Académique Documents

Professionnel Documents

Culture Documents

Car Loan Application Form

Transféré par

KarayalarDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Car Loan Application Form

Transféré par

KarayalarDroits d'auteur :

Formats disponibles

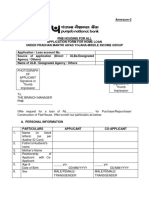

Annexure Car I S tate Bank of India Application for Car Loan/Two Wheeler Loan Signed Photograph of applicant (in

n case of individuals/ proprietorship)

GENERAL PROFILE 1. 2. 3. 4. Name of the borrower Gender Date of Birth Constitution of the borrower Individual Proprietorship/ Partnership Private Ltd. Public Ltd. M ale Female

5.

Address

PIN Code Telephone No. (Office) 6. 7. 8. 9. 10. Telephone No. (Residence) Income Tax ID (PAN No.) Passport Number Voter ID Number Have you stood Guarantee for any other borrower If so, give details thereof

Yes/No

11.

12.

Have you applied for a loan from SBI in the past (other than against TDR/NSCs/Govt. Securities) If so, give details

Yes/No

FOR INDIVIDUAL BORROWER 1. 2. 3. 4. 5. Occupation Name, address and telephone number of employer Nature of business Designation of the employee Present M onthly Income (copy of latest salary slip to be enclosed)

Application form: Car & Two Wheeler Loan

6. 7. 8.

Number of completed years of service Number of remaining years of service Has your spouse offered Guarantee(s) for any other borrower You belong to Any relatives in SBI If yes, Name, place of posting and nature of relationship FOR S ELF- EMPLOYED PERS ONS Yes/No

9. 10. 11.

SC/ST/OBC/Others Yes/No

1. 2.

Profession Annual Income (copy of Income Tax return to be enclosed) Number of years in business

3.

Name of account holder

DETAILS OF BANK ACCOUNTS Type of account Name of Bank & Branch

Account Number

S TATEMENT OF AS S ETS AND LIABILITY (APPLICABLE FOR INDIVIDUAL BORROWER) LIABILITIES AM OUNT ASSETS (In Rs.) Outstanding loan from Savings in Bank Bank Accumulated EPF/GPF Employer Units of UTI/M F/ P.F. NSCs/LIC Policies Co-operative Society Shares and Debentures Family & Friends Immovable Property Others (specify) Other Assets (specify)

AM OUNT (In Rs.)

LOAN REQUES T Amount of loan applied for: Rs. As per scheme, I/we opt for the loan on a fixed Rs. (In words) rate or interest /floating rate of interest. PURPOS E OF LOAN Cost (copy of invoice Name of vehicle, to be enclosed) make and model

Purchase of New vehicle / used vehicle

Name and address of Supplier

Application form: Car & Two Wheeler Loan

1. 2.

PROPOS ED REPAYMENT Equated M onthly Instalment Rs. For M ode of repayment

months

Check-off facility with employer Salary account and standing instructions at branch with undertaking Post-dated cheques

DECLARATION I/We hereby apply for a loan from State Bank of India to the extent indicated in the Loan Request Section of this application form. I/we declare that the foregoing particulars and information furnished in this application form are true, accurate and complete and that they shall form the basis of any loan State Bank of India may decide to sanction me. I/we confirm that I/we have/had no insolvency proceedings against me. Nor have I been adjudicated insolvent. I/we further confirm that I have read the terms and conditions and understood the contents therein. I/we am/are aware that the Equated M onthly instalment comprises Principal and interest based on Banks Prime Lending Rate which is subject to change from time to time. I/we agree that the State Bank of India has the option to reduce or increase the EM I or even extend the repayment period, consequent upon such changes in rate of interest. I/we agree that State Bank of India may at its discretion conduct discreet inquiries in respect of this application. I/we undertake to inform as to any change in my occupation/employment residential address and to provide any further information that the Bank may require. State Bank of India will be at liberty to take such action as it may deem necessary if my/our above statements are found to be untrue. I/we agree that State Bank of India shall have the sole discretion to reject/reduce my/our loan application without assigning any reason therefore. I/we further agree that my loan transactions shall be governed by the rules of State Bank of India, which may be in force from time to time.

