Académique Documents

Professionnel Documents

Culture Documents

Chapter 19 Solution

Transféré par

popolandDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 19 Solution

Transféré par

popolandDroits d'auteur :

Formats disponibles

Use the following to answer questions 21-25: 21-25.

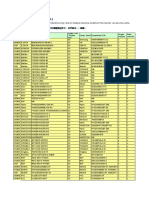

Listed below are ten terms followed by a list of phrases that describe or characterize five of the terms. Match each phrase with the correct term by placing the letter designating the best term in the space provided by the phrase. Terms: A. Antidilutive security B. Basic EPS C. Convertible bonds D. Dividend payout ratio E. Earnings available to common shareholders F. Issuance of new shares G. Multiple convertible securities H. Options, rights, and warrants I. Preferred dividends J. Preferred dividends Phrases: 21. ____ Need to be ranked high to low in terms of dilutive effect. 22. ____ No dilution considered. 23. ____ Tends to be low for growth companies. 24. ____ The numerator in the EPS formula. 25. ____ The treasury stock method is used. Answer: 21-G; 22-B; 23-D; 24-E; 25-H Use the following to answer questions 87-88: During 2006, Falwell Inc. had 500,000 shares of common stock and 50,000 shares of 6% cumulative preferred stock outstanding. The preferred stock has a par value of $100 per share. Falwell did not declare or pay any dividends during 2006. Falwell's net income for the year ended December 31, 2006, was $2.5 million. The income tax rate is 40%. Falwell granted 10,000 stock options to its executives on January 1 of this year. Each option gives its holder the right to buy 20 shares of common stock at an exercise price of $29 per share. The market price of the common stock averaged $30 per share during 2006, and the price on 12/31/06 was $33. 87. What is Falwell's basic earnings per share for 2006, rounded to the nearest cent? A) $3.14 B) $4.40 C) $5.00 D) None of the above is correct. Answer: B Rationale:

net income $2,500,000

preferred dividends - (50,000 x $100 x 6%) $2,200,000 500,000 shares = $4.40/share

= 500,000 common shares

88. What is Falwell's diluted earnings per share for 2006, rounded to the nearest cent? A) $3.14 B) $4.90 C) $4.34 D) Cannot determine from the given information. Answer: C Rationale: The computation ($ in 000's) is as follows: net preferred income $2,500,000 dividends - (50,000 x $100 x 6%) $2,200,000 506,667 shares = $4.34/share

= 500,000 + 6,667 * common shares net shares added from on 1/1/06 conversion of options

*10,000 options x 20 shares/option = 200,000 shares; Proceeds = 200,000 x $29 = $5,800,000 $5,800,000 / $30 per share = 193,333 shares of treasury stock Net shares added = 200,000 - 193,444 = 6,667 43. ABC declared and paid cash dividends in January of the current year to its common shareholders. The dividend: A) Will be added to the numerator of the earnings per share fraction for the current year. B) Will be added to the denominator of the earnings per share fraction for the current year. C) Will be subtracted from the numerator of the earnings per share fraction for the current year. D) Has no effect on the earnings per share for the coming year. Answer: D 45. When a company's only potential common shares are convertible bonds: A) Diluted EPS will be greater if the bonds are actually converted than if they are not converted. B) Diluted EPS will be smaller if the bonds are actually converted than if the bonds are not converted.

C) Diluted EPS will be the same whether or not the bonds are converted. D) The effect of conversion on diluted EPS cannot be determined without additional information. Answer: C 49.When computing earnings per share, cumulative preferred dividends not declared should be: A) Deducted from earnings for the year. B) Deducted, net of tax effect, from earnings for the year. C) Added to earnings for the year. D) Ignored. Answer: A 51.Which of the following is a correct statement concerning earnings per share? A) Earnings per share can never be a negative number. B) Earnings per share must be reported for all corporations. C) If a company has an extraordinary loss, at least two EPS amounts must be reported. D) Reported earnings per share is the result of dividing weighted-average shares by net income. Answer: C 56.When computing diluted earnings per share, stock options: A) Are included if they are antidilutive. B) Should be ignored. C) Are included if they are dilutive. D) Increase the numerator while not affecting the denominator. Answer: C 57. Basic and diluted earnings per share data are required to be reported: A) In footnotes to the financial statements. B) Only if they add to the relevance of the income statement. C) In the summary section of the annual report. D) On the face of the income statement. Answer: D 58.Which of the following will require a recalculation of weighted-average shares outstanding for all years presented? A) Stock dividends and stock splits. B) Stock dividends but not stock splits. C) Stock splits but not stock dividends. D) Stock rights. Answer: A 59. All other things equal, what is the effect on earnings per share when a corporation acquires shares of its own stock on the open market? A) Decrease.

