Académique Documents

Professionnel Documents

Culture Documents

Economic Focus 10-17-11

Transféré par

Jessica Kister-LombardoDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Economic Focus 10-17-11

Transféré par

Jessica Kister-LombardoDroits d'auteur :

Formats disponibles

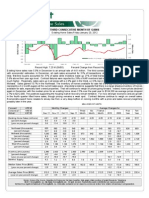

Economic Focus

ANOTHER LOOK AT SHORT SALES

There is another dramatic shift in home sales, according to Ron Peltier, chairman and chief executive officer of HomeServices of America Inc., the second-biggest U.S. residential brokerage which has over 700 offices under the Coldwell Banker brand. That dramatic shift is in banks willingness to sell than the mortgage balance to avoid foreclosing. Finally, common sense is coming into the equation.! Typically short sales sell at a discount of about 20% for home not in financial distress, in contrast to a 40% discount for bank-owned homes also known as REOs. That is of 20% more for the mortgage holder, so it is a clear financial incentive for banks to accommodate a short sale over having to process a foreclosure. HomeServices reports that the distressed sales were a mix of 60% foreclosure and 40% short sales. But that ratio has now flipped. Why Banks Should Short Sell: Following the Robo-Signing and subsequent delays in the foreclosure process, banks are facing the realities of how to dispose of these assets, which in fact become a liability to them: First, banks do not want to be landlords, they are in the business of lending on not acquiring real estate. There is increasing pressure on banks to hold and rent-out these properties so as not to flood the housing market with for sale inventory and further drive down values and selling prices. This is a policy that Fannie Mae and Freddie Mac are exploring for the same reasons and collectively that would place an enormous inventory of rental homes on the market. This would bring another wave of income loss and uncertainty further prolonging a housing market recovery. Short Sales Benefit All: Mortgage lenders recover more money - With either a short sale or foreclosure the bank stands to lose money. It makes so much more sense to negotiate the short sale with a 20% discount than to push RELEASE DATE Mon 10/17 9:15 am et Tue 10/18 8:30 am et Tue 10/18 1:00 pm et Wed 10/19 7:00 am et Wed 10/19 8:30 am et Wed 10/19 8:30 am et Wed 10/19 2:00 am et Thu 10/20 8:30 am et Thu 10/20 10:00 am et Thu 10/20 10:00 am et Thu 10/20 10:00 am et

1

for the week of October 17, 2011 Volume 15, Issue 40

Key Economic Reports Released This Week

ECONOMIC INDICATORS RELEASED BY Federal Reserve Board Bur. of Labor Statistics Department of Labor National Association of Home Builders Mortgage Bankers Association of America Bur. of Labor Statistics Department of Labor Bureau of the Census Dept. of Commerce Federal Reserve Board Bur. of Labor Statistics Department of Labor Bur. of Econ. Analysis Dept. of Commerce National Association of Realtors Federal Reserve Bank of Philadelphia CONSENSUS SURVEY1 IP 0.3% CU 77.5% 0.3% core 0.2 15 N/A 0.3% core 0.2% 590k N/A 405k 0.2% 4.90M -9.0% Wt. *** *** * * *** *** ** * ** ** ** INFLUENCE ON INTEREST RATES

Ind Production / Cap Utilization for September 11 Producer Price Index for September 11 NAHB Housing Index for September 11 MBA Mtg Apps Survey for week ending 10/14 Consumer Price Index for September 11 Housing Starts / Bldg Permits for September 11 Beige Book Jobless Claims for week ending 10/15 Leading Economic Indicators for September 11 Existing Home Sales for September 11 Philadelphia Fed Survey for October 11

If above consensus If below consensus If above consensus If below consensus

Undetermined Undetermined

If above consensus If below consensus If above consensus If below consensus

Undetermined

If above consensus If below consensus If above consensus If below consensus If above consensus If below consensus

Undetermined

Survey courtesy of Insight Economics, LLC

* Low Importance ** Moderate Importance *** Important **** Very Important

through a foreclosure and take 40% discount in a less predictable market. The housing market will be less damaged - Either way the market has to absorb this inventory before it can normalize. Short sales will better stabilize market values and sales prices and transaction time. Short sales will benefit the lenders, the homeowners, home values, selling prices, and finally it will benefit the housing industry as a whole including real estate and lending professionals. Short sales over foreclosures benefit the entire economy.

