Académique Documents

Professionnel Documents

Culture Documents

Can Anyone Explain To Me How These Ideas Could Shut Off The CDO Time Bomb

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Can Anyone Explain To Me How These Ideas Could Shut Off The CDO Time Bomb

Droits d'auteur :

Formats disponibles

Can anyone explain to me how these ideas could shut off the CDO time bomb?

Or am I right in saying how lackluster these ideas are? I wonder if the E.U. leaders and unelected officials will allow nature to take its course and collapse the EU, and return to nation states, or, there only other option is to engineer an event to grab full powers. It either collapses, or becomes a dictatorship, and we know they won't let it collapse... There will be a deal - and it will be the 2 trillion that 'the markets' originally said was necessary to cover everything - (although it is now quite clear that they had no idea Europe would actually get a deal of that magnitude together) This is just the self-same markets making the last bit of money out of other people's misery before they are stopped dead by the new deal. Once the debts are covered the markets can go screw themselves and act like hysterical 5 year old schoolgirls with someone else's economy. Given the state of the European economy if I was a member of the EU-hate gang I'd be getting concerned about things much closer to home. The (underlying) truth is that the comparable Northern European economies have been doing much better than us and have been for decades. I wonder why ! Whatever the outcome of this weekend's on - off, on again summit, it seems unlikely the 17 euro countries will get what's needed, given Germany's entrenched reluctance. As we predicted after the July 21 summit, Europe's leaders continue to fall behind the problem they're trying to solve. That's a constantly evolving debt crisis that gets bigger by the day. It doesn't stop and wait, its morbid momentum reflected in markets since early summer. What we'll see revealed in Brussels this weekend is that the euro zone is not just a flawed currency system, but it is also a flawed political system incapable of being led and incapable of making the difficult, often painful decisions required. Could it, for instance, ever impose the sort of fiscal discipline being attempted in the UK or the bank overcapitalization already complete here? I doubt it. That's not to be complacent about our own parlous position. We may be implementing fiscal and monetary policy decisions, but are they working? This crisis, whether elsewhere or in the euro zone, is like a virus mutating against a vaccine. Europe isn't using enough medicine while rest may have already administered what they can without any meaningful effect. The

patient remains ill and the drugs aren't working. Markets slide on reports of deadlock between France and Germany in talks over how to expand the euro zone bailout fund, making a resolution by this weekend's crucial summit increasingly unlikely. Devastating deregulation of financial and banking systems There is a lot of propaganda about time for a recap on what caused this entire financial crisis: Here are the real causes of the financial crisis all of which were nothing to do with the people of the UK or the world for that matter. Devastating deregulation of financial and banking systems facilitated by "campaign contributions" (AKA Bribes/pay offs) to politicians, presidents Etc. Fractional reserve banking allowing Reckless lending on the scale of 33 x the Banks depository Trillions in Derivative gambling and speculation ridiculously leveraging the markets and indexes making them unstable. The amount of derivatives still present in the system are estimated at 100 x the world GDP!! (time bomb waiting to explode) Tax avoidance by banks and corporations to the tune of 10s if not 100s of billions Government Bail outs undermining the entire principle of true free market capitalism causing insane moral hazard and risk taking as all risks are passed onto the innocent tax payer. Insane Financial sector Bonuses totaling 15-20 billion in the UK for example, causing reckless behavior and massive risk taking. Lending to people who did not have a good credit rating (subprime lending) Ridiculous Market and index manipulation Banks hiding debts of Countries to get them membership into the EU where they would not survive amongst much larger economies(Goldman Sachs Greece) Sub prime mortgage time bombs -causing 1000's of foreclosures. Credit debt Obligations rated AAA when they should have been rated junk Credit default swaps also ridiculously leveraging the financial systems Fighting illegal wars - Spending billions on mass genocide Corrupt rating agencies, no accountability ,no police investigations, no Jurisdiction corrupt politicians The general public was not responsible for any of the above and the UK Government debt was only 3% of GDP until we bailed out the bankers. Dont listen to the lies of the new world order and the establishment Silvio Berlusconi has named Ignazio Visco as the new head of the Bank of Italy. He wasn't one of the favourites in the running for the job, which won't be an easy one at the moment. He's the existing deputy director general of the bank. Visco will take over from Mario Draghi, who is taking over from Jean-Claude Trichet as head of the European Central Bank. Date: oct.21.2011

