Académique Documents

Professionnel Documents

Culture Documents

Berpaiia 20110627

Transféré par

Derrick MenezesDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Berpaiia 20110627

Transféré par

Derrick MenezesDroits d'auteur :

Formats disponibles

Berger Paints

Gearing up for higher scale

June 27, 2011

Reco Accumulate CMP Rs 100

Nifty Sensex

Berger Paints, the second largest player in the decorative

Target Price Rs109

5,470 18,234

paints market with a 17% market share, is expected to benefit from the long-term steady demand in paints industry

Expect revenue and earnings CAGR of 19% and 20% over

FY11-13E, leading to a comfortable cash flow position; Rule out additional fund raising despite planned capex of Rs140bn

Increasing shift towards water-based paints to augur well for

Price Performance

(%) Absolute Rel. to Nifty

Source: Bloomberg

1M (3) 1

3M 19 21

6M 12M (5) 8 32 34

operating margins, not factored in margin expansion due to higher raw material cost; Expect margins at 10.4% in FY13E price of Rs 109/share, valuing it at 17.5x FY13E (30% discount to Asian Paints) EPS of Rs 6.2/share

Initiate coverage with an ACCUMULATE rating and a target

Relative Price Chart

125 Rs % 50 114 38

Second largest player with 17% market share

Berger Paints is the second largest player in the decorative paints market with a 17% market share. Decorative paints constitute 80% of its sales and enjoy strong brand equity in the eastern regions. It has a pan India distribution network of 14,000 dealers and 7,700 tinting machines. Further, the company also has a strong foothold in the protective coatings market, which contributes nearly 10% to its total sales.

103

26

92

14

81

70 Jun-10

-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11

Berger Paints (LHS)

Rel to Nifty (RHS)

Source: Bloomberg

Decorative paints market to grow at a healthy rate in the future

Decorative paints constitute 70% of the Rs 170bn paints market. The per capita consumption of paints in India is very low at 1.5 kgs/year compared to 15-20 kgs in developed countries. While the short term macro environment could result in lower velocity of paint consumption growth to GDP growth, we believe, in the long term, with increasing per capita income and healthy economic growth, paints sector demand is poised for robust growth.

Stock Details

Sector Bloomberg Equity Capital (Rs mn) Face Value(Rs) No of shares o/s (mn) 52 Week H/L Market Cap (Rs bn/USD mn) Daily Avg Volume (No of sh) Daily Avg Turnover (US$mn) Consumers BRGR@IN 692 2 346 123/73 34/756 165353 0.4

Berger Paints to benefit from increasing size and scale

Berger is poised for a strong growth ahead, given the inherent growth in the decorative as well industrial paint segment and the companys increasing aggression to enhance its capacity and distribution reach, especially in the southern region. We expect revenue and earnings to grow at 19% and 20% CAGR respectively, over FY11-13E, driven by a healthy 15% increase in volumes. Moreover, the cash flow position remains strong with a healthy growth of 26% in operating cash flows over the same period.

Share Holding Pattern (%)

Mar -11 Dec-10 Sep-10 Promoters FII/NRI Institutions Private Corp Public

Source: Capitaline

75.6 7.6 4.0 2.0 10.8

75.6 7.3 4.5 2.0 10.7

75.6 7.3 4.5 1.9 10.8

Initiate coverage with an ACCUMULATE rating and a TP of Rs 109/share

We expect the historical discount in valuations of Berger Paints to Asian Paints to narrow in the future due to 1) It gaining considerable size and scale with healthy revenue CAGR and 2) increasing shift towards premium products enhancing operating margins. We have valued the company at 17.5x FY13E EPS of Rs 6.2/share, a discount of 30% to Asian Paints target PER of 25x FY13E EPS. Our target price of Rs 109/share, provides 9.5% upside from current levels. Hence, we initiate coverage with an ACCUMULATE recommendation. Valuation Table (Consolidated)

Pritesh Chheda, CFA pritesh.chheda@emkayglobal.com +91 22 6612 1273 Sweta Jain sweta.jain@emkayglobal.com +91 22 6624 2479

YEMar FY10 FY11 FY12E FY13E

Net Sales 18,913 23,281 28,967 33,174

EBITDA (Core) 1,991 2,373 2,802 3,456 (%) 10.5 10.2 9.7 10.4

EPS APAT 1,204 1,501 1,733 2,153 (Rs) 3.5 4.3 5.0 6.2

EPS % chg 33.9 24.7 15.5 24.3

RoE (%) 24.7 23.3 23.1 24.3

P/E (x) 28.6 22.9 19.9 16.0

EV/ EBITDA (x) 16.6 13.4 11.6 9.6

P/BV (x) 7.4 5.6 4.7 3.9

Emkay Global Financial Services Ltd

Initiating Coverage

Berger Paints

Initiating Coverage

Company Background

Second largest paints company in India Berger Paints started operations in 1923 in a small unit in Kolkata as Hadfields India Ltd. The current promoters, the Dhingras , entered the company in 1991 after acquiring UB Groups stake in the company. Berger Paints is the second largest decorative paints company in the country. It derives almost ~80% of revenue from decorative paints and the balance from industrial paints -largely automotive and protective coatings. It has a wide variety of product portfolio including interior and exterior wall coatings as well as metal and wood paints. It has strong and well established brands like Berger Silk, Berger Rangoli, Berger Illusions, Berger Weather Coat, Jadoo Enamel, etc that span across mass to premium category of the market. It has eight manufacturing facilities with a total capacity of 306,000 MT across India and four facilities overseas. It has 82+ depots with a widespread distribution network of 14,000 dealers across the country. Berger Paints has six subsidiaries and two JVs located across geographies including Cyprus, Russia, Poland and Nepal. The company has undergone many change of hands - In 1947, it was acquired by British Paints (Holdings), UK, which renamed the company as British Paints (India). The UK company was then acquired by Celanese Corporation, which later sold the Indian company to Berger, Jenson Nicholson Ltd in 1969. In 1983, the company was rechristened as Berger Paints India and it started using the trade name of Berger. Management profile

