Académique Documents

Professionnel Documents

Culture Documents

Melamine - Chemical Economics Handbook - SRI Consulting

Transféré par

Chirag DaveDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Melamine - Chemical Economics Handbook - SRI Consulting

Transféré par

Chirag DaveDroits d'auteur :

Formats disponibles

Melamine :: Chemical Economics Handbook :: SRI Consulting

Page 1

Home | About Us | Latest Releases | Members Area | Consulting | Newsletters | Contact | Login

Advanced Search

CEH Report

Table of Contents

Summary Introduction Manufacturing Processes Environmental Issues Supply and Demand by Region United States Producing Companies Salient Statistics Consumption Laminates Conventional laminates Laminate flooring Surface Coatings Automotive finishes-OEM Metal containers Coil coatings Metal furniture Other Wood Adhesives Molding Compounds Paper Treating Paper coatings Paper wet-strength resins Textile Treating Other Ceiling tiles Flame retardants Tire cord Miscellaneous Price Trade Imports Exports Canada Salient Statistics Consumption Price Trade Imports Exports Mexico Salient Statistics Consumption Price Central and South America Producing Companies Salient Statistics Consumption Western Europe Producing Companies Salient Statistics Production Consumption Laminates Conventional laminates Laminate flooring Wood Adhesives Surface Coatings Molding Compounds Textile and Paper Treating Other Flame retardants and melamine salts Concrete superplasticizers Miscellaneous Price Trade Imports Exports Central and Eastern Europe Producing Companies Salient Statistics

Melamine

Sebastian Bizzari and Chiyo Funada Published November 2010 CEH Home | View Report | Purchase

Abstract

The current world market for melamine is tight. Supplies tightened in early 2010, as world consumption accelerated in response to recovering economies. Factors behind the tightness in supply include production outages, low inventories, increased world consumption and the fact that melamine production from capacity commissioned in mid-2010 did not contribute significantly to world supply. Laminates and wood adhesives account for approximately 73% of world consumption. In 2010, conventional laminates accounted for approximately 8085% of melamine consumption in laminates, while laminate flooring accounted for the remainder. China is the largest single participant in the melamine market, accounting for 39% of world consumption in 2010; it accounted for 53%, 46% and 26% of world capacity, production and exports, respectively, in 2010. This trend is expected to continue during 20112015, as significant growth in Chinese consumption will result in the commissioning of additional capacity and increased production. As a region, Europe is the second-largest melamine market, accounting for nearly 32% of world consumption in 2010.

World consumption of melamine is expected to be robust during 20112015; average annual growth is expected to be 35% in most regions. China, Central and South America, the Middle East, and Central and Eastern Europe are expected to exhibit rapid demand growth. China is forecast to experience the fastest growth rates (around 8%) and volume increases in melamine consumption during 20102015. However, China's share of exports is expected to decline as a result of increased domestic consumption, competition from other sources of supply including Qatar and Trinidad, and increased regionalization of supply, in which many consuming regions are likely to source melamine locally. During 20102015, melamine consumption in Europe is forecast to grow at an average annual rate of almost 4%. Growth in Central and Eastern Europe is expected at almost 8%, largely the result of increased production of laminates and wood adhesives; consumption growth in Western Europe is forecast at a more moderate rate of 3.0% during 20102015. Other Asian countries, excluding Japan, are expected to show large volume increases during 20102015, at an average annual growth rate of 4.4%.

http://www.sriconsulting.com/CEH/Public/Reports/673.3000/

9/27/2011 9:43:19 AM

Melamine :: Chemical Economics Handbook :: SRI Consulting

Consumption Middle East Producing Companies Salient Statistics Consumption Japan Producing Companies Salient Statistics Consumption Wood Adhesives Surface Coatings Laminates Molding Compounds Textile and Paper Treating Other Price Trade Imports Exports China Producing Companies Salient Statistics Consumption Price Trade Imports Exports Other Asia Producing Companies Salient Statistics Consumption Africa and Oceania Salient Statistics Consumption

Page 2

Overall economic performance will continue to be the best indicator of future demand for melamine. Demand in most downstream markets is greatly influenced by general economic conditions. As a result, demand largely follows the patterns of the leading world economies. The major end-use markets include construction/remodeling, automotive production and original equipment manufacture (OEM).