B) No effect if the shares are held as treasury shares. C) Increase only if the shares are considered to be retired. D) Increase. Answer: D 60. If a stock dividend were distributed, when calculating the current year's EPS, the shares distributed are treated as having been issued: A) At the end of the year. B) At the beginning of the year. C) On the declaration date. D) On the date of distribution. Answer: B 61.If a stock split occurred, when calculating the current year's EPS, the shares are treated as issued: A) At the end of the year. B) On the first day of the next fiscal year. C) At the beginning of the year. D) On the date of distribution. Answer: C 69.Stock options do not affect the calculation of: A) Diluted EPS. B) Weighted-average common shares. C) The denominator in the diluted EPS fraction. D) Basic EPS. Answer: D 70. The calculation of diluted earnings per share assumes that stock options were exercised and that the proceeds were used to: A) Buy common stock as an investment. B) Retire preferred stock. C) Buy treasury stock. D) Increase net income. Answer: C 71. The calculation of diluted earnings per share assumes that stock options were exercised and that the proceeds were used to buy treasury stock at: A) The end-of-year market price. B) The average market price during the period. C) The purchase price stated on the options. D) The stock's par value. Answer: B 72. When we assume conversion of convertible bonds, the numerator is increased by:

A) B) C) D)

The amount of after-tax interest. The gross amount of interest. The weighted-average interest. The amount of cash paid during the current year for interest.

Answer: A 74.When we take into account the dilutive effect of convertible securities in the calculation of EPS, the method used is called the: A) Treasury stock method. B) If converted method. C) Optional method. D) Dilution method. Answer: B 75. Nonconvertible bonds affect the calculation of: A) Basic earnings per share. B) Diluted earnings per share. C) Both A and C. D) None of the above is correct. Answer: D 76. A simple capital structure might include: A) Stock rights. B) Convertible bonds. C) Nonconvertible preferred stock. D) Stock purchase warrants. Answer: C 100.On December 31, 2005, Albacore Company had 300,000 shares of common stock issued and outstanding. Albacore issued a 10% stock dividend on June 30, 2006. On September 30, 2006, 12,000 shares of common stock were reacquired as treasury stock. What is the appropriate number of shares to be used in the basic earnings per share computation for 2006? A) 303,000. B) 342,000. C) 312,000. D) 327,000. Answer: D Rationale: (300,000 x 1.10) (12,000 x 3/12) = 327,000 101. On December 31, 2005, Beta Company had 300,000 shares of common stock issued and outstanding. Beta issued a 5% stock dividend on June 30, 2006. On September 30, 2006, 40,000 shares of common stock were reacquired as treasury stock. What is the appropriate number of shares to be used in the basic earnings per share computation for 2006? A) 315,000. B) 307,500.

C) 305,000. D) 267,500. Answer: C Rationale: (300,000 x 1.05) (40,000 x 3/12) = 305,000 103.On December 31, 2005, the Frisbee Company had 250,000 shares of common stock issued and outstanding. On March 31, 2006, the company sold 50,000 additional shares for cash. Frisbee's net income for the year ended December 31, 2006 was $700,000. During 2006, Frisbee declared and paid $80,000 in cash dividends on its nonconvertible preferred stock. What is the 2006 basic earnings per share? A) $2.16. B) $3.50. C) $3.10. D) $2.80. Answer: A Rationale: $700,000 $80,000 $620,000 = = $2.16 250,000 + (50,000 x 9/12) 287,500 105.Getaway Travel Company reported net income for 2006 in the amount of $50,000. During 2006, Getaway declared and paid $2,000 in cash dividends on its nonconvertible preferred stock. Getaway also paid $10,000 cash dividends on its common stock. Getaway had 40,000 common shares outstanding from January 1 until 10,000 new shares were sold for cash on July 1, 2006. A 2-for-1 stock split was granted on July 5, 2006. What is the 2006 basic earnings per share? A) $.42. B) $.47. C) $.53. D) $.56. Answer: C Rationale: $50,000 $2,000 $48,000 = = $.53 (40,000 x 2) + (10,000 x 6/12 x 2) 90,000 110.At December 31, 2006, Hansen Corporation had 50,000 shares of common stock and 5,000 shares of 6%, $100 par cumulative preferred stock outstanding. No dividends were declared or paid in 2006. Net income was reported as $200,000. What is basic EPS? A) $4.00. B) $3.40. C) $3.64. D) $4.02. Answer: B Rationale: Learning Objective: 8 Level of Learning: 3

