Académique Documents

Professionnel Documents

Culture Documents

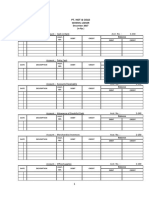

Invocing

Transféré par

Punit SharmaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Invocing

Transféré par

Punit SharmaDroits d'auteur :

Formats disponibles

An invoice or bill is a commercial document issued by a seller to the buyer, indicating the products, quantities, and agreed prices

for products or services the seller has provided the buyer. An invoice indicates the buyer must pay the seller, according to the payment terms. The buyer has a maximum amount of days to pay these goods and are sometimes offered a discount if paid before. In the rental industry, an invoice must include a specific reference to the duration of the time being billed, so rather than quantity, price and discount the invoicing amount is based on quantity, price, discount and duration. Generally speaking each line of a rental invoice will refer to the actual hours, days, weeks, months, etc being billed. From the point of view of a seller, an invoice is a sales invoice. From the point of view of a buyer, an invoice is a purchase invoice. The document indicates the buyer and seller, but the term invoiceindicates money is owed or owing. In English, the context of the term invoice is usually used to clarify its meaning, such as "We sent them an invoice" (they owe us money) or "We received an invoice from them" (we owe them money).

INVOICE:

A typical invoice contains

[1][2]

The word invoice (or Tax Invoice if in Australia and amounts include GST). A unique reference number (in case of correspondence about the invoice) Date of the invoice. Tax payments if relevant (e.g. GST or VAT) Name and contact details of the seller Tax or company registration details of seller (if relevant)[e.g. Australia Business Number (ABN) for Australian businesses.] Name and contact details of the buyer Date that the product was sent or delivered Purchase order number (or similar tracking numbers requested by the buyer to be mentioned on the invoice) Description of the product(s) Unit price(s) of the product(s) (if relevant) Total amount charged (optionally with breakdown of taxes, if relevant) Payment terms (including method of payment, date of payment, and details about charges for late payment)

In countries where wire transfer is the preferred method of settling debts the printed bill will contain the bank account number of the debtor and usually a reference code to be passed along the transaction identifying the payer. The US Defense Logistics Agency requires an employer identification number on invoices. The European Union requires a VAT (value added tax) identification number.

[3]

Recommendation about invoices used in international trade is also provided by the UNECE Committee on Trade, which involves more detailed description of logistics aspect of merchandise and therefore may [4] be convenient for international logistics and customs procedures.

VARITION:

There are different types of invoices: Pro forma invoice In foreign trade, a pro forma invoice is a document that states a commitment from the seller to provide specified goods to the buyer at specific prices. It is often used to declare value for customs. It is not a true invoice, because the seller does not record a pro forma invoice as an accounts receivable and the buyer does not record a pro forma invoice as an accounts payable. A pro forma invoice is not issued by the seller until the seller and buyer have agreed to the terms of the order. In few cases, pro forma invoice is issued for obtaining advance payments from buyer, either for start of production or for security of the goods produced. Credit memo - If the buyer returns the product, the seller usually issues a credit memo for the same or lower amount than the invoice, and then refunds the money to the buyer, or the buyer can apply that credit memo to another invoice. Commercial invoice - a customs declaration form used in international trade that describes the parties involved in the shipping transaction, the goods being transported, and the value of the [6] goods. It is the primary document used by customs, and must meet specific customs requirements, such as the Harmonized System number and the country of manufacture. It is used to calculate tariffs. Debit memo - When a company fails to pay or short-pays an invoice, it is common practice to issue a debit memo for the balance and any late fees owed. In function debit memos are identical to invoices. Self-billing invoice - A self billing invoice is when the buyer issues the invoice to himself (e.g. according to the consumption levels he is taking out of a vendor-managed inventory stock). Evaluated receipt settlement (ERS) - ERS is a process of paying for goods and services from a packing slip rather than from a separate invoice document. The payee uses data in the packing slip to apply the payments. "In an ERS transaction, the supplier ships goods based upon an Advance Shipping Notice (ASN), and the purchaser, upon receipt, confirms the existence of a corresponding purchase order or contract, verifies the identity and quantity of the goods, and then pays the [7] supplier."