Privacy Policy | Terms & Conditions | Site Map | Careers | Contact 2011 IHS, Inc. All rights reserved.

http://www.sriconsulting.com/CEH/Public/Reports/673.3000/

9/27/2011 9:43:19 AM

Vous aimerez peut-être aussi

- Investigate The Combination of Coconut Shell and Grained Palm Kernel To Replace Aggregate in Concrete: A Technical ReviewDocument10 pagesInvestigate The Combination of Coconut Shell and Grained Palm Kernel To Replace Aggregate in Concrete: A Technical ReviewKhan BrothersPas encore d'évaluation

- TDS - Rheofinish 288 FDDocument2 pagesTDS - Rheofinish 288 FDVenkata RaoPas encore d'évaluation

- Astm A762 PDFDocument10 pagesAstm A762 PDFCristian OtivoPas encore d'évaluation

- Testing of Concrete Joint SealerDocument23 pagesTesting of Concrete Joint SealerEvaresto Cole MalonesPas encore d'évaluation

- 226 PDFDocument8 pages226 PDFBatepola BacPas encore d'évaluation

- Application of Waste Foundry Sand For Evolution of Low-Cost ConcreteDocument6 pagesApplication of Waste Foundry Sand For Evolution of Low-Cost ConcreteseventhsensegroupPas encore d'évaluation

- CR 408 Ceramic TilesDocument1 pageCR 408 Ceramic TilesYuri ValenciaPas encore d'évaluation

- Astm C90Document7 pagesAstm C90Jairo MendezPas encore d'évaluation

- BS890Document21 pagesBS890ianbramleyPas encore d'évaluation

- Corrugated Pipe Single Wall Technical SpecificationDocument7 pagesCorrugated Pipe Single Wall Technical SpecificationbcsmurthyPas encore d'évaluation

- Properties of Bituminous Mixes Using Indonesian Natural Rock Asphalt - FurqonDocument11 pagesProperties of Bituminous Mixes Using Indonesian Natural Rock Asphalt - FurqonZakiyah Kamto IrfinPas encore d'évaluation

- Curing In-Place ConcreteDocument2 pagesCuring In-Place ConcreteaaPas encore d'évaluation

- Standard Test Method For Splitting Tensile Strength of Cylindrical Concrete Specimens1Document5 pagesStandard Test Method For Splitting Tensile Strength of Cylindrical Concrete Specimens1Lupita RamirezPas encore d'évaluation

- M 195-06 Lightweight Aggregates PDFDocument6 pagesM 195-06 Lightweight Aggregates PDFWalticoZegarraHerreraPas encore d'évaluation

- Astm.c330.1999 Concreto LeveDocument6 pagesAstm.c330.1999 Concreto LevepcpontesPas encore d'évaluation

- R-Kem II Masonry - OptDocument7 pagesR-Kem II Masonry - OptGnomo GnominPas encore d'évaluation

- Sika® Latex PDFDocument2 pagesSika® Latex PDFGina GaelaPas encore d'évaluation

- Setting Time of ConcreteDocument2 pagesSetting Time of ConcretevempadareddyPas encore d'évaluation

- European International Geotextilestandards Shortguide2010Document25 pagesEuropean International Geotextilestandards Shortguide2010Michael HarnackPas encore d'évaluation

- Astm C1073-12Document3 pagesAstm C1073-12oscarvargas8311Pas encore d'évaluation

- VOC Emissions Test ReportDocument3 pagesVOC Emissions Test ReportsobhiPas encore d'évaluation

- Fineness Test On CementDocument13 pagesFineness Test On CementTvsp Sekhar50% (2)

- Disclosure To Promote The Right To InformationDocument17 pagesDisclosure To Promote The Right To InformationIndira MukherjeePas encore d'évaluation

- ASTM D3359 Standard Test Methods For Measuring Adhesion by Tape TestDocument2 pagesASTM D3359 Standard Test Methods For Measuring Adhesion by Tape TestEdgarDavidDiazCamposPas encore d'évaluation