Mircea Halaciuga, Esq. 0040724581078 Financial news - Eastern Europe

Vous aimerez peut-être aussi

- Oct Bank - NewDocument7 pagesOct Bank - NewLisa Hester100% (1)

- Exam FmiDocument11 pagesExam FmiWinkel GrotePas encore d'évaluation

- Tinder Credit Union Bank StatementDocument3 pagesTinder Credit Union Bank Statementdudu adul100% (1)

- Questions Time Value of MoneyDocument3 pagesQuestions Time Value of Moneyarma nadeemPas encore d'évaluation

- Bob Chapman The EU Debt Crisis Has Not Been Solved If Europe Financially Implodes 5 11 2011Document4 pagesBob Chapman The EU Debt Crisis Has Not Been Solved If Europe Financially Implodes 5 11 2011sankaratPas encore d'évaluation

- Bob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011Document4 pagesBob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011sankaratPas encore d'évaluation

- Bob Chapman The European Ponzi Scheme and The Euro 4 1 2012Document5 pagesBob Chapman The European Ponzi Scheme and The Euro 4 1 2012sankaratPas encore d'évaluation

- Bob Chapman The Demise of The Euro As A World Currency 12 5 10Document3 pagesBob Chapman The Demise of The Euro As A World Currency 12 5 10sankaratPas encore d'évaluation

- Bob Chapman The Eurozone Crisis Disruptions of Financial Markets Worldwide 8 10 2011Document5 pagesBob Chapman The Eurozone Crisis Disruptions of Financial Markets Worldwide 8 10 2011sankaratPas encore d'évaluation

- Euro Crisis: England GovernorDocument19 pagesEuro Crisis: England GovernorRohit AnandPas encore d'évaluation

- 18 Reasons of Financial Collapse in EuropeDocument5 pages18 Reasons of Financial Collapse in EuropeShivam LambaPas encore d'évaluation

- Grim Economic Prospects and Overshadowed Banking SystemsDocument4 pagesGrim Economic Prospects and Overshadowed Banking SystemssankaratPas encore d'évaluation

- Adam Fisher Soros Hire How To Make Money in A World of RiskDocument6 pagesAdam Fisher Soros Hire How To Make Money in A World of RisktonerangerPas encore d'évaluation

- EU CrisisDocument6 pagesEU CrisisJosé Antonio PoncelaPas encore d'évaluation

- European Summit: A Plan With No DetailsDocument9 pagesEuropean Summit: A Plan With No Detailsrichardck61Pas encore d'évaluation

- The Absolute Return Letter 0612Document8 pagesThe Absolute Return Letter 0612Vu Latticework PoetPas encore d'évaluation

- A Personal Point of View About E.U.Document3 pagesA Personal Point of View About E.U.ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Mitch-Feierstein Economic-Collapse PDFDocument5 pagesMitch-Feierstein Economic-Collapse PDFdeliriousheterotopiasPas encore d'évaluation

- With The U.S. EconomyDocument4 pagesWith The U.S. EconomyBasavaraj PujariPas encore d'évaluation

- Bunch of CriminalsDocument13 pagesBunch of CriminalsRodrigoDiazPas encore d'évaluation

- Bob Chapman Bursting Bubbles Waning Currency Systems and Insolvent Financial Institutions 30 4 2011Document4 pagesBob Chapman Bursting Bubbles Waning Currency Systems and Insolvent Financial Institutions 30 4 2011sankaratPas encore d'évaluation

- Why A Eurobond Is Not EnoughDocument2 pagesWhy A Eurobond Is Not EnoughtpitikarisPas encore d'évaluation

