Académique Documents

Professionnel Documents

Culture Documents

Icsi-Banking and Insurance

Transféré par

api-37727740 évaluation0% ont trouvé ce document utile (0 vote)

121 vues2 pagesBANKING AND INSURANCE - LAW AND PRACTICE (50 MARKS) aims to provide good understanding of role and working of banking, insurance and risk management.

Description originale:

Titre original

icsi-banking and insurance

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBANKING AND INSURANCE - LAW AND PRACTICE (50 MARKS) aims to provide good understanding of role and working of banking, insurance and risk management.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

121 vues2 pagesIcsi-Banking and Insurance

Transféré par

api-3772774BANKING AND INSURANCE - LAW AND PRACTICE (50 MARKS) aims to provide good understanding of role and working of banking, insurance and risk management.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

PAPER 6 : BANKING AND INSURANCE –LAW AND PRACTICE

Level of knowledge : Working knowledge.

Objective : To provide good understanding of the role and working of banking,

insurance and risk management.

Detailed contents :

PART A : BANKING – LAW AND PRACTICE (50 MARKS)

1. Introduction to banking - historical perspective; emergence and importance of

commercial banking; an overview of development in banking since independence.

2. Relationship between banker and customer - legal framework – corporate banking,

loan documentation.

3. Law and procedure governing banking instruments - cheque, bill of exchange, letter

of credit, etc.

4. Management of assets - liabilities in commercial bank.

5. Lending policies - risk and profitability planning.

6. Development banking - development banking as distinguished from commercial

banking; growth of development banking; role of development banks in economic

development.

7. Reserve Bank of India and its control on commercial banks; impact of RBI’s

policies on operations of commercial banks; NABARD, NHB.

8. Law relating to Banking Regulation; bankers’ book evidence; recovery of debts due

to banks and financial institutions.

9. Banking sector reforms in India - an overview; cooperative banks; nationalised banks;

private sector banks; international banking – foreign banks, off-shore banking; recent

developments in banking sector.

PART B : INSURANCE - LAW AND PRACTICE (50 MARKS)

10. Definition of risk and uncertainty; classification of risk; sources of risk - external and

internal.

11. Insurance - meaning, nature and significance; essential requirements and principles

of risk insurance; re-insurance; nationalisation of insurance business in India; Insurance

Regulatory Development Authority Act.

12. Life insurance - law relating to Life Insurance; general principles of life insurance

contract; proposals and policy; assignment and nomination; title and claims; concept of

trusts in life policy; Life Insurance Corporation - role and functions.

13. General insurance – law relating to general insurance; different types of general

insurance; general insurance and life insurance; nature of fire insurance; various types

of fire policy; subrogation; double insurance; contribution; proximate cause; claims and

recovery.

14. Accident and motor insurance - nature, disclosure, terms and conditions; claims

and recovery; third party insurance; compulsory motor vehicle insurance; accident

insurance.

15. Deposit and credit insurance - nature, terms and conditions, claim, recovery, etc;

public liability insurance; emergency risk insurance.

16. Structure, power and function of General Insurance Corporation of India; Deposit

Insurance and Credit Guarantee Corporation; Claims Tribunal.

17. Marine insurance – law relating to marine insurance; scope and nature; types of

policy; insurable interest; disclosure and representation; insured perils; proximity cause;

voyage; warranties; measurement of subrogation; contribution; under insurance.

18. Risk management - nature, risk analysis, planning, control and transfer of risk;

administration of company’s properties and provision of adequate security arrangements.

19. Insurance surveyorship – appointment, legal provisions and licensing, functions.

20. Company Secretary vis-a-vis insurance and risk management; recent developments in

the insurance sector.