Name Kuldeep Singh Dhingra Designation Chairman Remarks Mr. Dhingra, the Chairman, has been a director of the company since July, 1991. Mr. Dhingra is a graduate and promoter of the company and has a long standing experience in paints and related industries. Gurbachan Singh Dhingra Vice Chairman Mr. Dhingra has been the director of the company since 1993. He is a graduate and has considerable experience in the paint industry, especially in its technical aspects. Mr. Bose is a B.Tech (Chemical) from IIT, Kanpur & PGDM from IIM, Ahmedabad having over 36 years of work experience. He started his career with Asian Paints and prior to joining Berger in 1984, he was associated with Abukon Nigeria Ltd. Mr. Roy is a B.E (Mech) from Jadavpur University, Kolkata & PGDM from IIM, Bangalore having over 19 years of work experience. He started his career with Asian Paints Limited and prior to joining Berger, he was associated with ICI (India) Limited. Mr. Dasgupta is a B.Sc (Hons) from Calcutta University, AICWA & Company Secretary having over 27 years of work experience.

Subir Bose

Managing Director

Abhijit Roy

Director and Chief Operating Officer Director and Chief Financial Officer

Srijit Dasgupta

Source: Company, Emkay Research

Snapshot on subsidiaries and joint ventures

Name Beepee Coatings Private Limited, India Berger Jenson & Nicholson, Nepal Berger Paints (Cyprus) Limited, Cyprus Berger Paints Overseas Limited, Russia Holding 100% 100% 100% 100% Remarks Entire facility dedicated to processing of company unit's. Recorded sales of Rs 102 mn and PAT of Rs 6 mn in FY10. Commenced its second decorative plant with a capacity of 18,000 MT in FY10. Recorded sales of Rs 305 mn with PAT of Rs 34 mn. It is a SPV for overseas investments for Berger Paints It was affected by the global slowdown in FY10 and hence, recorded a net loss of Rs 15 mn in FY10. It is a SPV for overseas investments for Berger Paints Acquired in FY09 for USD 38 mn; Technology leaders in External Insulation Finishing Systems (EIFS) in the B2B segment in Poland and neighbouring countries such as Ukraine, Russia and the Baltic states. Berger Becker Coatings Private Limited, India BNB Coatings India Limited, India

Source: Company, Emkay Research

Lusako Trading Limited, Cyprus Bolix S.A., Poland

100% 100%

49% 49%

A joint venture with Becker Industrial Coatings, it offers a range of wood coating products The Companys joint venture with Nippon Bee Chemicals Co. Ltd. of Japan (NBC) for manufacture of coatings for plastic substrates of automobiles.

Emkay Research

27 June 2011

Berger Paints

Initiating Coverage

Investment Rationale

Second largest player in the decorative paints market

Holds 17% market share with 14,000 dealers and 7,700 tinting machines Berger Paints , with a 17% market share, is the second largest company in the Rs120bn worth decorative paints market. This market is characterized as an oligopoly with 4-5 players constituting majority of the market. Berger Paints has a strong foothold in the eastern markets with strategically located plants there. Moreover, it has a strong distribution network including 80+ exclusive stock points and 14,000 dealers to service the decorative paint market across India. Rising consumerism in the country is expected to drive higher demand for decorative paints in future, and we believe Berger Paints is well placed to benefit from this. Competitive landscape

Company Berger Paints Asian Paints Kansai Nerolac Akzo Nobel Decorative market share 17% 53% 10% 9% Competitive position Second largest player in the decorative market. In industrial coatings, it is the leader in the protective coatings market It is the market leader in the decorative segment but lags second in the industrial segment Kansai is the largest player in the industrial segment and is the third largest player in the decorative segment Strong player in the premium decorative paint segment

Source: Company, Emkay Research

Strong place in protective coatings; expect industrial paints growth at 14%

Industrial paints constitute 20% of total sales for Berger Paints. Industrial paint market is worth Rs 50 bn and growing at 10-12% every year. The company has strong technical collaborations with DuPont Performance Coatings for automotive coatings. It also commands a strong leadership position in the protective coatings segment, which contributes 50% of its industrial sales . Taking cue from our capital goods and auto team estimates of 17% and 12% growth, we have modeled a 14% growth rate for industrial paints segment in our FY13E estimates. Industrial paints constitute 20% of FY11 sales

20%

80% Decorative paints

Source: Company

Industrial paints

Growing strongerwith considerable size and scale

Increasing its capacity by 52% over the next two years Berger Paints has developed a strong dealer network of 14,000 dealers with 7,700 tinting machines compared to 27,000 dealers and 17,000 tinting machines with Asian Paints. With a strong market foothold in the eastern and northern regions, Berger Paints is gaining momentum in the southern markets with its franchisee stores (40+ in nos.). It plans to scale these stores by 40-50 nos. in the coming years. Further, the company has embarked on an aggressive expansion plan to increase its production capacity by 52%, through the addition of 160,000 MT (Phase I and II at a cost of Rs 1.4 bn) capacity plant (scalable to 320,000 MT) in Andhra Pradesh over the next 2 years.

