Académique Documents

Professionnel Documents

Culture Documents

Credit Suisse Sean Keane's Money Markets 02 Dec 2011

Transféré par

Nicola DukeDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Credit Suisse Sean Keane's Money Markets 02 Dec 2011

Transféré par

Nicola DukeDroits d'auteur :

Formats disponibles

Sean Keanes Whats happening in the Money Markets

02 December 2011

EUR FX Swap premium remains elevated as Draghi notes collateral difficulties

Summary (click on link to jump to specific section):

Draghi hints and the market waits 2012 euro-zone funding hurdle still a monstrous 7.5bn per day EUR FX Swap premium remains elevated as Draghi notes collateral difficulties Two Fed Governors say no a discount rate cut, despite its premium to offshore funding rate USD 3 month LIBOR finally falls, after 91 successive increases USD FRA/OIS spreads at midday in Asia

Draghi hints and the market waits Mario Draghi did enough yesterday to maintain the mood of cautious optimism in the euro-zone markets, hinting and suggesting that more can be done, though clearly there is still some political position shuffling that needs to take place to get everyone comfortable. The market appears to be favouring the idea that Draghi is about to go to the dugout and take out the big bat after having watched a succession of strike outs in the lead up to this point. The fielders have moved back in a precautionary fashion, having previously been tight around the bases. Their fear is that the new ECB President will now hit the ball over their heads and clean out of the park with further significant announcements coming next week. If Draghi does come up with some game changing announcements then the capacity for further relief rallies into year-end is clearly significant. Uncommitted monies will be forced from the sidelines, equities will rally strongly into year end, and all manner of bearish trades will be forced into the open and put to the market sword. December is a time of year when p/l surprises are least welcome. Year end assessments have already been made, and the meagre payouts on bank books have been calculated. Any upsets to the profit projection at this late time are viewed very negatively, and traders will be encouraged to exit rather than add to risk. Draghi has the market (slightly) on the back foot for the first time in many months. The calendar is offering him the opportunity to press home this advantage, and drive a year- end rally in peripheral bonds, and European equities. Failure to capitalise on this timing advantage will be a squandered opportunity given the significant refunding that are coming up in 2012. 2012 euro-zone funding hurdle still a monstrous 7.5bn per day Bloomberg ran a good article reminding us that even though the ECB have been given a breathing space by the lowering of USD borrowing costs, the term financing problems facing the continents sovereigns and commercial banks remain formidable. As we said yesterday, the USD funding issue is a symptom and not the cause of this euro-zone crisis, and the cause is a malignancy that will take more than a 50bp reduction in short term funding costs to fix. Bloomberg note that 2012 will see euro-zone sovereigns directly competing with the continents commercial banks for funding, as both groups seek to refund a total of approximately $2trn in maturing debt next year. Euro-zone governments are estimated to need refunding of approximately 1.1trn in maturing bonds, with Italy alone having to refinance 113bn in Q1 alone. Alongside this Europe's commercial banks have approximately 500bn in refinancing coming due

