Académique Documents

Professionnel Documents

Culture Documents

4q07 08

Transféré par

api-3702531Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

4q07 08

Transféré par

api-3702531Droits d'auteur :

Formats disponibles

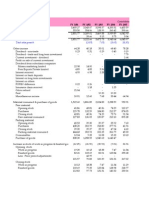

Colgate-Palmolive (India) Limited

Registered Office : Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED MARCH 31, 2008

Consolidated

Quarter Quarter Year Year Year Year

(Rs Crores) Ended Ended Ended Ended Ended Ended

31-Mar-08 31-Mar-07 31-Mar-08 31-Mar-07 31-Mar-08 31-Mar-07

(Audited) (Audited) (Audited) (Audited)

- Net Sales (Excl. Excise Duty) 391.33 343.25 1,473.38 1,295.14 1,473.85 1,295.62

- Other Income 21.40 17.35 84.78 67.00 77.18 65.93

Total Revenue 412.73 360.60 1,558.16 1,362.14 1,551.03 1,361.55

- (Increase) / Decrease in Stock in Trade 3.68 0.13 (2.17) (5.56) (0.82) (5.32)

- Raw and Packing Material Cost 75.47 59.14 280.03 239.27 361.67 264.96

- Purchase of Goods 97.65 94.61 354.92 342.65 237.37 313.02

- Employee Cost 30.74 25.09 117.28 111.91 123.82 113.42

- Voluntary Retirement Scheme - (0.78) 1.00 58.02 1.00 58.02

- Depreciation , Amortisation and Impairment 5.45 3.65 19.84 15.26 20.93 19.57

- Advertising & Sales Promotion 73.45 63.93 256.51 207.50 256.51 207.54

- Other Expenditure 59.78 46.81 237.26 190.50 243.38 193.91

Total Expenditure 346.22 292.58 1,264.67 1,159.55 1,243.86 1,165.12

Interest Expense 0.36 0.25 1.44 0.98 1.23 0.98

Profit from Ordinary Activities Before Tax 66.15 67.77 292.05 201.61 305.94 195.45

Provision for Taxation

-Current Tax 12.87 13.94 58.25 53.98 67.42 59.61

-Deferred Tax (2.64) 2.19 (2.16) (16.74) (2.43) (16.75)

-Fringe Benefit Tax 0.30 1.05 4.25 4.20 4.27 4.20

Net Profit after Tax and before minority interest 55.62 50.59 231.71 160.17 236.68 148.39

Minority Interest - - - - 0.92 -

Net Profit after Tax 55.62 50.59 231.71 160.17 235.76 148.39

Paid-up Equity Share Capital @ 13.60 #136.00 @ 13.60 #136.00 @ 13.60 #136.00

(@ - Face value: Rupee 1 per share)

(# - Face value: Rupees 10 per share)

Reserves excluding Revaluation Reserve 148.61 144.53 153.69 142.40

Basic and Diluted EPS (Rs.) 4.09 3.72 17.04 11.78 17.34 10.91

Dividend (Rs.Per share)

First Interim Dividend - - 6.00 4.25

Second Interim Dividend - 3.25 - 3.25

Final Dividend (Proposed) 7.00 - 7.00 -

Special Dividend (Proposed) - 2.00 - 2.00

Total 7.00 5.25 13.00 9.50

Aggregate of Public shareholding

- Number of Shares 66,636,481 66,636,481 66,636,481 66,636,481 66,636,481 66,636,481

- Percentage of holding 49% 49% 49% 49% 49% 49%

1. Net Sales for the year and for the quarter ended March 31, 2008 increased by 14% over the same periods of the previous year.

2. Net Profit after tax for the year and for the quarter increased by 45% and 10% respectively over the same periods of the previous year. The Net Profit after Tax for the

year ended March 31, 2007 has borne a charge of Rs. 58.02 Crores Pre-tax or Rs. 38.49 Crores net after tax (as disclosed separately above) on account of the Voluntary

Retirement Scheme implemented at the Company's manufacturing facility at Sewree, Mumbai.

