Académique Documents

Professionnel Documents

Culture Documents

Indian Accounting Standards

Transféré par

Manjunatha B KumarappaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Indian Accounting Standards

Transféré par

Manjunatha B KumarappaDroits d'auteur :

Formats disponibles

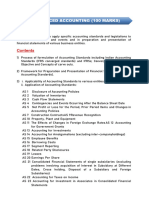

AS 1 * *01 **

Disclosure of Accounting Principles AS 2 AS 3 AS 4

Valuation of Inventories Cash Flow Statements Contingencies and Events Occurring After the Balance Sheet Date Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies Depreciation Accounting Construction Contracts

See Note 38 See Note 10 See Note 19

* *** *03 *** * * *** *04 * * * *06 * *01 *01 *01 *01 *01 *01 *01

AS 5 AS 6 AS 7 (Revised) AS 8 AS 9 AS 10 AS 11 (Revised 2003) AS 12 AS 13 AS 14 AS 15 (Revised 2005) AS 16 AS 17 AS 18 AS 19 AS 20 AS 21 AS 22 AS 23

See Note 2

Accounting for Research and Development Revenue Recognition Accounting for Fixed See Note 3 Assets The Effects Of Changes In See Foreign Exchange Rates Notes 14, 21,24, 37, 41 Accounting for Government Grants Accounting for See Note 11 Investments Accounting for See Notes 8, 15 Amalgamations Employee Benefits [click See here for related Notes 27, 28,29, 30 announcement] Borrowing Costs Segment Reporting Related Party Disclosures Leases Earnings Per Share Consolidated Financial Statements Accounting for taxes on income Accounting for See Note 5 See Notes 7, 12 See Note 42 See Notes 6, 9,16 See Notes 23, 36 See Notes 1, 22,39 See Notes 23, 35

*04 *02 *03 *02 *04 *04 *09 *09 *11

AS 24 AS 25 AS 26 AS 27 AS 28 AS 29 AS 30 AS 31 AS 32

Investments in Associates in Consolidated Financial Statements Discontinuing Operations Interim Financial Reporting Intangible Assets Financial Reporting of Interests in Joint Ventures Impairment of Assets Provisions, Contingent Liabilities and Contingent Assets Financial Instruments: Recognition and Measurement Financial Instruments: Presentation Financial Instruments: Disclosures

See Note 4 See Note 17 See Notes 13, 20,34 See Notes 18, 23,33 See Notes 25, 32 See Notes 26, 31 See Note 40

See Note 43

AS1- Disclosure of accounting policies AS2- Valuation of inventories AS3-Cash flow statements AS4-Contigencies and events occurring after the balance sheet date AS5-Np or NL and changes in accounting policies

AS6- Accounting for Depreciation AS7- Accounting for construction of contract AS8- Accounting for Research and Development AS9- Accounting for Revenue recognition AS10- Accounting for Fixed Assets, AS11- The effects of changes in Foreign exchange rates AS12- Accounting for Government Grants AS13-Accounting for investments AS14- Accounting for Amalgamation AS15- Accounting for Employee Benefits AS16- Accounting for Borrowing costs AS17-Segment reporting AS18- Related party disclosures AS19- Accounting for Leasing AS20- Earnings per share AS21- Consolidated Financial Statements AS22- Accounting for Taxes on invcome AS23- Accounting for invt in associates in consolidated fin statements AS24-Discontinuing operations AS25- Interim financial statements AS26-Intangible Assets AS27- Financial reporting of interest in joint ventures AS28- Accounting for impairment of loss AS29- Provisions contingent liabilities and assets AS30-Financial instruments

Cost accounting standards

CAS-1 Classification of Costs CAS-2 Capacity Determination, CAS-3 Overheads CAS-4 Cost of Production for captive consumption CAS-5 Average (Equalized) cost of transportation CAS-6 Material Cost CAS-7 Employee Cost CAS-8 Cost of utilities CAS-9 Packing material costs CAS-10 Direct expenses CAS-11 Administrative Overheads CAS-12 Repairs and maintenance CAS-13 Cost of service cost centre