in the first half of the year, and another 275bn to fund in the second half simply to replace maturing debt. Without any shrinking in the asset (or cost) side of the balance sheet, its reasonable to assume that these number will be the minimum required. The banks need to play catch up on the term debt that they have not issued over the past 6 months, and they also need to issue more for Basel 3 compliance, assuming the EU regulators do not offer them some relief in this area. The sovereigns meanwhile may need to issue more simply to keep up with their rising debt burden. Not all of the economic pain can be absorbed by fiscal cuts and tax hikes. Moodys are quoted in the article as saying that euro-zone banks need to refinance at an average 1 rate of $230bn every three months in 2012. This compares with a $132 billion average for the 11 quarters ended Sept. 30 2011. These numbers will clearly place tremendous pressures on the markets with investors effectively being asked to come up with around 7.5bn of financing each and every business day of the year in order to reach the 2trn number. This volume of issuance would suggest that pricing power will remain with the investor rather than the issuer, and the interest rate premiums that will need to be paid will remain substantial regardless of what President Draghi comes up with. This overhang of upcoming debt issuance will continue to act as a restraining factor on the euro-zone bond markets, and also on the eurozone commercial banks. One way to provide some direct offset to this funding pressure is to shrink the balance sheets rather than seek to fund them. There have been numerous political comments suggesting that this is not an acceptable action by the banks, with such actions likely to reduce the flow of credit to the domestic economies of the banks involved. SME financing in particular is likely to suffer in such an environment. To counter this domestic political pressure the euro-zone banks will be forced to continue offloading offshore assets, many of which are denominated in USD. The French banks have clearly taken significant steps on this path already, with both BNP and SocGen announcing they had undertaken large USD asset sales during their Q3 profit results a few weeks ago. As each of these sales takes place the pressure on the EURUSD basis swap will diminish, and eventually the exposure will fall to a more self-sustaining level. In the meantime the imbalance remains and the selling of USD assets by euro-zone commercial banks will likely continue despite the reduction in borrowing costs. EUR FX Swap premium remains elevated as Draghi notes collateral difficulties The premium for borrowing 3 month USD via the EURUSD FX Swap dropped further over the past 24 hours, and now stands at LIBOR+120bp. This is down around 50bp from the highs seen earlier in the week, but is still obviously trading at an elevated level. One of the reasons that have been suggested for this ongoing pricing premium (banks can now raise from the ECB for 3 months at approximately 73bp, versus 170bp in the FX swap market), is because of a lack of eligible collateral amongst the most stressed borrowers. Euro-zone banks can only access the ECB funding rate if they present eligible collateral to the ECB in exchange for USD funding. It was interesting therefore to hear ECB President Draghi refer to this very issue yesterday in his speech to the European Parliament: We are aware of the continuing difficulties for banks due to the stress on sovereign bonds, the tightness of funding markets and scarcity of eligible collateral in some financial 2 segments. These comments are identical to the ones he made a couple of weeks ago at the European 3 Banking Congress , and they indicate that the ECB are themselves seeing evidence of the collateral shortages that we have previously speculated were occurring. Given the huge volumes of weekly MRO financing that is taking place it is clearly not the case that there is a system-wide

shortage of collateral. There issue again comes back to the fact that the market is bifurcated between the have-lots and the have-nots, and the have-nots are the ones with the most urgent USD financing problem. The FT has written a very good short piece on this subject, citing a paper from an IMF economist on the importance of the dealer community in transferring collateral through the system. The paper talks about the velocity of collateral in the same way that economists talk about the velocity of money. It points out that a shortage of acceptable collateral would have a negative cascading impact on lending similar to the impact on the money supply of a reduction in the monetary base. Thus the first round impact on the real economy would be from the reduction in the primary source collateral pools in the asset management complex (hedge funds, pension and insurers etc), due to averseness from counterparty risk etc. The second round impact is from shorter chainsfrom constraining the collateral moves, and higher cost of capital 4 resulting from decrease in global financial lubrication. Aside from clearly pointing out that a breakdown in collateral transfers impedes the essential workings of the financial system the paper also calls upon global regulators to augment their monetary transmission data sets with information about the collateral markets, noting that There are links between pledged collateral that is intermediated by large banks and quantitative monetary policy instruments. President Draghi may well agree as the breakdown in the collateral transfer appears to be hindering a normalisation of the EURUSD basis swap rate, and may require further action from the ECB. One thing that we suggested yesterday is that the ECB could potentially undertake direct FX Swaps to get USD funding to those that most need it. This would be unusual for the ECB to do, though not outside its operating guidelines. The ECBs operational guidelines make clear that the Bank can undertake Foreign Exchange Swaps for monetary policy purposes. The document on The Implementation of Monetary Policy in the euro Area notes that They are used for finetuning purposes, mainly with the aim of managing the liquidity situation in the market and steering 5 interest rates The guidelines also note that such swaps are normally executed in a decentralised manner by the National Central Banks, though they note that the Governing Council of the ECB can decide that, under exceptional circumstances, bilateral foreign exchange swaps may be executed by the ECB. Given the ongoing dislocation in the markets, and the fact that the ECB President himself acknowledges that there are collateral problems, intervening in the FX Swap market would appear to be an entirely reasonable thing to do. It would also be dramatically effective at getting the USD funding to the precise counterparts that most need it. Two Fed Governors say no a discount rate cut, despite its premium to offshore funding rate We suggested yesterday that following the reduction of the USD borrowing costs for offshore central banks it may be the case that the Fed looks to lower the Discount Rate in the near future. The optics of having the emergency lending rate for domestic borrowers at 0.75% whilst the rate available to offshore institutions is around 0.60% is likely to draw some criticism from the US politicians. It was interesting therefore to see not one, but two of the regional Federal Reserve Bank 6 Presidents reject that notion yesterday during interviews with the WSJ . Both Dallas Fed President Richard Fisher and St. Louis Fed President James Bullard indicated that they saw no immediate need to take such action, with Bullard saying that demand for funds at the discount window had been low, evidencing no need for a reduction in the rate.

