Académique Documents

Professionnel Documents

Culture Documents

Results Tracker: Thursday, 20 Oct 2011

Transféré par

Mansukh Investment & Trading SolutionsTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Results Tracker: Thursday, 20 Oct 2011

Transféré par

Mansukh Investment & Trading SolutionsDroits d'auteur :

Formats disponibles

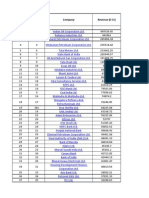

Results Tracker

Thursday, 20 Oct 2011

make more, for sure.

Q2FY12

Results to be Declared on 20th Oct 2011

COMPANIES NAME

ADI Rasayan

Esab India

Hexaware Tech

Kirloskar Bros

State Bank Trav

Alka Diamond

Excel Crop

Hindustan Media

Kothari World Fin

Sterlite Tech

Artson Engr

Exide Inds

Hitachi Home

KPIT Cummins

STI India

Arunoday Mills

FAG Bearings

HSIL

Lloyds Finance

Swaraj Engines

Ashapura Mine

Fresenius Kabi

IDBI Bank

Mahindra Forg

Thermax

Bajaj Auto

Fulford India

IITL PROJ

Nilkamal

Torrent Cables

Bajaj Holdings

Gandhi Spec

Indbank Merch

Noida Toll

Triton Valves

Bharat Bhushan Share

Garnet Constr

INDIAB POWER

Peoples Invest

Ugar Sugar

Bharat Bijlee

GHCL

Indiabulls Real Est

Piramal Health

Ultratech Cem

Bharat Seats

Croitre Inds

D B CORP

DCW

Deepak Fert

Dewan Housing

DHANLAK BANK

Global Sec

GM Breweries

Gujarat Alk

Gujarat Narm Val

Gujarat State Fert

Gujarat Terce

Hester Bio

Indiabulls Sec

Indoco Remedies

Industrial Invest

Info Edge India

Ishita Drugs

Jhaveri Weld

Kewal Kiran

Rane Brake

Repro India

Rishiroop Rub

Sadhana Nitr

Sagar Cements

Shree Digvijay

SREI Infra

Unitech Intl

WABCO India

Yes Bank

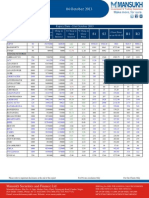

Results Announced on 19th Oct 2011 (Rs Million)

HDFC Bank

Quarter ended

201109

Interest Earned

67177

Year to Date

201009

% Var

48099.9

39.66

201109

Year ended

201009

% Var

201103

201003

% Var

126956.7

92297

37.55

199282.1

161727.3

23.22

Other Income

12116.8

9607.1

26.12

23317.1

19515.7

19.48

43351.5

39831

8.84

Interest Expended

37731.9

22837.2

65.22

69032

43027.3

60.44

93850.8

77863

20.53

Operating Expenses

20303.9

20303.9

20.87

39650.2

33227.3

19.33

71529.2

59398.1

20.42

3660.5

4544.8

-19.46

8096.8

10095

-19.79

19067.1

21405.9

-10.93

Tax

5604

4404.8

10651.2

8224.6

13404.4

11993.5

9121.4

22843.6

17238.5

29.5

32.52

18922.6

PAT

27.22

31.49

39263.9

29486.9

41.17

33.16

Equity

4676.6

4626

4676.6

4626

4577.4

31.64

37.57

32.76

38.53

1.09

-14.96

4652.3

OPM

1.09

-15.77

38.77

39.76

Operating Profit

Prov.& Contigencies

1.64

-2.49

The sales moved up 39.66% to Rs. 67177.00 millions for the September 2011 quarter as compared to Rs. 48099.90 millions during the yearago period.A good growth in profit of 31.49% reported to Rs. 11993.50 millions over Rs. 9121.40 millions of corresponding previous

quarter.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Indraprastha Gas

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

5974.97

14.99

1594.5

117.52

1476.98

344.43

1132.54

360.3

0

772.25

4467.91

5.39

1252.61

20.17

1232.43

238.89

993.54

330.76

0

662.78

Equity

PBIDTM(%)

