Académique Documents

Professionnel Documents

Culture Documents

Guidance For Claiming Expenses

Transféré par

rekha_angurajDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Guidance For Claiming Expenses

Transféré par

rekha_angurajDroits d'auteur :

Formats disponibles

Claiming Expenses

This guide explains what you can and cannot claim from your Company as expenses. To be allowable for tax purposes, expenses should be wholly, exclusively and necessarily be expended in the performance of your employment. HMRC are paying more attention to expenses claimed in your annual accounts. If we cannot prove the expenses claimed were justified, they can be added back to profits and treated as additional dividends with all taxes paid on them. Penalties of up to100% of undeclared tax may also be charged. Please pay particular attention to the section on tax investigation in this guide. After extensive face-to-face consultation with HMRC, we have clarified which expenses will be allowable and to what extent. EXPENSES GUIDELINES Travel Travel expenses can be claimed for business journeys, between workplaces or to a temporary workplace. If you spend most of your time at one workplace, even if the contract is for a period of less than 24 months, it may be assumed that you are travelling to a permanent workplace and travelling expenses will not be allowed. A two-year rule also applies, whereby if you travel to the same workplace for more than 24 months, travel expenses on such journeys cannot be claimed. As soon as you are aware the contract will take you beyond two years, travel expenses will cease to be allowed. For example, if you sign a contract that involves travelling to the same workplace for two years or more, travel expenses will not be allowed from the beginning. Furthermore, if you sign an extension that takes you up to or beyond two years from the start of your contract, travelling expenses cannot be claimed from the date of signing the extension.

Approved Mileage Allowance Payment

If you use your own car, motorbike or bicycle for business travel, you can receive a tax-free allowance per mile. This is called Approved Mileage Allowance Payment, or AMAPs. AMAPs cover any general or mileage-related expenses in relation to the car itself (such as fuel, servicing, tyres, road fund licence, insurance and depreciation) plus interest on any loan to buy the vehicle. No additional claims can be made for expenses of this type. The AMAPs amount is calculated as the number of miles of your business travel, multiplied by a rate expressed as pence per mile. The tax-free amount therefore depends only on business miles travelled and is not related to actual expenses incurred. The current generous AMAP rates are as follows: Car 40p per mile for the first 10,000 miles in a fiscal year, 25p per mile thereafter Motorcycle 24p per mile

Bicycle 20p per mile If you use a car or motorcycle, please ensure you attach petrol receipts to your expenses file to cover your mileage claim. In addition, parking and road toll charges can also be claimed in the normal way.

Overnight accommodation/meals

If you are required to stay overnight in order to fulfil your contract at a temporary workplace, the actual cost of accommodation and meals can be reimbursed. The amount reimbursed should not include a profit element. Receipts are required to be filed with your claim.

Subsistence

If you are working away overnight, you can claim incidental overnight expenses to cover personal bills such as phone calls home, laundry costs etc. The allowable expenses are: 5 per overnight stay in the UK 10 per overnight stay outside the UK

Meals

When working late - past your evening mealtime - a reasonable amount can be claimed for meals (for example, up to 20 in London and 15 elsewhere in the UK). Receipts are required to be filed with your claim. Your time sheet must also show that you were working past your evening meal times on the days you have claimed. You cannot claim for evening meals if you are working from home.

You cannot claim for lunch .

Entertaining UK clients is NOT allowable. Telephone and broadband The actual cost of itemised business calls (including VAT) can be claimed. You cannot claim for line rental. This refers to both your landline and mobile phone. Broadband subscription can only be claimed if the company is the subscriber and not yourself. Receipts have to be filed with your expenses claim. Stationery and postage The actual cost of business supplies can be claimed and there should be no private use. Receipts must be filed with your claim. Books and journals The cost of purchasing books and journals is generally NOT allowable. HMRC consider this expense is not incurred in the performance of your duties of employment, but merely puts you in a position to do your job and keep you up to date. Fees and subscriptions to professional bodies

