Académique Documents

Professionnel Documents

Culture Documents

2011 3Q Manila Office Market Beat

Transféré par

Josemari CuervoDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2011 3Q Manila Office Market Beat

Transféré par

Josemari CuervoDroits d'auteur :

Formats disponibles

MANILA OFFICE REPORT 3Q11

ECONOMY The Philippine domestic economy decelerated to 3.4% in the second quarter of 2011 compared to the 8.9% Gross Domestic Product (GDP) growth that was recorded in the same period last year. Growth was driven by the strong performance of the agriculture sector, as well as the modest expansion of the services sector, primarily financial intermediation, real estate, renting and business activities, and other services subsector. The Philippine Peso strengthened against the US Dollar to average P43.29 from January to August this year. Annual Inflation rate averaged 4.3% in the eight months to August, well inside the governments full year target of 3-5%. The results of the July 2011 Labor Force Survey (LFS) showed that Employment rate remained high at 92.9% while the Unemployment rate was estimated at 7.1%. Export earnings in the first six months of the year amounted to $24.757 billion while Imports was recorded at $30.501 billion. The latest Business Expectations Survey of the Bangko Sentral ng Pilipinas (BSP) shows improved business outlook for the third and fourth quarter of 2011. OVERVIEW The Philippine Real Estate Market continues positively in the third quarter of 2011. The healthy outlook and demand from the Business Process Outsourcing (BPO)/Call Center industry remains, driving the growth of office leasing operations. Developers continue shoring up projects to provide this industry, as well as other industries, with new space. However, project completions remain at a slow pace. Only a fraction of new space expected to be finished this quarter was delivered, while the remaining moved their target completions. While there are projects within Metro Manila that will offer fresh space for office lease, areas outside Metro Manila are also being developed to host prospective tenants, mainly BPOs. Development of offices are now being brought to where the human resources is. Most landlords continues to increase their lease rates. The view that 2011 will see the market gaining gradual increase as demand peaks and supply gradually diminish is still upheld given the current situation. Office market is anticipated to be neutral later this year. Investor sentiment remains positive even as a new global economic crisis is feared to occur. Low lease rates may still be enjoyed in areas without new spaces such as Manila City. Vacancy rates continue to decline. Makati CBDs prime rates is still averaged at Php850/sqm/mo, while vacancy rate dropped to 8.30%. The local Real Estate Investment Trust (REIT) continues to have issues regarding regulation and governance. REIT is expected to inject more capital into the market. However, developers, initially enthusiastic of the investment opportunity offered by REIT, are now hesitant in expanding to the REIT market citing strict and unworkable rules. Active campaign for green building projects are also undertaken by different sectors. Most developers are now applying said concept to new projects. OUTLOOK The market is expected to remain positive and become neutral by the last quarter of 2011. The BPO/Call Center industry is expected to continue to drive the growth of office leasing operations until the year ends and even beyond. Further increase in lease rates is expected. Inflationary pressures as a result of the rising oil prices, the European financial crisis, and the US economic issues will likely affect the market in the short-run, but this is expected to be mitigated by the initiatives and reforms implemented by the combined effort of the private sector and the government towards economic growth. A dialogue between the government and the private sector regarding REITs will hopefully settle issues and result in putting the market at par with international competition.

1 MANILA OFFICE REPORT 3Q11

BEAT ON THE STREET

Currently, the (REIT) regulations are too stringent. But then again, Im hopeful common sense will prevail and this will be a tremendous step forward for the Philippines, given the growing population and growing urbanization. Simon Treacy, group chief executive at MGPA, quoted from a BusinessWorld article dated 21 September 2011 ECONOMIC INDICATORS

2009 GDP Growth CPI Growth Unemployment Rate Employment Rate 1.13% 3.4% 7.5% 92.5% 2010 7.3% 3.8% 7.3% 92.7% 2011F 7-8% 3.5-5.5% 7.4% 92.6%

Source: NSCB, NSO, NEDA, CFEI

MARKET FORECAST ABSORPTON: Low absorption rates lingers

as most spaces taken up are replaced by newly constructed spaces and major expansions and new leases are still deliberated upon by both landlords and tenants.

CONSTRUCTION: A slow pace of project

completions persists, delaying commencement of the construction of other projects in the pipeline.

RENTAL RATES: Lease rates continue

going up especially in key centers such as Fort Bonifacio and Ortigas Center.