Vous aimerez peut-être aussi

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5D'EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Pas encore d'évaluation

- Banking & Insurance Law SyllabusDocument3 pagesBanking & Insurance Law Syllabusriko avPas encore d'évaluation

- Unlocking Capital: The Power of Bonds in Project FinanceD'EverandUnlocking Capital: The Power of Bonds in Project FinancePas encore d'évaluation

- Course Material Nlsiu MBLDocument6 pagesCourse Material Nlsiu MBLManjunatha GPas encore d'évaluation

- Development of Insurance in Angola: Case Study of a Key African Frontier Insurance MarketD'EverandDevelopment of Insurance in Angola: Case Study of a Key African Frontier Insurance MarketPas encore d'évaluation

- Banking and InsuranceDocument100 pagesBanking and InsuranceB I N O D ツPas encore d'évaluation

- SyllabusDocument76 pagesSyllabusamattirkeyPas encore d'évaluation

- Introduction To Insurance Law 2023 BulletinDocument2 pagesIntroduction To Insurance Law 2023 Bulletinadammatolla7Pas encore d'évaluation

- Syllabus of Banking & Insurance LawDocument4 pagesSyllabus of Banking & Insurance LawAkshay DhawanPas encore d'évaluation

- Lucknow Unoiversity Syllabus of BBA-302 & BBA-503Document2 pagesLucknow Unoiversity Syllabus of BBA-302 & BBA-503shailesh tandonPas encore d'évaluation

- UG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Document490 pagesUG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Kathiravan SPas encore d'évaluation

- New Syllabus PDFDocument77 pagesNew Syllabus PDFPrashantPas encore d'évaluation

- III 1 8Document8 pagesIII 1 8Anonymous UYHtL8Pas encore d'évaluation

- Banking InsuranceDocument2 pagesBanking InsuranceArghadeep ChandaPas encore d'évaluation

- Unit 5 Life Insurance: StructureDocument22 pagesUnit 5 Life Insurance: StructureSanjay PalPas encore d'évaluation

- IPPDocument77 pagesIPPshanifPas encore d'évaluation

- PCC203Document2 pagesPCC203DushyantPas encore d'évaluation

- Insurance LawDocument29 pagesInsurance LawChummaPas encore d'évaluation

- Syllabus PDFDocument81 pagesSyllabus PDFC RajkumarPas encore d'évaluation

- Syllab of Dip in Life Ins UnderwritingDocument17 pagesSyllab of Dip in Life Ins Underwritinganon_303912439100% (1)

- Consumer Perception Regarding Life InsuranceDocument53 pagesConsumer Perception Regarding Life InsuranceKajal Heer100% (1)

- Insurance Regulatory and Development AuthorityDocument3 pagesInsurance Regulatory and Development AuthorityDeepak SharmaPas encore d'évaluation

- Legal Department Policies ManualDocument14 pagesLegal Department Policies ManualLulu08Pas encore d'évaluation

- Web Aggregator SyllabusDocument5 pagesWeb Aggregator Syllabussam franklinPas encore d'évaluation

- Detailed SyllabusDocument80 pagesDetailed Syllabusshanmuga89Pas encore d'évaluation

- Banking and Insurance For SlideshowDocument100 pagesBanking and Insurance For SlideshowB I N O D ツPas encore d'évaluation

- Irda - IiiDocument15 pagesIrda - IiiB.Com (BI) CommercePas encore d'évaluation

- Law of InsuranceDocument3 pagesLaw of InsuranceAnantHimanshuEkkaPas encore d'évaluation

- IC38 Agent LifeDocument4 pagesIC38 Agent Lifedibyaduti_20009197Pas encore d'évaluation

- Irda Act & Types of InsuranceDocument19 pagesIrda Act & Types of InsuranceVinayak BhardwajPas encore d'évaluation

- Bank and Insurance RegulationDocument2 pagesBank and Insurance Regulationভোরের কুয়াশাPas encore d'évaluation

- IjaraDocument70 pagesIjaraUsama KhaledPas encore d'évaluation

- 10 - Chapter 2 - Background of Insurance IndustryDocument29 pages10 - Chapter 2 - Background of Insurance IndustryBounna PhoumalavongPas encore d'évaluation

