Académique Documents

Professionnel Documents

Culture Documents

Alia Moses Financial Disclosure Report For Moses, Alia

Transféré par

Judicial Watch, Inc.Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Alia Moses Financial Disclosure Report For Moses, Alia

Transféré par

Judicial Watch, Inc.Droits d'auteur :

Formats disponibles

Rev.!

l/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization Western District of Texas

5a. Report Type (check appropriate type)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) Moses, Alia

4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/13/2011 6. Reporting Period 01/01/2010 to 12/31/2010

Nomination,

Date [] Annual [] Final

U.S. District Judge - Active

[] Initial

5b. [] Amended Report

7. Chambers or Office Address 11 I E. Broadway, Room A-202 Del Rio, TX 78840

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be foflowed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. P O S I TI O N S. (Reporting individual only; see pp. 9-13 of filing instructions.)

NONE (No reportable positions.) POSITION

1. 2. 3. 4.

NAME OF ORGANIZATION/ENTITY

II. AGREEMENTS. meporting individual only; seepp. 14-16 of fillng instructions.)

~] NONE (No reportable agreements.) DATE

PARTIES AND TERMS

Moses, Alia

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting Moses, Alia

Date of Report 05/13/2011

III. NON-INVESTMENT INCOME. (Repo.i.g i.divldaol o.d spo.se; see pp. I 7-24 of ~ll.g instructions.)

A. Filers l~on-Investment Income

~] NONE (No reportable non-investment income.)

DATE

SOURCE AND TYPE

INCOME (yours, not spouses)

2.

3.

4.

B. Spouses Non-Investment Income - If you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

~]

NONE (No reportable non-investment income.)

DATE

1. 2010 2. 3. 4.

SOURCE AND TYPE

Self-Employed: Public Relations/Marketing/Writing Income

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE

1. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting Moses, Alia

Date of Report 05/13/2011

V. GIFTS. aneludes those to spouse a.d depe.de.t children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. (Includes those of spouse and dependent children; seepp. 32-33 of filing instructions.)

D

1. 2. 3. 4. 5.

NONE (No reportable liabilities.)

CREDITOR

Chase Visa

Credit Card

DESCRIPTION

VALUECODE

K

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting Moses, Alia

Date of Report 05/13/2011

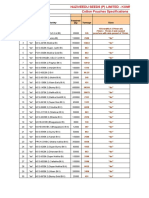

VII. INVES TMENTS and TRU S TS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period Gross value at end of reporting period (1) (2) Value Value Code 2 Method (.l-P) Code 3 Transactions during reporting period

(1)

Amount Code 1 (A-H)

(2)

Type (e.g., div., rent, or int.)

(l)

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 I Code 1 {J-P) (A-H)

(5) Identity of buyer/seller (if private transaction)

Westar Energy Inc Direct Stock Reinv Plan 2. 3. 4. 5. 6. 7. 8. 9. 10. Westar Energy Inc Common Stock The Bank and Trust Accounts NekTar Theraputics Common Stock Linsco Premier M Mkt Port Accts (Y) Nuveen High Yield Mun Bd Fd CI C (Y) Oppenheimer Rochester Natl Muni(Y) First Trust Muni C/E Port Ser 23 (Y) Kyliptix Solutions Inc Common Stk (Y) Championship Bull Riding Inc Comm Stk

A A A

Dividend Dividend Interest None

J J J J

T T T T

()

12. 13.

14.

16. 17.

I. Income Gain Codes: (See Colunms BI and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 o $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$i,001 - $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Othcr

C =$2,501 - $5,000 HI =$1,000,001 - $5,000,000 L =$50,001 - $100,000 PI =$1,000,001 - $5,000,000 P4 =More Ihan $50,000,000 S =Assessment W =Estimated

D=$5,001 - $15,000 H2 =More than $5,000,000 M=$100,001- $250,000 P2 =$5,000,001 -$25,000,000 T =Cash Market

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting Moses, Alia

Date of Report 05/13/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. t~,,,~ic,,,e~,,,rtolrepo,~.~

FINANCIAL DISCLOSURE REPORT Page 6 of 6 IX. CERTIFICATION.

Name of Person Reporting Moses, Alia

Date of Report 05/13/2011

l certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Vous aimerez peut-être aussi

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Pas encore d'évaluation

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.Pas encore d'évaluation

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.Pas encore d'évaluation

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29Pas encore d'évaluation

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.Pas encore d'évaluation

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Pas encore d'évaluation

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.Pas encore d'évaluation

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.Pas encore d'évaluation

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Pas encore d'évaluation

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.Pas encore d'évaluation

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.Pas encore d'évaluation

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.Pas encore d'évaluation

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.Pas encore d'évaluation

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.Pas encore d'évaluation

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.Pas encore d'évaluation

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.Pas encore d'évaluation

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.Pas encore d'évaluation

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.Pas encore d'évaluation

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Pas encore d'évaluation

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.Pas encore d'évaluation

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 5 Point Scale PowerpointDocument40 pages5 Point Scale PowerpointMíchílín Ní Threasaigh100% (1)

