Académique Documents

Professionnel Documents

Culture Documents

Econ Two

Transféré par

Karlyn CuaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Econ Two

Transféré par

Karlyn CuaDroits d'auteur :

Formats disponibles

Cua,Kathryn Joyce K.

10901191 Problem: The main problem discussed here in this paper is that the tax impose here in the Philippines is too discriminating towards the poor. Many people argue that the VAT is anti-poor since they are always the one who are hit the hardest. According to BIR Value-Added Tax is a form of sales tax levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services. In our current system, vat of 10% is imposed on all goods and is further revised to E-VAT of 10% on all goods and services and later on R-VAT of 12% which is effective on all goods and services. As we can see, the imposition of vat doesnt recognize the poor from the rich. Notably, everyone is to pay equally the huge amounts of e-vat charges that are levied upon practically anything and everything that people buy and pay forincluding food, fuel, shoes and clothes. The current tax bracket considerably doesnt lead to the equitable distribution of sources. Those people who earn a lot more income are only taxed up to a certain rate even if he exceeds and surpasses far greater than the normal income. While on the other hand, those people who earn just slightly higher may move on to the next bracket; furthermore, with the proposed greater simplification of the tax brackets in the near future, the more that the poor would be affected. Philippines is currently using the progressive tax wherein tax rates vary according to different factors like income. Those who are wealthier are taxed higher. But as time progresses, we are moving towards a flat rate system wherein there is a constant tax rate to all income levels and this is arguable more beneficial only to the affluent. Another arising issue in line with the discrimination of our tax system towards the poor is the controversial article nowadays that the market vendors, tricycle drivers, self-employed individuals and small entrepreneurs will have to issue receipts to further increase government revenues. Many people argue that this is a one-sided stance for the government. The government should focus more on big corporations instead of looking to get more out of these small-time owners.

SOLUTIONS: One solution for this arising problem is to lessen vat for basic commodities and to revise

our tax bracket. Lessening vat on basic commodities and focusing more to revising our tax bracket would greatly help the poor since taxing based more on income would bring in greater efficiency. Remember that personal income tax is a direct tax while VAT can be passed on to others. Large companies usually pass the VAT burden to the poor which wouldnt be the case if the tax would be imposed greater on a personal level of ability to consume. But the solution here is only to lessen VAT for basic commodities; other items that people may live without should remain with a 12% VAT. According to one report, data from the Department of Energy showed that 65.83% of electricity consumed is used by the three big sectors--industrial sector, commercial sector and public buildings and street lightings. The companies in these sectors would pass the VAT to the public through the prices of their products and services. 34.1 % of electricity consumed goes to residential customers but out of these, only 10% are used by wellto-do households which consumes more than 500-kilowatt-hours per month. This just goes to show that 90% of electricity VAT is paid directly and indirectly by the less fortunate. Since majority of these commodities is paid the poor, a great solution would be to lessen the VAT. To overcome the problem of decreased government revenues because of the proposal of

lessening the VAT, the incentives given like tax exemption and tax holidays of matured companies should be greatly reconsidered. It is only right to give incentives and tax holidays to new investments at a certain limit. One article recently surfaced about this and I think that this is good step. According to the proposed plan of the government, the Department of Finance is seriously reconsidering the replacement of income tax holidays (ITH) with reduced income tax exemption to investors except to those export-oriented enterprises that would locate in the countrys 30 poorest provinces. From 100% exemption, they are giving an option of 50% reduction in the income tax. So instead of the usual 30% income tax exemption, they are reducing it only to 15% exemption, 15% of which they have to pay. I think that this is a great idea so that the investors would still be lured and attracted to make investments in the country and at the same time the government is earning its part in revenue as well. This should only be applied to new investments. On the other hand, tax incentives from matured and well-established companies should be totally and completely abolished.

Another solution that I would like to advocate is to revise the uniform 30% corporate tax

on all companies. I think having the uniform rate would not account to those companies who earn smaller profits. The Corporate Tax system should have tax brackets as well depending on the level of profits. Those companies who have a greater share of in the market should share more in the contribution to the tax for the government. An example would be top companies like SM, Ayala Corporation and Gokongwei Industries. It wouldnt hurt much for them to pay a little more since they have big earnings anyway. Another issue with these large companies is the issue regarding Input Tax. These companies usually report a lot of their expenses as input tax. The government should think of a solution to limit these related expenses that should be covered as input tax or if not, they should have a limit imposed on the amount that can be used as a tax deductible expense. Another good solution is to increase taxes of vices and sin products. This is the much

heated topic nowadays and one of the focuses of the Aquino Administration. With the growing report of smokers and alcoholics by the World Health Organization, this is a good way to stop it and at the same time increase the revenue for the government. This is a win-win situation. Products under sin tax are considered to be non-essentials and consumers of these products are willing to pay more or at a premium price just to avail them. Usually, these include cigarettes, spirits and liquor. Presently, the government is proposing to amend the sin tax law that they said would generate additional revenues of P20 million in the first year of implementation. They are proposing to impose a single tax on all cigarettes whether it an expensive or cheaper brand of cigarette. Currently, we are using the multi-tier system wherein expensive cigarettes are taxed at a higher rate compared to the cheaper brands smoke by the lower-income consumers. Imposing a single tax rate on all cigarettes would greatly discourage the use of it. The World Health Organization (WHO) said that the cigarette tax in Singapore was equivalent to $192.56 per

1,000 sticks, while that in Brunei is at $39.3. In Malaysia, cigarettes are taxed $23.29 per 1,000 sticks. But in the Philippines, it said, the excise tax on cigarettes ranges from only $2.42 to $29.28 per 1,000 sticks. (Reference to PDI article published on 11 January 2008).

