Académique Documents

Professionnel Documents

Culture Documents

Global

Transféré par

Ssk IndeDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Global

Transféré par

Ssk IndeDroits d'auteur :

Formats disponibles

Handicrafts Brand : Mera Bhaarat Mahaan

&%' S&MMARY

HandicraIt production is a major Iorm oI employment in many developing countries and oIten a

signiIicant part oI the export economy. With increased globalization, however, products are becoming

more and more commoditized, with artisan producers Iacing increased competition Irom producers all

over the world, particularly in China and other Asian countries.

Although India's exports of handicrafts appear to be sizable, the country's share in the USD

100 billion international handicrafts market is just about 2 %.

The home accessory market, oIten used to estimate the demand Ior handcraIted goods, is strongly

inIluenced by Iashion, consumer purchasing patterns, and economic conditions in end markets.

Keeping up with Irequently changing market trends presents a major challenge Ior handicraIt

exporters, and many observers Iear that the advance oI globalization has intensiIied this challenge and

the precarious nature oI work and existence in artisan communities everywhere. However,

globalization combined with growing markets Ior home accessoriesespecially in the United States,

Canada, and Europealso creates many new opportunities. In particular, the demand Ior 'cultural

goods is projected to grow with rising international tourism and an increasing Iocus on interior

decoration, and as a reaction (notably in upscale markets) to the homogenization oI mass-produced

products. Naturally, new opportunities bring new challenges: handicraIt producers must be more

responsive in adapting designs to buyer requirements, provide timely production and delivery, and

improve quality and eIIiciency in view oI increased price competition and consumer expectations.

This study provides an analysis oI the global market Ior handicraIts and reveals the Iollowing trends

in the marketplace that impact handicraIt producers in developing countries:

There is a growing market for home accessory products, particularly in the high-end

segment. It is expected to grow not only in Western markets but in all regions as middle-class

populations expand rapidly, particularly in China and India. This trend suggests that there are

numerous and expanding opportunities Ior artisans in developing countries to create products Ior

these markets.

China and India-along with several other Asian countries-currently dominate handicraft

production worldwide, and are likely to continue to do so for the foreseeable future. Their

position is based largely on low-cost, high volume, Western-designed goods.

Many buyers and consumers seek unique products made in countries other than China.

While the market Ior purely indigenous designs is limited, 'global styleproducts that combine

ethnic elements with contemporary designsis a growing category and represents an opportunity

Ior handicraIt producers.

Low-end (priority on low prices) and high-end (priority on high quality) markets are

expanding, while the middle (moderate quality at moderate prices) is relatively stagnant.

Whereas competition at the low end is strong and requires signiIicant production capacity, the

'luxury market tends to Iocus more on distinctive designs, higher quality, and smaller quantities

with greater Ilexibility in pricing.

Distribution channels in end markets are shortening. arge and, increasingly, mid-size

retailers are importing directly, while small (and many oI the mid-size) retailers continue to

purchase merchandise principally, or entirely, Irom domestic wholesale importers. As this trend

continues, many wholesale importers are losing important clients and many independent retailers

are struggling to compete in a marketplace dominated by lower-priced 'big-box stores.

However, there is evidence that savvy small retailers can compete with distinctive, high-end

products. It is important to note that the vast majority oI importers, both wholesale and retail, rely

on the services oI Ioreign exporters and agents, which many market experts see as critical to the

success oI handicraIts in developing countries.

The large, direct-import retailers often operate in ways that present barriers to micro and

small enterprises. Their purchase orders typically require high production capacities, strict

delivery dates, and speciIic labeling, packaging, and packing. Advance deposits are unusual,

delayed payment terms are customary, and charge-back penalties Ior mistakes are common.

While similar barriers exist with some wholesale importers, many order smaller quantities, oIIer

prepayments to Iund production with balances paid upon delivery, and have Iewer requirements

that could result in charge-backs.

Buyers of all types prefer multiple product options to choose from, flexibility to make

design modifications, and, above all, reliable partners. There are countless sources oI product

in the world vying Ior attention; what buyers seek most are items that sell Irom a producer who

can deliver.