$200 ,000 30 ,000 $170 ,000 = = $3.40 50 ,000 50 ,000

119.During the current year, High Corporation had 3 million shares of common stock outstanding. Five thousand, $1,000, 6% convertible bonds were issued at face amount at the beginning of the year. High reported income before tax of $4 million and net income of $2.4 million for the year. Each bond is convertible into ten shares of common. What is diluted EPS? A) $.85. B) $.86. C) $.80. D) $.79. Answer: A Learning Objective: 10 Level of Learning: 3 Rationale: $2,400,000 + [$300,000 x (1 - 40%*)] $2,580,000 = = $.85 3,000,000 + (5,000 x 10) 3,050,000 131.Nagy Industries reported a net income of $619,369 on December 31, 2006. At the beginning of the year, the company had 500,000 common shares outstanding. On April 1, the company sold 27,000 shares for cash. On August 31, the company issued 48,000 additional shares as part of a merger. On December 1, 2006, the company declared and issued a 10% stock dividend. Required: Compute Nagy's net income that would produce a basic EPS of $2.00 per share for 2006. Answer: (500,000 x 1.10) + (27,000 x 9/12 x 1.10) + (48,000 x 4/12 x 1.10) = 589,875 weightedaverage shares X/589,875 = $2.00 EPS X = $1,179,750 137. On January 1, 2006, Shamu Corporation had 100,000 shares of common stock outstanding. The following transactions occurred during 2006: March 1: September 30: December 1: December 31: Reacquired 3,000 shares, accounted for as treasury stock. Sold all the treasury shares. Sold 12,000 new shares for cash. Reported a net income of $198,500.

The following transactions occurred during 2007: January 10: December 31: Declared and issued a 25% stock dividend. Reported a net income of $268,800.

Required: Calculate Shamu's basic earnings per share for both years for presentation in comparative financial statements that will be prepared at the end of 2006. Answer:

2006 EPS* 2006:

$198 ,500 = $1. [(100 ,000 1.25 ) (3,000 10 / 12 1.25 ) + (3,000 3 / 12 1.25 ) + (12 ,000 1 / 12 1.25 )]

2007:

$268,800 = $1.92 (100,000 3,000 + 3,000 + 12,000) x 1.25

*Since comparative financial statements are being reported in 2007, EPS for 2006 must be recalculated to reflect the stock dividend. 145. XYZ Company had 200,000 shares of common stock outstanding on December 31, 2005. On July 1, 2006, XYZ issued an additional 50,000 shares for cash. On January 1, 2006, XYZ issued 20,000 shares of convertible preferred stock. The preferred stock had a par value of $100 per share and paid a 5% dividend. Each share of preferred stock is convertible into 8 shares of common. During 2006, XYZ paid the regular annual dividend on the preferred and common stock. Net income for the year was $300,000. Required: Calculate XYZ's basic and diluted earnings per share for 2006. Answer: Basic [$300,000 - ($100 x 5% x 20,000)]/[(200,000 + (50,000 x 6/12)] = $.89 EPS Diluted $300,000 /[(200,000 + (50,000 x 6/12) + (20,000 x 8)] = $.78 EPS

Vous aimerez peut-être aussi

- DMP3e CH12 Solutions 05.17.10 RevisedDocument41 pagesDMP3e CH12 Solutions 05.17.10 Revisedmichaelkwok1Pas encore d'évaluation

