Académique Documents

Professionnel Documents

Culture Documents

Michael A Chagares Financial Disclosure Report For 2010

Transféré par

Judicial Watch, Inc.Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Michael A Chagares Financial Disclosure Report For 2010

Transféré par

Judicial Watch, Inc.Droits d'auteur :

Formats disponibles

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

1. Person Reporting (last name, first, middle initial) Chagares, Michael A. 4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

2. Court or Organization Third Circuit

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

3. Date of Report 06/13/201 I

6. Reporting Period

01/01/2010

to

Circuit Judge (Active)

12/31/2010

5b. [] Amended Report 7. Chambers or Office Address U.S. Post Office & Courthouse Newark, NJ 07102 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followetL Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. ~Repo,ing indiv~duu~ on~y; se, pp. 9-13 of f!ling instructions.)

[~ NONE (No reportable positions.)

POSITION

1. 2. 3. 4. 5. Adjunct Professor Advisory Board Advisory Board Board of Directors

NAME OF ORGANIZATION/ENTITY

Seton Hall University School of Law Historical Society of the U.S. District Court for the District of New Jersey Association of the Federal Bar of New Jersey Historical Society of the U.S. Court of Appeals for the Third Circuit

II. AGREEMENTS. R~po,ing ~ndividuot outy ; s~ ,,. 14-16 of filing instructions.)

~] NONE (No reportable agreements.) DATE

PARTIES AND TERMS

Cha_clares, Michael A.

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting Chagares, Michael A.

Date of Report 06/13/2011

III. NON-INVESTMENT IN COME. (Reporting individual and spouse; see pp. 17-24 of filing instructions.)

A. Filers Non-lnvestment Income

~] NONE (No reportable non-investment income.) DATE

1. 2010 2. 3. 4.

SOURCE AND TYPE

Seton Hall University School of Law

INCOME (yours, not spouses)

$26,550.00

B. Spouses Non-Investment Income - If you were married during anyportion of the reporting)ear, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.)

DATE

1. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS - transportation, lodging, food, entertainmeng

(Includes those to spouse and dependent children; see pp. 25-27 of f!ling instructions.)

NONE (No reportable reimbursements.)

SOURCE

I. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting Chagares, Michael A.

Date of Report 06/13/2011

V. GIFT S. ~lndudes those to spouse and depe.dcnt children; see pp. 28-31 of filing instructions.) NONE (No reportable gifts.) SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. (Includes those of spouse and dependent children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.) CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting Chagares, Michael A.

Date of Report 06/13/2011

VII. INVESTMENTS and TRUSTS - income, vogue, transactions tlncludes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (1) Amount Code 1 (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (1) (2) Value Value Code 2 Method (J-P) Code 3 Transactions during reporting period

(1)

Type (e.g., buy, sell, redemption)

(2)

(3)

(4)

Gain Code 1 (A-H)

(s)

Identity of buyer/seller (if private transaction)

Date Value mm/dd/yy Code 2 (J-P)

(Q-W)

1. 2. 3. 4. 5. 6. 7. 8. 9. 10.

I I.

Fidelity Cash Reserves TD Bank Dreyfus Money Market Fidelity IRA (comprised of Fidelity Growth & Income Fund) Bank of America Wells Fargo Exxon IViobil Stock Thrift Savings William Penn Life Ins. American General Life Ins.

Smith Barney (brok. act - Bank Dep. Prog. & F1. Power Stk) Roselle Savings

A A A A A A A D A A

B

Dividend Interest Dividend lnt./Div. Interest Interest Dividend Int./Div. Interest Interest

Interest

L J J J J J K M J J

K

T T T T T T T T T T

T

12.

Interest

13.

TD Bank (business checking acct.)

Interest

14.

15.

16.

17.