- Articles From General Knowledge Today: BancassuranceDocument4 pagesArticles From General Knowledge Today: BancassurancePrateek ChitambarePas encore d'évaluation

- PG - M.com - Finance & Control - 33544 Banking and InsuranceDocument282 pagesPG - M.com - Finance & Control - 33544 Banking and InsuranceShikha Sidar LLM 2021Pas encore d'évaluation

- Credits:3 3: SyllabusDocument2 pagesCredits:3 3: SyllabusAryan RajPas encore d'évaluation

- Comparative Study Between HDFC & ICICIDocument55 pagesComparative Study Between HDFC & ICICINamit Dehariya100% (5)

- Bba Hons Part-Iii Department of Accounting & Finance and Banking Banking and Insurance Theories Laws and Practice Part-ADocument2 pagesBba Hons Part-Iii Department of Accounting & Finance and Banking Banking and Insurance Theories Laws and Practice Part-AMeethila Noureen OpshoraPas encore d'évaluation

- Syllabus IIIDocument85 pagesSyllabus IIIAsħîŞĥLøÝå100% (1)

- Chapter-1 Introduction To Life InsuranceDocument52 pagesChapter-1 Introduction To Life InsuranceAnupreet28Pas encore d'évaluation

- 3.2. Law Relating To Commercial Banks-2Document51 pages3.2. Law Relating To Commercial Banks-2Madan ShresthaPas encore d'évaluation

- General InsuranceDocument13 pagesGeneral InsuranceSushant KamblePas encore d'évaluation

- HARSHUDocument22 pagesHARSHUvini2710Pas encore d'évaluation

- IRDADocument21 pagesIRDAknicknic100% (1)

- Development Authority (IRDA) Is A National Agency of The: Government of India HyderabadDocument5 pagesDevelopment Authority (IRDA) Is A National Agency of The: Government of India HyderabadSwarna RajpootPas encore d'évaluation

- New SyllabusDocument81 pagesNew SyllabuspranavyesPas encore d'évaluation

- SYLLABUS of Health InsuranceDocument10 pagesSYLLABUS of Health InsuranceSuchetana SenPas encore d'évaluation

- Introduction of CourseDocument17 pagesIntroduction of CourseSaad NahidPas encore d'évaluation

- LC 0603 Law of Contract Ii:: Module 01 Contracts of Indemnity - Sections 124-125 of The Indian Contract Act, 1872Document8 pagesLC 0603 Law of Contract Ii:: Module 01 Contracts of Indemnity - Sections 124-125 of The Indian Contract Act, 1872Manisha PawarPas encore d'évaluation

- BNK211 Banking LawDocument2 pagesBNK211 Banking LawdhitalkhushiPas encore d'évaluation

- Irda (Insurance Regulatory & Development Authority)Document20 pagesIrda (Insurance Regulatory & Development Authority)harishkoppalPas encore d'évaluation

- Expectations: Duties, Powers and Functions of IRDADocument3 pagesExpectations: Duties, Powers and Functions of IRDAAlnoor PujaniPas encore d'évaluation

- Research PaperDocument8 pagesResearch PaperAnonymous y3E7iaPas encore d'évaluation

- IRDAIDocument5 pagesIRDAIYash GoyalPas encore d'évaluation

- Merchant Banking and Financial ServicesDocument77 pagesMerchant Banking and Financial ServicespavithragowthamPas encore d'évaluation

- A Project Report On Stress Management at Icici-PrudentialDocument113 pagesA Project Report On Stress Management at Icici-PrudentialBabasab Patil (Karrisatte)0% (2)

- Banking & Insurance IIDocument44 pagesBanking & Insurance IInamanPas encore d'évaluation

- Executive SummaryDocument82 pagesExecutive SummaryDharmesh GuptaPas encore d'évaluation