Fees and subscriptions to the professional bodies you belong to are allowable, provided their membership is related to the work you do. Please pay for these fees through the company bank account, as the expenses claim form does not include this infrequent expense. Training Work related training and tuition costs can be claimed. The definition of "work-related training", is training for your current employment or a "related employment" where the training course or other activity is designed to impart, instil, improve or reinforce your knowledge, skills, or personal qualities. These skills and qualities are likely to prove useful to you as an employee when performing your duties, or will qualify or better qualify you to undertake your employment, or to participate in charitable or voluntary activities arising through your employment. In this context, 'related employment' covers relevant training undertaken within existing employment or with prospective employment in mind. This includes holding an office or employment with your employer, or to be held with your employer or a connected person. It also covers any such office or employment to which you have - or can realistically expect to have - a serious opportunity of being appointed. The intention here is to include all genuine training in a range of competencies, which you need in order to advance your career, or to achieve a career move. Training in leisure type activities, unless they have a genuine connection with your work duties, is not allowable. Please remember you are an employee of a company, so if you train for a prospective contract, this would fit into the related employment definition. Receipts with a full description of your course will have to be filed with your claim. Use of home as office HMRC have now altered their guidance on the use of your home as an office, and will only allow a tax-free sum of 3 per week, without any questions asked, unless you have a home working arrangement. (A draft licence agreement is available). We have decided that a fair contribution by the company for the use of your home as an office - is 50 per month. This should only be claimed after you have signed the licence agreement, which is annexed with this guide. You cannot claim for any other expenses such as electricity, council tax etc. Dispensation for expenses payments The above expenses can be claimed without the need to declare them on form P11D, if a form P11DX is completed and accepted by HMRC. We recommend that you submit this as soon as possible. A form P11DX is included as an appendix to this guide. Your duties and responsibilities It is your duty to see that your company operates legally. It is our duty to advise you how to remain within the law. We are also aware that you meet colleagues who will tell you that their accountants let them claim all sort of expenses. They will also say that their accountant has got dispensation from HMRC. This is not true. HMRC is not in the business of giving dispensation to individual firms of accountants. You will find a general dispensation form annexed to this guide - but no accountant has the right to allow or disallow expenses. Only HMRC can do that.

iXBRL When we file the Companys Corporation tax return we have to annex the underlying financial accounts. In the past this was in PDF format and HMRC randomly chose whose accounts to manually key into their software. Some accounts were then fed into benchmark software which compared your figures with businesses similar to yours and in your area. Expenses such as travelling and subsistence are compared as to the ratio of your income. If there are any inconsistencies, your accounts are sent to the investigation department. They will make a decision whether to investigate. We now have to file your accounts in IXBRL format, which means they are directly fed into HMRCs software and are automatically benchmarked. As you are aware that the government is pressurising HMRC to raise as much revenue as possible, so we suspect the HMRC will scrutinise many more tax returns then in the past and more and more tax investigation will take place.

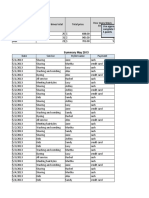

Tax Investigations An investigation is a very stressful and an expensive procedure. HMRC incurs a cost on every investigation and so they are very keen to recoup this cost and indeed make a profit. It is therefore, very likely that they will not be happy until they find something they can charge you with. Any discrepancies found will be taxed plus a 100% penalty is automatically charged. The penalty can be mitigated by up to 75% depending on how you co-operate with the investigation and how bad the understatement of taxable profits was. Once the under declaration is agreed, it can be applied to previous years and can go back for up to six years and in certain circumstances even more. As you are aware, our fixed fees do not cover investigations. There may also be other costs as in many cases you may need to employ the services of specialist tax investigation firms run by ex-HMRC employees. They can be very expensive. I am not trying to frighten you. I am just explaining what can be the consequences. Procedures for recording expenses Once a month, please complete your expenses schedule by using the annexed template. Please attach receipts to your schedule and file the documents at your home/office. Please do not send the receipts to us. You should pay the total amount of the claim to yourself. File the expenses claim in the appropriate folder or sub-folder in Dropbox.. The CSV summary tab will help you to update your ProfitBooks records.

Acknowledgement of the expenses guideline.

I have read this guide and whatever I claim can be entered in the Companys annual accounts and Corporation Tax Return.

