Académique Documents

Professionnel Documents

Culture Documents

Market Outlook 11th October 2011

Transféré par

Angel BrokingDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Market Outlook 11th October 2011

Transféré par

Angel BrokingDroits d'auteur :

Formats disponibles

Market Outlook

India Research

October 11, 2011

Dealers Diary

The Indian markets are expected to open gap up on the back of supportive global cues which lead to rally in global markets and positive opening in all the Asian markets in the early market trade. The domestic benchmark indices rallied for the second consecutive day yesterday as positive employment data from the US and easing concerns over euro-zone banks drove investor appetite for risk. Yesterday realty, consumer durable, oil and gas, technology and auto stocks rallied, while defensive healthcare and FMCG stocks closed subdued. Globally, US and European markets extended their upward movement yesterday backed by renewed optimism about the financial situation in Europe as German and France leaders vowed to unveil a new plan to address the European debt crisis by the end of the month which indicated that they have a concrete plan to fix the troubles in the European banking sector. On the global front the key event to watch out today will be UKs industrial production data. Also on the domestic front IIP numbers for August 2011 which will be released tomorrow, will be on the radar as well.

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%) 2.0 1.9 1.4 1.0 (0.1) 1.5 1.4 2.3 1.9 2.7 2.9 Chg (%) 3.0 3.5 1.8 1.0 0.0 1.1 (0.6)

(Pts) 91.6 81.0 65.4 (3.4) 106.3 191.7 230.2 149.4 (Pts) 86.7 95.6 83.6 28.0 (14.4)

(Close) 4,980 6,040 6,787 5,841 7,411 8,680 8,681 5,391 (Close) 2,566 5,399 8,606 2,668 2,345

324.7 16,557

147.5 10,495 202.7 11,113

330.1 11,433

Markets Today

The trend deciding level for the day is 16,461/4,951 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 16,69216,826/5,0205,060 levels. However, if NIFTY trades below 16,461/4,951 levels for the first half-an-hour of trade then it may correct up to 16,32716,096/4,9114,842 levels.

Indices SENSEX NIFTY S2 16,096 4,842 S1 16,327 4,911 R1 16,692 5,020 R2 16,826 5,060

4.1 17,711

Indian ADRs Infosys Wipro ICICI Bank HDFC Bank Advances / Declines Advances Declines Unchanged

Chg (%) 3.0 4.8 4.3 3.8

(Pts) 1.6 0.4 1.4 1.1 BSE 1,686 1,084 136

(Close) $53.8 $9.6 $35.0 $30.6 NSE 952 476 60

News Analysis

Bonds yields soar to the highest in three years National Telecom Policy 2011 SBI to raise `5,000cr through rights issue by December 2011 2QFY2012 Result Review Sintex Industries

Refer detailed news analysis on the following page

Net Inflows (October 07, 2011) ` cr Purch FII MFs 3,564 528

Sales 3,073 424

Net 491 104

MTD (2,227) (225)

YTD (4,180) 5,273

Volumes (` cr) BSE NSE 2,214 10,616

FII Derivatives (October 10, 2011) ` cr Index Futures Stock Futures Gainers / Losers Gainers Company Amtek Auto Sun TV Network Educomp Sol Tata Motors Jubilant Food Price (`) 131 288 278 171 754 chg (%) 12.7 10.2 9.0 7.4 7.0 Company Maruti Suzuki Voltas Engineers India Neyveli Lignite Adani Power Losers Price (`) 1,073 102 243 75 78 chg (%) (3.6) (2.8) (2.3) (2.0) (2.6) Purch 1,855 1,626 Sales 1,497 1,549 Net 358 77 Open Interest 12,784 26,467

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

Bond yields soar to the highest in three years

The Indian governments bond yields have shot up sharply following the announcement of higher government borrowings for FY2012. The Government of India had announced its intention to raise additional borrowings of `52,800cr in 2HFY2012 on September 29, 2011. Yields on the benchmark 10-year government bonds have soared to 8.74% (from 8.34% as of September 28, 2011), the highest in three years. Even the shorter tenure, one and five-year, bond yields have risen by 8bp and 18bp, respectively, over the same period. This rise is in-line with our expectations that G-sec yields being lower than FD rates would have an upward bias, even as broader deposit and lending rates peak at more or less current levels. While traditionally PSU banks were regarded as bond proxies, in recent years, they have been reducing their holding of excess government securities above SLR requirements, especially in the Available For Sale (AFS) portfolio and have reduced the duration of the AFS investment book, thereby reducing their vulnerability to fluctuation in bond yields. Having said that, in our view, if the yields stay at current high levels, it is likely to lead to underperformance of banks with relatively higher AFS investment proportion and/or higher AFS duration as higher MTM provisions will dent the profitability. Exhibit 1: AFS modified duration as of 1QFY2012