- Coerver Sample Session Age 10 Age 12Document5 pagesCoerver Sample Session Age 10 Age 12Moreno LuponiPas encore d'évaluation

- Masmud Vs NLRC and Atty Go DigestDocument2 pagesMasmud Vs NLRC and Atty Go DigestMichael Parreño Villagracia100% (1)

- Atlantean Dolphins PDFDocument40 pagesAtlantean Dolphins PDFBethany DayPas encore d'évaluation

- Three Categories of AutismDocument14 pagesThree Categories of Autismapi-327260204Pas encore d'évaluation

- Acitve and Passive VoiceDocument3 pagesAcitve and Passive VoiceRave LegoPas encore d'évaluation

- Lunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Document2 pagesLunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Kiwanis Club of WaycrossPas encore d'évaluation

- أثر البحث والتطوير على النمو الاقتصادي - دراسة قياسية لحالة الجزائر (1990 -2014)Document17 pagesأثر البحث والتطوير على النمو الاقتصادي - دراسة قياسية لحالة الجزائر (1990 -2014)Star FleurPas encore d'évaluation

- E F Eng l1 l2 Si 011Document2 pagesE F Eng l1 l2 Si 011Simona ButePas encore d'évaluation

- Governance Whitepaper 3Document29 pagesGovernance Whitepaper 3Geraldo Geraldo Jr.Pas encore d'évaluation

- FFT SlidesDocument11 pagesFFT Slidessafu_117Pas encore d'évaluation

- Agitha Diva Winampi - Childhood MemoriesDocument2 pagesAgitha Diva Winampi - Childhood MemoriesAgitha Diva WinampiPas encore d'évaluation

- Design and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionDocument11 pagesDesign and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionTejas PanchalPas encore d'évaluation

- Sleep and Dreams PDFDocument16 pagesSleep and Dreams PDFMarina Los100% (1)

- T2T - One - U12 - Grammarworksheet - 1 Should For Advice PDFDocument1 pageT2T - One - U12 - Grammarworksheet - 1 Should For Advice PDFGrissellPas encore d'évaluation

- The Development of Poetry in The Victorian AgeDocument4 pagesThe Development of Poetry in The Victorian AgeTaibur Rahaman0% (1)

- Cotton Pouches SpecificationsDocument2 pagesCotton Pouches SpecificationspunnareddytPas encore d'évaluation

- Didhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersDocument20 pagesDidhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersAndré Le RouxPas encore d'évaluation

- Baybay - Quiz 1 Code of EthicsDocument2 pagesBaybay - Quiz 1 Code of EthicsBAYBAY, Avin Dave D.Pas encore d'évaluation

- NURS FPX 6021 Assessment 1 Concept MapDocument7 pagesNURS FPX 6021 Assessment 1 Concept MapCarolyn HarkerPas encore d'évaluation

- Mae (256F) - HW3 PDFDocument2 pagesMae (256F) - HW3 PDFClairePas encore d'évaluation

- PDF - Unpacking LRC and LIC Calculations For PC InsurersDocument14 pagesPDF - Unpacking LRC and LIC Calculations For PC Insurersnod32_1206Pas encore d'évaluation

- The Problem Between Teacher and Students: Name: Dinda Chintya Sinaga (2152121008) Astry Iswara Kelana Citra (2152121005)Document3 pagesThe Problem Between Teacher and Students: Name: Dinda Chintya Sinaga (2152121008) Astry Iswara Kelana Citra (2152121005)Astry Iswara Kelana CitraPas encore d'évaluation

- Linux Command Enigma2Document3 pagesLinux Command Enigma2Hassan Mody TotaPas encore d'évaluation

- GMAT Sentence Correction Practice Test 03Document5 pagesGMAT Sentence Correction Practice Test 03krishnachivukulaPas encore d'évaluation

- Question 1 (1 Point) : SavedDocument31 pagesQuestion 1 (1 Point) : SavedCates TorresPas encore d'évaluation

- Grammar: English - Form 3Document39 pagesGrammar: English - Form 3bellbeh1988Pas encore d'évaluation

- Julian BanzonDocument10 pagesJulian BanzonEhra Madriaga100% (1)

- Pencak Silat New Rules 2020 - Slides Presentation (International) - As of 22 Aug 2020 - 1000hrs (1) (201-400)Document200 pagesPencak Silat New Rules 2020 - Slides Presentation (International) - As of 22 Aug 2020 - 1000hrs (1) (201-400)Yasin ilmansyah hakimPas encore d'évaluation

- TCS Digital - Quantitative AptitudeDocument39 pagesTCS Digital - Quantitative AptitudeManimegalaiPas encore d'évaluation