Académique Documents

Professionnel Documents

Culture Documents

Inox RU4QFY2008 110608

Transféré par

api-3862995Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Inox RU4QFY2008 110608

Transféré par

api-3862995Droits d'auteur :

Formats disponibles

Inox Leisure

4QFY2008 Result Update

NEUTRAL

Performance Highlights

Price Rs92

Subdued Revenue growth, up 18%: For 4QFY2008, Inox reported a

Target Price - subdued Topline growth of 18.4% yoy to Rs39.3cr (Rs33.2cr) as lower

Occupancy (4Q is a seasonally weak quarter) led to a muted 13.4% yoy

Investment Period - growth in Footfall. However, 4QFY2008 numbers are not strictly comparable

on a yoy basis owing to inclusion of Calcutta Cine Pvt Limited’s (CCPL)

Stock Info financials, whose amalgamation was approved by the court in 2QFY2008.

CCPL operates sevens screens and was acquired by Inox in FY2007. For

Sector Media

FY2008, Inox registered 30.6% yoy growth in Revenues to Rs185cr

Market Cap (Rs cr) 570 (Rs141cr) driven by addition of property leading to a 35% jump in footfalls.

Beta 0.9 Margins collapse, decline by 790bp: At the operating front, Inox delivered

52 WK High / Low 242 / 81

a dismal performance for the quarter registering a 790bp decline in

Operating Margin to 10% (17.9%) largely owing to a sharp 782bp increase in

Avg Daily Volume 182,328 Other expenditure and 287bp rise in Staff costs owing to a lower revenue

base. The sharp jump in Other expenditure is attributed to higher rental (as

Face Value (Rs) 10 new property additions are on a lease basis) and power costs. However, on

a full year basis, the company registered a 391bp decline in Operating

BSE Sensex 15,185

Margin to 21.8% (25.7%). Going ahead, we believe Margins would improve

Nifty 4,524 (owing to a lower base in FY2008) as fixed costs get spread over a larger

revenue base. However, rising E-tax outflow and execution in terms of

BSE Code 532706 property addition remain the key factors to watch out for.

NSE Code INOXLEISUR

Bottomline severely impacted, declines 86%: For the quarter, Inox

Reuters Code INOL.BO registered a sharp decline in Bottomline by 86% yoy to Rs0.6cr (Rs4.6cr)

impacted by sharp Margin contraction, relatively slower Revenue growth and

Bloomberg Code INOL IN steep drop in Other Income (down 79% yoy). On a full year basis, the

Shareholding Pattern (%) company delivered a muted 6.5% yoy growth in Earnings to Rs26.4cr

(Rs24.8cr) despite a 26% jump in Other Income.

Promoters 64.2

MF/Banks/Indian FIs Key Financials

16.6

Y/E March (Rs cr) FY2007 FY2008 FY2009E FY2010E

FII/ NRIs/ OCBs 3.3

Net Sales 141.4 184.7 261.5 337.1

Indian Public 15.9

% chg 38.2 30.9 41.6 28.9

Net Profit 24.8 26.4 32.3 42.6

Abs. 3m 1yr 3yr# % chg 41.3 6.4 22.5 31.7

OPM (%) 25.7 21.8 23.1 24.3

Sensex (%) (5.8) 7.2 48.2

FDEPS (Rs) 4.0 4.3 5.2 6.9

Inox (%) (12.0) (29.1) (47.1)

P/E (x) 23.0 21.6 17.6 13.4

# Since IPO Feb 23, 2006

P/BV (x) 2.4 2.2 2.0 1.8

Anand Shah RoE (%) 10.6 10.4 11.6 13.5

RoCE (%) 9.2 9.2 12.8 15.5

Tel: 022 – 4040 3800 Ext: 334

e-mail: anand.shah@angeltrade.com EV/Sales (x) 4.2 2.9 2.2 1.7

EV/EBITDA (x) 17.7 15.1 10.5 7.9

Shweta Boob Source: Company, Angel Research

Tel: 022 – 4040 3800 Ext: 311

e-mail: shweta.boob@angeltrade.com

June 11, 2008 1

Inox Leisure

Media

Key Highlights

Exhibit 1: Exhibition Capacity

Particulars 4QFY2008 4QFY2007 Addition Current Addition

Properties Under Operation 22 14 3 24 10

Screens Under Operation 76 51 25 84 33

Seats Under Operation 23,199 15,251 7,948 25,219 9,968

Source: Company, Angel Research, Note: Capacity is excluding Franchise Theaters

Exhibition Capacity: At the end of FY2008, Inox had 76 screens and 23,199 seats

under operation. No new screens were added during 4QFY2008. However, post

4QFY2008, the company added two new multiplexes - Faridabad (four screens with

1,108 seats) and Nagpur (four screens with 1,214 seats) taking its total tally to 84

screens.

