Académique Documents

Professionnel Documents

Culture Documents

Advance Financial Management

Transféré par

AMIT08006Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Advance Financial Management

Transféré par

AMIT08006Droits d'auteur :

Formats disponibles

(Finance Group Major Elective 1) COURSE NAME COURSE CODE SEMESTER SUBJECT NAME SUBJECT CODE : ADVANCE DIPLOMA

A IN BUSINESS MANAGEMENT SCIENCES : BQ : THIRD : ADVANCE FINANCIAL MANAGEMENT : 13543

Teaching and Examination Scheme:TEACHING SCHEME TH 05 TU -PR -EXAMINATION SCHEME & MAXIMUM MARKS PAPER HRS 03 TH 100 OR -PR -TW -TOTAL 100

NOTE: Two tests each of 25 marks to be conducted as per the schedule given by MSBTE. Total of tests marks for all theory subjects are to be converted out of 50 and to be entered in mark sheet under the head Sessional Work. (SW) RATIONALE: The subject deals with analyzing the importance of Financial Management and various aspects of Financial Management such as corporate finance investment banking infrastructure financing etc. OBJECTIVES: 1. Understand and apply the techniques of Risk analysis 2. Various structures in Corporate Finance have to be studied. 3. To understand the basic concept of Benchmarking and applying the same to corporate finance. 4. Analyze the Investment banking for valuation purposes. DETAILED CONTENTS: Section-I (Financial Management) CHAPTER CONTENTS

CORPORATE FINANCE- Capital structuring theory & practice, investment (project) identification & feasibility analysis with sensitivities, financing options- structuring & evaluation. off shore / on shore instruments, multiple option bonds- risk analysis, financial engineering

MARKS HOURS

10

08

3 4 5 6 7

CORPORATE FINANCE- Financial benchmarking- concept of shareholder value-maximization. interest rate structuring, bond valuation, financial interest rate swaps-treasury function in corporate world INVESTMENT BANKING- Valuation of corporate / projects / investment opportunities- due diligence procedures, credit rating of countries / state / investments & instruments INVESTMENT BANKING- joint venture formulations- RBI merchant banking- role & functions- loan syndication- IPO- primary issue management INFRASTRUCTURE FINANCING- issues and considerations financial feasibility, pricing earning model financing options

Sick companies act / Provisions of BIFR / Rehabilitation of sick units Indian financial systems TOTAL

10

07

06 06 08 06 04 50

05 05 06 05 04 40

Weightage:

70 % Numerical and 30 % Theory should be asked in examination (Section-I) Section- II (Management Accounting)

CHAPTER 1 2 3 4 5 6

CONTENTS

Introduction to Management Accounting- Recent Developments and Management Accounting for Service Companies

MARKS HOURS 02 06 04 08 06 10 02 05 04 06 05 08

Cost Analysis for Pricing Decisions- Economist Model, Full Price Costing, Target ROI, Pricing, Activity Based Costing

Measuring Quality- Total Quality Control, Quality Measures, Quality Circles, ISO 9000, Cost of Quality, Non Financial Measures of performance, Capital Budgeting Nature of Capital Budgeting, data requirement identifying relevant costs, Evaluation techniques. Short Term Decision Making- Decision tree analysis, Analytical frame work, Decision situations Return on Investment Analysis- Measuring profits to assets employed, a historical perspective, Residual Income, capitalizing v/s expensing, Identification of Assets in the investment Base Some other concepts in Management AccountingEconomic Value Added Benchmarking Life Cycle Costing Activity Based Cost Modeling Value Chain Analysis Strategic Business Unit and its accounting Balanced Scorecard TOTAL

14

10

50

40

Weightage: 40 % Numerical and 60 % Theory should be asked in examination (Section-II)

REFERENCE: Author HBR Ravi M. Kishor Van Horn Helfert Erich Robert S. Kaplan, Anthony A. Atkinson S.P Jain & K.L.Narang Jawahar Lal Title HBR Students Guide to Cost accounting Financial Management & Policy Techniques of Financial Analysis ADVANCE Management Accounting Name of the Publisher Harward Business Review Taxmann PHI Jaico --

ADVANCE Cost and Management -Accounting ADVANCE Management Accounting Text S Chand Publications and Cases