- 21st Century Global EconomicsDocument9 pages21st Century Global EconomicsMary M HuberPas encore d'évaluation

- Radoslaw Sikorski Poland and The Future of The EuDocument11 pagesRadoslaw Sikorski Poland and The Future of The Eui_blaitePas encore d'évaluation

- Eurozone Deal Saves Greece But Issues RemainDocument4 pagesEurozone Deal Saves Greece But Issues RemainsankaratPas encore d'évaluation

- Global Market Outlook May 2011Document7 pagesGlobal Market Outlook May 2011IceCap Asset ManagementPas encore d'évaluation

- Mauldin January 25Document11 pagesMauldin January 25richardck61Pas encore d'évaluation

- Bob Chapman Global Financial Conflagration The World of Fiat Money Is Buckling Under The Pressure of Unpayable Debts 01 05 10Document11 pagesBob Chapman Global Financial Conflagration The World of Fiat Money Is Buckling Under The Pressure of Unpayable Debts 01 05 10sankaratPas encore d'évaluation

- John Mauldin Weekly 10 SeptemberDocument11 pagesJohn Mauldin Weekly 10 Septemberrichardck61Pas encore d'évaluation

- George Soros On Soverign CrisesDocument8 pagesGeorge Soros On Soverign Crisesdoshi.dhruvalPas encore d'évaluation

- Rodrik On GreeceDocument2 pagesRodrik On GreecearnemelanPas encore d'évaluation

- 6 BaruchelloLintner Final DraftDocument21 pages6 BaruchelloLintner Final DraftTo-boter One-boterPas encore d'évaluation

- Bob Chapman The Demise of State Sovereignty Pressures On The Euro Amidst Rising Debt Levels 25 1 2012Document3 pagesBob Chapman The Demise of State Sovereignty Pressures On The Euro Amidst Rising Debt Levels 25 1 2012sankaratPas encore d'évaluation

- Bond Market Collapse Likely as Fiscal Debt and Monetization Take Financial System DownDocument3 pagesBond Market Collapse Likely as Fiscal Debt and Monetization Take Financial System DownsankaratPas encore d'évaluation

- The Economist - Finacial CrisisDocument4 pagesThe Economist - Finacial CrisisEnzo PitonPas encore d'évaluation

- Bob Chapman Credit Crisis Outrage Far From OverDocument4 pagesBob Chapman Credit Crisis Outrage Far From OversankaratPas encore d'évaluation

- Investment Commentary No. 275 21 March 2011: Real and Illusory DangersDocument8 pagesInvestment Commentary No. 275 21 March 2011: Real and Illusory DangersttiketitanPas encore d'évaluation

- Europe'S Debt Crisis and The Danger We Can'T Seepublished 7 Days AgoDocument3 pagesEurope'S Debt Crisis and The Danger We Can'T Seepublished 7 Days AgoHemangi PandeyPas encore d'évaluation

- Bob Chapman Spending Debt Which Is Other People S Money Further Recession and Financial Turmoil in America and The EU 1 10 2011Document4 pagesBob Chapman Spending Debt Which Is Other People S Money Further Recession and Financial Turmoil in America and The EU 1 10 2011sankaratPas encore d'évaluation

- Bob Chapman The Euro Zone and The Crisis of Sovereign Debt 4 2 2012Document4 pagesBob Chapman The Euro Zone and The Crisis of Sovereign Debt 4 2 2012sankaratPas encore d'évaluation

- Guide To The Eurozone CrisisDocument9 pagesGuide To The Eurozone CrisisLakshmikanth RaoPas encore d'évaluation

- October Market Brief 2012Document3 pagesOctober Market Brief 2012Christopher Michael QuigleyPas encore d'évaluation

- Fear Returns: World EconomyDocument6 pagesFear Returns: World EconomymuradgwaduriPas encore d'évaluation

- Mauldin Weekly Letter 10 MarchDocument10 pagesMauldin Weekly Letter 10 Marchrichardck61Pas encore d'évaluation