Jessica Lombardo Loan Officer Hi-Tech Mortgage 2184 McCulloch Boulevard, # A Lake Havasu City, AZ 86403 jessica@hi-techmortgage.com Office: 866.768.5626 Cell: 916.548.8533 Fax: 916.372.2518

Vous aimerez peut-être aussi

- The Market Whisperer - Part One PDFDocument159 pagesThe Market Whisperer - Part One PDFfeliceanu75% (8)

- Korea - Securities Lending and BorrowingDocument41 pagesKorea - Securities Lending and BorrowingtrucnhtPas encore d'évaluation

- Chapter - Buying and Selling SecuritiesDocument11 pagesChapter - Buying and Selling SecuritiesNahidul Islam IU100% (1)

- Short Sales The Current Housing MarketDocument25 pagesShort Sales The Current Housing Marketbrian3332Pas encore d'évaluation

- Introduction To Hedge Funds 2018 enDocument20 pagesIntroduction To Hedge Funds 2018 enVeera PandianPas encore d'évaluation

- Insiders Guide To The Best Techniques and StrategiesDocument12 pagesInsiders Guide To The Best Techniques and Strategiesabishakekoul50% (2)

- 2CEXAM Mock Question Licensing Examination Paper 12Document8 pages2CEXAM Mock Question Licensing Examination Paper 12Tsz Ngong KoPas encore d'évaluation

- Economic Focus 9-19-11Document1 pageEconomic Focus 9-19-11Jessica Kister-LombardoPas encore d'évaluation

- How to Sell a House Fast in a Slow Real Estate Market: A 30-Day Plan for Motivated SellersD'EverandHow to Sell a House Fast in a Slow Real Estate Market: A 30-Day Plan for Motivated SellersPas encore d'évaluation

- Economic Focus 1-16-12Document1 pageEconomic Focus 1-16-12Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus October 24, 2011Document1 pageEconomic Focus October 24, 2011Jessica Kister-LombardoPas encore d'évaluation

- UK Property Letting: Making Money in the UK Private Rented SectorD'EverandUK Property Letting: Making Money in the UK Private Rented SectorPas encore d'évaluation

- 7 Reasons Why Now Is A Great Time To Buy e BookDocument10 pages7 Reasons Why Now Is A Great Time To Buy e Bookapi-199906911Pas encore d'évaluation

- How To Sell Your Home-Sales Letter SHORT SALE1Document12 pagesHow To Sell Your Home-Sales Letter SHORT SALE1merujan1Pas encore d'évaluation

- How To Sell Your Home-Sales Letter SHORT SALE15Document11 pagesHow To Sell Your Home-Sales Letter SHORT SALE15merujan1Pas encore d'évaluation

- Econ Focus 6-20-11Document1 pageEcon Focus 6-20-11Jessica Kister-LombardoPas encore d'évaluation

- The All-New Real Estate Foreclosure, Short-Selling, Underwater, Property Auction, Positive Cash Flow Book: Your Ultimate Guide to Making Money in a Crashing MarketD'EverandThe All-New Real Estate Foreclosure, Short-Selling, Underwater, Property Auction, Positive Cash Flow Book: Your Ultimate Guide to Making Money in a Crashing MarketPas encore d'évaluation

- Brief ECO Newsletter 2012186 1Document1 pageBrief ECO Newsletter 2012186 1annawitkowski88Pas encore d'évaluation

- Economic Focus 7-11-11pdfDocument1 pageEconomic Focus 7-11-11pdfJessica Kister-LombardoPas encore d'évaluation

- Magic BPO Success Secrets: The Only Book You'll Ever Need to Learn the Truth About BPOsD'EverandMagic BPO Success Secrets: The Only Book You'll Ever Need to Learn the Truth About BPOsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Is The Stock Market DippingDocument3 pagesIs The Stock Market DippingWhale TeamPas encore d'évaluation

- Script - US Real Estate, Housing CrashDocument5 pagesScript - US Real Estate, Housing CrashMayumi AmponPas encore d'évaluation

- Introduction: Housing Market General Overview: Why Are You Afraid To Buy?Document26 pagesIntroduction: Housing Market General Overview: Why Are You Afraid To Buy?Larry RobertsPas encore d'évaluation