Vous aimerez peut-être aussi

- List of ASDocument2 pagesList of ASKarthick CskPas encore d'évaluation

- Ac StandardsDocument3 pagesAc Standardsdeba1644Pas encore d'évaluation

- List of Accounting StandardsDocument1 pageList of Accounting Standardsnselva444Pas encore d'évaluation

- Accounting StandardsDocument1 pageAccounting StandardsshashishashikantPas encore d'évaluation

- Financial and Management AccountingDocument2 pagesFinancial and Management AccountingDeepak RastogiPas encore d'évaluation

- Accounting Standards (Ass)Document2 pagesAccounting Standards (Ass)KarolinafischerPas encore d'évaluation

- 50 - List of Accounting StandardsDocument2 pages50 - List of Accounting StandardsgreatandyPas encore d'évaluation

- List of Accounting StandardsDocument2 pagesList of Accounting StandardsRaghava JinkaPas encore d'évaluation

- SyllabusDocument2 pagesSyllabusdeepaksangwan1612Pas encore d'évaluation

- As VS IndasDocument2 pagesAs VS IndasPavan KocherlakotaPas encore d'évaluation

- 04 Accounting Standards Issued by The ICAIDocument3 pages04 Accounting Standards Issued by The ICAIraghavendra_20835414Pas encore d'évaluation

- List of Accounting StandardsDocument5 pagesList of Accounting StandardsPraneeth SaiPas encore d'évaluation

- Presentation ON: Understanding of Accounting Standards By:-Pritam Agarwal Abhishek AnandDocument39 pagesPresentation ON: Understanding of Accounting Standards By:-Pritam Agarwal Abhishek AnandPrakash_Tandon_583Pas encore d'évaluation

- Accounting Standards: in IndiaDocument4 pagesAccounting Standards: in IndiathemeditatorPas encore d'évaluation

- Ind AS Vis-À-Vis IFRS and ASDocument4 pagesInd AS Vis-À-Vis IFRS and ASGurvinder Mann Singh PradhanPas encore d'évaluation

- Comparison of Ifrs, Ind As AsDocument7 pagesComparison of Ifrs, Ind As AsRudrin DasPas encore d'évaluation

- Ding of Accounting Standards 1-15Document25 pagesDing of Accounting Standards 1-15Moeen MakPas encore d'évaluation

- Presentation ON: Understanding of Accounting StandardsDocument38 pagesPresentation ON: Understanding of Accounting StandardsaggarwalgauravPas encore d'évaluation

- 3accountingstandards 120704142603 Phpapp02Document37 pages3accountingstandards 120704142603 Phpapp02MehtaMilanPas encore d'évaluation

- 1.3) Accounting StandardsDocument15 pages1.3) Accounting StandardsF93 SHIFA KHANPas encore d'évaluation

- Presentation ON: Understanding of Accounting Standards By:-Pritam Agarwal Abhishek AnandDocument38 pagesPresentation ON: Understanding of Accounting Standards By:-Pritam Agarwal Abhishek AnandAnkit GuptaPas encore d'évaluation

- Accounting StandardDocument6 pagesAccounting Standardamity_shPas encore d'évaluation

- Presentation ON: Understanding of Accounting Standards By:-Pritam AgarwalDocument38 pagesPresentation ON: Understanding of Accounting Standards By:-Pritam Agarwalpritamags60% (5)

- Financial Accounting Digital Assignment 3Document5 pagesFinancial Accounting Digital Assignment 3Jayagokul SaravananPas encore d'évaluation

- Indian Accounting StandardsDocument26 pagesIndian Accounting StandardsISHANJALI MADAAN 219005Pas encore d'évaluation

- Accounting Standards NPAEsDocument2 pagesAccounting Standards NPAEsraymond puaPas encore d'évaluation

- JAIIB AFM Practice MCQs Part 1Document17 pagesJAIIB AFM Practice MCQs Part 1preetmehtaPas encore d'évaluation

- Indian Accounting Standands V/S. International Accounting StandardsDocument70 pagesIndian Accounting Standands V/S. International Accounting StandardsVishal ChandakPas encore d'évaluation

- Accounting Standards-Introduction and List For MBA StudentsDocument7 pagesAccounting Standards-Introduction and List For MBA StudentsSantosh Parashar0% (1)

- The Detailed Revision Plan f1Document4 pagesThe Detailed Revision Plan f1Euthemeous MakrisPas encore d'évaluation