Emkay Research

27 June 2011

Berger Paints Gaining strength in comparison to Asian Paints

Particulars Stronger regions Dealer network Tinting machines Total current capacity Expansion plans

* Scalable to 320,000 MT

Initiating Coverage

Berger Paints East and North with increasing presence in South 14,000 7,700 306,000 MT 160,000 MT*

Asian Paints South and West with a pan India presence 27,000 17,000 595,000 MT 300,000 MT

We expect revenue momentum to continue with 19% revenue CAGR over FY11-13E

Moreover, we believe Berger Paints, with a strong second position in the decorative paints market, is well placed to benefit from the rising paint consumption in the country. The paints market is poised for a robust growth momentum in the long term, driven by increasing per capita consumption- currently at 1.5 kg/year compared to 20 kg/year in developed countries . Berger Paints has recorded strong 18% revenue CAGR over FY06-11 and we expect it to sustain its growth momentum going ahead. We expect the company to post a 19% revenue CAGR over FY11-13E, gaining a considerable revenue base of Rs 33 bn. (When Asian Paints was at this run-rate in FY06/07, it had recorded a 21% CAGR over FY06-11, gaining a critical size of Rs 77 bn.) While we are not factoring market share gains for Berger Paints, we believe the inherent growth in paints industry and the companys aggressive focus on increasing its distribution reach will aid Berger Paints in attaining considerable size and scale in the future. Gaining considerable revenue size

120 100 80 Rs bn 60 40 20 -

Berger Paints

Asian Paints

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

Source: Company, Emkay Research

Shift in product mix to augur well

Berger Paints is focus ing on raising the share of water-based paints in its total product portfolio and has also filled the product gap that existed with Asian Paints, through the introduction of premium products in the water-based paints. This shift of focus towards emulsions augurs well for the company as water-based paint is not only a high growth category, but also a higher margin product segment compared to solvent-based paints. Increasing contribution from this segment will drive higher revenue growth and also expand operating margins in the future. Water-based paints to record higher growth

Category Water-based paints - Emulsions, Distempers Solvent-based paints - Enamels, Primers, Thinners

Source: Company, Emkay Research

Industry Mix 60%

Remarks growing at 20-25%

40%

growing at 6-10%

Emkay Research

27 June 2011

Berger Paints

Initiating Coverage

Scope for expansion in operating margins

Increasing focus on water-based emulsion paints , backward integration of its emulsion requirements and higher operating efficiencies as the company gains size and scale could possibly result in higher operating margins in the future. However, we have modeled in a flat operating margin scenario over FY11-13E, owing to higher raw material costs environment. Given its increasing focus on enhancing its margins, we do not rule out a possibility that Berger Paints could narrow the margin gap to Asian Paints in its growth phas e. (In FY04, Asian Paints with revenue of Rs 25 bn had EBITDA margin of 13.5%, whereas Berger Paints, in FY11, with revenue of Rs 23 bn has EBITDA margin of 10.2%). EBITDA margin gap with the leadercould narrow in future

25 20 15 10 5 FY06 FY07 FY08 FY09 FY10 FY11 % Berger Paints Asian Paints

Source: Company, Emkay Res earch

Strong capex plans provide visibility to sustainable volume growth

Setting up a 160,000 MT capacity plant in AP scalable to 320,000 MT Healthy demand has led Berger Paints to embark on a strong expansion plan to enhance its manufacturing capacities. The company plans to increase its capacity from 306,129 MT by 52% over a period of 2 years. While it has already expended Rs 1.3 bn towards expansion in its Rishra and Goa plants, it plans to spend an additional Rs 1.4 bn in a greenfield plant in Andhra Pradesh over the next 2 years. This plant, with an initial capacity of 160,000 MT and scalability to 320,000 MT, is expected to commercially start production (Phase I and II with a capacity of 160,000 MT) from FY14. We believe this will help Berger Paints, not only sustain volume growth but also give it a stronger presence in the southern markets and increase its capacity in water-based paints, which is a faster growing segment with a higher margin profile. Substantial increase in gross block

Network of its production facilities

Proposed unit in Hindupur (A.P.) (160,000 MT in Phase I & II) (Scalable to 320,000 MT)

11.0

10.0 9.0 Rs bn

8.0

7.0

Howrah (28,560 MT) V V N (48,840 MT) Pondicherry (18,150 MT) Sikandrabad (21,639 MT ) Goa (44,654 MT) Rishra (33,450 MT) Jammu (95,920 MT) Surajpur (14,916 MT)

Source: Company, Emkay Research

6.0

FY12E

Emkay Research

27 June 2011

FY13E

FY09

FY10

FY11

5.0

Berger Paints

Initiating Coverage

Strong cash flow position

Strong cash flow position to fund the planned capex over the next two years With healthy profit growth over FY11-13E, we expect operating cash flow to register strong CAGR of 26% over this period. We believe its cash position for the next two years is comfortably placed to meet its capex requirement for Phase I and II of Andhra Pradesh plant with an initial capacity of 160,000 MT. Hence, we do not expect the company to raise additional funds from outside over the next two years. In FY10, it had issued 20mn shares on warrant conversion to a promoter group company, Jenson and Nicholson and issued additional 7.2 mn shares to Nalanda Fund at Rs 50.5/share to fund its growth prospects, leading to a total dilution of 8% on the expanded equity capital. We do not expect Berger Paints to dilute further equity, as it has sufficient internal accruals to fund its growth plans over the next two years. Cash flow position to remain healthy

