Académique Documents

Professionnel Documents

Culture Documents

Cell Ox

Transféré par

Husnain Ul Haq0 évaluation0% ont trouvé ce document utile (0 vote)

61 vues15 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

61 vues15 pagesCell Ox

Transféré par

Husnain Ul HaqDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 15

by

A case study strategic analysis report

Ali ZaIar

M.Zain Shahid

M.Husnain-ul-haq

Ali Haider Suleria

1

CONTENTS

%ABLE OF CON%EN%S ..................................................................... ERROR! BOOKMARK NOT DEFINED.

CASE ABS%#AC% ......................................................................................................................................2

VISION S%A%EMEN% (P#OPOSED) .............................................................................................................2

MISSION S%A%EMEN% AND IN%#ODUC%ION (AC%UAL) ........................................................................3

SWO% ANALYSIS ...................................................................................................................................4

S%#ENG%H .........................................................................................................................................4

OPPO#%UNI%IES ................................................................................................................................4

WEAKNESESS ....................................................................................................................................4

%H#EA%S ...............................................................................................................................................4

SO S%#A%EGIES .....................................................................................................................................5

WO S%#A%EGIES ....................................................................................................................................5

S% S%#A%EGIES ......................................................................................................................................5

WT STRATEGIES ...................................................................................................................................5

SPACE MA%#IX ......................................................................................................................................7

G#AND S%#A%EGY MA%#IX .......................................................................................................................8

IFE MA%#IX ............................................................................................................................................9

EFE ..........................................................................................................................................................9

CPM ....................................................................................................................................................... 10

%HE IN%E#NAL-EX%E#NAL (IE) MA%#IX ................................................................................................... 11

%HE IFE %O%AL WEIGH%ED SCO#E ....................................................................................................... 11

%HE EFE %O%AL WEIGH%ED SCO#E ...................................................................................................... 11

QSPM ..................................................................................................................................................... 12

#ECOMMENDA%IONS AND CONCLUSION .................................................................................................... 14

2

CASE ABSTRACT

David Pace Iaced some major challenges in manuIacturing, marketing,

selling, and distributing his product. %hese processes were complicated by

a construction industry generally resistant to change, even though

traditional home construction methods could not withstand the damage

inIlicted by recent hurricanes.

Drawing out inIormation about past events Ior the case study helped the

employees recognize and understand the importance oI their company's

key decision points and how those decisions had to be shaped and deIined.

%hey also realized the importance oI identiIying underlying issues and

variables that inIluence and impact current decisions, thereby locking in

certain paths and policies Ior the Iuture-right or wrong. %hey began to see

that their decisions went Iar beyond their immediate environment, and a

variety oI stakeholders were usually impacted (directly or indirectly) by a

speciIic decision process.

%he speciIic area oI past marketing activities Ior the company was

especially revealing. %hrough discussions with management, it became

evident that they Iirst needed to distinguish between the meaning oI sales

and marketing. David's desire to get the industry and customers to

recognize the value oI his product was going to eventually require a two-

pronged approach: one Iocused on sales with customer contacts and

training, and a second Iocused on marketing by convincing the general

public and industry that David produced a must-have superior product. A

marketing-oriented case study that looked at the marketing initiative oI the

company in the past was developed. %his process opened executives' eyes

in an unthreatening way and gave them motivation to immediately begin

developing Iuture-oriented scenarios.

AIter creating these past-experience case studies, the process oI basing the

Iuture alternatives and dilemmas on solid corporate precedence was Iairly

routine. %here was a natural progression oI activities and events that was

"in sync" with logical business operations. %he past became the logical

reIerence point Ior identiIying the key Iactors Ior the Iuture scenario

planning.

'SON STATEMENT (PROPOSED)

Our Vision is simple. 'CELLOX

is committed to Quality, Service and

People.with CELLOX you are building the future one blockat a time.

3

MSSON STATEMENT AND NTRODUCTON

(ACTUAL)

Cellox

LLC has been in business as an EPS manuIacturer since

1961. With over 49 years in the EPS industry and the only Iully integrated

ISO certiIied manuIacturer in the market, we can saIely say we are the

leading ICF manuIacturer.

