Académique Documents

Professionnel Documents

Culture Documents

Solution To Y Guess Jeans:: Item 1. Consolidated Financial Statements

Transféré par

AbuBakarSiddiqueDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Solution To Y Guess Jeans:: Item 1. Consolidated Financial Statements

Transféré par

AbuBakarSiddiqueDroits d'auteur :

Formats disponibles

Y Guess Jeans Page 93

Solution to Y Guess Jeans:

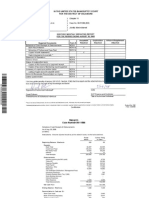

The layout of this case is as follows: first, the financials are reproduced, then the ratios and their formulas, with solutions, are shown. Cell formulas for ratios are not included, but can be assigned to a new column. Item 1. Consolidated Financial Statements COUNTY SEAT STORES, INC. AND SUBSIDIARY CONSOLIDATED BALANCE SHEETS (Amounts in Thousands, Except Share Amounts) (Unaudited) ASSETS Current Assets: Cash and cash equivalents Receivables Merchandise inventories Prepaid expenses Deferred tax benefit Total current assets Property and equipment, at cost Less--Accumulated depreciation and amortization Property and equipment, net Other Assets, net: Debt issuance costs Deferred income taxes Excess of purchase price over net assets acquired Other Total other assets, net Total Assets 3-Aug-96 $10,603 1,486 132,580 10,876 2,826 158,371 119,425 -65,943 53,482 3,816 2,016 814 6,646 $218,499 29-Jul-95 $8,125 2,778 143,474 11,177 10,296 175,850 117,466 -52,128 65,338 3,408 6,198 75,215 1,431 86,252 $327,440 3-Feb-96 $8,166 2,658 110,744 11,188 989 133,745 120,277 -61,674 58,603 3,073 2,368 1,303 6,744 $199,092

Y Guess Jeans Page 94

LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIT) Current Liabilities: Borrowings under credit agreement $81,800 Current maturities of long-term debt 26 Accounts payable 47,397 Accrued expenses 21,864 Accrued income taxes 3,183 Total current liabilities 154,270 Long-term debt 105,018 Other long-term liabilities 11,006 Redeemable preferred stock 48,521 Shareholders' Equity (Deficit): Common stock: par value $1.00 per share; 1,000 shares authorized, issued and outstanding 1 Paid-in capital 49,789 Accumulated deficit -150,106 Total shareholders' equity (deficit) -100,316 Total Liabilities & S.E. $218,499

$43,700 29 65,472 18,628 1,341 129,170 135,047 11,094 40,389 1 49,789 -38,050 11,740 $327,440

$27,000 25 36,754 19,913 3,007 86,699 130,031 11,242 44,319 1 49,789 -122,989 -73,199 $199,092

Y Guess Jeans Page 95

COUNTY SEAT STORES, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF OPERATIONS (Amounts in Thousands, Except Share Amounts) (Unaudited) 13 Weeks Ended 13 Weeks Ended 26 Weeks Ended August 3, July 29, August 3, 1996 1995 1996 Net sales $121,727 $130,110 $243,331 Cost of sales, including buying and occupancy 90,283 95,123 185,812 Gross profit 31,444 34,987 57,519 Selling, general and administrative expenses 33,647 32,169 64,949 Depreciation and amortization 2,956 3,531 5,915 Loss from operations -5,159 -713 -13,345 Interest expense, net 5,072 5,200 9,759 Loss before income taxes and extraordinary items -10,231 -5,913 -23,104 Income taxes 3,909 -2,456 -1,240 Loss before extraordinary items -14,140 -3,457 -21,864 Extraordinary items, net of income tax benefit 9,997 Net loss ($14,140) ($13,454) ($21,864)

26 Weeks Ended July 29, 1995 $254,299 190,061 64,238 62,042 6,787 -4,591 10,311 -14,902 -6,527 -8,375 9,997 ($-18,372)

Y Guess Jeans Page 96

COUNTY SEAT STORES, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) (Unaudited) 26 Weeks August 3, 1996 Cash Flows from Operating Activities: Net loss Adjustments to reconcile net loss to net cash used for operating activities: Extraordinary items Depreciation and amortization Amortization of debt issuance costs and discount Rent expense in excess of cash outlays, net Deferred tax benefit -1,240 -3,880 Changes in operating assets and liabilities: Receivables Merchandise inventories Prepaid expenses Accounts payable Accrued expenses Accrued income taxes Other non-current assets and liabilities Net cash used for operating activities ($21,864) 5,915 492 53 625 -21,836 313 11,211 2,746 -70 -26 -23,681 Ended July 29, 1995 ($18,372) 9,997 6,787 924 189 2,371 -47,203 -1,288 25,358 -4,047 -3,161 -471 -32,796

