Académique Documents

Professionnel Documents

Culture Documents

ICWAI Inter Direct Tax Solved June 2011

Transféré par

rk_rkaushikCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ICWAI Inter Direct Tax Solved June 2011

Transféré par

rk_rkaushikDroits d'auteur :

Formats disponibles

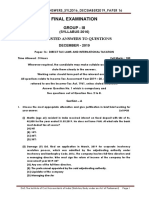

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.

com

Q2 (a)

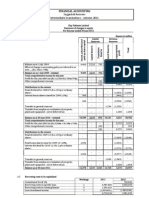

Computation of total income and tax liability of Sneha for AY 2011-12

Profit and Gains of Business or Profession : Net Profit as per Profit and Loss Account Add : Expenses not allowed Proprietrix Salary Motor Car Expenses (1/3rd) Donation to Goa University Income Tax Life Insurance Premium Reserve for future loss Excess Depreciation Cost of small machine being capital nature 12,000 2,500 60,000 8,000 10,000 2,000 500 6,000 Rs. Rs. 3,62,250

1,02,000 ----------4,09,250

Less : Items belonging to other heads / not taxable Profit on Sale of residential house Disallowed Bad Debts Interest on Securities Dividend Horse Race Income Business Income Long Term Capital Gains

33,500 62,000 12,600 4,000 16,000

(1,28,100) ----------3,35,150 33,500

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com Income from Other Sources Dividend from Indian Company Rs 4000 exempt Interest on Securities 12600X100/90 Horse Race Income Nil 14,000 16,000

Interest received from friends Gross Total Income Less : Deduction U/s Chapter VI A

4,000

34,000 ---------4,02,650

U/s 80C Life Insurance Premium U/s 80G 50% qualifying amnt Rs 35915 Total Income Rounded off Computation of Total Income LTCG (Taxable @ 20%) Normal Income Total Income Tax Liability Tax on LTCG 33500@20% Tax on Normal Income (Rs3,41,190 Rs 1,90,000) 10% Total Income Add Cess @ 3% Total Tax Payable Rounded Off 6,700 15,119 21,819 655 22,474 22,470 33,500 3,41,190 3,74,690

10,000 17,958

(27.958) 3,74,692 3,74,690

Note Qualifying amount for deduction u/s 80G is all income excluding LTCG and other deductions under Chapter VI A i.e Rs 4,02,650- Rs 33,500= Rs3,59,150. Maximum permissible deduction u/s 80G is 10% of Rs 3,59,150= Rs 35,915

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer to Question 2(b)

Calculation of Income from Capital of Scindia for AY 2011-12

Rs. Plot Sale consideration 35,00,000 Less : Brokerage at 1% (35,000) Net Sale Consideration 34,65,000 Less : Indexed Cost of Acquisition 420000X711/140 (21,33,000) -----------Long Term Caoital Gains 13,32,000 Less : Exemption U/s 54F 1332000X1800000/3465000 (6,91,948) Taxable Long Term Capital Gains 6,40,052

If Scindia sells the new residential house on 1-1-2013, that is with in 3 years from the date of purchase, then Rs6,91,948 being the amount of capital gains exempted U/s 54F well be chargeable to tax for the year the house is sold i.e AY 2013-14 as Long Term Capital Gains.

If Scinida purchases any other residential house within two years from the date of transfer of the original asset, then Rs 6,91,948 will be taxable as Long Term capital gain for the year in which another house is purchased i.e here AY 2013-14.

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer Q. 3(a) 1. The amount of Gratuatiy received as a Government exmployee is fully excempt from tax as per Section 10(10)(i) of Income Tax Act, 1961. 2. As an employee of a seasonal factory, in a private sector, covered under the Payment of Gratuity Act 1972. COMPUTATION OF GRATUITY TAXABLE Amount Received as Gratuity Less : Exemption U/s 10(10)(II) Rs 10,70,000

1 Actual Amount received Rs 10,70,000 2 7/26X30X1,25,000) Rs 10,09,615 3 Maximum Limit Rs 10,00,000 - Least of the above three is exempted Rs 10,00,000 ----------------Taxable Gratuity Rs. 70,000

Answer Q 3(b) 1. 2. 3. 4. Special discount offered on the firms production to employee is not taxable as perquisite. Use of lap top is not treated as Perquisite Reimbursement of travel expenses to wife an employee is taxable as perquisite This will be treated as perquisite

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer Q 3(c) Conditions under which the registered political pary gets tax exemption under Sec. 13A 1. It should maintain such books of accounts and documents as would enable the AO to properly deduce its income 2. for each contribution above Rs 20000, Political PAry should keep and maintain proper records showing the details,name and address of the contribution. 3. Accounts of Political Party to be audited by Chartered Accountants.