- 4190512-Banking & InsuranceDocument4 pages4190512-Banking & InsurancejinalPas encore d'évaluation

- Insurance Law Notes RNDocument84 pagesInsurance Law Notes RNRudraksh NagarPas encore d'évaluation

- MOA of NCERTDocument13 pagesMOA of NCERTapi-3772774100% (1)

- Receipt of ComputerDocument1 pageReceipt of Computerapi-3772774Pas encore d'évaluation

- Practical Test Paper1Document3 pagesPractical Test Paper1api-3772774Pas encore d'évaluation

- MbaweDocument3 pagesMbaweapi-3772774Pas encore d'évaluation

- Jnanpith Awardees of IndiaDocument2 pagesJnanpith Awardees of Indiaapi-3772774Pas encore d'évaluation

- M Tech CSDocument5 pagesM Tech CSapi-3772774Pas encore d'évaluation

- CS-12 Computer Architecture: Sachin ChandraDocument12 pagesCS-12 Computer Architecture: Sachin Chandraapi-3772774Pas encore d'évaluation

- DbconnectivityDocument4 pagesDbconnectivityapi-3772774Pas encore d'évaluation

- End Term Practical Examination EcomDocument3 pagesEnd Term Practical Examination Ecomapi-3772774Pas encore d'évaluation

- Concurrency ControlDocument19 pagesConcurrency Controlapi-3772774100% (2)

- CS 16Document8 pagesCS 16api-3772774Pas encore d'évaluation

- AICTE Norms & CompliancesDocument2 pagesAICTE Norms & Compliancesapi-3772774100% (1)

- ConcurrencyDocument14 pagesConcurrencyapi-3772774Pas encore d'évaluation

- Appl - Form - UBI BankDocument4 pagesAppl - Form - UBI Bankapi-3772774100% (2)

- Adv For RecruitmentDocument12 pagesAdv For Recruitmentapi-3772774Pas encore d'évaluation

- Alumni MeetDocument1 pageAlumni Meetapi-3772774Pas encore d'évaluation

- Uml FSMDocument9 pagesUml FSMYahyajanPas encore d'évaluation

- Math Worksheets For Kids (Count The Animals)Document9 pagesMath Worksheets For Kids (Count The Animals)Zêd Ha FådēdPas encore d'évaluation

- This Succession-Reviewer JethDocument184 pagesThis Succession-Reviewer JethMary Robelyn de Castro100% (1)

- PCARD AssignmentDocument7 pagesPCARD AssignmentMellaniPas encore d'évaluation

- How Jesus Transforms The 10 CommandmentsDocument24 pagesHow Jesus Transforms The 10 CommandmentsJohn JiangPas encore d'évaluation

- Bill Ackman Questions For HerbalifeDocument40 pagesBill Ackman Questions For HerbalifedestmarsPas encore d'évaluation

- A Dictionary of Idiomatic Expressions in Written Arabic - For The Reader of Classical and Modern TextsDocument290 pagesA Dictionary of Idiomatic Expressions in Written Arabic - For The Reader of Classical and Modern TextsAbdul SalamPas encore d'évaluation

- UHF Integrated Long-Range Reader: Installation and User ManualDocument24 pagesUHF Integrated Long-Range Reader: Installation and User ManualARMAND WALDOPas encore d'évaluation

- SUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoDocument4 pagesSUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoPrince CalicaPas encore d'évaluation

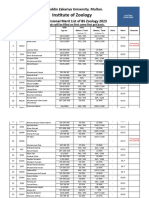

- 5953-6th Merit List BS Zool 31-8-2023Document22 pages5953-6th Merit List BS Zool 31-8-2023Muhammad AttiqPas encore d'évaluation

- Stress Strain Curve For Ductile and Brittle MaterialsDocument13 pagesStress Strain Curve For Ductile and Brittle MaterialsDivyeshkumar MorabiyaPas encore d'évaluation