Y Guess Jeans Page 97

(continued) COUNTY SEAT STORES, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) (Unaudited) Cash Flows from Financing Activities: Borrowings under the Credit Agreement, net Issuance of long-term debt Debt issuance costs and prepayment premiums Principal payments on long-term debt and capital leases Repayment of long-term debt Dividend to parent Advance to parent Net cash provided by financing activities Cash Flows from Investing Activities: Capital expenditures Proceeds from disposal of property and equipment Net cash used for investing activities Net Increase (Decrease) in Cash and Cash Equivalents Cash and Cash Equivalents: Beginning of period End of period Memo: Cash Paid During the Period For: Interest $12,519 Income taxes 29,800 -1,257 -12 -1,051 27,480 73,700 104,943 -6,781 -20 -150,795 -1,051 -235 19,761

-1,365 3 -1,362 2,437 8,166 $10,603

-9,313 14 -9,299 -22,334 30,459 $8,125

$8,931 $70 $514

Y Guess Jeans Page 98

Item 2: Ratios, Formulas, and Values. Note: Some formulas must have income statement items multiplied by 2

CATEGORY FINANCIAL RATIO 1. Current Ratio 2. Net Working Capital $47,102.00 3. Quick Ratio (Current Assets - Inventory) / Current Liabilities 4. Cash Flow to Total Debt Net Income + Depr. Expense / (Curr. Liabs.-A/P-Accrued Expenses) + LT Debt 5. Cash Flow from (CFFO) Net Income + Noncash Charges Operations + Change in Operating Curr. Liabs. Change in Operating Curr. Assets (or just pull # from Statement of Cash Flows) 6. Cash Cycle (CC) CC = (Days Inventory Held + Days Sales Outstanding Days Payables Outstanding) or, equivalently, CC = Inventory Conversion Period + Receivables Conversion Period Payables Deferral Period Days Sales Outstanding days= Days Held in Inventory days= Days Payable days= 7. Cash Turnover CT = 365 / CC 8. Net Liquid Balance NLB = (Cash + ST Investments) (Notes Payable + Current Portion of LT Debt) 9. Defensive Interval Cash + ST Investments Daily Operating Expenses where Daily Operating Expenses =(COGS + Selling, General, & Administrative Expenses Depreciation Expense) / 365 0.08 -21.05% ($27,732,000) 0.08 -19.80% ($33,346,000) FORMULA Current Assets/Current Liabilities Current Assets - Current Liabilities 6 months ending Aug. 3, '96 1.04 $5,536.00 6 months ending July 29, '95 1.36

84.78

76.89

1.11 130.22 46.55 4.31 ($36,820.00) 7.90

1.99 137.77 62.87 4.75 ($57,376.00) 6.04

Y Guess Jeans Page 99

1. Times Interest Earned EBIT / Interest Expense 2. Long-Term Debt to Capital* Long-Term Debt / (Long-Term Debt + Equity) where Long-Term Debt includes Long-term notes and bonds, term loans, and capital lease obligations 3. Total Liabilities to Total Total Liabilities / Total Assets Assets 1. Return on Equity (ROE)

1.21 2.08

-0.40 1.63

1.83

1.18

or N/A

2. Profit Margin on Sales (or Net Profit Margin) 3. Return on Total Assets (ROA)

Earnings Available to Shareholders / Common Equity where Earnings Available = N/A (Net Income - Preferred Stock Dividends Sinking Fund Payments - Amortization) Net Income Revenues -11.27% or N/A Net Income Total Assets -25.07% or N/ A

N/A -9.46% -14.66% or N/A

* It is unclear if the "other long-term liabilities" on the balance sheet represents terms loans or capital lease obligations. Regardless, be very careful in interpreting this ratio due to the negative equity in both years. Conclusions: This company illustrates what happens to a company's liquidity and debt ratios when it starts experiencing losses. It is difficult to find any positives in the financial ratios; at least the amount by which NLB is negative has declined. Y. Guess would want to be very careful with this account. If it has good gross margins (branded jeans generally do), Y. Guess may hate to lose the account. An experienced credit analyst would offer the following: (1) cut back on terms from net 30 to net 15 or shorter; (2) keep in contact with County Seat to monitor its financial position, and continue to monitor its D&B experience; (3) sell with letter of credit backing; (4) possibly go to cash on delivery or even cash before delivery terms. Students may miss the first recommendation, but should come up with 2, 3, and 4 based on information in the body of the case and their understanding of Chapter 5.