- Repair Manual King Fahd SaDocument27 pagesRepair Manual King Fahd SaPrasobh Shamohan100% (1)

- PGA-ESS Inc Company Profile 2017Document28 pagesPGA-ESS Inc Company Profile 2017Axcel CabalunaPas encore d'évaluation

- Summary of DPWH BluebookDocument61 pagesSummary of DPWH BluebookrhouiePas encore d'évaluation

- Astm C150 C150M 22Document5 pagesAstm C150 C150M 22Saiful ArifPas encore d'évaluation

- C373.22947 Absorción AguaDocument7 pagesC373.22947 Absorción AguaLuisa AcevedoPas encore d'évaluation

- Materials and Methods: Chapter-3Document8 pagesMaterials and Methods: Chapter-3javedsaqi100% (1)

- Concrete Cylinder Curing MethodsDocument8 pagesConcrete Cylinder Curing Methodsjem guiPas encore d'évaluation

- 2015.10.24, Rock Durability Tests (DMI TEST Etc) PDFDocument31 pages2015.10.24, Rock Durability Tests (DMI TEST Etc) PDFkyuguPas encore d'évaluation

- Slag Cement For Use in Concrete and MortarsDocument6 pagesSlag Cement For Use in Concrete and MortarsJose Francisco Villarreal CanalesPas encore d'évaluation

- Manufacturing DLC Using PPC for Concrete PavementsDocument1 pageManufacturing DLC Using PPC for Concrete PavementsairpavsetPas encore d'évaluation

- Roof GuardDocument2 pagesRoof Guardpravi3434Pas encore d'évaluation

- Estimating Guide For Woven Mesh GabionsDocument3 pagesEstimating Guide For Woven Mesh GabionsJayson TeePas encore d'évaluation

- Is 5512 1983 PDFDocument17 pagesIs 5512 1983 PDFBijaya RaulaPas encore d'évaluation

- Plastic (Stucco) Cement: Standard Specification ForDocument4 pagesPlastic (Stucco) Cement: Standard Specification ForAlejandroPas encore d'évaluation

- C13330 PDFDocument2 pagesC13330 PDFJose VasquezPas encore d'évaluation

- SS S 210aDocument10 pagesSS S 210akeithc01Pas encore d'évaluation

- Method B7 - The Determination of The Treton Impact Value of Aggregate.Document3 pagesMethod B7 - The Determination of The Treton Impact Value of Aggregate.GUO LEI100% (1)

- Astm c90 1970Document5 pagesAstm c90 1970Andres GmoPas encore d'évaluation

- Grouts Standards and TestingDocument12 pagesGrouts Standards and TestingmithileshPas encore d'évaluation

- Asbestos Surveying - Mdhs100Document44 pagesAsbestos Surveying - Mdhs100Adam EdwardsPas encore d'évaluation

- Compressive Strength of Hydraulic Cement Mortar (Using 50 MM or 2 In. Cube Specimens)Document4 pagesCompressive Strength of Hydraulic Cement Mortar (Using 50 MM or 2 In. Cube Specimens)Evert RiveraPas encore d'évaluation

- Grouted RiprapDocument8 pagesGrouted RiprapEdison G. CaluzaPas encore d'évaluation

- C933 PDFDocument2 pagesC933 PDFDIAZCORDOBAPas encore d'évaluation

- Disclosure To Promote The Right To InformationDocument18 pagesDisclosure To Promote The Right To Informationsudhir5441Pas encore d'évaluation

- Astm C 936-2007Document2 pagesAstm C 936-2007Nikolay DrumevPas encore d'évaluation

- Classification of CementDocument2 pagesClassification of Cementstuckinyournightmare storiesPas encore d'évaluation

- Introduction of Cement: When Was Cement Begin?Document11 pagesIntroduction of Cement: When Was Cement Begin?مايف سعدونPas encore d'évaluation

- Astm C188.8830Document3 pagesAstm C188.8830jegancivilPas encore d'évaluation

- ASTM C332-17 Standard Specification For Lightweight Aggregates For Insulating ConcreteDocument4 pagesASTM C332-17 Standard Specification For Lightweight Aggregates For Insulating Concretebenedick barquinPas encore d'évaluation