'We strive to bring the highest quality products to Architects, Engineers,

General Contractors, Builders and Owners. Here at Cellox, we are proud

oI our many successIul partnerships and having played an integral role in

the construction Iield as an ICF manuIacturer

Our customers are our top priority and as an ICF manuIacturer we have

supplied the ICF industry with solutions, innovative technology, and

exceptional customer service Ior over 20 years. We continue to do so. In

Iact, each member oI our technical staII has extensive on-site ICF

construction experience and is dedicated to improving the ICF

construction process while promoting ICF education.

ission

Statement

4

SWOT ANALYSS

STRENGTH

O GeneraI Eco profiIe

O DurabiIity / SustainabiIity

O RecycIabiIity

O Strong/ Iight materiaI

O Economic and competitive

OPPORTUNITIES

O Added by the product

shape

O Low qty production series /

higher varities

O Energy efficiency

reguIation

O Eco IabeIing

O PLA materiaI

WEAKNESESS

O Plastic image in general

O USE OF VOC`s (Volatile

Organic Compound)

O Styrene

O Fire

O Lacking supporting evidence

report

%H#EA%S

O Competitors working on

weaknesses

O #enewable material like PLA

O Governmental requirements

O Consumer/ retailer pressure

O Demand Ior high variety

O One component solution

5

SO STRATEGIES

Invest more in ICF`s

Market your PoP products

Market your recycle friendliness

WO STRATEGIES

Open outlets on coastal areas for

ICF product promotion

Stream line your PoP supply chain

buy invest on new plant.

Hire or outsource a new advertising

team and strategy

ST STRATEGIES

Call on workshops for more

awareness for ICF products.

Give Construction workers more

incentives for ICF products

Should also do more R&D on PPM

products so company can improvise

on new packaging

WT STRATEGIES

Run a campaign to show how plastic

is environment friendly

Increase ICF production by

purchasing a new plant.

Cost cut the expenses to reduce

negative income generation

6

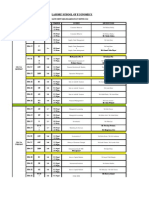

Financial Ratio Analysis

Growth Rates % Cellox

SaIes (Qtr vs year ago qtr) (5.00)

Net ncome (YTD vs YTD) (37.30)

Net ncome (Qtr vs year ago qtr) (52.40)

SaIes (5-Year AnnuaI Avg.) 14.86

Net ncome (5-Year AnnuaI Avg.) 7.25

Dividends (5-Year AnnuaI Avg.) 15.37

Price Ratios

Current P/E Ratio 22.4

P/E Ratio 5-Year High 83.5

P/E Ratio 5-Year Low 14.8

Price/SaIes Ratio 3.46

Price/Book 'aIue 2.73

Price/Cash FIow Ratio 13.30

Profit Margins

Gross Margin 87.6

Pre-Tax Margin 22.2

Net Profit Margin 15.5

5Yr Gross Margin (5-Year Avg.) 87.0

5Yr PreTax Margin (5-Year Avg.) 23.5

5Yr Net Profit Margin (5-Year Avg.) 18.9

FinanciaI Condition

Debt/Equity Ratio 0.08

Current Ratio 1.6

Quick Ratio 1.1

nterest Coverage 34.6

Leverage Ratio 1.7

Book 'aIue/Share 9.04

nvestment Returns %

Return On Equity 12.3

Return On Assets 7.4

Return On CapitaI 11.3

Return On Equity (5-Year Avg.) 19.4

Return On Assets (5-Year Avg.) 10.1

Return On CapitaI (5-Year Avg.) 16.2

Management Efficiency

ncome/EmpIoyee 71,000

Revenue/EmpIoyee 458,000

ReceivabIe Turnover 5.3

nventory Turnover 1.0

Asset Turnover 0.5

7

SPACE MATR

-2 -3

-1 -3

3 -1

5 -5

4 -5

-2 2

-5 1

1 1

-2 2

-4

1

Control over Suppliers and Distributors Profit Potential

Market Share Growth Potential

Product Quality Financial Stability

Environmental Stability (ES) Average Financial Strength (FS) Average

Competitive Advantage (CA) Average Industry Strength (IS) Average

Customer Loyalty Ease of Entry into Market

Technological Know-how Resource Utilization

Competitive Advantage (CA) Industry Strength (IS)

orking Capital

Cash Flow

Competitive Pressure

Barriers to Entry into Market

Environmental Stability (ES)