Vous aimerez peut-être aussi

- Attachments To: Mid-Term ExamDocument7 pagesAttachments To: Mid-Term Examveda20Pas encore d'évaluation

- (5414) Specialized Design Services Sales Class: $500,000 - $999,999Document15 pages(5414) Specialized Design Services Sales Class: $500,000 - $999,999Christyne841Pas encore d'évaluation

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkPas encore d'évaluation

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiPas encore d'évaluation

- Glosario de FinanzasDocument9 pagesGlosario de FinanzasRaúl VargasPas encore d'évaluation

- Pro Forma Models - StudentsDocument9 pagesPro Forma Models - Studentsshanker23scribd100% (1)

- Financial Statements, Cash Flow, and TaxesDocument29 pagesFinancial Statements, Cash Flow, and TaxesHooriaKhanPas encore d'évaluation

- The Income Statement and The Statement of Cash FlowsDocument31 pagesThe Income Statement and The Statement of Cash FlowsdanterozaPas encore d'évaluation

- Financial Statements, Cash Flows, and TaxesDocument31 pagesFinancial Statements, Cash Flows, and Taxesjoanabud100% (1)

- Chapter 03 - Operating Decisions and the Income StatementDocument10 pagesChapter 03 - Operating Decisions and the Income StatementJie Bo Ti67% (3)

- ITC Cash Flow StatementDocument1 pageITC Cash Flow StatementIna PawarPas encore d'évaluation

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidPas encore d'évaluation

- Accounting Clinic IDocument40 pagesAccounting Clinic IRitesh Batra100% (1)

- ACC101-Chapter12new 000 PDFDocument26 pagesACC101-Chapter12new 000 PDFShibasundar Behera100% (1)

- Cash Flows From Operating ActivitiesDocument5 pagesCash Flows From Operating ActivitiesIrfan MansoorPas encore d'évaluation

- Total Application of Funds Fixed Assets Fixed AssetsDocument14 pagesTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiPas encore d'évaluation

- Cash FlowsDocument26 pagesCash Flowsvickyprimus100% (1)

- Financial Accounting & AnalysisDocument9 pagesFinancial Accounting & AnalysisRiya DhanukaPas encore d'évaluation

- Analyze Cash FlowsDocument5 pagesAnalyze Cash FlowsAmit VarmaPas encore d'évaluation

- SEx 9Document24 pagesSEx 9Amir Madani100% (1)

- Statement of Cash Flow - Ias 7Document5 pagesStatement of Cash Flow - Ias 7Benjamin JohnPas encore d'évaluation

- Tax Advance IndexDocument38 pagesTax Advance IndexLan TranPas encore d'évaluation

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSDocument7 pagesIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22Pas encore d'évaluation

- Apple Inc.: Form 10-QDocument55 pagesApple Inc.: Form 10-QdsafoijoafjoasdPas encore d'évaluation

- Alwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsDocument14 pagesAlwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsFarrukhsgPas encore d'évaluation

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiPas encore d'évaluation

- Business Activities and Financial StatementsDocument23 pagesBusiness Activities and Financial StatementsUsha RadhakrishnanPas encore d'évaluation

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyPas encore d'évaluation

- Interest Income, Non-BankDocument206 pagesInterest Income, Non-BankArturo RiveroPas encore d'évaluation

- Cash Flow StatementDocument28 pagesCash Flow StatementJaan Sonu100% (2)

- Stock Valuation Report AnalysisDocument8 pagesStock Valuation Report AnalysisHarish SharmaPas encore d'évaluation

- 10000006490Document17 pages10000006490Chapter 11 DocketsPas encore d'évaluation

- 2010 Ibm StatementsDocument6 pages2010 Ibm StatementsElsa MersiniPas encore d'évaluation

- Topic 3 5 Ratio AnalysisDocument16 pagesTopic 3 5 Ratio AnalysisEren BarlasPas encore d'évaluation

- 109Document34 pages109danara1991Pas encore d'évaluation

- Definition of 'Accounting'Document10 pagesDefinition of 'Accounting'Humaira ShafiqPas encore d'évaluation