- Financial-Management 345Document1 pageFinancial-Management 345khurramPas encore d'évaluation

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- c2 2Document3 pagesc2 2Kath LeynesPas encore d'évaluation

- Sol Man - MC PTXDocument5 pagesSol Man - MC PTXiamjan_101Pas encore d'évaluation

- CHAPTER 11 Without AnswerDocument3 pagesCHAPTER 11 Without Answerlenaka0% (1)

- ToaDocument5 pagesToaGelyn CruzPas encore d'évaluation

- EXERCISES On EARNINGS PER SHAREDocument4 pagesEXERCISES On EARNINGS PER SHAREChristine AltamarinoPas encore d'évaluation

- DocxDocument12 pagesDocxNothingPas encore d'évaluation

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorPas encore d'évaluation

- Contributed CapitalDocument3 pagesContributed CapitalCharize YebanPas encore d'évaluation

- F3ch2dilemna Socorro SummaryDocument8 pagesF3ch2dilemna Socorro SummarySushii Mae60% (5)

- CHAPTER 9 Without AnswerDocument6 pagesCHAPTER 9 Without AnswerlenakaPas encore d'évaluation

- Here Is The Condensed 2008 Balance Sheet For Skye ComputerDocument1 pageHere Is The Condensed 2008 Balance Sheet For Skye ComputerAmit PandeyPas encore d'évaluation

- ARTS CPA Review ARTS CPA ReviewDocument28 pagesARTS CPA Review ARTS CPA ReviewAG VenturesPas encore d'évaluation

- Chapter 19 - Consol. Fs Part 4Document17 pagesChapter 19 - Consol. Fs Part 4PutmehudgJasdPas encore d'évaluation

- 05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersDocument6 pages05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersMerr Fe PainaganPas encore d'évaluation

- Chapter 35Document7 pagesChapter 35loisePas encore d'évaluation

- UntitledDocument12 pagesUntitledMaykel BolañosPas encore d'évaluation

- B. Winnings Not Exceeding 10,000 D. Interest Income From Bank DepositsDocument3 pagesB. Winnings Not Exceeding 10,000 D. Interest Income From Bank DepositsVanesa Calimag ClementePas encore d'évaluation

- Taxation Law Reviewer Highlights Key ConceptsDocument19 pagesTaxation Law Reviewer Highlights Key ConceptsPatricia Blanca SDVRPas encore d'évaluation

- Financial Management 2Document6 pagesFinancial Management 2Julie R. UgsodPas encore d'évaluation

- Financial Statement Analysis: Select A Tab To Get StartedDocument33 pagesFinancial Statement Analysis: Select A Tab To Get StartedHarold Beltran DramayoPas encore d'évaluation

- Problem2 Financial ManagementDocument4 pagesProblem2 Financial ManagementCamille MenesesPas encore d'évaluation

- Financial Accounting ExamDocument12 pagesFinancial Accounting Examjano_art21Pas encore d'évaluation

- E. All of The Above. A. Total Revenue Equals Total CostDocument22 pagesE. All of The Above. A. Total Revenue Equals Total CostNicole KimPas encore d'évaluation

- Group 1 ThesisDocument9 pagesGroup 1 ThesisFallcia B. AranconPas encore d'évaluation

- Lesson1-Fundamentals of SAP1Document16 pagesLesson1-Fundamentals of SAP1Sharmaine Joy SurPas encore d'évaluation

- Earnings Per ShareDocument3 pagesEarnings Per ShareYeshua DeluxiusPas encore d'évaluation

- Calculate basic earnings per share (BEPS) for two companiesDocument2 pagesCalculate basic earnings per share (BEPS) for two companiesdagohoy kennethPas encore d'évaluation

- Multiple Choice Questions on VAT Exemptions for Agricultural and Marine Food ProductsDocument20 pagesMultiple Choice Questions on VAT Exemptions for Agricultural and Marine Food ProductsKean Leigh Felicano IIIPas encore d'évaluation

- Acc2002 PPT FinalDocument53 pagesAcc2002 PPT FinalSabina TanPas encore d'évaluation