2,100 1,400 700 Rs mn 0 FY08 -700 -1,400 -2,100

Source: Company, Emkay Research

FY09

FY10

FY11

FY12E

FY13E

Cashflow from operations

Free cashflow

Emkay Research

27 June 2011

Berger Paints

Initiating Coverage

Key Risks

Raw material cost volatility

TiO2, 23% of raw material costs, is on a structural uptrend Titanium dioxide (TiO2) is one of the main raw material inputs , constituting 23% of the total input cost and 10% of sales in FY10. The prices of titanium dioxide have been on an uptrend since FY10 and have increased by 32% YoY for 1QFY12. While c ontinuing demand-supply mismatch is likely to keep the prices of titanium dioxide firm in the near future, prices of other raw materials like vegetable oils, crude oil, etc. continue to witness an inflationary scenario. Thus , firm prices will keep margins under pressure, owing to lag in product price increases . Uptrend in vegetable oil (index) price movement

700 Indexed Rs/ 10kg 650 600 550 500 450 400 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Trend in TiO2 price movement Structural uptrend

220 200 Rs/kg 180 160 140 120 100 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Bloomberg, Capital line

Berger Paints, being second, is the price-taker

Berger Paints is the second largest player and hence, is subject to the perils of not being the leader with a pricing power in the market place. While in the past, there have not been any significant instances of the leader, Asian Paints, taking an unwarranted move to disrupt the market structure, Berger Paints, being a price-taker, will always stand a risk to the pricing decisions of Asian Paints.

Change in velocity could influence earnings estimates

While the Indian economy has registered a healthy growth over the last decade, current high inflationary environment could lead to interest rate hike, which can hamper the demand for housing and new infrastructural development, in turn, affecting the velocity for paints demand. This could result in lower volumes and consequently, profit growth for the paint companies. Nevertheless, the low per capita consumption of paints in India, at 1.5 kgs against 15-20 kgs in the developed countries, provides ample growth opportunities driven by increasing per capita income over a longer time period and rules out catastrophic impact in short-term. Trend in velocity of volumes: GDP growth

FY06 GDP growth (%) Volume growth (%)* Velocity (x) 9.5 13.1 1.4 FY07 9.6 16.4 1.7 FY08 9.3 16.5 1.8 FY09 6.8 10.8 1.6 FY10 8.0 16.0 2.0 FY11 8.6 17.3 2.0

% 15 10 5 0 FY06 FY07 FY08 FY09 FY10 FY11

Paint volumes highly correlated with GDP growth

20

* Volume growth is a combination of Asian Paints and Berger Paints

GDP growth

Source: Co mpany, Emkay Research

Berger Paints volume gowth

Emkay Research

27 June 2011

Berger Paints

Initiating Coverage

Financials

Revenues to register 19% CAGR over FY11-13E

We expect volume growth of 15% over FY11-13E Berger Paints witnessed 18% CAGR over FY06-11, driven by a strong up-tick in the paints demand leading to a healthy volume CAGR of 13%. While concerns on the short-term demand scenario persist, we believe over a longer term, the company is poised for a healthy growth. We have estimated 19% revenue CAGR over FY11-13E aided by healthy volume growth of 15% (at 1.9x GDP growth assumption of 8%). The company has already undertaken a 7% price hike in 1QFY12, which will further aid overall sales growth in coming quarters. We expect the subsidiaries to contribute 7% to the consolidated sales by FY13E. Our assumptions for paints growth

30 25 20 15 10 5 0 FY08 FY09 FY10 FY11 FY12E FY13E Sales (LHS)

Source: Company, Emkay Research

Consolidated revenue growth trajectory

35 30 25 Rs bn 20 15 10 5 0 Growth (RHS)

(%) Volume growth

%

FY08 14.0 0.9 15.0

FY09 3.2 7.4 10.9

FY10 14.7 -5.9 7.9

FY11 19.0 4.8 24.7

FY12E 14.6 10.0 26.0

FY13E 15.0 0.0 15.0

Price growth Value growth

Operating margins to remain stable

We expect Berger Paints consolidated operating margin to remain stable at 10.4% for FY13. While the company has undertaken 7% price hike in 1QFY12 and is adequately covered for its raw material requirement for this season, continuing high prices , especially of titanium dioxide, could keep margins under pressure. Nevertheless, as the product mix shifts towards water-based emulsion paints, there is scope for margin expansion in the future. With no incremental debt, we expect interest costs to remain at similar levels and hence, PAT to grow at 20% CAGR over FY11-13E. EBITDA margins to remain stable

4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 FY08 FY09 FY10 FY11 FY12E FY13E EBITDA margin 11.0 10.5 10.0 9.5 9.0 8.5 8.0 7.5 7.0

PAT to grow at 20 % CAGR over FY11-13E

2.5 2.0 Rs bn 1.5 1.0 0.5 0.0 FY08 FY09 PAT FY10 FY11 FY12E FY13E

%

8.0 7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0

Rs bn

EBITDA

Source: Company, Emkay Research

PAT margin

Emkay Research

27 June 2011

Berger Paints

Initiating Coverage

Return ratios to remain at healthy levels

Berger Paints has lower RoE at 23% compared to Asian Paints RoE of 45% for FY11 due to the lower profitability that Berger Paints operates at, as against Asian Paints. Given our expectations of stable operating margins over the coming quarters, RoE and RoCE of the company is also likely to remain more or less flat at 24% and 28% respectively, for FY13E. Return ratios to remain healthy

31 29 27 25 23 21 19 17 15 FY08 FY09 RoE FY10 FY11 RoCE FY12E FY13E

RoE compared to peers

FY08 Berger Paints Asian Paints Kansai Nerolac* Akzo Noble* 28.6 49.2 20.2 7.3 FY09 22.3 38.1 15.1 11.0 FY10 24.7 55.8 21.4 16.2 FY11 23.3 44.6 22.5 16.9 FY12E 23.1 38.2 21.9 14.4 FY13E 24.3 35.0 22.4 12.7

Source: Company, Emkay Research. * Bloomberg data

Emkay Research

27 June 2011

Berger Paints

Initiating Coverage

Valuation and Recommendation

Second obvious option cannot be ignored

Berger Paints is the second largest player (17% market share) in the decorative paints market and has recorded healthy revenue run-rate of 18% CAGR over FY05-11. Berger Paints, with a strong presence in the eastern markets with strategically located plants there, is increasing its reach in the southern markets through the franchisee stores. Moreover, it has a strong distribution network of 14,000 dealers with 7,700 tinting machines across India. With a strong second position in the decorative paints market, we believe Berger Paints cannot be ignored.