Answer Q 3(d) Inter Source Adjustment 1. Sec 70 of Income Tax Act , 1961 2. Loss from a source is allowed to be Adjusted against income from another Source under the same head of income Inter Head adjustment Sec 71 of Income Tax Act, 1961 Loss under one head of income is to be adjusted under income under another head of income.

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer Q 4 (a) Computation of amount of interest allowable as exemption under Section 24 of IT Act ,1961 Amount (Rs.) 1,55,833*

Interest for Preconstruction up to 31-03-2010 (see working note) Amount allowable yearly (Beginning from AY 2011-12 to next 5 years, so 155833/5) Interest on own loan Rs10,00,000*11% Interest on loan taken from friend Rs 500000*15%*1/2 Interest Total (1+2+3) Note Interest for Preconstruction up to 31-03-2010 Rs1000000x11%x17/12 = Rs 1,55,833 Interest commences from 01/11/2009 to 31/03/2011

31,167

1,10,000 2 37,500 3 ------------1,78.667

1. If the house was meant for self occupation, then under Sec 24 maximum amount eligible for deduction is Rs 150000. 2 If the house is let out from 1.01.2003, the entire amount of interest i.e Rs1,78.667 is eligible for deduction.

Under 80C, there is an additional amount of Rs 20000 is eligible for deduction towards Principal repayment of loan provided that total deduction available u/s 80C is limited to Rs 100000.

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer Q 4 (d) Tax Liability under Income from other Sources Date of Gift Details of Gift and donar Taxable/ Not Taxable Taxable Not Taxable Amount (Rs.) 50,000 Nil

01.07.2010 01-09-2010 01-12-2010 01-12-2010

15-12-2010

Gift from Raju, a friend, by Chq. Cash Gift from sister in law (sister in law being a relative) Gift of diamond ring on his birthday By his friend (gift from friend taxable) Cash gift of Rs 31000 each made by Four friends on the occasion of his Sons marriage (Cash Gift is not made To assessee, it is for his sons marriage) Gift of a rose wood cot made by friend On house opening ceremony (According To wealth tax, Rose wood is not coming Under definition of property and hence Not taxable) Income from other Sources

Taxable

75,000

Taxable

1.24,000

Not Taxable

Nil ----------2,49,000

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

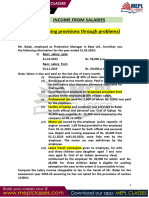

Answer Q 5 (a) Computation of Business Income of Miss Vivitha under Regular Provision and Presumptive Provisions of the Act.

Regular Rs. Income (Rs52,50,000 @ 8%) Net Profit LESS Depreciation on Machinery (Available only under Regular) Rs3,10,000x15% Rs50000x15%X1/2 (put to use for part of year) Business Income 4,35,000

Presumptive Rs. 4,20,000

(46,500) (3,750) ---------3,84,750

Not Applicable Not Applicable -------------4,20,000

The condition to be complied is that, since the income is falling below the presumptive limit of 8% of the turnover , then he can go for assessing the tax under income of Rs3,84,750 by getting his books of account audited under Sec 44 AB.

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer Q 5 (b) Computation of total Income of Mrs. Arundhati and her Tax liability for AY 2011-12

Particulars Income from House Property Loss from House Property Capital Gains Short term Capital Loss Eligible for set off against long term Or short capital gains for next 8 years Income from Other Sources Family Pension Bank Deposit Interest Loss from House Property can be Set off from inter head adjustment Sec 71 Income after Setoff of house property loss (1 from 2 above) Income from Horse Race Agriculture income exempted Total Income Rs 1,32,000 Rs 17,000 Rs (1,00,000)

Amount (Rs.)