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqPas encore d'évaluation

- Preeti 149Document16 pagesPreeti 149Preeti NeelamPas encore d'évaluation

- Illustration On AFN (FE 12)Document39 pagesIllustration On AFN (FE 12)Jessica Adharana KurniaPas encore d'évaluation

- IAS 7 CASH FLOWDocument28 pagesIAS 7 CASH FLOWEynar MahmudovPas encore d'évaluation

- Calculate cash flow statements using direct and indirect methodsDocument5 pagesCalculate cash flow statements using direct and indirect methodszigeunerunddiebePas encore d'évaluation

- Working CapitalDocument10 pagesWorking CapitalSaurabh BhardwajPas encore d'évaluation

- Annual Report Project ExplanationDocument8 pagesAnnual Report Project Explanationmax mostPas encore d'évaluation

- Financial Reporting & Analysis Session Provides InsightsDocument41 pagesFinancial Reporting & Analysis Session Provides InsightspremoshinPas encore d'évaluation

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainPas encore d'évaluation

- SEx 7Document16 pagesSEx 7Amir Madani100% (1)

- Chapter 5 - With SolutionsDocument40 pagesChapter 5 - With SolutionsPrimus Ong100% (1)

- Chapter 2 - Basic Financial StatementsDocument12 pagesChapter 2 - Basic Financial StatementsParas AbbiPas encore d'évaluation

- Document Research: MorningstarDocument52 pagesDocument Research: Morningstaraaa_13Pas encore d'évaluation

- Cash Flow Statement (C.F.S.)Document6 pagesCash Flow Statement (C.F.S.)Kopal ChoubeyPas encore d'évaluation

- Finance For NonfinanceDocument35 pagesFinance For Nonfinancelasyboy20Pas encore d'évaluation

- Financial Accounting & AnalysisDocument6 pagesFinancial Accounting & AnalysisAmandeep SinghPas encore d'évaluation

- Financial Statements PDFDocument91 pagesFinancial Statements PDFHolmes MusclesFanPas encore d'évaluation

- Marchex 10Q 20121108Document60 pagesMarchex 10Q 20121108shamapant7955Pas encore d'évaluation

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineD'EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)D'EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Évaluation : 3.5 sur 5 étoiles3.5/5 (17)

- 401 Final Research ProposalDocument6 pages401 Final Research ProposalAbuBakarSiddiquePas encore d'évaluation

- Cultural Influences On Leadership - HouseDocument95 pagesCultural Influences On Leadership - HouseAbuBakarSiddiquePas encore d'évaluation

- Bus 401 Amu by SiddiqueDocument12 pagesBus 401 Amu by SiddiqueAbuBakarSiddiquePas encore d'évaluation

- Private Universities 1Document30 pagesPrivate Universities 1AbuBakarSiddiquePas encore d'évaluation

- Outline of Introduction and BackgroundDocument6 pagesOutline of Introduction and BackgroundAbuBakarSiddiquePas encore d'évaluation

- 204 Final Term Paper.Document10 pages204 Final Term Paper.AbuBakarSiddiquePas encore d'évaluation

- How Far Ban Glades Hi People Are Aware That Natural Gas Is Running Out Final PCDocument37 pagesHow Far Ban Glades Hi People Are Aware That Natural Gas Is Running Out Final PCAbuBakarSiddiquePas encore d'évaluation

- Private Universities - Are They Really Selling Degrees?Document4 pagesPrivate Universities - Are They Really Selling Degrees?AbuBakarSiddiquePas encore d'évaluation

- Im04 KB FXDocument18 pagesIm04 KB FXAbuBakarSiddiquePas encore d'évaluation

- Credit Policy and CollectionsDocument29 pagesCredit Policy and CollectionsAbuBakarSiddiquePas encore d'évaluation

- Cash Collection Systems: Professor of Financial Economics University of Nebraska Kearney, NEDocument15 pagesCash Collection Systems: Professor of Financial Economics University of Nebraska Kearney, NEAbuBakarSiddiquePas encore d'évaluation

- CV - RajgirDocument4 pagesCV - RajgirAbuBakarSiddiquePas encore d'évaluation

- The Role of Working CapitalDocument9 pagesThe Role of Working CapitalAbuBakarSiddiquePas encore d'évaluation

- Solution To Kimball - Credit Standards and Credit Period DecisionDocument5 pagesSolution To Kimball - Credit Standards and Credit Period DecisionAbuBakarSiddiquePas encore d'évaluation

- Candidates Profile 10Document2 pagesCandidates Profile 10AbuBakarSiddiquePas encore d'évaluation