Home accessories and dcor, gifts, and products for garden and outdoor living spaces are

~hot, with forecasted continued growth, as are products that are simultaneously decorative

,3/functional. These categories present extensive opportunities Ior handicraIt producers.

The handicraIt producers in developing countries should pursue the Iollowing strategies in order to

compete in the global marketplace:

1. Focus on markets and channels in which there is less direct competition with high-volume, lowcost

producers oI 'industrial handicraIts, Ior example, the independent retailer market by way oI

wholesale importers. Rather than competing directly with China, identiIy and sell to market

niches such as high-end home accessories and the importers whose smaller orders are declined by

large craIt Iactories.

2. Develop more products that embrace the concept oI global style in order to both access the large

and growing demand Ior contemporary design and remain distinctive in the marketplace.

Opportunities Ior handicraIts exist in all market segments, but are most abundant Ior products that

Iit comIortably into people`s homes and bring an authentic indigenous element into their lives.

3. ook to local and regional markets Ior opportunities that may have been overlooked and can

serve as a springboard to larger and more competitive markets.

4. Constantly upgrade skills and techniques, including detailed handiwork, quality (especially

Iinishes), product development, and customer service to remain competitive, diIIicult to imitate,

and appealing to work with. Investments to reliably deliver modest quantities oI unique, highquality

goods destined Ior higher-end retail stores are advised over those intended to improve the

ability to compete with low-cost, high-capacity producers.

Introduction:

%he best opportunity for the India exporters of handicraft items exist in the low-end of the

market, as labour costs are generally lower in India. While preparing the export plan, it is

important to keep in mind that the trade structure of the handicraft market in the EU is

highly complex in the sense that handicrafts and wooden gifts are distributed through many

different intermediaries and retailers. %here are hardly any shops selling only wooden gifts

and handicrafts.

Mera Bharat Mahaan is an export organization that deals in woodwork , clay , metal and

other home dcor handicrafts.

Why Germany?

According to Eurostat Statistics :

Though roughly 10 oI India`s trade share comes Irom Germany, it is a market that can be exploited

Iurther. But this 10 Iorms a very miniscule part oI Germany`s trade almost less then 2. The leader

being China & Sri anka (15) Iollowed by Thailand (4). The presence oI Indian handicraIts is almost

negligible and Germany is the right place because in EU it has the largest consumer base Ior giIts and

handicraIts.

The EU giIts and handicraIts market is worth 35 bn .IN 2008 Germany was the largest EU market

comprising oI 24.6 oI the total market share Iollowed by France at 17.2. EU customers value style ,

quality oI construction and Iunctionality oI the product.

In 2005, the total EU consumption of wooden gifts and

handicrafts amounted to 1,251 million. According to

different market research firms, the wooden gifts and

handicrafts market in the EU is likely to increase by 2-

3% annually until the end of the decade.

In 2005 the period total production of wooden gifts and

handicrafts in the EU amounted to 936 million. %he

frames market accounted for 64% of consumption of

wooden gifts and handicrafts in 2005 while the

statuettes and caskets market accounted for 36% of

consumption of wooden gifts and handicrafts during the period.

In 2006, the total value of wooden gifts and handicrafts imported into the EU amounted to

717.2 million. Imports from developing countries grew almost 5% from 2004 to 2006.

Almost 46% of total imports into the EU come from China. %he rest of the imports from

developing countries are supplied by Indonesia 10.8%, %hailand 9%, India 5% and others

0.2%.

The two countries expect to achieve bilateral trade worth t20 billion ($26 billion) by 2012 roughly

doubling the current trade volume between them, which is euro13 billion.

#esearchers have predicted that the German handicraft, wooden and gift article market will

slowly increase until 2009, by approximately 1.8% annually.

In spite oI the subdued German economy, the German market Ior handicraIts and hobby products

is one oI the sectors which are still experiencing some growth. Sectors involving products Ior the

home are increasingly popular. The ongoing recession is encouraging German consumers to

concentrate on activities involving home and Iamily.