Rate of Inflation

Technological Changes

Price Elasticity of Demand

Financial Strength (FS)

Return on Investment

Leverage

Liquidity

8

y-axis FS ES 3.2 (-4.7) (1.5)

x-axis CA IS (-3.5) 1.5 (2)

GRAND STRATEGY MATR

Cellox Company lies in the third quadrant because they are somewhat at a

weak competitive position and industry growth is also not very rapid.

Factors which were considered while making this matrix were

1. Market development

2. Market penetration

3. Product development

4. Forward integration

5. Backward integration

6. Horizontal integration

7. #elated diversiIication

9

FE MATR

STRENGTHS Weights Ratings Weighted score

General Ecoprofile 0.15 2 0.30

Durability / Sustainability 0.03 4 0.12

Recyclability 0.09 3 0.27

Strong/ light material 0.17 1 0.17

Economic and competitive 0.12 1 0.12

WEAKNESESS

!lastic image in general 0.08 3 0.24

USE OF VOC's 0.14 1 0.14

Styrene 0.09 2 0.18

Fire 0.02 3 0.06

Lacking supporting evidence report 0.10 3 0.30

Total 1 1.86

EFE

OPPORTUNITIES Weights Ratings Weighted score

O Added by the product shape 0.07 2 0.14

O Low qty production series / higher

varities

0.15 3 0.45

O Energy efficiency regulation 0.05 1 0.05

O Eco labeling 0.03 3 0.09

O !LA material 0.08 4 0.32

THREATS

O Competitors working on

weaknesses

0.11 3 0.33

10

O Renewable material like !LA 0.10 1 0.10

O Governmental requirements 0.10 2 0.20

O Consumer/ retailer pressure 0.23 1 0.23

O Demand for high variety 0.08 4 0.32

Total 1 2.26

CPM

CELLOX

BK MCD

Success factors Weights #atings Score #atings Score #atings Score

Advertising

0.14 3 0.42 2 0.28 4 0.56

Quality

0.15 4 0.6 2 0.3 1 0.15

Price competitiveness

0.1 4 0.4 4 0.4 4 0.4

Financial position

0.17 1 0.17 2 0.34 3 0.51

Market share

0.13 2 0.26 4 0.52 3 0.39

Global expansion

0.25 3 0.75 3 0.75 4 1

Product development

0.2 2 0.4 2 0.4 4 0.8

Total

1 2.58 2.71 3.25

11

THE NTERNAL-ETERNAL (E) MATR

%HE IFE %O%AL WEIGH%ED SCO#E

S%#ONG AVE#AGE WEAK

3.0 %O 4.0 2.0 %O 2.99 1.0 %O 1.99

HIGH

I II III

3.0 %O

3.99

MEDIUM

IV V VI

%HE EFE

%O%AL

WEIGH%ED

SCO#E

2.0 %O

2.99

2

LOW

VII VIII IX

1.0 %O

1.99

1 Cellox Score

2 Industry Score

1

12

QSPM

Strategic Alternatives

Key Internal Factors Weight

Acquire a new

manufacturing

plant

Improve the

existing setup by

adding new

features

Strengths AS TAS AS TAS

1. Corporate citizenship should be encouraged to

ensure access to even international markets.

0.05 4 0.20 3 0.15

2. Negative income generation can lead to shortage oI

working captial

0.04 2 0.08 2 0.08

3. Most oI the sales are generated through POP

0.05 3 0.15 4 0.20

4. Serving the largest economy in the world.

0.08 3 0.24 2 0.16

5. Consolidation taking place in the Plastic industry

increases purchasing power and shiIts bargaining

power in their Iavor.

