Académique Documents

Professionnel Documents

Culture Documents

Investment Multiplier

Transféré par

Rishi BansalDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Investment Multiplier

Transféré par

Rishi BansalDroits d'auteur :

Formats disponibles

ASSIGNMENT ON INVESTMENT MULTIPLIER

SUBMITTED TO AMRINDER SINGH

SUBMITTED BY GAURAV KATARIA (5706) MBA-1, SEC -E

SCHOOL OF MANAGEMENT STUDIES, PUNJABI UNIVERSITY PATIALA

INTRODUCTION TO INVESTMENT MULTIPLIER Investment Multiplier tells us about the changes in income for changes in the investment. The concept o Multiplier was developed by Kahn. With change in the investment here will be a change in the income, because the investment expenditure turns into income. There after the income induce the consumption to increase depending on the level of marginal propensity of consumption. This way an increase in the consumption expenditure creates incomes in the second round. The induced income again increases the consumption. This cycle repeats and an increase in the investment generates income several times more. This is called as the multiplier effect. WHAT IS THE INVESTMENT MULTIPLIER? Investment multiplier is simply the multiplier effect of an injection of investment into an economy. In general, a multiplier shows how a sum injected into an economy travels and generates more output. For example if you buy $100 worth of chips. Say the stallowner saves $10 and spends $90 on burgers. Then the burger stall owner saves 10% that is $9 and consumes the rest ($81) on cheese, and so on... Each $ receivedm 10% is saved (marginal propensity to save- MPS) and 90% consumed (marginal propensity to consume - MPC). This eventually results in 100/(1-.9)=$1000 worth of expenditure in the economy. The multiplier=1/(1-MPC). The investment multiplier is simply the same idea applied to an increase in investment as opposed to consumption above. Using consumption just makes it easier to understand; investment multiplier is just the same. Now, autonomous investment increases for many reasons. People might start believing that better times are ahead, hence prepare for the future. Another could be that more people decide to become entrepreneurs. Another could be government policies that make small loans available for SMEs. Another could be peace rather than war. Another could be change in trade reginme towards an open economy so people try to invest to export... hope that helped.

MULTIPLIER EFFECT The multiplier has a time lag. The multiplier works into the long run. Each year some income is added and consumption is generated. This may taper with time but it shall continue for ever, theoretically. This is called multiplier effect

DERIVATION OF MULTIPLIER

Illustration For a given change in the Investment of Rs. 10,000 cr and a MPC of 0.5: Multiplier is the inverse of Marginal Propensity of Consumption.

Then the multiplier value shall be 2. For the given illustration the Y will

increase to Rs, 20,000 cr Working of Multiplier

ASSUMPTIONS OR LIMITATIONS OR LEAKAGES IN MULTIPLIER 1. Multiplier effect lasts over a larger time period. There is time lag in the realization of multiplier effect. So in the short run only a part of the multiplier effect can be got. The remaining is considered as a leakage n the multiplier. 2. If the increased incomes are used in the repayment of old debts, the multiplier effect stops. 3. The increased incomes shall be spent on domestic consumption only. Money pent on imports will shift the multiplier effect outside the country. 4. With increased incomes the Government increases tax, the multiplier effect reduces. This is because the disposable income decreases each time. 5. There shall not be liquidity preference. If people hold cash balances with out spending the multiplier effect stops. 6. Investment in second hand securities and gold reduces multiplier effect. 7. There should be excess capacity in the industry to produce goods with increasing demand for consumer goods.

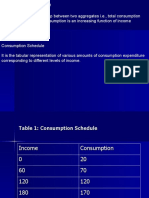

WHAT IS CONSUMPTION FUNCTION? HOW IS IT DETERMINED? Consumption function is also called propersity to consume. Consumption means amount spent on consumption at a given level of income. Consumption function or propersity to consume means the whole of schedule showing consumption expenditure at various level of income. FACTORS INFLUENCE CONSUMPTION These factors are 1. The real income of the individual. 2. His Past savings. 3. Rate of interest. Income plays a major role in order to influence consumption function. Past saving are very small and for specific purpose like contributions to social security (Pension etc). Rate of interest encourage some people save more to earn a higher rate of interest. AVERAGE AND MARGINAL PROPERSITY TO CONSUMER The r/s between income and consumption is measured by the average and marginal propersity to consume. APC = C / Y [Where C --> Consumption and Y --> Income] APC is the ratio of consumption and income where MPC = /\ C / /\Y MPC is the rate of change in consumption to the change in income. The normal r/s between income and consumption is such that income rises, consumption also rises, but by less than the rise in come.