- Quiz#5 - Wacc-Levrage Student 25q-25ptsDocument4 pagesQuiz#5 - Wacc-Levrage Student 25q-25ptsVinícius AlvesPas encore d'évaluation

- Examination About Investment 8Document3 pagesExamination About Investment 8BLACKPINKLisaRoseJisooJenniePas encore d'évaluation

- Personal Online Banking - BDO Network Bank, Inc.Document2 pagesPersonal Online Banking - BDO Network Bank, Inc.Kenneth Dumdum HermanochePas encore d'évaluation

- Chapter 13 - AnswerDocument36 pagesChapter 13 - Answerlooter198Pas encore d'évaluation

- Fin Man Case Study On Fs AnalysisDocument6 pagesFin Man Case Study On Fs AnalysisRechellePas encore d'évaluation

- Book Value Per Share Basic Earnings PerDocument61 pagesBook Value Per Share Basic Earnings Perayagomez100% (1)

- Interim and Segment ReportingDocument6 pagesInterim and Segment Reportingallforgod19Pas encore d'évaluation

- Consolidated Balance Sheets and Income Statements of Pare and SubsidiaryDocument3 pagesConsolidated Balance Sheets and Income Statements of Pare and SubsidiaryRaymundo Eirah100% (1)

- Chap 8 Responsibility AccountingDocument51 pagesChap 8 Responsibility AccountingXel Joe BahianPas encore d'évaluation

- Assignment Transfer Tax ComputationDocument3 pagesAssignment Transfer Tax ComputationAngelyn SamandePas encore d'évaluation

- 2019 11 30 Acc222 Exercises01Document1 page2019 11 30 Acc222 Exercises01Primitivo Suasin Bangahon Jr.Pas encore d'évaluation

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianPas encore d'évaluation

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerPas encore d'évaluation

- Acctg 2 QuizDocument4 pagesAcctg 2 QuizAshNor RandyPas encore d'évaluation

- Inventories (Avi)Document13 pagesInventories (Avi)chowchow123Pas encore d'évaluation

- Asset Turnover, ROI, and Financial Ratios Practice TestDocument5 pagesAsset Turnover, ROI, and Financial Ratios Practice TestMaketh.ManPas encore d'évaluation

- Chapter 7 Problems Speed and Refrigerator StatsDocument2 pagesChapter 7 Problems Speed and Refrigerator StatsEhab hoba100% (1)

- Introduction To Business Combinations: Summary of Items by TopicDocument30 pagesIntroduction To Business Combinations: Summary of Items by TopicKyla Ramos DiamsayPas encore d'évaluation

- Separate Financial Statements Chapter 20Document2 pagesSeparate Financial Statements Chapter 20PutmehudgJasdPas encore d'évaluation

- Reporting Segment InformationDocument8 pagesReporting Segment InformationGlen JavellanaPas encore d'évaluation

- Toa Quizzer 1: Multiple ChoiceDocument18 pagesToa Quizzer 1: Multiple ChoiceRukia KuchikiPas encore d'évaluation

- Comprehensive Income & Discontinued Oper PDFDocument8 pagesComprehensive Income & Discontinued Oper PDFDarwin Competente Lagran0% (1)

- Identifying Disposal Groups and Noncurrent Assets Held for SaleDocument1 pageIdentifying Disposal Groups and Noncurrent Assets Held for SalestudentonePas encore d'évaluation

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Document4 pagesPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangPas encore d'évaluation

- Chapter 6 Cost-Volume-Profit Relationships Multiple Choice QuestionsDocument12 pagesChapter 6 Cost-Volume-Profit Relationships Multiple Choice QuestionsKhaled Abo YousefPas encore d'évaluation

- Chapter 11 Risk and Return in Capital Markets Key ConceptsDocument14 pagesChapter 11 Risk and Return in Capital Markets Key ConceptsshuPas encore d'évaluation

- Exam 3 Review and Sample ProblemsDocument14 pagesExam 3 Review and Sample ProblemsCindy MaPas encore d'évaluation

- Dividend Policy 1Document9 pagesDividend Policy 1Almira BesoniaPas encore d'évaluation

- BCSV5.2 - Organization and FormationDocument9 pagesBCSV5.2 - Organization and Formationjam linganPas encore d'évaluation