0.03 --- --- --- ---

6. Web site is poorly designed and not useIul.

0.04 --- --- --- ---

7. Workshop Ior ICF products

0.05 --- --- --- ---

8. ICF products are the newest material available Ior

construction in market

0.06 2 0.12 1 0.06

9. Market Leader oI POP products

0.06 3 0.18 2 0.12

10. Negative income oI $238,000

0.06 3 0.18 3 0.18

11. Holds 17.1 percent oI market share

0.05 2 0.10 2 0.10

13

Weaknesses

1. Stock price has been losing value over the past Iive

0.06 1 0.06 1 0.06

2. Constantly negative income Ior 5 Years

0.06 3 0.18 2 0.12

3. No #D to improve PPM products

0.05 2 0.10 3 0.15

4. Not serving International markets.

0.04 3 0.12 1 0.04

5. Lack oI interest Ior construction workers Ior ICF

Products.

0.05 4 0.20 3 0.15

6. Lack oI organizational structure.

0.02 3 0.06 2 0.04

7. Decreased amount oI advertising.

0.08 3 0.24 2 0.16

SUBTOTAL 1.98 1.42

Key External Factors Weight

Acquire a new

manufacturing

plant

.

Improve the

existing setup by

adding new

features

Opportunities AS TAS AS TAS

1. Demand Ior PoP is relatively inelastic.

0.05 3 0.15 2 0.10

2. Worldwide Plastic products sales continue to grow

Iaster than most segments oI the world economy.

0.06 3 0.18 2 0.12

3. World Packaging sales to exceed $800 billion in

2005, up 6.4 percent.

0.07 3 0.21 2 0.14

4. Advancements in technology.

0.05 2 0.10 1 0.05

14

5. Increase oI natural disasters

0.07 4 0.28 3 0.21

6. Barriers to entry are high.

0.05 --- --- --- ---

Threats

1. People have a negative perception about plastic

products

0.06 3 0.18 1 0.06

2. #igid Credit policy

0.05 1 0.05 4 0.20

3. Assets located overseas Irom global markets are

subject to threat oI expropriation and terrorism.

0.03 --- --- --- ---

4. %hreats oI global business in dealing with varied

regulatory environments and currency Iluctuations.

0.07 --- --- --- ---

5. Increasing pricing pressures.

0.03 3 0.03 1 0.03

6. Negative publicity.

0.02 1 0.02 4 0.08

SUBTOTAL 0.88 0.66

TOTAL ATTRACTIVNESS SCORE 2.91 2.07

RECOMMENDATONS AND CONCLUSON

%he authors implemented this case study scenario planning strategy by enabling Cellox

decision makers and managers to discover things Ior themselves, rather than doing the

work Ior them. Managers became reIlective practitioners with access to appropriate

inIormation. Not only did Cellox executives have to deal with their Wisconsin location

and a reluctant construction industry, but the scenario planning strategy helped them to

carve through these Iuture issues: contractor training, regional product manuIacturing

versus regional product distribution, lead times required Ior product certiIication and

approval in states and counties, job site technical assistance Ior contractors, Iranchising

ICF construction crews, production capacity issues associated with a Iirst "super-sized"

product order, organizational structure over the next decade, and the qualiIications

required Ior Iuture personnel. %his was a signiIicant outcome Ior a small-sized company

that thought it was only Iacing a couple oI key issues in the Iuture.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Online Leave Mana Online Leave Management Systemgement SystemDocument5 pagesOnline Leave Mana Online Leave Management Systemgement SystemHusnain Ul HaqPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Impact of Employer Branding On Talent Acquisition in Banking Sector of Pakistan.Document56 pagesThe Impact of Employer Branding On Talent Acquisition in Banking Sector of Pakistan.Husnain Ul Haq50% (2)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Death, Doomed Cities and Loneliness: Poetry of 20 CenturyDocument1 pageDeath, Doomed Cities and Loneliness: Poetry of 20 CenturyHusnain Ul HaqPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- CH 9Document12 pagesCH 9Husnain Ul HaqPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Maths IIIDocument2 pagesMaths IIIHusnain Ul HaqPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Steel Mill Purchase Offer FinalDocument2 pagesSteel Mill Purchase Offer FinalHusnain Ul HaqPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- AlaaqayDocument2 pagesAlaaqayHusnain Ul HaqPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- InfoooooDocument2 pagesInfoooooHusnain Ul HaqPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Building The Supply Chain of The FutureDocument10 pagesBuilding The Supply Chain of The Futureludl79Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Mids Winter 2010Document8 pagesMids Winter 2010Husnain Ul HaqPas encore d'évaluation

