Académique Documents

Professionnel Documents

Culture Documents

Ebm

Transféré par

Anushree Harshaj GoelDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ebm

Transféré par

Anushree Harshaj GoelDroits d'auteur :

Formats disponibles

FORE SCHOOL OF MANAGEMENT

PROJECT APPRAISAL POLYPROPYLENE MULTIYARN

Synopsis

Submitted by: Surbhi Grover 191058 Aditit Goyal - 191063 11/10/2011 Amit Sharma 191069 Anushree Gupta 191079 Ritika Gupta - 191107

The group will be submitting the final project on: PROJECT APPRAISALPOLYPROPYLENE MULTIYARN. The project appraisal will cover the following heads: Marketing appraisal :

a. Projected Demand Estimates of the projected demand for each of the products proposed to be manufactured for the next five years together with source of information. Some of the sources for the estimates of future demand are specialized publications. There are a number of consultancy organizations in the country which would also be able to undertake a detailed market study on behalf of the promoters.

b. Projected Supply Estimates of the projected supply (industry aggregates) of each of the products proposed to be manufactured for the next five years together with source of information. These estimates to include data on the present installed capacity, capacity likely to materialize in each of the next five years and current production and expected production for the next five years. Figures of existing capacity and production would be available from industry publications.

c. Current Prices Details about current prices of proposed products: International, CIF, FOB and Landed cost.

d. Price Assumed For The Product Details regarding the trends in prices during the last five years. If the prices are controlled by the Government, details of the basis on which the prices were fixed for future projections of revenue. The price assumed for the product is important in deciding the viability of the project. It is advisable to assume a price somewhat lower than the net price realized by other existing manufactures. Often, a new entrant in the market would have to offer his products at a relatively lower price in order to attract customers and to get established in the market. In the case of products for which prices fluctuate at short intervals, it is preferable to assume a reasonable price based, inter alia, on the average price for the previous few quarters/months depending on the periodicity of fluctuations. It must be

noted that it is difficult for a company to realize the price prevailing during periods of temporary shortages. Financial appraisal :

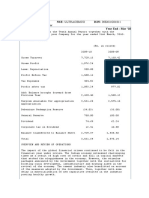

A. COST OF THE PROJECT The reasonableness of the cost of the project as submitted by the borrower should be thoroughly examined. Realistic estimates should be used so as to conserve scarce resources and prevent cost over-runs. Entrepreneurs may seek to keep the project cost deliberately low or high, to minimise promoters contribution or to secure excessive funding. In assessing the project cost estimates, it is essential to guard against such possibilities. Reasonableness of the cost of the project should be examined with reference to various factors. While assessing these costs, escalation on account of inflation during the implementation period should be provided for in case of projects with longer implementation schedule exceeding one year. Cost Comparison with Similar Projects/Installed Capacity In addition to the micro assessment of various aspects of the costs discussed above, it is necessary to compare the cost of the proposed project with costs of similar projects appraised in the institutions in the recent past to ensure the reasonableness of the cost estimates. Capital cost per unit of installed capacity should be compared with similar projects appraised by the institution. However, it should be borne in mind that variations in scope of the project, implementation schedule, means of financing etc. will have a bearing on the total cost of the project and suitable adjustments should be made while comparing with similar assisted projects. B. MEANS OF FINANCE The proposed means of financing of a project proposal, as regard its reasonableness must similarly be examined. The means of financing should conform to a financially sound capital structuring of the company.

Finally the project will also include the following parameters: Develop an EXCEL BASED INTEGRATED FINANCIAL MODEL for a detailed financial feasibility study. Projected financial statements with all the schedules. Evaluation criteria. Sensitivity analysis on the following parameters: Decrease in capacity utilization by 5%. Increase in raw material prices by 5%.

Credit Risk Determination, Credit Risk Rating and Term Loan Pricing. All the work will be done with help of Microsoft excel.

Vous aimerez peut-être aussi

- BCC Study GuideDocument44 pagesBCC Study GuideTemne HardawayPas encore d'évaluation

- Ds Iron Condor StrategiaDocument43 pagesDs Iron Condor StrategiaFernando ColomerPas encore d'évaluation

- Loan Agreement Template 3Document4 pagesLoan Agreement Template 3Athena Salas0% (1)

- 2034 Glyn CT New Water BillDocument2 pages2034 Glyn CT New Water BillAce MereriaPas encore d'évaluation

- ICC project evaluation guidelinesDocument26 pagesICC project evaluation guidelinesrubydelacruz0% (1)

- The Project Feasibility StudyDocument17 pagesThe Project Feasibility StudyJoshua Fabay Abad100% (2)

- Preparing Feasibility Studies for Business ViabilityDocument22 pagesPreparing Feasibility Studies for Business ViabilityGuianne Carlo BustamantePas encore d'évaluation