- Economic Focus 9-5-11Document1 pageEconomic Focus 9-5-11Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus August 1, 2011Document1 pageEconomic Focus August 1, 2011Jessica Kister-LombardoPas encore d'évaluation

- Buyers' Agents Provide Similar Services For The Home Purchaser. They Know The Local MarketDocument3 pagesBuyers' Agents Provide Similar Services For The Home Purchaser. They Know The Local MarketANKIT SINGHPas encore d'évaluation

- The Economic Backdrop Not As Strong As AdvertisedDocument2 pagesThe Economic Backdrop Not As Strong As AdvertisedValuEngine.comPas encore d'évaluation

- Economic Focus 11-14-11Document1 pageEconomic Focus 11-14-11Jessica Kister-LombardoPas encore d'évaluation

- UK's Housing Boom - Is The Party Over?: by Jay Lakhani, President, Bindal FXDocument4 pagesUK's Housing Boom - Is The Party Over?: by Jay Lakhani, President, Bindal FXPawan SharmaPas encore d'évaluation

- The Wright Report:: Sacramento's Residential Investment AnalysisDocument26 pagesThe Wright Report:: Sacramento's Residential Investment AnalysisWright Real EstatePas encore d'évaluation

- Levitin - Clearing The Mortgage Market Through Principle Reductions RTC 2.0Document24 pagesLevitin - Clearing The Mortgage Market Through Principle Reductions RTC 2.0annawitkowski88Pas encore d'évaluation

- SPRING 2012: Policy Continues To Drive Housing PerformanceDocument4 pagesSPRING 2012: Policy Continues To Drive Housing PerformanceJason CarrierPas encore d'évaluation

- Mortgage Modifications Lag ForeclosuresDocument3 pagesMortgage Modifications Lag ForeclosuresValuEngine.comPas encore d'évaluation

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoPas encore d'évaluation

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaPas encore d'évaluation

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaPas encore d'évaluation

- Wakefield Reutlinger Realtors Newsletter 1st Quarter 2013Document4 pagesWakefield Reutlinger Realtors Newsletter 1st Quarter 2013Wakefield Reutlinger RealtorsPas encore d'évaluation

- SPRING 2012: Policy Continues To Drive Housing PerformanceDocument4 pagesSPRING 2012: Policy Continues To Drive Housing PerformancelsteamdebokPas encore d'évaluation

- Senate Hearing, 112TH Congress - The State of The Housing MarketDocument47 pagesSenate Hearing, 112TH Congress - The State of The Housing MarketScribd Government DocsPas encore d'évaluation

- September 2007 Charleston Market ReportDocument7 pagesSeptember 2007 Charleston Market ReportbrundbakenPas encore d'évaluation

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialPas encore d'évaluation

- Economic Focus 8-29-11Document1 pageEconomic Focus 8-29-11Jessica Kister-LombardoPas encore d'évaluation

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialPas encore d'évaluation

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialPas encore d'évaluation

- Economic Focus 7-18-11Document1 pageEconomic Focus 7-18-11Jessica Kister-LombardoPas encore d'évaluation

- RCI April 2012 HighlightsDocument24 pagesRCI April 2012 HighlightsNational Association of REALTORS®Pas encore d'évaluation

- 5 Real Estate Market Predictions For 2023Document4 pages5 Real Estate Market Predictions For 2023muxie SSUSSPas encore d'évaluation

- Enc2135 Project 1 Final Draft-2Document8 pagesEnc2135 Project 1 Final Draft-2api-643122560Pas encore d'évaluation

- Quarterly Review: Investment Property vs. Real Estate Investment Trust (REIT)Document4 pagesQuarterly Review: Investment Property vs. Real Estate Investment Trust (REIT)Nicholas FrenchPas encore d'évaluation

- Time To BuyDocument12 pagesTime To BuyJohn WymanPas encore d'évaluation

- Beverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsDocument2 pagesBeverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsNanette MarchandPas encore d'évaluation

- Does New Data Really Suggest A Housing Market BottomDocument4 pagesDoes New Data Really Suggest A Housing Market BottommatthyllandPas encore d'évaluation