- Accounting Standards SummaryDocument5 pagesAccounting Standards SummaryVinesh MoilyPas encore d'évaluation

- List of Accounting StandardsDocument3 pagesList of Accounting StandardsManish MohantyPas encore d'évaluation

- 1f9b0008-a5aa-48b6-923f-33607527d48bDocument2 pages1f9b0008-a5aa-48b6-923f-33607527d48bNihad ƏhmədovPas encore d'évaluation

- Accounting StandardsDocument39 pagesAccounting StandardsMadan JhaPas encore d'évaluation

- Form 20FDocument398 pagesForm 20FNguyen KyPas encore d'évaluation

- Simsr MMS (2010-12) Financial Management: Accounting StandardsDocument36 pagesSimsr MMS (2010-12) Financial Management: Accounting StandardsRahul GiddePas encore d'évaluation

- Financial AccountingDocument1 056 pagesFinancial AccountingCalmguy Chaitu96% (28)

- Indian Accounting StandardsDocument9 pagesIndian Accounting StandardsAman Singh0% (1)

- FRRB IssuesDocument47 pagesFRRB IssuesAayushi AroraPas encore d'évaluation

- International Accounting Standards Pocket Guide: September 1999Document40 pagesInternational Accounting Standards Pocket Guide: September 1999Takhleeq AkhterPas encore d'évaluation

- Ifrs 1Document4 pagesIfrs 1SAI TEJAPas encore d'évaluation

- Basic Accounting Concepts and ConventionsDocument27 pagesBasic Accounting Concepts and Conventionspramod singhPas encore d'évaluation

- Announcement For The Students of CPT Level For June, 2017 Examination Section A: Fundamentals of AccountingDocument2 pagesAnnouncement For The Students of CPT Level For June, 2017 Examination Section A: Fundamentals of AccountingAmarjit PriyadarshanPas encore d'évaluation

- Accounting StandardsDocument7 pagesAccounting StandardsKiran Maruti ShindePas encore d'évaluation

- ResourcesDocument74 pagesResourcesDarshan LunawatPas encore d'évaluation

- Normas Internacionales de Información FinancieraDocument10 pagesNormas Internacionales de Información FinancieraMicaelofNebadonPas encore d'évaluation

- Represented by Group No-2: Arijeet Swarap KumarDocument14 pagesRepresented by Group No-2: Arijeet Swarap Kumararijit_bhowmick9064Pas encore d'évaluation

- Presented by Ajesh Mukundan PDocument17 pagesPresented by Ajesh Mukundan PAjesh Mukundan P100% (1)

- Accounting StandardsDocument44 pagesAccounting StandardsMadhu BalaPas encore d'évaluation

- International Public Sector Accounting StandardsDocument5 pagesInternational Public Sector Accounting StandardsSirkd ShumbaPas encore d'évaluation

- Division of Corporation Finance: Financial Reporting ManualDocument358 pagesDivision of Corporation Finance: Financial Reporting ManualankushbindwalPas encore d'évaluation

- Presented By-:: Hitesh Khanna Gagandeep Kaur Gaurav Sharma Atul KoccharDocument39 pagesPresented By-:: Hitesh Khanna Gagandeep Kaur Gaurav Sharma Atul KoccharsethigaganPas encore d'évaluation

- AS-1 Disclosure of Accounting PoliciesDocument32 pagesAS-1 Disclosure of Accounting PoliciesSamrat MukherjeePas encore d'évaluation

- Financial Analysis & Reporting Part II Course I - Oral VersionDocument53 pagesFinancial Analysis & Reporting Part II Course I - Oral VersionantoinePas encore d'évaluation

- Training Material of AuditDocument89 pagesTraining Material of AuditNaeem Uddin100% (10)

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsD'EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsPas encore d'évaluation

- Absorption (Variable) Costing and Cost-Volume-Profit AnalysisDocument41 pagesAbsorption (Variable) Costing and Cost-Volume-Profit AnalysisPapsie PopsiePas encore d'évaluation

- Mile High CyclesDocument4 pagesMile High Cyclesnino7578Pas encore d'évaluation

- Maths Project: Planning A Home BudgetDocument10 pagesMaths Project: Planning A Home Budgetadil rizviPas encore d'évaluation