WHAT IS MARGINAL PROPERSITY TO CONSUME? SHOW HOW MULTIPLIER DEPENDS ON THE MAGNITUDE OF THE MPC. MPC shows r/s between a given rise in investing and the resulting change in income. Suppose we invest 100Rs, so we expect more than that as additional income. We spend some amount from additional income and save the rest income. Additional spending depends on their MPC. Now we suppose MPC is 3/4. Then they will spend 75 Rs and save 25 Rs. If the MPC is stable the series of consecutive expenditure becomes. /\(income) Y = 100 + 100 x (3/4) + 100 x (3/4)2 + 100 x (3/4)3 => /\Y = 100 [1 + (3/4) + (3/4)2 + (3/4)3 + ......] We see that an initial primary investment of 100 Rs gives rise to an icrease of 40 Rs in the National Income. The investment Multiplier measures the r/s between an increase in income caused by a primary increase in investment Investment Multiplier = /\Y / /\I In our case, Multiplier = 400/100 = 4 Multiplier is given by the following formula Multiplier = I / I MPC If MPC = 4/5 than Multiplier is 5 If MPC = 9/10 than Multiplier is 10 But If MPC = 1 than Multiplier is infinite this shows a little increase of investment will load automatically a full employment. If MPC = 0 than Multiplier = 1 shows increase in investment is equal to increase in total income.

Limitation of the Multiplier Concept The factors which tends to reduce multiplying effect are called Leakage. The various limitation of multiplier are 1. MPC Not Constant MPC is assumed constant in keyness concept of multiplier so that mps will necassarily be constant. Keyness ignor the possibility of leakager. In dynamic economy MPC or MPS never be constant. 2. Debit Concellation If people use a part of new increment in income to repay their add debts instead of spending on further consumption. 3. Purchase of Old Stock and Securities If new income is spent on buying on buying old stock, shares and securities, consumption will be less and multiplies in respect will be low. 4. Net Imports If import is greater than export than if means outflow of funds to foreign coutries. 5. Price Inflation If the price of goods increase mpc will automatically increase. Instead of all above problem, Multiplier have very importance in economics and for economics policy. Its play a vital role as an instrument of income.

DISTINGUISH BETWEEN AUTONOMOUS AND INTRODUCED INVESTMENT ON WHAT FACTORS INVESTMENT DEPEND? In the keynessian system employment depends upon effective demand. Effective demand should be constitute of investment and consumption. Investment mean addition to stock of capital to the nations like building of new factories, new machines etc. Autonomous and Induced Investment is done by Govt. for promoting peoples welfares as under plan developed. Induced investment is made by the people as a result of change in income level or consumption. CONCEPT OF MARGINAL EFFICIENCY OF CAPITAL (MEC) It has very importance in macro economics. When ever an enterprise makes a certain investment in his business, he first looks into the marginal efficiency of capital. What return he is going to certain from the given investment. MEC is the expected rate of profit of a new capital asset. Lets suppose, we invest 10,000 Rs on purchase of new machine. The net return of this machine is expected to Rs. 1000 per annum, The MEC will be 1000/10000 x 100 = 10% Show the ratio of expected annual return.

FACTORS ON WHICH INVESTMENT DEPENDS. Investment depends on 1. MEC 2. Rate of Interest 1. MEC The MEC is the expected annual rate of return on an additional unit of a capital good. According to Keynels The MEC is the rate of discount which makes the present value of the prospective field from the Capital asset equal to its supply price. MEC is -vely shoped. 2. Rate of Interest As the investment increases the rate of interest also increase so MEC decline. Factors Effecting MEC MEC is influenced by shortrun as well as long run factors. These are A. Short Run Factors i. Demand for the Product. ii. Liquid Assets. iii. Sudden changes in income. iv. Current rate of investment. B. Long Run Factors i. Rate of Growth of Population ii. Technological Development iii. Rate of Taxes.