Bank Dena Bank* Oriental Bank Bank of Maharashtra# State Bank of India Syndicate Bank Axis Bank Canara Bank Allahabad Bank* Punjab National Bank Bank of Baroda* Indian Overseas Bank Indian Bank Union Bank Andhra Bank J&K Bank Bank of India South Indian Bank*

#

AFS (` cr) 2,897 14,860 4,116 72,000 3,750 25,213 25,355 13,835 22,212 10,390 15,116 11,000 2,658 10,264 2,169 6,028 31,530 1,771

AFS (%) 14.6 33.0 18.0 24.5 11.0 33.5 29.5 30.3 22.0 13.0 29.5 29.6 22.1 17.1 8.6 33.2 37.3 20.9

AFS mod. dur. (years) 3.97 3.64 3.33 3.15 3.15 3.01 2.67 2.67 2.64 2.50 2.19 1.69 1.60 1.59 1.09 0.97 0.62 0.39

Federal Bank*

Source: Company, Angel Research; Note:* AFS + HFT Mod duration, #Latest available data

October 11, 2011

Market Outlook | India Research

National Telecom Policy 2011

The new telecom policy draft 2011 was released yesterday by the Telecom Minister, Kapil Sibal. It was a qualitative extension of the proposed draft in February 2011. Following are the key highlights of the policy: One Nation-One Licence This implies the abolition of roaming charges within the country. As per TRAI, currently GSM operators derive ~8% of their wireless revenue from roaming, out of which ~50% is from international roaming. Therefore, effectively 4% of revenue, which is from national roaming, will be at risk. This might impact the earnings of telecom players in the near term. Delinking of licence fees and spectrum charges Previously, licence fees was inclusive of spectrum up to 4.4MHz; but after delinking, separate charges will be levied to avail spectrum along with licence fee. This will increase the capex outgo for companies from 2015 when regional licences would come up for renewals. Under the Spectrum Act, the ministry intends to deal with all issues related to mobile permits, including re-farming, pricing of spectrum, withdrawal of allotted spectrum and norms for sharing and trading. Re-farming will increase the capex outgo for all companies as they will have to shift from 900MHz spectrum to 1,800MHz. All future spectrum allocations will be priced at market rates. At this juncture, the possible financial impact will be due to the one nation, one-licence proposition. Other propositions are still in the nascent stage and we expect some discreet decisions on this only by December 2011.

SBI to raise `5,000cr through rights issue by December 2011

State Bank of India (SBI) is likely to raise `5,000cr through a rights issue of shares by December. The government is expected to infuse ~`3,000cr, keeping its stake in the bank at ~60%. The `5,000cr rights issue, according to the management would be the first tranche in the entire process of raising ~`20,000-`30,000cr over the next few years. While this infusion of ~`5,000cr is expected to shore up the tier 1 ratio of the bank to ~8%, it would be still short of the benchmark 9% that most large banks currently have. While the capital adequacy ratio is expected to be an overhang on the stock, however, in the medium term considering the attractive valuations (1.3x FY2013 ABV) and structural positives, we maintain a buy on the bank with a target price of `2,403

Result Review Sintex Industries

For 2QFY2012, Sintex Industries registered strong top-line growth. The companys net sales grew by 25.3% yoy and to `1,157cr on the back of strong growth of 25.9% yoy in the plastic segment to `1,043cr (`828cr). The company reported a 93bp yoy contraction in OPM to 17.7% (18.6%), largely on back of increased purchase of traded goods, up by 132bp yoy. Net profit declined by 61.2% yoy to `39cr (`100cr). The sharp decline in PAT was due to `60cr loss on forex exchange on outstanding FCCBs. Consequently, with an extraordinary increase in forex losses, PAT margin also declined by 749bp to 3.4%. We will be coming out with an updated report post management concall. We may revise our estimates and target price post the concall today.