There are estimated 3,500-5,000 retailers in this product sector ranging Irom small, specialised

retailers to department stores, DIY stores and toy stores with hobby/craIts departments. An

increasing number oI traditional retailers are also oIIering their customers the chance to buy Irom

their online-shops. Some retailers do not have normal shops/outlets anymore but sell exclusively

online.

German craIters are always interested in new products. These could be Ior already established

craIts such as card-making, rubber stamping, decoupage (plain and 3D), patchwork and quilting,

soIt toy and doll making or beading to mention just the most widely known. CraIters in Germany

are price conscious but more emphasis is put on quality and variety. There is also interest in new

craIting trends.

Specialist consumer Iairs are very important Iorums. The main one oI these is the Creativa an

annual event which, was attended last year by over 400 exhibitors mainly Irom Germany but also

most other European countries as well as America. During its 5-day duration, the Creativa

attracted some 76,500 visitors in 2009 (an increase oI 5.3 over the previous year) who spent

approx. t118 per person amounting to t8.3 million at the Iair. Many exhibitors can also expect

Iollow-up sales via catalogues or online-shops. The next event is Irom 17.03.-21.03.2010 in

Dortmund. Further inIormation can be Iound on the website:

http://www.westIalenhallen.de/5022.php . This website is also available in English.

Another major specialist consumer Iair is the Kreativ Welt, which is held annually in

Wiesbaden. ast year some 50,000 people visited the Iair, spending on average t 150 per person.

ast year some 400 companies Irom Germany, Benelux, Sweden and the Baltic Countries

exhibited. The next event is Irom 28.10.-31.10.2010 in Wiesbaden. Further inIormation can be

Iound on the Iollowing website:

Both oI these Iairs would be excellent venues to introduce products new to the German market

direct to consumers as companies could get a very accurate impression oI how much interest the

product is likely to generate. It must be stressed, however, that German speaking personnel

should be available on the stand.

The main events on the trade side are:

O Fahoba kreativ , which is also held annually in Dortmund. Although a relatively small

event (52 exhibitors and over 2,000 visitors in 2009) it is quite important to this sector.

Visitors are typically owners/buyers Ior specialist retail/wholesale businesses as well as

buyers Ior the larger stores/chains. Products on oIIer cover most hobby and handicraIts

materials and supplies. New trends are introduced through seminars and workshops at the

Fahoba kreativ, where the decision makers can usually try out the new products/trends.

Exhibitors are mostly commission agents, but also some manuIacturers. The next event

will be held Irom 27.08.-29.08.2010 in Dortmund. Further inIormation can be Iound on the

Iollowing website:http://www.westIalenhallen.de/4514.php The website is also available

in English. handarbeit + hobby , held annually in Cologne. This is a very international

event. There were 212 exhibitors Irom 24 countries and 8,788 visitors Irom 54 countries in

2009. Main products exhibited are: Needlework yarns and implements, haberdashery,

tapestry, home-textiles knitting and sewing machines, craIt and hobby supplies. The next

event will be held Irom 26.03.-28.03.2010 in Cologne. Further inIormation can be Iound

on this website:http://www.handarbeit-hobby.de/ The website is also available in English.

Germany`s TV shopping channels (QVC, RT-Shop and HSE Home Shopping Europe) have

also increased the number oI products Irom the hobby and handicraIts sector shown in their

presentations. OI particular interest are rubber stamping, scrapbooking and card-making.

Market Segmentation:

%he German handicraft market can be segmented roughly into upper, middle, and lower

segments. %his segmentation applies both to the retail and other levels (such as wholesalers

and importers) in the market.

O Upper segment: 5-10%

O Upper-middle segment: 20-30%

O ower-middle segment: 30-40%

O ower Segment: 20-40%

Distribution intermediaries

While exporting, choosing the right trading partner is very important. As mentioned earlier,

the trade structure of the handicrafts and wooden gifts market in the EU is very complex.

%herefore it is a must for exporters willing to export to the EU to find out the best trading

partner according to their specific profile, product range and goals. Some main distribution

channels exporter may consider are -

O Agents

O Importers-wholesalers

O Buying Groups

O #etailers

O Export marketing organisations.