- Emulsified Asphalt: Standard Specification ForDocument3 pagesEmulsified Asphalt: Standard Specification Forsebastian novoaPas encore d'évaluation

- Evaluating The Effect of Mixing Method On Cement HydrationDocument14 pagesEvaluating The Effect of Mixing Method On Cement HydrationManishMokalPas encore d'évaluation

- Astm C 618 02 1Document4 pagesAstm C 618 02 1Ciro Arnold Gonzales PauccarPas encore d'évaluation

- Vernon Paltoo - TIC-Melamine Workshop June 1230hrsDocument54 pagesVernon Paltoo - TIC-Melamine Workshop June 1230hrsRajendra VegadPas encore d'évaluation

- Alberta's Plastic Resins and Plastic Products Industry: Economic CommentaryDocument7 pagesAlberta's Plastic Resins and Plastic Products Industry: Economic CommentarynabilPas encore d'évaluation

- Paint and Coatings Industry OverviewDocument3 pagesPaint and Coatings Industry OverviewYash VasantaPas encore d'évaluation

- Absorption PART IIDocument1 pageAbsorption PART IIChirag DavePas encore d'évaluation

- Absorption PART IDocument1 pageAbsorption PART IChirag DavePas encore d'évaluation

- Table TopicDocument1 pageTable TopicChirag DavePas encore d'évaluation

- Floating Head Type of Heat ExchangerDocument1 pageFloating Head Type of Heat ExchangerChirag DavePas encore d'évaluation

- Shell and Tubes ExchangerDocument1 pageShell and Tubes ExchangerChirag DavePas encore d'évaluation

- Dimensionless Numbers in Heat TansferDocument2 pagesDimensionless Numbers in Heat TansferChirag DavePas encore d'évaluation

- Optimize Condenser Design with Heat Exchanger TipsDocument1 pageOptimize Condenser Design with Heat Exchanger TipsChirag DavePas encore d'évaluation

- Absorption PART IDocument1 pageAbsorption PART IChirag DavePas encore d'évaluation

- HEx Thermal Design-NotesDocument1 pageHEx Thermal Design-NotesChirag DavePas encore d'évaluation

- Optimize Condenser Design with Heat Exchanger TipsDocument1 pageOptimize Condenser Design with Heat Exchanger TipsChirag DavePas encore d'évaluation

- Sri Sri Ravi Shankar - Official WebsiteDocument4 pagesSri Sri Ravi Shankar - Official WebsiteChirag DavePas encore d'évaluation

- Excel VBA Is FunDocument3 pagesExcel VBA Is FunChirag DavePas encore d'évaluation

- Shell and Tubes Components PDFDocument3 pagesShell and Tubes Components PDFChirag DavePas encore d'évaluation

- Assignment: Separation Column Top Pressure (Kpa) Distillate Rate D (Kmol/Hr)Document60 pagesAssignment: Separation Column Top Pressure (Kpa) Distillate Rate D (Kmol/Hr)Chirag DavePas encore d'évaluation

- Matlab Tutorial1Document9 pagesMatlab Tutorial1Asterix100% (6)

- LHY Tutorial GuiDocument18 pagesLHY Tutorial GuiChristopher CardozoPas encore d'évaluation

- Final Octane Number Assignment SharingDocument3 pagesFinal Octane Number Assignment SharingChirag DavePas encore d'évaluation

- LHY Tutorial GuiDocument18 pagesLHY Tutorial GuiChristopher CardozoPas encore d'évaluation

- WinRAR User ManualDocument29 pagesWinRAR User ManualMcSwitch01Pas encore d'évaluation

- Floor Cleaning Method StatementsDocument24 pagesFloor Cleaning Method StatementsmullerPas encore d'évaluation

- Page - 1Document49 pagesPage - 1Ankur GadhyanPas encore d'évaluation

- New Zealand Currency - Notes and CoinsDocument20 pagesNew Zealand Currency - Notes and CoinsChips ZedPas encore d'évaluation

- Communication Notes Unit 4 To 5 PDFDocument64 pagesCommunication Notes Unit 4 To 5 PDFavishanaPas encore d'évaluation