Vous aimerez peut-être aussi

- Jesse Livermore-How To Trade in Stocks (1940 Original) - EN PDFDocument80 pagesJesse Livermore-How To Trade in Stocks (1940 Original) - EN PDFSteve Yarnall100% (4)

- 2018 July 20 CME Advanced Gap TechniquesDocument19 pages2018 July 20 CME Advanced Gap TechniquesVinicius FreitasPas encore d'évaluation

- Strategic ManagementDocument98 pagesStrategic Managementvandanaprab88% (48)

- Lec-12B - Revison - Consumption Savings and InvestmentDocument24 pagesLec-12B - Revison - Consumption Savings and InvestmentMsKhan0078Pas encore d'évaluation

- Consumption Function and MultiplierDocument24 pagesConsumption Function and MultiplierVikku AgarwalPas encore d'évaluation

- Chap 4 CVP AnalysisDocument47 pagesChap 4 CVP Analysisyanachii22100% (1)

- Ricardian Theory of Rent/ Classical Theory of RentDocument4 pagesRicardian Theory of Rent/ Classical Theory of Rentrspa100% (1)

- Big Push Theory of DevelopmentDocument2 pagesBig Push Theory of DevelopmentPankaj Patil100% (1)

- The Investment MultiplierDocument12 pagesThe Investment MultipliersurbhissPas encore d'évaluation

- Keynesian Investment MultiplierDocument13 pagesKeynesian Investment MultiplierBhart BhardwajPas encore d'évaluation

- Classical Theory of Full EmploymentDocument16 pagesClassical Theory of Full Employmentsuchitracool1100% (1)

- Production FunctionDocument29 pagesProduction Functionsinghanshu21100% (2)

- Tax Incidence and Shifting ExplainedDocument12 pagesTax Incidence and Shifting ExplainedRajesh ShahiPas encore d'évaluation

- Project Report On Portfolio ManagementDocument118 pagesProject Report On Portfolio ManagementMohan Chakradhar100% (1)

- Post-Keynesion Approach To Demand For MoneyDocument7 pagesPost-Keynesion Approach To Demand For MoneyAppan Kandala Vasudevachary100% (7)

- Capital BudgetingDocument23 pagesCapital BudgetingNoelJr. Allanaraiz100% (4)

- Determination of Income & Employment Powerpoint PresentationDocument38 pagesDetermination of Income & Employment Powerpoint Presentationdevesh soniPas encore d'évaluation

- Role of Money in Developing and Mixed EconomyDocument3 pagesRole of Money in Developing and Mixed EconomyAjeet KrishnamurthyPas encore d'évaluation

- Investment Multiplier - EconomicsDocument5 pagesInvestment Multiplier - Economicsanon_357116694100% (1)

- 9.6 Keynesian MultiplierDocument23 pages9.6 Keynesian MultiplierkimmoPas encore d'évaluation

- Foreign Trade Multilier and Global RepercussionsDocument8 pagesForeign Trade Multilier and Global RepercussionsangelPas encore d'évaluation

- Theory of MultiplierDocument9 pagesTheory of MultiplierUday PanditPas encore d'évaluation

- Rural-Urban Migration ModelDocument5 pagesRural-Urban Migration ModelSilviaPas encore d'évaluation

- Chapter Two-Four Sector EconomyDocument27 pagesChapter Two-Four Sector Economynotes.mcpu0% (1)

- Nelson's Low Level Equilibrium Trap Theory ExplainedDocument3 pagesNelson's Low Level Equilibrium Trap Theory ExplainedKris Sara Sajiv100% (1)

- Investment FunctionDocument18 pagesInvestment FunctionRishab Jain 2027203Pas encore d'évaluation

- Marginal Productivity Theory of Distribution (2388) - PROJECTDocument16 pagesMarginal Productivity Theory of Distribution (2388) - PROJECTAnushka Sharma100% (1)

- Baumol Inventory Theory - Amitabha SarkarDocument3 pagesBaumol Inventory Theory - Amitabha SarkarTripti Dutta100% (1)

- MultiplierDocument47 pagesMultiplierShruti Saxena100% (3)

- Microeconomics FundamentalsDocument128 pagesMicroeconomics FundamentalsJEMALYN TURINGAN0% (1)

- Meade's Model of Economic Growth and DeterminantsDocument18 pagesMeade's Model of Economic Growth and DeterminantsHasanah Ameril100% (1)

- Nature and Structure of EconomyDocument3 pagesNature and Structure of EconomyAnkita Kumari SinghPas encore d'évaluation