1400

24.02

1400

24.91

% Var

33.73

Year ended

201109

201009

178.11

27.29

482.65

19.84

44.18

13.99

8.93

0

16.52

11348.93

28.47

3191.34

207.62

2983.72

666.5

2317.22

744.31

0

1572.92

7825.67

16.29

2338.29

20.17

2318.11

469.81

1848.3

614.13

0

1234.17

0

-3.58

1400

28.12

1400

29.88

% Var

45.02

201103

201003

74.77

36.48

929.35

28.71

41.87

25.37

21.2

0

27.45

17504.63

30.85

5017.41

131.63

4885.79

1028.71

3857.07

1259.39

0

2597.68

10838.37

153.87

4018.9

0

4018.9

774.52

3244.38

1089.42

0

2154.97

0

-5.89

1400

25.63

1400

32.97

% Var

61.51

-79.95

24.85

0

21.57

32.82

18.88

15.6

0

20.54

0

-22.28

A decent increase of about 33.73% in the sales to Rs. 5974.97 millions was observed for the quarter ended September 2011. The sales figure

stood at Rs. 4467.91 millions during the year-ago period.A humble growth in net profit of 16.52% reported in the quarter ended

September 2011 to Rs. 772.25 millions from Rs. 662.78 millions.OP of the company witnessed a marginal growth to 1594.50 millions from

1252.61 millions in the same quarter last year.

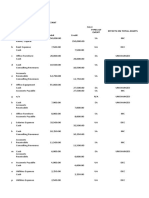

Hindustan Zinc

Quarter ended

Year to Date

Year ended

Sales

201109

26368.2

201009

22016.1

% Var

19.77

201109

54838.9

201009

41718.3

% Var

31.45

201103

100393

201003

81344

% Var

23.42

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

3867.8

18515.8

120.3

18156.9

1455.2

16701.7

3254.8

0

13446.9

1845.4

13098

0

12886.4

1158.4

11728

2240.8

0

9487.2

109.59

41.36

0

40.9

25.62

42.41

45.25

0

41.74

7421.4

37992.4

185.2

37524.4

2800.5

34723.9

6327.9

0

28396

3429.8

24900.3

65.5

24623.2

2281.1

22342.1

3945.7

0

18396.4

116.38

52.58

182.75

52.39

22.77

55.42

60.37

0

54.36

8520.5

64748.5

194

64342.9

4747.4

59595.5

10590.6

0

49004.9

6002.5

53922.8

439.2

53483.6

3342.5

50141.1

9727

0

40414.1

41.95

20.08

-55.83

20.3

42.03

18.86

8.88

0

21.26

Equity

PBIDTM(%)

8450.6

70.22

4225.3

59.49

100

18.03

8450.6

69.28

4225.3

59.69

100

16.07

8450.6

64.5

4225.3

66.29

100

-2.71

The September 2011 quarter revenue stood at Rs. 26368.20 millions, up 19.77% as compared to Rs. 22016.10 millions during the

corresponding quarter last year.Net Profit recorded in the quarter ended September 2011 rise to 41.74% to Rs. 13446.90 millions

compared to R. 9487.20 millions in corresponding previous quarter.Operating Profit saw a handsome growth to 18515.80 millions from

13098.00 millions in the quarter ended September 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Hindustan Zinc

Quarter ended

Year to Date

Year ended

Sales

201109

26368.2

201009

22016.1

% Var

19.77

201109

54838.9

201009

41718.3

% Var

31.45

201103

100393

201003

81344

% Var

23.42

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

3867.8

18515.8

120.3

18156.9

1455.2

16701.7

3254.8

0

13446.9

1845.4

13098

0

12886.4

1158.4

11728

2240.8

0

9487.2

109.59

41.36

0

40.9

25.62

42.41

45.25

0

41.74

7421.4

37992.4

185.2

37524.4

2800.5

34723.9

6327.9

0

28396

3429.8

24900.3

65.5

24623.2

2281.1

22342.1

3945.7

0

18396.4

116.38

52.58

182.75

52.39

22.77

55.42

60.37

0

54.36

8520.5

64748.5

194

64342.9

4747.4

59595.5

10590.6

0

49004.9

6002.5

53922.8

439.2

53483.6

3342.5

50141.1

9727

0

40414.1

41.95

20.08

-55.83

20.3

42.03

18.86

8.88

0

21.26

Equity

PBIDTM(%)

