Académique Documents

Professionnel Documents

Culture Documents

EoDR 24 08 2006

Transféré par

api-3818152Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

EoDR 24 08 2006

Transféré par

api-3818152Droits d'auteur :

Formats disponibles

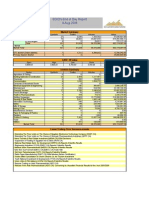

EGID's End of Day Report

24-Aug-2006

Market Summary

Symbols Trades Volume Value

Advanced 72 27,792 38,133,644 799,811,833.25

Declined 26 2,740 1,302,296 67,196,929.19

Stocks

Unchanged 7 94 114,203 3,767,585.53

Total 105 30,626 39,550,143 870,776,347.97

Bonds 1 2 48,000 5,033,232.00

Market Total 106 30,628 39,598,143 875,809,579.97

OTC Market (Orders Market) 6 754 3,210,640 5,323,530.47

Primary Dealers Market 0 0

CASE 30 Index

Open High Low Close %

5,890.09 6,060.68 5,890.09 6,060.68 2.90

Sectors Summary

Sector Symbols Trades Volume Value

Agriculture & Fishing 0 0 0 0.00

Building Materials & Construction 19 3,040 2,128,887 128,912,121.14

Chemicals 6 409 261,831 11,118,670.63

Communication 4 2,748 3,224,835 87,327,700.16

Consumer & Household Goods 0 0 0 0.00

Electrical Equipment & Engineering 4 342 587,040 4,509,609.03

Entertainment 5 636 517,286 17,298,551.66

Financial Services 18 5,516 3,829,023 143,912,331.93

Food & Beverage 6 208 78,912 3,011,662.64

Health & Pharmaceuticals 7 255 125,962 3,277,280.83

Holding Companies 3 6,399 7,897,701 286,749,309.20

Housing & Real Estate 8 2,539 2,030,325 40,876,667.91

Information Technology 1 1,117 1,492,592 19,790,182.37

Media 2 278 329,723 2,686,330.60

Mills & Storage 7 111 32,322 832,678.30

Mining & Gas 3 1,048 352,778 32,620,351.57

Miscellaneous Services 0 0 0 0.00

Paper & Packaging & Plastics 2 4 732 7,137.41

Retailers 1 36 10,210 594,843.29

Textiles & Clothing 6 5,779 16,509,110 86,397,313.77

Trade 0 0 0 0.00

Utilities 3 161 140,874 853,605.54

Market Total 105 30,626 39,550,143 870,776,347.97

Latest Trading Floor Announcements

- Reversal Orders : 24-08-2006

- Orders Cancellation

- Insider Trading Executions: Trading Session 23/8/2006

- El Kahera Housing (ELKA.CA) To Sell Treasury Stocks

- Listing Requests: 23/08/2006

- Suspension of Trading on Multi M Group For Metallic & Wooden Industries

- A Deal On Prime Securities Stock Brokers ( PRMS.CA) Took Place on 23/8/2006

- Global Capital stock brokers Fulfilled its Commitments Towards The Settlement Guarantee Fund

- A Deal On Prime Capital Portfolio Managers ( PCPM.CA) Took Place on 23/8/2006

- A Deal On Prime Investments Fund Managers (PIFM.CA) Took Place on 23/8/2006

- De-listing of Arab Gulf Investments (Forced de-listing)

- Release From Six of October Development & Investment (SODIC) (OCDI.CA) Concerning a Study of an Appropriate Indicator to Reflect E

- Transport Works Company Financial Statements For The Year Ended 30/6/2006

- Suspension of a Trader

- Housing & Development Bank - Order Cancellation

Top Movers

Day Total Price

Symbol Change Trades Volume Value High Low Close

Gainers

Housing & Development Bank - Less Rights 50 Coupon 6.635 495 261,667 5,214,075.64 20.50 18.68 19.93

Egyptian Starch & Glucose 4.996 9 997 82,561.57 82.81 82.81 82.81

United Arab Shipping 4.992 18 14,545 91,778.95 6.31 6.31 6.31

Upper Egypt Contracting 4.990 2 900 19,881.00 22.09 22.09 22.09

Mena Touristic & Real Estate Investment 4.984 16 13,370 343,609.00 25.70 25.70 25.70

