Académique Documents

Professionnel Documents

Culture Documents

Frederick J Kapala Financial Disclosure Report For 2010

Transféré par

Judicial Watch, Inc.Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Frederick J Kapala Financial Disclosure Report For 2010

Transféré par

Judicial Watch, Inc.Droits d'auteur :

Formats disponibles

AO I0 Roy.

1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization District Court, N D Illinois i 5a. Report Type (check appropriate ~pe)

] Nomination, [] A .... Date I [] Final

Re~otl Required by the Ethics in Go vermnent Act t!/ 1978 (5 U.S.C. app..~k" I01-111)

I. Persou Reporting (last name, first, middle initial) Kapala, Frederick J. 4. Title (Article III judges indicate active or senior status; magistrate judges indicate full- or part-time) District Judge

3. Date ul" Report 05/031201 I 6. Reporting Period 01/01/2010 to 12/3112010

[] Initial

5b. [] Amended Rcport

7. Chambers or Office Address 211 South Court Street Rockford, IL61101

8. On Ihc basis of the information contained in this Report and an) modificalions pertaining thereto, it is, in my opinion, in compliance wilh applicable laws and regulations.

Reviewing Officer

Date

IMPOR TANT NOTES: the instrocaons accompanying this form mast be followed. Complete all parts,

checkit~g the NONE box for each part where you have no reportable information. Sign on lust page.

I. POSITIONS. (Reparti, g i, divid,,ot ,o0V sec l,p. 9-t3 of filing instrttction.t.)

~ NONE (No reportable positions.) POSITION I. 2. 3. 4. 5. Trustee Trustee Director Trust # 1 Trnst # 2 ~]an Illinois not-for-profit corporation NAME OF ORGANIZATION/ENTITY

ll. AGREEMENTS. m,,v,,.i,,~ indi,,i,hmlmdy: seepp. 14-16 ,~ffiling htstructions.)

[~ NONE (No reportable DATE

I. 12/31/2010 2. 3.

agreelllellls.)

PARTIES AND TERMS

State of Illinois Retirement Syslem, pension benefits payable at retirement at or after age 55

Ka )ala, Frederick J.

FINANCIAL DISCLOSURE REPORT Page 2 of 7

Name of Person Rcporling Kapala, Frederick J.

Date ~r Repnrl 05/03/2011

l I I. N ON-INVESTMENT IN COME. g,r,,,,;,,,, indi,.idttal aml,l,Ottse; s,~pp. 17-24 ,,ffilittg ittvtructions.)

A. Fliers Non-Investment Income

[] NONE (No reportable non-investment htcome.) DATE

I. 2010 2. 3. ,~.

SOURCE AND TYPE

State of Illinois - Appellate Court Judge retirement payments

INCOME (yours, not spo~,ses)

$155,307.84

B. Spouses Non-Investment Income - t[j,,,,, n,ere tt arried d tri,lg atO, porrion of the reporting.~,ear, con,plete this sectlm~.

(Dollar amount noi reqiffre~l e.r~e~?.~? hatforaria~.l ...............

NONE (No reportable

DATE

1. 1~31/2010

1?OlT-ilTVeSfll?elil

income.) SOURCE AND TYPE

Catholic Diocese of Rockford, substitute teaching

2. 3.

4.

IV. R_EIMBURSEMENTS -,~o,,.w,~,~o,,. ~,,,~g~,,~,~,,,,~. ~.,,,~,oi,,,,,,,,,.

(htcludes those m ~pouse and d~pendent children; see pp. 25-27 ,?[~filing instructions.)

NONE (No reportable reimb~rsements.) SOURCE

I. 2. 3. 4.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

5.

FINANCIAL DISCLOSURE REPORT Page 3 of 7

V. GIFTS. (hwh.h.s tht,se to spm,sc at,d del, tndent thildren; see pp. 2,q-31of f!linL~" instr.ctions~)

NONE (No reportable gifts.) SOURCE 1. 2. 3.

4.

DESCRIPTION

VALUE

5.

NONE (No reportable liabilities.) CREDITOR DESCRIPTION VALUE CODE

2. 3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 4 of 7

~ame of Persnn Repurlin~ Kapala, Frederick J.