Target Market:

O !rofessional Men and Women ( Age :30 - 50 years )

%hey are likely to buy on festivals like thanksgiving and Christmas and also for

housewarming.

O Geographical

Geographically the target market would be situated in high population density areas.

4 Cologne - 11 million

4 Berlin - 6 million

4 Munich - 6 million

4 rankfurt -5 million

O Demographics

4 As stated by Statistisches Bundesamt (ederal Statistical Office Of Germany)

the population of Germany 86,468,000 making it the 14

th

most populous

country in the world.

4 Germany has an aging population with nearly 20% population being over 65

years of age and 64% people in the age bracket of 35 - 64 years. %he

population growth rate is - 0.0333%.

Strengths:

1. India - EU %A likely to come into being end of 2011.

2. %he Broad-Based %rade and Investment Agreement (B%IA) proposed to be signed

early next year will give a fillip to bilateral trade which could increase to 100 billion.

3 AbundanL and cheap labour hence can compeLe on prlce

4 Low caplLal lnvesLmenL and hlgh raLlo of value addlLlon

3 All manufacLurers of handlcrafLs are exempL from obLalnlng an lndusLrlal llcense Lo

manufacLure

6. @here are no resLrlcLlons regardlng Lhe locaLlon of Lhe manufacLurlng unlL

7. %ax holidays.

8. Cheap and abundant labour.

Weaknesses:

1. Currency Fluctuations have tremendous effect on the export business.

%he India handicraft industry was worst hit by the sudden rupee appreciation during

the last year. ollowing rupee appreciation of over 13% against the value of US

dollar in the last financial year, the handicraft sector of the country lost revenues of

around $500 million and could export only around $3 billion, as against the target of

$3.5 billion.

During 2007-08 (April to March), the exports of handicrafts have shown a decrease

of #s.3276.09 crore, from #s. 17288.14 to #s. 14012.05 crore, a decrease of

18.95% in rupees term. In dollar terms, the exports have shown the decrease of US

$ 330.12 millions i.e. the exports decreased by 8.66% over the similar period in

2006-2007.

During 2008-09 (April to August), the exports of handicrafts have shown an increase

of #s. 130.31 crore, from #s. 4302.04 to #s. 4432.35 crore, an increase of 3.03% in

rupees term. In dollar terms, the exports have shown the increase of US $ 8.03

millions i.e. the exports increased by 0.77% over the similar period in 2007- 2008.

O Standardisation and supply chain issues.

O Strong product development skills required.

!romotion:

The organizations who are developing the new and innovative items are required to give publicity

at the international level in order to explore the possibility to market their items. Effective and well

designed publicity drive create awareness amongst the potential buyers as to the strength of the

products ranges being offered by ndia and also help in dissemination of National policies and

information on other issues like Social Environmental, working condition to educate buyers and

consumers. t is, therefore, proposed to launch a systematic publicity campaign through audiovisual/

printed publicity by making video film preparing posters, catalogues, folders, brochures on

ndian Handicraft/Carpet, Road Shows, Catalogue Shows, fashion shows, live demonstration by

crafts persons and such other methods as will create positive image of ndian Handicrafts in the

foreign markets.

With the view to market their products the organizations may like to participate in various

international exhibitions/fairs, Buyer Seller Meets etc., display their items in reputed departmental

stores. n order to create awareness about ndian Culture at the international level it is also

necessary to depute crafts persons for live demonstration during the international

fair/exhibition/Buyer Seller Meet and to organize the cultural exchange programme between various

countries. The market is a dynamic place and situation is ever changing in terms of the potentiality,

taste,fashion and nternational focus. With the increased international competition, market trends are

changing and market segments are becoming more and more country specific as well as product

focused. n order to meet with the challenges and opportunities organizations are required to

participate in fair and exhibitions, conduct market studies etc.

n order to identify the export market and publicize their products the financial assistance will

be provided to the organizations for:

O Participation in nternational fair(s)/exhibitions(s) abroad.

O Participation in Buyers-Sellers Meet(s) in ndia and Abroad.