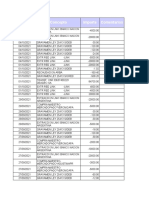

It will be interesting to see whether Bernanke and Dudley push for a change given that they are the ones who will be more politically exposed when the USD borrowing lines come up for discussion during the Chairmans next Congressional testimony. USD 3 month LIBOR finally falls, after 91 successive increases Short dated USD cash markets again traded a little better in New York yesterday, with local dealers reporting further lending activity taking place after a long drought. Interestingly the flow of funds that appeared to be taking place was from some of the smaller lenders, with little signs of a wall of money hitting the street from the US Money Market Funds as yet. The funds will want to see better secondary market liquidity in the paper of euro-zone issuers before they again commit significant funds to those names. Borrowers still want funding for 90 days and beyond, but the lenders that are in the markets only want the credit risk for a maximum of 90 days. At this stage the best that many borrowers can hope for is simply to get themselves fully funded over the calendar year end, and hope that money market conditions have eased by the time they return to the markets in 2012. One very welcome development for borrowers yesterday was that after 91 consecutive up-moves in the fixing rate, the 3 month USD LIBOR finally set a little lower, falling by 0.00167 of a basis point. Its not a lot of change for a 50bp reduction in the offshore borrowing cost, but those who are short funding will be relieved that the upward move has been at least temporarily interrupted. The forecast today is for the rate to again move a touch lower, though its quite possible that it could remain unchanged. The longer dated FRA/OIS spreads have actually pushed a little wider over the past 24 hours, signalling that the market sees the expected 3 month LIBOR rate in the mid to high 60s in the second half of next year, versus its current level around 0.525%. This forward premium has been a gravitational force pulling the spot LIBOR rate higher in recent months. Despite the reduction in offshore USD borrowing costs the 3 month USD LIBOR rate should still continue to push higher to meet the forwards. Any relief that has been engendered by the reduction in Fed lending costs to the ECB will have more of an impact on the FX Swap market than it will on the LIBOR fixing, which is still struggling to catch up with the forwards. As we wrote yesterday, LIBOR is an unsecured lending rate which means that the lender of cash will necessarily charge a premium for lending unsecured funds due to the additional credit risk involved. If the secured repo rate from the ECB is effectively 0.73% (allowing for initial margin and haircuts) then LIBOR should logically be higher. USD FRA/OIS spreads at midday in Asia attached courtesy of the Credit Suisse STIRT desk in Singapore. FRA 0*3 1*4 2*5 3*6 4*7 5*8 6*9 7*10 8*11 9*12 OIS 0.525 0.526 0.562 0.591 0.614 0.630 0.643 0.654 0.663 0.672 Spread 0.100 42.5 0.113 41.3 0.123 43.9 0.130 46.2 0.132 48.2 0.132 49.8 0.130 51.2 0.128 52.6 0.125 53.9 0.123 54.9

IMM FRA/OIS Spreads 21-Dec-11 21-Mar-12 21-Mar-12 20-Jun-12 20-Jun-12 19-Sep-12 19-Sep-12 19-Dec-12 19-Dec-12 20-Mar-13 20-Mar-13 19-Jun-13 19-Jun-13 18-Sep-13 18-Sep-13 18-Dec-13

42.8 47.3 51.9 55.3 56.3 54.4 53.1 54.4

References:

1. 2. 3. 4.