- Greece's Economic Troubles & More Economic UpdatesDocument22 pagesGreece's Economic Troubles & More Economic UpdatesTimothy100% (1)

- Mauldin Weekly 19 November 2011 LetterDocument8 pagesMauldin Weekly 19 November 2011 Letterrichardck61Pas encore d'évaluation

- Bob Chapman Sovereign Debt Crisis Washington Complicit in Massive Financial Fraud On Wall Street 8 5 10Document4 pagesBob Chapman Sovereign Debt Crisis Washington Complicit in Massive Financial Fraud On Wall Street 8 5 10sankaratPas encore d'évaluation

- Petrocapita - February 6 2012 Briefing - Next Time The Market Should Set Interest RatesDocument5 pagesPetrocapita - February 6 2012 Briefing - Next Time The Market Should Set Interest RatesCapita1Pas encore d'évaluation

- The Euro Debate Gets PhilosophicalDocument10 pagesThe Euro Debate Gets PhilosophicalAAOI2Pas encore d'évaluation

- Europe CrisisDocument10 pagesEurope Crisistarunmishra123Pas encore d'évaluation

- Why Europe SleptDocument3 pagesWhy Europe SleptBisserPas encore d'évaluation

- Wien Byron - July 2010 Market Commentary - Smartest ManDocument4 pagesWien Byron - July 2010 Market Commentary - Smartest ManGlenn BuschPas encore d'évaluation

- Bob Chapman Economic Crisis The Sovereign Debt Bubble 19 February 2010Document10 pagesBob Chapman Economic Crisis The Sovereign Debt Bubble 19 February 2010sankaratPas encore d'évaluation

- Globalisation Fractures: How major nations' interests are now in conflictD'EverandGlobalisation Fractures: How major nations' interests are now in conflictPas encore d'évaluation

- EUROPEAN UNION TO EMERGE STRONGER FROM ECONOMIC CRISISDocument11 pagesEUROPEAN UNION TO EMERGE STRONGER FROM ECONOMIC CRISISKatisha KaylaPas encore d'évaluation

- Don't Sell The Euro Short. It's Here To StayDocument2 pagesDon't Sell The Euro Short. It's Here To StayFaraz AliPas encore d'évaluation

- America vs. Europe - Which Is The Bigger Threat To The World EconomyDocument8 pagesAmerica vs. Europe - Which Is The Bigger Threat To The World EconomyBrendan ChuaPas encore d'évaluation

- EMS CrisisDocument6 pagesEMS CrisisDivya SharmaPas encore d'évaluation

- The Future of EuroDocument5 pagesThe Future of EuroQuýt BéPas encore d'évaluation

- Agcapita - February 6 2012 Briefing - Next Time The Market Should Set Interest RatesDocument5 pagesAgcapita - February 6 2012 Briefing - Next Time The Market Should Set Interest RatesCapita1Pas encore d'évaluation

- W. Bello: Turning Villains Into Victims Finance Capital and GreeceDocument35 pagesW. Bello: Turning Villains Into Victims Finance Capital and GreeceGeorge PaynePas encore d'évaluation

- Let's Talk About Our Future. Now!Document28 pagesLet's Talk About Our Future. Now!saitamPas encore d'évaluation

- European Capitalism: Varieties of Crisis: AbstractDocument16 pagesEuropean Capitalism: Varieties of Crisis: AbstractarnemelanPas encore d'évaluation

- Articol - Ziaristi de InvestigatieDocument7 pagesArticol - Ziaristi de InvestigatieARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Around The World Economies in A Thousand WordsDocument3 pagesAround The World Economies in A Thousand WordsARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- A Two-Speed Europe in 2021Document3 pagesA Two-Speed Europe in 2021ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Bank Supervision - Outlook and TrendsDocument10 pagesBank Supervision - Outlook and TrendsARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- In Politics, Supply Is Slow To Meet Demand.Document3 pagesIn Politics, Supply Is Slow To Meet Demand.ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Currency Swap Agreement - China and The European UnionDocument4 pagesCurrency Swap Agreement - China and The European UnionARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike Serban100% (1)

