Académique Documents

Professionnel Documents

Culture Documents

Long Term Finance

Transféré par

sriramg24Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

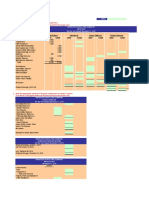

Long Term Finance

Transféré par

sriramg24Droits d'auteur :

Formats disponibles

SOURCES OF LONG TERM FINANCE The sources from which a finance manager can raise long-term funds are

broadly classified as 1) External Sources 2) Internal Sources. Internal sources include retained earnings, depreciation (as depreciation only represents reduction in the value of the asset through wear and tear, obsolescence etc, and is not an actual cash outflow). The focus in this article is on the long-term external source of finance. Various sources of long-term finance are Share capital * Equity share capital * Preference share capital. Debenture Capital * Non-Convertible Debentures (NCD) * Fully Convertible Debentures (FCD) * Partly Convertible Debentures (PCD) Term Loans * Rupee term loans * Foreign currency terms loans. There are many other sources of long-term finance like deferred credit, unsecured loans and deposits, suppliers credit scheme, leasing and hire purchase which are beyond the scope of this article. Equity Capital: Equity capital represents the ownership capital. The equity shareholders collectively own the company and enjoy all the rewards and the risks associated with the ownership. However, unlike the sole proprietor or the partner of the firm, the downside risk of the shareholders is limited to their capital contribution. Residual Claim: It refers to the residual income on which the shareholders have a right. Residual income is the income left after the claims of all others lenders of long-term finance in the form of interest and taxes have been met. It is the figure of profit after tax less dividend to be paid to preference shareholders. The equity shareholders have a residual claim on the income of the company. The company has distributed the whole profit as dividend to the equity holders or the company may retain a part of its profit. The dividend decision is the decision of the board of directors. Equity Shareholders cannot contest it in a court of law. Liquidation: Refers to the closure of a company. It may be due to losses and non-viability of the operations. The capital contributed by the equity shareholders cannot be redeemed until the liquidation of the company. From the companys point of view funds through equity capital has both advantages and disadvantages. The main advantages are: * It is a source of permanent capital * Payments of dividend is not a legal obligation * Equity capital provides the base for raising debt as equity represents the commitment of promoters to the growth of the company.

The main disadvantages are: * Non-voting shares refer to the equity shares which do not carry voting rights. Thus, non-voting shareholders do not involve in making management decisions. * Public offer of equity capital can result in a dilution of the effective control exercised by the existing shareholders. However, this can be avoided by issuing of non-voting shares (which no corporate is yet allowed to do). * Unlike interest on debentures, dividends on equity are not tax deductible. Out-flow amounts on dividends will not provide any tax-shield.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- FX Forward ContractsDocument2 pagesFX Forward ContractsQuant_GeekPas encore d'évaluation

- Z01 GITM4380 13E IM PracticeQuizes&Solutions PDFDocument55 pagesZ01 GITM4380 13E IM PracticeQuizes&Solutions PDFGolamSarwar100% (5)

- Kotak FinalDocument46 pagesKotak FinalRahul FaliyaPas encore d'évaluation

- HSBC Personal Banking Hotline User Guide (2233 3000) : Please Select Language Cantonese English PutonghuaDocument3 pagesHSBC Personal Banking Hotline User Guide (2233 3000) : Please Select Language Cantonese English PutonghuaSaxon ChanPas encore d'évaluation

- Chapter 13 SolutionsDocument5 pagesChapter 13 SolutionsStephen Ayala100% (1)

- Principles of Investments 1st Edition Bodie Solutions ManualDocument35 pagesPrinciples of Investments 1st Edition Bodie Solutions Manualdesight.xantho1q28100% (27)

- Activity 01Document3 pagesActivity 01Mahra AlMazroueiPas encore d'évaluation

- Advanced Corporate Finance - Assignment 1Document4 pagesAdvanced Corporate Finance - Assignment 1Arush SinhalPas encore d'évaluation

- CHAPTER 7 - MATHEMATICS of FINANCE, Seventh Edition by Robert L. Brown, Steve Kopp and Petr Zima (Z-Lib - Org) - 261-289Document29 pagesCHAPTER 7 - MATHEMATICS of FINANCE, Seventh Edition by Robert L. Brown, Steve Kopp and Petr Zima (Z-Lib - Org) - 261-289Tisha YatolPas encore d'évaluation

- ch06 SM RankinDocument12 pagesch06 SM Rankinhasan jabrPas encore d'évaluation

- Fortune Brands Inc: FORM 10-QDocument49 pagesFortune Brands Inc: FORM 10-Qtomking84Pas encore d'évaluation

- Using British Virgin Islands Companies For International ListingsDocument5 pagesUsing British Virgin Islands Companies For International ListingskalinovskayaPas encore d'évaluation

- Unit 4 Derivatives Part 1Document19 pagesUnit 4 Derivatives Part 1UnathiPas encore d'évaluation

- Excel 1 - Common Sized Financial Statements - IrvinDocument2 pagesExcel 1 - Common Sized Financial Statements - Irvinapi-581024555Pas encore d'évaluation

- Wahlen Int3e EX03-11Document3 pagesWahlen Int3e EX03-11林義哲Pas encore d'évaluation

- Book 11Document4 pagesBook 11Actg SolmanPas encore d'évaluation

- F9 Part CDocument8 pagesF9 Part Cnguyen quynhPas encore d'évaluation

- Pricing With SmileDocument4 pagesPricing With Smilekufeutebg100% (1)

- The Forex Scalping Guide: How To Scalp ForexDocument27 pagesThe Forex Scalping Guide: How To Scalp ForexSusanto Yang100% (4)

- Bonds Valuation PowerpointDocument39 pagesBonds Valuation Powerpointttongoona3Pas encore d'évaluation

- Liberty - July 30 2019Document1 pageLiberty - July 30 2019Lisle Daverin BlythPas encore d'évaluation

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalPas encore d'évaluation

- Foreign Exchange QuesDocument2 pagesForeign Exchange QuesumerPas encore d'évaluation

- Consolidation Q80Document5 pagesConsolidation Q80Nolan TitusPas encore d'évaluation

- Aan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodDocument25 pagesAan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodNamra SaeedPas encore d'évaluation

- Preferential Allotment of Shares - Companies Act, 2013 - ProcedureDocument4 pagesPreferential Allotment of Shares - Companies Act, 2013 - ProcedureRamesh MandavaPas encore d'évaluation

- Performance Indicators - Shell Annual Report 2016Document4 pagesPerformance Indicators - Shell Annual Report 2016Wassef MBPas encore d'évaluation

- Day Trading StrategiesDocument4 pagesDay Trading Strategiesthushantha50% (2)

- Final Gitman - pmf13 - PPT 07 GE Stock Valuation To 50Document51 pagesFinal Gitman - pmf13 - PPT 07 GE Stock Valuation To 50asimPas encore d'évaluation