................................................................... Director of

Vous aimerez peut-être aussi

- Credit Card DetailsDocument5 pagesCredit Card Detailsjrbossfps75% (8)

- Refunds: Chapter - 19Document28 pagesRefunds: Chapter - 19Ashma KhanalPas encore d'évaluation

- Chargeback GuideDocument693 pagesChargeback GuideElvis RenPas encore d'évaluation

- Citi Personal LoanDocument38 pagesCiti Personal LoanYousuke FuumaPas encore d'évaluation

- Wholesale Credit AppDocument3 pagesWholesale Credit AppReload GamingPas encore d'évaluation

- Your Deposit Account Agreement: Effective May 11, 2020Document33 pagesYour Deposit Account Agreement: Effective May 11, 2020Steph BryattPas encore d'évaluation

- Membership ApplicationDocument5 pagesMembership ApplicationAbhishek VijayPas encore d'évaluation

- Benefits of Using Swift PaymentsDocument6 pagesBenefits of Using Swift PaymentsMidhunPas encore d'évaluation

- DIY Company Formation in USADocument10 pagesDIY Company Formation in USAMoiz SubhanPas encore d'évaluation

- Dental Treatment Refund Form PDFDocument4 pagesDental Treatment Refund Form PDFMick BurnsPas encore d'évaluation

- StatusDocument1 pageStatusMinisterPas encore d'évaluation

- No Monthly Fees or Minimums for Asterisk-Free Checking AccountDocument3 pagesNo Monthly Fees or Minimums for Asterisk-Free Checking AccountMarcells Danyel JordanPas encore d'évaluation

- DecreeDocument3 pagesDecreehappyhollergal100% (1)

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloPas encore d'évaluation

- New DMV and SSN BenefitsDocument1 pageNew DMV and SSN BenefitsGeetha Madhuri SammetaPas encore d'évaluation

- Opening a UK bank account as an international studentDocument6 pagesOpening a UK bank account as an international studentHarry NugrahaPas encore d'évaluation

- CA5403: Your National Insurance Number: About This FormDocument4 pagesCA5403: Your National Insurance Number: About This FormluzipopPas encore d'évaluation

- Qualified Theft Now Pending Before The Regional Trial Court - Branch 21Document2 pagesQualified Theft Now Pending Before The Regional Trial Court - Branch 21Peput CabugsaPas encore d'évaluation

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaPas encore d'évaluation

- LTA Claim FormDocument1 pageLTA Claim FormSupratikPas encore d'évaluation

- Martin Nussbaum Credit Report SummaryDocument1 pageMartin Nussbaum Credit Report SummaryChris PearsonPas encore d'évaluation

- Instruments of PaymentDocument35 pagesInstruments of PaymentMd Alamin Mia SabujPas encore d'évaluation

- New Company Dormancy ConfirmationDocument1 pageNew Company Dormancy ConfirmationusernameusernaPas encore d'évaluation

- English Bill of Rights 1689Document3 pagesEnglish Bill of Rights 1689Arwa JuzarPas encore d'évaluation

- United Kingdom: Old Age, Disability, and SurvivorsDocument8 pagesUnited Kingdom: Old Age, Disability, and SurvivorsOyong HaryadiPas encore d'évaluation

- Traverlers Cheqes AssignmentDocument3 pagesTraverlers Cheqes AssignmentPradeep DhanushkaPas encore d'évaluation

- Self Service Direct DepositDocument18 pagesSelf Service Direct DepositJordan WebbPas encore d'évaluation

- CARES Act FundingDocument23 pagesCARES Act FundingHNNPas encore d'évaluation

- Recognition Act 1968Document3 pagesRecognition Act 1968MinisterPas encore d'évaluation

- UK State Pension StatementDocument7 pagesUK State Pension StatementElmer LeonardPas encore d'évaluation

- British CitizenshipDocument15 pagesBritish CitizenshipDamon CulbertPas encore d'évaluation

- RBC Mortgage Discharge - LienDocument14 pagesRBC Mortgage Discharge - Liencondomadness13Pas encore d'évaluation

- Student Visa Application GuideDocument22 pagesStudent Visa Application GuideTPas encore d'évaluation

