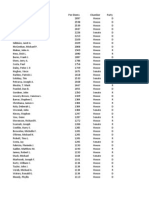

- Co Sponsor Vote Count On Property Tax Elimination AmendmentDocument2 pagesCo Sponsor Vote Count On Property Tax Elimination AmendmentPAindyPas encore d'évaluation

- PA Sunda Hunting Lawsuit DocumentDocument26 pagesPA Sunda Hunting Lawsuit DocumentPAindyPas encore d'évaluation

- Weekly Credit Outlook For Public Finance - November 8, 2013 PDFDocument18 pagesWeekly Credit Outlook For Public Finance - November 8, 2013 PDFPAindyPas encore d'évaluation

- PEL Letter To Scranton 9-30-13 PDFDocument4 pagesPEL Letter To Scranton 9-30-13 PDFPAindyPas encore d'évaluation

- Whitewood v. Corbett, 2013Document53 pagesWhitewood v. Corbett, 2013PennLivePas encore d'évaluation

- Restaurant Opportunity Center - 2011Document26 pagesRestaurant Opportunity Center - 2011PAindyPas encore d'évaluation

- PSBA - Legal Opinion 2005Document9 pagesPSBA - Legal Opinion 2005PAindyPas encore d'évaluation

- Property Tax Coalition LetterDocument2 pagesProperty Tax Coalition LetterPAindyPas encore d'évaluation

- Pew Pension Data - StatesDocument2 pagesPew Pension Data - StatesPAindyPas encore d'évaluation

- Restaurant Opportunity Center - 2010Document23 pagesRestaurant Opportunity Center - 2010PAindyPas encore d'évaluation

- Per Diem Totals - Jan-June 2013Document8 pagesPer Diem Totals - Jan-June 2013PAindyPas encore d'évaluation

- House GOP Will Bock Budget Over MedicaidDocument3 pagesHouse GOP Will Bock Budget Over MedicaidPAindyPas encore d'évaluation

- Bridges by CountyDocument2 pagesBridges by CountyPAindyPas encore d'évaluation

- June Per DiemsDocument4 pagesJune Per DiemsPAindyPas encore d'évaluation

- PA Lawsuit Against Montgomery County OfficialDocument23 pagesPA Lawsuit Against Montgomery County OfficialPAindyPas encore d'évaluation

- Kennedy-Shaffer Approval LetterDocument4 pagesKennedy-Shaffer Approval LetterPAindyPas encore d'évaluation

- Pennsylvania DOS DocumentsDocument1 pagePennsylvania DOS DocumentsPAindyPas encore d'évaluation

- May Per DiemsDocument4 pagesMay Per DiemsPAindyPas encore d'évaluation

- Management DirectiveDocument5 pagesManagement DirectivePAindyPas encore d'évaluation

- PLCB Denial LetterDocument2 pagesPLCB Denial LetterPAindyPas encore d'évaluation

- Delaware DOS Documents 2Document1 pageDelaware DOS Documents 2PAindyPas encore d'évaluation

- Pennsylvania DOS Documents 2Document1 pagePennsylvania DOS Documents 2PAindyPas encore d'évaluation

- Delaware DOS DocumentsDocument1 pageDelaware DOS DocumentsPAindyPas encore d'évaluation

- Kennedy-Shaffer Appeal LetterDocument2 pagesKennedy-Shaffer Appeal LetterPAindyPas encore d'évaluation

- PA Supreme Court - Eakin Concurring Opinion On Judicial RetirementDocument29 pagesPA Supreme Court - Eakin Concurring Opinion On Judicial RetirementPAindyPas encore d'évaluation

- PA Supreme Court - Judicial Retirement RulingDocument3 pagesPA Supreme Court - Judicial Retirement RulingPAindyPas encore d'évaluation

- PA Property Tax Collection 1981-1982 Through 2011-2012Document1 pagePA Property Tax Collection 1981-1982 Through 2011-2012PAindyPas encore d'évaluation