- Chapter Xiii: Department of Public Enterprises: 13.1.1 Irregular Payment To EmployeesDocument6 pagesChapter Xiii: Department of Public Enterprises: 13.1.1 Irregular Payment To EmployeesbawejaPas encore d'évaluation

- LLW2601-8 Dismissal - Notes LLW2601-8 Dismissal - NotesDocument16 pagesLLW2601-8 Dismissal - Notes LLW2601-8 Dismissal - NotesNabeelah AngamiaPas encore d'évaluation

- Family Worship PDF - by Kerry PtacekDocument85 pagesFamily Worship PDF - by Kerry PtacekLeo100% (1)

- Ami Aptio Afu User Guide NdaDocument32 pagesAmi Aptio Afu User Guide NdaMarcoPas encore d'évaluation

- Stanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11Document81 pagesStanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11stanwichPas encore d'évaluation

- Ficha Tecnica Gato Big Red 30tonDocument16 pagesFicha Tecnica Gato Big Red 30tonCesar Augusto Arias CastroPas encore d'évaluation

- Rawls TheoryDocument4 pagesRawls TheoryAcademic ServicesPas encore d'évaluation

- Jashim Otobi Furniture: Proprietor: Md. Jashim SheikhDocument2 pagesJashim Otobi Furniture: Proprietor: Md. Jashim SheikhAr-rahbar TravelsPas encore d'évaluation

- Prom 2015: The Great GatsbyDocument14 pagesProm 2015: The Great GatsbyMaple Lake MessengerPas encore d'évaluation

- Dxgbvi Abdor Rahim OsmanmrDocument1 pageDxgbvi Abdor Rahim OsmanmrSakhipur TravelsPas encore d'évaluation

- Case 1 - Masters and Associates - Sasot GroupDocument10 pagesCase 1 - Masters and Associates - Sasot GroupRobin Venturina100% (1)

- Sample QP 1 Jan2020Document19 pagesSample QP 1 Jan2020M Rafeeq100% (1)

- White Collar Crime Fraud Corruption Risks Survey Utica College ProtivitiDocument41 pagesWhite Collar Crime Fraud Corruption Risks Survey Utica College ProtivitiOlga KutnovaPas encore d'évaluation

- The Life of CardoDocument7 pagesThe Life of CardoBlessie Arabe100% (3)

- Listing of Internet Slang and AcronymsDocument4 pagesListing of Internet Slang and AcronymsabeegamePas encore d'évaluation

- Fitzgerald TransformationOpenSource 2006Document13 pagesFitzgerald TransformationOpenSource 2006muthu.manikandan.mPas encore d'évaluation

- CLASS XI Business - Studies-Study - MaterialDocument44 pagesCLASS XI Business - Studies-Study - MaterialVanshPas encore d'évaluation

- POLITICAL SYSTEM of USADocument23 pagesPOLITICAL SYSTEM of USAMahtab HusaainPas encore d'évaluation

- China Signposts: A Practical Guide For Multinationals in 2022Document16 pagesChina Signposts: A Practical Guide For Multinationals in 2022APCO WorldwidePas encore d'évaluation

- Employment in IndiaDocument51 pagesEmployment in IndiaKartik KhandelwalPas encore d'évaluation

- Ready, Set, Growth hack:: A beginners guide to growth hacking successD'EverandReady, Set, Growth hack:: A beginners guide to growth hacking successÉvaluation : 4.5 sur 5 étoiles4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetD'EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetÉvaluation : 5 sur 5 étoiles5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityD'EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Financial Risk Management: A Simple IntroductionD'EverandFinancial Risk Management: A Simple IntroductionÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (34)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)D'EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Évaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- Joy of Agility: How to Solve Problems and Succeed SoonerD'EverandJoy of Agility: How to Solve Problems and Succeed SoonerÉvaluation : 4 sur 5 étoiles4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsD'EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistD'EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistÉvaluation : 4 sur 5 étoiles4/5 (32)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)