- Maximize Profits with Producer EquilibriumDocument15 pagesMaximize Profits with Producer EquilibriumNidhish Thampi100% (1)

- Goods and Money Market InteractionsDocument25 pagesGoods and Money Market Interactionsparivesh_kmr0% (1)

- JMK's Psychological Law of ConsumptionDocument3 pagesJMK's Psychological Law of ConsumptionPrasanthi Dornadula100% (1)

- Harrod Model of Growth Explained in DepthDocument6 pagesHarrod Model of Growth Explained in Depthvikram inamdarPas encore d'évaluation

- Inflationary & Deflationary GapDocument6 pagesInflationary & Deflationary GaprosheelPas encore d'évaluation

- Liquidity Preference Theory PDFDocument12 pagesLiquidity Preference Theory PDFgaurav singhPas encore d'évaluation

- Producer Equilibrium/Least Cost Combination: AssumptionsDocument5 pagesProducer Equilibrium/Least Cost Combination: AssumptionsJessy SinghPas encore d'évaluation

- Harrod Domar WPDocument14 pagesHarrod Domar WPtalha hasib0% (1)

- Keynesian Theory of Income and Employment (KYNDocument29 pagesKeynesian Theory of Income and Employment (KYNDhanesh MohanachandranPas encore d'évaluation

- 5 Phases of A Business CycleDocument5 pages5 Phases of A Business CycleValerie CoPas encore d'évaluation

- The Simple Keynesian Model of Income Determination ExplainedDocument60 pagesThe Simple Keynesian Model of Income Determination ExplainedRakesh Seela100% (2)

- Comparative Advantage Theory in <40 CharactersDocument37 pagesComparative Advantage Theory in <40 CharactersRohit Kumar100% (1)

- Isoquant Curve Properties and AssumptionsDocument3 pagesIsoquant Curve Properties and AssumptionsRameesha RehmanPas encore d'évaluation

- Fiscal and Monetary Policies of IndiaDocument13 pagesFiscal and Monetary Policies of IndiaRidhika GuptaPas encore d'évaluation

- CBSE Class 12 Economics Full Study MaterialDocument85 pagesCBSE Class 12 Economics Full Study Materialsakshamkohli97Pas encore d'évaluation

- Relative Income HypothesisDocument8 pagesRelative Income Hypothesisthafsira100% (2)

- Concept of Money SupplyDocument7 pagesConcept of Money SupplyMD. IBRAHIM KHOLILULLAHPas encore d'évaluation

- Consumption FunctionDocument15 pagesConsumption FunctionAkshat MishraPas encore d'évaluation

- Marginal Efficiency of CapitalDocument21 pagesMarginal Efficiency of CapitalVikku Agarwal100% (3)

- Consumption Function and Its TypesDocument13 pagesConsumption Function and Its TypesTashiTamangPas encore d'évaluation

- Trade CycleDocument6 pagesTrade CycleGhanshyam BhambhaniPas encore d'évaluation

- What Is Mercantilism?: Balance of TradeDocument6 pagesWhat Is Mercantilism?: Balance of TradeMarjorie Cabauatan BirungPas encore d'évaluation

- Supply of MoneyDocument13 pagesSupply of MoneyNonit Hathila100% (1)

- Cardinal and Ordinal UtilityDocument39 pagesCardinal and Ordinal UtilityAnkapa Naidu Dama78% (9)

- Main Market FormsDocument9 pagesMain Market FormsP Janaki Raman50% (2)

- 4.0 ProductionDocument17 pages4.0 ProductionNotYGurLzPas encore d'évaluation

- Balanced Growth TheoryDocument16 pagesBalanced Growth Theoryrabia liaqat100% (3)

- National IncomeDocument25 pagesNational Incomeshivamset576100% (2)

- National Income DeterminationDocument27 pagesNational Income Determinationsachinrema100% (1)

- Indifference Analysis ExplainedDocument91 pagesIndifference Analysis ExplainedShweta SinghPas encore d'évaluation

- The Investment MultiplierDocument7 pagesThe Investment MultiplierSai Ram Kumar100% (1)

- Macro CH 7 & 8 PDFDocument26 pagesMacro CH 7 & 8 PDFAKSHARA JAINPas encore d'évaluation