{NSN LVJA6V6S972L <go>} http://www.ecb.int/press/key/date/2011/html/sp111201.en.html http://www.bis.org/review/r111121d.pdf http://ftalphaville.ft.com/blog/2011/12/01/775341/draghi-we-are-aware-of-the-scarcity-ofeligible-collateral/ 5. http://www.ecb.int/pub/pdf/other/gendoc2011en.pdf 6. http://blogs.wsj.com/economics/2011/12/01/fed-official-dont-see-central-bank-cuttingdiscount-rate/

For all links, Credit Suisse has not reviewed the linked site and takes no responsibility for the content contained therein. This link is provided solely for your convenience and information. Following this link or any other link on the Credit Suisse Web site shall be at your own risk.

If you want to be added to this subscription list, click [HERE] and please supply your contact name, company name, and phone number Prepared by Sean Keane of Triple T Consulting for Credit Suisse (Hong Kong) Limited Credit Suisse Contacts: Bunt Ghosh Managing Director & Vice Chairman - Fixed Income ph: +852-2101-6386 email: bunt.ghosh@credit-suisse.com Alister Moss Managing Director - Fixed Income ph: +852-2101-6346 email: alister.moss@credit-suisse.com

======================================================================= The attached or accompanying materials comprise market commentary which is published by Credit Suisse (CS) for information purposes only. These materials and any views expressed therein do not constitute a recommendation or advice and are not sufficient basis for an investment decision. The information in these materials is obtained or derived from publicly available sources believed to be reliable, but CS makes no representations as to its accuracy or completeness. The commentator and/or CS may receive or develop additional or different information subsequent to your receipt of these materials. The materials and the views expressed therein are subject to change and subsequent views may be inconsistent with information and views previously provided to you. CS does not undertake to update these materials or to notify you should the views of the commentator or CS change. These materials are not provided by CS Research Departments, and they are not research reports; they are market commentary. The views presented in the market commentary may differ materially from the views of CS Research Departments and other divisions at CS. CS has a number of policies in place designed to ensure the independence of CS Research Departments from those providing market commentary, including policies relating to trading securities prior to distribution of research reports. Such policies do not apply to these materials. CS trading desks trade or may trade as principal in any securities (or related securities) that are the subject of these materials. Such trading desks may have accumulated, or be in the process of accumulating, long or short positions in the subject security or related securities on the basis of these or other materials. Trading desks may have, or take, positions inconsistent with these materials and the views of the commentator or other materials or market commentary that may be provided from time to time. =======================================================================

Vous aimerez peut-être aussi

- Accenture If Country Leaves EuroDocument8 pagesAccenture If Country Leaves EuroMayank LodhaPas encore d'évaluation

- Accounting 202 Chapter 14 TestDocument2 pagesAccounting 202 Chapter 14 TestLương Thế CườngPas encore d'évaluation

- Draft Business Plan TemplateDocument6 pagesDraft Business Plan TemplateSanket MotePas encore d'évaluation

- 3) T24 Islamic Banking - Bai Salam R16Document34 pages3) T24 Islamic Banking - Bai Salam R16Aga APas encore d'évaluation

- ECB Can Act As A Safety Valve, But Will Not Solve The CrisisDocument2 pagesECB Can Act As A Safety Valve, But Will Not Solve The CrisisNicholas AngPas encore d'évaluation

- Deutsche Bank - A ReviewDocument7 pagesDeutsche Bank - A ReviewkristianPas encore d'évaluation

- Eurozone: Outlook For Financial ServicesDocument20 pagesEurozone: Outlook For Financial ServicesEuglena VerdePas encore d'évaluation