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N = $250.001 - $500,000 P3 -$25.000.001 - $50.000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1,000,000 K = $15,001 - $50,000 O =$500,001 - $1,000~000 R = Cost (Real Estale Only) V :-Other

C =$2,50t - $5,000 HI =$1,000,001 - $5,000,000 L =$50,001 - $ 100,000 P I =$ 1,000,001 - $5,000,000 P4 -More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting Chagares, Michael A.

Date of Report 06/13/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicate part of report.)

FINANCIAL DISCLOSURE REPORT Page 6 of 6 IX. CERTIFICATION.

Name of Person Reporting Chagares, Michael A.

Date of Report 06/13/2011

l certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Michael A. Chagares

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Vous aimerez peut-être aussi

- DAR Clearance Application Form (Blank)Document1 pageDAR Clearance Application Form (Blank)Adonis Zoleta Aranillo50% (4)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- UDHR CardsDocument5 pagesUDHR Cardsalonsovalpo216981Pas encore d'évaluation

- Correctional AdministrationDocument9 pagesCorrectional AdministrationGlorious El Domine50% (4)

- Lacey A Collier Financial Disclosure Report For 2010Document6 pagesLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Brian S Miller Financial Disclosure Report For 2010Document6 pagesBrian S Miller Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Carolyn R Dimmick Financial Disclosure Report For 2010Document6 pagesCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Donald W Molloy Financial Disclosure Report For 2010Document6 pagesDonald W Molloy Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Henry F Floyd Financial Disclosure Report For 2010Document6 pagesHenry F Floyd Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Kenneth A Marra Financial Disclosure Report For 2010Document6 pagesKenneth A Marra Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Ronald E Longstaff Financial Disclosure Report For 2010Document6 pagesRonald E Longstaff Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Lucy H Koh Financial Disclosure Report For Koh, Lucy HDocument12 pagesLucy H Koh Financial Disclosure Report For Koh, Lucy HJudicial Watch, Inc.Pas encore d'évaluation

- Ronald L Buckwalter Financial Disclosure Report For 2010Document6 pagesRonald L Buckwalter Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Carol E Jackson Financial Disclosure Report For 2010Document6 pagesCarol E Jackson Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Raymond J Dearie Financial Disclosure Report For 2010Document7 pagesRaymond J Dearie Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Roslynn R Mauskopf Financial Disclosure Report For 2010Document6 pagesRoslynn R Mauskopf Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Michael R Murphy Financial Disclosure Report For 2010Document6 pagesMichael R Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Sam A Lindsay Financial Disclosure Report For 2010Document6 pagesSam A Lindsay Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Eric F Melgren Financial Disclosure Report For 2010Document6 pagesEric F Melgren Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- John F Keenan Financial Disclosure Report For 2010Document6 pagesJohn F Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Scott O Wright Financial Disclosure Report For 2010Document6 pagesScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- William B Enright Financial Disclosure Report For 2010Document6 pagesWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Royce C Lamberth Financial Disclosure Report For 2010Document6 pagesRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Jeffrey S Sutton Financial Disclosure Report For 2010Document8 pagesJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- William C Lee Financial Disclosure Report For 2010Document6 pagesWilliam C Lee Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Susan O Mollway Financial Disclosure Report For 2010Document7 pagesSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Delwen L Jensen Financial Disclosure Report For 2010Document6 pagesDelwen L Jensen Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- James L Edmondson Financial Disclosure Report For 2010Document6 pagesJames L Edmondson Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Garland E Burrell JR Financial Disclosure Report For 2010Document6 pagesGarland E Burrell JR Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Philip M Pro Financial Disclosure Report For 2010Document6 pagesPhilip M Pro Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- William C Canby JR Financial Disclosure Report For 2010Document6 pagesWilliam C Canby JR Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Robert S Lasnik Financial Disclosure Report For 2010Document7 pagesRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Jerome A Holmes Financial Disclosure Report For 2010Document6 pagesJerome A Holmes Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Gregory M Sleet Financial Disclosure Report For 2010Document6 pagesGregory M Sleet Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Dale A Kimball Financial Disclosure Report For 2010Document6 pagesDale A Kimball Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- James R Hall Financial Disclosure Report For 2010Document6 pagesJames R Hall Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Glen H Davidson Financial Disclosure Report For 2010Document6 pagesGlen H Davidson Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Kimberly J Muller Financial Disclosure Report For Muller, Kimberly JDocument6 pagesKimberly J Muller Financial Disclosure Report For Muller, Kimberly JJudicial Watch, Inc.Pas encore d'évaluation