INTERNET REFERENCE:

www.mckinseyquarterly.com

Vous aimerez peut-être aussi

- The Balanced Scorecard: Turn your data into a roadmap to successD'EverandThe Balanced Scorecard: Turn your data into a roadmap to successÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- AUDIT FUNCTION STRATEGY (Driving Audit Value, Vol. I ) - The best practice strategy guide for maximising the audit added value at the Internal Audit Function levelD'EverandAUDIT FUNCTION STRATEGY (Driving Audit Value, Vol. I ) - The best practice strategy guide for maximising the audit added value at the Internal Audit Function levelPas encore d'évaluation

- MBA SyllabusDocument18 pagesMBA SyllabusShaheen MahmudPas encore d'évaluation

- Final Paper20 Revised Business ValuationDocument698 pagesFinal Paper20 Revised Business ValuationSukumar100% (5)

- MBA Syllabus: Department of Accounting and Information Systems Jagannath University, DhakaDocument18 pagesMBA Syllabus: Department of Accounting and Information Systems Jagannath University, DhakaIbrahim Arafat ZicoPas encore d'évaluation

- Stage 5 Syllabus - 2006Document9 pagesStage 5 Syllabus - 2006Ishfaq KhanPas encore d'évaluation

- FSA Course Outline 10-06-2016Document6 pagesFSA Course Outline 10-06-2016Supreet NarangPas encore d'évaluation

- Final Paper 20Document856 pagesFinal Paper 20rssarin100% (1)

- National University: Department of AccountingDocument8 pagesNational University: Department of AccountingMd MostakPas encore d'évaluation

- Department of Management Part1Document12 pagesDepartment of Management Part1Md Mizanur RahmanPas encore d'évaluation

- Befa R16 Syllabus - 1 PDFDocument4 pagesBefa R16 Syllabus - 1 PDFAnjani SmilyPas encore d'évaluation

- IT7T1Document2 pagesIT7T1Vyshnavi ThottempudiPas encore d'évaluation

- Paper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarksDocument12 pagesPaper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarkssangkitaPas encore d'évaluation

- MFC OU SyllabiDocument53 pagesMFC OU SyllabiRaghu RamPas encore d'évaluation

- AttachmentDocument102 pagesAttachmentDaksh OswalPas encore d'évaluation

- 1MIE21Document1 page1MIE21sibi chandanPas encore d'évaluation

- 19MST22Document1 page19MST22sibi chandanPas encore d'évaluation

- Accounting For Managerial DecisionsDocument2 pagesAccounting For Managerial DecisionsvineethkmenonPas encore d'évaluation

- Business Analhysis PDFDocument2 pagesBusiness Analhysis PDFjhonny1811Pas encore d'évaluation

- Bachelor of Commerce (Honours) Programme Code: BCH Duration - 3 Years Full TimeDocument102 pagesBachelor of Commerce (Honours) Programme Code: BCH Duration - 3 Years Full TimeVatsal SinghPas encore d'évaluation

- Solapur Uni. Mcom III & IV SyllabusDocument7 pagesSolapur Uni. Mcom III & IV Syllabusshaikh_naeem10Pas encore d'évaluation

- UG B.com Computer Applications 123 44 Management Accounting 8181Document316 pagesUG B.com Computer Applications 123 44 Management Accounting 8181Mukash AgarwalPas encore d'évaluation

- Iibs-Pgdm 1t-Finance SyllabusDocument2 pagesIibs-Pgdm 1t-Finance Syllabusb bPas encore d'évaluation

- Course Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Document8 pagesCourse Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Annie EinnaPas encore d'évaluation

- FINF315 FinManDocument4 pagesFINF315 FinManYash BhardwajPas encore d'évaluation

- ICAI Final SyllabusDocument19 pagesICAI Final SyllabusrockwithakmPas encore d'évaluation

- 2 FA Course ENG Final PDFDocument142 pages2 FA Course ENG Final PDFAudra GreenPas encore d'évaluation

- Course Outline Financial Management-2018-19Document4 pagesCourse Outline Financial Management-2018-19Jayesh MahajanPas encore d'évaluation

- Non-CBCS Wef 2009-'10Document45 pagesNon-CBCS Wef 2009-'10ryan smithPas encore d'évaluation

- Scope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnDocument4 pagesScope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnPrabhjeet KalsiPas encore d'évaluation

- MFC Part-I (Semester I & II)Document11 pagesMFC Part-I (Semester I & II)angelagarwalPas encore d'évaluation

- Instructor-In-Charge: Prof. Niranjan Swain: Niranjanswain@pilani - Bits-Pilani.c.inDocument13 pagesInstructor-In-Charge: Prof. Niranjan Swain: Niranjanswain@pilani - Bits-Pilani.c.inSiddharth MehtaPas encore d'évaluation

