Académique Documents

Professionnel Documents

Culture Documents

Freedom

Transféré par

Ali Shinghania ShinghaniaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Freedom

Transféré par

Ali Shinghania ShinghaniaDroits d'auteur :

Formats disponibles

Q7(iii)difference :a.

cannot be changed after the period begins, whereas a flexible budget can be c hanged after the period begins. b. is concerned only with future acquisitions of fixed assets, whereas a flexibl e budget is concerned with expenses that vary with sales. c. is a plan for a single level of production, whereas a flexible budget is seve ral plans (one for each of several production levels). d. includes only fixed costs, whereas a flexible budget includes only variable c osts

sum no7(ii) :Raw Material Direct Labour Variable F.O. Variable S.O. 4.25 5.75 7.75 0 ----------17.75 Desired Profit(PU) 1.00 ---------------Selling Price 18.75 ans

The selection of the system depends on the type and nature of the concern and it s products. The wage payment systems can be divided into two main systems as fol lows. 1. Piece rate system 2. Time rate system. Essential Characteristics Of A Good Wage Payment System:A sound system of wage payment is one that satisfies employer and employee by fu lfilling following criteria. * Wage payment system should be fair and justifiable to the workers and organiza tion.

* Wage payment system zing labor turnover. * Wage payment system * Wage payment system * Wage payment system . * Wage payment system * Wage payment system * Wage payment system he workers. * Wage payment system ation.

should help in maximizing workers' satisfaction and minimi should assure minimum guaranteed wages to all workers. should assure equal pay for equal work. should provide more wages to efficient and skilled workers should follow government policy and trade union's norms. should be simple and understandable to all the workers. should help in improving performance and productivity of t should be flexible enough to suit the needs of the organiz

sum no 6(ii) :Sale Price=200 V.Cost=120 so Contribution is80(200-120) and (!) P/V Ration = Contribuion / sale X100 =80/200*100=40% (2) BEP(In Units)= Fixed Cost / contribution per unit = 96000/80=1200 units In= 1200unitsXRs. 200= 2,40,000 (3) SAle for a desired profit of1,20,000 would be (Fixed cost+D.Profit)/P/V ratio = (96,000+1,20,000)/40% , =5,40,000 (4) Profit at a sale of7,00,000 would by 7,00,000*.40-96000 = 1,84,000 ( Sale Xp/v ration-FC) (5) net profit after TAX is 1,00,000 so before tax we need to earn Rs. 2,00,000 So logic is same , we need a desired profit Rs. 2,00,000 It would be (96000+200000)/.40=Rs. 7,40,000

*brek even chart:The Break-even Analysis depends on three key assumptions: Average per-unit sales price (per-unit revenue): This is the price that you receive per unit of sales. Take into account sales di scounts and special offers. Get this number from your Sales Forecast. For non-un it based businesses, make the per-unit revenue $1 and enter your costs as a perc ent of a dollar. The most common questions about this input relate to averaging many different products into a single estimate. The analysis requires a single n umber, and if you build your Sales Forecast first, then you will have this numbe r. You are not alone in this, the vast majority of businesses sell more than one item, and have to average for their Break-even Analysis. Average per-unit cost:

This is the incremental cost, or variable cost, of each unit of sales. If you bu y goods for resale, this is what you paid, on average, for the goods you sell. I f you sell a service, this is what it costs you, per dollar of revenue or unit o f service delivered, to deliver that service. If you are using a Units-Based Sal es Forecast table (for manufacturing and mixed business types), you can project unit costs from the Sales Forecast table. If you are using the basic Sales Forec ast table for retail, service and distribution businesses, use a percentage esti mate, e.g., a retail store running a 50% margin would have a per-unit cost of .5 , and a per-unit revenue of 1. Monthly fixed costs: Technically, a break-even analysis defines fixed costs as costs that would conti nue even if you went broke. Instead, we recommend that you use your regular runn ing fixed costs, including payroll and normal expenses (total monthly Operating Expenses). This will give you a better insight on financial realities. If averag ing and estimating is difficult, use your Profit and Loss table to calculate a w orking fixed cost estimate-it will be a rough estimate, but it will provide a us eful input for a conservative Break-even Analysis.....