Place: Date:

Applicants Signature

Application form: Car & Two Wheeler Loan

FOR OFFICE USE ONLY Cost of Article(s)/vehicle to be purchased : Rs. ______________________ (A) Amount of M argin : Rs. _______________________ (B)

Percentage of M argin : (Percentage of applicants contribution to invoice price) Amount of Loan (A-B) Security offered : : Rs. _________________________ The loan will be secured by

Primary Security : Hypothecation of Article(s)/vehicle (Noting of Banks hypothecation charge in the books of the R.T.O. and registration Book will be essential for vehicle. A copy of the Registration Book also to be furnished after noting of hypothecation charge). Collateral Security : i) Third Party Guarantee of the Spouse, if married ii) Third Party Guarantee of iii) Pledge of Securities listed hereunder: Sr.No. of Security Face Value/ M arket Value (Please specify) Rs. M aturity Value Rs. Date of M aturity Whether Lien Noted (Yes/No)

Nature of Security (e.g., N.S.C./LIC Policy, Fixed Deposits etc.)

Brief Reasons for waiver of Third Party Guarantee (if any): Housing Loan borrower and satisfactory track record of at least three years. In the past repaid Term/Demand Loan (other than a loan against a specified security etc.) as per repayment schedule Has been maintaining a deposit account with us for at least 5 years and average deposit has been of the order of Rs.25,000.00 Any other reason . Repayment: To be repaid in Equated M onthly Instalments of Rs. ___________ each) The request of the applicant for a Loan of Rs. _______________ for purchase of ___________ Car/M UV/SUV as contained in the enclosed application is in conformity with the extant scheme of the Bank in this regard. Irrevocable letter of Authority as per Annexure II and Letter from the Drawing and Disbursing Officer as per Annexure III obtained as a check-off facility with a reputed employer is available. * Rate of Interest: Floating @ ______% below/above SBAR i.e. ____% p.a. Fixed @ __________% p.a.

Sanctioned a Term Loan of Rs._____________ (Rs.) to Shri/Smt./Kum. __________________________ on terms and conditions noted above.

Recommending Authority * To be deleted when no check-off is available

Sanctioning Authority

Application form: Car & Two Wheeler Loan

Vous aimerez peut-être aussi

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersD'EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersÉvaluation : 3 sur 5 étoiles3/5 (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsD'EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Home Loan Application FormDocument4 pagesHome Loan Application FormSudeep ChatterjeePas encore d'évaluation

- The Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayDocument6 pagesThe Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayNitin BhatnagarPas encore d'évaluation

- Account Opening Form For Resident Individuals (Single/Joint) (SF/CA/FD/RD/OD/CC)Document4 pagesAccount Opening Form For Resident Individuals (Single/Joint) (SF/CA/FD/RD/OD/CC)Jyothi Pradeep KumarPas encore d'évaluation

- Pradhan Mantri Mudra Loan Application FormDocument4 pagesPradhan Mantri Mudra Loan Application FormArun VijilanPas encore d'évaluation

- Application Form EMPLOYEES CAR LOAN SCHEME (New/Reconditioned Car)Document4 pagesApplication Form EMPLOYEES CAR LOAN SCHEME (New/Reconditioned Car)assadPas encore d'évaluation

- MUDRA - Loan ApplicationDocument5 pagesMUDRA - Loan ApplicationuksrajPas encore d'évaluation

- Application for MSME Loan Provisionally AcknowledgedDocument7 pagesApplication for MSME Loan Provisionally AcknowledgedChristopher GarrettPas encore d'évaluation

- Annexure - Common Loan Application Form With Formats I, II and III-EnglishDocument12 pagesAnnexure - Common Loan Application Form With Formats I, II and III-EnglishThe LoanWalaPas encore d'évaluation

- UHBVNHead Office Phone No LDocument6 pagesUHBVNHead Office Phone No LPardeep MalikPas encore d'évaluation

- BCC BR 107 338 Mudra-1-1Document20 pagesBCC BR 107 338 Mudra-1-1Arun GuptaPas encore d'évaluation

- Above 10 Lakh To 100 Lakh) : Udyog Aadhar Registration No.Document5 pagesAbove 10 Lakh To 100 Lakh) : Udyog Aadhar Registration No.poonamPas encore d'évaluation

- Business Loan Application FormDocument12 pagesBusiness Loan Application FormsyediliyassikandarPas encore d'évaluation

- Loan Application Template PDFDocument5 pagesLoan Application Template PDFaslan firstPas encore d'évaluation

- 181119-Application Form Annexure PL37Document3 pages181119-Application Form Annexure PL37GoebbelsPas encore d'évaluation

- Bank of Maharashtra FormDocument5 pagesBank of Maharashtra FormSujay KamuniPas encore d'évaluation

- Sbi Mudra Loan Application Form PDFDocument4 pagesSbi Mudra Loan Application Form PDFRaviTeja KvsnPas encore d'évaluation