- Variance AnalysisDocument51 pagesVariance AnalysisAnonymous 5F68VLDbPas encore d'évaluation

- Chapter 6 Solutions Comm 305Document31 pagesChapter 6 Solutions Comm 305mike0% (5)

- Group 6 Mcs Case Report-3Document4 pagesGroup 6 Mcs Case Report-3Respati AdityoPas encore d'évaluation

- Factory Accounting (Online Material) PDFDocument31 pagesFactory Accounting (Online Material) PDFramkumar100% (1)

- Data The Eastern Division of Countryside Communications PLC Assembles A SingleDocument2 pagesData The Eastern Division of Countryside Communications PLC Assembles A SingleAmit PandeyPas encore d'évaluation

- Blackhealth Manufacturing Company-RevisitedDocument8 pagesBlackhealth Manufacturing Company-RevisitedRahul Sharma100% (1)

- Unit II: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDocument43 pagesUnit II: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsJosh EspirituPas encore d'évaluation

- Level 3 Costing & MA Text Update June 2021pdfDocument125 pagesLevel 3 Costing & MA Text Update June 2021pdfAmi KayPas encore d'évaluation

- Endeavour Twoplise Ltd. - Question - 21355890Document7 pagesEndeavour Twoplise Ltd. - Question - 21355890Namita GoburdhanPas encore d'évaluation

- Standard Costing: A Managerial Control Tool: Cornerstones of Managerial Accounting, 6eDocument91 pagesStandard Costing: A Managerial Control Tool: Cornerstones of Managerial Accounting, 6esamuel tjandraPas encore d'évaluation

- Quiz 2 - MANACDocument13 pagesQuiz 2 - MANACParam ShahPas encore d'évaluation

- UM PPT Process CostDocument92 pagesUM PPT Process CostRahul ShendePas encore d'évaluation

- As 2Document10 pagesAs 2krithika vasanPas encore d'évaluation

- USHIO Philippines IncDocument30 pagesUSHIO Philippines IncAlexandria EvangelistaPas encore d'évaluation

- MA3 Sample Exams Plus SolutionsDocument89 pagesMA3 Sample Exams Plus Solutionsbooks_sumiPas encore d'évaluation

- Animal Production Grade 10 2 LRDocument40 pagesAnimal Production Grade 10 2 LRgemma salomonPas encore d'évaluation

- Lanen - Fundamentals of Cost Accounting - 6e - Chapter 2 - NotesDocument6 pagesLanen - Fundamentals of Cost Accounting - 6e - Chapter 2 - NotesRorPas encore d'évaluation

- Afar Job Order Costing Spoilage DefectiveDocument4 pagesAfar Job Order Costing Spoilage DefectiveKaye Angelie UsogPas encore d'évaluation

- LP5 Standard Costing and Variance AnalysisDocument23 pagesLP5 Standard Costing and Variance AnalysisGwynette DalawisPas encore d'évaluation

- Mca MGTDocument105 pagesMca MGTAkshansh Pal SinghPas encore d'évaluation

- Extra Credit Assignments - Cost AccountingDocument6 pagesExtra Credit Assignments - Cost Accountingstamford1234Pas encore d'évaluation

- Standard Costing and Variance Analysis: This Accounting Materials Are Brought To You byDocument16 pagesStandard Costing and Variance Analysis: This Accounting Materials Are Brought To You byChristian Bartolome LagmayPas encore d'évaluation

- LABOUR COSTING With AnswersDocument53 pagesLABOUR COSTING With AnswersHafsa Hayat100% (2)

- Lesson 3 Sample Problem #1Document4 pagesLesson 3 Sample Problem #1not funny didn't laughPas encore d'évaluation

- Managerial Accounting 14Th Edition Warren Test Bank Full Chapter PDFDocument65 pagesManagerial Accounting 14Th Edition Warren Test Bank Full Chapter PDFNicoleTuckeroajx100% (9)

- CN04HODocument51 pagesCN04HOAbood AlissaPas encore d'évaluation

- Cost and Management Accounting and Quandative TechniqueDocument86 pagesCost and Management Accounting and Quandative TechniquesaiyuvatechPas encore d'évaluation