(62,000)

NIL

1,49,000

87,000 55,000 NIL 1,42,000

Tax on Total Income NIL, Since Mrs Arundhati being a Sr. Citizen and her total taxable income is less that rs 2,40,000 (notified slab) no Tax on her Total income. Where as, as per Sec 115BB TDS at rate of 30% +education cess+HSEC need to be deducted on Horse Racing Income of Rs 55,000.

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer to Q 6 (a) Clubbing of Income of Mr Rajiv for AY 2011-12 Particulars Opening Capital (01.04.2009) Investment as on 10-04-2009 out of Gift from his wife Profit for the year 2009-10 Capital Employed (1+2+3) Profit 20010-11 Amount (Rs.) 5,00,000 1,00,000 2,00,000 8,00,000 4,00,000 1 2 3

Note. Capital contribution out of Gift from wife needs to be clubbed with Mr. Rajiv Income Profit for 2010-11 Rs 400000 needs to be shared between Mr Rajiv and Mrs Rajiv in ratio of 7:1 that is capital employed. So, Income assessable under the hands of Mr Rajiv will be Rs4,00,000*7/8 = Rs 3,50000 and in hands of Mrs Rajiv it will be Rs 400000*1/8 = Rs50000.

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer to Q 6 (b) Computation of Perquisite value of Car 1 and Car 2 Particulars Car 1 (Rs.) Car 2 (Rs.) 33,000 45,000 10,800 28,800 --------39,600

Drivers Salary (Actual) Running and maintenance expenses Driver Salary @ Rs 900 per month Capacity above 1.6 ltr CC @ Rs2400 per month Perquisite

--------78,000

Answer to Q 6 C)

Computation of Taxable Capital Gains Fair Market Value of the Asset on the date of conversion Less : Indexed cost of acquisition Rs400000X711/100 Rs 35,00,000

28,44,000 -----------6,56,000

Long term Capital Gains on conversion of asset to stock in trade

Note Value recorded in books is not significant here as on the date of conversion of capital asset in to stock in trade, it becomes important that the market value as existing should be taken. Loss of Rs 3,00,000 (Rs 35,00000 FMV less sold stock in trade Rs 3200000) is treated as business loss of the assessee.

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com Answer 7 (a) Computation of Taxable Wealth (Net Wealth) of Mr. Banerjee Sl No,. 1 Particulars Building Net Maintainable Rent (Rs 60000*X12.5) Note Market Value is irrelavent ADD Adjustment for Unbuilt area Asset Value 2 Jwellery Bought in april 09 out of money remitted to India from Australia is exempted Purchased in April 2010 out of Sale proceed Of motor car brought and sold from abroad 3 Interest in Urban Land Value of interest in Urban Land is taxable Shares Shares are not Assets under wealth tax and Hence not taxable Vacant House Plot Vacant House plot not taxable under wealth tax Amount (Rs.)

7,50,000

3,00,000 ------------10,50,000

NIL

14,00,000

17,00,000

NIL

NIL

Cash Cash in excess of Rs 50000 is taxable under Wealth tax (180000-50000) Urban Land Urban land purchased in year 2099 out of Withdrawl from NRE account is exempted

1,30,000

NIL ---------------42,80,000

NET WEALTH

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer Q 7(b) A Protective assessment is made when there are doubt about true ownership of the income. It is at the discretion of the AO, income will be added in the hands of one of the assessee in order to be on the safer side. So, when the true identity of the person is established, the extra assessment is cancelled. IT department cannot recover the tax from both the assessees in respect of the same income. Department also cannot impose penalty on protective assessment.

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer Q 8(b) Computation of Total Income of Mr Ramachandran for the AY 2011-12 Particulars Profit or Gains of Business or Profession Income on Capital Income from Capital Gain Long Term Capital Gains Income from Other Sources Interest on loan Interest from Bank FD Rs 20,000 Rs.10,000 46,000 1,04,000 Amount (Rs.)