8450.6

70.22

4225.3

59.49

100

18.03

8450.6

69.28

4225.3

59.69

100

16.07

8450.6

64.5

4225.3

66.29

100

-2.71

The September 2011 quarter revenue stood at Rs. 26368.20 millions, up 19.77% as compared to Rs. 22016.10 millions during the

corresponding quarter last year.Net Profit recorded in the quarter ended September 2011 rise to 41.74% to Rs. 13446.90 millions

compared to R. 9487.20 millions in corresponding previous quarter.Operating Profit saw a handsome growth to 18515.80 millions from

13098.00 millions in the quarter ended September 2011.

Crompton Greaves

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

14514.7

168.2

1782.2

0.5

1781.7

267.1

1514.6

391.4

-10.3

1123.2

14447.8

199.8

2508.9

0

2508.9

195.1

2313.8

728.9

54.5

1584.9

Equity

PBIDTM(%)

1283

11.62

1283

16.41

% Var

0.46

Year ended

201109

201009

-15.82

-28.96

0

-28.98

36.9

-34.54

-46.3

-118.9

-29.13

29203

324.8

3805.4

14.8

3790.6

552.9

3237.7

824.3

3.9

2413.4

27876.9

353.9

4756.7

0

4756.7

367.5

4389.2

1382.6

39.9

3006.6

0

-29.16

1283

13.03

1283

17.06

% Var

4.76

201103

201003

-8.22

-20

0

-20.31

50.45

-26.23

-40.38

-90.23

-19.73

59514.7

793.8

10118.9

39.9

10079

808.9

9270.1

2326.8

-110.2

6943.3

52839.9

687.5

9265.1

43.5

9221.6

519

8702.6

2933

195

5769.6

% Var

12.63

15.46

9.22

-8.28

9.3

55.86

6.52

-20.67

-156.51

20.34

0

-23.63

1283

16.12

1283

16.8

0

-4.02

The total revenue for the quarter ended September 2011 remained nearly unchanged at Rs. 14514.70 millions.The Company's Net profit

for the September 2011 quarter have declined marginally to Rs. 1123.20 millions as against Rs. 1584.90 millions reported during the

corresponding quarter ended.The company reported a degrowth in operating Profit to 1782.20 millions from 2508.90 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Torrent Power

Quarter ended

Year to Date

201109

201009

Sales

19982.4

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

234.9

5893.8

806.8

5087

1048.8

4038.2

1118.4

277.5

2919.8

Equity

PBIDTM(%)

4724.5

29.49

Year ended

201109

201009

17281.8

% Var

15.63

201103

201003

35527.7

% Var

14.5

68345.6

59093.9

% Var

15.66

40677.6

212.1

5190.5

825.8

4364.7

982

3382.7

1156.6

455.9

2226.1

10.75

13.55

-2.3

16.55

6.8

19.38

-3.3

-39.13

31.16

430.1

12560.5

1603.6

10956.9

2082.8

8874.1

2467.2

658.7

6406.9

404.8

11322.6

1665.9

9656.7

1945.2

7711.5

2441.3

836.6

5270.2

6.25

10.93

-3.74

13.46

7.07

15.08

1.06

-21.26

21.57

924.6

21604

3389

18215

3926.8

14288.2

3631

993.5

10657.2

472.7

18358.6

3140.6

15218

3353.5

11864.5

3499

1424

8365.5

95.6

17.68

7.91

19.69

17.1

20.43

3.77

-30.23

27.39

4724.5

30.03

0

-1.8

4724.5

30.88

4724.5

31.87

0

-3.11

4724.5

31.61

4724.5

31.07

0

1.75

The September 2011 quarter revenue stood at Rs. 19982.40 millions, up 15.63% as compared to Rs. 17281.80 millions during the

corresponding quarter last year.A comparatively good net profit growth of 31.16% to Rs. 2919.80 millions was reported for the quarter

ended September 2011 compared to Rs. 2226.10 millions of previous same quarter.The company reported a good operating profit of

5893.80 millions compared to 5190.50 millions of corresponding previous quarter.