Losers

Alexandria Commercial & Maritime Bank 5.000- 1 500 10,925.00 21.85 21.85 21.85

Calyon Bank Egypt 4.988- 14 3,265 78,360.00 24.00 24.00 24.00

ASEC For Cement Co. 4.973- 4 542 16,467.96 30.40 30.38 30.38

Ameriyah Cement 4.541- 18 3,450 100,096.50 30.59 28.88 29.01

Rakta Paper Manufacturing 4.381- 3 725 6,330.80 8.74 8.73 8.73

Trades

Egyptian Financial Group-Hermes Holding Company 1.558 5,272 6,129,257 259,703,123.73 42.81 41.60 42.37

Arab Cotton Ginning 1.783 2,944 4,264,161 53,542,824.49 12.71 12.39 12.56

Telecom Egypt 3.462 2,327 3,039,487 38,151,626.29 12.76 12.16 12.55

Egyptian American Bank (EAB) 1.296- 1,738 897,902 50,596,059.34 59.00 55.50 56.35

El Nasr Clothes & Textiles (Kabo) 4.420 1,553 10,921,267 20,692,371.67 1.90 1.83 1.89

Volume

El Nasr Clothes & Textiles (Kabo) 4.420 1,553 10,921,267 20,692,371.67 1.90 1.83 1.89

Egyptian Financial Group-Hermes Holding Company 1.558 5,272 6,129,257 259,703,123.73 42.81 41.60 42.37

Arab Cotton Ginning 1.783 2,944 4,264,161 53,542,824.49 12.71 12.39 12.56

Telecom Egypt 3.462 2,327 3,039,487 38,151,626.29 12.76 12.16 12.55

Egyptian Kuwaiti Holding 2.510 1,046 1,654,832 23,297,029.47 2.48 2.37 2.45

Value

Egyptian Financial Group-Hermes Holding Company 1.558 5,272 6,129,257 259,703,123.73 42.81 41.60 42.37

El Ezz Steel Rebars 3.212 987 866,122 55,663,186.46 65.01 62.50 64.27

Arab Cotton Ginning 1.783 2,944 4,264,161 53,542,824.49 12.71 12.39 12.56

Orascom Construction Industries (OCI) 3.891 366 224,921 53,262,843.02 238.25 230.00 236.81

Egyptian American Bank (EAB) 1.296- 1,738 897,902 50,596,059.34 59.00 55.50 56.35