Gaining scale and size

Berger Paints is increasing its capacity by 52% over the next two years, which provides healthy volume growth visibility in the future. Moreover, the inherent growth in the paints industry coupled with the companys aggression to expand its geographical reach will help Berger Paints attain reasonable revenue size of Rs 33 bn by FY13E.

with healthy growth momentum

We forecast 19% revenue CAGR over FY11-13E driven by 15% volume growth and 5% price-led growth. While high raw material costs continue to keep pressure on profitability and will lead to a flat operating margin over this period, we expect the company to post earnings CAGR of 20% over FY11-13E.

Valuation gap to Asian Paints to narrow

Trading at 38% discount to Asian Paints expect the gap to narrow At the current market price, the stock is trading at 19.9x FY12E EPS of Rs 5.0/share and 16.0x FY13E EPS of Rs 6.2/share. At 16.0 x FY13E EPS, it is trading at 38% discount to the market leader, Asian Paints. Historically, the company has traded at an average discount of 40% to Asian Paints one-year forward mean PER. We believe that going forward; this discount should narrow due to the following reasons: Gaining considerable size with a revenue CAGR of 19% over FY11-13E Product mix shifting towards higher growth and better margin business of water-based emulsion paints Increasing presence across India with rising penetration in the south

Initiate with ACCUMULATE and target price of Rs 109/share

We have valued Berger Paints at 17.5x FY13E earnings, a 30% discount to Asian Paints target PER multiple of 25x. This gives us a fair price of Rs 109/share, which provides 9.5% upside from the current levels . Hence, we initiate coverage on the stock with an ACCUMULATE rating and a target price of Rs 109/share. Comparative valuations

CMP Rs Berger Paints Asian Paints Kansai Nerolac* Akzo Nobel*

* Source: Bloomberg

Mcap Rs bn 34.4 285.3 46.2 33.2

Sales (Rs bn) FY13E 33.2 108.2 29.3 15.2

PAT (Rs bn) FY13E 2.2 11.5 2.5 1.8

EPS CAGR (%) FY11-13E 19.8 14.5 8.3 11.5

PER (x) FY12E 19.9 30.1 21.2 18.9 FY13E 16.0 25.8 18.5 17.9

EV/EBITDA (x) FY12E 11.6 18.1 12.9 16.1 FY13E 9.6 15.6 11.1 17.3

RoE (%) FY12E 23.1 38.2 21.9 14.4 FY13E 24.3 35.0 22.4 12.7

100 2976 858 902

Emkay Research

27 June 2011

10

Berger Paints

Initiating Coverage

PER band

150 120 90 60 30 0 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Apr-11 20x 15x 10x 5x

1 Year forward PER band

25 20 15 10 5 0 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Apr-11

1 year forward PER band

35 30 25 20 15 10 5 0 Jun-02 Jun-03 Jun-04 Jun-05 Jun-06 Jun-07 Jun-08 Jun-09 Jun-10

Discount to Asian Paints

100% 80% 60% 40% 20% 0% Jun-02 Jun-03 Jun-04 Jun-05 Jun-06 Jun-07 Jun-08 Jun-09 -20% Jun-10

Berger Paints

Asian Paints

PER discount

Emkay Research

27 June 2011

11

Berger Paints

Initiating Coverage

Annexure - I

Industry overview

Per capita consumption of paints is low at 1.5 kgs/year The Indian Paints Industry, estimated at USD 3.8 bn, is growing at 1.8-2x GDP growth since the last few years. This industry is characterized with many players in the unorganized sector. However, the organized segment that cons titutes 80% of total paint industry is concentrated with top 4 players commanding more than 90% share of the organized market. The per capita consumption of paints in India remains very low at 1.5 kgs, against 15-20 kgs in developed countries. This industry is categorized in two segments decorative, which contributes 70% and industrial that contributes 30% to the total industry size.

Decorative paints (70% of total paint industry)

Decorative paints constitute 70% of total paints market of Rs 170 bn and has witnessed a 17% CAGR over FY06-11. The demand for decorative paints is highly co-related to the GDP growth of the country. While 70% of the decorative demand is from re-painting needs and is driven by rising purchasing power of the consumer and the economic growth in the country; emergence of a sizeable middle class and growing urbanization drives the demand for new painting requirements , which forms 30% of the decorative segment. Decorative paint demand led by re-painting requirements

30% Driven by increasing middle class, growing urbanisation and higher availability of affordable housing Re-painting Fresh painting

70% Driven by rising purchasing power, increasing re-painting cycle and higher economic growth

Source: Industry, Emkay Research

Industrial paints (30% of total paint industry)

The industrial paints category, estimated at Rs 50 bn constitutes 30% of the overall paints industry. This category is further sub-divided into different segments based on the user industry and constitutes automotive paints, protective paints, powder coatings and coil paints. Hence, the key demand driver for this category of paints depends on the industrial activity in its user-industries like automobiles, power, marine, consumer durables, etc.