Since our excise tax is not that high yet, the government would be still be able to impose a high excise tax on these products.

Additional rate of taxes should be imposed to luxurious items and other establishments

like golf club shares and casinos. Jewelry, yachts, private jets, watches, perfumes, radiocontrolled toys are some of the luxury items that the riches buy. Since they are part of the nonessential goods, these things wont probably affect the poor that much. They dont need it as part of their basic commodities. The rich have money to spend and they would be willing to pay more even if the price is slightly higher just to be able to avail of it. Golf club shares are also things that the rich avails. Presently, some of the golf club is considered a non-profit organization and the membership dues that they bill to their stockholders are not subjected to 12% value-added tax. The membership fees they collect are solely for the purpose of maintaining the amenities and the golf course facilities. According to the BIR Ruling No. DA (VAT-020)120-2010, The Bureau of Internal Revenue (BIR) held that although a non-profit golf club may be subject to VAT on activities or transactions made in the regular conduct or pursuit of a commercial or an economic activity for profit, the operation of the golf club, in itself, and the billing and collection of membership dues from members/stockholders are not the business activities mentioned in Sections 106 to 108 of the Tax Code. Hence, the monthly memberships dues being billed by the golf club to its members are not subject to 12 percent VAT. Another establishment that is highly controversial is the taxation of the Philippine Amusement and Gaming Corporation (PAGCOR).It is government owned and controlled corporation which is said to be the thirdlargest revenue making center of the government. For the past 9 years, it has been generating an income of P30 Billion yearly. This is a great deal of money but the thing is that it exempted from E-VAT. It has to remit 5% of its net winnings as franchise tax and 50% to the national treasury but it is not subjected to Tax. The government should considering taxing it since this is also part of the luxury that the rich enjoys. Most people that play on these Casinos are rich people or are foreigners that take their time in playing. It would be a huge number if you impose vat yearly to an income of P30 billion. The last solution would be to add more tax to imported goods. The current administration

should bring back the surcharge or additional tax on top of whatever tariff on many imported goods not only to enhance government revenue but to also protect our local industries. Tariff is a tax levied on imports by the customs authorities of a country to raise state revenue, and/or to protect domestic industries from more efficient or predatory competitors from abroad. All imported goods are subjected to uniform rate of 10% VAT. An additional tax on these imported

goods will increase the prices of these goods encouraging people to buy more locally made products. This is a good solution since based on our previous discussions, it is thought to be that the easiest way to increase income and GDP is to lessen the imports. In 2005, there was an issue regarding this matter wherein the World Trade Organization (WTO) removed the tariff. According to the report, the loss here in potential revenues could cover the budget deficit before of more than P300 billion. In conclusion, to summarize the whole point of the solutions proposed here, those who have more in life should pay more and have larger share in VAT. As The Trade Union Congress of the Philippines has said, It is immoral to subject the poor to taxation while whose earning far greater incomes are granted VAT exemptions.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The RGT (Red Global de Trueque)Document65 pagesThe RGT (Red Global de Trueque)MantarayoPas encore d'évaluation

- Method of BudgetingDocument2 pagesMethod of BudgetingNAMRATA SHARMAPas encore d'évaluation

- Puppets On A Shoestring - Effects On Municipal Government of Canadas System of Public Finance 1976Document42 pagesPuppets On A Shoestring - Effects On Municipal Government of Canadas System of Public Finance 1976Hamilton ReporterPas encore d'évaluation

- Science Illustrated 2008-01, 02 - Jan, Feb 2008 - Extremes of Nature PDFDocument86 pagesScience Illustrated 2008-01, 02 - Jan, Feb 2008 - Extremes of Nature PDFKarlyn CuaPas encore d'évaluation

- Finman ReportDocument4 pagesFinman ReportKarlyn CuaPas encore d'évaluation

- Makeup OrganizersDocument1 pageMakeup OrganizersKarlyn CuaPas encore d'évaluation

- Finman ReportDocument4 pagesFinman ReportKarlyn CuaPas encore d'évaluation

- Finman ReportDocument4 pagesFinman ReportKarlyn CuaPas encore d'évaluation

- Finman ReportDocument4 pagesFinman ReportKarlyn CuaPas encore d'évaluation

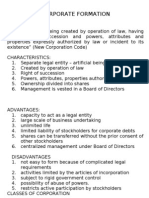

- Corporate - Formation 3T 2010-11Document10 pagesCorporate - Formation 3T 2010-11Francesca PaduaPas encore d'évaluation