O Conducting Market Studies Abroad.

O Deputation of crafts persons for live demonstration during various fairs/foreign

Exhibitions/Cultural Exchange Programme agreed between ndia & other countries.

O issuing journaIs;

O organizing promotionaI events;

O organizing trade fairs;

O advertising handicraft' products

O upgrading skiIIs;

O assisting handicrafts in finding market outIets;

O SoIving generaI market outIet probIems.

PRICING

Among Lhe four markeLlng mlx producL dlsLrlbuLlng channels promoLlon and prlce only prlce creaLes lncome and

Lhe oLher Lhree generaLe cosLs rlce besldes creaLlng lncome plays a ma[or role as a sLraLeglc facLor ln developlng

compeLlLlve advanLage ln Lhe markeL @he amounL of lncome and promoLlon of a company regardlng Lhe

poslLlonlng and flndlng a sulLable poslLlon ln Lhe mlnd of cusLomers are relaLed Lo sulLable prlclng ueclslon maklng

for prlclng ls noL an easy Lask and many facLors are affecLlng ln Lhls declslon @he reason for some companles whlch

are noL so acLlve for exporL prlclng ls LhaL Lhey have a good sale ln lnLernal markeL because of Lhelr producL

characLer whlch has good lnLernal markeL or ln some counLrles due Lo llmlLlng lmporL regulaLlon @hese companles

are worrled abouL helr global compeLlLlve poslLlons Loo and need a prescrlpLlon for Lhelr fuLure acLlvlLy because

Lhey also feel LhaL ln Lhe global markeLlng acLlng eLhnocenLrlc wlll noL be enough @wo maln facLors for Lhls

company Lo be consldered are lnLernal markeL condlLlon and Lhe amounL of auLhorlLy granLed Lo exporL managers

for declarlng prlce Lo dlfferenL cusLomers

Environmental factors affecting pricing

Marketers must deal with a number oI environmental Iactors when making pricing decisions. Currency Iluctuation,

inIlation, government controls and subsidies, competitive behavior, and market demand are among these Iactors.

Some oI these Iactors work in conjunction with others; Ior example, inIlation may be accompanied by government

controls.

When currency fluctuation occurs, there are two options Ior pricing: one is to Iix the price oI products in country

target market. In this case, any appreciation or depreciation oI the value oI the currency in the country oI production

will lead to gain or losses Ior the seller. The other option is to Iix the price oI products in home country currency. II

it is done, any appreciation or depreciation oI the home country currency will result in price increases or decreases

Ior customers and no immediate consequences Ior the seller. In actual practice, a manuIacturer and its distributor

may work together to maintain Market share in international market. Either party, or both, may choose to take a

lower proIit percentage. In the long term contracts, both parties agree an exchange rate clause, which allows them to

agree to supply and purchase at Iixed prices in each company`s national currency. In this case iI the exchange rate

Iluctuate within a speciIied range, say plus or minus oI Iive percent, the agreed price will not be changed, but iI

more than that, say plus or minus oI ten percent, then new discussion or negotiation Ior adjusting the prices should

be opened.( Darlin, 1998)

Inflation, or a persistent upward change in price levels, is a worldwide phenomenon. InIlation requires periodic

adjustments. These adjustments are caused by rising costs that must be covered by increased selling prices. An

essential requirement when pricing in an inIlationary environment is the maintenance oI operating proIit margins.

IFO costing method is prescribed by some practitioners under conditions oI rising prices.

Government control can also limit the Ireedom to adjust prices, and the maintenance oI margins should be

compromised. In a country that is undergoing severe Iinancial diIIiculties and is in the midst oI a Iinancial crisis

(e.g., a Ioreign exchange shortage caused in part runaway inIlation), government oIIicials are under pressure to take

some type oI action. Governmental actions in the case oI hard Iinancial problems include use oI broad or selective

price controls, prior cash deposit requirements Ior imports, customs duties Ior imports, value added tariIIs,

proliIeration oI rules and regulations, and subsidization. All oI these controls are against exporting pricing when a

company wants to export products to an importing country which is under control oI the government. In Iact the

more control rendered by a government the more diIIicult to enter in that country market. In this case the availability

oI this market is not so suitable.