Demand drivers Short term pain. Long term remains strong

For decorative paints Demand for decorative paints emanates from new house construction (30%) and repainting needs (70%). While the demand for re-painting could be linked to the economic activity, demand for new house construction would depend on the construction activity in the commercial and residential space. Encouraging economic growth and an improvement in business environment are likely to drive the demand for commercial space over a long run. According to a report by Cushman & Wakefield in October 2010, 240mn sq ft of commercial property and 4.25mn units of residential property will be required to meet demand over 2010-2014. Similarly, demand for office space will be 55mn sq ft and hotels will witness a demand for 78mn room nights over the same period. This signifies the robust growth potential that the paints industry is poised for, over the ensuing years.

Emkay Research

27 June 2011

12

Berger Paints

Initiating Coverage

Distribution of demand Residential property Commercial property Office space Hotels

Source: Cushman & Wakefield

Estimated demand for 2010-14 4.25 mn units 240 mn sq ft 55 mn sq ft 78mn room nights

For Industrial paints Demand for industrial paints is derived from its application in the user-industries like automotive, consumer durables and the capital goods industries. As automotive segment constitutes 40% of total industrial paints, operating environment in this segment is a major demand driver for the industrial paints category. Further, infrastructural development in sectors like power, ports, roads, oil and gas etc, will be another key driver of volume growth in industrial paints. Automotive segment While rising macro headwinds like increase in interest rates, fuel prices and inflation will lead to subdued demand in 1HFY11, it is likely to recover from 2HFY11 once the consumer makes the psychological adjustment for higher fuel prices and interest rates. We expect growth rates to revert to healthy levels from FY13E. Our auto team estimates a 10% YoY growth agains t ~30% growth in passenger cars and 9% YoY growth against 36% growth In M&HCV segment for FY12. In FY13E, the growth rates are expected to recover to 17% and 12% for passenger cars and M&HCV segment, respectively. Trend in passenger car segment

3.0 2.5 2.0 1.5 1.0 0.5 FY07 FY08 FY09 FY10 FY11 FY12e FY13e % YoY Cars (mn units)

Source: Company, Emkay Research

Trend in commercial vehicles segment

35% 30% 25% 20% 15% 10% 5% 0%

0.4 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.0 FY07 FY08 FY09 FY10 FY11 FY12e FY13e % YoY

60% 40% 20% 0% -20% -40% -60%

M&HCV Trucks (mn units)

Consumer durables segment According to CEAMA, the consumer durable market is currently pegged at around Rs 350 bn and has witnessed a growth of approximately 13% in the last few months. However, with tightening credit situation, it is likely to witness some short term pressure. Nevertheless, over a longer period, consumer durables market is poised to grow at healthy double-digit growth driven by increasing per capita income and higher discretionary spend in the country.

Emkay Research

27 June 2011

13

Berger Paints

Initiating Coverage

Annexure - II

Growth comparison

Berger Paints Growth (%) FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12E FY13E Volume 15.3 11.4 13.0 14.0 3.2 14.7 19.0 14.6 15.0 Revenue 23.0 18.8 18.9 15.0 12.6 11.7 24.5 26.0 15.0 EBITDA 16.1 27.9 13.9 16.6 (5.4) 38.8 19.6 20.4 24.0 PAT 31.1 22.1 17.7 11.1 (3.9) 35.4 23.4 15.6 23.7 Volume 13.2 13.8 17.8 17.5 13.4 16.4 16.8 15.1 15.1 Asian Paints Revenue 15.2 18.7 21.7 21.2 24.9 20.0 23.4 25.9 14.8 EBITDA 8.1 20.3 19.5 31.7 3.4 75.6 13.0 16.7 17.3 PAT 13.3 26.4 21.1 40.4 (3.3) 86.5 14.1 13.7 17.0

Margins and return ratio comparison

Berger Paints Ratios (%) FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12E FY13E EBITDA margin 9.7 10.4 10.0 10.1 8.5 10.6 10.2 9.7 10.5 PAT margin 7.0 7.2 7.1 6.9 5.9 7.1 7.1 6.5 7.0 RoE 29.4 32.5 32.9 29.6 23.2 23.1 22.7 23.2 24.3 RoCE 29.6 35.0 32.7 29.8 26.3 29.5 31.3 31.8 33.4 EBITDA margin 15.1 15.3 15.0 16.3 13.5 19.8 18.1 16.8 17.1 Asian Paints PAT margin 9.0 9.6 9.5 11.0 8.5 13.3 12.3 11.1 11.3 RoE 31.8 37.1 39.3 45.0 36.0 51.2 43.3 38.0 34.9 RoCE 41.0 47.8 50.8 58.9 49.1 70.8 59.7 53.9 49.9

Raw material mix comparison

Berger Paints Raw material cost as a % to sales FY05 FY06 FY07 FY08 FY09 FY10

Note: Standalone financials

Asian Paints Others 13.4 13.6 15.3 16.3 14.7 13.9 Pigments 15.8 14.7 15.8 14.7 16.2 17.0 Solvents 7.1 7.4 8.1 7.1 7.7 5.8 Resins and Oils 7.6 7.3 8.6 8.4 8.8 7.2 Others 17.8 16.6 16.2 16.5 17.0 16.1

Pigments 11.3 10.5 11.1 9.5 10.3 11.2

Solvents 12.9 13.6 14.9 13.4 15.2 12.1

Resins and Oils 14.9 12.8 11.9 12.2 12.1 12.1

Highlights

Volumes for Berger Paints and Asian Paints have grown at an average velocity of 1.6x and 1.9x to GDP, respectively. Only remarkable difference between the growth rates has been in FY09, when Berger Paints witnessed a weak volume growth of 3.2% against 13.4% for Asian Paints. Historically, Berger Paints has witnessed lower margins than Asian Paints. However, with increasing scale, higher backward integration and shifting product mix towards premium -end of water based paints; there is a possibility that the margin gap could narrow in future. Similarly, due to Berger Paints lower margin profile, the company has relatively lower RoE compared to Asian Paints. Nevertheless, we expect it to remain at healthy levels of 24%.

