Académique Documents

Professionnel Documents

Culture Documents

UST

Transféré par

James JeffersonDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

UST

Transféré par

James JeffersonDroits d'auteur :

Formats disponibles

1. What are the primary business risks associated with UST Inc.?

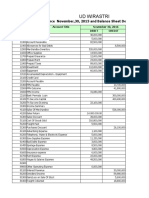

What are the attributes of UST Inc.? Evaluate from theviewpoint of the bondholder.Over the years, UST has been a dominant producer in the tobacco industry, specifically the moist tobacco industry. Eventhough the past strategy with UST has entailed raising the prices of its products on a regular basis, the company still showssigns of positive growth. Additionally, there have been recent issues with smokeless tobacco products, such as lawsuits.However, there remains a constant consumer demand for UST products. When evaluating the business risk of a company,one of the primary drivers of its business risk stems from the price elasticity of its products. Thus, these are a few reasonsthat illustrate that the smokeless tobacco industry (USTs most dominant EBIT contributor) has a relatively steep demandcurve and should be considered as having an inelastic consumer demand. Also, it is important to note that UST hasproducts outside of its core operations in the wine and premium cigar market. Also, UST has introduced products in theprice value market as consumer demand has increased.Brand name and market position - superiorCash flow generating capacity- superiorCyclicality of revenues - superiorProductdiversification poorGeographic diversification - goodAsset tangibility - goodLitigation Risk poorObviously, the twomost troubling business risks associated with UST are its litigation and product diversification risks. The smokelesstobacco industry will always face potential lawsuits because of the ongoing health concerns. Also, even though UST hasdiversified into other markets (wine and cigars), these products are very minimally attributing to USTs EBIT.Nevertheless, UST products have a steady demand for their products, they produce positive cash flows year-to-year, and thecompany has a dominant market position and brand name with regard to their core business. For these reasons, it isdetermined that UST has a relatively low business risk. 2. Discuss USTs past financial performance. Is the past performance expected to continue in the future?UST HistoricalFinancial Performance5-year CAGR 10year CAGRNet Sales 5% 9%EBIT6% 11%EPS 9% 13%5-year Average 10-year AverageGross Profit Margin 79.7% 77.3%Net Margin 32.7%31.3%ROE 122.8% 89.1%Dividend Payout 61.6%57.8%The historical financial data indicates that that compound annual growth per year has been declining in the past fiveyear compared with the past ten years in Net Sales, EBIT, and EPS. Obviously, this is a sign of UST slowing down itsfinancial performance due to factors such as an increase in competitors, less consumer demand, etc... Nevertheless, it iscomforting that within the past five years, the operating data is generally not moving backwards and is still growing (at amuch slower rate). When analyzing the 5-year and 10-year averages, the data indicates that UST financials are still steadyand increasing.Exhibit 2 suggests that the market share of UST has been slowly decreasing over the past 7-years.Due to the fact that there has been increased competition in the premium smokeless tobacco market, UST is losing marketshare with products in its core operations. Furthermore, the price value products in the industry are showing a dramaticincrease in market share, yet UST only shows a 0.6% market share in 1998 (late mover). For these reasons, UST needs tofocus their efforts on attracting the growing demand with the price value smokeless tobacco products in order to strengthentheir long-