- Ancer L Haggerty Financial Disclosure Report For 2010Document7 pagesAncer L Haggerty Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- George H Wu Financial Disclosure Report For 2010Document6 pagesGeorge H Wu Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- George C Steeh Financial Disclosure Report For 2010Document6 pagesGeorge C Steeh Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Samuel Conti Financial Disclosure Report For 2010Document7 pagesSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Malcom J Howard Financial Disclosure Report For 2010Document6 pagesMalcom J Howard Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Donetta W Ambrose Financial Disclosure Report For 2010Document7 pagesDonetta W Ambrose Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Lee R West Financial Disclosure Report For 2010Document6 pagesLee R West Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Charles C Lovell Financial Disclosure Report For 2010Document6 pagesCharles C Lovell Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- David S Doty Financial Disclosure Report For 2010Document7 pagesDavid S Doty Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Harold L Murphy Financial Disclosure Report For 2010Document7 pagesHarold L Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- John P Bailey Financial Disclosure Report For 2010Document7 pagesJohn P Bailey Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Stephen Anderson Financial Disclosure Report For 2010Document7 pagesStephen Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Leonard D Wexler Financial Disclosure Report For 2010Document6 pagesLeonard D Wexler Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Charles N Clevert Financial Disclosure Report For 2010Document6 pagesCharles N Clevert Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Richard L Nygaard Financial Disclosure Report For 2010Document7 pagesRichard L Nygaard Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Ralph R Beistline Financial Disclosure Report For 2010Document6 pagesRalph R Beistline Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Robert C Broomfield Financial Disclosure Report For 2010Document6 pagesRobert C Broomfield Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Vanessa D Gilmore Financial Disclosure Report For 2010Document6 pagesVanessa D Gilmore Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Harold D Vietor Financial Disclosure Report For 2010Document6 pagesHarold D Vietor Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- George C Smith Financial Disclosure Report For 2010Document6 pagesGeorge C Smith Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Terry J Hatter JR Financial Disclosure Report For 2010Document6 pagesTerry J Hatter JR Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Alicemarie Stotler Financial Disclosure Report For 2010Document6 pagesAlicemarie Stotler Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- James C Cacheris Financial Disclosure Report For 2010Document7 pagesJames C Cacheris Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Fortunato P Benavides Financial Disclosure Report For 2010Document12 pagesFortunato P Benavides Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Rebecca F Doherty Financial Disclosure Report For 2010Document7 pagesRebecca F Doherty Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityD'EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityPas encore d'évaluation

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Pas encore d'évaluation

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.Pas encore d'évaluation

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29Pas encore d'évaluation

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.Pas encore d'évaluation

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.Pas encore d'évaluation

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.Pas encore d'évaluation

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.Pas encore d'évaluation

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.Pas encore d'évaluation

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.Pas encore d'évaluation

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Pas encore d'évaluation

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Pas encore d'évaluation

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.Pas encore d'évaluation

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.Pas encore d'évaluation

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.Pas encore d'évaluation

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.Pas encore d'évaluation

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Pas encore d'évaluation

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.Pas encore d'évaluation

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.Pas encore d'évaluation

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.Pas encore d'évaluation

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.Pas encore d'évaluation

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.Pas encore d'évaluation

- Domingo Vs Sheer - Strong Family Ties JurisDocument25 pagesDomingo Vs Sheer - Strong Family Ties JurisGerald MesinaPas encore d'évaluation

- Introduction Legal English Units 4-10 and Keys PDFDocument100 pagesIntroduction Legal English Units 4-10 and Keys PDFAni Rukhadze100% (2)