3. Pursuant to the scheme of reduction of share capital u/s 100 of the Companies Act, 1956 of India as approved by the Shareholders and Bombay High Court, the

Company reduced the face value of it's shares from Rs 10 per share to Re 1 per share effective November 1, 2007. Consequently, the Company has paid Rs 122.4 Crores

(Rs 9 per share) to Shareholders on December 14, 2007.

4. The Company has proposed the Final Dividend of Rs. 95.2 Crores (Rs. 7/ share) subject to shareholders' approval.

5. In accordance with the requirements of Accounting Standard -17, Segment Reporting, the Company's business segment is 'Personal Care' (including Oral Care) and

hence it has no other primary reportable segments.

6. Effective November 1, 2007, the company has acquired 75% of the shareholding of three companies namely Advanced Oral Care Products Pvt. Ltd., Professional Oral

Care Products Pvt. Ltd. and SS Oral Hygiene Products Pvt. Ltd. Accordingly, in respect of consolidated results, previous year figures are not comparable.

7. Previous period/year figures have been reclassified to conform with current period/year presentation, where applicable.

8. Information on investor complaints pursuant to Clause 41 of the Listing Agreement for the quarter ended March 31, 2008:

Received during Resolved during

Nature of complaints * Opening Balance the quarter the quarter Closing Balance

Non receipt of dividend warrants - 1 1 -

Non receipt of share certificates lodged for transfer

or capital reduction - 1 1 -

Others - - - -

* Excludes disputed cases and sub-judice matters.

The above results have been reviewed by the Audit Committee and approved by the Board of Directors at their Meeting held today.

The full text of Colgate releases is available: www.colgate.co.in.

COLGATE-PALMOLIVE (INDIA) LIMITED

Mumbai ROGER CALMEYER

May 30, 2008 MANAGING DIRECTOR

Vous aimerez peut-être aussi

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Indian Insider Buyings June 19, 2008-DhananDocument2 pagesIndian Insider Buyings June 19, 2008-Dhananapi-3702531Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- DUBARINDIAAR200708Document164 pagesDUBARINDIAAR200708Santosh KumarPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- GilletteDocument14 pagesGilletteapi-3702531Pas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Fem CareDocument16 pagesFem Careapi-3702531Pas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Dabur IndiaDocument43 pagesDabur Indiaapi-3702531Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Colgate AR March 2005Document72 pagesColgate AR March 2005ashusingh0141Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- ColgateDocument32 pagesColgateapi-3702531Pas encore d'évaluation

- ColgateDocument32 pagesColgateapi-3702531Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- India - Insider Buying 25th July 2008Document2 pagesIndia - Insider Buying 25th July 2008api-3702531Pas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- BSE Special Situations 18th June 2008Document1 pageBSE Special Situations 18th June 2008api-3702531Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Indian Insider Buyings June 13, 2008-DhananDocument2 pagesIndian Insider Buyings June 13, 2008-Dhananapi-3702531Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Indian Insider Buyings June 17, 2008-DhananDocument2 pagesIndian Insider Buyings June 17, 2008-Dhananapi-3702531Pas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- BSE Special Situations 16th June 2008Document4 pagesBSE Special Situations 16th June 2008api-3702531Pas encore d'évaluation

- BSE Special Situations 17th June 2008Document2 pagesBSE Special Situations 17th June 2008api-3702531Pas encore d'évaluation

- Indian Insider Buyings June 12, 2008-DhananDocument2 pagesIndian Insider Buyings June 12, 2008-Dhananapi-3702531Pas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Theory of ArchitectureDocument21 pagesTheory of ArchitectureRana A MataryPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Company Law Registration and IncorporationDocument10 pagesCompany Law Registration and IncorporationAyush BansalPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- 750 Famous Motivational and Inspirational QuotesDocument53 pages750 Famous Motivational and Inspirational QuotesSaanchi AgarwalPas encore d'évaluation

- Lease of Playground To A SchoolDocument2 pagesLease of Playground To A SchoolSutapaPas encore d'évaluation