Dish TV India

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

4822.7

92

1310.4

634

676.4

1162

-485.6

0

0

-485.6

3261.5

246.2

744.2

352.7

391.5

843.2

-451.7

0

0

-451.7

Equity

PBIDTM(%)

1063.4

27.17

1062.6

22.82

% Var

47.87

Year ended

201109

201009

-62.63

76.08

79.76

72.77

37.81

7.5

0

0

7.5

9426.5

228.7

2568.6

968

1600.6

2269.4

-668.8

0

0

-668.8

6304.5

522.8

1342.7

694.2

648.5

1732

-1083.5

0

0

-1083.5

0.08

19.08

1063.4

27.25

1062.6

21.3

% Var

49.52

201103

201003

-56.25

91.3

39.44

146.82

31.03

-38.27

0

0

-38.27

14365.5

880.3

3268.4

1511.4

1757

3654

-1897

0

0

-1897

10847.9

686.1

1632.8

1216.4

416.4

3037.9

-2621.5

-0.3

0

-2621.2

0.08

27.94

1063

22.75

1062.1

15.05

% Var

32.43

28.3

100.17

24.25

321.95

20.28

-27.64

-100

0

-27.63

0.08

51.16

The Sales for the quarter ended September 2011 of Rs. 4822.70 millions rose by 47.87% from Rs. 3261.50 millions.The Net Loss for the

quarter ended September 2011 is Rs. -485.60 millions as compared to Net Loss of Rs. -451.70 millions of corresponding quarter ended

September 2010The company reported a good operating profit of 1310.40 millions compared to 744.20 millions of corresponding previous

quarter.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Bajaj Finance

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

4916.8

16.2

2996

1673.2

1322.8

34

1288.8

415.1

0

873.7

3203.2

61.2

1645.4

832.9

812.5

29.4

783.1

255.4

0

527.7

Equity

PBIDTM(%)

366.3

60.93

366

51.37

% Var

53.5

Year ended

201109

201009

-73.53

82.08

100.89

62.81

15.65

64.58

62.53

0

65.57

9413.5

37

5793.6

3097

2696.6

61.5

2635.1

853.3

0

1781.8

6159.6

72.2

3099.7

1560.3

1539.4

50.1

1489.3

493.8

0

995.5

0.08

18.62

366.3

61.55

366

50.32

% Var

52.83

201103

201003

-48.75

86.91

98.49

75.17

22.75

76.94

72.8

0

78.99

13923.3

138

7597.3

3779.5

3817.8

118.6

3699.2

1229.6

0

2469.6

9100.6

61

3436

2016.7

1419.4

76.4

1343

448.9

0

894.1

0.08

22.3

366.3

54.57

366

37.76

% Var

52.99

126.23

121.11

87.41

168.97

55.24

175.44

173.91

0

176.21

0.08

44.52

The turnover zoomed to Rs. 4916.80 millions, up 53.50% for the September 2011 quarter as against Rs. 3203.20 millions during the yearago period.Net profit for the quarter ended September 2011 increased significantly by 65.57% to Rs. 873.70 millions from Rs. 527.70

millions.Operating profit for the quarter ended September 2011 rose to 2996.00 millions as compared to 1645.40 millions of corresponding

quarter ended September 2010.