Management accounting ;*Management accounting is concerned with the provisions and use of accounting in formation to managers within organizations, to assist management making decision s and managerial control functions. Management accounting is also concerned with the process of identification, meas urement and accumulation of product and service costs; preparation of statements relating to materials, labor and overheads; standard costs; budgeting for decis ion-making; and the communication of information used by management to plan, eva luate and control an entity to assure appropriate use of and accountability for its resources. Management accounting also comprises of preparation of financial reports for non - management groups such as shareholders, creditors, regulatory agencies and tax authorities. In the late 1980s, accounting practitioners and educators were heavily criticize d on the grounds that management accounting practices (and, even more so, the cu rriculum taught to accounting students) had changed little over the preceding 60 years, despite radical changes in the business environment........

difference between :-cost sheet and production account. meaning :- *Cost sheet is a statement of cost. In other words, when costing info rmation are set out in the form of a statement, it is called cost sheet *a financial statement that shows production costs only, as op posed to a profit and loss account, which shows sales and costs of sales. A manu facturing account will include direct materials and labor costs and the producti on overhead. 1. Cost sheet is made just for showing total cost of production but production a ccount is just like trading and profit and loss account and it shows total cost and total net profit from producing specific units of production. 2. Production Account follows the rules of double entry system but cost sheet does not follow the rules of double entry system. 3. Production Account has four parts two. The first part shows prime cost, seco nd part shows cost of goods manufacturing, third part shows gross profit and fou rth part shows net profit. Cost Sheet presents the elements of costs in a classi fied manner and the cost ascertained at different states such as prime cost; wor ks cost; cost of production; cost of goods sold; cost of sales and total cost. 4. With the help of Production Account, we can not prepare tenders or quotatio ns because it shows historical detail regarding production of units. But estimat ed cost sheets can be prepared on the basis of actual cost sheets and these are useful for preparing tenders or quotations.

BIN CARD is a stock status recording document for a particular material/item hel d in a stock room

a record kept of the amount, type, etc., of raw materials and supplies on hand, as in a manufacturing plant. Also called stock book, stock ledger

Q1:freedom:-

The great problem of any federal structure is to prevent the growth of local and

regional interests which are not conducive to the interest of the nation as a w hole. In order to avoid such commercial rivalries and jealousies among the units , the framer of the federal constitution takes it as absolutely necessary to inc orporate a free trade clause which would ensure the economic unity within the co untry. Generally speaking, trade means buying and selling of goods while the ter m commerce includes all forms of transportation such as by land, air or water. I n other words, organised activities with a view to earning profits are termed tr ade or commerce. However, right to trade definitely not mean right to commit cri me. Therefore, activities like hiring out criminal to commit murder, selling obs cene pictures or trafficking of human being cannot properly enter into the conce pt of trade and commerce. Nevertheless, there are certain issues, regarding the nature and scope of the terms trade and commerce; which have created difficultie s for the court because of several variables. In one hand, precedent serve as a binding source of law and judges generally apply it whereas; on the other hand s ome judges try to follow the sociological school of thought and therefore attemp t to harmonise the individual interest with the interest of the contemporary soc iety. Further, if one analyses, the Realist jurisprudential thought, he will eas ily find out how social status, background and experiences of the judges influen ce the judgements.

Q2:-harmonius The judiciary interprets how legislation should apply in a particular case as no legislation unambiguously and specifically addresses all matters. Legislation m ay contain uncertainties for a variety of reasons: Words are imperfect symbols to communicate intent. They are ambiguous and change in meaning over time. Unforeseen situations are inevitable, and new technologies and cultures make app lication of existing laws difficult. Uncertainties may be added to the statute in the course of enactment, such as th e need for compromise or catering to special interest groups. Therefore, the court must try to determine how a statute should be enforced. Thi s requires statutory construction. It is a tenet of statutory construction that the legislature is supreme (assuming constitutionality) when creating law and th at the court is merely an interpreter of the law. Nevertheless in practice, by p erforming the construction the court can make sweeping changes in the operation of the law.

Q3:-arbitration

An arbitration agreement is an agreement made between two parties when an arbitr ator, a mediator, listens to both sides and makes a fair decision based on the e vidence presented. There are many essentials of an arbitration agreement, all of which contribute to both the process and the decision made by the arbitrator. A n arbitrator can be used for multiple types of businesses and for contract negot iations. Written Agreement According to PRLog.org, the law states that any arbitration agreement must be ma de in writing. When the arbitration agreement is in the form of a written contra

ct and signed by both parties and the arbitrator, neither side is able to claim that they did not understand a portion of the agreement or something that was me ntioned by the arbitrator. The written document must also state that the two par ties agreed on the case of the arbitration, though it is often assumed if the tw o parties signed the document, they agreed on the arbitrator's decision. Morality According to PRLog.org, the matter that is brought up to an arbitrator must not be anything that is or is related to illegal or immoral activity. For example, t wo parties cannot go to an arbitrator to determine who owes what money in a case relating to the purchase of cocaine, because the drug is illegal and the posses sion of the drug is a federal offense. Whether a matter is immoral is up to the judgment of the arbitrator before the proceedings take place. Acceptance of Agreement When the arbitrator makes his decision, both parties are assumed to accept the d ecision and institute the ruling immediately, according to PRLog.org. However, b oth parties may not always agree on the decision. For example, the National Hock ey League's Chicago Blackhawks took goaltender Antti Niemi to arbitration at the end of July, 2010. The arbitrator ruled in favor of Niemi, granting him a salar y of $2.75 million for the 2010-11 season. The Blackhawks, however, declined to accept the ruling, due to a limited amount of space on their payroll under the l eague's salary cap. As a general principle, though, many arbitration agreements are accepted due to the nature of the proceedings. A mediator determines which p arty is correct, ultimately making a ruling he believes is fair.