October 11, 2011

Market Outlook | India Research

Quarterly Bloomberg estimates

Infosys Ltd

Particulars (` cr) Net Sales EBITDA EBITDA margin (%) Net Profit

Source: Bloomberg, Angel Research

2QFY12E 8,071 2,444 30 1,893

2QFY11 6,947 2,315 33 1,737

yoy (%) 16.2 5.6 9.0

1QFY12 7,485 2,176 29 1,722

qoq (%) 7.8 12.3 9.9

Reliance Industries Ltd

Particulars (` cr) Net Sales EBITDA EBITDA margin (%) Net Profit

Source: Bloomberg, Angel Research

2QFY12E 79,890 10,304 13 5,792

2QFY11 57,479 9,396 16 4,923

yoy (%) 39.0 9.7 17.6

1QFY12 81,018 9,926 12 5,661

qoq (%) (1.4) 3.8 2.3

Economic and Political News

Credit offtake by priority sectors up 17.3% in August 2011 CRISIL cuts India GDP forecast for FY2012 to 7.6% Government to spend `30cr to dispose Union Carbide waste

Corporate News

BHEL wins `4,000cr contract to set up power plant Mahindra Satyam in deal for financial services CRM M&M resumes operations at Rudrapur plant RIL to sign a deal with Disney's UTV

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

October 11, 2011

Market Outlook | India Research

Research Team Tel: 022-3935 7800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

Address: 6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3935 7800

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

October 11, 2011

Vous aimerez peut-être aussi

- Market Outlook: Dealer's DiaryDocument5 pagesMarket Outlook: Dealer's DiaryVaibhav BhadangePas encore d'évaluation

- Market Outlook 14th October 2011Document6 pagesMarket Outlook 14th October 2011Angel BrokingPas encore d'évaluation

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 27th February 2012Document5 pagesMarket Outlook 27th February 2012Angel BrokingPas encore d'évaluation

- Market Outlook Market Outlook: Dealer's DiaryDocument6 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 2nd December 2011Document6 pagesMarket Outlook 2nd December 2011Angel BrokingPas encore d'évaluation

- Market Outlook 20th September 2011Document4 pagesMarket Outlook 20th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument21 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 8th December 2011Document5 pagesMarket Outlook 8th December 2011Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument24 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 20th January 2012Document11 pagesMarket Outlook 20th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 9th November 2011Document11 pagesMarket Outlook 9th November 2011Angel BrokingPas encore d'évaluation

- Market Outlook 13th September 2011Document4 pagesMarket Outlook 13th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 26th December 2011Document4 pagesMarket Outlook 26th December 2011Angel BrokingPas encore d'évaluation

- Market Outlook 6th September 2011Document4 pagesMarket Outlook 6th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingPas encore d'évaluation

- Market Outlook 18th January 2012Document7 pagesMarket Outlook 18th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 21st December 2011Document5 pagesMarket Outlook 21st December 2011Angel BrokingPas encore d'évaluation

- Market Outlook 19th January 2012Document8 pagesMarket Outlook 19th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook Market Outlook: Dealer's DiaryDocument8 pagesMarket Outlook Market Outlook: Dealer's DiaryangelbrokingPas encore d'évaluation

- Market Outlook Market Outlook: Dealer's DiaryDocument9 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 24th October 2011Document14 pagesMarket Outlook 24th October 2011Angel BrokingPas encore d'évaluation

- Market Outlook 9th March 2012Document4 pagesMarket Outlook 9th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 25th July 2011Document8 pagesMarket Outlook 25th July 2011Angel BrokingPas encore d'évaluation

- Market Outlook 29th August 2011Document4 pagesMarket Outlook 29th August 2011Angel BrokingPas encore d'évaluation

- Indian Bank: Performance HighlightsDocument10 pagesIndian Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Market Outlook 23rd November 2011Document5 pagesMarket Outlook 23rd November 2011Angel BrokingPas encore d'évaluation

- Market Outlook, 21st February, 2013Document14 pagesMarket Outlook, 21st February, 2013Angel BrokingPas encore d'évaluation

- Market Outlook 20th October 2011Document12 pagesMarket Outlook 20th October 2011Angel BrokingPas encore d'évaluation

- Market Outlook 15th September 2011Document4 pagesMarket Outlook 15th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingPas encore d'évaluation

- Market Outlook 5th October 2011Document4 pagesMarket Outlook 5th October 2011Angel BrokingPas encore d'évaluation