Date of Report 05/031201 I

VI I. IN VESTMENTS a n d TRUSTS - i,,e,,,,,. ,.,n,,~, transactions et,,ct,,a,,~ ~t,,,se of spo,,se a,,,t ,t,pe,,ae,,, ct, itar,,,,; see tp. ~ 4-~o ,,1iti,,g it,.rtructim,.~.)

[~]

NONE ova

reporlab[e

income, assets, or transactions.)

B. Income during reporting I~riod (I) (2) Amount Type (e.g.. Code I div., rent, (A-H) or inl.) C. Gross value al e~~d of reporting period (I) Value Code 2 (J-P) {2) Value Melhod Code 3 (Q-W)

(i) Type (e.g.. buy, sell, redemption)

A. Description of Asscls (including trust assets} Place "iX)" after each asset exempt from prior disclosure

Transactions during reporting period

(2) (3) (4) Date Value mm/dd/yy Code 2 (J-P) (5) Identity of buyer/seller (if private transaclion)

Gain Code I (A-H)

I. 2. 3. 4. 5. 6. 7. 8. 9. 10. I I. 12. 13. 14. 15. 16. 17.

Chase Bank account # I Blackhawk Bank account # I Blackhawk Bank acconnt # 2 Blackhawk Bank account # 3 Hacris N.A. Bank Account # I Alpine Bank CD Scottrade Bank deposit program Universal Infotainment Systems Co~poration Fairholme Fund Trust 1/ I, trustee and income beneficiary - Drugslore.con| stock Trust # 2, trustee and income beneficiary - Drugslorc.com stock IRA # I - Time Wan~cr, Inc. stock - Time Warner Cable Inc. stock - AOL Inc.

A A A A A A A A D

Interest Interest Interest Interest Interest Interest Interest Dividend Dividend None

K

K

T

T

T L K T T

Closed L J M J T T T T Buy 12/17/10 J 08/21/10 J

None

lnt./Div.

T

Sold Sold Sold 06/16/10 06/16110 06/16/10 J J J

I. Inc,mw G:Un Codc~:

A =$ I.(]Dtl t~r less

L] =$1,001 - $2,500

C =$2.501 - $5.tlf)fl

D =$5,1){)1 - $15.t)on

FINANCIAL DISCLOSURE REPORT Page 5 of 7

Name nF Pcrs~)n Rtporling Kapala, Frederick J.

D,nle of Rcpnrl 05/03/201 I

Vll. INVESTMENTS and TRUSTS - i,,,., .......

.,t,,,. , ...... e,i,,,,s (hwludes those ,~f sp,,use m,d dependent children; see pp. 34-60 , fili,g Instructi,,ns.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" aflcr each asset cxcmpl from prior disclosure Income during reporting p~riod (I) Amount Code I (A-H) 12) Type (e.g.. div.. rent, or int.) Gross value at end ofreporting period 11) (2) Value Value Method Cod.,: 2 (J-P) Code 3 (O-w) Transaclions during reporting period (2) (3) (4) Value Gain Dale mm/dd!yy Code 2 Code I (J-P) [A-I-I} (5) Identity of buyer/seller (ifprivalc transaclion}

Type (e.g.. buy. sell. redemption)

18. 19.

:20. 21. 22. 23. 24.

- YamanaGoldlnc IRA # 2

- Drugstore.corn stock A lnt./Div.

- CitiGroup Real Estate # I, Winnebago County, Illinois (2005, $100,000) Real Estate # 2, Wilmebago County, Illinois (2003, $25,000) Real Estate # 3. Winnebago County, Illinois ($60,349)

None None None L K L

R R S

FINANCIAL DISCLOSURE REPORT Page 6 of 7

Name of Persnn Reporting Kapala, Frederick J.

Dale of Report 05;031201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (Imlicatepartt~freport.)

Pan Vll, Line 14. the IRA was convcrlcd from a Traditional IRA to a Roth IRA Part VII, Line 19, the IRA was converted from a Traditional IRA to a Roth IRA Part VII, Line 22 was purchased on July 12, 2005 for $100,000. Part VII, Line 23 was purchased on September 15, 2003 for $25,000. Part VII, Line 24, Ihe assessed value is $60,349.

FINANCIAL DISCLOSURE REPORT Page 7 or7 IX. CERTIFICATION.

Name tff Person Reporting Kapala, Frederick J.