State Bank of Patiala

Quarter ended

Interest Earned

Year to Date

Year ended

201109

201009

% Var

201109

201009

% Var

201103

201003

% Var

19219.2

15715.2

22.3

19219.2

15715.2

22.3

64781.1

59752.7

8.42

Other Income

1858

1605.9

15.7

1858

1605.9

15.7

7555.4

6744.4

12.02

Interest Expended

13998

10047.1

39.32

13998

10047.1

39.32

41446.3

44410.5

-6.67

Operating Expenses

2960.1

2960.1

3.12

2960.1

2870.5

3.12

13297.7

9009.5

47.6

Prov.& Contigencies

1650.9

2182.4

-24.35

1650.9

2182.4

-24.35

6960.3

4403.8

58.05

Tax

914.4

659.7

914.4

659.7

3164.4

1553.8

1561.4

1553.8

1561.4

38.61

-0.49

4102.6

PAT

38.61

-0.49

6529.6

5508.9

29.65

18.53

Equity

2947.5

2947.5

2947.5

2947.5

2947.5

21.43

28.02

21.43

28.02

0

-23.51

2947.5

OPM

27.16

21.89

Operating Profit

0

-23.51

0

24.09

The revenue for the September 2011 quarter is pegged at Rs. 19219.20 millions, about 22.30% up against Rs. 15715.20 millions recorded

during the year-ago period.The Net proft of the company remain more or less same to Rs. 1553.80 millions from Rs. 1561.40 millions

,decline by -0.49%.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Vous aimerez peut-être aussi

- Results Tracker: Thursday, 26 July 2012Document7 pagesResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Friday, 21 Oct 2011Document8 pagesResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Friday, 20 July 2012Document7 pagesResults Tracker: Friday, 20 July 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Tuesday, 07 Aug 2012Document7 pagesResults Tracker: Tuesday, 07 Aug 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker 22.10.11Document14 pagesResults Tracker 22.10.11Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Q2FY12 - Results Tracker 28.10.11Document7 pagesQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Saturday, 21 July 2012Document10 pagesResults Tracker: Saturday, 21 July 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Wednesday, 19 Oct 2011Document6 pagesResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Saturday, 04 Aug 2012Document7 pagesResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Tuesday, 25 Oct 2011Document5 pagesResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Thursday, 02 Aug 2012Document7 pagesResults Tracker: Thursday, 02 Aug 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Friday, 03 Feb 2012Document7 pagesResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Wednesday, 02 Nov 2011Document8 pagesResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Tuesday, 01 Nov 2011Document13 pagesResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Tuesday, 24 July 2012Document7 pagesResults Tracker: Tuesday, 24 July 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Wednesday, 08 Aug 2012Document4 pagesResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Thursday, 16 Aug 2012Document8 pagesResults Tracker: Thursday, 16 Aug 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Q1FY12 Results Tracker 17th August-Mansukh Investment and TradingDocument5 pagesQ1FY12 Results Tracker 17th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsPas encore d'évaluation

- Q1FY12 Results Tracker 13th August-Mansukh Investment and TradingDocument16 pagesQ1FY12 Results Tracker 13th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker 04.11.11Document8 pagesResults Tracker 04.11.11Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Weekly Market Outlook 23.04.12Document5 pagesWeekly Market Outlook 23.04.12Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliPas encore d'évaluation

- Nepal's Major Exports to India and Third Countries in the First Six Months of 2011-12Document8 pagesNepal's Major Exports to India and Third Countries in the First Six Months of 2011-12Suniel ChhetriPas encore d'évaluation

- Fundamental Analysis of StocksDocument12 pagesFundamental Analysis of Stocksverma vikasPas encore d'évaluation

- Economic Financial Company AnalysisDocument6 pagesEconomic Financial Company AnalysisJaya SudhakarPas encore d'évaluation

- Lakh RS, Y/e June FY09 FY08 FY07Document10 pagesLakh RS, Y/e June FY09 FY08 FY07gaurav910Pas encore d'évaluation

- WEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Document6 pagesWEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Holding Equity OpenDocument48 pagesHolding Equity OpenOffice WorkPas encore d'évaluation