Emkay Research

27 June 2011

14

Berger Paints

Initiating Coverage

Consolidated Financials

Income Statement

Y/E, Mar (Rs. m) Net Sales Growth (%) Expenses Growth (%) Raw Materials % Of Sales Employee Cost % Of Sales Other Expenditure % Of Sales Ebidta Growth (%) Ebidta% Other Income Interest Depreciation PBT Tax PAT (Before EO Item) Growth (%) Net Margin% E/O Item Reported PAT FY10 18,913 16.5 16,922 13.5 11,931 63.1 1,246 6.6 3,745 19.8 1,991 49.8 10.5 238 152 358 1,720 516 1,204 45.3 6.4 0 1,204 FY11 23,281 23.1 20,909 23.6 14,686 63.1 1,448 6.2 4,775 20.5 2,373 19.1 10.2 428 238 401 2,161 660 1,501 24.7 6.4 0 1,501 FY12E 28,967 24.4 26,165 25.1 18,936 65.4 1,641 5.7 5,587 19.3 2,802 18.1 9.7 437 297 450 2,491 759 1,733 15.5 6.0 0 1,733 FY13E 33,174 14.5 29,718 13.6 21,531 64.9 1,867 5.6 6,320 19.1 3,456 23.3 10.4 448 297 498 3,109 956 2,153 24.3 6.5 0 2,153

Balance Sheet

Y/E, Mar (Rs. m) Equity Share Capital Reserves Networth Secured Loans Unsecured Loans Loan Funds Net Deferred Tax Minority interest Capital Employed Gross Block Less: Depreciation Net Block Capital Work In Progress Goodwill Investments Current Assets Inventories Debtors Cash & Bank Loans & Advances Other Current Assets Current Liabilities & Prov Net Current Assets Miscellaneous Expenditure Capital Deployed FY10 692 5,273 5,965 2,673 0 2,674 264 0 8,903 6,757 2,462 4,295 326 0 1,282 6,567 3,299 2,423 413 432 0 3,566 3,001 8,903 FY11 692 6,203 6,895 3,022 0 3,022 263 0 10,180 7,196 2,863 4,333 826 0 526 9,015 4,437 2,753 1,265 560 0 4,520 4,495 10,180 FY12E 692 7,415 8,107 3,022 0 3,022 263 0 11,393 8,046 3,314 4,733 1,026 0 526 9,994 4,818 3,204 1,305 668 0 4,886 5,108 11,393 FY13E 692 8,925 9,617 3,022 0 3,022 263 0 12,902 8,446 3,812 4,635 1,676 0 526 11,551 5,519 3,664 1,605 764 0 5,486 6,066 12,902

Cash Flow

Y/E, Mar (Rs. m) Pre-Tax Profit Depreciation Non Cash Chg in Working Cap Tax Paid Operating Cash Flow Capex Free Cash Flow Investments Equity Capital Loans Dividend Others Net Change in Cash Opening Cash Position Closing Cash Position FY10 1,720 358 236 35 -502 1,846 -622 1,224 -1,237 1,255 -1,002 -191 0 49 364 413 FY11 2,161 401 0 -642 -660 1,260 -940 320 756 -579 348 -450 458 852 413 1,265 FY12E 2,491 450 0 -573 -759 1,610 -1,050 560 0 0 0 -520 0 40 1,265 1,305 FY13E 3,109 498 0 -657 -956 1,994 -1,050 944 0 0 0 -644 0 300 1,305 1,605

Key Ratios

Y/E, Mar Profitability % Ebidta Mgn PAT Mgn ROCE ROE Per Share Data EPS BVPS DPS Valuations (X) PER P/BV Ev/Sales Ev/Ebidta Dividend Yield (%) Turnover (X Days) Debtor TO Days Inventory TO Days Gearing Ratio Net Debt/Equity (X) Total Debt/Equity (X) 0.4 0.4 0.3 0.4 0.2 0.4 0.1 0.3 44.6 60.2 40.6 60.6 37.5 58.3 37.8 56.9 28.6 7.4 2.0 16.6 1.1 22.9 5.6 1.6 13.4 1.3 19.9 4.7 1.3 11.6 1.5 16.0 3.9 1.1 9.6 1.9 3.5 13.4 1.1 4.3 17.8 1.3 5.0 21.3 1.5 6.2 25.6 1.9 10.5 6.4 22.6 24.7 10.2 6.4 25.1 23.3 9.7 6.0 25.9 23.1 10.4 6.5 28.0 24.3 FY10 FY11 FY12E FY13E

Emkay Research

27 June 2011

15

Berger Paints

Initiating Coverage

Emkay Rating Distribution

BUY ACCUMULATE HOLD REDUCE SELL Expected total return (%) (stock price appreciation and dividend yield) of over 25% within the next 12-18 months. Expected total return (%) (stock price appreciation and dividend yield) of over 10% within the next 12-18 months. Expected total return (%) (stock price appreciation and dividend yield) of upto 10% within the next 12-18 months. Expected total return (%) (stock price depreciation) of upto (-)10% within the next 12-18 months. The stock is believed to under perform the broad market indices or its related universe within the next 12-18 months.