- Research: Euro Area: "What To Watch" in The Coming MonthsDocument7 pagesResearch: Euro Area: "What To Watch" in The Coming MonthsvladvPas encore d'évaluation

- Market Bulletin: The Week That WasDocument5 pagesMarket Bulletin: The Week That WasLiz WilliamsPas encore d'évaluation

- Global Ebrief Subject: What The Past Could Mean For Greece, JapanDocument5 pagesGlobal Ebrief Subject: What The Past Could Mean For Greece, Japandwrich27Pas encore d'évaluation

- Euro Debt Crises: Written by Shoaib YaqoobDocument4 pagesEuro Debt Crises: Written by Shoaib Yaqoobhamid2k30Pas encore d'évaluation

- 12-12-11 Spreading The RiskDocument3 pages12-12-11 Spreading The RiskThe Gold SpeculatorPas encore d'évaluation

- Credit Suisse On The Interdistrict Settlement Vs Target2 ComparisonDocument10 pagesCredit Suisse On The Interdistrict Settlement Vs Target2 ComparisonjpkoningPas encore d'évaluation

- Fragmentation and Monetary Policy in The Euro AreaDocument31 pagesFragmentation and Monetary Policy in The Euro AreaAdolfPas encore d'évaluation

- Economist Insights 21 May2Document2 pagesEconomist Insights 21 May2buyanalystlondonPas encore d'évaluation

- Vinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalDocument4 pagesVinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalFinterestPas encore d'évaluation

- Economist Insights 2013 09 302Document2 pagesEconomist Insights 2013 09 302buyanalystlondonPas encore d'évaluation

- Auerback EuroDocument3 pagesAuerback EuroJoao GalambaPas encore d'évaluation

- Noticia de Econimist (European Banks)Document4 pagesNoticia de Econimist (European Banks)WeNdi J. AndradePas encore d'évaluation

- 2 Trilioane Euro Cheltuite PTR Impiedicare Prabusire Zona Euro Pina in Iunie2012Document4 pages2 Trilioane Euro Cheltuite PTR Impiedicare Prabusire Zona Euro Pina in Iunie2012abelardbonaventuraPas encore d'évaluation

- International Finance 2Document4 pagesInternational Finance 2Mis Alina DenisaPas encore d'évaluation

- Economist Insights 2013 07 29Document2 pagesEconomist Insights 2013 07 29buyanalystlondonPas encore d'évaluation

- C1 - Consequences of EMUDocument5 pagesC1 - Consequences of EMUTrái Chanh Ngọt Lịm Thích Ăn ChuaPas encore d'évaluation

- RMF July UpdateDocument12 pagesRMF July Updatejon_penn443Pas encore d'évaluation

- ING Think Rates Spark Hawkish Risks in The Fed DotsDocument5 pagesING Think Rates Spark Hawkish Risks in The Fed DotsOwm Close CorporationPas encore d'évaluation

- Ac5596 SpecMktUpdt 111411 F v2Document4 pagesAc5596 SpecMktUpdt 111411 F v2FGPas encore d'évaluation

- QBAMCO An Adult Approach I and IIDocument14 pagesQBAMCO An Adult Approach I and IIisaac_crumPas encore d'évaluation

- CIBC Faded Euphoria 11-1-11Document3 pagesCIBC Faded Euphoria 11-1-11Penna111Pas encore d'évaluation

- Economist Insights 20120521Document2 pagesEconomist Insights 20120521buyanalystlondonPas encore d'évaluation

- 28-10-11 Eurozone Leaders Agree On Some Rescue DetailsDocument3 pages28-10-11 Eurozone Leaders Agree On Some Rescue DetailsWilliam J GreenbergPas encore d'évaluation

- Danske Research EndgameDocument5 pagesDanske Research EndgameZerohedgePas encore d'évaluation

- Debt Reduction Without DefaultDocument13 pagesDebt Reduction Without DefaultitargetingPas encore d'évaluation

- Deutsche Bank - Five Years After Subprime: Lending Trends in Europe and The USDocument2 pagesDeutsche Bank - Five Years After Subprime: Lending Trends in Europe and The USkentselvePas encore d'évaluation