- Complaint Affidavit For Filing of BP 22 CaseDocument3 pagesComplaint Affidavit For Filing of BP 22 Casesei1david100% (1)

- Non-State InstitutionsDocument19 pagesNon-State InstitutionsMichelle Taton Horan100% (2)

- Project Feasibility Study Written ReportDocument23 pagesProject Feasibility Study Written ReportChristian Ico EspirituPas encore d'évaluation

- Fixed Deposit - FD 082022Document1 pageFixed Deposit - FD 082022kainingPas encore d'évaluation

- Financial AppraisalDocument13 pagesFinancial Appraisalajityadav1987100% (1)

- FEBTC vs. Querimit ruling on CD paymentDocument1 pageFEBTC vs. Querimit ruling on CD paymentFayda Cariaga100% (3)

- Lordofwar Ocr Part3Document721 pagesLordofwar Ocr Part3Ky HendersonPas encore d'évaluation

- 18 Project Feasibility StudyDocument9 pages18 Project Feasibility StudyJemPas encore d'évaluation

- Objection HandlingDocument4 pagesObjection HandlingPrerna AroraPas encore d'évaluation

- Canara Bank OfficersDocument2 524 pagesCanara Bank Officerssaurs283% (6)

- Economic Analysis of A ProjectDocument3 pagesEconomic Analysis of A ProjectIla BhattaPas encore d'évaluation

- Capital Budgeting: Long-Term Investment Decisions - The Key To Long Run Profitability and Success!Document31 pagesCapital Budgeting: Long-Term Investment Decisions - The Key To Long Run Profitability and Success!Palak NarangPas encore d'évaluation

- Capital Budgeting at IOCLDocument12 pagesCapital Budgeting at IOCLFadhal AbdullaPas encore d'évaluation

- Project Resource & Financial StatementsDocument18 pagesProject Resource & Financial StatementsAsma ZeeshanPas encore d'évaluation

- Project Feasibility Study GuideDocument8 pagesProject Feasibility Study Guideeyerusalem tesfayePas encore d'évaluation

- PB& A Chapter Seven To Eleven 2023Document26 pagesPB& A Chapter Seven To Eleven 2023wubePas encore d'évaluation

- Evaluation of Capital ProjectsDocument3 pagesEvaluation of Capital ProjectsashibhallauPas encore d'évaluation

- Project AppraisalDocument39 pagesProject AppraisalDebasmita SahaPas encore d'évaluation

- Capital Budgeting Analysis and TechniquesDocument19 pagesCapital Budgeting Analysis and TechniquesMELAT ROBELPas encore d'évaluation

- Select Business and Technology Collage: Project ManagementDocument8 pagesSelect Business and Technology Collage: Project ManagementYonas D. EbrenPas encore d'évaluation

- Chapter 6 11 12Document15 pagesChapter 6 11 12wubePas encore d'évaluation

- Project MGT Mod 3Document16 pagesProject MGT Mod 3rahulking219Pas encore d'évaluation

- Key Steps in Project AppraisalDocument4 pagesKey Steps in Project Appraisaljaydeep5008Pas encore d'évaluation

- SNVM Unit 3Document21 pagesSNVM Unit 3Megha PatelPas encore d'évaluation

- Chapter-Six 6.preparation of Operating Budgets: Financial AccountingDocument6 pagesChapter-Six 6.preparation of Operating Budgets: Financial AccountingWendosen H FitabasaPas encore d'évaluation

- Case StudyDocument5 pagesCase StudyAnwar JaveriaPas encore d'évaluation

- Real Estate Project Feasibility StudyDocument11 pagesReal Estate Project Feasibility StudyBRENDA BRADECINAPas encore d'évaluation

- Chapter Two Financial Analysis and Appraisal of Projects 2.1. Introduction: Scope & Rationale 2.1.1. What Is Commercial/financial Analysis?Document51 pagesChapter Two Financial Analysis and Appraisal of Projects 2.1. Introduction: Scope & Rationale 2.1.1. What Is Commercial/financial Analysis?revolution of the resolutionPas encore d'évaluation

- Project IdentificationDocument7 pagesProject Identificationsimmi33Pas encore d'évaluation

- The Financial Sector of IndiaDocument11 pagesThe Financial Sector of IndiaGunjan MishraPas encore d'évaluation

- Icramid 11133Document8 pagesIcramid 11133Arun KumarPas encore d'évaluation

- Capital BudgetingDocument64 pagesCapital BudgetingNiaz AhmedPas encore d'évaluation

- Material No. 9 - Cost AnalysisDocument7 pagesMaterial No. 9 - Cost AnalysisrhbqztqbzyPas encore d'évaluation