- Basic Loan Application For SME Loans: Affix Photographs of Applicant/Co-obligant /guarantorDocument13 pagesBasic Loan Application For SME Loans: Affix Photographs of Applicant/Co-obligant /guarantorDamoooPas encore d'évaluation

- Rudra Singh - 98 - Tyco - Edp - Exp 7Document14 pagesRudra Singh - 98 - Tyco - Edp - Exp 7tanmay ghoraiPas encore d'évaluation

- Bank’s Logo Loan ApplicationDocument4 pagesBank’s Logo Loan ApplicationMonika ShuklaPas encore d'évaluation

- Agriculture Loan App - FCFLDocument6 pagesAgriculture Loan App - FCFLankitssinghgadhwalPas encore d'évaluation

- Stand-Up India Loan Application Form-EnglishDocument5 pagesStand-Up India Loan Application Form-EnglishRajesh KumarPas encore d'évaluation

- SIDBI Loan Sanction Request for Solar PV Plant InstallationDocument5 pagesSIDBI Loan Sanction Request for Solar PV Plant InstallationPalaniswamy KPas encore d'évaluation

- Neral Format: Photo (Affix For Each Applic Ant)Document6 pagesNeral Format: Photo (Affix For Each Applic Ant)Noorul AmeenPas encore d'évaluation

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocument4 pagesCommon Loan Application Form Under Pradhan Mantri MUDRA Yojanaडा. सत्यदेव त्यागी आर्यPas encore d'évaluation

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocument5 pagesCommon Loan Application Form Under Pradhan Mantri MUDRA YojanaBijay TiwariPas encore d'évaluation

- Mudra App FormDocument6 pagesMudra App FormpraveenaPas encore d'évaluation

- Stand Up India Application Form PDFDocument5 pagesStand Up India Application Form PDFakibPas encore d'évaluation

- The Manager: Aryavart BankDocument8 pagesThe Manager: Aryavart BankRuchi SharmaPas encore d'évaluation

- Atmanirbar Bharat ApplicationDocument6 pagesAtmanirbar Bharat Applicationbijay kumarPas encore d'évaluation

- PMMY Loan Application FormDocument6 pagesPMMY Loan Application Formsumit6singhPas encore d'évaluation

- Sbi Home Top Up - FormDocument4 pagesSbi Home Top Up - FormDR. D.Y. PATIL INTERNATIONAL SCHOOL PATNA100% (1)

- Business Loan ApplicationDocument2 pagesBusiness Loan ApplicationMohammadPas encore d'évaluation

- Bank of Baroda: (Head Office, Mandvi, Baroda) Particulats To Be Supplied by The Applicant/Guarantor For AdvanceDocument3 pagesBank of Baroda: (Head Office, Mandvi, Baroda) Particulats To Be Supplied by The Applicant/Guarantor For AdvanceShiv DwivediPas encore d'évaluation

- Baroda Ashray Loan Application FormDocument6 pagesBaroda Ashray Loan Application FormAkhila ReddyPas encore d'évaluation

- SBI HSG Loan Application FormDocument5 pagesSBI HSG Loan Application Formrajesh.bhagiratiPas encore d'évaluation

- Home Loan Application FormDocument2 pagesHome Loan Application Formanon_300020848Pas encore d'évaluation

- Application Form For PMAY MIG Loan PDFDocument8 pagesApplication Form For PMAY MIG Loan PDFakibPas encore d'évaluation

- Business Loan ApplicationDocument6 pagesBusiness Loan Applicationcatipop450Pas encore d'évaluation

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocument5 pagesCommon Loan Application Form Under Pradhan Mantri MUDRA YojanaPrabhaveen PrabhaPas encore d'évaluation

- Application For Agro Processing LoanDocument6 pagesApplication For Agro Processing Loanparas rawatPas encore d'évaluation

- Application Form - Reduce Monthly Repayment Amount PDFDocument2 pagesApplication Form - Reduce Monthly Repayment Amount PDFasdsaPas encore d'évaluation

- Revised Schedule SheetDocument2 pagesRevised Schedule SheetDinesh chandra jaiswalPas encore d'évaluation

- Provisional Acknowledgement: WWW - Pnbindia.inDocument7 pagesProvisional Acknowledgement: WWW - Pnbindia.inNANDINI KHANNAPas encore d'évaluation

- Term Deposit Opening FormDocument2 pagesTerm Deposit Opening FormcvjgdjkkbmncnnPas encore d'évaluation