30,000 -----------2,30,000 (50,000) 1,80,000

Gross Total Income LESS : Chapter VI A Deducton U/s 80 C PPF Total Income Computation of Tax Liability Tax on Long Term Capital Gain (Rs180,000-Rs46,000) Rs 1,34,000 Less : Maximum exemption Rs 1,60,000 -------------Rs 26,000 Tax @ 20% on LTCG (Rs46000-Rs26000)20% Add: Education Cess Total Tax liability Rs 4000

Rs120 ----------Rs 4,120

APPLIED DIRECT TAXATION - JUNE 2011 CMA Raveendranath Kaushik kaushik@accountspoint.com cmakaushik.blospot.com

Answer Q 8 c) Liability towards TDS in following cases

1. An Indian Company Pays dividend on Preference Shares to a share holders Dividend Paid by Indian company is subject to DDT (Dividend Distribution Tax) and hence covered under Sec 115-O and so there is no TDS shall be deducted on dividend paid and exempt in hands of share holders

2. Foreign enterprise enters in to a contract for fabrication and supply of components for machinery TDS is to be deducted in this case. As per Sec 194C if payment either for full or part of the work undertaken by any contractor tax is to be deducted by the assessee. If a deductee is an individual then 1% TDS is deducted and if it is a company then 2% is deducted. 3. A domestic company pay to a doctor a monthly retainer ship of Rs 2,500for attending outpatient clinic at its factory premises. Doctors come under professional service. As per section 194J any person who is indulged in professional services performs any professional duty or take up assignment of professional in nature then TDS at rate of 10% on total payment should be deducted. TDS is applicable only if the total of payment made to such professional service exceeds Rs 30000 in a year (not meaning single payment of Rs 30000, it also includes series of payment not exceeding Rs 30000). In this case since doctor is paid Rs2,500 and it is not clear is it one time payment for the whole year or not, we can assume and conclude that there is no TDS to be deducted.

Vous aimerez peut-être aussi

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdPas encore d'évaluation

- Suggested Tax Paper May 2011Document11 pagesSuggested Tax Paper May 2011Sudhir PanigrahiPas encore d'évaluation

- F6PKN 2015 Jun A PDFDocument10 pagesF6PKN 2015 Jun A PDFabby bendarasPas encore d'évaluation

- © The Institute of Chartered Accountants of IndiaDocument0 page© The Institute of Chartered Accountants of IndiaP VenkatesanPas encore d'évaluation

- 9mys 2010 Dec A PDFDocument7 pages9mys 2010 Dec A PDFGabriel SimPas encore d'évaluation

- Taxation (Nov. 2007)Document17 pagesTaxation (Nov. 2007)P VenkatesanPas encore d'évaluation

- f6pkn 2011 Dec ADocument12 pagesf6pkn 2011 Dec Aabby bendarasPas encore d'évaluation

- F6PKN 2012 Dec A PDFDocument13 pagesF6PKN 2012 Dec A PDFabby bendarasPas encore d'évaluation

- Taxation Test 4 Scheduled Nov 2023 Solution 1689761654Document15 pagesTaxation Test 4 Scheduled Nov 2023 Solution 1689761654mwmw4prdy2Pas encore d'évaluation

- Guideline Answers: Professional ProgrammeDocument115 pagesGuideline Answers: Professional ProgrammeArham SoganiPas encore d'évaluation

- Taxation Full Test 1 Unscheduled May 2023 Solution 1677483923Document38 pagesTaxation Full Test 1 Unscheduled May 2023 Solution 1677483923Vinayak PoddarPas encore d'évaluation

- pcc-2011 TaxDocument19 pagespcc-2011 TaxHeena NigamPas encore d'évaluation

- PGBP-2Document10 pagesPGBP-2Srinivas T. RajuPas encore d'évaluation

- Milton Form16Document4 pagesMilton Form16sundar1111Pas encore d'évaluation

- Suggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Document13 pagesSuggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Parasuram IyerPas encore d'évaluation

- Scanner Ipcc Paper 4Document34 pagesScanner Ipcc Paper 4Meet GargPas encore d'évaluation

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespiePas encore d'évaluation

- 7 Finalnew Sugg June09Document17 pages7 Finalnew Sugg June09mknatoo1963Pas encore d'évaluation

- Taxation Review Dec2017Document7 pagesTaxation Review Dec2017Shaiful Alam FCAPas encore d'évaluation

- Chinnaduran Form16Document4 pagesChinnaduran Form16sundar1111Pas encore d'évaluation

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiPas encore d'évaluation

- Babu Form 16Document4 pagesBabu Form 16sundar1111Pas encore d'évaluation

- Financial Management 1Document36 pagesFinancial Management 1nirmljnPas encore d'évaluation