GRADE A RENTAL VS. VACANCY RATES

1,500 1,400 1,300 1,200 1,100 1,000 900 800 700 600 500 400 300 200 100 0

PHP/sq.m./mth

10% 9% 8% 7% 6% 5% 4% 3% 2% 1% 0%

3Q084Q081Q092Q093Q094Q091Q102Q103Q104Q101Q112Q113Q11

Rent

Vacancy

MANILA OFFICE REPORT 3Q11

MARKET / SUBMARKET STATISTICS

*Php/sqm/mth Exchange Rate: US$ = Php43.8100 EUR = Php59.2750 Source: CFEI

** all grades

MARKET HIGHLIGHTS

FOR INDUSTRY-LEADING INTELLIGENCE TO SUPPORT YOUR REAL ESTATE AND BUSINESS DECISIONS, GO TO CUSHMAN & WAKEFIELDS KNOWLEDGE CENTER AT:

www.cushmanwakefield.com/knowledge

*Market terms & definitions based on BOMA and NAIOP standards. This report contains information available to the public and has been relied upon by Cushman & Wakefield on the basis that it is accurate and complete. Cushman & Wakefield accepts no responsibility if this should prove not to be the case. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by our principals. 2010 Cushman & Wakefield, Inc. All rights reserved. Please consider your environmental responsibility before printing this report.

Cuervo Far East, Inc. 101 Esteban St. Cor. Dela Rosa St., Legaspi Village, Makati City, Philippines Trunk Line: (632) 750-6610 Fax: (632) 750-6603

MANILA OFFICE REPORT 3Q11

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- BIR Revenue Regulation No. 6-2013Document2 pagesBIR Revenue Regulation No. 6-2013Josemari CuervoPas encore d'évaluation

- Batangas Risk - TSUNAMI HAZARD MAPDocument1 pageBatangas Risk - TSUNAMI HAZARD MAPJosemari CuervoPas encore d'évaluation

- Southern Manila West Growth AreaDocument28 pagesSouthern Manila West Growth AreaJosemari CuervoPas encore d'évaluation

- Enterprise ValuationDocument1 pageEnterprise ValuationJosemari CuervoPas encore d'évaluation

- EU Demographic CrisisDocument7 pagesEU Demographic CrisisJosemari CuervoPas encore d'évaluation

- Overview Slide 1Q11Document1 pageOverview Slide 1Q11Josemari CuervoPas encore d'évaluation

- 2011 1Q Manila Office Market BeatDocument2 pages2011 1Q Manila Office Market BeatJosemari CuervoPas encore d'évaluation

- Marketview: 2012: The Year of Government Deleveraging MARCH 2012Document9 pagesMarketview: 2012: The Year of Government Deleveraging MARCH 2012Josemari CuervoPas encore d'évaluation

- PPH Small Business Review5Document18 pagesPPH Small Business Review5Josemari CuervoPas encore d'évaluation

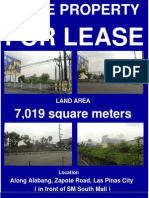

- 7,000 Sqm. Prime Property For Long-Term LeaseDocument2 pages7,000 Sqm. Prime Property For Long-Term LeaseJosemari CuervoPas encore d'évaluation

- Why The Philippines Is A BPO DestinationDocument67 pagesWhy The Philippines Is A BPO DestinationJosemari Cuervo67% (3)

- Manila Office 4Q10 Market BeatDocument2 pagesManila Office 4Q10 Market BeatJosemari CuervoPas encore d'évaluation

- Manila Office 3Q10 Market BeatDocument2 pagesManila Office 3Q10 Market BeatJosemari CuervoPas encore d'évaluation

- Philippines Leasing Guidelines (12 Oct 2010)Document8 pagesPhilippines Leasing Guidelines (12 Oct 2010)Josemari Cuervo100% (14)

- Office Space Across The World 2011 - Low ResDocument20 pagesOffice Space Across The World 2011 - Low ResJosemari CuervoPas encore d'évaluation

- Manila Office Market Beat 2Q10Document1 pageManila Office Market Beat 2Q10Josemari CuervoPas encore d'évaluation

- 100,000 Per SQMDocument2 pages100,000 Per SQMJosemari CuervoPas encore d'évaluation

- BB Philippines Potential GC Aug08 enDocument6 pagesBB Philippines Potential GC Aug08 enJosemari CuervoPas encore d'évaluation

- Manila Office Market Beat 1Q10Document1 pageManila Office Market Beat 1Q10Josemari Cuervo0% (1)

- Philippines Leasing Guidelines 2010Document8 pagesPhilippines Leasing Guidelines 2010Josemari CuervoPas encore d'évaluation

- IRR RESA (PRBRESVer.1) (Consultation Draft)Document12 pagesIRR RESA (PRBRESVer.1) (Consultation Draft)Josemari CuervoPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- ANZ Commodity Daily 720 081012Document8 pagesANZ Commodity Daily 720 081012anon_370534332Pas encore d'évaluation

- Attracting Investor Attention Through AdvertisingDocument46 pagesAttracting Investor Attention Through Advertisingroblee1Pas encore d'évaluation

- Ibs The Reef, Rawang 1 30/04/23Document3 pagesIbs The Reef, Rawang 1 30/04/23Suhail amdanPas encore d'évaluation

- Rocky Owns and Operates Balboa S Gym Located in Philadelphia TheDocument1 pageRocky Owns and Operates Balboa S Gym Located in Philadelphia TheBube KachevskaPas encore d'évaluation