term financial performance. Thus, because of the increased competition in the smokeless tobacco industry, USThas to constantly look for innovative ways in order for them to be a driving force in the smokeless tobacco industry. 3. (a) Compare USTs financial performance and capital structure to other tobacco firms.Exhibit TN-3 Summary Financial Information for UST and other Tobacco CompaniesUSTPhillip MorrisNorth AtlanticRJR NabiscoDimonStandard CommercialUniversalMedian (exUST)Gross Profit Margin (%)80.141.765.446.212.39.714.328NetMargin (%)32.910.31.13.52.41.83.02.7ROE (%)103.449.3NM8.412.522.525.622.5ROA(%)53.813.20.42.42.73.46.53.1Debt/Book Cap (%)17.647.590.054.471.972.359.465.7Debt/Market Cap(%)1.510.1NA52.168.370.439.248.0EBITDA/Interest coverage(x)105.612.71.63.73.35.44.44.1Corporate CreditratingAB+BBB-BB+BB-ANMUSTs margins were far superior to all of its competitors; its growth margin was 2.9x theindustry median and its net margin was12x the median. USTs ROE was an astonishing 103.4% and its ROA is equallyimpressive at 53.8% compared to a 3.1% median. Its debt/book capitalization and debt/market capitalization is 3.7x and 32xlower than the median respectively. Its interest coverage of 105.6 xs is 25 xs more than the industry median.(b) Why is Wall Street concerned about USTs future prospects leading to a neutral rating on the company?Wall Street feltthat the companys management was content with its dominant market share and was being too lax and slow in respondingto smaller competitors particularly in the value segment of the market. Analysts were also concerned about the softeningsmokeless tobacco market where unlike cigarette companies lack the option of fighting declining domestic consumptionwith international growth; UST had no immediate opportunity for expanding internationally. Finally, the public and politicalsentiment was negative regarding the tobacco industry. 4. Why is UST considering a leveraged recapitalization after such a long history of conservative debt policy?UST isconsidering a leveraged recapitalization as a mean to enhance the firms value. First, UST will benefit from the interest taxshield (roughly the increase in debt multiplied by the corporate tax rate), in addition; this value plus the initial enterprisevalue will be distributed across a small number of outstanding shares significantly increasing the value of each share.Moreover, servicing this debt should not add any extra risk of financial distress due to the highly cash generative nature of USTs business plus the predictability of their future cash flows with a high level of confidence.Second, this debt will help discipline managers from investing in projects that earn returns below the firms cost of capitalwhere UST have historically performed poorly. USTs investment in non-core operations of its wine business and cigarsbusiness generated operating profit margins of 14.9% and 5.9% respectively compared to its tobacco operating profitmargin of 57.9%. By adding interest payment obligations into the framework excess cash will be better utilized instead of being invested into underperforming operations and projects. 5.) Should UST undertake the $1 billion recapitalization?(a)Prepare a pro-forma (1999) income statements to evaluateUSTs ability to make interest payments.Exhibit TN-4: Income Statement ProjectionsActual 1998Pro-forma 1999 (I)Pro-forma 1999 (II)Pro-forma 1999 (III)Pro-forma 1999 (IV)Sales1423.21494.361494.361494.361494.365% Annual GrowthEBIT753.3792.01792.01792.01792.0153%of salesInterest Expense-

2.2070.578.287Pretaxearnings755.5790.52721.51713.81705.01Taxes287.6300.40274.17271.25267.9038% tax rateNetIncome467.9490.12447.34442.56437.11Net debt00100010001000Interest Rate-0.07050.07820.087Interest Coverage--11.210.139.10EBIT/Interest ExpenseDebt Rating-ABBBBBWhen examining USTs ability to make interest payments, it isimportant to focus on the interest coverage ratio under each of the different pro-forma scenarios. The interest coverage ratioillustrates the ability of the company (in this case, UST) to make interest payments on the outstanding debt. As the interestcoverage ratio approaches 1, the ability of the company to make these interest payments becomes problematic. From abondholders perspective, the bondholder wants to be sure that the company is always able to make the interest payments.For UST, in this case, as the debt rating of UST decreases from a bond rating of A (Scenario II) to a debt rating of BB(Scenario II), the interest coverage ratio is decreasing. However, from the bondholders perspective, the decrease does notwarrant a cause for alarm just yet. The 9.10 coverage ratio is still a quality measure, and shows that UST is able to meet thedemand for the interest payments as of the current projection.(b) Calculate the valuation impact of the recapitalization plan by estimating the value of the interest tax shields, assuming acorporate tax rate of 38%. What other factors, beyond the corporate interest tax shields, should UST consider in assessingthe valuation impact of the plan?Exhibit TN-5: Valuation ModelStatus Quo$1 Billion Recap PlanPV Tax Shields(tD)0.00380.00 38%*$1000Value of UST (S = Vu)6,469.006,849.00 $380 + 6469Net Debt0.001,000.00Stock Price34.8836.92 6849/185.5Shares Repurchasedn/a27.08Shares 185.50158.42Market Equity6,469.006,849.00Debt/MarketEquity0.000.15 1000/6849There are other factors, beyond the corporate tax shield, that UST should consider whenassessing the impact of the $1 billion dollar recapitalization plan. Some of these factors include the signal that UST will besending to investors with this recapitalization plan. The effect that the recapitalization will have on the value of the firm;due to the change of the capital structure. Since the firm will be adding debt, and incurring tax savings, this will have apositive effect on the stock price (Yes, it is true that the number of shares will also be decreasing, leading to a higher E.P.S).Another factor that should be considered is the fact that this recapitalization will have a negative effect on the firmsliquidity. Since the debt/equity value of the firm will be increasing, the leverage of the firm is increasing, and consequentlythe riskiness of the shares of common stock will also be increasing. It is important for UST to consider these factors as thefirm implements and follows through with the recapitalization. 6.) UST Inc. has paid uninterrupted dividends since 1912. Assess the impact of the plan on USTs $ dividend and dividendper share, assuming it continues to payout 64% of its earnings as dividends.Exhibit TN-6: Impact of Recapitalization on DividendsDebt = $1 BillionActual 1998Pro-forma 1999 No debtPro-forma1999 Rd = 7.82Net Income467.9491442.56Shares185.5185.5158.42Earnings per Share2.522.652.79NI/SharesDividendPayout301.1314.2283.24NI*.64Dividends per Share1.621.691.79EPS*.64When assessing the impact of the plan on the $dividend and the dividend per share, it is clear that the recapitalization plan reduces the total dividend payout from $314.2 to$283.24; however, the dividend per share value increases from $1.69 to $1.79. This is caused in part by the reduced number of shares outstanding as a result of the recapitalization. These assumption are based on the fact that UST continues itspolicy of paying out 64% of earnings as dividends. It is important for UST to continue to uphold this