- Chapter 8Document11 pagesChapter 8Neelabh KumarPas encore d'évaluation

- The Theory of Multiplier and Acceleration Principle: Vaghela Nayan K. SDJ International CollegeDocument21 pagesThe Theory of Multiplier and Acceleration Principle: Vaghela Nayan K. SDJ International CollegeAnonymous y3E7iaPas encore d'évaluation

- 5th Sem (Macro-Economics) Super 25 Question & AnswerDocument17 pages5th Sem (Macro-Economics) Super 25 Question & Answersadfeel145Pas encore d'évaluation

- TelecomDocument6 pagesTelecomRishi BansalPas encore d'évaluation

- FactsheetDocument3 pagesFactsheetRishi BansalPas encore d'évaluation

- ETF BrochureDocument9 pagesETF BrochureamticrazyPas encore d'évaluation

- ESHANDocument6 pagesESHANRishi BansalPas encore d'évaluation

- 5663Document5 pages5663Rishi BansalPas encore d'évaluation

- ICICI Channel DevelopmentDocument56 pagesICICI Channel DevelopmentRishi BansalPas encore d'évaluation

- Stock and Bonds - ActivityDocument11 pagesStock and Bonds - Activitysab x btsPas encore d'évaluation

- Policy Details PageDocument2 pagesPolicy Details PageLuci PoroPas encore d'évaluation

- Ééêvéeþòié - Éeòé ÉxéDocument13 pagesÉéêvéeþòié - Éeòé ÉxéRakesh TanwaniPas encore d'évaluation

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaPas encore d'évaluation

- 3.1 Income Elasticity of DemandDocument35 pages3.1 Income Elasticity of DemandBighnesh MahapatraPas encore d'évaluation

- Chapter-2 Concept of DerivativesDocument50 pagesChapter-2 Concept of Derivativesamrin banuPas encore d'évaluation

- Quantitative ProblemsDocument8 pagesQuantitative ProblemsrahimPas encore d'évaluation

- Ultratech Cement ReportDocument19 pagesUltratech Cement Reportkishor waghmarePas encore d'évaluation

- Trial Balance December 2016Document1 pageTrial Balance December 2016Faie RifaiPas encore d'évaluation

- Economics Higher Level Paper 3: Instructions To CandidatesDocument6 pagesEconomics Higher Level Paper 3: Instructions To CandidatesAndres Krauss100% (1)

- Sale of City of Watertown Owned Properties March 2022Document2 pagesSale of City of Watertown Owned Properties March 2022NewzjunkyPas encore d'évaluation

- Multi-Act MSSP PMSDocument39 pagesMulti-Act MSSP PMSAnkurPas encore d'évaluation

- EOQDocument53 pagesEOQFredericfrancisPas encore d'évaluation

- The Value of Common Stocks: Principles of Corporate FinanceDocument27 pagesThe Value of Common Stocks: Principles of Corporate FinancechooisinPas encore d'évaluation

- SharingDocument21 pagesSharingAmber ZahraPas encore d'évaluation

- Tanzania Budget Highlights 2021-22Document35 pagesTanzania Budget Highlights 2021-22Arden Muhumuza KitomariPas encore d'évaluation

- Causes and Measures of Disequilibrium in Balance of PaymentsDocument6 pagesCauses and Measures of Disequilibrium in Balance of PaymentsMonika PathakPas encore d'évaluation

- Relevant Costing quiz solutionsDocument3 pagesRelevant Costing quiz solutionsFiona MoralesPas encore d'évaluation

- Economics of Strategy 6Th Edition PDF Full ChapterDocument41 pagesEconomics of Strategy 6Th Edition PDF Full Chapterrosa.green630100% (27)

- 05march 2019 - India - Daily PDFDocument39 pages05march 2019 - India - Daily PDFCoupant CapitalPas encore d'évaluation

- Ch17 - Money Growth and InflationDocument49 pagesCh17 - Money Growth and InflationĐào Việt PhúcPas encore d'évaluation

- CaseStudy PresentationDocument15 pagesCaseStudy PresentationMelisa KhawPas encore d'évaluation

- EOLA's Equity Distribution - v4Document18 pagesEOLA's Equity Distribution - v4AR-Lion ResearchingPas encore d'évaluation

- q17 Iaetrfcnrfc AnsDocument2 pagesq17 Iaetrfcnrfc AnsIan De DiosPas encore d'évaluation