- Broadband Only NO BT SportDocument3 pagesBroadband Only NO BT SportAbhay PratapPas encore d'évaluation

- Form To Get NinoDocument3 pagesForm To Get NinoFrancisco Vergara PerucichPas encore d'évaluation

- Alpari Uk Bank DetailsDocument3 pagesAlpari Uk Bank DetailsreniestessPas encore d'évaluation

- Mobile Services Tax Invoice BreakdownDocument3 pagesMobile Services Tax Invoice BreakdownValencia MabenPas encore d'évaluation

- National Insurance NumberDocument2 pagesNational Insurance NumberPOPESCUPas encore d'évaluation

- COA 04 April 2023Document7 pagesCOA 04 April 2023Ludmila AleksandrovičaPas encore d'évaluation

- Verifying Your Identity - YBM3838 - 071221Document2 pagesVerifying Your Identity - YBM3838 - 071221BusyharriedmumPas encore d'évaluation

- Leaving UK - Get Tax RightDocument4 pagesLeaving UK - Get Tax Right_Cristi_Pas encore d'évaluation

- Notary Statement ExamplesDocument1 pageNotary Statement ExamplesMariagmzPas encore d'évaluation

- VN 04 Credit Cards FaqDocument5 pagesVN 04 Credit Cards FaqdhakaeurekaPas encore d'évaluation

- Philippine Geothermal, Inc. vs. Commissioner of Internal Revenue, 465 SCRA 308 (2005)Document2 pagesPhilippine Geothermal, Inc. vs. Commissioner of Internal Revenue, 465 SCRA 308 (2005)VerlynMayThereseCaroPas encore d'évaluation

- Paid in Full Receipt TemplateDocument1 pagePaid in Full Receipt Templategulam anzerPas encore d'évaluation

- Confirmation of The Non-Acquisition of British CitizenshipDocument2 pagesConfirmation of The Non-Acquisition of British CitizenshipGarethPas encore d'évaluation

- Africa Scholarship Application Form 2021Document5 pagesAfrica Scholarship Application Form 2021Abdinasir Mohamed AdanPas encore d'évaluation

- Government Grants Act ExplainedDocument3 pagesGovernment Grants Act ExplainedHaseeb HassanPas encore d'évaluation

- Why Is England or The UK Sometimes Called 1Document27 pagesWhy Is England or The UK Sometimes Called 1Rias Wita SuryaniPas encore d'évaluation

- Google UK 2008 AccountsDocument26 pagesGoogle UK 2008 AccountsPaidContentUKPas encore d'évaluation

- Claim Form 2013Document30 pagesClaim Form 2013Matt EnticottPas encore d'évaluation

- Applying for a UK National Insurance NumberDocument2 pagesApplying for a UK National Insurance NumbergrungeshoesPas encore d'évaluation

- My RBC Bank StatementDocument4 pagesMy RBC Bank Statementعبد الالهPas encore d'évaluation

- Uws Uk Bank Account DetailsDocument2 pagesUws Uk Bank Account DetailsAdeyinka AkinlawonPas encore d'évaluation

- Equifax Report First American Bank Reporting Pulled 10/06/2021Document1 pageEquifax Report First American Bank Reporting Pulled 10/06/2021larry-612445Pas encore d'évaluation

- Passport Application DeclarationDocument9 pagesPassport Application DeclarationSimon HildrethPas encore d'évaluation

- Verification To Work in UKDocument2 pagesVerification To Work in UKsweetcheaks_natPas encore d'évaluation

- Settled Status.: Tel Web Our Ref DateDocument6 pagesSettled Status.: Tel Web Our Ref DateioanaPas encore d'évaluation

- What Is Eon Bank Group Mol-Mymode Freedom Mastercard Unembossed Card?Document8 pagesWhat Is Eon Bank Group Mol-Mymode Freedom Mastercard Unembossed Card?wan norizanPas encore d'évaluation

- Tik Tok Anchor AgreementDocument4 pagesTik Tok Anchor AgreementPolo OaracilPas encore d'évaluation

- A Cheque Is A DocumentDocument15 pagesA Cheque Is A Documentmi06bba030Pas encore d'évaluation