Main Factors affecting on pricing for Handicraft:

O The cost oI manuIacturing, distributing and marketing our product.

O The physical location oI production plants might inIluence price. For example, Toyota

have plants in their European market, in the United Kingdom and Turkey.

O Fluctuations in Ioreign currencies aIIect pricing. Due to relatively low US Dollar price

during the 2010s our imports to the United States expensive, but exports relatively cheap.

However Iluctuations make it very diIIicult Ior companies to make long-term decisions -

such as building large Iactories in global markets i.e. costs oI production are cheap today,

but could be expensive in the Iuture, impacting upon the price that the business is Iorced

to charge.

O The price that the international consumer is willing to pay Ior the product.

O The price that competitors in international markets are already charging.

O Business environment Iactors such as government policy and taxation.

Pricing Strategic Matrix based on the quality

P

r

i

c

e

Quality

ow High

o

w

Economy Penetration

H

i

g

h

Skimming Premium

Pricing Strategies Matrix

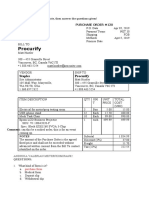

GkCSS MAkGIN 2011 2012 2013 2014 201S

Sa|es (In Luro) 33400 62000 72600 86300 103900

rect Cost of Goods 26830 29330 36074 42600 49830

Cther cost 0 0 0 0 0

1ota| Cost of goods

so|d

26830 29330 36074 42600 49830

Gross Margn 26370 32630 36326 41000 36070

Gross margn 497 326 303 473 327

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Categories Topics Page No: Arts & CultureDocument104 pagesCategories Topics Page No: Arts & CultureZyesha KaifPas encore d'évaluation

- MathFundas WWW - Qmaths.inDocument64 pagesMathFundas WWW - Qmaths.inRobin VermaPas encore d'évaluation

- Squares TableDocument1 pageSquares TableSsk IndePas encore d'évaluation

- GA-History of IndiaDocument233 pagesGA-History of IndiaRuchita RanjanPas encore d'évaluation

- Range PlanDocument18 pagesRange PlanSsk IndePas encore d'évaluation

- Clerk Competition BoosterDocument70 pagesClerk Competition Boosterdheeru0071Pas encore d'évaluation

- The History of Bandhani or Tie and DyeDocument3 pagesThe History of Bandhani or Tie and DyeSsk Inde100% (1)

- Article 2 Chemical Finishing and Its MechanismsDocument6 pagesArticle 2 Chemical Finishing and Its MechanismsSsk IndePas encore d'évaluation

- NAFTADocument9 pagesNAFTASsk IndePas encore d'évaluation

- Retail MathematicsDocument2 pagesRetail MathematicsSsk IndePas encore d'évaluation

- Knitting by SamirDocument13 pagesKnitting by SamirSsk IndePas encore d'évaluation

- Assignment On Supply Chain ManagementDocument3 pagesAssignment On Supply Chain ManagementSsk IndePas encore d'évaluation

- ITC InfotechDocument1 pageITC InfotechSsk IndePas encore d'évaluation

- Retail MathematicsDocument2 pagesRetail MathematicsSsk IndePas encore d'évaluation

- Retail PPT - FinalDocument24 pagesRetail PPT - FinalSsk IndePas encore d'évaluation

- ITC InfotechDocument1 pageITC InfotechSsk IndePas encore d'évaluation

- Presentation 4Document1 pagePresentation 4Ssk IndePas encore d'évaluation

- Fashion MarketingDocument3 pagesFashion MarketingSsk IndePas encore d'évaluation

- Marketing Strategy-LG ElectronicsDocument28 pagesMarketing Strategy-LG ElectronicsSsk Inde80% (5)

- Fashion MarketingDocument3 pagesFashion MarketingSsk IndePas encore d'évaluation

- Fashion MarketingDocument3 pagesFashion MarketingSsk IndePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- CATC DL Ch06 E Commerce FundamentalsDocument16 pagesCATC DL Ch06 E Commerce Fundamentals01-11-09 ธีรายุ ฟื้นหัวสระPas encore d'évaluation