- Mrs. Lagarde: "Progress To Reform The EU System Was Too Slow. "Document4 pagesMrs. Lagarde: "Progress To Reform The EU System Was Too Slow. "ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Prudential Regulation Authority ("PRA") Supervision of International Banks ActionsDocument4 pagesPrudential Regulation Authority ("PRA") Supervision of International Banks ActionsARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- My Judgment On This Sinful WorldDocument11 pagesMy Judgment On This Sinful WorldARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- The Crisis Has Dealt A Blow To Europe's Rosy ImageDocument5 pagesThe Crisis Has Dealt A Blow To Europe's Rosy ImageARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike Serban100% (1)

- A World of Debt - A "Whole City of Sky-Scrapers" of DebtDocument4 pagesA World of Debt - A "Whole City of Sky-Scrapers" of DebtARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- The World Bank Cut Its Forecast For Growth in 2014Document3 pagesThe World Bank Cut Its Forecast For Growth in 2014ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike Serban100% (1)

- "What's Up Doc" in This "Union" That's Not A Union in Fact But Is Called The European UnionDocument4 pages"What's Up Doc" in This "Union" That's Not A Union in Fact But Is Called The European UnionARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- The European Central Bank Could Adopt Negative Interest Rates or Purchase Assets From Banks If NeededDocument4 pagesThe European Central Bank Could Adopt Negative Interest Rates or Purchase Assets From Banks If NeededARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Hang in There Guys, You're Doing Ok!Document3 pagesHang in There Guys, You're Doing Ok!ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Democratic Politics Is Not Consumer Goods", It Is Citizen Goods".Document3 pagesDemocratic Politics Is Not Consumer Goods", It Is Citizen Goods".ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Europe's Determination To Stay With The Common Currency Will Play An Important Role in How The Euro Crisis Unfolds in 2013Document3 pagesEurope's Determination To Stay With The Common Currency Will Play An Important Role in How The Euro Crisis Unfolds in 2013ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- German Economy Is StrugglingDocument2 pagesGerman Economy Is StrugglingARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- A Euro Zone "Disaster" Was Averted But Only Temporarily, Was The Verdict On 2012.Document2 pagesA Euro Zone "Disaster" Was Averted But Only Temporarily, Was The Verdict On 2012.ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Euro Zone Monetary Policy Can Only Buy More TimeDocument4 pagesEuro Zone Monetary Policy Can Only Buy More TimeARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- The "Shadow Economies" in The Crisis-Ridden Countries of The Euro ZoneDocument3 pagesThe "Shadow Economies" in The Crisis-Ridden Countries of The Euro ZoneARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Private Equity Alert Mezzanine Finance in Central & Eastern Europe 102009Document3 pagesPrivate Equity Alert Mezzanine Finance in Central & Eastern Europe 102009ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike Serban100% (1)

- The Cyprus Agreement Did Not Require Ratification by The Cypriot ParliamentDocument3 pagesThe Cyprus Agreement Did Not Require Ratification by The Cypriot ParliamentARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- The Cost of "NonEurope"Document2 pagesThe Cost of "NonEurope"ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Greece Is A "Test Site" For What It Is To Follow For EuropeDocument2 pagesGreece Is A "Test Site" For What It Is To Follow For EuropeARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- The Next Boom of The Global Markets and EconomiesDocument3 pagesThe Next Boom of The Global Markets and EconomiesARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- The European Banking Union Concept - Fact or FictionDocument3 pagesThe European Banking Union Concept - Fact or FictionARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- A Closer Fiscal Union Needs To Be Arranged Before The ECB Is Granted More PowersDocument3 pagesA Closer Fiscal Union Needs To Be Arranged Before The ECB Is Granted More PowersARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Greece Is A "Test" Site For What It Is To Follow For EuropeDocument2 pagesGreece Is A "Test" Site For What It Is To Follow For EuropeARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- EuroZone Finance Ministers: Spain Has An Extra Year To Bring Its Budget Deficit Under ControlDocument3 pagesEuroZone Finance Ministers: Spain Has An Extra Year To Bring Its Budget Deficit Under ControlARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Retail Teller Oracle FLEXCUBE Universal Banking Release 11.3.1.0.0EU (April) (2012) Oracle Part Number E51534-01Document45 pagesRetail Teller Oracle FLEXCUBE Universal Banking Release 11.3.1.0.0EU (April) (2012) Oracle Part Number E51534-01Omar AlgaddarPas encore d'évaluation