- Market Outlook 31st January 2012Document10 pagesMarket Outlook 31st January 2012Angel BrokingPas encore d'évaluation

- Opening Bell: Market Outlook Today's HighlightsDocument8 pagesOpening Bell: Market Outlook Today's HighlightsNaleep GuptaPas encore d'évaluation

- Market Outlook 13th October 2011Document5 pagesMarket Outlook 13th October 2011Angel BrokingPas encore d'évaluation

- DEN Networks to deliver 100%+ earnings growth on digitizationDocument8 pagesDEN Networks to deliver 100%+ earnings growth on digitizationvignesh_sundaresan_1Pas encore d'évaluation

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 22nd December 2011Document4 pagesMarket Outlook 22nd December 2011Angel BrokingPas encore d'évaluation

- Commodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Document4 pagesCommodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Narnolia Securities LimitedPas encore d'évaluation

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingPas encore d'évaluation

- Market Outlook 6th March 2012Document3 pagesMarket Outlook 6th March 2012Angel BrokingPas encore d'évaluation

- Market Outlook 2nd November 2011Document8 pagesMarket Outlook 2nd November 2011Angel BrokingPas encore d'évaluation

- Economy News: Morning Insight July 22, 2011Document13 pagesEconomy News: Morning Insight July 22, 2011डॉ. विनय कुमार पंजियारPas encore d'évaluation

- Market Outlook 19th April 2012Document7 pagesMarket Outlook 19th April 2012Angel BrokingPas encore d'évaluation

- Market Outlook 19th October 2011Document7 pagesMarket Outlook 19th October 2011Angel BrokingPas encore d'évaluation

- Market Outlook 3rd May 2012Document13 pagesMarket Outlook 3rd May 2012Angel BrokingPas encore d'évaluation

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 10th August 2011Document5 pagesMarket Outlook 10th August 2011Angel BrokingPas encore d'évaluation

- Market Outlook 250912Document3 pagesMarket Outlook 250912Angel BrokingPas encore d'évaluation

- Market Outlook 4th April 2012Document4 pagesMarket Outlook 4th April 2012Angel BrokingPas encore d'évaluation

- Market Outlook: India Research Dealer's DiaryDocument3 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingPas encore d'évaluation

- Market Outlook 13th December 2011Document4 pagesMarket Outlook 13th December 2011Angel BrokingPas encore d'évaluation

- Market Outlook 040113Document14 pagesMarket Outlook 040113Angel BrokingPas encore d'évaluation

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingPas encore d'évaluation

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryD'EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Nonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryD'EverandNonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingPas encore d'évaluation

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingPas encore d'évaluation

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingPas encore d'évaluation

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingPas encore d'évaluation

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingPas encore d'évaluation

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingPas encore d'évaluation

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingPas encore d'évaluation

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingPas encore d'évaluation

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingPas encore d'évaluation

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingPas encore d'évaluation

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingPas encore d'évaluation

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingPas encore d'évaluation

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingPas encore d'évaluation

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingPas encore d'évaluation

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingPas encore d'évaluation

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingPas encore d'évaluation

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingPas encore d'évaluation

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingPas encore d'évaluation

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingPas encore d'évaluation

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingPas encore d'évaluation

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingPas encore d'évaluation

- IBPS PO Model Paper - Allahabad Bank Probationary Officer Exam Previous Year Question PaperDocument52 pagesIBPS PO Model Paper - Allahabad Bank Probationary Officer Exam Previous Year Question PaperSona LavaniaPas encore d'évaluation

- Merger Between RIL and RPLDocument3 pagesMerger Between RIL and RPLSaurabh LambaPas encore d'évaluation

- RIL Integrated Annual Report 2020 21Document215 pagesRIL Integrated Annual Report 2020 21Manoj Kumar KoyalkarPas encore d'évaluation

- Reliance Retail Ltd business divisionsDocument28 pagesReliance Retail Ltd business divisionsSavan BhattPas encore d'évaluation

- Executive Leadership-Asia-Pacific: Mukesh Ambani: - Biloni Doshi - Tom PhillipsDocument15 pagesExecutive Leadership-Asia-Pacific: Mukesh Ambani: - Biloni Doshi - Tom PhillipsBiloni KadakiaPas encore d'évaluation