- f6pkn 2010 Jun AnsDocument12 pagesf6pkn 2010 Jun AnsTahir ArshadPas encore d'évaluation

- IT Assignment - MDocument8 pagesIT Assignment - Mrushabh pareetPas encore d'évaluation

- Ganaesmurthy Form16Document4 pagesGanaesmurthy Form16sundar1111Pas encore d'évaluation

- Chelladurai Form16Document4 pagesChelladurai Form16sundar1111Pas encore d'évaluation

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111Pas encore d'évaluation

- Cash Flow Question Paper1Document10 pagesCash Flow Question Paper1CA Sanjeev Jarath100% (3)

- F6PKN 2013 Jun Ans PDFDocument14 pagesF6PKN 2013 Jun Ans PDFabby bendarasPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Suggested Solutions TPExfpPDocument6 pagesSuggested Solutions TPExfpPtarangtgPas encore d'évaluation

- Suggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingDocument6 pagesSuggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingUssama AbbasPas encore d'évaluation

- Income Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreeDocument6 pagesIncome Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreevickycdPas encore d'évaluation

- VRS NotesDocument82 pagesVRS NotesrisingiocmPas encore d'évaluation

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarPas encore d'évaluation

- As Per New Budget Technosys - Investment - Declaration Form Fy 2014-15Document4 pagesAs Per New Budget Technosys - Investment - Declaration Form Fy 2014-15sandip_chauhan5862Pas encore d'évaluation

- Drafting - Dec 2018Document119 pagesDrafting - Dec 2018rk_19881425Pas encore d'évaluation

- Test-7 (Sol.)Document4 pagesTest-7 (Sol.)iamneonkingPas encore d'évaluation

- IPCC Taxation Guideline Answer Nov 2015 ExamDocument16 pagesIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaPas encore d'évaluation

- Income Tax Ready Reckoner - Budget 2023-1Document14 pagesIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್Pas encore d'évaluation

- Corporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalDocument76 pagesCorporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalNidhi LathPas encore d'évaluation

- Aditya Sharma - II Mid Term Paper Shikha MamDocument9 pagesAditya Sharma - II Mid Term Paper Shikha MamAditya SharmaPas encore d'évaluation

- Thirumoorthy Form16Document4 pagesThirumoorthy Form16sundar1111Pas encore d'évaluation

- Preparation &Submission-ITR-I-June-16Document7 pagesPreparation &Submission-ITR-I-June-16আদি ত্যPas encore d'évaluation

- Capii Income Tax and Vat July2015Document15 pagesCapii Income Tax and Vat July2015casarokarPas encore d'évaluation

- Paper - 4: Taxation Section A: Income Tax Law: DebitsDocument27 pagesPaper - 4: Taxation Section A: Income Tax Law: DebitsUdit KaushikPas encore d'évaluation

- Suggested Answer - Syl16 - Dec2018 - Paper - 16 Final Examination: Suggested Answers To QuestionsDocument30 pagesSuggested Answer - Syl16 - Dec2018 - Paper - 16 Final Examination: Suggested Answers To QuestionsVishalPas encore d'évaluation

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002Pas encore d'évaluation

- 54606bos43769 p4Document27 pages54606bos43769 p4HARSHAL MITTALPas encore d'évaluation

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocument6 pagesIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvPas encore d'évaluation

- Amendments by Finance Act-2014 PDFDocument36 pagesAmendments by Finance Act-2014 PDFvinod240027100% (7)

- Final Examination: Suggested Answers To QuestionsDocument23 pagesFinal Examination: Suggested Answers To QuestionsRanadeep ReddyPas encore d'évaluation

- Tax SuggestedDocument28 pagesTax SuggestedHemaPas encore d'évaluation

- Income From SalariesDocument6 pagesIncome From Salariesmayankking404Pas encore d'évaluation

- Form 16Document3 pagesForm 16Alla VijayPas encore d'évaluation

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaPas encore d'évaluation

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalPas encore d'évaluation

- Rupees in 000: Page 1 of 6Document6 pagesRupees in 000: Page 1 of 6Royal XpreSsPas encore d'évaluation

- Nesletter - January 2017Document5 pagesNesletter - January 2017rk_rkaushikPas encore d'évaluation