Timesheet - Invoices for hourly services such as by lawyers and consultants often pull data from a timesheet. A Timesheet invoice may also be generated by Operated equipment rental companieswhere the invoice will be a combination of timesheet based charges and equipment rental charges. Invoicing - The term invoicing is also used to refer to the act of delivering baggage to a flight [citation needed] company in an airport before taking a flight. Statement - A periodic customer statement includes opening balance, invoices, payments, credit memos, debit memos, and ending balance for the customer's account during a specified period. A monthly statement can be used as a summary invoice to request a single payment for accrued monthly charges. Progress billing used to obtain partial payment on extended contracts, particularly in the construction industry (see Schedule of values) Collective Invoicing is also known as monthly invoicing in Japan. Japanese businesses tend to have many orders with small amounts because of the outsourcing system (Keiretsu), or of demands for less inventory control (Kanban). To save the administration work, invoicing is normally processed on monthly basis. Continuation or Recurring Invoicing is standard within the equipment rental industry, including tool rental. A recurring invoice is one generated on a cyclical basis during the lifetime of a rental contract. For example if you rent an excavator from 1 January to 15 April, on a calendar monthly arrears billing cycle, you would expect to receive an invoice at the end of January, another at the end of February, another at the end of March and a final Off-rent invoice would be generated at the point when the asset is returned. The same principle would be adopted if you were invoiced in advance, or if you were invoiced on a specific day of the month. Electronic Invoicing is not necessarily the same as EDI invoicing. Electronic invoicing in its widest sense embraces EDI as well as XML invoice messages as well as other format such as pdf. Historically, other formats such as pdf were not included in the wider definition of an electronic invoice because they were not machine readable and the process benefits of an electronic message could not be achieved. However, as data extraction techniques have evolved and as environmental concerns have begun to dominate the business case for the implementation of electronic invoicing, other formats are now incorporated into the wider definition.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Schedule and FormulasDocument55 pagesSchedule and FormulasRodmae VersonPas encore d'évaluation

- Project Proposal by Nigah-E-Nazar FatimiDocument8 pagesProject Proposal by Nigah-E-Nazar Fatiminazarfcma5523100% (3)

- Broker HandbookDocument84 pagesBroker Handbookdfisher1118100% (2)

- Functions of Bombay Stock ExchangeDocument9 pagesFunctions of Bombay Stock ExchangeOmkar Shingare50% (2)

- Entrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual Full Chapter PDFDocument66 pagesEntrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual Full Chapter PDFmelrosecontrastbtjv1w100% (13)

- Letter-SB-Request For Special Session-11 October 2023Document5 pagesLetter-SB-Request For Special Session-11 October 2023cj.pulga.palPas encore d'évaluation

- Lembar - JWB - Soal - B - Sesi 2Document11 pagesLembar - JWB - Soal - B - Sesi 2Sandi RiswandiPas encore d'évaluation

- CHAPTER 1, 2, 3 and 4Document33 pagesCHAPTER 1, 2, 3 and 4Jobelle MalabananPas encore d'évaluation

- Fundamentals of Trade FinanceDocument9 pagesFundamentals of Trade FinanceMohammed SuhalePas encore d'évaluation

- Wikborg Global Offshore Projects DEC15Document13 pagesWikborg Global Offshore Projects DEC15sam ignarskiPas encore d'évaluation

- Hba O1Document3 pagesHba O1rahul100% (1)

- Eom Ii - Test - 15-08-2021Document21 pagesEom Ii - Test - 15-08-2021Bithal PrasadPas encore d'évaluation

- Project On Project ManagementDocument92 pagesProject On Project ManagementSrinath NavadaPas encore d'évaluation

- Learning Exercises Bsa 3101 Corporate LiquidationDocument2 pagesLearning Exercises Bsa 3101 Corporate LiquidationRachel Mae FajardoPas encore d'évaluation

- Midterm Quiz 1 (Basic Concepts and Principles On Extinguishment of Obligations) SubmissionsDocument3 pagesMidterm Quiz 1 (Basic Concepts and Principles On Extinguishment of Obligations) SubmissionsJinky ValdezPas encore d'évaluation

- Industrial Tour Report On CSE (Chittagong Stock Exchange)Document42 pagesIndustrial Tour Report On CSE (Chittagong Stock Exchange)Khan Md Fayjul100% (2)

- Vijay Tiwari AgreementDocument8 pagesVijay Tiwari AgreementAdvocate Shishir SaxenaPas encore d'évaluation

- SPA Lakad Lupa Titling RehistroDocument2 pagesSPA Lakad Lupa Titling RehistroRonbert Alindogan RamosPas encore d'évaluation

- Sample Employment ContractDocument2 pagesSample Employment Contracttimmy_zamora100% (1)

- Tqs Finals Operations-AuditDocument46 pagesTqs Finals Operations-AuditCristel TannaganPas encore d'évaluation

- Purchases, Cash Basis P 2,850,000Document2 pagesPurchases, Cash Basis P 2,850,000Dummy GooglePas encore d'évaluation

- Group 2: Topic 1Document29 pagesGroup 2: Topic 1jsemlpzPas encore d'évaluation

- IMF Reformation of BangladeshDocument125 pagesIMF Reformation of BangladeshSajjad HossainPas encore d'évaluation

- Contracts Undercredit Transaction S - Lecture NotesDocument85 pagesContracts Undercredit Transaction S - Lecture NotesJanetGraceDalisayFabreroPas encore d'évaluation

- Notes Receivable - Measurement and Determination of Interest ExpenseDocument6 pagesNotes Receivable - Measurement and Determination of Interest ExpenseMiles SantosPas encore d'évaluation

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshPas encore d'évaluation

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeSz. RolandPas encore d'évaluation

- CEM115-1 Seatwork QuestionsDocument4 pagesCEM115-1 Seatwork QuestionsYarisse RivasPas encore d'évaluation

- Stanley Black DeckerDocument9 pagesStanley Black Deckerarnabkp14_7995349110% (1)

- GonzalesDocument2 pagesGonzalesPrecious Gonzales100% (1)