CASE 30 Companies Performance

ALEXANDRIA MINERAL OILS COMPANY 3.248 893 315,410 29,078,397.57 93.00 90.00 92.19

ARAB COTTON GINNING 1.783 2,944 4,264,161 53,542,824.49 12.71 12.39 12.56

ARAB POLVARA SPINNING & WEAVING CO. 2.429 396 349,658 2,652,297.31 7.70 7.40 7.59

COMMERCIAL INTERNATIONAL BANK (EGYPT) 2.214 949 638,703 44,230,755.88 69.90 68.00 69.25

EASTERN TOBACCO 0.184 33 5,390 1,616,672.59 300.00 299.88 299.94

EGYPTIAN AMERICAN BANK (EAB) 1.296- 1,738 897,902 50,596,059.34 59.00 55.50 56.35

EGYPTIAN COMPANY FOR MOBILE SERVICES (MOBINIL) 3.327 38 11,562 1,608,766.79 140.00 135.00 139.14

EGYPTIAN FINANCIAL GROUP-HERMES HOLDING COMPAN 1.558 5,272 6,129,257 259,703,123.73 42.81 41.60 42.37

EGYPTIAN FOR TOURISM RESORTS 1.499 91 57,639 2,458,149.69 44.00 42.25 42.65

EGYPTIAN INTERNATIONAL PHARMACEUTICALS (EIPICO) 0.986 97 86,335 1,946,021.11 22.85 22.34 22.54

EGYPTIAN MEDIA PRODUCTION CITY 2.685 267 325,995 2,616,907.28 8.25 7.65 8.03

EL AHLI INVESTMENT AND DEVELOPMENT 4.696 681 967,394 10,994,953.59 11.40 11.00 11.37

EL EZZ PORCELAIN (GEMMA) 4.711 930 782,426 9,910,090.82 13.00 12.10 12.67

EL EZZ STEEL REBARS 3.212 987 866,122 55,663,186.46 65.01 62.50 64.27

EL KAHERA HOUSING 4.396 1,151 1,207,625 16,065,007.64 13.70 12.58 13.30

EL WATANY BANK OF EGYPT 0.497 44 59,789 1,450,619.11 24.80 24.00 24.26

MEDINET NASR HOUSING 1.055 363 133,473 9,844,256.31 74.74 72.00 73.75

NATIONAL SOCIETE GENERALE BANK (NSGB) 4.901 653 387,027 14,828,604.57 39.60 36.50 38.31

NILE COTTON GINNING 2.368 712 909,651 5,113,773.63 5.69 5.42 5.62

OLYMPIC GROUP FINANCIAL INVESTMENTS 3.319 351 223,131 9,793,009.94 46.00 42.50 43.89

ORASCOM CONSTRUCTION INDUSTRIES (OCI) 3.891 366 224,921 53,262,843.02 238.25 230.00 236.81

ORASCOM HOTELS AND DEVELOPMENT 2.281 513 439,824 14,398,818.47 33.00 32.00 32.74

ORASCOM TELECOM HOLDING (OT) 4.112 329 155,336 46,051,161.33 303.00 290.00 296.46

ORIENTAL WEAVERS 0.528 163 62,994 4,314,481.67 69.00 67.67 68.49

RAYA HOLDING FOR TECHNOLOGY AND COMMUNICATION 3.352 1,117 1,492,592 19,790,182.37 13.69 12.91 13.26

SIDI KERIR PETROCHEMICALS 2.019 152 36,943 3,471,850.50 96.00 92.50 93.98

SIX OF OCTOBER DEVELOPMENT & INVESTMENT (SODIC) 3.012 117 47,052 4,537,725.19 98.25 93.05 96.44

SUEZ CEMENT 0.859 16 3,416 260,617.45 78.30 74.25 76.29

TELECOM EGYPT 3.462 2,327 3,039,487 38,151,626.29 12.76 12.16 12.55

UNITED HOUSING & DEVELOPMENT 2.443 589 422,899 7,801,343.88 18.75 18.12 18.45

This report was issued for Free by Egypt for Information Dissemination (EGID), and is intended for personal use only. If you have purchased this

report, or obtained it from any other source than EGID, then please contact us through one of the following:

Contact Information :

Postal Address :

Egypt for Information Dissemination (EGID) Telephone: +20 2 396 1500

1 Abu Bakr Khairat Street, Downtown, Cairo, Egypt Fax: +20 2 396 1501

Website: http://www.egidegypt.com E-Mail: info@egidegypt.com

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- SF - 25-96 - Performance BondDocument2 pagesSF - 25-96 - Performance Bond123pratus100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Project Two Chainz (Dual Process - Marry or Stay Single)Document10 pagesProject Two Chainz (Dual Process - Marry or Stay Single)TucsonTycoonPas encore d'évaluation

- The Founder Group Oto July Notes 2022Document20 pagesThe Founder Group Oto July Notes 2022Dirio FregosiPas encore d'évaluation

- EoDR 06 09 2006Document2 pagesEoDR 06 09 2006api-3818152Pas encore d'évaluation

- EoDR 04 09 2006Document2 pagesEoDR 04 09 2006api-3818152Pas encore d'évaluation

- EoDR 03 09 2006Document2 pagesEoDR 03 09 2006api-3818152Pas encore d'évaluation

- EoDR 30 08 2006Document2 pagesEoDR 30 08 2006api-3818152Pas encore d'évaluation

- EoDR 09 08 2006Document2 pagesEoDR 09 08 2006api-3818152Pas encore d'évaluation

- EoDR 08 08 2006Document2 pagesEoDR 08 08 2006api-3818152Pas encore d'évaluation

- EoDR 02 08 2006Document2 pagesEoDR 02 08 2006api-3818152Pas encore d'évaluation

- EoDR 01 08 2006Document2 pagesEoDR 01 08 2006api-3818152Pas encore d'évaluation