DOMAIN NAME ISSUES With the advancement of e-commerce, the domain names have come to acquire the sa me value as a trademark or the business name of a company. The value attached to domain names makes it lucrative for cyber criminals to indulge in domain name i nfringements and the global nature and easier and inexpensive procedure for regi stering domain names further facilitates domain name infringements. When a perso n gets a domain name registered in bad faith, i.e. in order to make huge profits by registering a domain name corresponding to a trademark of another person, wi th an intent to sell the domain name to the trademark owner at a higher price, s uch activities are known as cybersquatting. The IT Act does not deal with the do main name issues. In India the domain name infringement cases are dealt with acc ording to the trademark law. With most of the countries providing for specific l egislations for combating and curbing cyber squatting, India also needs to addre ss the issue and formulate legal provisions against cyber squatting. For settlem ent of Disputes, WIPO has introduced a new mechanism called ICANN (Internet Corp oration for Assigned Names and Numbers) for settlement of disputes relating to d omain names. As the parties are given the right to file the case against the dec ision of ICANN in their respective jurisdictions, the decisions of ICANN is havi ng only persuasive value for the domain users. .

CHAPTER II SPECIFIC PERFORMANCE OF CONTRACTS

9. Defences respecting suits for relief based on contract. 9. Defences respecting suits for relief based on contract.-Except as otherwise provided herein, where any relief is claimed under this Chapter in respect of a contract, the person against whom the relief is claimed may plead by way of defence any ground which is available to him under any law relating to contracts. CONTRACTS WHICH CAN BE SPECIFICALLY ENFORCED 10. Cases in which specific performance of contract enforceable. 10. Cases in which specific performance of contract enforceable.Except as otherwise provided in this Chapter, the specific performance of any contract may, in the discretion of the court, be enforced(a) when there exists no standard for ascertaining the actual damage caused by the non-performance of the act agreed to be done; or 618 (b) when the act agreed to be done is such that compensation in money for its non-performance would not afford adequate relief. Explanation.-Unless and until the contrary is proved, the court shall presume(i) that the breach of a contract to transfer immovable property cannot be adequately relieved by compensation in money; and (ii) that the breach of a contract to transfer movable property can be so relieved except in the following cases:(a) where the property is not an ordinary article of commerce, or is of special value or interest to the plaintiff, or consists of goods which are not easily obtainable in the market; (b) where the property is held by the defendant as the agent or trustee of the plaintiff.

use of stamps:Use of adhesive stamps on certain instruments - The following instruments may be stamped with adhesive stamps, namely: (a) Bills of exchange payable otherwise than on demand and drawn in sets, when the amount of duty does not exceed one anna for each part of the set . (b) Transfers of debentures of public companies and associations. (c) Copies of maps and plans and printed copies when chargeable with duty under Article 24 of Schedule-I.

answer:-1. Decree is not binding against Mahendra... Becuase decree is binding o nly on those persons against whom it is passed... It is issued against Brij & Su resh... Hence, it is not binding against Mahendra

Procedure for issuing Accounting Standards in India:?ASB of ICAI (Institute of Chartered Accountants of India) after consultation wi th various study groups prepares the draft of Accounting standard. The draft as prepared will be circulated to Council members of ICAI and to the s pecified bodies like ICSI, ICWAI, CBDT, FICCI, ASSOCHAM, RBI, SEBI etc for their comments. ?After the meeting with the above bodies the exposure draft is finalized and is issued to ICAI and public for their comments. ?After considering the comments received, the draft is finalized by ASB and subm itted to ICAI. The ICAI if found necessary may with consultation with ASB make required modific ation and issue the final AS NACAS to recommend to MCA for notifying the AS as issued to be complied with.

solution 3(i) Alok Chopra Underwritten 60000 Marked applications ) Balance 18000 Unmarked appications 00) (ratio 4:3:3) balance 9000 Excess of Benny (3000) redistributed to Alok and Benny in the ratio 4:3) ( 4000) 80000 (32000) (58000) 48000 (12000 ) (9000 ) 2000 ( 90 60000 ( 42000 Benny

36000

(7000)

Net liability 6000

32000

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Actor Employment Agreement: © 2014-2015 Focal Press 1Document13 pagesActor Employment Agreement: © 2014-2015 Focal Press 1sbPas encore d'évaluation