- Is The New Year Too Happy?: The Global Economic and Financial Markets OutlookDocument35 pagesIs The New Year Too Happy?: The Global Economic and Financial Markets Outlookwbowen92888Pas encore d'évaluation

- The World Economy... - 26/03/2010Document2 pagesThe World Economy... - 26/03/2010Rhb InvestPas encore d'évaluation

- Tipping Point Nov 2011 FINALDocument51 pagesTipping Point Nov 2011 FINALAsad RaufPas encore d'évaluation

- The Pensford Letter - 1.16.12Document5 pagesThe Pensford Letter - 1.16.12Pensford FinancialPas encore d'évaluation

- SPEX Issue 8Document10 pagesSPEX Issue 8SMU Political-Economics Exchange (SPEX)Pas encore d'évaluation

- La Euro Crisis. Causas y Sintomas (31-37)Document7 pagesLa Euro Crisis. Causas y Sintomas (31-37)Samara MendozaPas encore d'évaluation

- Banking On Bonds - The New Links Between States and MarketsDocument19 pagesBanking On Bonds - The New Links Between States and MarketsAdrian SanduPas encore d'évaluation

- MACRO-143 FinalDocument22 pagesMACRO-143 FinalmahdeeazammahiPas encore d'évaluation

- Current Edition Contains: 1: A Couple of Notes On EuropeDocument11 pagesCurrent Edition Contains: 1: A Couple of Notes On EuropeJan KaskaPas encore d'évaluation

- A Quick View On MM FundsDocument8 pagesA Quick View On MM FundsjpleboutetPas encore d'évaluation

- George Soros: The ECB Must Step in To Save The EurozoneDocument5 pagesGeorge Soros: The ECB Must Step in To Save The Eurozoneapi-63605683Pas encore d'évaluation

- Commerzbank ForecastDocument16 pagesCommerzbank ForecastgordjuPas encore d'évaluation

- Cityam 2011-09-16Document40 pagesCityam 2011-09-16City A.M.Pas encore d'évaluation

- European Central Bank Master ThesisDocument6 pagesEuropean Central Bank Master Thesisvxjtklxff100% (1)

- Rates Spark: Third Wave Gloom: Economic and Financial AnalysisDocument4 pagesRates Spark: Third Wave Gloom: Economic and Financial AnalysisOwm Close CorporationPas encore d'évaluation

- EU Summit 09.12.2011 Pohled Z Finančních Trhů (Dokument V AJ)Document3 pagesEU Summit 09.12.2011 Pohled Z Finančních Trhů (Dokument V AJ)Ivana LeváPas encore d'évaluation

- Vol 2 No. 43 January 09, 2012Document1 pageVol 2 No. 43 January 09, 2012Amit GuptaPas encore d'évaluation

- Cedar Review July 2011Document9 pagesCedar Review July 2011Robert BrennanPas encore d'évaluation

- European Bank Funding and DeleveragingDocument12 pagesEuropean Bank Funding and DeleveragingLucia FrankovaPas encore d'évaluation

- Fixing The Euro ZoneDocument11 pagesFixing The Euro ZoneAlexandra DarmanPas encore d'évaluation

- Fighting Solvency Time-Bombs With Liquidity Bazookas: in This EditionDocument7 pagesFighting Solvency Time-Bombs With Liquidity Bazookas: in This EditionalphathesisPas encore d'évaluation

- Asia Maxima (Delirium) - 3Q14 20140703Document100 pagesAsia Maxima (Delirium) - 3Q14 20140703Hans WidjajaPas encore d'évaluation

- Week in Focus: Sovereign Debt Crisis: What Can Be Done If It Escalates?Document16 pagesWeek in Focus: Sovereign Debt Crisis: What Can Be Done If It Escalates?timurrsPas encore d'évaluation

- European Doom and GloomDocument6 pagesEuropean Doom and GloomjaiswaniPas encore d'évaluation

- Greek RestructuringDocument8 pagesGreek RestructuringSeven LovePas encore d'évaluation