Dale of Rcporl 05/03!201 I

I certify that all information given above (including information pertaining In my sponse and minor or dependent children, it any) is accurate, true, and cnmplete to the best of my knowledge and belief, anti that any information not reported ~vas withheld because il met applicable statutnry provishms permilting non-disclosnre. I further certify tha! earned income from oulside employment and bonoraria and the acceptance nf gifts whicb have been repurled are in compliance ~vith the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIl. AND CRIMINAL SANCTIONS {5 U.S.C. app. 104)

Committce on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Vous aimerez peut-être aussi

- Eugene E Siler Financial Disclosure Report For 2010Document7 pagesEugene E Siler Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- George M Marovich Financial Disclosure Report For 2009Document6 pagesGeorge M Marovich Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- James C Turk Financial Disclosure Report For 2010Document7 pagesJames C Turk Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Patricia A Seitz Financial Disclosure Report For 2010Document7 pagesPatricia A Seitz Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Gregory M Sleet Financial Disclosure Report For 2010Document6 pagesGregory M Sleet Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Carol E Jackson Financial Disclosure Report For 2010Document6 pagesCarol E Jackson Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Lawrence H Silberman Financial Disclosure Report For 2010Document7 pagesLawrence H Silberman Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Norma L Shapiro Financial Disclosure Report For 2010Document8 pagesNorma L Shapiro Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Alvin K Hellerstein Financial Disclosure Report For 2009Document8 pagesAlvin K Hellerstein Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Delwen L Jensen Financial Disclosure Report For 2010Document6 pagesDelwen L Jensen Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- JR Louis Guirola Financial Disclosure Report For 2010Document6 pagesJR Louis Guirola Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Garland E Burrell JR Financial Disclosure Report For 2009Document6 pagesGarland E Burrell JR Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Lacey A Collier Financial Disclosure Report For 2010Document6 pagesLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Malcom J Howard Financial Disclosure Report For 2010Document6 pagesMalcom J Howard Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Thomas N ONeill JR Financial Disclosure Report For 2009Document6 pagesThomas N ONeill JR Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Harold D Vietor Financial Disclosure Report For 2010Document6 pagesHarold D Vietor Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Susan O Mollway Financial Disclosure Report For 2010Document7 pagesSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Scott O Wright Financial Disclosure Report For 2010Document6 pagesScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Richard A Schell Financial Disclosure Report For 2009Document6 pagesRichard A Schell Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Joan B Gottschall Financial Disclosure Report For 2010Document10 pagesJoan B Gottschall Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Jeffrey S Sutton Financial Disclosure Report For 2010Document8 pagesJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Carolyn R Dimmick Financial Disclosure Report For 2010Document6 pagesCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- James T Trimble Financial Disclosure Report For 2010Document12 pagesJames T Trimble Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- George P Kazen Financial Disclosure Report For 2009Document7 pagesGeorge P Kazen Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- James C Turk Financial Disclosure Report For 2009Document7 pagesJames C Turk Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Sarah E Barker Financial Disclosure Report For 2010Document7 pagesSarah E Barker Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Michael R Murphy Financial Disclosure Report For 2010Document6 pagesMichael R Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Bobby E Shepherd Financial Disclosure Report For 2010Document7 pagesBobby E Shepherd Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Kenneth M Karas Financial Disclosure Report For 2010Document7 pagesKenneth M Karas Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Sam A Lindsay Financial Disclosure Report For 2010Document6 pagesSam A Lindsay Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Robert C Jones Financial Disclosure Report For 2010Document6 pagesRobert C Jones Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Betty B Fletcher Financial Disclosure Report For 2010Document7 pagesBetty B Fletcher Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Alicemarie Stotler Financial Disclosure Report For 2010Document6 pagesAlicemarie Stotler Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- James L Edmondson Financial Disclosure Report For 2010Document6 pagesJames L Edmondson Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Mark A Goldsmith Financial Disclosure Report For Goldsmith, Mark ADocument7 pagesMark A Goldsmith Financial Disclosure Report For Goldsmith, Mark AJudicial Watch, Inc.Pas encore d'évaluation