Exhibit 2: Operational Parameters

Particulars 4QFY2008 4QFY2007 % chg FY2008 FY2007 % chg

Footfalls (Mn) 2.5 2.2 13.4 12.5 9.3 35.0

Occupancy (%) 29.0 36.0 40.0 42.0

Average Ticket Price, ATP (Rs) 134.0 128.0 4.7 127.0 125.0 1.6

F&B SPH (Rs) 31.0 27.0 14.8 29.0 27.0 7.4

Source: Company, Angel Research

Outlook and Valuation

During FY2008-10, we expect Inox to register a CAGR of 35.1% in Topline mainly

driven by addition in seating capacity as we expect ATP and F&B Spend to improve

only marginally. We expect the screens to increase from the current 84 to 111 in

FY2009 and 142 in FY2010. At the operating front, we expect Margins to improve by

250bp over FY2008-10 (largely owing to a lower base effect in FY2008) driving a robust

42.7% CAGR in EBITDA supported by lower overheads (spread over a larger screen

base). However, as majority of future expansion is in Non E-tax exempt areas,

additional pressure on Margins cannot be ruled out. Despite modest Revenue growth

and Margin expansion, we expect Bottomline growth to remain subdued over the

mentioned period owing to lower Other Income (as surplus funds get deployed towards

expansion). As a result, we expect the company to register Net Profit CAGR of 27%

during FY2008-10.

Inox commands a premium over its peers owing to its superior positioning and better

execution capabilities. However, we believe this premium would narrow down due to

subdued Earnings growth over FY2008-10E. At the CMP of Rs184, Inox is trading at

13.4x FY2010E EPS, which is relatively expensive compared to its peers and leaves

little upside for investors. We maintain our Neutral view on the stock.

June 11, 2008 2

Inox Leisure

Media

Exhibit 3: 4QFY2008 Performance

Y/E March (Rs cr) 4QFY2008 4QFY2007 % chg FY2008 FY2007 % chg

Net Sales 39.3 33.2 18.4 184.7 141.4 30.6

Film Distributor Share 8.7 8.6 1.9 45.0 34.8 29.3

(% of Sales) 22.2 25.7 24.3 24.6

Consumption of F&B 2.3 1.8 22.8 10.6 7.4 43.0

(% of Sales) 5.7 5.5 5.7 5.2

Staff costs 4.9 3.2 53.6 18.2 11.6 56.9

(% of Sales) 12.5 9.7 9.9 8.2

Film Rights/ Print Costs 1.4 1.0 42.7 5.4 9.7 (44.2)

(% of Sales) 3.5 2.9 2.9 6.9

Other expenditure 18.1 12.7 42.6 65.3 41.6 57.0

(% of Sales) 46.0 38.2 35.4 29.4

Total Expenditure 35.4 27.3 29.8 144.5 105.1 37.5

Operating Profit 3.9 6.0 (33.7) 40.2 36.3 10.7

OPM (%) 10.0 17.9 21.8 25.7

Interest 0.9 1.1 (19.6) 6.0 6.7 (10.1)

Depreciation 2.8 2.0 41.1 9.3 6.4 45.5

Other Income 0.7 3.1 (78.7) 11.6 9.2 26.4

PBT (excl. Ext Items) 0.9 6.0 (84.4) 36.5 32.4 12.6

Ext Income/(Expense) - - 0.01 -

PBT (incl. Ext Items) 0.9 6.0 (84.4) 36.5 32.4 12.6

(% of Sales) 2.4 18.0 19.8 22.9

Provision for Taxation 0.3 1.3 (78.9) 10.1 7.6 32.8

(% of PBT) 30.1 22.3 27.7 23.5

Recurring PAT 0.6 4.6 (86.0) 26.4 24.8 6.4

PATM (%) 1.7 14.0 14.3 17.5

Reported PAT 0.6 4.6 (86.0) 26.4 24.8 6.5

Equity shares (cr) 61.2 59.5 61.2 59.5

EPS (Rs) 0.1 0.8 4.3 4.2

Source: Company, Angel Research

June 11, 2008 3

Inox Leisure

Media

TM

Angel Broking Limited

Research Team Tel: 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose

possession this document may come are required to observe these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to

change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every

effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use

the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive

at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the

merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -

futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying

charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its

subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that

may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without

notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of

the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect

to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies

referred to in this report, as on the date of this report or in the past.