- Other Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasDocument4 pagesOther Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasLumingPas encore d'évaluation

- Assignment: Fin 441 Bank ManagementDocument11 pagesAssignment: Fin 441 Bank ManagementNazir Ahmed ZihadPas encore d'évaluation

- CRI Assignment QuestionDocument9 pagesCRI Assignment QuestionIts MothPas encore d'évaluation

- S 290 Pre Course Work AnswersDocument7 pagesS 290 Pre Course Work Answerszug0badej0n2100% (2)

- ADRHPDocument578 pagesADRHPKaran TeckchandaniPas encore d'évaluation

- Lect 4 What - Is - Innovarion-2Document41 pagesLect 4 What - Is - Innovarion-2Johnson Lozano JimenezPas encore d'évaluation

- Ryan Boot Co. Case StudyDocument6 pagesRyan Boot Co. Case Studyphoenix2959Pas encore d'évaluation

- Ch-02-S-Developing Marketing Strategies and PlansDocument45 pagesCh-02-S-Developing Marketing Strategies and PlansIsmat Zerin SwarnaPas encore d'évaluation

- FINS3616 Tutorials - Week 4, QuestionsDocument2 pagesFINS3616 Tutorials - Week 4, QuestionsLena ZhengPas encore d'évaluation

- Cleaning Product Business PlanDocument4 pagesCleaning Product Business PlanSantosh Arakeri0% (1)

- Chapter 2 Engineering EconomicsDocument34 pagesChapter 2 Engineering EconomicsharoonPas encore d'évaluation

- Test 4Document4 pagesTest 4Dương Thu HàPas encore d'évaluation

- ComprehensiveDocument9 pagesComprehensiveChristopher RogersPas encore d'évaluation

- A Cash Flow Mapping ProcedureDocument2 pagesA Cash Flow Mapping Procedurethava477cegPas encore d'évaluation

- SAPM Punithavathy PandianDocument22 pagesSAPM Punithavathy PandianVimala Selvaraj VimalaPas encore d'évaluation

- Role of ICT in AgribusinessDocument26 pagesRole of ICT in AgribusinessEsther Dominguez100% (1)

- Overview of Integrated Marketing CommunicationsDocument40 pagesOverview of Integrated Marketing Communicationshhunter530Pas encore d'évaluation

- CH 10Document30 pagesCH 10Johnny Wong100% (1)

- Chapter 7: Consumers, Producers, and The Efficiency of Mark..Document6 pagesChapter 7: Consumers, Producers, and The Efficiency of Mark..Savannah Simone PetrachenkoPas encore d'évaluation

- UT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)Document5 pagesUT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)UT Dallas Provost's Technology GroupPas encore d'évaluation

- The Manager of The 21st CenturyDocument5 pagesThe Manager of The 21st Centurysabin dangolPas encore d'évaluation

- 1 Gcworld Midterm Exam Reviewer PDFDocument4 pages1 Gcworld Midterm Exam Reviewer PDFGabreille Rullamas ChavezPas encore d'évaluation

- 840 RobinsonDocument12 pages840 RobinsonFaula Iman SitompulPas encore d'évaluation

- POM Q1 Week 4Document15 pagesPOM Q1 Week 4Mary Ann Isanan84% (19)

- Tuten SMM Ch10Document22 pagesTuten SMM Ch10JannatPas encore d'évaluation

- Why Ethical Problems Occur in BusinessDocument8 pagesWhy Ethical Problems Occur in BusinessPriyesh BheshjaliyaPas encore d'évaluation

- Quiz 6Document3 pagesQuiz 6faithPas encore d'évaluation

- Soal B Inggris Form Andhika Xiii Mipa 6 02Document3 pagesSoal B Inggris Form Andhika Xiii Mipa 6 02Andhika MeyerPas encore d'évaluation

- Monopolistic Competition: Chapter 16-1Document36 pagesMonopolistic Competition: Chapter 16-1Naveed ShaikhPas encore d'évaluation