- LSR Macro Picture: Danger ZoneDocument11 pagesLSR Macro Picture: Danger Zonenelson ongPas encore d'évaluation

- The Impending Monetary Revolution, the Dollar and GoldD'EverandThe Impending Monetary Revolution, the Dollar and GoldPas encore d'évaluation

- Banking in Crisis: How strategic trends will change the banking business of the futureD'EverandBanking in Crisis: How strategic trends will change the banking business of the futurePas encore d'évaluation

- The Incomplete Currency: The Future of the Euro and Solutions for the EurozoneD'EverandThe Incomplete Currency: The Future of the Euro and Solutions for the EurozonePas encore d'évaluation

- FX Levels 15 SeptemberDocument8 pagesFX Levels 15 SeptemberNicola DukePas encore d'évaluation

- Data Report of Crypto Hedge FundDocument18 pagesData Report of Crypto Hedge FundSHIVANIPas encore d'évaluation

- FX Levels 17 SeptemberDocument7 pagesFX Levels 17 SeptemberNicola DukePas encore d'évaluation

- FX Levels 17 SeptemberDocument7 pagesFX Levels 17 SeptemberNicola DukePas encore d'évaluation

- FX Levels 16 SeptemberDocument7 pagesFX Levels 16 SeptemberNicola DukePas encore d'évaluation

- Combined CandlesDocument11 pagesCombined CandlesNicola Duke100% (2)

- FX Levels 04 SeptemberDocument7 pagesFX Levels 04 SeptemberNicola DukePas encore d'évaluation

- FX Levels 10 SeptemberDocument8 pagesFX Levels 10 SeptemberNicola DukePas encore d'évaluation

- FX Levels 12 SeptemberDocument8 pagesFX Levels 12 SeptemberNicola DukePas encore d'évaluation

- FX Levels 08 SeptemberDocument7 pagesFX Levels 08 SeptemberNicola DukePas encore d'évaluation

- FX Levels 09 SeptemberDocument8 pagesFX Levels 09 SeptemberNicola DukePas encore d'évaluation

- FX Levels 20augustDocument7 pagesFX Levels 20augustNicola DukePas encore d'évaluation

- FX Levels 11 SeptemberDocument8 pagesFX Levels 11 SeptemberNicola DukePas encore d'évaluation

- FX Levels 05 SeptemberDocument8 pagesFX Levels 05 SeptemberNicola DukePas encore d'évaluation

- Daily FX Levels 25augustDocument7 pagesDaily FX Levels 25augustNicola DukePas encore d'évaluation

- Daily FX Levels 01 SeptemberDocument7 pagesDaily FX Levels 01 SeptemberNicola DukePas encore d'évaluation

- FX Levels 02 SeptemberDocument7 pagesFX Levels 02 SeptemberNicola DukePas encore d'évaluation

- Daily FX Levels 27augustDocument7 pagesDaily FX Levels 27augustNicola DukePas encore d'évaluation

- Daily FX Levels 28augustDocument7 pagesDaily FX Levels 28augustNicola DukePas encore d'évaluation

- FX Levels 29augustDocument7 pagesFX Levels 29augustNicola DukePas encore d'évaluation

- Weekly Chart Analysis 24augustDocument13 pagesWeekly Chart Analysis 24augustNicola DukePas encore d'évaluation

- Daily FX Levels 22augustDocument7 pagesDaily FX Levels 22augustNicola DukePas encore d'évaluation

- Daily FX Levels 21augustDocument7 pagesDaily FX Levels 21augustNicola DukePas encore d'évaluation

- Weekly Chart Analysis 01septemberDocument13 pagesWeekly Chart Analysis 01septemberNicola DukePas encore d'évaluation

- Daily FX Levels 26augustDocument7 pagesDaily FX Levels 26augustNicola DukePas encore d'évaluation

- DailyFX Levels 18augustDocument7 pagesDailyFX Levels 18augustNicola DukePas encore d'évaluation

- DailyFX Levels 19augustDocument7 pagesDailyFX Levels 19augustNicola DukePas encore d'évaluation