Sebi Registration No : INB 010996539

June 11, 2008 4

Vous aimerez peut-être aussi

- Ashok Leyland: Performance HighlightsDocument9 pagesAshok Leyland: Performance HighlightsSandeep ManglikPas encore d'évaluation

- Bharat Forge: Performance HighlightsDocument13 pagesBharat Forge: Performance HighlightsarikuldeepPas encore d'évaluation

- B D E (BDE) : LUE ART XpressDocument18 pagesB D E (BDE) : LUE ART XpresshemantPas encore d'évaluation

- Amara Raja Batteries: Performance HighlightsDocument10 pagesAmara Raja Batteries: Performance HighlightssuneshsPas encore d'évaluation

- Vascon Engineers - Kotak PCG PDFDocument7 pagesVascon Engineers - Kotak PCG PDFdarshanmadePas encore d'évaluation

- Cipla: Performance HighlightsDocument8 pagesCipla: Performance HighlightsKapil AthwaniPas encore d'évaluation

- Motherson Sumi System DataDocument4 pagesMotherson Sumi System DataNishaVishwanathPas encore d'évaluation

- Alembic Angel 020810Document12 pagesAlembic Angel 020810giridesh3Pas encore d'évaluation

- 29 Apr 03 INCODocument8 pages29 Apr 03 INCOpd98004Pas encore d'évaluation

- Airtel AnalysisDocument15 pagesAirtel AnalysisPriyanshi JainPas encore d'évaluation

- Bhel-3qfy11 Ru-210111Document12 pagesBhel-3qfy11 Ru-210111kshintlPas encore d'évaluation

- IVRCL Infrastructure: Performance HighlightsDocument7 pagesIVRCL Infrastructure: Performance Highlightsanudeep05Pas encore d'évaluation

- JBM Auto (Q2FY21 Result Update)Document7 pagesJBM Auto (Q2FY21 Result Update)krippuPas encore d'évaluation

- Tata Steel: Performance HighlightsDocument13 pagesTata Steel: Performance HighlightssunnysmvduPas encore d'évaluation

- Bharat Forge StoryDocument4 pagesBharat Forge Storysoni_rajendraPas encore d'évaluation

- Enil 25 8 08 PLDocument12 pagesEnil 25 8 08 PLapi-3862995Pas encore d'évaluation

- Q2FY18 Results Update | Ashok LeylandDocument10 pagesQ2FY18 Results Update | Ashok LeylandJitendra GaglaniPas encore d'évaluation

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadePas encore d'évaluation

- Q2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsDocument10 pagesQ2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsbradburywillsPas encore d'évaluation

- Ashok Leyland Kotak 050218Document4 pagesAshok Leyland Kotak 050218suprabhattPas encore d'évaluation

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaPas encore d'évaluation

- Exide Industries: Performance HighlightsDocument4 pagesExide Industries: Performance HighlightsMaulik ChhedaPas encore d'évaluation

- IDirect SKFIndia Q2FY20Document10 pagesIDirect SKFIndia Q2FY20praveensingh77Pas encore d'évaluation

- UltraTech Cement's strong growth visibilityDocument10 pagesUltraTech Cement's strong growth visibilityLive NIftyPas encore d'évaluation

- Cyient 2QFY19 Earnings Update: Revenue Beats Estimates; Margins Expand 152bpsDocument6 pagesCyient 2QFY19 Earnings Update: Revenue Beats Estimates; Margins Expand 152bpsADPas encore d'évaluation

- Annual Report of Info Edge by Icici SecurityDocument12 pagesAnnual Report of Info Edge by Icici SecurityGobind yPas encore d'évaluation

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebPas encore d'évaluation

- IDFC Bank: CMP: Inr63 TP: INR68 (8%)Document8 pagesIDFC Bank: CMP: Inr63 TP: INR68 (8%)Devendra SarafPas encore d'évaluation

- Reliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Document18 pagesReliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Abhiroop DasPas encore d'évaluation

- IVRCL Infrastructure: Performance HighlightsDocument11 pagesIVRCL Infrastructure: Performance HighlightsPratik GanatraPas encore d'évaluation

- E I L (EIL) : Ngineers Ndia TDDocument8 pagesE I L (EIL) : Ngineers Ndia TDADPas encore d'évaluation

- Wipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityDocument14 pagesWipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityPramod KulkarniPas encore d'évaluation

- Anand Rural Electrification Corp Buy 25oct10Document2 pagesAnand Rural Electrification Corp Buy 25oct10bhunkus1327Pas encore d'évaluation

- Tata Steel: Performance HighlightsDocument6 pagesTata Steel: Performance Highlightsmd.iet87Pas encore d'évaluation

- Ambuja Cements 1QCY10 Results Update EBITDA GrowthDocument8 pagesAmbuja Cements 1QCY10 Results Update EBITDA Growth张迪Pas encore d'évaluation

- Atul Auto: Rural Uptick Holds The KeyDocument10 pagesAtul Auto: Rural Uptick Holds The KeyAnonymous y3hYf50mTPas encore d'évaluation

- Weak Balance Sheet Drags Profitability: Q3FY18 Result HighlightsDocument8 pagesWeak Balance Sheet Drags Profitability: Q3FY18 Result Highlightsrishab agarwalPas encore d'évaluation

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDocument17 pagesQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyPas encore d'évaluation

- Havells India Q1FY23 earnings dampened by raw material volatilityDocument12 pagesHavells India Q1FY23 earnings dampened by raw material volatilityResearch ReportsPas encore d'évaluation

- Cholamandalam Investment Q2FY17 Result UpdateDocument2 pagesCholamandalam Investment Q2FY17 Result UpdateAkshit SandoojaPas encore d'évaluation

- Q3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedDocument10 pagesQ3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedbradburywillsPas encore d'évaluation

- Titan Industries: Performance HighlightsDocument10 pagesTitan Industries: Performance Highlightscbz786skPas encore d'évaluation

- Angel Broking M&MDocument5 pagesAngel Broking M&Mbunny711Pas encore d'évaluation

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathPas encore d'évaluation

- KEI Industries' Strong Revenue Growth of 39.4% in 4QFY18Document7 pagesKEI Industries' Strong Revenue Growth of 39.4% in 4QFY18greyistariPas encore d'évaluation

- VA Tech Wabag-KotakDocument9 pagesVA Tech Wabag-KotakADPas encore d'évaluation

- Escorts: CMP: INR1,107 TP: INR 1,175 (+6%) Strong Operating Performance Led by Cost ManagementDocument12 pagesEscorts: CMP: INR1,107 TP: INR 1,175 (+6%) Strong Operating Performance Led by Cost ManagementdfhjhdhdgfjhgdfjhPas encore d'évaluation

- BHEL FY2009 Flash Result UpdateDocument5 pagesBHEL FY2009 Flash Result UpdateFirdaus JahanPas encore d'évaluation

- Cyient: Poor Quarter Recovery Likely in The Current QuarterDocument9 pagesCyient: Poor Quarter Recovery Likely in The Current QuarterADPas encore d'évaluation

- Polycab India's Q1FY23 revenue up 48%, margins expandDocument10 pagesPolycab India's Q1FY23 revenue up 48%, margins expandResearch ReportsPas encore d'évaluation

- Hero MotoCorp 1QFY18 Results Update: GST compensation, RM hurt margin; Volume guidance slightly loweredDocument12 pagesHero MotoCorp 1QFY18 Results Update: GST compensation, RM hurt margin; Volume guidance slightly loweredSAHIL SHARMAPas encore d'évaluation

- Ambuja Cement: Weak Despite The BeatDocument8 pagesAmbuja Cement: Weak Despite The BeatDinesh ChoudharyPas encore d'évaluation

- Karvy Bharat Froge Stock Report 2016Document7 pagesKarvy Bharat Froge Stock Report 2016rchawdhry123Pas encore d'évaluation

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalPas encore d'évaluation

- Sanghi Industries: CMP: Inr56 TP: INR80 (+44%)Document10 pagesSanghi Industries: CMP: Inr56 TP: INR80 (+44%)Positive ThinkerPas encore d'évaluation