Emkay Global Financial Services Ltd. Paragon Center, H -13 -16, 1st Floor, Pandurang Budhkar Marg, Worli, Mumbai 400 013. Tel No. 6612 1212. Fax: 6624 2410

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to info themselves of, and to observe, such restrictions. This material is for the personal information of the rm authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation o an offer to buy any security f in any jurisdiction where such an offer or solicitation would be illegal. No person associated with Emkay Global Financial Services Ltd. is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither Emkay Global Financial Services Lt d., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forwardlooking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this mat erial may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or ac t as a market maker in the financial instruments of the company (ies) discussed herein or may perform or seek to perform investment banking services for such company(ies)or act as advisor or lender / borrower to such company(ies) or have other potential c onflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without Emkay Global Financial Services Ltd.sprior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.

Emkay Research

27 June 2011

www.emkayglobal.com 16

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

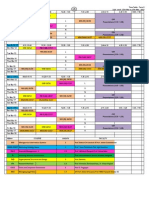

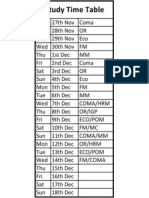

- Term V Week 11Document1 pageTerm V Week 11Derrick MenezesPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Krishna Nee Begane Baro LyricsDocument2 pagesKrishna Nee Begane Baro LyricsDerrick MenezesPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Term III Week XiDocument1 pageTerm III Week XiDerrick MenezesPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Tata Motors ItDocument1 pageTata Motors ItDerrick MenezesPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Study TTDocument1 pageStudy TTDerrick MenezesPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Pythagorean Theorem WorksheetDocument11 pagesPythagorean Theorem WorksheetJames ChanPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Book BindingDocument14 pagesBook Bindingpesticu100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Active Faults in MalaysiaDocument52 pagesActive Faults in MalaysiaHazim HaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Superposition and Statically Indetermina - GDLCDocument25 pagesSuperposition and Statically Indetermina - GDLCAnonymous frFFmePas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- SCIENCEEEEEDocument3 pagesSCIENCEEEEEChristmae MagantePas encore d'évaluation

- Igcse Revision BookDocument23 pagesIgcse Revision BookJo Patrick100% (2)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Unnatural Selection BiologyDocument2 pagesUnnatural Selection BiologyAlexa ChaviraPas encore d'évaluation

- Uji Efektivitas Mikroba Rumpun BambuDocument7 pagesUji Efektivitas Mikroba Rumpun BambuUse Real ProjectPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Rankine-Hugoniot Curve: CJ: Chapman JouguetDocument6 pagesRankine-Hugoniot Curve: CJ: Chapman Jouguetrattan5Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Do Roman Catholics KnOw About The Great Pyramids of China?Document11 pagesDo Roman Catholics KnOw About The Great Pyramids of China?.Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Kwasaki ZX10R 16Document101 pagesKwasaki ZX10R 16OliverPas encore d'évaluation

- UC Lennox Serie 13 Acx Merit R-410aDocument52 pagesUC Lennox Serie 13 Acx Merit R-410ajmurcia80Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Bahir Dar University BIT: Faculity of Mechanical and Industrial EngineeringDocument13 pagesBahir Dar University BIT: Faculity of Mechanical and Industrial Engineeringfraol girmaPas encore d'évaluation

- Ask A Monk EnlightenmentDocument16 pagesAsk A Monk EnlightenmentPetruoka EdmundasPas encore d'évaluation

- Serving North Central Idaho & Southeastern WashingtonDocument12 pagesServing North Central Idaho & Southeastern WashingtonDavid Arndt100% (3)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Assignment 4 SolutionsDocument9 pagesAssignment 4 SolutionsNengke Lin100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 20160323014547-16MnCr5 - 16MnCrS5Document1 page20160323014547-16MnCr5 - 16MnCrS5Chaitanya DattaPas encore d'évaluation

- Siprotec 7ut82 ProfileDocument2 pagesSiprotec 7ut82 ProfileOliver Atahuichi TorrezPas encore d'évaluation

- Microbiology Part 3Document74 pagesMicrobiology Part 3Authentic IdiotPas encore d'évaluation

- (G. Lakshmi Narasaiah) Finite Element Analysis PDFDocument349 pages(G. Lakshmi Narasaiah) Finite Element Analysis PDFmoljaime1326Pas encore d'évaluation

- Datasheet Ark XH Battery System EngDocument2 pagesDatasheet Ark XH Battery System EngLisa CowenPas encore d'évaluation

- Updated SAP Cards Requirement JalchdDocument51 pagesUpdated SAP Cards Requirement Jalchdapi-3804296Pas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Solid Modeling Techniques: Constructive Solid Geometry (CSG)Document22 pagesSolid Modeling Techniques: Constructive Solid Geometry (CSG)amolPas encore d'évaluation

- How To Eat WellDocument68 pagesHow To Eat WelleledidiPas encore d'évaluation

- Disectie AnatomieDocument908 pagesDisectie AnatomieMircea SimionPas encore d'évaluation

- Genie GS-1930 Parts ManualDocument194 pagesGenie GS-1930 Parts ManualNestor Matos GarcíaPas encore d'évaluation

- SAT Biochar Ethylene Poster 10 - 10b PDFDocument1 pageSAT Biochar Ethylene Poster 10 - 10b PDFsherifalharamPas encore d'évaluation

- Zest O CorporationDocument21 pagesZest O CorporationJhamane Chan53% (15)

- 1986 EMT Disruption of Microbial Cells For Intracellular ProductsDocument11 pages1986 EMT Disruption of Microbial Cells For Intracellular ProductsLezid CortesPas encore d'évaluation

- History and Philo of ScienceDocument5 pagesHistory and Philo of ScienceJan Oliver YaresPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)