tradition of thisdividend payout ratio in order to keep the stockholders happy, and to not signal any negative ideas to the stockholders andto Wall Street.

Vous aimerez peut-être aussi

- Cash App - Statement 2020Document4 pagesCash App - Statement 2020ss ds67% (3)

- Debt Policy at Ust Case SolutionDocument2 pagesDebt Policy at Ust Case Solutiontamur_ahan50% (2)

- West Teleservice: Case QuestionsDocument1 pageWest Teleservice: Case QuestionsAlejandro García AcostaPas encore d'évaluation

- Ust Inc Case SolutionDocument16 pagesUst Inc Case SolutionJamshaid Mannan100% (2)

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncWill Tan80% (5)

- Sun Microsystems Case PDFDocument30 pagesSun Microsystems Case PDFJasdeep SinghPas encore d'évaluation

- Assignment Schumpeter Finanzberatung DEC-5-21Document2 pagesAssignment Schumpeter Finanzberatung DEC-5-21RaphaelPas encore d'évaluation

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Ust SolutionDocument3 pagesUst SolutionAdeel_Akram_Ch_9271Pas encore d'évaluation

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangPas encore d'évaluation

- Ameritrade Case SolutionDocument34 pagesAmeritrade Case SolutionAbhishek GargPas encore d'évaluation

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- TN15 Teletech Corporation 2005Document8 pagesTN15 Teletech Corporation 2005kirkland1234567890100% (2)

- Monmouth Case QuestionsDocument1 pageMonmouth Case Questionssakshi gulatiPas encore d'évaluation

- Corporate Finance UST CaseDocument7 pagesCorporate Finance UST Casepradhu1100% (1)

- LEASE OR BUY DECISION 1 21102021 103436amDocument4 pagesLEASE OR BUY DECISION 1 21102021 103436ammaha hassan100% (1)

- case-UST IncDocument10 pagescase-UST Incnipun9143Pas encore d'évaluation

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73Pas encore d'évaluation

- UST IncDocument16 pagesUST IncNur 'AtiqahPas encore d'évaluation

- Corp Finance HBS Case Study: Debt Policy at UST IncDocument4 pagesCorp Finance HBS Case Study: Debt Policy at UST IncTang LeiPas encore d'évaluation

- Debt Policy at Ust Inc Case AnalysisDocument23 pagesDebt Policy at Ust Inc Case AnalysisLouie Ram50% (2)