- Bai Tap Chuong 7Document19 pagesBai Tap Chuong 7Nguyen Quang PhuongPas encore d'évaluation

- Cash and Proof of Cash ProblemsDocument2 pagesCash and Proof of Cash ProblemsDivine MungcalPas encore d'évaluation

- List of Contents: Rayalaseema Hypo Hi-StrengthDocument57 pagesList of Contents: Rayalaseema Hypo Hi-StrengthShams SPas encore d'évaluation

- Cash QUESTDocument12 pagesCash QUESTJan Nelson BayanganPas encore d'évaluation

- The Role and Scope of Management AccountingDocument16 pagesThe Role and Scope of Management AccountingNassir CeellaabePas encore d'évaluation

- General Comments: The Chartered Institute of Management AccountantsDocument25 pagesGeneral Comments: The Chartered Institute of Management AccountantsSritijhaaPas encore d'évaluation

- CFR Full NotesDocument84 pagesCFR Full Notespooja sonu100% (1)

- UNIT II The Accounting Process Service and TradingDocument22 pagesUNIT II The Accounting Process Service and TradingAlezandra SantelicesPas encore d'évaluation

- Final Assignment - IUB - MBA - Managerial EconomicsDocument12 pagesFinal Assignment - IUB - MBA - Managerial EconomicsMohammed Iqbal HossainPas encore d'évaluation

- AREOPA - Principles of IC AccountingDocument39 pagesAREOPA - Principles of IC AccountingJoris g. ClaeysPas encore d'évaluation

- Spes Form 5 - Placement Report Cum Gsis - Dec2016Document1 pageSpes Form 5 - Placement Report Cum Gsis - Dec2016Joel AndalesPas encore d'évaluation

- 06 Rajashree Foods AAR OrderDocument6 pages06 Rajashree Foods AAR OrderanupPas encore d'évaluation

- Final Presentationon SharekhanDocument15 pagesFinal Presentationon SharekhanRajat SharmaPas encore d'évaluation

- UnpaidDividend 2009 2010Document49 pagesUnpaidDividend 2009 2010harsh bangurPas encore d'évaluation

- Land Bank of The PhilippinesDocument30 pagesLand Bank of The PhilippinesAdam WoodPas encore d'évaluation

- Article 1: Turkish Airlines General Conditions of CarriageDocument23 pagesArticle 1: Turkish Airlines General Conditions of CarriageAutomation SystemsPas encore d'évaluation

- Arab-Malaysian Finance Berhad V Taman Ihsan Jaya SDN BHD - 2008Document3 pagesArab-Malaysian Finance Berhad V Taman Ihsan Jaya SDN BHD - 2008Norkamilah Mohd RoselyPas encore d'évaluation

- MilesTek Military/Aerospace CatalogDocument52 pagesMilesTek Military/Aerospace CatalogNickChippyEngbergPas encore d'évaluation

- Marks Obtained in Sent-Up Examination February 2018Document24 pagesMarks Obtained in Sent-Up Examination February 2018Pankaj GuptaPas encore d'évaluation

- SDP Prospectus (Part4)Document565 pagesSDP Prospectus (Part4)Mazlinda Md RaisPas encore d'évaluation

- GKDocument79 pagesGKramPas encore d'évaluation

- Krishna Singh RBI AssignmentDocument8 pagesKrishna Singh RBI AssignmentJNU BSCAGPas encore d'évaluation

- RRJ EnterprisesDocument1 pageRRJ EnterprisesOFC accountPas encore d'évaluation

- Topic 6 Financial Management in The WorkshopDocument27 pagesTopic 6 Financial Management in The Workshopjohn nderitu100% (1)

- City Laundry: Chart of Account Assets LiabilitiesDocument6 pagesCity Laundry: Chart of Account Assets LiabilitiesGina Calling DanaoPas encore d'évaluation

- Business Risk Measurement MethodsDocument2 pagesBusiness Risk Measurement MethodsSahaa NandhuPas encore d'évaluation

- Nonlinear Neural Network Forecasting Model For Stock Index Option Price Hybrid GJR-GARCH Approach PDFDocument7 pagesNonlinear Neural Network Forecasting Model For Stock Index Option Price Hybrid GJR-GARCH Approach PDFamina azouzPas encore d'évaluation