- Course Content: Course Content Term I Course Title: Behavioral Sciences-1Document3 pagesCourse Content: Course Content Term I Course Title: Behavioral Sciences-1sunilPas encore d'évaluation

- KU MBA Syllabus 2013Document4 pagesKU MBA Syllabus 2013Vinod JoshiPas encore d'évaluation

- Mba Marketing 1stDocument5 pagesMba Marketing 1stAbhinav RandevPas encore d'évaluation

- PG - M.Com - Finance & Control - 335 41 MANAGEMENT ACCOUNTING - 2542Document300 pagesPG - M.Com - Finance & Control - 335 41 MANAGEMENT ACCOUNTING - 2542shahyasir100% (1)

- Format For Course Curriculum: Course Code: ACCT315 Credit Units: 3 Level: UGDocument4 pagesFormat For Course Curriculum: Course Code: ACCT315 Credit Units: 3 Level: UGLoolik SoliPas encore d'évaluation

- Financial Management: Objective Unit-I:An Overview of Financial ManagementDocument1 pageFinancial Management: Objective Unit-I:An Overview of Financial ManagementAachal SinghPas encore d'évaluation

- (H) ModuleDocument102 pages(H) ModuleKanshi Bhardwaj0% (1)

- Management AccountingDocument4 pagesManagement AccountingSakchiPas encore d'évaluation

- Course Outline 2015Document2 pagesCourse Outline 2015henocdane5Pas encore d'évaluation

- BBA Syllabus FinalDocument13 pagesBBA Syllabus FinalHimanshuPas encore d'évaluation

- M.B.A. IiDocument55 pagesM.B.A. IiVishal kharePas encore d'évaluation

- MBA-Tourism - PDF - INTERNATIONAL TOURISM PDFDocument38 pagesMBA-Tourism - PDF - INTERNATIONAL TOURISM PDFpadmavathiPas encore d'évaluation

- SYllabus - ACCDocument2 pagesSYllabus - ACCVarshini SivakumarPas encore d'évaluation

- MBA Syllabus: Department of Accounting and Information Systems Jagannath University, DhakaDocument18 pagesMBA Syllabus: Department of Accounting and Information Systems Jagannath University, Dhakasakib990100% (1)

- FinanceDocument3 pagesFinanceRakshitha ChikkannaPas encore d'évaluation

- Business FinanceDocument5 pagesBusiness FinanceTanmay SinghalPas encore d'évaluation

- Revision Book CAFMDocument104 pagesRevision Book CAFMDeep Patel100% (1)

- SYLLABUS - Financial Statement AnalysisDocument4 pagesSYLLABUS - Financial Statement AnalysisTâm NhưPas encore d'évaluation

- RS Financial ManagementDocument139 pagesRS Financial ManagementVishwas ShettyPas encore d'évaluation

- CS8T1 MefaDocument2 pagesCS8T1 MefaKishoreReddyPas encore d'évaluation

- MBS 2nd Sem SyllabusDocument11 pagesMBS 2nd Sem SyllabusABishnu BagalePas encore d'évaluation

- Syllabusfsfdfsdfsfsff2023Onwards MBA FinanceDocument26 pagesSyllabusfsfdfsdfsfsff2023Onwards MBA FinanceAbhishek BhattacharjeePas encore d'évaluation

- SPPU - MBA Revised Curriculum 2019 CBCGS & OBE PatternDocument14 pagesSPPU - MBA Revised Curriculum 2019 CBCGS & OBE PatternPravin DeokarPas encore d'évaluation

- 2 FA Course ENG Final PDFDocument142 pages2 FA Course ENG Final PDFCinar InalPas encore d'évaluation

- Accounting For Decision Making: For: IBA Academic Committee By: Rustom Kavasji Chairman, Accounting & Law, IBA, KarachiDocument19 pagesAccounting For Decision Making: For: IBA Academic Committee By: Rustom Kavasji Chairman, Accounting & Law, IBA, KarachiAhsan IqbalPas encore d'évaluation

- 58 - Management 3rd YearDocument10 pages58 - Management 3rd YearRoman SiddiqPas encore d'évaluation

- Paper-8 Cost Accounting & Financial Mangement (Syllabus 2012) PDFDocument492 pagesPaper-8 Cost Accounting & Financial Mangement (Syllabus 2012) PDFJolly Singhal100% (1)

- Financial Management: Partner in Driving Performance and ValueD'EverandFinancial Management: Partner in Driving Performance and ValuePas encore d'évaluation