- Cal Fall 2011Document1 pageCal Fall 2011AbuBakarSiddiquePas encore d'évaluation

- Final ReportDocument25 pagesFinal ReportAbuBakarSiddiquePas encore d'évaluation

- DBBL Case Study of CSRDocument19 pagesDBBL Case Study of CSRAbuBakarSiddique100% (2)

- Debate Moral DevaluationDocument2 pagesDebate Moral DevaluationAbuBakarSiddiquePas encore d'évaluation

- BlionDocument1 pageBlionAbuBakarSiddiquePas encore d'évaluation

- Performance Based IncentivesDocument25 pagesPerformance Based IncentivesSaritha PuttaPas encore d'évaluation

- India Strategy - Booster shots for key sectors in 2022Document210 pagesIndia Strategy - Booster shots for key sectors in 2022Madhuchanda DeyPas encore d'évaluation

- The U.S.-China Trade War and Options For TaiwanDocument5 pagesThe U.S.-China Trade War and Options For TaiwanThe Wilson CenterPas encore d'évaluation

- St. Saviour's ULURP LetterDocument3 pagesSt. Saviour's ULURP LetterChristina WilkinsonPas encore d'évaluation

- Research Project Report of Nidhi SoniDocument104 pagesResearch Project Report of Nidhi SoniVipin VermaPas encore d'évaluation

- Risk Appetite Framework for South African InstituteDocument19 pagesRisk Appetite Framework for South African Institutemuratandac3357Pas encore d'évaluation

- Assocham Logistics SectorDocument4 pagesAssocham Logistics SectorSarat GudlaPas encore d'évaluation

- Wholesale Juice Business PlanDocument25 pagesWholesale Juice Business PlanKiza Kura CyberPas encore d'évaluation

- 2 - OFW Reintegration Program Generic PresentationDocument19 pages2 - OFW Reintegration Program Generic PresentationReintegration CagayanPas encore d'évaluation

- Foreign Exchange Manual (March 2020)Document561 pagesForeign Exchange Manual (March 2020)Mehmood Ul HassanPas encore d'évaluation

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word Documentishagoyal595160100% (1)

- Chapter 1: Hospitality Spirit. An OverviewDocument26 pagesChapter 1: Hospitality Spirit. An OverviewKhairul FirdausPas encore d'évaluation

- Ms-4 Combined BookDocument380 pagesMs-4 Combined Bookanandjaymishra100% (1)

- 2022 PDFDocument2 pages2022 PDFPreeti VirmaniPas encore d'évaluation

- Nepal COSDocument45 pagesNepal COSLeo KhkPas encore d'évaluation

- CG Question 567Document1 pageCG Question 567Maryam MalikPas encore d'évaluation

- EfasDocument2 pagesEfasapi-282412620100% (1)

- Short Iron Condor Spread - FidelityDocument8 pagesShort Iron Condor Spread - FidelityanalystbankPas encore d'évaluation

- Marketing Plan of A New Product:: "ANGEL" Baby PerfumeDocument24 pagesMarketing Plan of A New Product:: "ANGEL" Baby PerfumeMehnaz Tabassum ShantaPas encore d'évaluation

- PS3 SolutionDocument8 pagesPS3 Solutionandrewlyzer100% (1)

- Eighth Plan EngDocument419 pagesEighth Plan EngMurahari ParajuliPas encore d'évaluation

- High Low Method and Overhead RatesDocument5 pagesHigh Low Method and Overhead RatesHafizah Mardiah0% (1)

- Acct Statement - XX7301 - 03052023Document1 pageAcct Statement - XX7301 - 03052023Pranay BhosalePas encore d'évaluation

- Govt ch3Document21 pagesGovt ch3Belay MekonenPas encore d'évaluation

- ATM 8 Fleet Planning A162Document11 pagesATM 8 Fleet Planning A162Muhriddin OripovPas encore d'évaluation

- College Accounting Competency Appraisal Course ProblemsDocument9 pagesCollege Accounting Competency Appraisal Course ProblemsFelixPas encore d'évaluation

- Account Number Customer Id Account Currency Opening Balance Closing BalanceDocument1 pageAccount Number Customer Id Account Currency Opening Balance Closing Balancesamaa adelPas encore d'évaluation

- Loan Functions of BanksDocument6 pagesLoan Functions of BanksMark AmistosoPas encore d'évaluation

- The Green Register - Spring 2011Document11 pagesThe Green Register - Spring 2011EcoBudPas encore d'évaluation