- Imfpa-Ncnda 26 Ago 2019Document9 pagesImfpa-Ncnda 26 Ago 2019Pardes SASPas encore d'évaluation

- Labor Law 1 Cases Employer-Employee RelationshipDocument183 pagesLabor Law 1 Cases Employer-Employee RelationshipAngie MadarazoPas encore d'évaluation

- Koppel Inc. Vs Makati Rotary ClubDocument18 pagesKoppel Inc. Vs Makati Rotary ClubmonjekatreenaPas encore d'évaluation

- Position PaperDocument15 pagesPosition PaperNikko MarcialPas encore d'évaluation

- Nickel Ore Sale and Purchase Contract - S&M Clean r2Document7 pagesNickel Ore Sale and Purchase Contract - S&M Clean r2johan JacobPas encore d'évaluation

- Managerial EmployeeDocument29 pagesManagerial EmployeeEngelov AngtonivichPas encore d'évaluation

- Arbitration PPT 1Document26 pagesArbitration PPT 1Rachana P NPas encore d'évaluation

- Edi v. GranDocument2 pagesEdi v. GranChariPas encore d'évaluation

- AAA Case No. 1310-0417-78 - 4 January 1980Document5 pagesAAA Case No. 1310-0417-78 - 4 January 1980contestantlauPas encore d'évaluation

- Prantiya Vidyut Mandal Vs RSE BoardDocument26 pagesPrantiya Vidyut Mandal Vs RSE BoardManu GuptaPas encore d'évaluation

- U115HDocument39 pagesU115HDiego CamachoPas encore d'évaluation

- Jargons in Human Resource Management 256Document89 pagesJargons in Human Resource Management 256NukdPas encore d'évaluation

- Finals DigestDocument58 pagesFinals DigestDaniel AcusarPas encore d'évaluation

- JVC Working Agmt Draft - Legal Review (Raw Version)Document16 pagesJVC Working Agmt Draft - Legal Review (Raw Version)TITO JR REYESPas encore d'évaluation

- PetroGreen - NDA Draft TemplateDocument9 pagesPetroGreen - NDA Draft TemplateAtty. Keel Achernar DinoyPas encore d'évaluation

- 170591-2015-Sara Lee Phils. Inc. v. Macatlang20210424-12-1j3l0b4Document12 pages170591-2015-Sara Lee Phils. Inc. v. Macatlang20210424-12-1j3l0b4Anonymous RabbitPas encore d'évaluation

- Texas Supreme Court 14-0192 Response To Petition (1) Tom CrowsonDocument37 pagesTexas Supreme Court 14-0192 Response To Petition (1) Tom CrowsonxyzdocsPas encore d'évaluation

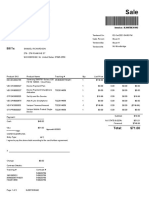

- Bill To:: NJ-WoodbridgeDocument3 pagesBill To:: NJ-WoodbridgeKenneth Sanders67% (3)

- Elcee Farms v. NLRCDocument5 pagesElcee Farms v. NLRCbearzhugPas encore d'évaluation

- Origin of Alternative Dispute Resolution System in IndiaDocument149 pagesOrigin of Alternative Dispute Resolution System in IndiaBrian AlmeriaPas encore d'évaluation

- Proposal to Convert ADR Cell to CentreDocument50 pagesProposal to Convert ADR Cell to CentreSarfraz AlamPas encore d'évaluation

- BPP COURSE GUIDE: ARBITRATION LAW AND PRACTICEDocument94 pagesBPP COURSE GUIDE: ARBITRATION LAW AND PRACTICEAndy Sphicas100% (1)

- A.10 CIAC Revised Rules of Procedure-1Document30 pagesA.10 CIAC Revised Rules of Procedure-1Jo YabotPas encore d'évaluation

- Chapter 8 HandoutsDocument2 pagesChapter 8 HandoutsAthena BorjaPas encore d'évaluation

- India's Shift Towards International ArbitrationDocument14 pagesIndia's Shift Towards International ArbitrationMarius DamianPas encore d'évaluation

- ALU-TUCP v. NLRCDocument3 pagesALU-TUCP v. NLRCKriselPas encore d'évaluation

- Complaint Mediation: If Settlement Is Reached, Case Is Considered ClosedDocument1 pageComplaint Mediation: If Settlement Is Reached, Case Is Considered ClosedArthur F. AnchetaPas encore d'évaluation

- PNB vs Cabansag: Philippine labor laws protect overseas Filipino workersDocument13 pagesPNB vs Cabansag: Philippine labor laws protect overseas Filipino workersMarchini Sandro Cañizares KongPas encore d'évaluation

- Labor Law Bar ExamsDocument44 pagesLabor Law Bar ExamsJuan Tamad IV100% (2)