- DailyCharts 14augustDocument7 pagesDailyCharts 14augustNicola DukePas encore d'évaluation

- Weekly Charts 18august2014Document13 pagesWeekly Charts 18august2014Nicola DukePas encore d'évaluation

- Technicals / Charts For 15august14Document7 pagesTechnicals / Charts For 15august14Nicola DukePas encore d'évaluation

- IT Head DataDocument2 pagesIT Head DataTejas SuryawanshiPas encore d'évaluation

- PCC203Document2 pagesPCC203DushyantPas encore d'évaluation

- Apollo Tyres Limited: Rating RationaleDocument4 pagesApollo Tyres Limited: Rating Rationaleragha_4544vPas encore d'évaluation

- Application Format For Sub Agent (E SBTR)Document2 pagesApplication Format For Sub Agent (E SBTR)Rafikul RahemanPas encore d'évaluation

- Histori TransaksiDocument2 pagesHistori TransaksiwandaPas encore d'évaluation

- Movimientos HistoricosDocument22 pagesMovimientos HistoricosVerónica RodPas encore d'évaluation

- E-Commerce and Its Application: Unit-IVDocument37 pagesE-Commerce and Its Application: Unit-IVVasa VijayPas encore d'évaluation

- Punjab Group of CollegesDocument2 pagesPunjab Group of Collegesmuhammad ijazPas encore d'évaluation

- De La Salle-College of Saint Benilde: S.Y. 2011-2012 3 TrimesterDocument3 pagesDe La Salle-College of Saint Benilde: S.Y. 2011-2012 3 TrimesterJean Nicole PangilinanPas encore d'évaluation

- Atul LTDDocument27 pagesAtul LTDFast SwiftPas encore d'évaluation

- Underwriting AgmtDocument45 pagesUnderwriting Agmtmansi_makenPas encore d'évaluation

- Modern Money MechanicsDocument40 pagesModern Money MechanicsEdgar Ricardo Ortega Pineda100% (4)

- Cash Collection and Hand Over 03mayDocument4 pagesCash Collection and Hand Over 03mayUser ProfolicPas encore d'évaluation

- Principles of Economics Chapter 19Document38 pagesPrinciples of Economics Chapter 19Riannon ParkerPas encore d'évaluation

- T24 R11 Release HighlightsDocument61 pagesT24 R11 Release HighlightsOscar RamoPas encore d'évaluation

- Philippine National Bank v. ManaloDocument2 pagesPhilippine National Bank v. ManaloMark Joseph M. VirgilioPas encore d'évaluation

- Module 1 and 3 AssignmentDocument12 pagesModule 1 and 3 AssignmentPrincess Maeca OngPas encore d'évaluation

- Money and BankingDocument16 pagesMoney and BankingSiddhi JainPas encore d'évaluation

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaPas encore d'évaluation

- Customer Relationship ManagementDocument88 pagesCustomer Relationship Managementphanindra_madasu0% (1)

- Robo-Galore!! Lynn's List of Top Mortgage Signers For First Half of 2011Document5 pagesRobo-Galore!! Lynn's List of Top Mortgage Signers For First Half of 201183jjmack85% (13)

- Introduction To Indian Financial SystemDocument14 pagesIntroduction To Indian Financial SystemshrahumanPas encore d'évaluation

- AXIS BANK-Wealth ManagementDocument155 pagesAXIS BANK-Wealth Managementakanungo91% (11)

- The Nature and History of InsuranceDocument24 pagesThe Nature and History of InsuranceAdnan RasheedPas encore d'évaluation

- Islamic Financial SystemDocument24 pagesIslamic Financial System✬ SHANZA MALIK ✬Pas encore d'évaluation

- First Division: Peoples Bank & Trust Company OdomDocument180 pagesFirst Division: Peoples Bank & Trust Company OdomJames Evan I. ObnamiaPas encore d'évaluation

- US21FI12 Quiz Question Pool 04sep2013Document63 pagesUS21FI12 Quiz Question Pool 04sep2013NitinPas encore d'évaluation