- Eicher Motors Q2FY20 result update sees muted volume growthDocument10 pagesEicher Motors Q2FY20 result update sees muted volume growthDushyant ChaturvediPas encore d'évaluation

- IRCON International 2QFY20 Result Review 14-11-19Document7 pagesIRCON International 2QFY20 Result Review 14-11-19Santosh HiredesaiPas encore d'évaluation

- Performance Highlights: NeutralDocument10 pagesPerformance Highlights: Neutralvipin51Pas encore d'évaluation

- Anant Raj Industries: Performance HighlightsDocument11 pagesAnant Raj Industries: Performance HighlightsPraveen Kumar DusiPas encore d'évaluation

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioD'EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioPas encore d'évaluation

- Tech OutlookDocument2 pagesTech Outlookapi-3862995Pas encore d'évaluation

- Tech OutlookDocument2 pagesTech Outlookapi-3862995Pas encore d'évaluation

- Hdfcbank 25-8-08 PLDocument5 pagesHdfcbank 25-8-08 PLapi-3862995100% (1)

- Cement Monthly Update 26-8-08 PLDocument9 pagesCement Monthly Update 26-8-08 PLapi-3862995Pas encore d'évaluation

- Sterlite IndustriesDocument23 pagesSterlite Industriesapi-3862995Pas encore d'évaluation

- Notes+ +26th+june+2008Document15 pagesNotes+ +26th+june+2008api-3862995Pas encore d'évaluation

- 2 WheelerDocument9 pages2 Wheelerapi-3862995100% (1)

- Downlaod L&TDocument9 pagesDownlaod L&Tapi-3862995Pas encore d'évaluation

- Downlaod L&TDocument9 pagesDownlaod L&Tapi-3862995Pas encore d'évaluation

- SunPharma 1-9-08 PLDocument9 pagesSunPharma 1-9-08 PLapi-3862995Pas encore d'évaluation

- Enil 25 8 08 PLDocument12 pagesEnil 25 8 08 PLapi-3862995Pas encore d'évaluation

- Financial Services 25-8-08 PLDocument2 pagesFinancial Services 25-8-08 PLapi-3862995Pas encore d'évaluation

- India DailyDocument30 pagesIndia Dailyapi-3862995Pas encore d'évaluation

- India DailyDocument30 pagesIndia Dailyapi-3862995Pas encore d'évaluation

- ENAM RanbaxyDocument2 pagesENAM Ranbaxyapi-3862995Pas encore d'évaluation

- Edel 230608Document9 pagesEdel 230608api-3862995Pas encore d'évaluation

- India DailyDocument36 pagesIndia Dailyapi-3862995Pas encore d'évaluation

- TU544 HDFC LTD 080624Document7 pagesTU544 HDFC LTD 080624api-3862995Pas encore d'évaluation

- Ambuja Cements LimitedDocument5 pagesAmbuja Cements Limitedapi-3862995Pas encore d'évaluation

- Varun Shipping LKP SharesDocument3 pagesVarun Shipping LKP Sharesapi-3862995Pas encore d'évaluation

- India DailyDocument15 pagesIndia Dailyapi-3862995Pas encore d'évaluation

- EIH HotelsDocument2 pagesEIH Hotelsapi-3862995Pas encore d'évaluation

- Technicals 12062008 RCHDocument4 pagesTechnicals 12062008 RCHapi-3862995Pas encore d'évaluation

- Market StrategyDocument3 pagesMarket Strategyapi-3862995Pas encore d'évaluation

- India DailyDocument17 pagesIndia Dailyapi-3862995Pas encore d'évaluation

- IDFC SSKI+FinancialsDocument18 pagesIDFC SSKI+Financialsapi-3862995Pas encore d'évaluation

- Market StrategyDocument6 pagesMarket Strategyapi-3862995Pas encore d'évaluation

- TU535 Infosys Technologies Limited 080618Document6 pagesTU535 Infosys Technologies Limited 080618api-3862995Pas encore d'évaluation

- Technicals 19062008 AlsDocument3 pagesTechnicals 19062008 Alsapi-3862995Pas encore d'évaluation

- Plastics+ RNDocument4 pagesPlastics+ RNapi-3862995Pas encore d'évaluation

- Coca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Document6 pagesCoca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Sayan BiswasPas encore d'évaluation