- Capital Budgeting at MakeMyTripDocument82 pagesCapital Budgeting at MakeMyTripPratik Jalan100% (1)

- Demand ForecastingDocument11 pagesDemand ForecastingSaloni SanghaviPas encore d'évaluation

- Commercial Banking System and Role of RBIDocument9 pagesCommercial Banking System and Role of RBIRishi exportsPas encore d'évaluation

- Assessment 2 - Evaluation of Capital ProjectsDocument5 pagesAssessment 2 - Evaluation of Capital ProjectsMaria VayaniPas encore d'évaluation

- Business Economics - Va 66Document12 pagesBusiness Economics - Va 66onlinetrash45Pas encore d'évaluation

- Project ApraissalDocument19 pagesProject ApraissalPremchandra GuptaPas encore d'évaluation

- Project Feasibility MethodsDocument6 pagesProject Feasibility MethodsLuo ZhongPas encore d'évaluation

- LESSON 2 and 3 Project Analysis and AppraissalDocument32 pagesLESSON 2 and 3 Project Analysis and Appraissalwambualucas74Pas encore d'évaluation

- Madras University MBA Managerial Economics PMBSE NotesDocument11 pagesMadras University MBA Managerial Economics PMBSE NotesCircut100% (1)

- FinalDocument19 pagesFinalPayal PurohitPas encore d'évaluation

- Notes of PM- Lect-3b- Project Identification [Compatibility Mode]_10c2e08cf0589c5b5a620a46a200e3c1Document15 pagesNotes of PM- Lect-3b- Project Identification [Compatibility Mode]_10c2e08cf0589c5b5a620a46a200e3c1Animesh SorengPas encore d'évaluation

- PM Lalit Sir Material PDFDocument62 pagesPM Lalit Sir Material PDFTanay SoniPas encore d'évaluation

- Unit 6 EditedDocument22 pagesUnit 6 Editedtibebu yacobPas encore d'évaluation

- ACFrOgCChX61dVtT9hglabokDSyiLz17eiG_1x5n30UZT3seXfyEpTROXdanCSMe3n-8zRI8pW9q0bh2iOaTtQ9WYYHkyz3si2hM_wlAS9ojWltOrmoilkcSqR7w3zmQxAw_wlQFNBcxIAyUhFwGDocument3 pagesACFrOgCChX61dVtT9hglabokDSyiLz17eiG_1x5n30UZT3seXfyEpTROXdanCSMe3n-8zRI8pW9q0bh2iOaTtQ9WYYHkyz3si2hM_wlAS9ojWltOrmoilkcSqR7w3zmQxAw_wlQFNBcxIAyUhFwGSakib ShaikhPas encore d'évaluation

- General Parts of Business PlanDocument6 pagesGeneral Parts of Business PlanGabriel MartinPas encore d'évaluation

- Budget Types Explained in DetailDocument3 pagesBudget Types Explained in DetailMohan RanganPas encore d'évaluation

- Financial and Economic Analysis For Investment ProjectsDocument4 pagesFinancial and Economic Analysis For Investment ProjectsQadir AttalPas encore d'évaluation

- Pan-Europa Foods Corporate Strategy Case Study AnalysisDocument6 pagesPan-Europa Foods Corporate Strategy Case Study AnalysisPrathibha VemulapalliPas encore d'évaluation

- 5PM FinancialAnlysDocument4 pages5PM FinancialAnlysAmba GeetanjaliPas encore d'évaluation

- Project Cost Estimation TechniquesDocument46 pagesProject Cost Estimation TechniquesbryanPas encore d'évaluation

- Long-term investment analysisDocument13 pagesLong-term investment analysissamuel kebedePas encore d'évaluation

- Project appraisal methods & techniquesDocument29 pagesProject appraisal methods & techniquesDEV BHADANAPas encore d'évaluation

- 302 Unit 2Document19 pages302 Unit 2Vishal YadavPas encore d'évaluation

- University of Jahangir NagarDocument9 pagesUniversity of Jahangir NagarNoor NabiPas encore d'évaluation

- The Super ProjectDocument5 pagesThe Super ProjectAbhiPas encore d'évaluation

- What Is Project Crashing?: in - Html#Ixzz4Evbim43H Attribution Non-Commercial Share AlikeDocument5 pagesWhat Is Project Crashing?: in - Html#Ixzz4Evbim43H Attribution Non-Commercial Share AlikeVaishali ShuklaPas encore d'évaluation

- Fin. Analysis & Project FinancingDocument14 pagesFin. Analysis & Project FinancingBethelhem100% (1)

- Demand Forecasting Techniques & Significance/TITLEDocument9 pagesDemand Forecasting Techniques & Significance/TITLErivu_biswasPas encore d'évaluation