- SP Keynote PDFDocument61 pagesSP Keynote PDFNduong NguyenPas encore d'évaluation

- Solution Manual For Work Systems The Methods Measurement Management of Work Mikell P GrooverDocument12 pagesSolution Manual For Work Systems The Methods Measurement Management of Work Mikell P GrooverTimothyHilldpgoa100% (76)

- Randy Furst: Reporter at The Star TribuneDocument17 pagesRandy Furst: Reporter at The Star Tribunecoll0229Pas encore d'évaluation

- FM Global Loss Prevention Data Sheet 3 26 Fire Protection Fo Non Storage Sprinklered PropertiesDocument13 pagesFM Global Loss Prevention Data Sheet 3 26 Fire Protection Fo Non Storage Sprinklered PropertiesDaniel Aloysio Rojas Martins67% (3)

- StandardDocument7 pagesStandardAnand PatelPas encore d'évaluation

- Secure Check CatalogDocument16 pagesSecure Check CatalogR J Managemen GroupPas encore d'évaluation

- Voucher RcaDocument2 pagesVoucher Rcatisay12100% (1)

- PAL Application Form - DownloadableDocument1 pagePAL Application Form - Downloadablefaye virayPas encore d'évaluation

- KSA CompaniesDocument364 pagesKSA CompaniesMahmoud33% (6)

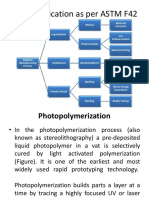

- AM Classification As Per ASTM F42Document19 pagesAM Classification As Per ASTM F42RajijackPas encore d'évaluation

- Lewis Waterman: Jump To Navigationjump To SearchDocument4 pagesLewis Waterman: Jump To Navigationjump To Searchjhayr123Pas encore d'évaluation

- Home TeamDocument1 pageHome TeamGpe C. BaronPas encore d'évaluation

- W.P. No. 16534 (W) of 2013: Tower Infotech Limited and Another - Versus-The Union of India & OrsDocument4 pagesW.P. No. 16534 (W) of 2013: Tower Infotech Limited and Another - Versus-The Union of India & OrsChandrasekhar BabuPas encore d'évaluation

- Id Number Title Year OrganizationDocument16 pagesId Number Title Year Organizationarissa50% (2)

- Civil Work Power Block AreaDocument370 pagesCivil Work Power Block AreaapsPas encore d'évaluation

- Challenges For Newspapers From Going OnlineDocument6 pagesChallenges For Newspapers From Going OnlineCasualKillaPas encore d'évaluation

- Fior Corporate Brochure 2021Document8 pagesFior Corporate Brochure 2021Ana KhanPas encore d'évaluation

- Excel Assignment-1Document2 pagesExcel Assignment-1SACCM SupportPas encore d'évaluation

- ABC Game Standardized Work Facilitator GuideDocument19 pagesABC Game Standardized Work Facilitator GuideMohamed Mamdouh El kfrawyPas encore d'évaluation

- Paperbag RRLDocument5 pagesPaperbag RRLDonita Gloria100% (2)

- Baggy Paper WebDocument59 pagesBaggy Paper WebLuận NgôPas encore d'évaluation

- Prof. K. Viyyana Rao, Vice-Chancellor, Acharya Nagarjuna University. 2. Prof. M. Srimannarayana, Professor in XLRI University, JamshedpurDocument1 pageProf. K. Viyyana Rao, Vice-Chancellor, Acharya Nagarjuna University. 2. Prof. M. Srimannarayana, Professor in XLRI University, JamshedpursatyakumarkollaPas encore d'évaluation

- Cost Report Format - Efficycle 2012Document18 pagesCost Report Format - Efficycle 2012Gaurav ChhabraPas encore d'évaluation

- NEDC Letter - NPDES Permit Transfers - West Linn PaperDocument7 pagesNEDC Letter - NPDES Permit Transfers - West Linn PaperNorthwest Environmental Defense CenterPas encore d'évaluation

- 3M Professional Floor Sanding Products Catalog: InnovationDocument28 pages3M Professional Floor Sanding Products Catalog: InnovationDan George IIIPas encore d'évaluation