- Intro PPT 2 - CHAPTER 2 - CRIMINAL JUSTICE SYSTEMDocument19 pagesIntro PPT 2 - CHAPTER 2 - CRIMINAL JUSTICE SYSTEMKenneth PuguonPas encore d'évaluation

- SCC Chemicals vs. CA G.R. No. 128538 February 28, 2001Document6 pagesSCC Chemicals vs. CA G.R. No. 128538 February 28, 2001Nikki BinsinPas encore d'évaluation

- Recebido Vs PeopleDocument2 pagesRecebido Vs PeopleJaz SumalinogPas encore d'évaluation

- Metro Bank & Trust Company vs. MirandaDocument1 pageMetro Bank & Trust Company vs. MirandaBenjo Romil NonoPas encore d'évaluation

- Adr Cases Compilation PDFDocument67 pagesAdr Cases Compilation PDFLemuel Angelo M. EleccionPas encore d'évaluation

- Rayos V HernandezDocument14 pagesRayos V Hernandeznia_artemis3414Pas encore d'évaluation

- Sierra vs. People DigestDocument2 pagesSierra vs. People DigestRussell John HipolitoPas encore d'évaluation

- 2016 SEC Rules of ProcedureDocument53 pages2016 SEC Rules of ProcedureRemy Rose AlegrePas encore d'évaluation

- ASEANDocument114 pagesASEANBunchhom RatanakPas encore d'évaluation

- Amar Singh Vs Union of IndiaDocument18 pagesAmar Singh Vs Union of IndiajonamjonamPas encore d'évaluation

- Anti-Suffragists Student MaterialsDocument4 pagesAnti-Suffragists Student MaterialsKaren IdkPas encore d'évaluation

- Gsis CasesDocument14 pagesGsis Casesfaith turnoPas encore d'évaluation

- Labor Relations Case Digests 1Document7 pagesLabor Relations Case Digests 1Macy TangPas encore d'évaluation

- Vilando V HRETDocument11 pagesVilando V HRETred gynPas encore d'évaluation

- Musevenis Family Runs The GoveernmentDocument61 pagesMusevenis Family Runs The GoveernmentDekweriz50% (2)

- Far Eastern University Institute of Law: Subject Offerings and ScheduleDocument4 pagesFar Eastern University Institute of Law: Subject Offerings and ScheduleJames Patrick NarcissoPas encore d'évaluation

- Msweavb I Mikvi: F WGKVDocument15 pagesMsweavb I Mikvi: F WGKVScientia Online CarePas encore d'évaluation

- Quiz - No. - 2 Daily, Ma. Jhoan A.Document2 pagesQuiz - No. - 2 Daily, Ma. Jhoan A.Ma. Jhoan DailyPas encore d'évaluation

- HoWPoR Rules 2005Document26 pagesHoWPoR Rules 2005veera_swamy2Pas encore d'évaluation

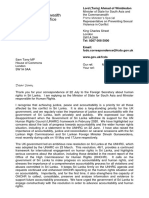

- Letter From Lord Ahmad of Wimbledon To Sam Tarry MP 05082021Document2 pagesLetter From Lord Ahmad of Wimbledon To Sam Tarry MP 05082021Thavam RatnaPas encore d'évaluation

- FH TransnationalRepressionReport2021 Rev020221 CaseStudy IranDocument3 pagesFH TransnationalRepressionReport2021 Rev020221 CaseStudy IranRafael BaptistaPas encore d'évaluation

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 779Document3 pagesAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 779Justia.comPas encore d'évaluation

- McGarry v. Bucket Innovations - ComplaintDocument23 pagesMcGarry v. Bucket Innovations - ComplaintSarah BursteinPas encore d'évaluation

- Taxation Law Internal Assignment Utkarsh DixitDocument5 pagesTaxation Law Internal Assignment Utkarsh DixitAshish RajPas encore d'évaluation

- Economy Schein EngDocument2 pagesEconomy Schein EngMateo AvilésPas encore d'évaluation