- Scrabble Scrabble Is A Word Game in Which Two or Four Players Score Points by Placing Tiles, EachDocument4 pagesScrabble Scrabble Is A Word Game in Which Two or Four Players Score Points by Placing Tiles, EachNathalie Faye De PeraltaPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Odyssey Marine Exploration, Inc. v. The Unidentified, Shipwrecked Vessel or Vessels - Document No. 3Document11 pagesOdyssey Marine Exploration, Inc. v. The Unidentified, Shipwrecked Vessel or Vessels - Document No. 3Justia.comPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Due Process of LawDocument2 pagesDue Process of Lawjoe100% (4)

- Mapua Cwtsstudentsmodule (Ay08 09)Document62 pagesMapua Cwtsstudentsmodule (Ay08 09)anon-805332Pas encore d'évaluation

- G.R. No. 178511 - Supreme Court of The PhilippinesDocument4 pagesG.R. No. 178511 - Supreme Court of The PhilippinesJackie Z. RaquelPas encore d'évaluation

- Nonviolent Communication Lessons 2-20-18Document210 pagesNonviolent Communication Lessons 2-20-18Ice George100% (1)

- Dwnload Full Practicing Statistics Guided Investigations For The Second Course 1st Edition Kuiper Solutions Manual PDFDocument36 pagesDwnload Full Practicing Statistics Guided Investigations For The Second Course 1st Edition Kuiper Solutions Manual PDFdavidkrhmdavis100% (11)

- Carr v. NH State Prison, Warden - Document No. 2Document5 pagesCarr v. NH State Prison, Warden - Document No. 2Justia.comPas encore d'évaluation

- School of The Scripture PreviewDocument10 pagesSchool of The Scripture PreviewJoseph Chan83% (6)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Trading SecretsDocument99 pagesTrading SecretsGary100% (3)

- CDP Project InstructionsDocument6 pagesCDP Project InstructionsNarendra ReddyPas encore d'évaluation

- PMMSI Vs CADocument1 pagePMMSI Vs CAFermari John ManalangPas encore d'évaluation

- Unit 4 Classical and Keynesian Systems: 4.0 ObjectivesDocument28 pagesUnit 4 Classical and Keynesian Systems: 4.0 ObjectivesHemant KumarPas encore d'évaluation

- Syllabus Tourism Laws CKSCDocument6 pagesSyllabus Tourism Laws CKSCDennis Go50% (2)

- @PAKET A - TPM BAHASA INGGRIS KuDocument37 pages@PAKET A - TPM BAHASA INGGRIS KuRamona DessiatriPas encore d'évaluation

- Stock Control Management SyestemDocument12 pagesStock Control Management SyestemJohn YohansPas encore d'évaluation

- Aluminium, Metal and The SeaDocument186 pagesAluminium, Metal and The SeaMehdi GhasemiPas encore d'évaluation

- Chenrezi Sadhana A4Document42 pagesChenrezi Sadhana A4kamma100% (7)

- Q4 SMEA-Sta.-Rosa-IS-HS-S.Y 2021-2022Document38 pagesQ4 SMEA-Sta.-Rosa-IS-HS-S.Y 2021-2022junapoblacioPas encore d'évaluation

- Crimiology MCQ 2Document15 pagesCrimiology MCQ 2varunendra pandeyPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 2202 Infantilization Essay - Quinn WilsonDocument11 pages2202 Infantilization Essay - Quinn Wilsonapi-283151250Pas encore d'évaluation

- Unit 25 Sound Recording Lab LacDocument16 pagesUnit 25 Sound Recording Lab Lacapi-471521676Pas encore d'évaluation

- Sol2e Printables Unit 5ADocument2 pagesSol2e Printables Unit 5AGeorgio SentialiPas encore d'évaluation

- Services Marketing-Unit-Ii-ModifiedDocument48 pagesServices Marketing-Unit-Ii-Modifiedshiva12mayPas encore d'évaluation

- Schedule 1 Allison Manufacturing Sales Budget For The Quarter I Ended March 31 First QuarterDocument16 pagesSchedule 1 Allison Manufacturing Sales Budget For The Quarter I Ended March 31 First QuarterSultanz Farkhan SukmanaPas encore d'évaluation

- Jacksonville's Taste 2012Document100 pagesJacksonville's Taste 2012Ali KhanPas encore d'évaluation