- 660 Final Assignment (Maruf)Document29 pages660 Final Assignment (Maruf)Maruf ChowdhuryPas encore d'évaluation

- Financial Statement Analysis of Beximco Pharma LTD On 2009Document14 pagesFinancial Statement Analysis of Beximco Pharma LTD On 2009Marshal RichardPas encore d'évaluation

- Managerial Accounting Insights for Legend GuitarsDocument33 pagesManagerial Accounting Insights for Legend GuitarsMah ElPas encore d'évaluation

- Chair Ids PLDocument3 pagesChair Ids PLHarry SinghPas encore d'évaluation

- Ch10 Tool Kit NPV Dan IRRDocument23 pagesCh10 Tool Kit NPV Dan IRRSyarif Bin DJamalPas encore d'évaluation

- LAPORAN KEUANGAN 2020 TrioDocument3 pagesLAPORAN KEUANGAN 2020 TrioMT Project EnokPas encore d'évaluation

- JokiDocument3 pagesJokiNyoman Devi PuspitaPas encore d'évaluation

- Prospectus My RH Bib FDocument355 pagesProspectus My RH Bib FharizhamidonPas encore d'évaluation

- Baf Annual Report 2022Document558 pagesBaf Annual Report 2022Tahir Mustafa ChohanPas encore d'évaluation

- In The Matter of Purshottam Budhwani - Appeal No.91 of 2013Document15 pagesIn The Matter of Purshottam Budhwani - Appeal No.91 of 2013Shyam SunderPas encore d'évaluation

- Report Petro ItauDocument11 pagesReport Petro ItauQuatroAPas encore d'évaluation

- Capitallization Table Template: Strictly ConfidentialDocument3 pagesCapitallization Table Template: Strictly Confidentialsh munnaPas encore d'évaluation

- Traders in FuturesDocument10 pagesTraders in FuturesmymadhavaPas encore d'évaluation

- FS 006245 Mag 06 2023Document1 pageFS 006245 Mag 06 2023grshop euPas encore d'évaluation

- LiabilitiesDocument5 pagesLiabilitiesmalaya negadPas encore d'évaluation

- IB, PE & VC Recommended ResourcesDocument1 pageIB, PE & VC Recommended ResourcesRoll 16 Ritik KumarPas encore d'évaluation

- The Importance of Asset Allocation: PerspectivesDocument3 pagesThe Importance of Asset Allocation: PerspectivesMatteo MarcantogniniPas encore d'évaluation

- Edge Trading Secrets BookDocument80 pagesEdge Trading Secrets BookJorge Simoes100% (4)

- BF2 AssignmentDocument5 pagesBF2 AssignmentIbaad KhanPas encore d'évaluation

- Cash Flow Statement and AnalysisDocument2 pagesCash Flow Statement and Analysisaashidua15gmailcomPas encore d'évaluation

- Global Reinsurance Highlights 2018Document88 pagesGlobal Reinsurance Highlights 2018sumanT9Pas encore d'évaluation

- Dr. Sharan Shetty PHD (Banking & Finance) Mba (Finance) B. Com (Hons)Document54 pagesDr. Sharan Shetty PHD (Banking & Finance) Mba (Finance) B. Com (Hons)Nagesh Pai MysorePas encore d'évaluation

- Goldman Sachs Investment Strategy Group PDFDocument4 pagesGoldman Sachs Investment Strategy Group PDFJennyPas encore d'évaluation

- Individual Assignment - EffaDocument16 pagesIndividual Assignment - EffayuhanaPas encore d'évaluation

- SCDL Financial Management Sample QuestionsDocument8 pagesSCDL Financial Management Sample QuestionsketanPas encore d'évaluation

- Theories of Venture Capital and Capital Market ImperfectionDocument32 pagesTheories of Venture Capital and Capital Market ImperfectionДр. ЦчатерйееPas encore d'évaluation

- IasDocument229 pagesIasPeter Apollo Latosa100% (1)

- Chapter 04 Channel Strat Devt DesignDocument12 pagesChapter 04 Channel Strat Devt DesignAj CapungganPas encore d'évaluation

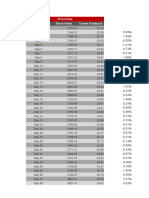

- Price Data Date Stock Index Turner FastbuckDocument14 pagesPrice Data Date Stock Index Turner FastbuckRampraveen ChamarthiPas encore d'évaluation