- Feasibility Study of A Medium - Sized Full Service Hotel in Bauchi Metropolis, Bauchi NigeriaDocument5 pagesFeasibility Study of A Medium - Sized Full Service Hotel in Bauchi Metropolis, Bauchi NigeriaFuadPas encore d'évaluation

- Estate Tax-Handout 2Document4 pagesEstate Tax-Handout 2Xerez SingsonPas encore d'évaluation

- CFAS With KeyDocument5 pagesCFAS With KeyChesca Marie Arenal PeñarandaPas encore d'évaluation

- Use The Following Information To Answer The Question(s) BelowDocument36 pagesUse The Following Information To Answer The Question(s) BelowOla PietruszewskaPas encore d'évaluation

- Afm Examiner's Report March June 2022Document15 pagesAfm Examiner's Report March June 2022Abha AbhaPas encore d'évaluation

- TEST BANK For Government and Not For Profit Accounting Concepts and Practices 6th Edition by Granof Khumawala20190702 86031 1d2i3lg PDFDocument16 pagesTEST BANK For Government and Not For Profit Accounting Concepts and Practices 6th Edition by Granof Khumawala20190702 86031 1d2i3lg PDFMaria Ceth SerranoPas encore d'évaluation

- RH Perennial - Nov 21Document46 pagesRH Perennial - Nov 21sambitPas encore d'évaluation

- FM Course Outline & Materials-Thappar UnivDocument74 pagesFM Course Outline & Materials-Thappar Univharsimranjitsidhu661Pas encore d'évaluation

- Statement of Account: HDFC Bank LimitedDocument1 pageStatement of Account: HDFC Bank LimitedPraveen Kumar MPas encore d'évaluation

- Past Paper Inspector Inland Revenue FBR IIR Jobs in FPSCDocument3 pagesPast Paper Inspector Inland Revenue FBR IIR Jobs in FPSCDedag DawoodPas encore d'évaluation

- Part 2 Working Capital Management Qs PDFDocument15 pagesPart 2 Working Capital Management Qs PDFAnuar LoboPas encore d'évaluation

- Health Insurance and Risk ManagementDocument7 pagesHealth Insurance and Risk ManagementPritam BhowmickPas encore d'évaluation

- Cash Book RevisionDocument2 pagesCash Book RevisionSwati ChamariaPas encore d'évaluation

- Jaya Property Annual Report 2015Document169 pagesJaya Property Annual Report 2015KeziaPas encore d'évaluation

- LeasingDocument19 pagesLeasingJHONPas encore d'évaluation

- Chapter 2 Ca AnswersDocument9 pagesChapter 2 Ca Answersfaaltu accountPas encore d'évaluation

- Solution Manual For Advanced Accounting 12th EditionDocument5 pagesSolution Manual For Advanced Accounting 12th EditionDrAndrewFarrelleqdy100% (39)

- MANOJSING RAJPUT Affidavit As Per SC ORDERDocument9 pagesMANOJSING RAJPUT Affidavit As Per SC ORDERVarzan BodhanwalaPas encore d'évaluation

- Kaplan Sensoy Strömberg 2009 Should Investors Bet On The Jockey or The HorseDocument41 pagesKaplan Sensoy Strömberg 2009 Should Investors Bet On The Jockey or The HorseThắng VũPas encore d'évaluation

- FASTag Application FormDocument6 pagesFASTag Application FormLizzi JPas encore d'évaluation

- Chhattisgarh State Electricity Regulatory Commission Raipur: CSERC Tariff Order FY 2023-24Document284 pagesChhattisgarh State Electricity Regulatory Commission Raipur: CSERC Tariff Order FY 2023-24eepocapsldcPas encore d'évaluation

- BNP Paribas - Paris Saint Paul - Le MaraisDocument1 pageBNP Paribas - Paris Saint Paul - Le MaraisfredericcroyPas encore d'évaluation

- United States Securities and Exchange Commission Washington, D.C. 20549 Form 1-Z Exit Report Under Regulation A General InstructionsDocument2 pagesUnited States Securities and Exchange Commission Washington, D.C. 20549 Form 1-Z Exit Report Under Regulation A General InstructionsAnthony ANTONIO TONY LABRON ADAMSPas encore d'évaluation

- Training Manual Bookkeeping Financial & ManagementDocument81 pagesTraining Manual Bookkeeping Financial & ManagementJhodie Anne Isorena100% (1)

- Financial Statement Analysis of "Beximco Pharma": Submitted ToDocument3 pagesFinancial Statement Analysis of "Beximco Pharma": Submitted TojtopuPas encore d'évaluation

- TEST-TABLE (All Tables Only For Rating, Billing, Payment&collectionsDocument1 pageTEST-TABLE (All Tables Only For Rating, Billing, Payment&collectionsBhaskar SenPas encore d'évaluation