- Ethics and Compliance As A Trajectory For Shaping India To Become A $ 5 Trillion Economy and The Role of CMA'sDocument5 pagesEthics and Compliance As A Trajectory For Shaping India To Become A $ 5 Trillion Economy and The Role of CMA'srk_rkaushikPas encore d'évaluation

- News Letter - March2017 PDFDocument7 pagesNews Letter - March2017 PDFAnonymous T1zmhdPas encore d'évaluation

- Governance and Social Responsibility Models in Ancient IndiaDocument13 pagesGovernance and Social Responsibility Models in Ancient Indiark_rkaushik100% (1)

- Macauro: Internet Banking-Benefits and ChallengesDocument5 pagesMacauro: Internet Banking-Benefits and Challengesrk_rkaushikPas encore d'évaluation

- Research Bulletin 1Document76 pagesResearch Bulletin 1rk_rkaushikPas encore d'évaluation

- Newsletter Feb16Document5 pagesNewsletter Feb16rk_rkaushikPas encore d'évaluation

- Newsletter August2016Document5 pagesNewsletter August2016rk_rkaushikPas encore d'évaluation

- Newsletter October 2016Document5 pagesNewsletter October 2016rk_rkaushikPas encore d'évaluation

- Macauro: Tourism in India: Innovation and DevelopmentDocument5 pagesMacauro: Tourism in India: Innovation and Developmentrk_rkaushikPas encore d'évaluation

- Newsletter July2016Document5 pagesNewsletter July2016rk_rkaushikPas encore d'évaluation

- Ipcc 2012Document11 pagesIpcc 2012rk_rkaushikPas encore d'évaluation

- Newsletter September 2016Document5 pagesNewsletter September 2016rk_rkaushikPas encore d'évaluation

- Macauro: Emerging Trends in Banking - Challenges and OpportunitiesDocument4 pagesMacauro: Emerging Trends in Banking - Challenges and Opportunitiesrk_rkaushikPas encore d'évaluation

- Paper: Cost Accounting and Financial Management: Raveendranath Kaushik & Associates Cost AccountantDocument13 pagesPaper: Cost Accounting and Financial Management: Raveendranath Kaushik & Associates Cost Accountantrk_rkaushikPas encore d'évaluation

- News Letter4 - Aug 2015Document5 pagesNews Letter4 - Aug 2015rk_rkaushikPas encore d'évaluation

- Newsletter Jan 2016Document5 pagesNewsletter Jan 2016rk_rkaushikPas encore d'évaluation

- Macauro: Consumer Awareness & Attitude Towards Green MarketingDocument6 pagesMacauro: Consumer Awareness & Attitude Towards Green Marketingrk_rkaushikPas encore d'évaluation

- News Letter3 - Sep 2015Document4 pagesNews Letter3 - Sep 2015rk_rkaushikPas encore d'évaluation

- News Letter6 - Jun 2015Document5 pagesNews Letter6 - Jun 2015rk_rkaushikPas encore d'évaluation

- Full Lengthpaper PESITDocument9 pagesFull Lengthpaper PESITrk_rkaushikPas encore d'évaluation

- Ipcc 2012Document11 pagesIpcc 2012rk_rkaushikPas encore d'évaluation

- Macauro: Agricultural Business Awareness To Farmers and IndiansDocument4 pagesMacauro: Agricultural Business Awareness To Farmers and Indiansrk_rkaushikPas encore d'évaluation

- News Letter6 - Jun 2015Document5 pagesNews Letter6 - Jun 2015rk_rkaushikPas encore d'évaluation

- Ipcc 2012Document11 pagesIpcc 2012rk_rkaushikPas encore d'évaluation

- Corporate GovernanceDocument9 pagesCorporate Governancerk_rkaushikPas encore d'évaluation

- Risk Management in Banking SectorDocument10 pagesRisk Management in Banking Sectorrk_rkaushik100% (1)

- Solutions To November 2011 Cost Accounting and Financail Mangement PaperDocument16 pagesSolutions To November 2011 Cost Accounting and Financail Mangement Paperrk_rkaushikPas encore d'évaluation

- CSR - Role of AuditorsDocument7 pagesCSR - Role of Auditorsrk_rkaushikPas encore d'évaluation

- Northbrook CollegeDocument10 pagesNorthbrook CollegeDaniyal AsifPas encore d'évaluation