- Financial Analysis of Reliance Industries Limited: Arindam BarmanDocument109 pagesFinancial Analysis of Reliance Industries Limited: Arindam Barmananon_645298319100% (1)

- Credit Note On Reliance Power LimitedDocument5 pagesCredit Note On Reliance Power LimitedPenFriendPas encore d'évaluation

- List of NBFCs with asset size ₹ 100 crore and aboveDocument88 pagesList of NBFCs with asset size ₹ 100 crore and aboveamandeepPas encore d'évaluation

- Current Affairs Pocket PDF - October 2015 by AffairsCloud PDFDocument24 pagesCurrent Affairs Pocket PDF - October 2015 by AffairsCloud PDFKUMAR JAIVARDHAN100% (1)

- Outbound Logistic ManagementDocument104 pagesOutbound Logistic ManagementronypatelPas encore d'évaluation

- Coca-Cola: Company Profile and BackgroundDocument4 pagesCoca-Cola: Company Profile and BackgroundDhanasekaran ArumugamPas encore d'évaluation

- House Journal of University of Petroleum & Energy StudiesDocument28 pagesHouse Journal of University of Petroleum & Energy StudiesUniversity Of Petroleum And Energy StudiesPas encore d'évaluation

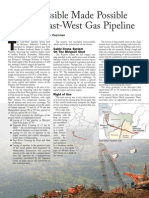

- Reliance East West Pipeline Punj LoydDocument3 pagesReliance East West Pipeline Punj LoydPuneet Zaidu100% (1)

- Project On Risk & Return Analysis of Reliance Mutual FundDocument74 pagesProject On Risk & Return Analysis of Reliance Mutual FundPiya Bhatnagar0% (1)

- The People Who Run Reliance IndustriesDocument6 pagesThe People Who Run Reliance IndustriesIshpreet Singh BaggaPas encore d'évaluation

- Reliance Communications Signs Non-Binding Term Sheet With Tillman Global Holdings and TPG For Sale of Its Tower Assets and Related Infrastructure (Company Update)Document2 pagesReliance Communications Signs Non-Binding Term Sheet With Tillman Global Holdings and TPG For Sale of Its Tower Assets and Related Infrastructure (Company Update)Shyam SunderPas encore d'évaluation

- Business Studies Project - BHARAT BHARATDocument11 pagesBusiness Studies Project - BHARAT BHARATabarajitha sureshkumarPas encore d'évaluation

- Curriculum Vitae: Oil & Gas Offshore & Onshore Client Qa/Qc RepresentativeDocument6 pagesCurriculum Vitae: Oil & Gas Offshore & Onshore Client Qa/Qc RepresentativeN S SivamPas encore d'évaluation

- Kotak Mahindra Life Insurance Recruitment and Selection ProcessDocument75 pagesKotak Mahindra Life Insurance Recruitment and Selection ProcessVankishKhoslaPas encore d'évaluation

- Case 1 Reliance Industries Limited DemegerDocument5 pagesCase 1 Reliance Industries Limited DemegerSoniaPas encore d'évaluation

- 5 6172620504097096522Document6 pages5 6172620504097096522Pushpinder KumarPas encore d'évaluation

- Case Study ONGCDocument15 pagesCase Study ONGCRaavi SinghPas encore d'évaluation

- Reliance Retail Store Operation ReportDocument46 pagesReliance Retail Store Operation ReportRuhiPas encore d'évaluation

- Summer Training Report On Reliance MoneyDocument65 pagesSummer Training Report On Reliance Moneyniteshkumar sharma100% (2)

- Summer Internship Project On Customer Satisfaction in Jio MartDocument76 pagesSummer Internship Project On Customer Satisfaction in Jio Martarpita ghoshPas encore d'évaluation

- Customer Satisfaction at Reliance Mutual FundDocument47 pagesCustomer Satisfaction at Reliance Mutual FundPrince Satish ReddyPas encore d'évaluation

- Entrepreneur - Mukesh AmbaniDocument2 pagesEntrepreneur - Mukesh AmbaniAmit Patil100% (1)

- Reliance Single PremiumDocument80 pagesReliance Single Premiumsumitkumarnawadia22Pas encore d'évaluation

- Divya Pandya NNDocument29 pagesDivya Pandya NNKrishnaPas encore d'évaluation

- Reliance Industries Segment AnalysisDocument23 pagesReliance Industries Segment AnalysisFeilix BennyPas encore d'évaluation