- Tritec CaseDocument23 pagesTritec CaseinsanomonkeyPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Ind As 109Document6 pagesInd As 109ashmit bahlPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Compliance Portal - Non-Filing of Return - User Guide - V2.0Document94 pagesCompliance Portal - Non-Filing of Return - User Guide - V2.0Videesh Kakarla0% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Strategy Paper IbizsimDocument10 pagesStrategy Paper Ibizsimcharu.chopra3237Pas encore d'évaluation

- Risk Identification & MeasurementDocument24 pagesRisk Identification & Measurementvmtripathi0967% (3)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Cash Flow StatementDocument31 pagesCash Flow StatementRajeevPas encore d'évaluation

- Head Retail Banking President in Memphis TN Resume Terry RenouxDocument3 pagesHead Retail Banking President in Memphis TN Resume Terry RenouxTerryRenouxPas encore d'évaluation

- C18-IRB-38-03 Regulatory Frameworks Report (Wacc) !!!!!!Document136 pagesC18-IRB-38-03 Regulatory Frameworks Report (Wacc) !!!!!!Mike BabenkoPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Falak Ishrat Bba Mba Integrated ECON153Document20 pagesFalak Ishrat Bba Mba Integrated ECON153sehar Ishrat SiddiquiPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Securitization PrimerDocument27 pagesSecuritization PrimerRangarajan RamanujamPas encore d'évaluation

- 09Document8 pages09asnairahPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Business Environment and Strategic ManagementDocument40 pagesBusiness Environment and Strategic Managementsmithanil100% (1)

- Ade Thi HP IIDocument94 pagesAde Thi HP IIhihoquaPas encore d'évaluation

- CFM 221 2023 Capital Budgets NotesDocument19 pagesCFM 221 2023 Capital Budgets NotesChantell KatlegoPas encore d'évaluation

- Project On: Strategic ManagementDocument4 pagesProject On: Strategic ManagementSACHIN THOMAS GEORGE MBA19-21Pas encore d'évaluation

- Tea Farming and Processing Business Plan in NigeriaDocument16 pagesTea Farming and Processing Business Plan in NigeriaGodwith UdohPas encore d'évaluation

- Theory of Big PushDocument11 pagesTheory of Big Pushতথাগত চক্রবর্তী0% (1)

- Investment AlternativesDocument19 pagesInvestment AlternativesJagrityTalwarPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Chapter21 - InitialDocument47 pagesChapter21 - InitialEvePas encore d'évaluation

- UIHC PresentationDocument25 pagesUIHC PresentationAnonymous Ht0MIJPas encore d'évaluation

- PDFDocument19 pagesPDFVINOD MEHTAPas encore d'évaluation

- Investment Bank in BangladeshDocument13 pagesInvestment Bank in BangladeshTopu RoyPas encore d'évaluation

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)sajid bhattiPas encore d'évaluation

- Chapter 5: Intercompany Profit Transactions - InventoriesDocument38 pagesChapter 5: Intercompany Profit Transactions - InventoriesRizki BayuPas encore d'évaluation

- The Subprime PanicDocument40 pagesThe Subprime Panicariel agPas encore d'évaluation

- Ethiopia, 6.625% 11dec2024, USDDocument1 pageEthiopia, 6.625% 11dec2024, USDLloyd Ki'sPas encore d'évaluation

- Royal Bank of Scotland: Corporate Rap SheetDocument9 pagesRoyal Bank of Scotland: Corporate Rap SheetMohsen KhanPas encore d'évaluation

- Company Analysis ReDocument21 pagesCompany Analysis ReDarshan JainPas encore d'évaluation

- Carlos Correia - David Flynn - Enrico Uliana - Michael Wormald - Johnathan Dillon - Financial Management-Juta & Company (Pty) LTD (2015)Document1 196 pagesCarlos Correia - David Flynn - Enrico Uliana - Michael Wormald - Johnathan Dillon - Financial Management-Juta & Company (Pty) LTD (2015)sosage100% (2)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Pinkerton ADocument14 pagesPinkerton AGandhi Jenny Rakeshkumar BD20029Pas encore d'évaluation