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoPas encore d'évaluation

- The Homeowner's Guide to For Sale By Owner: Everything You Need to Know to Sell Your Home Yourself and Save ThousandsD'EverandThe Homeowner's Guide to For Sale By Owner: Everything You Need to Know to Sell Your Home Yourself and Save ThousandsÉvaluation : 5 sur 5 étoiles5/5 (2)

- Buying: A HomeDocument21 pagesBuying: A HomeBen HessPas encore d'évaluation

- Quarterly Review: Who Robbed The Piggy Bank: The Fed DilemmaDocument4 pagesQuarterly Review: Who Robbed The Piggy Bank: The Fed DilemmaNicholas FrenchPas encore d'évaluation

- Finding the Uncommon Deal: A Top New York Lawyer Explains How to Buy a Home For the Lowest Possible PriceD'EverandFinding the Uncommon Deal: A Top New York Lawyer Explains How to Buy a Home For the Lowest Possible PricePas encore d'évaluation

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoPas encore d'évaluation

- Onsumer Atch Anada: Canadian Housing Prices - Beware of The AverageDocument4 pagesOnsumer Atch Anada: Canadian Housing Prices - Beware of The AverageSteve LadurantayePas encore d'évaluation

- Real Estate Finance: The Indian Real Estate Market: Contribution To The EconomyDocument6 pagesReal Estate Finance: The Indian Real Estate Market: Contribution To The EconomyHarish HarishredPas encore d'évaluation

- Buyinga Home Spring 2015Document20 pagesBuyinga Home Spring 2015Jeremy LarkinPas encore d'évaluation

- Jasmine ChoiDocument18 pagesJasmine ChoiChoi JasminePas encore d'évaluation

- What Is Loan-To-Value Ratio?: Pag-IBIG Financing AdminDocument5 pagesWhat Is Loan-To-Value Ratio?: Pag-IBIG Financing AdminAppraiser PhilippinesPas encore d'évaluation

- The Retreat at Storm Branch: Lot Sizes Up To 3.56 Acres!Document16 pagesThe Retreat at Storm Branch: Lot Sizes Up To 3.56 Acres!Aiken StandardPas encore d'évaluation

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoPas encore d'évaluation

- New Home Sales January 2012Document1 pageNew Home Sales January 2012Jessica Kister-LombardoPas encore d'évaluation

- January Housing StartsDocument1 pageJanuary Housing StartsJessica Kister-LombardoPas encore d'évaluation

- Economic Focus 1-23-12Document1 pageEconomic Focus 1-23-12Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus January 30, 2012Document1 pageEconomic Focus January 30, 2012Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoPas encore d'évaluation

- January Existing Home SalesDocument1 pageJanuary Existing Home SalesJessica Kister-LombardoPas encore d'évaluation

- Housing Starts December 2011Document1 pageHousing Starts December 2011Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus 12-12-11Document1 pageEconomic Focus 12-12-11Jessica Kister-LombardoPas encore d'évaluation

- Construction Spending 1-3-12Document2 pagesConstruction Spending 1-3-12Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus 12-19-11Document1 pageEconomic Focus 12-19-11Jessica Kister-LombardoPas encore d'évaluation

- Existing Home SalesDocument1 pageExisting Home SalesJessica Kister-LombardoPas encore d'évaluation

- Construction Spending December 2011Document1 pageConstruction Spending December 2011Jessica Kister-LombardoPas encore d'évaluation

- Winter Wonderland 2011 - AttendeeDocument1 pageWinter Wonderland 2011 - AttendeeJessica Kister-LombardoPas encore d'évaluation

- New Home Sales November December) 2011Document1 pageNew Home Sales November December) 2011Jessica Kister-LombardoPas encore d'évaluation

- Housing StartsDocument1 pageHousing StartsJessica Kister-LombardoPas encore d'évaluation

- Existing Home SalesDocument1 pageExisting Home SalesJessica Kister-LombardoPas encore d'évaluation

- Housing Starts Oct 2011Document1 pageHousing Starts Oct 2011Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus 12-5-11Document1 pageEconomic Focus 12-5-11Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus 11-14-11Document1 pageEconomic Focus 11-14-11Jessica Kister-LombardoPas encore d'évaluation

- November Construction SpendingDocument1 pageNovember Construction SpendingJessica Kister-LombardoPas encore d'évaluation

- Existing Home Sales October 2011Document1 pageExisting Home Sales October 2011Jessica Kister-LombardoPas encore d'évaluation