- Principal Of Budgeting: Fundamentals, Types, ComponentsDocument6 pagesPrincipal Of Budgeting: Fundamentals, Types, ComponentsZulkarnain DahalanPas encore d'évaluation

- PGDM (Finance) FULL NOTES-Project - Appraisal - FinanceDocument57 pagesPGDM (Finance) FULL NOTES-Project - Appraisal - Financeanimesh_sarkar_3Pas encore d'évaluation

- PROJECT REPORT ON AViva LIFE INSURANCEDocument62 pagesPROJECT REPORT ON AViva LIFE INSURANCEMayank100% (12)

- Cross Border MDocument5 pagesCross Border MAnushree Harshaj GoelPas encore d'évaluation

- Case 1 United Products, Inc.: Teaching NotesDocument56 pagesCase 1 United Products, Inc.: Teaching Notesjmukerje60% (5)

- Unfulfilled Education Aspiration: Article SummaryDocument5 pagesUnfulfilled Education Aspiration: Article SummaryAnushree Harshaj GoelPas encore d'évaluation

- CH 07Document31 pagesCH 07Fathan AzhariPas encore d'évaluation

- Ultratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Document7 pagesUltratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Anushree Harshaj GoelPas encore d'évaluation

- Book Review - It Happened in India by Kishore Biyani: Fore School of ManagementDocument3 pagesBook Review - It Happened in India by Kishore Biyani: Fore School of ManagementAnushree Harshaj GoelPas encore d'évaluation

- FinanceDocument96 pagesFinanceAnushree Harshaj GoelPas encore d'évaluation

- Don't Put All Your Eggs in One Basket: Diversification ExplainedDocument9 pagesDon't Put All Your Eggs in One Basket: Diversification ExplainedAnushree Harshaj GoelPas encore d'évaluation

- Abhishek ReportDocument67 pagesAbhishek ReportAbhishek KarPas encore d'évaluation

- Bank Statement June-August 2019Document1 pageBank Statement June-August 2019sathish skPas encore d'évaluation

- Credit Risk Management at State Bank of HyderabadDocument86 pagesCredit Risk Management at State Bank of HyderabadSagar Paul'g100% (1)

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariPas encore d'évaluation

- TN Comptroller's Report: Volunteer Energy CooperativeDocument6 pagesTN Comptroller's Report: Volunteer Energy CooperativeDan LehrPas encore d'évaluation

- Indian Economy QuestionsDocument25 pagesIndian Economy QuestionsPadyala SriramPas encore d'évaluation

- Financial InclusionDocument6 pagesFinancial InclusionsignPas encore d'évaluation

- Forward Contracts Prohibitions On PDFDocument23 pagesForward Contracts Prohibitions On PDFIqbal PramaditaPas encore d'évaluation

- Orban Co-Operative BankDocument27 pagesOrban Co-Operative BankYaadrahulkumar MoharanaPas encore d'évaluation

- 2010 FirstRand Annual Report 1Document450 pages2010 FirstRand Annual Report 1Sathya SeelanPas encore d'évaluation

- GRC - Governance, Risk Management, and ComplianceDocument16 pagesGRC - Governance, Risk Management, and ComplianceBhavesh RathodPas encore d'évaluation

- Wolters Kluwer-OneSumX-Basel IV Vs Basel III InfographicDocument1 pageWolters Kluwer-OneSumX-Basel IV Vs Basel III InfographicAlkPas encore d'évaluation

- IKO Guide Lipiec 2019Document32 pagesIKO Guide Lipiec 2019Damian MotylskiPas encore d'évaluation

- Multination Finance Butler 5th EditionDocument3 pagesMultination Finance Butler 5th EditionUnostudent2014Pas encore d'évaluation

- Account Statement From 29 Jul 2020 To 31 Jul 2020Document1 pageAccount Statement From 29 Jul 2020 To 31 Jul 2020Ashwin PrajapatiPas encore d'évaluation

- Chapter-2 Review of Literature 110-143Document34 pagesChapter-2 Review of Literature 110-143city9848835243 cyberPas encore d'évaluation

- Ibps RRB Po 2017 Capsule by Gopal Sir NewDocument83 pagesIbps RRB Po 2017 Capsule by Gopal Sir NewPraveen ChaudharyPas encore d'évaluation

- Financial Accountant JournalDocument55 pagesFinancial Accountant Journalburhan_qureshiPas encore d'évaluation

- Lab 6 - Inheritance and Polymorphism Answer The Following QuestionsDocument1 pageLab 6 - Inheritance and Polymorphism Answer The Following Questionsflowerpot321Pas encore d'évaluation

![Notes of PM- Lect-3b- Project Identification [Compatibility Mode]_10c2e08cf0589c5b5a620a46a200e3c1](https://imgv2-2-f.scribdassets.com/img/document/720532042/149x198/6929450bc4/1712389021?v=1)