- ASD Applicaton Format1Document3 pagesASD Applicaton Format1jijish1098Pas encore d'évaluation

- 11 Msme Loan Application FormDocument6 pages11 Msme Loan Application FormRAKESH BABUPas encore d'évaluation

- Common Application Format For MSME Loans - IBA ApprovedDocument5 pagesCommon Application Format For MSME Loans - IBA ApprovedPriya KalraPas encore d'évaluation

- SOD Against Deposits/NSCs/LIC PoliciesDocument1 pageSOD Against Deposits/NSCs/LIC PoliciessinghnaikPas encore d'évaluation

- KT 1070169204Document4 pagesKT 1070169204shivu patilPas encore d'évaluation

- Bosa Loan FormDocument4 pagesBosa Loan FormIsaac OkotPas encore d'évaluation

- ASD Applicaton FormatDocument3 pagesASD Applicaton Formatshivalk3100% (1)

- Common Loan Application Form - EnglishDocument7 pagesCommon Loan Application Form - EnglishSwiftPas encore d'évaluation

- Applicant Information (If More Than One Applicant, Copy Form and Complete For Each)Document1 pageApplicant Information (If More Than One Applicant, Copy Form and Complete For Each)NoePas encore d'évaluation

- Comp/Feb/Int/5034 | PSRF245009032007 NACH mandate instructionDocument2 pagesComp/Feb/Int/5034 | PSRF245009032007 NACH mandate instructionAnithaPas encore d'évaluation

- PMAY Application FormDocument4 pagesPMAY Application Formkundan_bokPas encore d'évaluation

- 1171439738484-Traders Easy Loan SchemeDocument4 pages1171439738484-Traders Easy Loan Schemekiran_vadePas encore d'évaluation

- Union Bank of India Application-Form-For-msmes2Document8 pagesUnion Bank of India Application-Form-For-msmes2SHUBHAM GHARATPas encore d'évaluation

- AGRICULTURE Loan Application FormDocument9 pagesAGRICULTURE Loan Application FormKasipag LegalPas encore d'évaluation

- Subject: - Grant of Children Education AllowanceDocument5 pagesSubject: - Grant of Children Education AllowancePardeep MalikPas encore d'évaluation

- Training Report PTPS PanipatDocument38 pagesTraining Report PTPS PanipatPardeep Malik100% (1)

- Subject: - Grant of Children Education AllowanceDocument5 pagesSubject: - Grant of Children Education AllowancePardeep MalikPas encore d'évaluation

- Identy CardsDocument1 pageIdenty CardsPardeep MalikPas encore d'évaluation

- Haryana Power Generation Corporation LTD.: Travlling Allownce Bill of Officer / OfficialDocument3 pagesHaryana Power Generation Corporation LTD.: Travlling Allownce Bill of Officer / OfficialPardeep MalikPas encore d'évaluation

- Training ReportDocument23 pagesTraining ReportSumit GuptaPas encore d'évaluation

- Q.R. Form No.a-3Document4 pagesQ.R. Form No.a-3Pardeep MalikPas encore d'évaluation

- Trining Report PTPS, Panipat (Pardeep Malik)Document32 pagesTrining Report PTPS, Panipat (Pardeep Malik)Pardeep MalikPas encore d'évaluation

- Essentiality CertificateDocument6 pagesEssentiality CertificatePardeep MalikPas encore d'évaluation

- Q.R. Form - Minis TrialDocument5 pagesQ.R. Form - Minis TrialPardeep MalikPas encore d'évaluation

- Q.R. Form No.a-3Document4 pagesQ.R. Form No.a-3Pardeep MalikPas encore d'évaluation

- Admission Form Dav ThermalDocument2 pagesAdmission Form Dav ThermalPardeep MalikPas encore d'évaluation

- Extn Beyond 55-50 YrsDocument1 pageExtn Beyond 55-50 YrsPardeep MalikPas encore d'évaluation

- Essentiality CertificateDocument2 pagesEssentiality CertificatePardeep MalikPas encore d'évaluation

- BSNL 2G-3G Prepaid Application FormDocument2 pagesBSNL 2G-3G Prepaid Application FormShaji Mullookkaaran100% (1)

- Birth CertificatesDocument2 pagesBirth CertificatesPardeep MalikPas encore d'évaluation

- ATM CardDocument2 pagesATM CardPardeep MalikPas encore d'évaluation

- Particulars For Grant of Acp Scale (Ist/Iind)Document1 pageParticulars For Grant of Acp Scale (Ist/Iind)Pardeep MalikPas encore d'évaluation