- Design of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Document11 pagesDesign of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Burlacu AndreiPas encore d'évaluation

- Hierarchy of The Inchoate Crimes: Conspiracy Substantive CrimeDocument18 pagesHierarchy of The Inchoate Crimes: Conspiracy Substantive CrimeEmely AlmontePas encore d'évaluation

- Matrix of Consumer Agencies and Areas of Concern: Specific Concern Agency ConcernedDocument4 pagesMatrix of Consumer Agencies and Areas of Concern: Specific Concern Agency ConcernedAJ SantosPas encore d'évaluation

- Mercury 150HPDocument5 pagesMercury 150HP이영석0% (1)

- AkDocument7 pagesAkDavid BakcyumPas encore d'évaluation

- Rehabilitation and Retrofitting of Structurs Question PapersDocument4 pagesRehabilitation and Retrofitting of Structurs Question PapersYaswanthGorantlaPas encore d'évaluation

- CT018 3 1itcpDocument31 pagesCT018 3 1itcpraghav rajPas encore d'évaluation

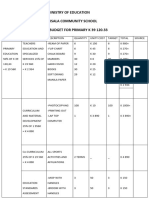

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesPas encore d'évaluation

- List of People in Playboy 1953Document57 pagesList of People in Playboy 1953Paulo Prado De Medeiros100% (1)

- Go Ask Alice EssayDocument6 pagesGo Ask Alice Essayafhbexrci100% (2)

- Liga NG Mga Barangay: Resolution No. 30Document2 pagesLiga NG Mga Barangay: Resolution No. 30Rey PerezPas encore d'évaluation

- MCoal Coal July Investor SlidesDocument26 pagesMCoal Coal July Investor SlidesMCoaldataPas encore d'évaluation

- Data Sheet: Elcometer 108 Hydraulic Adhesion TestersDocument3 pagesData Sheet: Elcometer 108 Hydraulic Adhesion TesterstilanfernandoPas encore d'évaluation

- SH210 5 SERVCE CD PDF Pages 1 33Document33 pagesSH210 5 SERVCE CD PDF Pages 1 33Em sulistio87% (23)

- August 2015Document96 pagesAugust 2015Cleaner MagazinePas encore d'évaluation

- Week 7 Apple Case Study FinalDocument18 pagesWeek 7 Apple Case Study Finalgopika surendranathPas encore d'évaluation

- Emergency and Safety ProceduresDocument22 pagesEmergency and Safety Procedurespaupastrana94% (17)

- United States v. Manuel Sosa, 959 F.2d 232, 4th Cir. (1992)Document2 pagesUnited States v. Manuel Sosa, 959 F.2d 232, 4th Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Donation Drive List of Donations and BlocksDocument3 pagesDonation Drive List of Donations and BlocksElijah PunzalanPas encore d'évaluation

- Dr. Najeebuddin Ahmed: 969 Canterbury Road, Lakemba, Sydney, NSW, Australia, 2195Document2 pagesDr. Najeebuddin Ahmed: 969 Canterbury Road, Lakemba, Sydney, NSW, Australia, 2195Najeebuddin AhmedPas encore d'évaluation

- Epenisa 2Document9 pagesEpenisa 2api-316852165100% (1)

- SemiDocument252 pagesSemiGPas encore d'évaluation

- Interest Rates and Bond Valuation: All Rights ReservedDocument22 pagesInterest Rates and Bond Valuation: All Rights ReservedAnonymous f7wV1lQKRPas encore d'évaluation

- EW160 AlarmsDocument12 pagesEW160 AlarmsIgor MaricPas encore d'évaluation

- Milestone 9 For WebsiteDocument17 pagesMilestone 9 For Websiteapi-238992918Pas encore d'évaluation

- Heat Exchanger Designing Using Aspen PlusDocument6 pagesHeat Exchanger Designing Using Aspen PlusMeethiPotterPas encore d'évaluation

- Hardware Architecture For Nanorobot Application in Cancer TherapyDocument7 pagesHardware Architecture For Nanorobot Application in Cancer TherapyCynthia CarolinePas encore d'évaluation

- VISCOROL Series - Magnetic Level Indicators: DescriptionDocument4 pagesVISCOROL Series - Magnetic Level Indicators: DescriptionRaduPas encore d'évaluation

- Millionaire Next Door QuestionsDocument7 pagesMillionaire Next Door Questionsapi-360370073Pas encore d'évaluation

- STM Series Solar ControllerDocument2 pagesSTM Series Solar ControllerFaris KedirPas encore d'évaluation