- Ricardo M Urbina Financial Disclosure Report For 2010Document6 pagesRicardo M Urbina Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Gregory L Frost Financial Disclosure Report For 2010Document8 pagesGregory L Frost Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Joe L Heaton Financial Disclosure Report For 2010Document8 pagesJoe L Heaton Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Jose A Gonzalez JR Financial Disclosure Report For 2009Document10 pagesJose A Gonzalez JR Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Robert B Propst Financial Disclosure Report For 2010Document7 pagesRobert B Propst Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Ronald E Longstaff Financial Disclosure Report For 2010Document6 pagesRonald E Longstaff Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Richard L Nygaard Financial Disclosure Report For 2010Document7 pagesRichard L Nygaard Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Terry J Hatter JR Financial Disclosure Report For 2010Document6 pagesTerry J Hatter JR Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Lee R West Financial Disclosure Report For 2010Document6 pagesLee R West Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Stephen F Williams Financial Disclosure Report For 2010Document9 pagesStephen F Williams Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Berle M Schiller Financial Disclosure Report For 2010Document7 pagesBerle M Schiller Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Lawrence E Kahn Financial Disclosure Report For 2009Document6 pagesLawrence E Kahn Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Richard G Kopf Financial Disclosure Report For 2009Document6 pagesRichard G Kopf Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Robert C Broomfield Financial Disclosure Report For 2010Document6 pagesRobert C Broomfield Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Elaine E Bucklo Financial Disclosure Report For 2010Document6 pagesElaine E Bucklo Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Harry Lee Hudspeth Financial Disclosure Report For 2010Document7 pagesHarry Lee Hudspeth Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- William J Hibbler Financial Disclosure Report For 2010Document6 pagesWilliam J Hibbler Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- John R Smoak Financial Disclosure Report For 2010Document7 pagesJohn R Smoak Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Vanessa D Gilmore Financial Disclosure Report For 2010Document6 pagesVanessa D Gilmore Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Marcia S Krieger Financial Disclosure Report For 2010Document14 pagesMarcia S Krieger Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Leonard I Garth Financial Disclosure Report For 2009Document8 pagesLeonard I Garth Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Joel M Flaum Financial Disclosure Report For 2009Document6 pagesJoel M Flaum Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Janis L Sammartino Financial Disclosure Report For Sammartino, Janis LDocument6 pagesJanis L Sammartino Financial Disclosure Report For Sammartino, Janis LJudicial Watch, Inc.Pas encore d'évaluation

- Stephan P Mickle Financial Disclosure Report For 2009Document7 pagesStephan P Mickle Financial Disclosure Report For 2009Judicial Watch, Inc.Pas encore d'évaluation

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerD'EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerPas encore d'évaluation

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- Opinion - JW V NavyDocument7 pagesOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.Pas encore d'évaluation

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29Pas encore d'évaluation

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Pas encore d'évaluation

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.Pas encore d'évaluation

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.Pas encore d'évaluation

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.Pas encore d'évaluation

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.Pas encore d'évaluation

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.Pas encore d'évaluation

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.Pas encore d'évaluation

- Holder Travel Records CombinedDocument854 pagesHolder Travel Records CombinedJudicial Watch, Inc.Pas encore d'évaluation

- Gitmo Water Test ReportDocument2 pagesGitmo Water Test ReportJudicial Watch, Inc.Pas encore d'évaluation

- Visitor Tent DescriptionDocument3 pagesVisitor Tent DescriptionJudicial Watch, Inc.Pas encore d'évaluation

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Pas encore d'évaluation

- May 2007 BulletinDocument7 pagesMay 2007 BulletinJudicial Watch, Inc.Pas encore d'évaluation

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Pas encore d'évaluation

- Schoolboard PowerpointDocument2 pagesSchoolboard PowerpointJudicial Watch, Inc.Pas encore d'évaluation

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Pas encore d'évaluation

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- Navy Water Safety ProductionDocument114 pagesNavy Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- JW Cross Motion v. NavyDocument10 pagesJW Cross Motion v. NavyJudicial Watch, Inc.Pas encore d'évaluation

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.Pas encore d'évaluation

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.Pas encore d'évaluation

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Pas encore d'évaluation

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.Pas encore d'évaluation

- Balanced and Unbalanced Growth in Respect of Indian EconomyDocument15 pagesBalanced and Unbalanced Growth in Respect of Indian EconomyRajat KaushikPas encore d'évaluation

- Florist Shop Business PlanDocument19 pagesFlorist Shop Business PlanBrave King100% (1)

- Britannia Industries: PrintDocument1 pageBritannia Industries: PrintTejaswiniPas encore d'évaluation

- In Re Blinds To Go Share Purchase Litigation, 443 F.3d 1, 1st Cir. (2006)Document13 pagesIn Re Blinds To Go Share Purchase Litigation, 443 F.3d 1, 1st Cir. (2006)Scribd Government DocsPas encore d'évaluation