- Pennsylvania Treasury Memo On NIC PaymentsDocument9 pagesPennsylvania Treasury Memo On NIC PaymentsPAindyPas encore d'évaluation

- April Per DiemsDocument8 pagesApril Per DiemsPAindyPas encore d'évaluation

- Liquor Real Estate Owners AssociationDocument1 pageLiquor Real Estate Owners AssociationPAindyPas encore d'évaluation

- Chapter 4Document38 pagesChapter 4Haidee Sumampil67% (3)

- This Study Resource Was Shared Via: de La Salle LipaDocument2 pagesThis Study Resource Was Shared Via: de La Salle LipaAngel ObligacionPas encore d'évaluation

- MosaerBaer PDFDocument167 pagesMosaerBaer PDFJupe JonesPas encore d'évaluation

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Accounting Chapter 2Document56 pagesAccounting Chapter 2hnhPas encore d'évaluation

- Unit 2 Promotion of A New VentureDocument19 pagesUnit 2 Promotion of A New VentureAmish Suri100% (1)

- Internship Report On MBLDocument102 pagesInternship Report On MBLNazish Sohail100% (2)

- A Project On Analysis of Ulips in IndiaDocument78 pagesA Project On Analysis of Ulips in IndiaNadeem NadduPas encore d'évaluation

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickPas encore d'évaluation

- Compound Financial InstrumentDocument6 pagesCompound Financial InstrumentBeverlene BatiPas encore d'évaluation

- IASB Conceptual FrameworkDocument26 pagesIASB Conceptual FrameworkALEXERIK23100% (4)

- What Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsDocument10 pagesWhat Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsLucky ChaudhryPas encore d'évaluation

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratPas encore d'évaluation

- STD 12 Accountancy1Document264 pagesSTD 12 Accountancy1Chetan KhonaPas encore d'évaluation

- Thermo Fisher Acquires Life Technologies Finance ModelDocument19 pagesThermo Fisher Acquires Life Technologies Finance Modelvardhan0% (2)

- Quiz No. 2 FSA Oral Recits Quiz3Document1 pageQuiz No. 2 FSA Oral Recits Quiz3Louiza Kyla AridaPas encore d'évaluation

- Learning Guide: Basic Account Works Level IIDocument29 pagesLearning Guide: Basic Account Works Level IIBeka AsraPas encore d'évaluation

- Home OfficeDocument4 pagesHome OfficeVenessa Lei Tricia G. JimenezPas encore d'évaluation

- Epiphone Limited Lifetime WarrantyDocument4 pagesEpiphone Limited Lifetime WarrantybaalkaraPas encore d'évaluation

- Renegotiation of Long-Term International Investment AgreementsDocument43 pagesRenegotiation of Long-Term International Investment AgreementsAlyzeh S. Zahid100% (1)

- SPCC Accounts Term 2 HomeworkDocument2 pagesSPCC Accounts Term 2 HomeworkHarsh MishraPas encore d'évaluation

- Iesco Online Billl-March 17Document1 pageIesco Online Billl-March 17Muhammad Asif HussainPas encore d'évaluation

- GTB 2017aDocument386 pagesGTB 2017afisayobabs11Pas encore d'évaluation

- Bhurelal Money LaunderingDocument262 pagesBhurelal Money Launderingtyrwer100% (1)

- Republic v. SorianoDocument3 pagesRepublic v. SorianoEllis LagascaPas encore d'évaluation

- PPP Forgiveness Application 5.15.2020Document11 pagesPPP Forgiveness Application 5.15.2020CNBC.com100% (3)

- Chapter 18 - Financial Management Learning GoalsDocument25 pagesChapter 18 - Financial Management Learning GoalsRille LuPas encore d'évaluation

- Chapter 16 Notes - Complex Financial InstrumentsDocument13 pagesChapter 16 Notes - Complex Financial InstrumentsAli Nath0% (2)

- Fabm2 q2 Module 4 TaxationDocument17 pagesFabm2 q2 Module 4 TaxationLady HaraPas encore d'évaluation