- Debt Policy at UST Inc.Document11 pagesDebt Policy at UST Inc.Omkar BibikarPas encore d'évaluation

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193Pas encore d'évaluation

- Kraft Foods Case SummaryDocument2 pagesKraft Foods Case Summaryrkodo1126Pas encore d'évaluation

- Nestle and Alcon - The Value of ADocument33 pagesNestle and Alcon - The Value of Akjpcs120% (1)

- Coursehero 40252829Document2 pagesCoursehero 40252829Janice JingPas encore d'évaluation

- Wikler Case Competition PowerpointDocument16 pagesWikler Case Competition Powerpointbtlala0% (1)

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakPas encore d'évaluation

- Teuer Furniture Case AnalysisDocument3 pagesTeuer Furniture Case AnalysisPankaj Kumar0% (1)

- Bed Bath Beyond (BBBY) Stock ReportDocument14 pagesBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- LinearDocument6 pagesLinearjackedup211Pas encore d'évaluation

- AMERICAN HOME PRODUCTS CORPORATION Group1.4Document11 pagesAMERICAN HOME PRODUCTS CORPORATION Group1.4imawoodpusherPas encore d'évaluation

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaPas encore d'évaluation

- XLS EngDocument26 pagesXLS EngcellgadizPas encore d'évaluation

- Daktronics E Dividend Policy in 2010Document26 pagesDaktronics E Dividend Policy in 2010IBRAHIM KHANPas encore d'évaluation

- World Wide Paper CompanyDocument2 pagesWorld Wide Paper CompanyAshwinKumarPas encore d'évaluation

- Corporation CaseDocument39 pagesCorporation Caseayane_sendoPas encore d'évaluation

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- AirThread Valuation SheetDocument11 pagesAirThread Valuation SheetAngsuman BhanjdeoPas encore d'évaluation

- Seagate NewDocument22 pagesSeagate NewKaran VasheePas encore d'évaluation

- Fuel SalesDocument11 pagesFuel SalesFabiola SE100% (1)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenPas encore d'évaluation

- This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)Document52 pagesThis Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)mehar noorPas encore d'évaluation

- Sampa Video Case SolutionDocument6 pagesSampa Video Case SolutionRahul SinhaPas encore d'évaluation

- Session 19 - Dividend Policy at Linear TechDocument2 pagesSession 19 - Dividend Policy at Linear TechRichBrook7Pas encore d'évaluation

- Mercury Athletic FootwearDocument4 pagesMercury Athletic FootwearAbhishek KumarPas encore d'évaluation

- Group BDocument10 pagesGroup BHitin KumarPas encore d'évaluation

- This Study Resource Was: Gain Control of Robertson Tool in May 2003?Document4 pagesThis Study Resource Was: Gain Control of Robertson Tool in May 2003?Pedro José ZapataPas encore d'évaluation

- PolarSports Solution PDFDocument8 pagesPolarSports Solution PDFaotorres99Pas encore d'évaluation

- Group Ariel StudentsDocument8 pagesGroup Ariel Studentsbaashii4Pas encore d'évaluation

- Mercury Athletic CaseDocument3 pagesMercury Athletic Casekrishnakumar rPas encore d'évaluation

- Full ReportDocument20 pagesFull ReportSakshi Sidana100% (1)

- Case Sheet - Ameritrade: GROUP 16: Answer 9Document31 pagesCase Sheet - Ameritrade: GROUP 16: Answer 9tripti maheshwariPas encore d'évaluation

- Airthread Acquisition Operating AssumptionsDocument27 pagesAirthread Acquisition Operating AssumptionsnidhidPas encore d'évaluation

- Flow Valuation, Case #KEL778Document20 pagesFlow Valuation, Case #KEL778SreeHarshaKazaPas encore d'évaluation

- Case2 Team4 v4Document7 pagesCase2 Team4 v4whatifknowPas encore d'évaluation

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncIrfan MohdPas encore d'évaluation

- Case2Team4 v4Document8 pagesCase2Team4 v4PranjalPhirkePas encore d'évaluation

- CaseDocument5 pagesCaseAnton BorisovPas encore d'évaluation

- 2011 Financial PresentationDocument21 pages2011 Financial Presentationwilliams1370Pas encore d'évaluation