- Construction Spending Oct. 2011Document1 pageConstruction Spending Oct. 2011Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoPas encore d'évaluation

- Economic Focus 10-10-11Document1 pageEconomic Focus 10-10-11Jessica Kister-LombardoPas encore d'évaluation

- Housing Starts Oct 2011Document1 pageHousing Starts Oct 2011Jessica Kister-LombardoPas encore d'évaluation

- New Home Sales September 2011Document1 pageNew Home Sales September 2011Jessica Kister-LombardoPas encore d'évaluation

- TranscriptsDocument474 pagesTranscriptsToàn Huỳnh ThanhPas encore d'évaluation

- DanLoeb BloombergDocument9 pagesDanLoeb BloombergbillcanePas encore d'évaluation

- Lecture16 DerivativeMarketsDocument17 pagesLecture16 DerivativeMarketsRubeenaPas encore d'évaluation

- MM2 Microstsfructure2 Tutorial PDFDocument11 pagesMM2 Microstsfructure2 Tutorial PDFhiyogiyoPas encore d'évaluation

- Silber - 1984 - Marketmaker Behavior in An Auction Market, An Analysis of Scalpers in Futures MarketsDocument18 pagesSilber - 1984 - Marketmaker Behavior in An Auction Market, An Analysis of Scalpers in Futures MarketsjpkoningPas encore d'évaluation

- Q3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleDocument12 pagesQ3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleSAGAR VAZIRANIPas encore d'évaluation

- Full Download Investments An Introduction 12th Edition Mayo Solutions ManualDocument35 pagesFull Download Investments An Introduction 12th Edition Mayo Solutions Manualmagreen2pp100% (36)

- Real Estate Bulletin PDFDocument16 pagesReal Estate Bulletin PDFmariae2Pas encore d'évaluation

- Specialist Use of The Short Sale by Richard NeyDocument9 pagesSpecialist Use of The Short Sale by Richard Neyaddqdaddqd100% (3)

- Derivatives and Risk ManagementDocument64 pagesDerivatives and Risk Managementannafuentes100% (1)

- Reg Section 1.864-2Document5 pagesReg Section 1.864-2EDC AdminPas encore d'évaluation

- Trading Software: (English Medium)Document23 pagesTrading Software: (English Medium)RahulPas encore d'évaluation

- AIMA Journal: Alternative Investment Management AssociationDocument32 pagesAIMA Journal: Alternative Investment Management Associationhttp://besthedgefund.blogspot.comPas encore d'évaluation

- The Lunchtime TraderDocument130 pagesThe Lunchtime TradernanakstarPas encore d'évaluation

- George Soros - Reflections On The Crash of 2008 and What It Means - An Ebook Update To The New Paradigm For Financial Markets PDFDocument88 pagesGeorge Soros - Reflections On The Crash of 2008 and What It Means - An Ebook Update To The New Paradigm For Financial Markets PDFJoao Alves Monteiro NetoPas encore d'évaluation

- Covered Call Option Strategy Reverse Covered Call Protective Put Reverse of A Protective PutDocument2 pagesCovered Call Option Strategy Reverse Covered Call Protective Put Reverse of A Protective PutMayara CabralPas encore d'évaluation

- Technical and Fundamental AnalysisDocument75 pagesTechnical and Fundamental Analysiseuge_prime2001Pas encore d'évaluation

- One-Day Interbank Deposit Futures Contract (Di1)Document6 pagesOne-Day Interbank Deposit Futures Contract (Di1)DanielPas encore d'évaluation

- Trading Strategy: Morning NoteDocument6 pagesTrading Strategy: Morning Notenagaraja h iPas encore d'évaluation

- Seth Klarman Letter 1999 PDFDocument32 pagesSeth Klarman Letter 1999 PDFBean LiiPas encore d'évaluation

- Risk ManagementDocument24 pagesRisk ManagementSoujanya NagarajaPas encore d'évaluation

- Forward Contract: Derivative Goes DownDocument4 pagesForward Contract: Derivative Goes DownNitinKumarAmbasthaPas encore d'évaluation

- Glaucus Research - West China Cement - HK 2233 - Strong Sell August 8 2012Document52 pagesGlaucus Research - West China Cement - HK 2233 - Strong Sell August 8 2012mistervigilantePas encore d'évaluation