- Sources of FinanceDocument32 pagesSources of FinanceDeepshikha Gupta100% (1)

- TM 8: Mid Term Test Tm9: Stakeholder'S Roles and ResponsibilityDocument18 pagesTM 8: Mid Term Test Tm9: Stakeholder'S Roles and ResponsibilitysharaPas encore d'évaluation

- Qualified Vendors List (QVL)Document4 pagesQualified Vendors List (QVL)Niél ÓliverPas encore d'évaluation

- Stock Near One Year High in Indian Stock MarketDocument15 pagesStock Near One Year High in Indian Stock MarketSagar DeshpandePas encore d'évaluation

- Company Law Registration and IncorporationDocument10 pagesCompany Law Registration and IncorporationAyush BansalPas encore d'évaluation

- PP Os Module 1 Dec 20Document70 pagesPP Os Module 1 Dec 20Komal ShahaPas encore d'évaluation

- Placement 2021Document16 pagesPlacement 2021Physics loverPas encore d'évaluation

- Lesson 2 Organization PDFDocument20 pagesLesson 2 Organization PDFAngelita Dela cruzPas encore d'évaluation

- Founders Forum 2020Document17 pagesFounders Forum 2020CodyPas encore d'évaluation

- NABSAMRUDDHI FINANCE ANNUAL REPORT 2021-22Document112 pagesNABSAMRUDDHI FINANCE ANNUAL REPORT 2021-22Sumit Kumar GuptaPas encore d'évaluation

- Bse 20171024Document53 pagesBse 20171024BellwetherSataraPas encore d'évaluation

- Week4-23-28 Sept 2019 ModifiedDocument592 pagesWeek4-23-28 Sept 2019 ModifiedArka GangulyPas encore d'évaluation

- Airan Limited - Annual Report - 18-19 PDFDocument128 pagesAiran Limited - Annual Report - 18-19 PDFSneha SehgalPas encore d'évaluation

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaPas encore d'évaluation

- Surfside Beach PPP DataDocument4 pagesSurfside Beach PPP DataWMBF NewsPas encore d'évaluation

- Company Name Regional Office Sr. NoDocument9 pagesCompany Name Regional Office Sr. NosheelPas encore d'évaluation

- Business Quiz: By: T.Saisrinivas J.RushvikDocument67 pagesBusiness Quiz: By: T.Saisrinivas J.RushvikRavi TejaPas encore d'évaluation

- Dividend: HistoryDocument20 pagesDividend: Historyanup bhattPas encore d'évaluation

- 10 Tech Stocks That Could Triple The - Perfect 10 - Portfolio - InvestorPlaceDocument5 pages10 Tech Stocks That Could Triple The - Perfect 10 - Portfolio - InvestorPlaceJorge VasconcelosPas encore d'évaluation

- PFRS 11 Joint ArrangementsDocument2 pagesPFRS 11 Joint ArrangementsElla MaePas encore d'évaluation

- PYFA Annual Report 2018Document160 pagesPYFA Annual Report 2018leddy teresaPas encore d'évaluation

- Financial Management Sources and SecuritiesDocument49 pagesFinancial Management Sources and SecuritiesKishore JohnPas encore d'évaluation

- Raport Kroll II OcrDocument154 pagesRaport Kroll II OcrSergiu BadanPas encore d'évaluation

- PS2023Document50 pagesPS2023Lucky PrincePas encore d'évaluation

- Benefits Of Bank Mergers And AcquisitionsDocument15 pagesBenefits Of Bank Mergers And AcquisitionsSantosh kumar sahooPas encore d'évaluation

- Introducing Shopee - Leading E-Commerce Platform in SEADocument4 pagesIntroducing Shopee - Leading E-Commerce Platform in SEACuong VUongPas encore d'évaluation

- Instruction: Show Your Solution. No Solution Incorrect AnswerDocument1 pageInstruction: Show Your Solution. No Solution Incorrect AnswerRian ChiseiPas encore d'évaluation

- KPMG's JP en Asean M&a 2019Document5 pagesKPMG's JP en Asean M&a 2019VINA FAUZIA NURAINIPas encore d'évaluation

- Retained EarningsDocument8 pagesRetained Earningsjelai anselmoPas encore d'évaluation