- Economic Factors PESTELDocument11 pagesEconomic Factors PESTELnatalie_calabresePas encore d'évaluation

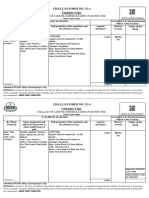

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheZahoorNabiPas encore d'évaluation

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573Pas encore d'évaluation

- k48 - Anh 2 CLCTCNH - Le Anh MinhDocument72 pagesk48 - Anh 2 CLCTCNH - Le Anh MinhMinh Anh0% (1)

- Public Finance & Taxation - Chapter 4, PT IVDocument24 pagesPublic Finance & Taxation - Chapter 4, PT IVbekelesolomon828Pas encore d'évaluation

- (1 Point) : True FalseDocument18 pages(1 Point) : True FalseElla DavisPas encore d'évaluation

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011592Pas encore d'évaluation

- An Assignment ON Wealth Management Organisation: Submitted by S. Ramnath (098004100038) Ii Mba-BimDocument5 pagesAn Assignment ON Wealth Management Organisation: Submitted by S. Ramnath (098004100038) Ii Mba-Bimanon_552306714Pas encore d'évaluation

- Maths ExamDocument17 pagesMaths ExamBenjamin GeorgePas encore d'évaluation

- Chapter 2 RRLDocument21 pagesChapter 2 RRLBrent Roger De la CruzPas encore d'évaluation

- S2 PPTDocument12 pagesS2 PPTPUSHKAL AGGARWALPas encore d'évaluation

- 2nd-Q - Week-1-BF-Amortization - JOSEPH AURELLODocument13 pages2nd-Q - Week-1-BF-Amortization - JOSEPH AURELLOFairly May LaysonPas encore d'évaluation

- Kerala Water Authority: Office of The Executive EngineerDocument32 pagesKerala Water Authority: Office of The Executive EngineerKkrkollam KrishnaKumarPas encore d'évaluation

- 10000003728Document32 pages10000003728Chapter 11 DocketsPas encore d'évaluation

- 5010 Ohada Fin Reporting p2Document12 pages5010 Ohada Fin Reporting p2serge folegwePas encore d'évaluation

- RETAILLENDING1Document57 pagesRETAILLENDING1Pawan Kumar Mandrawalia100% (1)

- FIN 542 International Financial Management: Mechanics of Foreign Exchange Exchange Rate Parity Text p98Document17 pagesFIN 542 International Financial Management: Mechanics of Foreign Exchange Exchange Rate Parity Text p98Anonymous rcCVWoM8bPas encore d'évaluation

- Module 5 Answer KeysDocument5 pagesModule 5 Answer KeysJaspreetPas encore d'évaluation

- SOC-Citygem 30062021Document2 pagesSOC-Citygem 30062021Super 247Pas encore d'évaluation

- ICAI QuestionsDocument244 pagesICAI QuestionsdonaPas encore d'évaluation

- Cost of Capital Final Ppt1Document12 pagesCost of Capital Final Ppt1Mehul ShuklaPas encore d'évaluation

- Session Readings (Euro Issues)Document8 pagesSession Readings (Euro Issues)Arathi SundarramPas encore d'évaluation

- DFGTBTDocument316 pagesDFGTBTLexuz GatonPas encore d'évaluation

- Formatted Accounting Finance For Bankers AFB 1 PDFDocument6 pagesFormatted Accounting Finance For Bankers AFB 1 PDFSijuPas encore d'évaluation

- Test On Cashbook and Petty CashbookDocument5 pagesTest On Cashbook and Petty Cashbookshamawail hassanPas encore d'évaluation

- 100 Question Law On SalesDocument11 pages100 Question Law On SalesSBWRB100% (1)

- Modul Pratama - JawabanDocument127 pagesModul Pratama - JawabanDity Rakhma QintariPas encore d'évaluation

- Name: - 5.1 Problem Set 115Document14 pagesName: - 5.1 Problem Set 115Clair BlushPas encore d'évaluation

- Financial MathematicsDocument5 pagesFinancial MathematicsTAFARA MAROZVAPas encore d'évaluation