- Your National Insurance LetterDocument1 pageYour National Insurance LetterfixithubltdPas encore d'évaluation

- Regional Acceptance Ach Draft Form-OneDocument2 pagesRegional Acceptance Ach Draft Form-Onejohnlove720% (1)

- Divers and Diving Supervisors Revenue Expences Under CISDocument5 pagesDivers and Diving Supervisors Revenue Expences Under CISCailean FraserPas encore d'évaluation

- Thinking of Working For Yourself?Document17 pagesThinking of Working For Yourself?StaceyPas encore d'évaluation

- 1 MondayDocument6 pages1 MondayCeline Marie Libatique AntonioPas encore d'évaluation

- All-Time High (ATH) - Cryptocurrency Price List - CoinGoLiveDocument1 pageAll-Time High (ATH) - Cryptocurrency Price List - CoinGoLivejorgefkingPas encore d'évaluation

- Revenue Regulations No. 01-99: Rule 1.coverageDocument24 pagesRevenue Regulations No. 01-99: Rule 1.coveragesaintkarriPas encore d'évaluation

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiPas encore d'évaluation

- Creating Vouchers: Chapter OutlineDocument8 pagesCreating Vouchers: Chapter OutlineRSETIPas encore d'évaluation

- Tax Invoice: RAJKOT GAS SERVICE (000010176)Document1 pageTax Invoice: RAJKOT GAS SERVICE (000010176)Rahul ShuklaPas encore d'évaluation

- Midterm Tasks1Document24 pagesMidterm Tasks1Kamran Memmedov100% (1)

- TOEFL Additional Score Report Request FormDocument2 pagesTOEFL Additional Score Report Request Formvishwa tejaPas encore d'évaluation

- Account summary and transactionsDocument6 pagesAccount summary and transactionsAbdul HaseebPas encore d'évaluation

- Vodafone bill details for Rs 638.76 chargesDocument2 pagesVodafone bill details for Rs 638.76 chargesRajneesh JhoradPas encore d'évaluation

- Quix 2 Tax-Key 2Document13 pagesQuix 2 Tax-Key 2shaira may padorPas encore d'évaluation

- File Return On TimeDocument7 pagesFile Return On TimeAmanat AhmedPas encore d'évaluation

- In 031588Document1 pageIn 031588daltonico111Pas encore d'évaluation

- Intacc Chap 16 ReviewerDocument8 pagesIntacc Chap 16 ReviewerJea XelenePas encore d'évaluation

- Project On Pan Card and Its BenefitsDocument22 pagesProject On Pan Card and Its BenefitsShambhavi SharmaPas encore d'évaluation

- ATM Timeout or Command RejectDocument21 pagesATM Timeout or Command RejectDass HariPas encore d'évaluation

- Wells Fargo Everyday CheckingDocument4 pagesWells Fargo Everyday Checkingpeter.pucciPas encore d'évaluation

- HTR 40748Document2 pagesHTR 40748Krishna SaiPas encore d'évaluation

- Depreciation RecaptureDocument3 pagesDepreciation RecaptureNiño Rey LopezPas encore d'évaluation

- On January 1 2014 Alicia Masingale Established Leopard Realty WhichDocument1 pageOn January 1 2014 Alicia Masingale Established Leopard Realty WhichAmit PandeyPas encore d'évaluation

- Lic Ecs Mandate Form EnglishDocument3 pagesLic Ecs Mandate Form EnglishpajipitarPas encore d'évaluation

- New Income Tax Rates for Corporations Under CREATEDocument22 pagesNew Income Tax Rates for Corporations Under CREATEJeanette LampitocPas encore d'évaluation

- VAT AssignmentDocument3 pagesVAT AssignmentReema KumariPas encore d'évaluation

- Statement of Account As at 16 July 2023: For Adjust Alignment Issue, Didn't RemoveDocument2 pagesStatement of Account As at 16 July 2023: For Adjust Alignment Issue, Didn't RemovekakakkawaiiPas encore d'évaluation

- Evergreen Shipping InvoiceDocument1 pageEvergreen Shipping InvoiceRamuni GintingPas encore d'évaluation