- In Partial Fulfillment of The Course Requirements in BusorgaDocument3 pagesIn Partial Fulfillment of The Course Requirements in BusorgaKarlyn CuaPas encore d'évaluation

- Business OrganizationDocument3 pagesBusiness OrganizationKarlyn CuaPas encore d'évaluation

- 02-FI-02 - SDD - MSRDC - VBSL - Funds Creation Allocation - V1Document13 pages02-FI-02 - SDD - MSRDC - VBSL - Funds Creation Allocation - V1DanielpremassisPas encore d'évaluation

- 2.3. Budget Cycle - Budget LegislationDocument7 pages2.3. Budget Cycle - Budget LegislationJudy Ann TusiPas encore d'évaluation

- Tally PDFDocument185 pagesTally PDFArunPas encore d'évaluation

- Budget MA1Document8 pagesBudget MA1Sheena CalderonPas encore d'évaluation

- Constitution and ByLaws - Amended 111808Document11 pagesConstitution and ByLaws - Amended 111808Forkedcreekyachtclub FcycPas encore d'évaluation

- EF2B HDT Budget BlackMoney 15FC Subsidies PCB4Document54 pagesEF2B HDT Budget BlackMoney 15FC Subsidies PCB4016 Durgesh kumarPas encore d'évaluation

- HCM 400 Final ProjectDocument9 pagesHCM 400 Final ProjectEunice AppiahPas encore d'évaluation

- Horizontal and Vertical AnalysisDocument3 pagesHorizontal and Vertical AnalysisJane Ericka Joy MayoPas encore d'évaluation

- BUDGET AT A GLANCE Full PDFDocument440 pagesBUDGET AT A GLANCE Full PDFTamilnadu KaatumanarkovilPas encore d'évaluation

- Artificial Grass For Sport Artificial Grass For Sport: Part 5 of 8 Part 5 of 8Document18 pagesArtificial Grass For Sport Artificial Grass For Sport: Part 5 of 8 Part 5 of 8ifyjoslynPas encore d'évaluation

- Economics AQA As Unit 2 Workbook AnswersDocument20 pagesEconomics AQA As Unit 2 Workbook AnswersFegsdf Sdasdf0% (1)

- Department of Labor: lm3 BlankformDocument5 pagesDepartment of Labor: lm3 BlankformUSA_DepartmentOfLabor100% (6)

- GAM-govacco Notes Part 2Document3 pagesGAM-govacco Notes Part 2hoxhiiPas encore d'évaluation

- 08-Regulations Governing Business Trip A..ty - Higher School of EconomicsDocument13 pages08-Regulations Governing Business Trip A..ty - Higher School of EconomicsCha Icha NathaPas encore d'évaluation

- Capital Budgeting and The AHPDocument17 pagesCapital Budgeting and The AHPMadalina CiobanuPas encore d'évaluation

- Topic 2 Capital Budgeting PDFDocument65 pagesTopic 2 Capital Budgeting PDFKobe TannerPas encore d'évaluation

- Planning Technical ActivitiesDocument40 pagesPlanning Technical ActivitiesKen Andrie Dungaran GuariñaPas encore d'évaluation

- Interaction Between Monetary and Fiscal Policies - Wikipedia, The Free EncyclopediaDocument5 pagesInteraction Between Monetary and Fiscal Policies - Wikipedia, The Free Encyclopediaashugkp1811Pas encore d'évaluation

- Oracle Purchasing User's Guide-3Document23 pagesOracle Purchasing User's Guide-3nanindwPas encore d'évaluation

- Sir David Arculus Et Al. (2009a) Arculus Review - A Report For The Conservative PartyDocument58 pagesSir David Arculus Et Al. (2009a) Arculus Review - A Report For The Conservative PartyPiotr WójcickiPas encore d'évaluation

- RevFY2010CYITC 072109Document2 pagesRevFY2010CYITC 072109Susie CambriaPas encore d'évaluation

- Economic Survey 2011-12 PDFDocument286 pagesEconomic Survey 2011-12 PDFsantoshPas encore d'évaluation

- MDLZ Mondelez CAGNY 2017Document50 pagesMDLZ Mondelez CAGNY 2017Ala BasterPas encore d'évaluation

- Military Spending ReportDocument31 pagesMilitary Spending ReportaristafirsantoroPas encore d'évaluation

- Assignment Drive SPRING 2017 Program MBA Semester I Ssubject Code & Name MBA104 Financial and Management Accounting BK Id B1624 Credit 4 Marks 60Document3 pagesAssignment Drive SPRING 2017 Program MBA Semester I Ssubject Code & Name MBA104 Financial and Management Accounting BK Id B1624 Credit 4 Marks 60rakeshPas encore d'évaluation

- II PUC EconomicsDocument5 pagesII PUC EconomicsArvind KorePas encore d'évaluation

- Riyadh Real Estate Market Overview H2 2014 EnglishDocument31 pagesRiyadh Real Estate Market Overview H2 2014 EnglishTy BorjaPas encore d'évaluation