- Untitled Form - Google Forms00Document3 pagesUntitled Form - Google Forms00Ericka Rivera SantosPas encore d'évaluation

- SpectraSensors TDL Analyzers in RefineriesDocument8 pagesSpectraSensors TDL Analyzers in Refineries1977specopsPas encore d'évaluation

- Evaluation of Whole-Body Vibration (WBV) On Ready Mixed Concrete Truck DriversDocument8 pagesEvaluation of Whole-Body Vibration (WBV) On Ready Mixed Concrete Truck DriversmariaPas encore d'évaluation

- Red Bank Squadron - 01/22/1942Document28 pagesRed Bank Squadron - 01/22/1942CAP History LibraryPas encore d'évaluation

- Protein Metabolism and Urea Recycling in Rodent HibernatorsDocument5 pagesProtein Metabolism and Urea Recycling in Rodent HibernatorsBud Marvin LeRoy RiedeselPas encore d'évaluation

- 120-202 Lab Manual Spring 2012Document107 pages120-202 Lab Manual Spring 2012evacelon100% (1)

- Harvard Referencing GuideDocument6 pagesHarvard Referencing GuideKhánh Nguyên VõPas encore d'évaluation

- ListwarehouseDocument1 pageListwarehouseKautilya KalyanPas encore d'évaluation

- Essential Intrapartum and Newborn CareDocument6 pagesEssential Intrapartum and Newborn CareDianne LabisPas encore d'évaluation

- Responsibility Accounting Practice ProblemDocument4 pagesResponsibility Accounting Practice ProblemBeomiPas encore d'évaluation

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniPas encore d'évaluation

- Factors Associated With Early Pregnancies Among Adolescent Girls Attending Selected Health Facilities in Bushenyi District, UgandaDocument12 pagesFactors Associated With Early Pregnancies Among Adolescent Girls Attending Selected Health Facilities in Bushenyi District, UgandaKIU PUBLICATION AND EXTENSIONPas encore d'évaluation

- Osma Osmadrain BG Pim Od107 Feb 2017pdfDocument58 pagesOsma Osmadrain BG Pim Od107 Feb 2017pdfDeepakkumarPas encore d'évaluation

- CGMP Training ToolDocument21 pagesCGMP Training Toolbabusure99Pas encore d'évaluation

- Biography of Murray (1893-1988) : PersonologyDocument6 pagesBiography of Murray (1893-1988) : PersonologyMing100% (1)

- Exterior Wall PrimerDocument2 pagesExterior Wall PrimerAsian PaintsPas encore d'évaluation

- Red Winemaking in Cool Climates: Belinda Kemp Karine PedneaultDocument10 pagesRed Winemaking in Cool Climates: Belinda Kemp Karine Pedneaultgjm126Pas encore d'évaluation

- Reading TOEFL - Short Reading Per Question TypeDocument25 pagesReading TOEFL - Short Reading Per Question Typejax7202Pas encore d'évaluation

- Course Syllabus MGTP 31206 31207Document12 pagesCourse Syllabus MGTP 31206 31207NamitBhasinPas encore d'évaluation

- TextDocument3 pagesTextKristinePas encore d'évaluation

- Hotel ClassificationDocument10 pagesHotel ClassificationRonelyn Boholst100% (1)

- Choke Manifold Procedures 3932324 01Document4 pagesChoke Manifold Procedures 3932324 01Saïd Ben Abdallah100% (1)

- ត្នោត (Borassus flabellifer L.)Document11 pagesត្នោត (Borassus flabellifer L.)yeangdonalPas encore d'évaluation

- Cor Tzar 2018Document12 pagesCor Tzar 2018alejandraPas encore d'évaluation

- Microporous WikiDocument2 pagesMicroporous WikiIris BalcarcePas encore d'évaluation

- Bsbfia401 3Document2 pagesBsbfia401 3nattyPas encore d'évaluation

- Protection Solutions: Above-the-NeckDocument42 pagesProtection Solutions: Above-the-NeckMatt DeganPas encore d'évaluation

- Leon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3Document3 pagesLeon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3WCTV Digital TeamPas encore d'évaluation

- 27nov12 PA Task Force On Child Protection ReportDocument445 pages27nov12 PA Task Force On Child Protection ReportDefendAChildPas encore d'évaluation