- Results Tracker: Tuesday, 15 Nov 2011Document12 pagesResults Tracker: Tuesday, 15 Nov 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Pidilite financial metrics and valuation analysisDocument3 pagesPidilite financial metrics and valuation analysisTejaswi KancherlaPas encore d'évaluation

- Results Tracker: Tuesday, 18 Oct 2011Document4 pagesResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- ET Top 500 Companies List India 2014Document45 pagesET Top 500 Companies List India 2014Saakshi KaulPas encore d'évaluation

- India's Top Companies 2012: Revenue, Profit & Industry FiguresDocument18 pagesIndia's Top Companies 2012: Revenue, Profit & Industry FiguresRaj KumariPas encore d'évaluation

- KSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutDocument2 pagesKSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutInam Ul Haq MinhasPas encore d'évaluation

- Results Tracker 21.04.12Document3 pagesResults Tracker 21.04.12Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Accounts AssignmentDocument15 pagesAccounts AssignmentGagandeep SinghPas encore d'évaluation

- Results Tracker: Friday, 03 Aug 2012Document4 pagesResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Sector Wise List of Listed NSE Companies: Electrical EquipmentDocument29 pagesSector Wise List of Listed NSE Companies: Electrical EquipmentharshitabaranwalPas encore d'évaluation

- Results Tracker: Saturday, 14 July 2012Document4 pagesResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Overview of Movement of Stock Market IndexesDocument26 pagesOverview of Movement of Stock Market IndexesAlok AgarwalPas encore d'évaluation

- Profit Loss Account Crores: IncomeDocument8 pagesProfit Loss Account Crores: Incomerajputana12Pas encore d'évaluation

- Weekly Market Outlook 11.03.13Document5 pagesWeekly Market Outlook 11.03.13Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1Pas encore d'évaluation

- PTCLDocument169 pagesPTCLSumaiya Muzaffar100% (1)

- Equity Funds Hybrid Funds Fund-of-Funds: 30 December 2011Document28 pagesEquity Funds Hybrid Funds Fund-of-Funds: 30 December 2011Ahmed HusainPas encore d'évaluation

- Core OpDocument2 pagesCore Opsatyap15Pas encore d'évaluation

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker: Thursday, 19 July 2012Document4 pagesResults Tracker: Thursday, 19 July 2012Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Stock Market: Presented By:-Dev Ranjan Diwakar 10DM112 PGDM Sec-BDocument28 pagesStock Market: Presented By:-Dev Ranjan Diwakar 10DM112 PGDM Sec-BDev R. DiwakarPas encore d'évaluation

- Fuzzy Lookup ScripDocument65 pagesFuzzy Lookup ScripNeha MalhotraPas encore d'évaluation

- Financial Project Report ON Ultratech Cement India LTDDocument11 pagesFinancial Project Report ON Ultratech Cement India LTDDinesh AilaniPas encore d'évaluation

- CMP Price Market 52W 52W ROE P/E P/BV EV/ Change Cap (CR) High Low Ebitda Ompany Name (M.Cap)Document7 pagesCMP Price Market 52W 52W ROE P/E P/BV EV/ Change Cap (CR) High Low Ebitda Ompany Name (M.Cap)SandeepMalooPas encore d'évaluation

- NDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-InDocument30 pagesNDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-Inpriyamvada_tPas encore d'évaluation

- Dividen & Dividen Payout by Year Dividen Dalam RP 000.000 Dan DP % Dividen Net Income Before Tax DP 2010Document10 pagesDividen & Dividen Payout by Year Dividen Dalam RP 000.000 Dan DP % Dividen Net Income Before Tax DP 2010Sabar Andriko SianturiPas encore d'évaluation

- Oil India Limited Financial and Physical Results for Q1-Q4 of FY 2010-11 and 2009-10Document7 pagesOil India Limited Financial and Physical Results for Q1-Q4 of FY 2010-11 and 2009-10aabid_chem3363Pas encore d'évaluation

- Multi-Party and Multi-Contract Arbitration in the Construction IndustryD'EverandMulti-Party and Multi-Contract Arbitration in the Construction IndustryPas encore d'évaluation