- Inventory Trading SampleDocument28 pagesInventory Trading SampleMarcelino CalataPas encore d'évaluation

- Hanoi University Thesis Topics for Management, Tourism, Accounting & FinanceDocument3 pagesHanoi University Thesis Topics for Management, Tourism, Accounting & FinanceJay EusebsPas encore d'évaluation

- SoeHoeCom DynamicProScalperUserGuideDocument12 pagesSoeHoeCom DynamicProScalperUserGuideDhaiyat LakersPas encore d'évaluation

- EMH Analysis of Indian Equity MarketsDocument73 pagesEMH Analysis of Indian Equity MarketsAashutosh SinghPas encore d'évaluation

- Macroeconomics: Money, Banking, and Rbi - Mcqs With Answers - Part IDocument11 pagesMacroeconomics: Money, Banking, and Rbi - Mcqs With Answers - Part IDharmaDazzlePas encore d'évaluation

- Individual Customer Information FormDocument8 pagesIndividual Customer Information Formodan81Pas encore d'évaluation

- Hospital Corporation CaseDocument6 pagesHospital Corporation CaseRithika Baruah100% (3)

- Other ExDocument17 pagesOther ExDaniel HunksPas encore d'évaluation

- DbipoDocument555 pagesDbipoKaushal ShahPas encore d'évaluation

- Mag Invest Ka Online FINALDocument12 pagesMag Invest Ka Online FINALvipereyesPas encore d'évaluation

- How To Become A Great Boss Jeffrey J. FoxDocument19 pagesHow To Become A Great Boss Jeffrey J. FoxFrancisco MoralesPas encore d'évaluation

- Unit 3: Insurance: An OverviewDocument46 pagesUnit 3: Insurance: An OverviewhabtamuPas encore d'évaluation

- 2018 TranscriptsDocument316 pages2018 TranscriptsOnePunchManPas encore d'évaluation

- FCT IPO - Investor PresentationDocument21 pagesFCT IPO - Investor PresentationbandaliumPas encore d'évaluation

- Free Sample Aptitude Test Questions and AnswersDocument7 pagesFree Sample Aptitude Test Questions and AnswersKarnakar ReddyPas encore d'évaluation

- Private Equity Fundraising ProcessDocument69 pagesPrivate Equity Fundraising ProcessYash ModiPas encore d'évaluation

- Practice PaperDocument10 pagesPractice PaperVishwanathPas encore d'évaluation

- TCS India Process - Separation KitDocument25 pagesTCS India Process - Separation KitT HawkPas encore d'évaluation

- Introduction of Mutual FundsDocument5 pagesIntroduction of Mutual FundsSh IVa Ku MAr100% (1)

- Annual Report 2011 HighlightsDocument73 pagesAnnual Report 2011 HighlightsDanesh RanchhodPas encore d'évaluation

- Perbandingan Kinerja Keuangan Perusahaan Manufaktur Menggunakan Analisis Rasio KeuanganDocument22 pagesPerbandingan Kinerja Keuangan Perusahaan Manufaktur Menggunakan Analisis Rasio KeuanganIrma Retno DewiPas encore d'évaluation

- Riding the Bus: A Day in the Life of Chris GardnerDocument28 pagesRiding the Bus: A Day in the Life of Chris GardnerSang Hwa LeePas encore d'évaluation

- How Traditional Firms Must Compete in The Sharing EconomyDocument4 pagesHow Traditional Firms Must Compete in The Sharing EconomyJorgePas encore d'évaluation

- Bengal & Assam Company LTD - ULJK PDFDocument2 pagesBengal & Assam Company LTD - ULJK PDFAnonymous OqMWnzGs7zPas encore d'évaluation

- For Each Question 23 - 30, Mark One Letter (A, B or C) For The Correct Answer. - You Will Hear The Conversation TwiceDocument2 pagesFor Each Question 23 - 30, Mark One Letter (A, B or C) For The Correct Answer. - You Will Hear The Conversation TwiceMa Emilia100% (1)

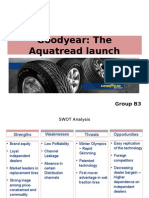

- GoodyearDocument10 pagesGoodyearMiteshwar SinghPas encore d'évaluation