- Background of The Study and Related LiteratureDocument5 pagesBackground of The Study and Related LiteratureJohn Andrae MangloPas encore d'évaluation

- Presentation On Non Banking Financial CompaniesDocument17 pagesPresentation On Non Banking Financial CompaniesMayurpmPas encore d'évaluation

- Mortgage Letter 2010-14Document3 pagesMortgage Letter 2010-14YuriPas encore d'évaluation

- City of Windhoek: Application & Cancellation For Direct DebitingDocument2 pagesCity of Windhoek: Application & Cancellation For Direct Debitingknowledge4self WiseCONAPas encore d'évaluation

- Short-Run Exchange Rate Determination Using CIP ModelDocument12 pagesShort-Run Exchange Rate Determination Using CIP ModeldrooldudeabhiPas encore d'évaluation

- Banking Law B.com - Docx LatestDocument38 pagesBanking Law B.com - Docx LatestViraja GuruPas encore d'évaluation

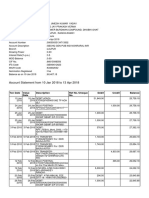

- Account Statement From 10 Jan 2018 To 13 Apr 2018Document3 pagesAccount Statement From 10 Jan 2018 To 13 Apr 2018UMESH KUMAR YadavPas encore d'évaluation

- 4 Banking LawDocument85 pages4 Banking LawRamesh BuridiPas encore d'évaluation

- Chapter 3Document23 pagesChapter 3Soman DiggewadiPas encore d'évaluation

- Receipt ReportDocument1 pageReceipt Reportjowie james octatPas encore d'évaluation

- Loan Account Statement For LTHYD00045241956Document3 pagesLoan Account Statement For LTHYD00045241956Pavan KumarPas encore d'évaluation

- OKash Loan Contract SummaryDocument1 pageOKash Loan Contract SummaryAbdullahi Olajide IbrahimPas encore d'évaluation

- DWDDocument2 pagesDWDCrystal EricksonPas encore d'évaluation

- CH 14 PracticeDocument6 pagesCH 14 Practicealiss2007100% (2)

- Legacy Group Case Exposed Schemes Duping BillionsDocument2 pagesLegacy Group Case Exposed Schemes Duping Billionsmountain girlPas encore d'évaluation

- EBA Report On Liquidity Measures Under Article 509 (1) of The CRRDocument46 pagesEBA Report On Liquidity Measures Under Article 509 (1) of The CRRgrobbebolPas encore d'évaluation

- AC Power Booster - SBI PO CLERK BOB PO 2018 PDFDocument112 pagesAC Power Booster - SBI PO CLERK BOB PO 2018 PDFPrathyusha KunaparajuPas encore d'évaluation

- Kotak Bank Statement Nov2023Document9 pagesKotak Bank Statement Nov2023peak10officialPas encore d'évaluation

- Commerce Guru: AccountancyDocument1 pageCommerce Guru: AccountancyHEMMU SAHU INSTITUTEPas encore d'évaluation

- Jpso 061915Document8 pagesJpso 061915theadvocate.comPas encore d'évaluation

- Doc1544 9849Document1 pageDoc1544 9849georgebates1979Pas encore d'évaluation

- Estmt - 2022 11 17Document4 pagesEstmt - 2022 11 17phillip davisPas encore d'évaluation

- Business MathematicsDocument6 pagesBusiness MathematicsabhiPas encore d'évaluation

- Noc From BLDRDocument3 pagesNoc From BLDRsameersbnPas encore d'évaluation