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Variable Costing & Segment Reporting-FINALDocument29 pagesVariable Costing & Segment Reporting-FINALTin Bernadette DominicoPas encore d'évaluation

- Master Budget Illustrationv2Document16 pagesMaster Budget Illustrationv2Rianne NavidadPas encore d'évaluation

- CH 2 - Financial Statements For Decision MakingDocument38 pagesCH 2 - Financial Statements For Decision MakingAwais JavedPas encore d'évaluation

- Classification of Land and Building Costs Spitfire Company Was I PDFDocument1 pageClassification of Land and Building Costs Spitfire Company Was I PDFAnbu jaromiaPas encore d'évaluation

- Lembar JawabanDocument110 pagesLembar JawabanHanna FMPas encore d'évaluation

- P2 Short Notes PDFDocument61 pagesP2 Short Notes PDFTilentos GG100% (1)

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoPas encore d'évaluation

- Booker Group PLC 2013Document80 pagesBooker Group PLC 2013bini bomPas encore d'évaluation

- AKPI - Annual Report - 2015 PDFDocument185 pagesAKPI - Annual Report - 2015 PDFMuchammad Yatin100% (1)

- Balance Sheet (Standard) : PT - Cahaya Semesta SelularDocument1 pageBalance Sheet (Standard) : PT - Cahaya Semesta SelularTabryan TajrilPas encore d'évaluation

- Fair Value Measurement and ReportingDocument79 pagesFair Value Measurement and ReportingMai TrầnPas encore d'évaluation

- Assignment Print View 3.4Document4 pagesAssignment Print View 3.4Zach JaapPas encore d'évaluation

- q1 Business Math Module 5Document17 pagesq1 Business Math Module 5Reigi May100% (2)

- Review construction contract gross profit calculationsDocument3 pagesReview construction contract gross profit calculationsAvishchal ChandPas encore d'évaluation

- B.T. Hernandez CompanyDocument3 pagesB.T. Hernandez Companylee serojalesPas encore d'évaluation

- AccountancyDocument4 pagesAccountancyAbhijan Carter BiswasPas encore d'évaluation

- Grade11 Fabm1 Q2 Week3Document14 pagesGrade11 Fabm1 Q2 Week3Mickaela MonterolaPas encore d'évaluation

- ps10 Eco110Document15 pagesps10 Eco110Jayasudhakar BaddigamPas encore d'évaluation

- Ratio Analysis Berger Asian PaintsDocument11 pagesRatio Analysis Berger Asian PaintsHEM BANSALPas encore d'évaluation

- Chapter 7 Word ProblemDocument3 pagesChapter 7 Word ProblemRaheel AhmedPas encore d'évaluation

- The Role of Cash Flow in Explaining The Change in Company LiquidityDocument14 pagesThe Role of Cash Flow in Explaining The Change in Company LiquidityEmekaPas encore d'évaluation

- Chapter 13 (Incomplete)Document22 pagesChapter 13 (Incomplete)Dan ChuaPas encore d'évaluation

- Diskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Document3 pagesDiskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Hafizd FadillahPas encore d'évaluation

- Vedant Fashions Q2FY23 NuvamaDocument9 pagesVedant Fashions Q2FY23 NuvamaRajesh VoraPas encore d'évaluation

- INTRODUCTIONDocument79 pagesINTRODUCTIONdrkotianrajeshPas encore d'évaluation

- PDF 04Document7 pagesPDF 04Hiruni LakshaniPas encore d'évaluation

- 2010 LCCI Bookkeeping and Accounts Series 3Document8 pages2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- Q 211 Centipede PDFDocument2 pagesQ 211 Centipede PDFboke layPas encore d'évaluation

- ETS Study GuidesDocument170 pagesETS Study GuidessaketramaPas encore d'évaluation

- City of Bingham Project FinancialsDocument46 pagesCity of Bingham Project FinancialsNicky 'Zing' Nguyen100% (7)